PNX Finance 2025 Review: Everything You Need to Know

Executive Summary

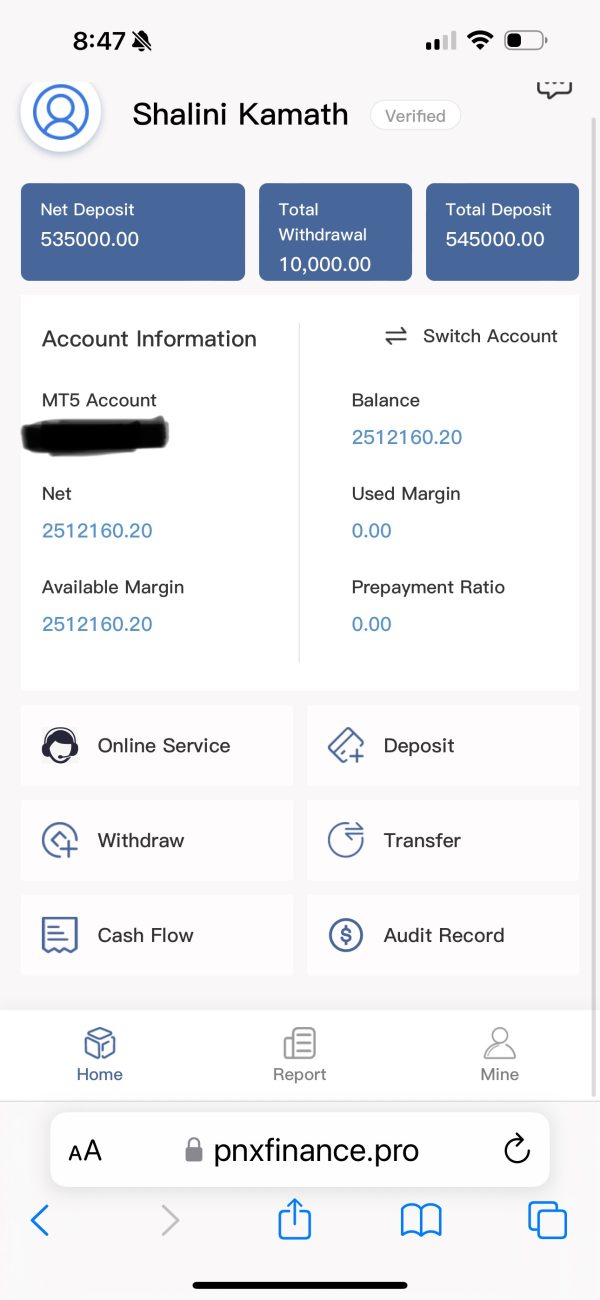

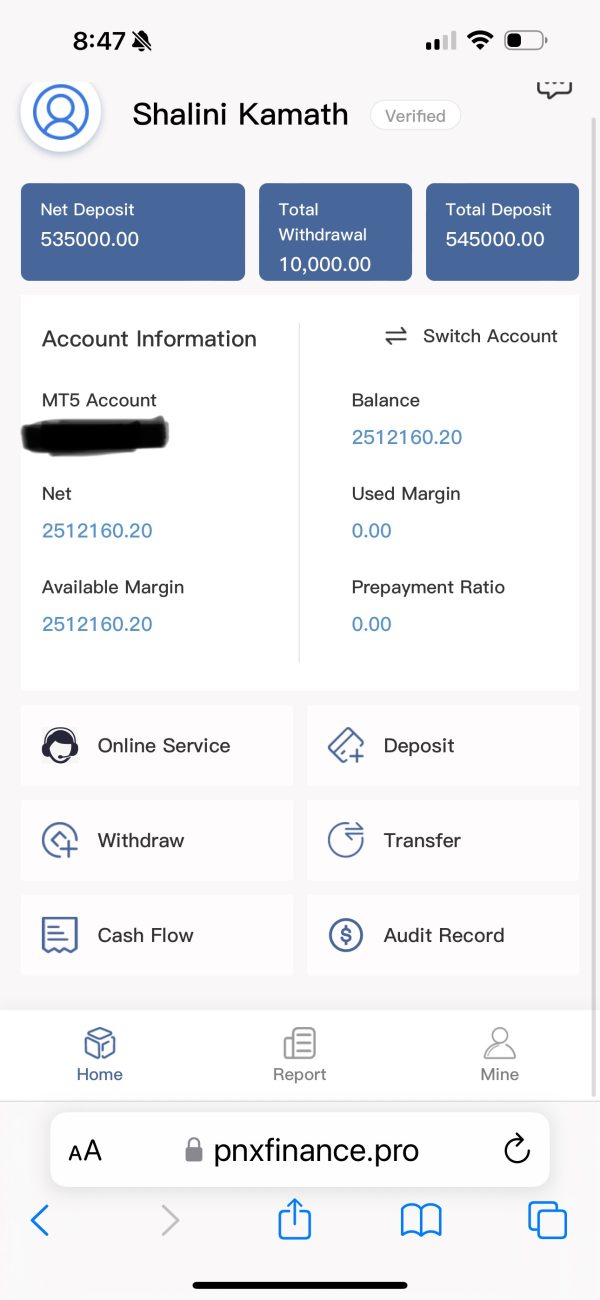

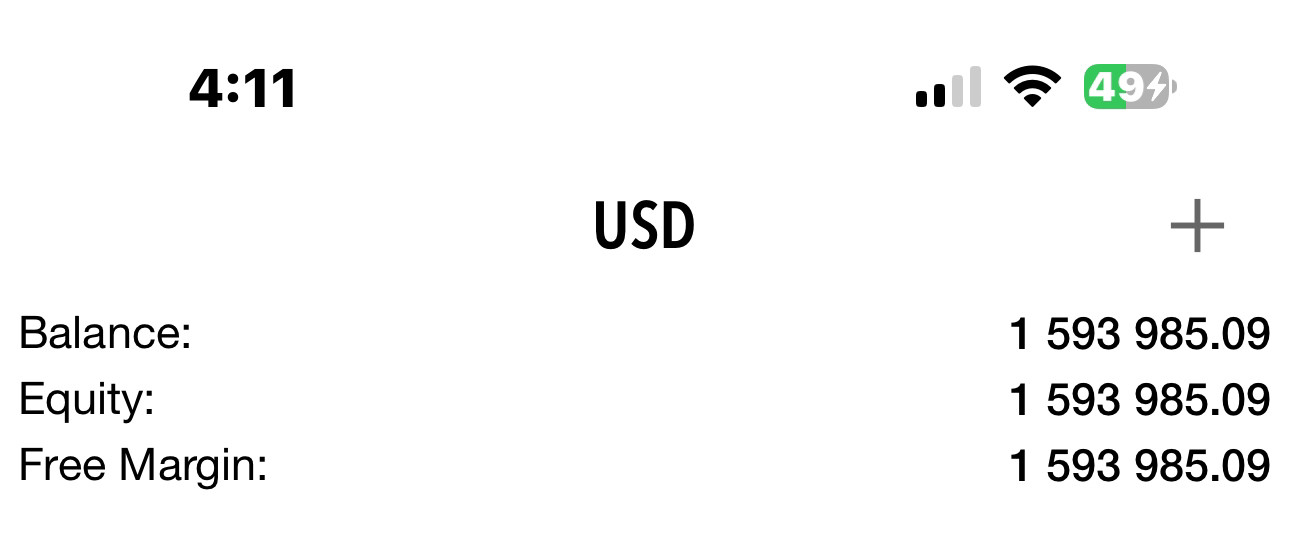

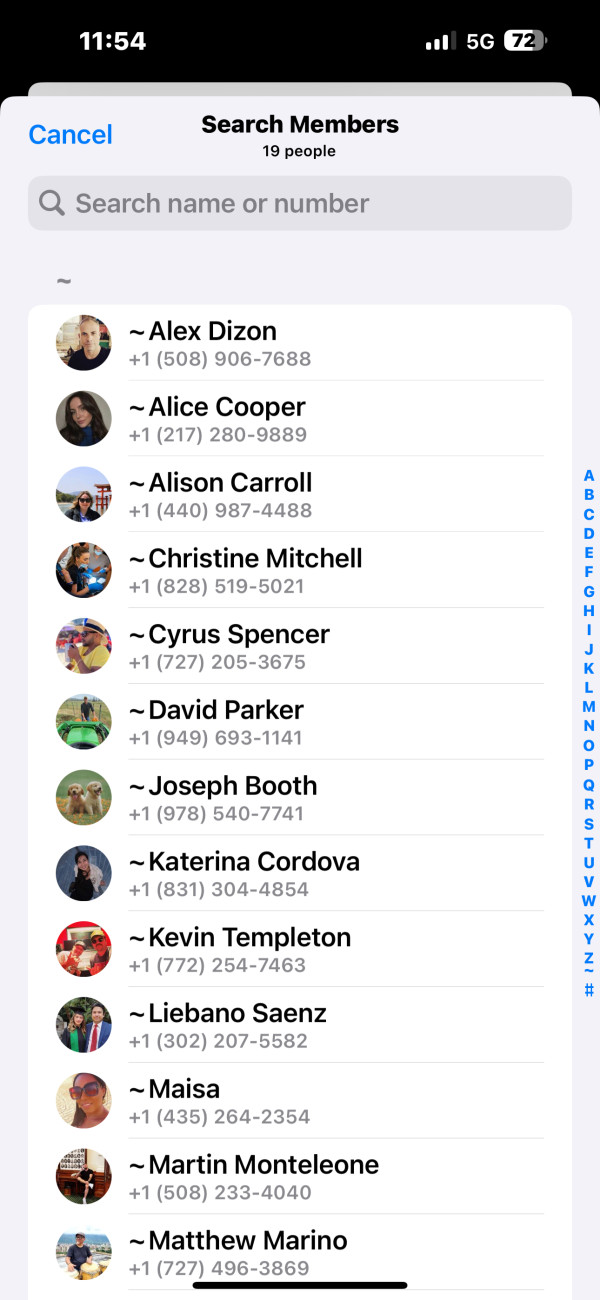

