Is Kaerm IM safe?

Business

License

Is Kaerm IM Safe or a Scam?

Introduction

Kaerm IM is a relatively new player in the forex market, having launched its operations in September 2023. As a contract for difference (CFD) broker, it offers a range of trading services across various asset classes, including forex, commodities, and cryptocurrencies. However, the rapid emergence of new brokers like Kaerm IM raises concerns among traders about their legitimacy and operational integrity. In an industry rife with scams and unregulated entities, it is crucial for traders to conduct thorough evaluations before committing their funds. This article aims to provide a comprehensive analysis of Kaerm IMs credibility by examining its regulatory status, company background, trading conditions, client fund safety, customer experiences, and overall risk profile.

Regulation and Legitimacy

The regulatory framework within which a broker operates is a significant indicator of its legitimacy. Kaerm IM claims to be regulated by the Financial Crimes Enforcement Network (FinCEN) in the United States, which is primarily focused on preventing money laundering and other financial crimes. However, it is essential to note that FinCEN does not regulate trading activities in derivatives, such as CFDs, which raises questions about the broker's operational compliance.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FinCEN | 31000255528484 | USA | Regulated, but not for CFDs |

Despite being registered with FinCEN, Kaerm IM is not a member of the National Futures Association (NFA), which is a significant regulatory body for forex and futures trading in the U.S. This lack of NFA membership is a red flag, as it indicates that Kaerm IM does not adhere to the stringent standards set by this authority. Furthermore, the brokers website shares a similar design template with several other dubious brokers, suggesting a potential strategy to mislead investors. Therefore, the question remains: Is Kaerm IM safe given its questionable regulatory status?

Company Background Investigation

Kaerm IM presents itself as a significant entity in the financial services sector, claiming to be one of the largest firms in Oklahoma. However, the lack of verifiable information regarding its ownership structure and management team raises concerns about its transparency. The brokers website does not provide detailed insights into its history, development, or the backgrounds of its key personnel, which are crucial for assessing the firm's credibility.

The absence of transparent information can lead to skepticism among potential clients. A reputable broker typically discloses its management team's qualifications and experiences, along with a history of corporate governance. Without such disclosures, it is challenging to ascertain the legitimacy of Kaerm IM's operations. In light of this, traders should be cautious and consider whether they can trust a broker that lacks clear information about its management and ownership.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is vital. Kaerm IM claims to offer competitive trading fees, including floating spreads as low as 1 pip and leverage ratios ranging from 1:100 to 1:500. However, the website lacks detailed information on minimum deposits, commissions, and other essential trading costs, which is atypical for a reputable broker.

| Fee Type | Kaerm IM | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1 pip | 1-2 pips |

| Commission Model | Not specified | Varies widely |

| Overnight Interest Range | Not specified | Varies widely |

The lack of transparency regarding commissions and overnight interest rates can lead to unexpected costs for traders, which is a significant concern. Furthermore, the absence of a well-known trading platform, as Kaerm IM uses a proprietary web-based platform, raises questions about the reliability and execution quality of trades. Traders may face risks associated with price manipulation and high trading fees, making it essential to evaluate whether Kaerm IM is safe for trading.

Client Fund Safety

Client fund safety is a paramount concern for traders, and it is essential to assess how Kaerm IM handles client funds. The broker does not provide clear information regarding fund segregation, investor protection measures, or negative balance protection policies. In the event of a financial crisis or insolvency, the lack of such safeguards can jeopardize client investments.

Historically, brokers without robust fund protection measures have faced severe scrutiny and legal actions, leading to significant financial losses for their clients. Therefore, potential clients must question whether Kaerm IM has implemented adequate safety protocols to protect their investments. The absence of a clear strategy for fund safety raises alarms about the broker's reliability.

Customer Experience and Complaints

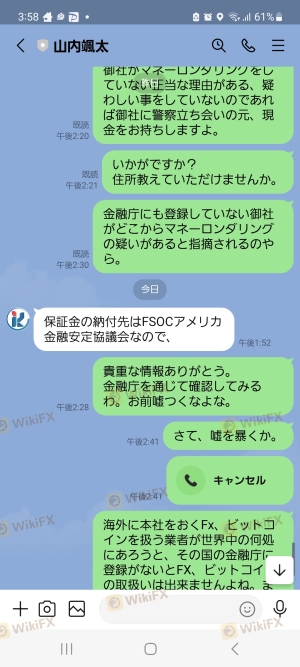

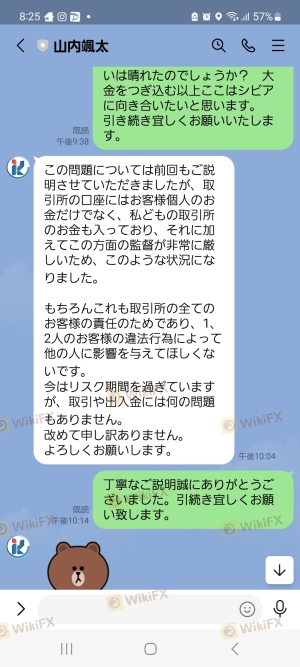

Analyzing customer feedback is critical in assessing the credibility of a broker. Many reviews and reports indicate that Kaerm IM has received a significant number of complaints, primarily related to withdrawal issues and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Unresponsive |

| Poor Customer Support | Medium | Slow response |

Common complaints include difficulties in withdrawing funds and a lack of responsive customer support. These issues can significantly impact the trading experience and raise concerns about the brokers operational integrity. In some cases, users have reported unresponsive customer service, leading to frustration and distrust. Such patterns of complaints further exacerbate the question: Is Kaerm IM safe for traders?

Platform and Trade Execution

The quality of a trading platform is a crucial factor that can influence a trader's success. Kaerm IM utilizes a proprietary web-based trading platform, which may not have the same level of reliability and features as established platforms like MetaTrader 4 or 5. Feedback regarding the platform's performance indicates that users have experienced issues with order execution, including slippage and order rejections.

The potential for price manipulation and high trading fees on a proprietary platform poses risks that traders should consider. Without a transparent and well-supported trading environment, the likelihood of encountering execution issues increases, which can adversely affect trading outcomes.

Risk Assessment

Given the various concerns surrounding Kaerm IM, it is essential to conduct a comprehensive risk assessment. The following risk scorecard summarizes the key risk areas associated with the broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Lack of NFA membership and unclear status |

| Fund Safety | High | Unclear fund segregation and protection |

| Customer Support | Medium | Frequent complaints about withdrawal issues |

| Platform Reliability | High | Proprietary platform raises execution concerns |

To mitigate these risks, potential traders are advised to thoroughly investigate the broker's reputation, read customer reviews, and consider using a demo account before committing significant capital.

Conclusion and Recommendations

In conclusion, the investigation into Kaerm IM raises several red flags regarding its legitimacy and safety as a trading platform. The broker's regulatory status is questionable, with a lack of oversight from key authorities like the NFA. Furthermore, the absence of transparency about trading conditions, fund safety measures, and customer support issues further complicates the assessment of whether Kaerm IM is safe.

Given the potential risks associated with trading through Kaerm IM, it is advisable for traders to exercise caution. Those seeking reliable trading opportunities may consider alternative brokers that are well-regulated and have a proven track record of client satisfaction. Reputable options include brokers regulated by top-tier authorities such as the FCA, ASIC, or SEC, which offer greater security and transparency for traders.

Is Kaerm IM a scam, or is it legit?

The latest exposure and evaluation content of Kaerm IM brokers.

Kaerm IM Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Kaerm IM latest industry rating score is 1.37, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.37 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.