Is DRW safe?

Pros

Cons

Is DRW Safe or Scam?

Introduction

DRW, a prominent trading firm established in 1992, has carved a niche in the global financial markets, particularly in the forex sector. Known for its innovative trading strategies and diverse asset offerings, DRW operates as a liquidity provider, engaging in various financial instruments including equities, commodities, and cryptocurrencies. However, the forex market is rife with risks, and traders must exercise caution when selecting a broker. The importance of assessing the legitimacy and safety of a trading platform cannot be overstated, as many unregulated brokers operate in the shadows, potentially exposing investors to significant risks. This article aims to provide a comprehensive analysis of DRW's credibility by examining its regulatory status, company background, trading conditions, customer fund safety, and user experiences. Our investigation is based on a review of multiple credible sources, including regulatory databases, customer feedback, and expert analyses, to ensure a well-rounded evaluation of whether DRW is safe or a scam.

Regulation and Legitimacy

Understanding the regulatory status of a trading firm is crucial for assessing its safety. DRW operates without valid regulation, which raises significant concerns regarding investor protection and operational transparency. Below is a summary of DRW's regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

The absence of regulation means that DRW is not subject to oversight by any governmental or financial authorities, which can lead to a higher likelihood of encountering unethical practices. Furthermore, without regulatory compliance, clients lack access to investor protection schemes, making their funds vulnerable. While DRW has a long-standing presence in the market, its unregulated status is a significant red flag. Historical compliance issues, such as accusations of market manipulation by the CFTC in 2013, further complicate the firms credibility. Although the case was dismissed, it highlights the potential risks associated with trading with an unregulated entity. Therefore, potential investors must weigh these factors carefully when considering whether DRW is safe.

Company Background Investigation

DRW Holdings, LLC, founded by Don Wilson in 1992, has evolved into one of the largest trading firms globally, with a presence in major financial hubs such as Chicago, London, and Singapore. The firm specializes in various asset classes, leveraging advanced technology and quantitative research to drive its trading strategies. However, the ownership structure remains somewhat opaque, with limited information available about its management team and operational practices. This lack of transparency could be a cause for concern for potential clients.

The management team at DRW boasts extensive experience in trading and finance, but the firm's unregulated status raises questions about the level of accountability and oversight in its operations. Transparency in a brokerage's operations and management is critical for building trust with clients. The absence of detailed information regarding the team behind DRW and their qualifications may deter potential investors from engaging with the firm. Therefore, while DRW has a reputable history, its lack of transparency and regulatory oversight is a significant factor in evaluating whether DRW is safe for trading.

Trading Conditions Analysis

When assessing a trading platform, understanding the fee structure and trading conditions is essential. DRW's overall cost structure is not well-documented, leading to potential confusion for clients regarding fees and commissions. The following table summarizes the core trading costs associated with DRW:

| Fee Type | DRW | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | N/A | Varies |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The lack of clear information regarding spreads, commissions, and overnight fees is concerning. Many users have reported difficulties in understanding the fee structure, which can lead to unexpected costs during trading. Moreover, the absence of a transparent commission model may indicate potential hidden fees that could affect profitability. This ambiguity in trading conditions raises questions about whether DRW is safe for traders, especially those who may not be experienced in navigating complex fee structures.

Customer Fund Safety

The safety of customer funds is a paramount concern for any trading platform. DRW's unregulated status poses significant risks regarding fund security. Without proper regulation, there are no guarantees regarding fund segregation, investor protection, or negative balance protection policies. The following points summarize the fund safety measures associated with DRW:

- Fund Segregation: DRW does not provide clear information on whether customer funds are held in segregated accounts, which is a standard practice among regulated brokers to protect client assets.

- Investor Protection: The absence of regulatory oversight means that clients are not protected by compensation schemes, leaving their investments vulnerable to loss in the event of the firm's insolvency.

- Negative Balance Protection: There is no indication that DRW offers negative balance protection, which could leave traders liable for debts exceeding their account balance.

The lack of transparency surrounding these critical aspects of fund safety raises serious concerns about whether DRW is safe for potential investors. Historical issues related to fund withdrawals and customer complaints further exacerbate these concerns, making it essential for prospective clients to proceed with caution.