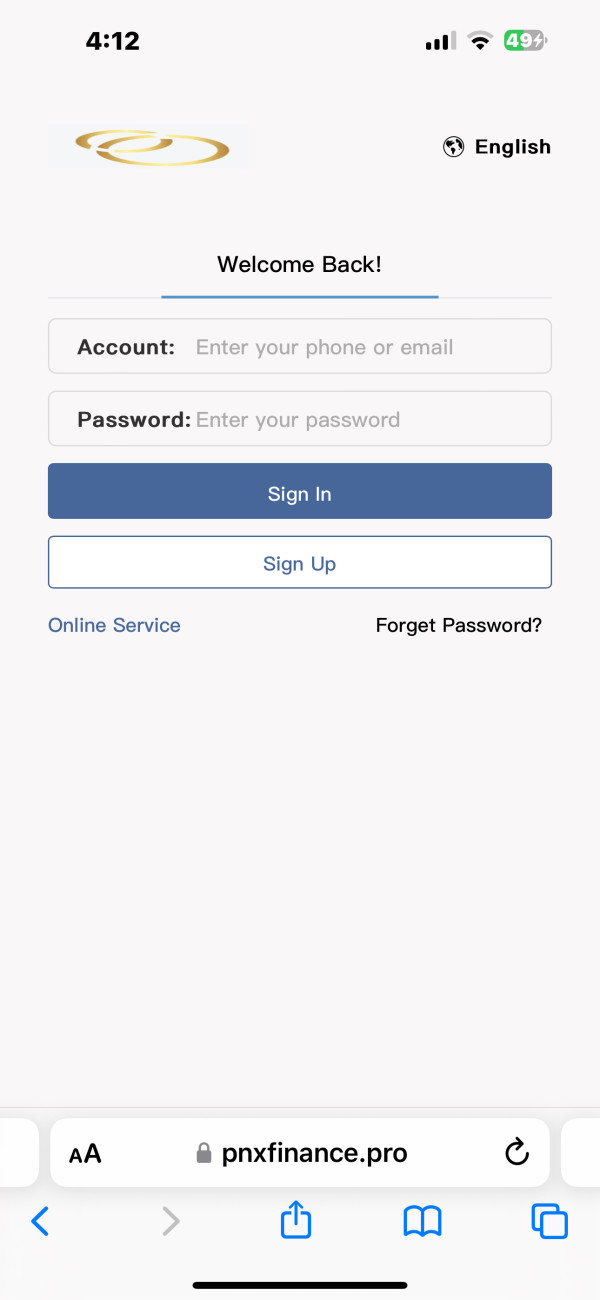

This PNX Finance review shows a broker that creates big risks for traders. PNX Finance is a high-risk platform with possible fraud and very little transparency. The company says it started in 2012, but it really registered in 2023. It offers forex, gold, and index trading services. The broker targets forex traders with promises of many trading chances, but evidence suggests it is bad for most users because of regulatory problems and negative user feedback.

