xmr markets 2025 Review: Everything You Need to Know

1. Abstract

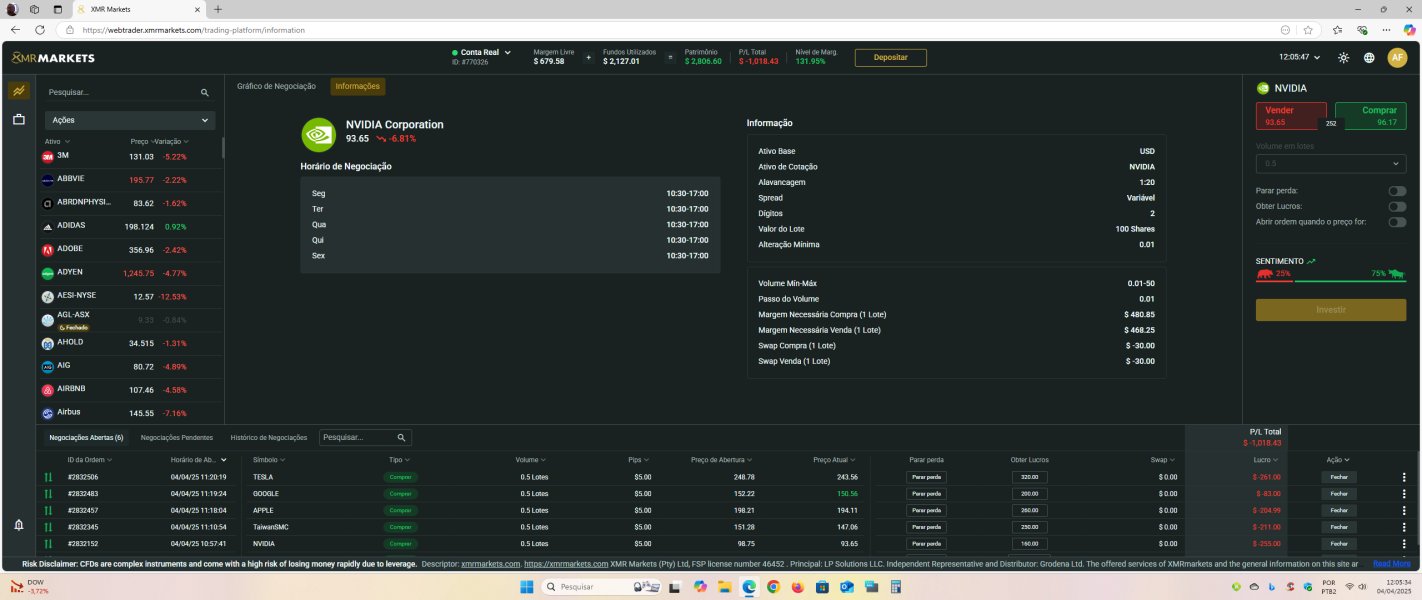

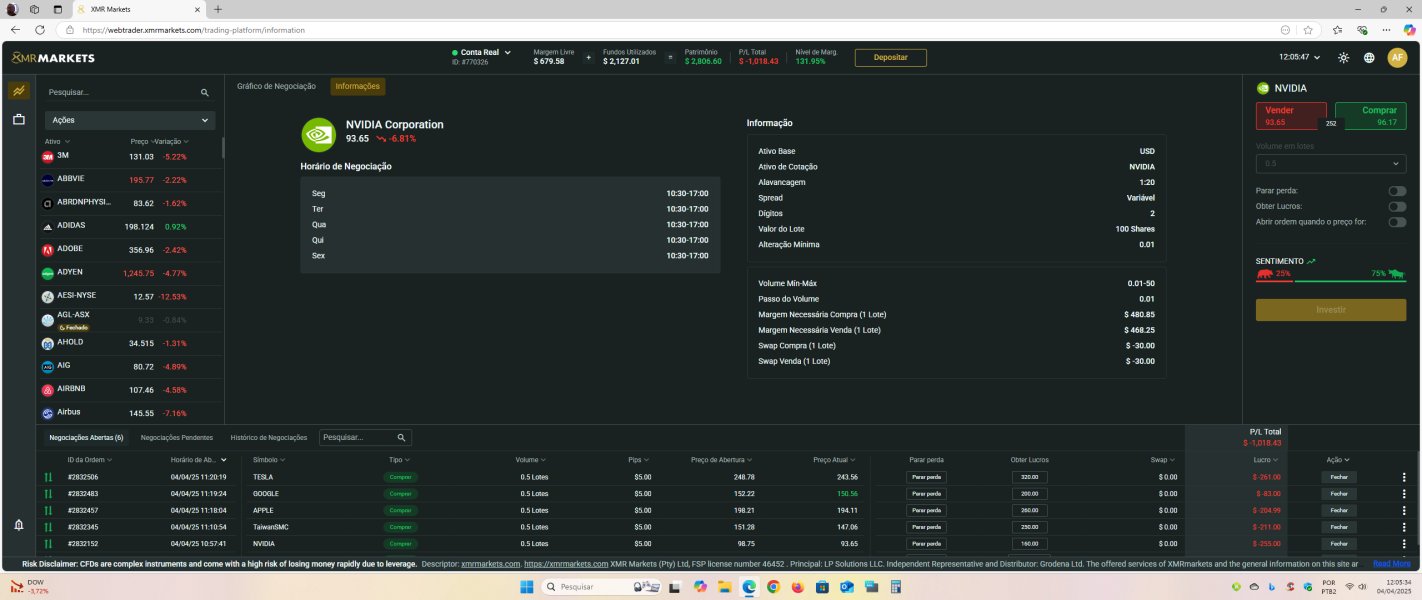

In this xmr markets review, XMR Markets is a broker that has created big controversy among traders. The platform gets mixed reports and faces serious concerns about fund safety and legal status, which makes potential users feel uncertain. The broker mainly serves forex and cryptocurrency traders. It offers CFD trading along with traditional forex transactions. However, the high minimum deposit of 2,500 USD raises red flags, especially when combined with questions about platform transparency and poor customer service support. The company is officially registered according to FSCA regulations in South Africa . But significant user feedback points to potential risks, including warnings of possible scams. This assessment uses various users' experiences and publicly available data. The review aims to give traders deep insights into what to expect from the broker. It emphasizes both the attractive features and the risks behind its business model.

Words: ~200

2. Notices

XMR Markets is regulated only by the South African Financial Services Committee . This means its operational practices and legal standing may vary a lot across different regions. Users should carefully check local laws and regulatory requirements before using the platform. This review relies on user feedback and publicly available information. While every effort has been made to present an unbiased evaluation, individual experiences may differ. The evaluation method includes examining regulatory details, deposit requirements, commissions, and users' reported experiences with funding security and platform performance. Given these factors, potential traders should stay cautious. They should do their own research to confirm if XMR Markets suits their specific trading needs.

Words: ~130

3. Rating Framework

Below is the detailed rating framework based on six key dimensions:

4. Broker Overview

XMR Markets is a broker based in Johannesburg, South Africa. The company has developed a controversial reputation among traders in the forex and cryptocurrency sectors. It provides a platform for trading both traditional forex pairs and alternative digital assets such as Bitcoin, Litecoin, and Ripple. The company was founded under South African jurisdiction and operates under strict FSCA oversight . The broker acts mainly as an intermediary offering market access and technical support. Despite its regulatory backing, key aspects such as its unusually high minimum deposit and unclear account features worry users. The broker's business model focuses on providing technological support and market access rather than offering many proprietary trading tools. This has led to mixed reviews, especially as many clients express concern about the transparent management of their funds and overall service reliability.

