promarkets finance 2025 Review: Everything You Need to Know

Abstract

The promarkets finance review shows a bad picture of ProMarkets Finance. This unregulated forex broker has serious problems with trust and legitimacy that experts are questioning. The platform gets poor ratings overall because it has no regulatory oversight and users give it bad reviews. Investors should be very careful, especially those who want to trade forex and cryptocurrency. The platform doesn't share important information about spreads, commissions, minimum deposits, and leverage, which makes it even more risky. Users complain about poor account conditions, slow customer support, and bad trading experiences, so ProMarkets Finance doesn't have the basic transparency and security that modern financial platforms should have. Industry experts say that without regulatory control, people can lose money more easily and the platform might be accused of fraud. This promarkets finance review warns potential investors to find safer and more reliable trading partners.

Notice

ProMarkets Finance doesn't specify any regulation jurisdiction, which is important to know. Without clear oversight, users from different regions may face different legal risks when they use the platform. The ratings and analyses in this review come from user feedback and public information to help potential investors make smart decisions. Since there's no verifiable regulatory backing, users must do their own research before proceeding. This analysis uses only publicly available data and reported experiences, so it should not be taken as professional financial advice.

Rating Framework

Broker Overview

ProMarkets Finance is an online broker that has come under intense scrutiny recently. The company has serious problems because it's unregulated and uses questionable business practices. The company doesn't share specific details about when it was founded, its background, or how it operates, but early research shows that it works without backing from any recognized regulatory entity. This lack of regulatory oversight is one of the main concerns that users and market analysts have raised. The broker claims to serve traders who are interested in both forex and cryptocurrency markets, but there's no public information about how they actually operate, which makes people doubt whether the broker is legitimate. As a result, most people in the community have negative feelings about it because potential investors face significant uncertainty and risk when they use the platform.