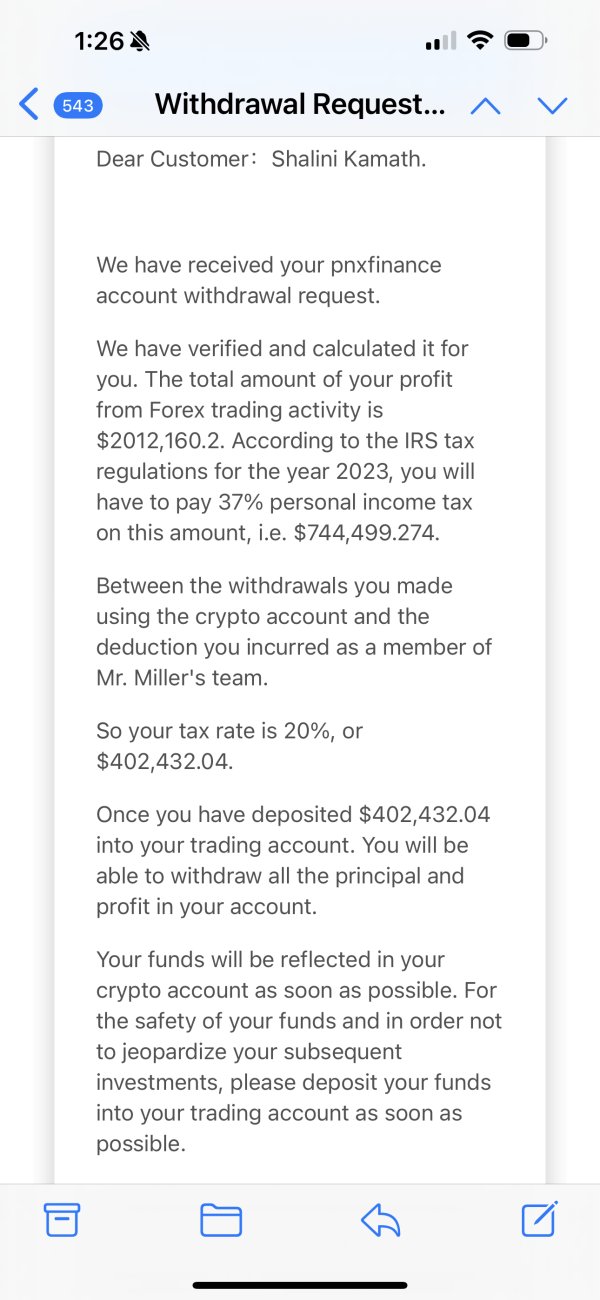

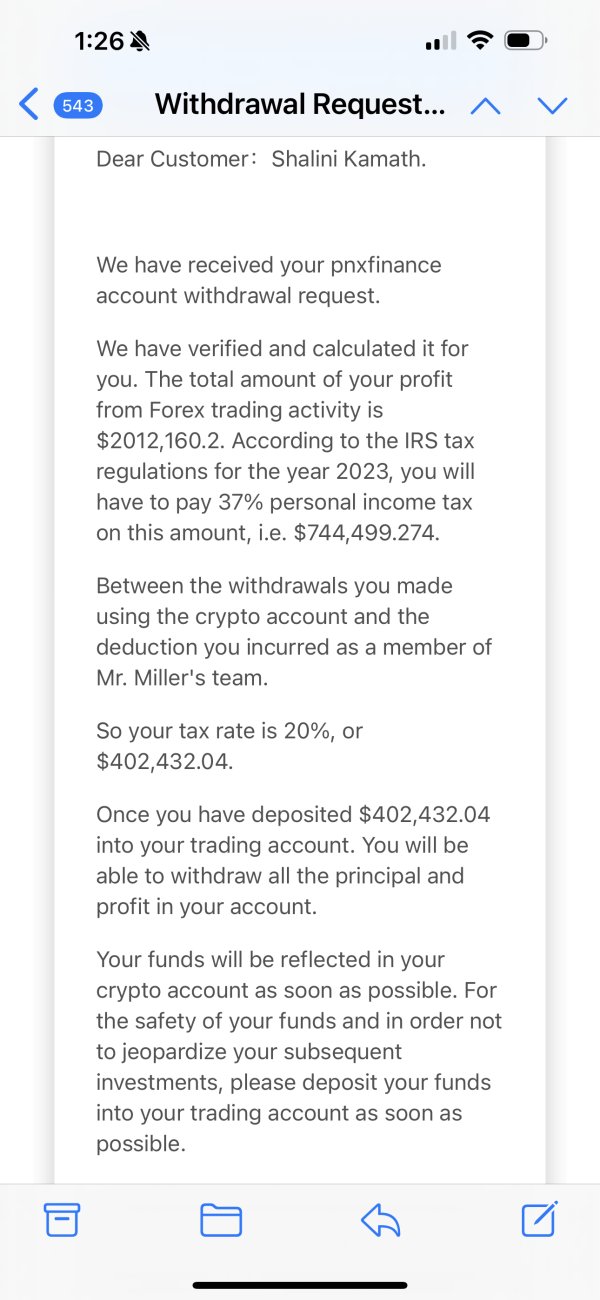

Fraud recovery experts have flagged PNX Finance for risky broker practices. Many user complaints point to possible scam operations. The platform lacks proper regulatory oversight and clear business practices, making it dangerous for both new and experienced traders who want reliable trading services.

Important Notice

Regional Entity Differences: PNX Finance is registered in Colorado, United States, but it lacks clear regulatory licensing from established financial authorities. Traders should know that the company's registration status does not guarantee regulatory compliance or consumer protection.

Review Methodology: This evaluation uses available information summaries, user feedback, and industry assessments. Due to limited transparent information from the broker itself, this review relies heavily on third-party sources and user complaints to provide an accurate assessment.

Rating Framework

Broker Overview

PNX Finance presents itself as an established financial services provider. It claims to have been founded in 2012. However, official records show the company actually registered in 2023, which raises immediate concerns about the broker's transparency and credibility. The company is headquartered in Colorado, United States, and positions itself as a comprehensive forex and financial trading service provider.

This difference between claimed establishment date and actual registration highlights the broker's questionable approach to presenting company information. The broker operates as a forex trading platform offering multiple financial instruments, but it lacks effective regulatory oversight that would typically protect trader interests. According to available information, PNX Finance provides access to foreign exchange markets, precious metals trading, and stock index instruments.

However, the absence of clear regulatory licensing and concerning feedback from users suggest that the broker's business model may not align with industry best practices or trader protection standards.

Regulatory Status: PNX Finance is registered in Colorado, United States, but specific information about regulatory licensing from established financial authorities is not mentioned in available sources.