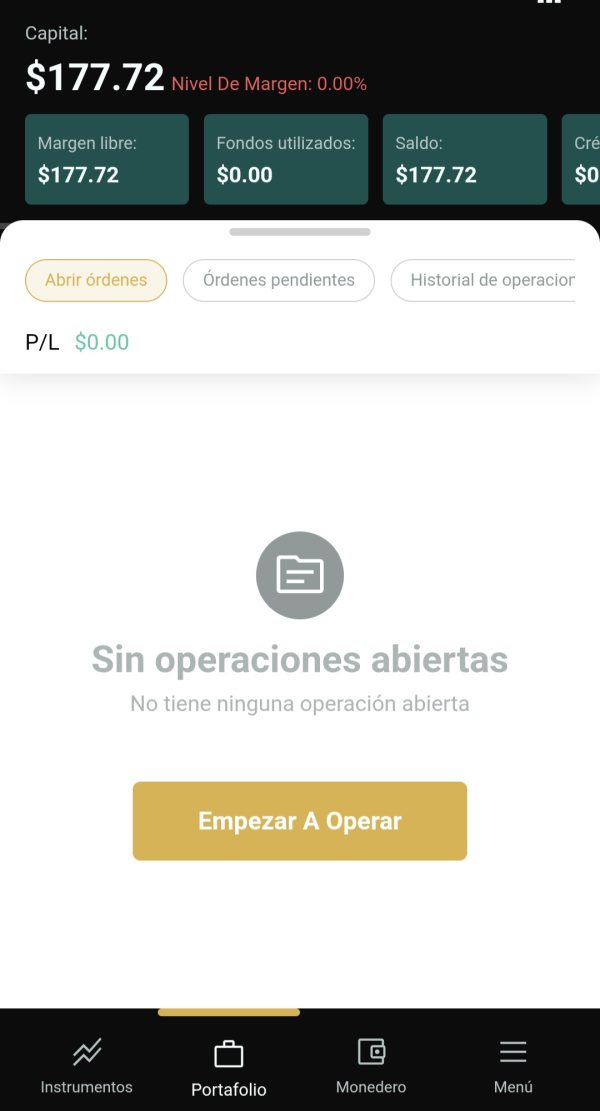

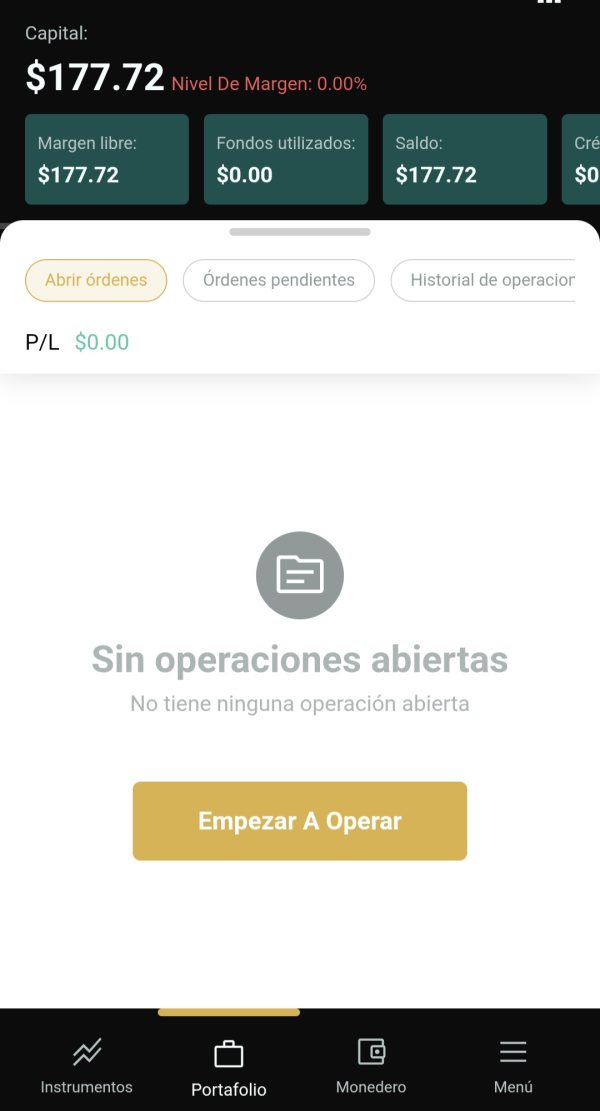

XMR Markets has developed a platform that supports both web-based and mobile trading. This dual offering aims to attract forex and crypto traders who value the flexibility of accessing their accounts on the go. However, while the broker promises a broad selection of tradable instruments that span from forex pairs to popular cryptocurrencies, the lack of complete information on deposit and promotional programs leaves many potential investors uncertain. There is a clear need for improvement in both transparency and user communication. As noted in this xmr markets review, the broker may appeal to experienced traders who are comfortable with higher risk levels. But caution is advised for new market entrants who may not fully understand the existing operational limitations.