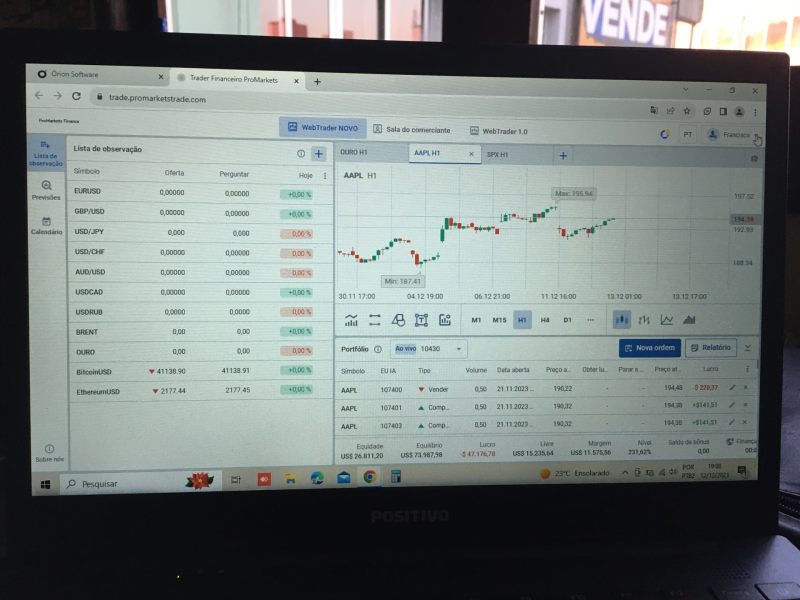

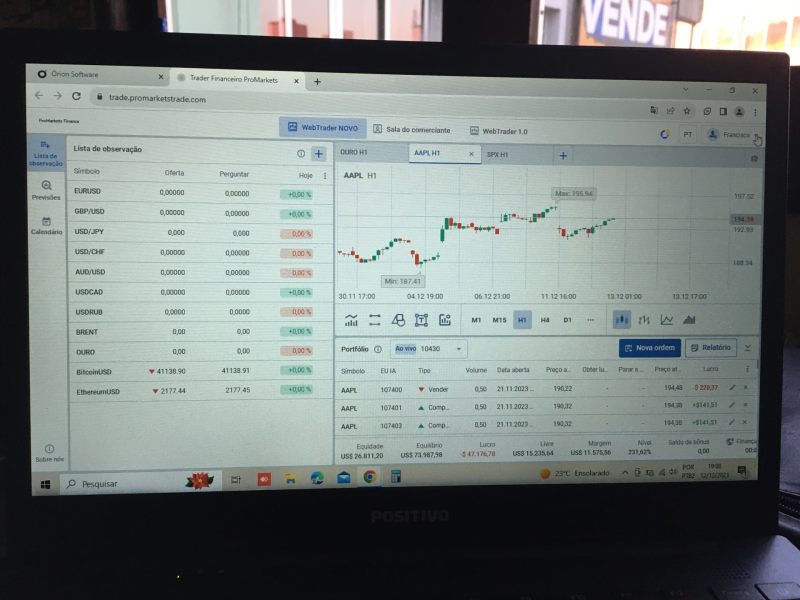

The promarkets finance review also highlights more unclear issues about the trading conditions and support that the broker offers. ProMarkets Finance seems to try to copy established forex trading platforms, but important details like which specific platforms they use, what types of assets they offer, or any special trading tools are clearly missing. The broker mainly offers trading in forex and cryptocurrencies, but details about the technology that powers these services remain unclear. This lack of transparency, combined with its unregulated status, continues to hurt user confidence. The absence of solid regulatory credentials puts ProMarkets Finance at a disadvantage compared to reputable institutions, which makes potential investors question whether it can protect their investments effectively. These missing details and uncertainties appear throughout this promarkets finance review.

ProMarkets Finance is notably unregulated and has no connection to any recognized regulatory authority. This means the company operates in regulatory grey areas, which leaves investors exposed to higher risks without the reassurance that comes from supervision by respected financial regulatory bodies.