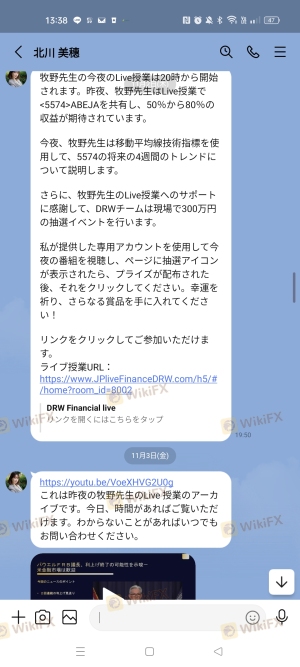

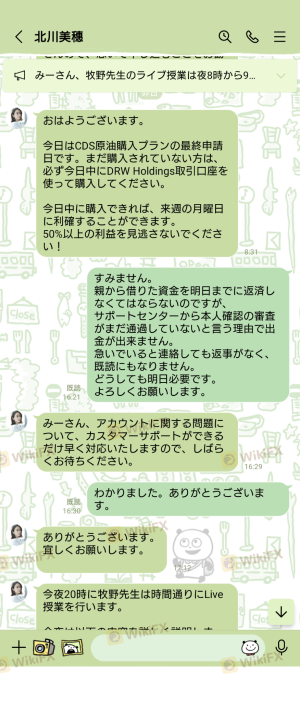

Customer Experience and Complaints

Analyzing customer feedback provides valuable insights into the overall experience of trading with a broker. DRW has received mixed reviews, with several users reporting issues related to fund withdrawals and customer service responsiveness. The following table summarizes common complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Lack of Transparency | Medium | Limited feedback |

| Customer Support | High | Inconsistent |

Many clients have expressed frustration over difficulties in withdrawing funds, often citing slow processing times or unclear withdrawal policies. This pattern of complaints raises significant concerns about the reliability of DRW's services. Furthermore, the company's response to these complaints has been inconsistent, leading to dissatisfaction among users. For instance, one user reported waiting weeks for a withdrawal request to be processed, while another faced challenges in obtaining clear answers regarding their account status. Such experiences contribute to the perception that DRW may not be a safe option for traders seeking reliable and responsive service.

Platform and Execution

The performance of a trading platform is crucial for ensuring a seamless trading experience. DRW's platform has received mixed reviews, with users reporting varying experiences regarding stability and execution quality. Key considerations include:

- Order Execution Quality: Users have reported instances of slippage and order rejections, which can significantly impact trading outcomes. High-frequency traders, in particular, may find these issues detrimental to their strategies.

- Platform Stability: While some users praise the platform's functionality, others have experienced outages during critical trading periods, raising concerns about reliability.

- Signs of Manipulation: There have been anecdotal reports suggesting potential platform manipulation, although concrete evidence is lacking. However, the unregulated nature of DRW raises concerns about the oversight of trading practices.

Overall, while some aspects of DRW's platform may be satisfactory, the mixed feedback and potential issues with execution quality lead to questions about whether DRW is safe for traders who rely on consistent and reliable trading conditions.

Risk Assessment

Engaging with DRW carries inherent risks due to its unregulated status and historical issues. The following risk assessment summarizes key risk areas associated with trading with DRW:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No oversight from financial authorities. |

| Fund Safety Risk | High | Lack of fund segregation and protection. |

| Operational Risk | Medium | Mixed reviews on platform stability. |

| Customer Service Risk | High | Reports of slow response and withdrawal issues. |

Given the high-risk levels associated with regulatory and fund safety concerns, potential investors should approach trading with DRW with caution. To mitigate these risks, it is advisable to conduct thorough research, consider using smaller amounts for initial trades, and maintain a diversified portfolio to reduce exposure.

Conclusion and Recommendations

In conclusion, while DRW has a long-standing history in the trading industry, its unregulated status and the associated risks raise significant concerns about whether DRW is safe for traders. The lack of transparency, mixed customer feedback, and historical issues with fund withdrawals suggest that potential investors should exercise caution. For those considering engaging with DRW, it is crucial to proceed with due diligence and be aware of the potential risks involved.

For traders seeking reliable alternatives, it is recommended to consider regulated brokers with robust investor protection measures in place. Brokers regulated by reputable authorities can provide a safer trading environment, ensuring that client funds are protected and that there is recourse in case of disputes. Overall, while DRW may offer certain trading opportunities, the associated risks and concerns indicate that it may not be the best choice for every trader.

Is DRW a scam, or is it legit?

The latest exposure and evaluation content of DRW brokers.

DRW Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

DRW latest industry rating score is 1.37, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.37 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.