Words: ~350

XMR Markets operates under the regulatory oversight of the South African Financial Services Committee . According to available data, this broker holds license number 46452, ensuring a basic level of regulatory compliance within South Africa. However, its regulation does not extend to broader international jurisdictions. Users outside South Africa should verify the compatibility of local trading laws.

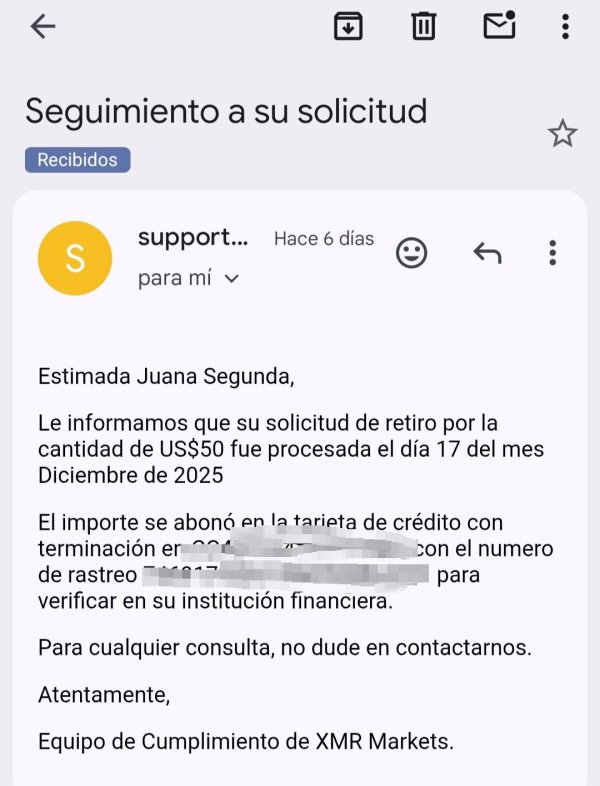

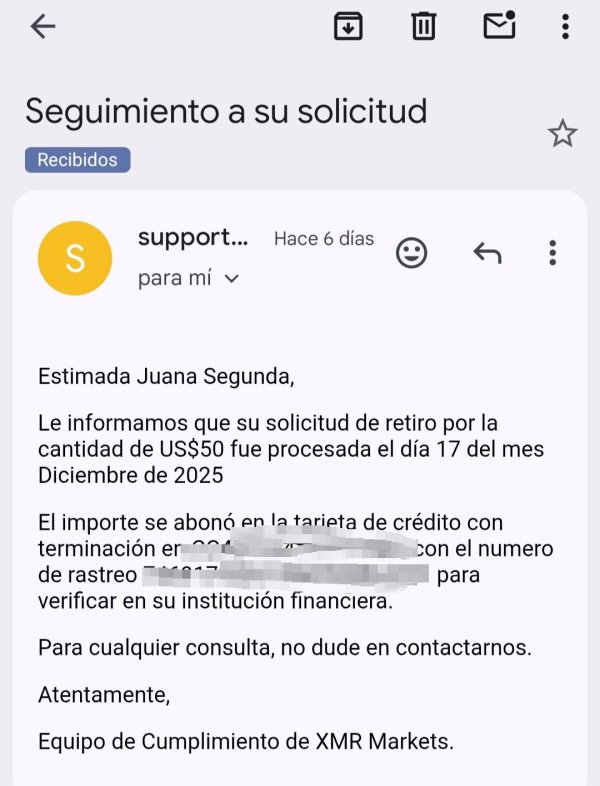

When it comes to deposits and withdrawals, specific details about the exact methods remain limited in the published data. The lack of clear information on this issue adds another layer of complexity for potential traders. A notable point is that the minimum deposit requirement is set at 2,500 USD, which is very high. This amount may prevent novice traders or those with limited capital from opening an account.