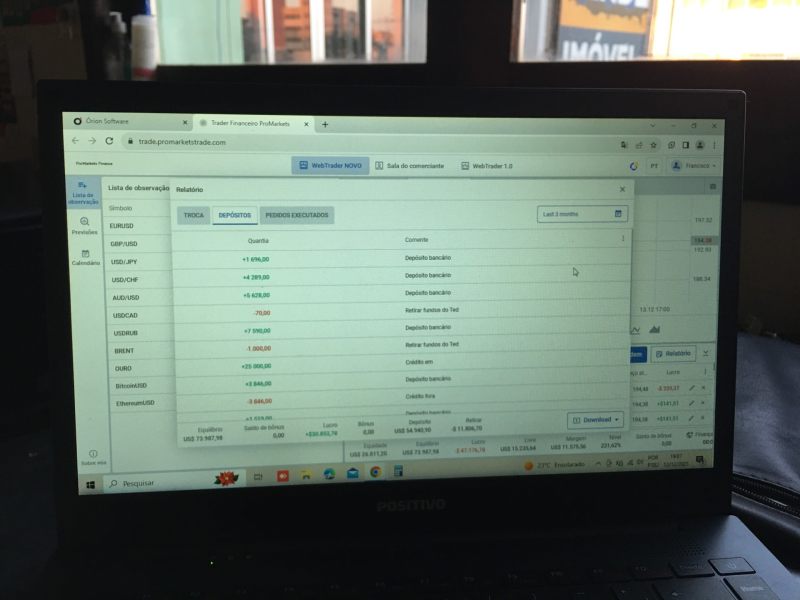

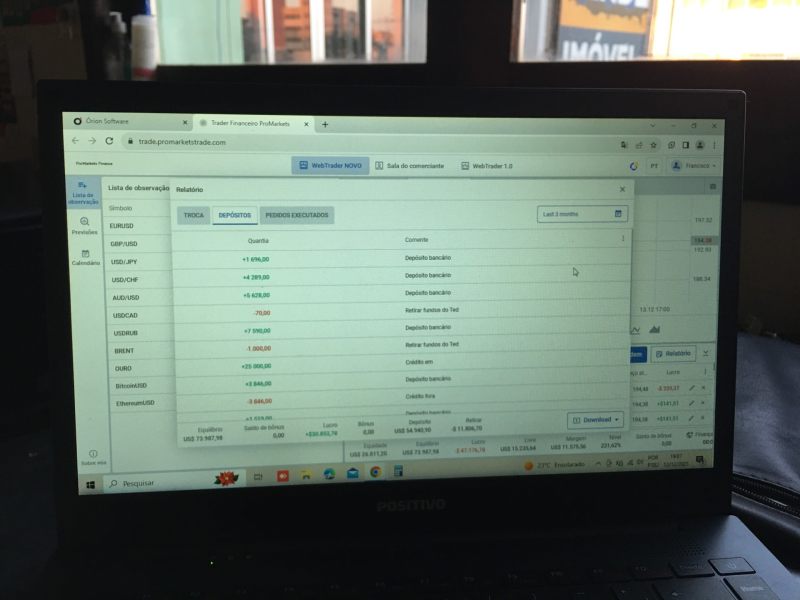

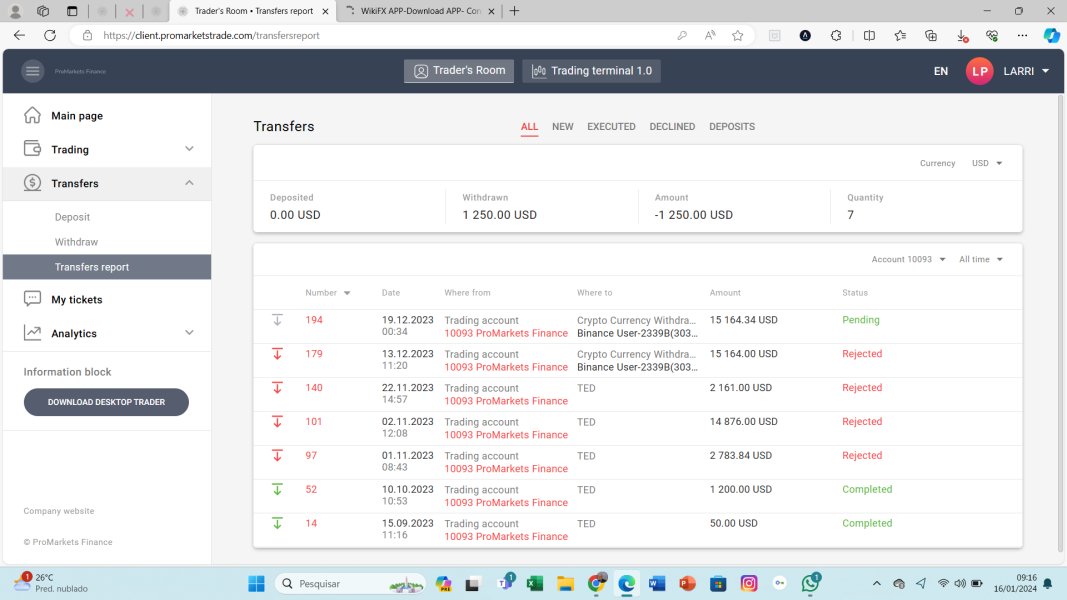