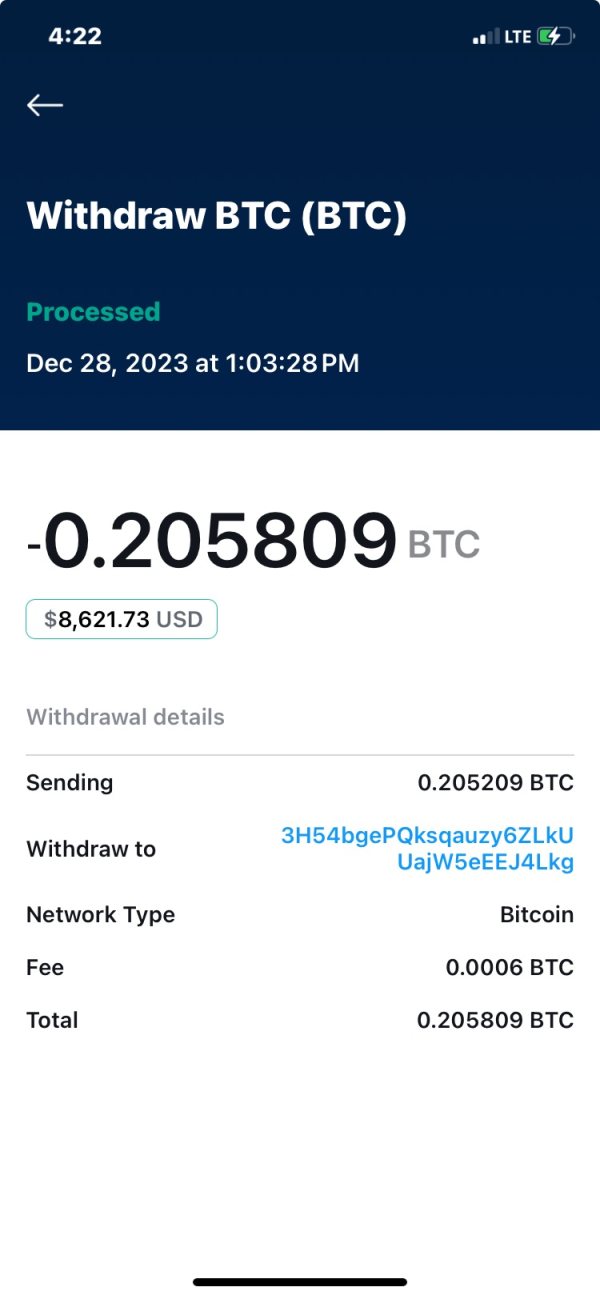

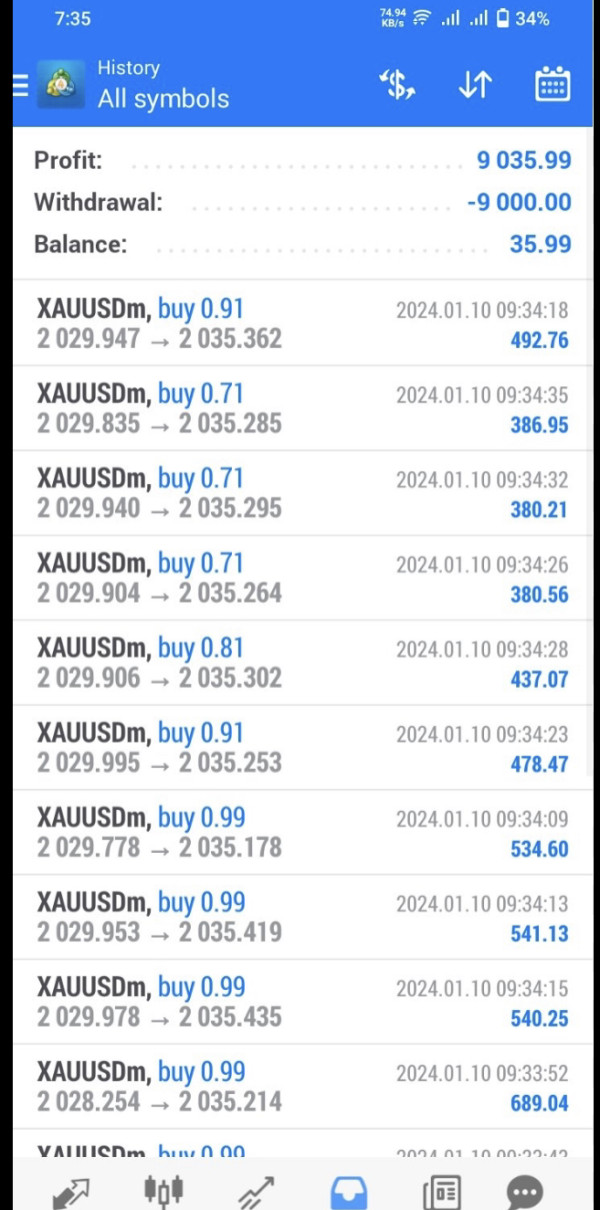

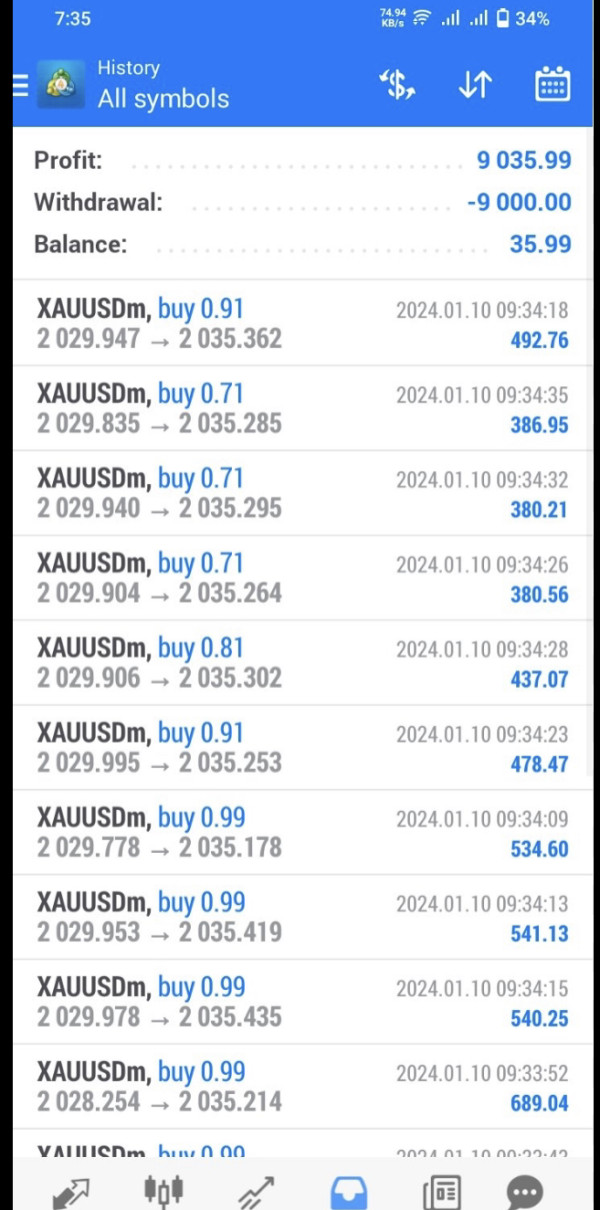

Deposit and Withdrawal Methods: The available information summary does not provide details about specific deposit and withdrawal options offered by the broker.

Minimum Deposit Requirements: Specific minimum deposit requirements are not disclosed in the available information sources.

Bonuses and Promotions: No information about bonus offers or promotional activities is mentioned in the current PNX Finance review materials.