Regarding bonuses or promotional incentives, available resources do not provide detailed information. This lack of clarity may force traders to rely only on the base features offered by the broker. However, the platform provides access to a suite of tradable assets that include both foreign exchange pairs and cryptocurrencies, specifically popular choices such as Bitcoin, Litecoin, and Ripple.

In terms of cost structure, there is a significant gap in the publicly shared information about spreads, commissions, and any associated fees. Traders must actively seek this information to understand the true cost of executing trades on the platform. The details on leverage ratios are also limited, with specifics varying by the client's jurisdiction. The platform is available via a flexible approach that includes both mobile and web-based options. However, regional restrictions and customer service language options have not been explained in the available sources, leading to further confusion.

Words: ~450

6. Detailed Rating Analysis

6.1 Account Conditions Analysis

When evaluating the account conditions of XMR Markets, several factors must be closely examined. This xmr markets review highlights that the platform offers limited information on the range of account types available. With the minimum deposit requirement standing at 2,500 USD, many novice or small-scale traders might find it hard to start trading financially. The high entry barrier suggests that the broker targets experienced traders who can commit a large amount of capital. Additionally, important factors like the account opening procedure, verification process, and special account features are either missing or poorly detailed. User feedback consistently shows dissatisfaction with the deposit threshold, often mentioning the financial burden imposed by such a high minimum deposit. When compared to competitors in the market, XMR Markets falls short, as many brokers offer lower minimum deposits and more flexible account options. According to industry sources, this high barrier makes the perceived risks related to fund safety worse, as potential clients are cautious about giving large amounts of money to a broker with unclear operational practices. Overall, the strict account conditions contribute to a lower overall score in this category.

Words: ~210

The trading tools and resources provided by XMR Markets are another critical area of scrutiny. In this xmr markets review, the broker is noted for offering CFD trading capabilities alongside its forex and cryptocurrency trading options. However, there remains a significant lack of detailed information about the specific trading tools available. For example, there is minimal mention of advanced charting functions, risk management tools, or automated trading systems such as expert advisors that are often standard in modern trading platforms. Furthermore, research and analytical tools are either poorly detailed or entirely absent from the publicly available data. In many trader reviews, the limited description of the available tools has emerged as a concern, leaving users uncertain about the depth and quality of market analysis they will receive. While the broker does provide the essential infrastructure for CFD trading, the actual suite of supporting resources falls short of what is offered by more established competitors. As a result, while the platform meets the basic criteria needed for trading, the overall range and sophistication of its tools and resources are lacking. This gap has a direct impact on the overall trading experience, suggesting that traders looking for deep market analysis may need to rely on third-party platforms or additional resources.

Words: ~215

6.3 Customer Service and Support Analysis

Customer service is a critical aspect largely discussed by traders, and for XMR Markets, it is an area that creates considerable concern. In this xmr markets review, significant negative sentiment surrounds the quality of customer support. There is a notable lack of detailed information on the channels available for support, such as live chat, email, or telephone assistance. Users have reported instances where unresolved issues, mainly related to funds safety, contributed to a reduced sense of trust and reliability. The response times appear to be inconsistent. There is little evidence to suggest that the broker provides adequate multi-language support, which is essential for attracting an international clientele. Additionally, the feedback from users who have attempted to resolve issues shows a level of dissatisfaction with the overall responsiveness and effectiveness of the support channels. Although some traders might argue that the basic support framework is in place, the recurring theme of unresolved concerns, particularly regarding funding and account queries, paints a grim picture. Specialist reports and feedback across various trading forums have also highlighted these problems. As a result, customer service remains one of the most damaging factors in the overall perception of XMR Markets. Potential clients are advised to exercise extra caution when it comes to fund protection and dispute resolution processes.

