Is Standard Guarantee Trading Pro safe?

Business

License

Is Standard Guarantee Trading Pro Safe or a Scam?

Introduction

Standard Guarantee Trading Pro positions itself as an online broker in the forex market, claiming to provide a platform for trading various financial instruments, including currencies, commodities, and cryptocurrencies. However, the growing number of online trading platforms has led to increased scrutiny, as traders must be cautious when selecting a broker. The need for due diligence is critical, as many platforms operate without proper regulation, potentially leading to significant financial losses. In this article, we will investigate the safety and legitimacy of Standard Guarantee Trading Pro, utilizing information gathered from various sources, including regulatory warnings, user reviews, and expert analyses. Our evaluation framework will focus on regulatory compliance, company background, trading conditions, customer safety, and overall user experience.

Regulation and Legitimacy

The regulatory status of a trading platform is paramount in assessing its safety and legitimacy. Standard Guarantee Trading Pro has been flagged by the UK's Financial Conduct Authority (FCA) as an unauthorized firm, indicating that it operates without the necessary licensing to provide financial services. This lack of regulation raises significant red flags for potential investors, as unregulated brokers are not held accountable to any governing body, making it difficult for traders to recover their funds in case of disputes.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Conduct Authority (FCA) | N/A | United Kingdom | Blacklisted |

The FCA's warning highlights the importance of engaging only with authorized firms, as this provides a level of protection for traders. Without such oversight, clients of Standard Guarantee Trading Pro may find themselves vulnerable to fraud and malpractice. The absence of regulatory compliance not only undermines the credibility of this broker but also suggests a pattern of operational misconduct that could jeopardize clients' investments.

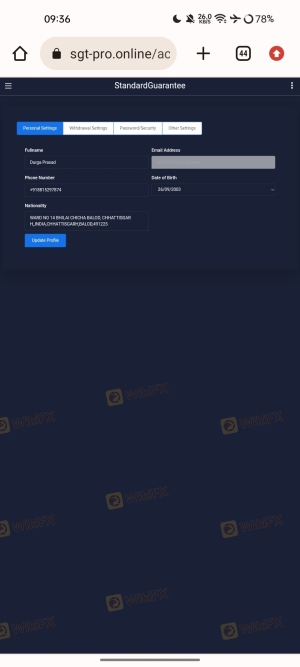

Company Background Investigation

A thorough examination of Standard Guarantee Trading Pro reveals a concerning lack of transparency regarding its ownership and management structure. The firm claims to be based in Greenville, USA, but there is scant information available about its founding, history, or the individuals behind its operations. This anonymity is a significant cause for concern, as reputable brokers typically provide clear information about their management team and corporate structure.

The absence of a well-defined management team raises questions about the qualifications and experience of those running the firm. In the financial industry, a knowledgeable and experienced management team is essential for ensuring compliance with regulations and maintaining operational integrity. Furthermore, without a clear ownership structure, clients may find it difficult to hold anyone accountable in the event of disputes or misconduct.

Trading Conditions Analysis

The trading conditions offered by Standard Guarantee Trading Pro warrant careful consideration. While the broker advertises competitive spreads and low fees, the reality may be quite different. Many unregulated brokers employ deceptive pricing strategies designed to lure in traders, only to impose hidden fees once funds have been deposited.

| Fee Type | Standard Guarantee Trading Pro | Industry Average |

|---|---|---|

| Spread on Major Pairs | Varies (often high) | 1.0 pips |

| Commission Structure | Unclear | $5 per lot |

| Overnight Interest Range | N/A | Varies |

The lack of clarity around fees is particularly troubling, as traders may face unexpected costs that significantly impact their profitability. Furthermore, the absence of a transparent commission structure raises doubts about the broker's intentions, suggesting that clients may be subjected to unfavorable trading conditions.

Customer Funds Safety

When evaluating the safety of a trading platform, the security of customer funds is a critical aspect. Standard Guarantee Trading Pro's lack of regulation means that it is not required to implement robust security measures, such as segregating client funds from operational funds. This practice is vital in protecting clients' investments in the event of the broker's insolvency.

Moreover, the absence of investor protection schemes, such as the Financial Services Compensation Scheme (FSCS) in the UK, leaves clients without any recourse if the broker fails or engages in fraudulent activities. Historical data indicates that unregulated brokers often experience financial difficulties, leading to the potential loss of client funds without any means of recovery.

Customer Experience and Complaints

User feedback is a valuable indicator of a broker's reliability and overall service quality. In the case of Standard Guarantee Trading Pro, numerous complaints have surfaced regarding withdrawal issues, poor customer service, and unresponsive support teams.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Difficulties | High | Slow to respond |

| Poor Customer Support | Medium | Often unhelpful |

| Misleading Information | High | No clear response |

Many users have reported their inability to withdraw funds, citing excuses such as system errors or excessive fees. These types of complaints are common among unregulated brokers, as they often employ tactics to delay or deny withdrawals to retain client funds. The overall sentiment among users suggests a lack of trust in the platform, which is a significant red flag for potential investors.

Platform and Trade Execution

The performance and reliability of a trading platform are crucial for a positive trading experience. Standard Guarantee Trading Pro claims to offer a user-friendly interface and various trading tools; however, user reviews indicate that the platform suffers from stability issues and frequent downtime.

Additionally, concerns regarding order execution quality, including slippage and rejections, have been reported. These issues can severely impact traders' abilities to execute their strategies effectively, leading to potential losses. If the platform exhibits signs of manipulation or unfair practices, it further confirms the need for caution.

Risk Assessment

Engaging with Standard Guarantee Trading Pro presents various risks that traders should be aware of. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Operates without necessary licenses |

| Fund Security | High | No investor protection or fund segregation |

| Customer Support | Medium | Poor response times and unresolved complaints |

| Trading Conditions | High | Unclear fee structures and potential hidden costs |

To mitigate these risks, potential traders are advised to conduct thorough research and consider alternative, regulated brokers that provide a safer trading environment.

Conclusion and Recommendations

In conclusion, the evidence suggests that Standard Guarantee Trading Pro is not a safe trading platform. The lack of regulatory oversight, transparency, and numerous user complaints raise serious concerns about its legitimacy. Traders should exercise extreme caution when considering this broker, as it exhibits several characteristics commonly associated with scams.

For those seeking a reliable trading experience, it is advisable to choose brokers with strong regulatory frameworks, transparent fee structures, and positive user feedback. Alternatives such as regulated brokers with established reputations can provide a safer environment for trading and better protection for client funds. Always prioritize safety and due diligence when engaging with any financial platform.

Is Standard Guarantee Trading Pro a scam, or is it legit?

The latest exposure and evaluation content of Standard Guarantee Trading Pro brokers.

Standard Guarantee Trading Pro Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Standard Guarantee Trading Pro latest industry rating score is 1.37, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.37 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.