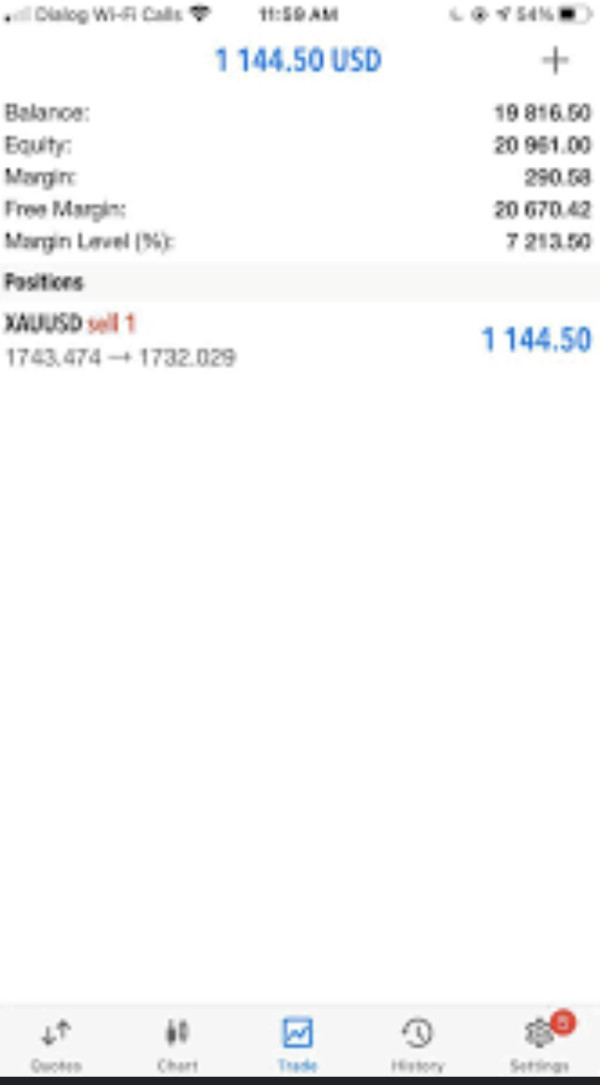

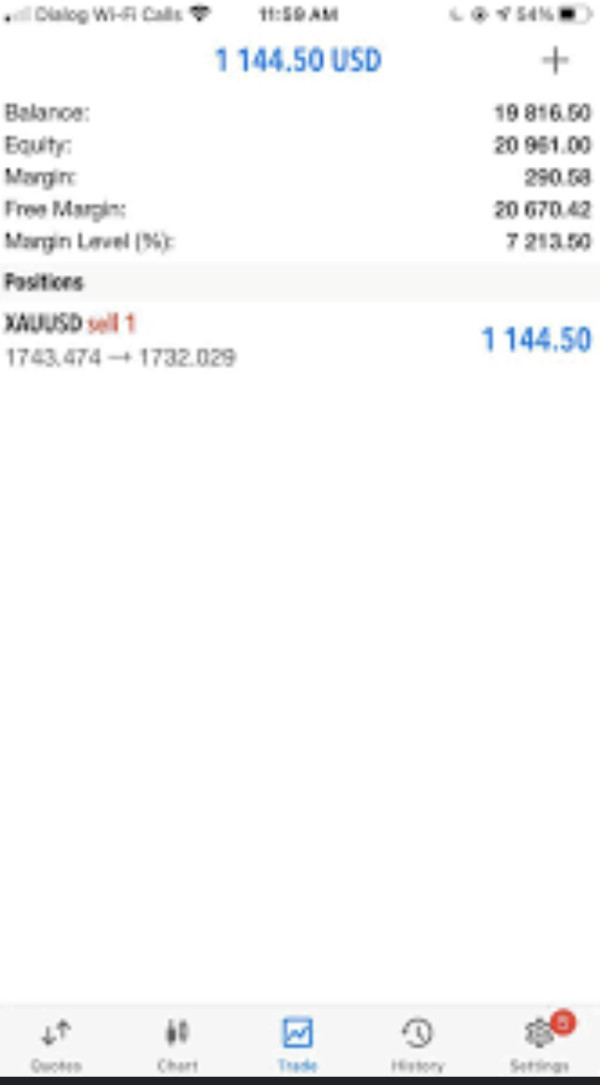

Tradeable Assets: The broker offers trading in forex pairs, gold, and various stock indices. This provides access to multiple financial markets.

Cost Structure: Detailed information about spreads, commissions, and other trading costs is not specified in available sources.

Leverage Ratios: Specific leverage offerings are not mentioned in the information summary.

Platform Options: Trading platform details and options are not clearly specified in available materials.

Regional Restrictions: Geographic limitations for service availability are not detailed in current sources.

Customer Service Languages: Supported languages for customer service are not specified.

Detailed Rating Analysis

Account Conditions Analysis (Score: 2/10)

The account conditions offered by PNX Finance receive a poor rating due to the complete lack of transparency regarding account types and their specific features. Available information sources do not mention different account tiers, their respective benefits, or the criteria for accessing various account levels. This absence of clear account structure information makes it impossible for potential traders to make informed decisions about which account type might suit their trading needs.

The minimum deposit requirements, which are fundamental to account opening decisions, are not disclosed in any available materials. This lack of transparency extends to account opening procedures, with no clear information about the verification process, required documentation, or timeframes for account activation. The PNX Finance review materials consistently point to this opacity as a significant red flag for potential users.

Without clear account condition details, traders cannot assess whether the broker's offerings align with their trading capital, experience level, or strategic requirements. This information gap, combined with the broker's questionable regulatory status, contributes to the low rating in this critical evaluation dimension.

PNX Finance's tools and resources receive a very low rating due to the absence of information about trading tools, analytical resources, and educational materials. The available information summary does not mention specific trading tools such as technical analysis software, market research capabilities, or advanced order management systems that are typically expected from legitimate forex brokers.

Educational resources, which are crucial for trader development and success, are not described in any available materials. This includes the absence of information about webinars, trading guides, market analysis reports, or educational content that would help traders improve their skills and market understanding. The lack of such resources suggests either their non-existence or the broker's failure to properly communicate their availability.

Automated trading support, including expert advisor compatibility and algorithmic trading capabilities, is not mentioned in the available sources. This absence of information about modern trading tools and educational support significantly impacts the broker's utility for both novice and experienced traders.

Customer Service and Support Analysis (Score: 3/10)

Customer service and support receive a below-average rating based on available user feedback and the general lack of information about support channels. While specific customer service channels are not detailed in available materials, user complaints suggest significant issues with support quality and responsiveness. Multiple sources indicate that users have experienced difficulties with customer service, particularly regarding withdrawal issues and account management.