Words: ~210

6.4 Trading Experience Analysis

A closer look at the trading experience on XMR Markets reveals important problems that affect overall user satisfaction. In this xmr markets review, users have indicated that the trading platform, while functional, falls short in several key aspects. There is limited specific data about platform stability, such as uptime statistics or instances of order execution delays. This lack of transparency poses a challenge for traders who rely on speedy and reliable trade execution. Additionally, the execution quality in terms of order fill and slippage is not well-documented in the available literature, leaving many to guess about the efficiency and timeliness of order processing. The platform is reportedly accessible on both mobile and web-based interfaces. Yet user comments suggest that interface design and overall user accessibility do not meet the high standards seen in leading global platforms. Furthermore, the trading environment, especially during periods of high market volatility, is reported to be less than ideal. While the promise of CFD trading is appealing, the technological strength and the suite of integrated trading functionalities seem to need significant improvement. These shortcomings are made worse by the concerns over regulatory limitations and fund security, which further hurt the user's overall trading experience. It is important for potential users to weigh these factors when considering trading on XMR Markets.

Words: ~215

6.5 Trustworthiness Analysis

Trust is a key concern when selecting a trading broker, and it is in this area that XMR Markets appears to struggle significantly. The broker is regulated by the South African Financial Services Committee under license number 46452. However, the extent of this regulation is limited only to South Africa. Different reports and user reviews warn of potential fund safety risks, citing instances where customers expressed concerns over possible misuse or lack of transparency in how client funds are managed. The absence of clear information on fund protection measures, such as segregated accounts or independent audits, makes these worries worse. Furthermore, there is little available insight into the company's financial reporting or management transparency, leaving traders without enough assurance about its long-term stability. Industry observers argue that the broker's relatively low trust score is a serious red flag for anyone thinking about engagement. As such, while the regulatory oversight from the FSCA provides a basic framework of oversight, it is not strong enough to remove widespread concerns. Overall, the persistent safety doubts highlighted in numerous user feedback sessions show that traders must exercise extreme caution. This is especially true if they are considering substantial investments with XMR Markets.

Words: ~210

6.6 User Experience Analysis

When examining the overall user experience provided by XMR Markets, it becomes clear that several factors contribute to a poor trading environment. User satisfaction is notably low, mainly due to persistent concerns about fund security and the perceived risk of scam-like characteristics. Many users report that the registration and verification processes lack clarity and efficiency, which hurts the smooth onboarding of new traders. Furthermore, the interface design and ease of use of the platform have not met user expectations, leaving clients to navigate through complicated menus and unclear instructions. The lack of complete information on deposit and fund withdrawal methods further hurts the user experience, as financial transactions are a critical part of trading confidence. Additionally, the absence of enough educational and research resources leaves traders feeling poorly equipped to make informed decisions, thus affecting their overall satisfaction. In total, these experiences highlight the challenges that many users face when engaging with the platform. It is recommended that for those experienced in forex and cryptocurrency trading, a higher level of watchfulness and thorough research is maintained. This summary of user feedback suggests that XMR Markets would benefit greatly from improvements not only in its platform design but also in its overall transparency and customer support strategies.

Words: ~205

7. Conclusion

In summary, XMR Markets emerges as a controversial broker with several built-in risks, as highlighted in this xmr markets review. Despite achieving regulatory oversight by the FSCA and offering a range of forex and cryptocurrency trading options, the high minimum deposit requirement and serious concerns about fund safety and overall transparency cannot be overlooked. The broker appears most suited to experienced forex and crypto traders who can afford the risk and are capable of navigating the platform's limitations. However, for many investors, particularly those new to the market or with limited capital, the drawbacks seem to outweigh the benefits. It is recommended that potential clients conduct thorough research before committing to trading with XMR Markets.

Words: ~140Optional xmr markets review

All data cited is based on publicly available information and user feedback reports as of the latest compilation in 2025. Different sources indicate variations in details; thus, potential traders are advised to verify current regulatory and operational details before entering into any trading agreement.