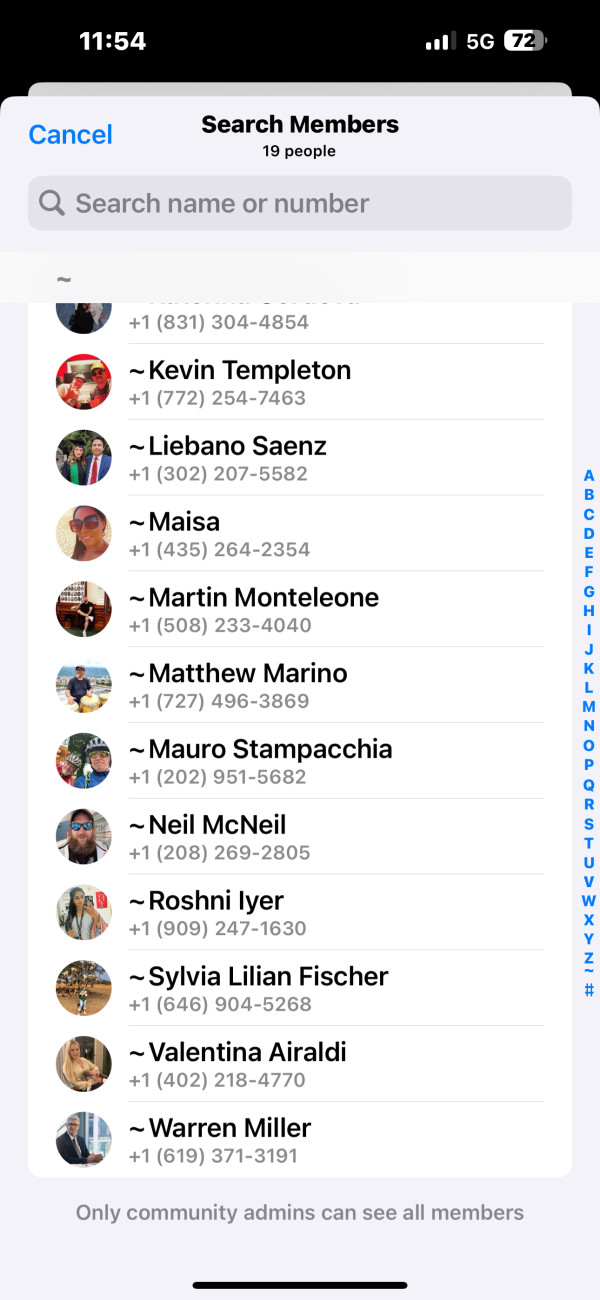

According to fraud recovery experts, there have been complaints about PNX Finance's handling of customer issues, with some users alleging fraudulent behavior. The response time for customer inquiries and the quality of support provided appear to be inadequate based on available user feedback. The absence of clear information about support channels, operating hours, and multilingual support capabilities further contributes to the poor rating.

The lack of transparent communication about customer service capabilities, combined with negative user experiences reported in various sources, indicates that PNX Finance may not provide the level of support that traders require for successful trading operations.

Trading Experience Analysis (Score: 3/10)

The trading experience with PNX Finance receives a below-average rating due to limited information about platform stability, execution quality, and overall trading environment. Available sources do not provide specific details about platform performance, order execution speeds, or the reliability of trading systems. This lack of technical performance data makes it difficult to assess the actual trading experience users can expect.

User feedback suggests concerns about the overall trading environment, with some reporting negative experiences that extend beyond simple platform functionality issues. The absence of information about mobile trading capabilities, platform features, and trading tools integration suggests either poor development of these aspects or inadequate communication about available features.

The PNX Finance review materials consistently point to user dissatisfaction with various aspects of the trading experience, though specific technical details are not provided. Without clear information about platform capabilities and with negative user sentiment, the trading experience appears to fall short of industry standards.

Trust and Security Analysis (Score: 1/10)

Trust and security receive the lowest possible rating due to multiple red flags identified in available assessments. PNX Finance has been evaluated as a high-risk platform with potential fraudulent practices, according to fraud recovery experts. The broker's lack of transparency about its regulatory status and the discrepancy between claimed establishment date and actual registration date significantly undermine trust.

The absence of information about fund security measures, client fund segregation, and regulatory protections creates serious concerns about trader safety. Industry assessments consistently classify PNX Finance as a risky broker, with warnings about potential fraudulent activities. The lack of proper regulatory oversight means traders have limited recourse in case of disputes or fund recovery issues.

User complaints about potential scam behavior, combined with the broker's poor transparency and questionable regulatory status, make PNX Finance a high-risk choice for any trader concerned about fund security and regulatory protection.

User Experience Analysis (Score: 2/10)

User experience receives a poor rating based on predominantly negative user feedback and concerns about overall platform usability. Available user reviews and complaints suggest widespread dissatisfaction with various aspects of the PNX Finance service, ranging from account management issues to concerns about fund safety. The overall user sentiment appears to be overwhelmingly negative, with multiple complaints about the broker's practices.

The registration and verification process details are not clearly described in available materials, making it difficult for potential users to understand what to expect when opening an account. This lack of clarity about basic procedures contributes to user confusion and frustration. Fund operation experiences, particularly regarding withdrawals, appear to be problematic based on user complaints.

The user profile analysis suggests that PNX Finance is not suitable for most types of traders, particularly those new to forex trading who require reliable platforms and strong regulatory protection. The negative feedback pattern indicates systemic issues with user satisfaction and service delivery.

Conclusion

This comprehensive PNX Finance review reveals a broker that poses significant risks to traders across multiple dimensions. The platform demonstrates a concerning lack of transparency, questionable regulatory status, and predominantly negative user feedback. While PNX Finance claims to offer trading in multiple asset classes including forex, gold, and indices, the absence of proper regulatory oversight and transparent business practices makes it unsuitable for most traders.

The broker is particularly inappropriate for novice traders who require strong regulatory protection and reliable customer support. Even experienced traders should exercise extreme caution given the high-risk assessment and potential for fraudulent practices. The main advantage of diverse asset offerings is heavily outweighed by significant disadvantages including lack of transparency, poor regulatory status, and negative user experiences that suggest potential scam operations.