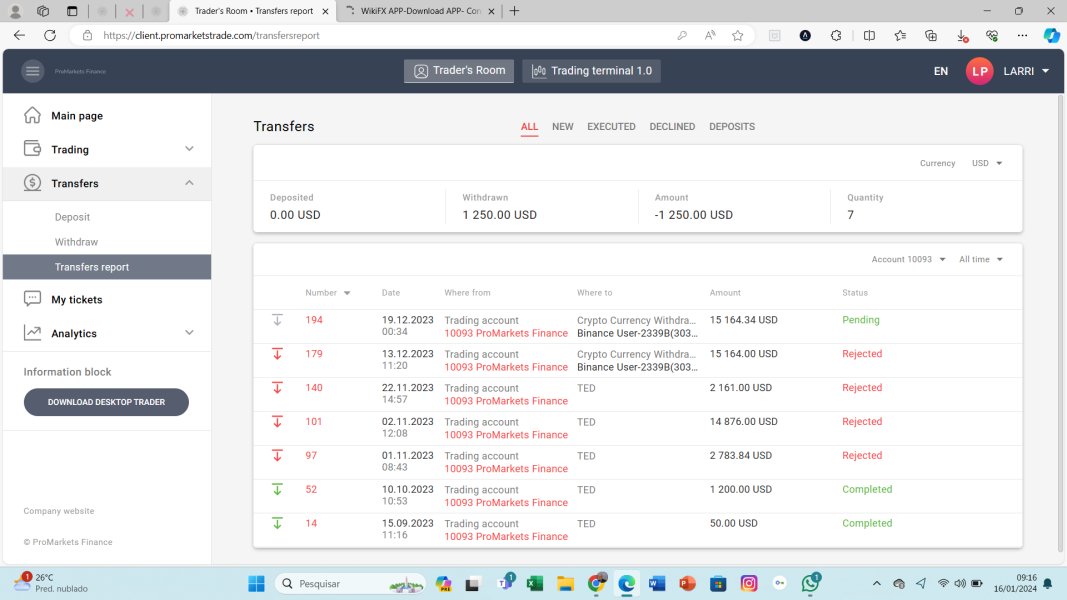

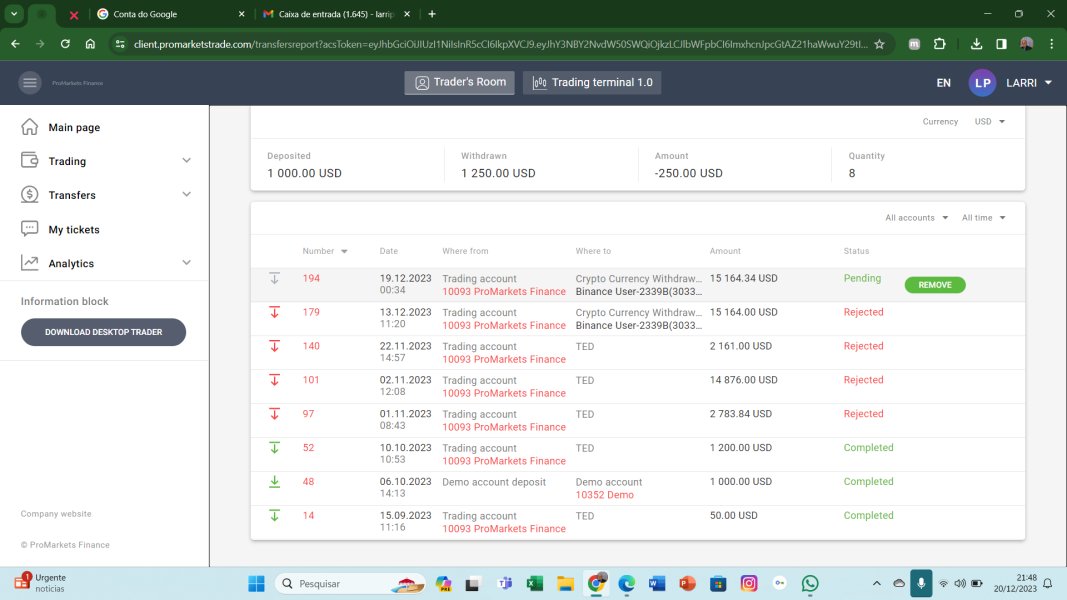

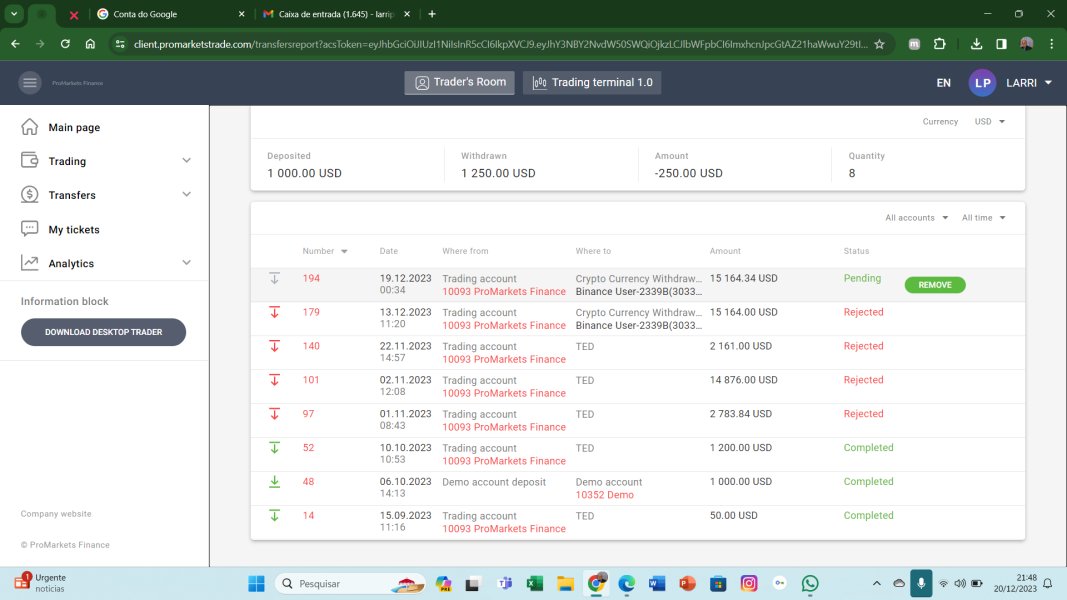

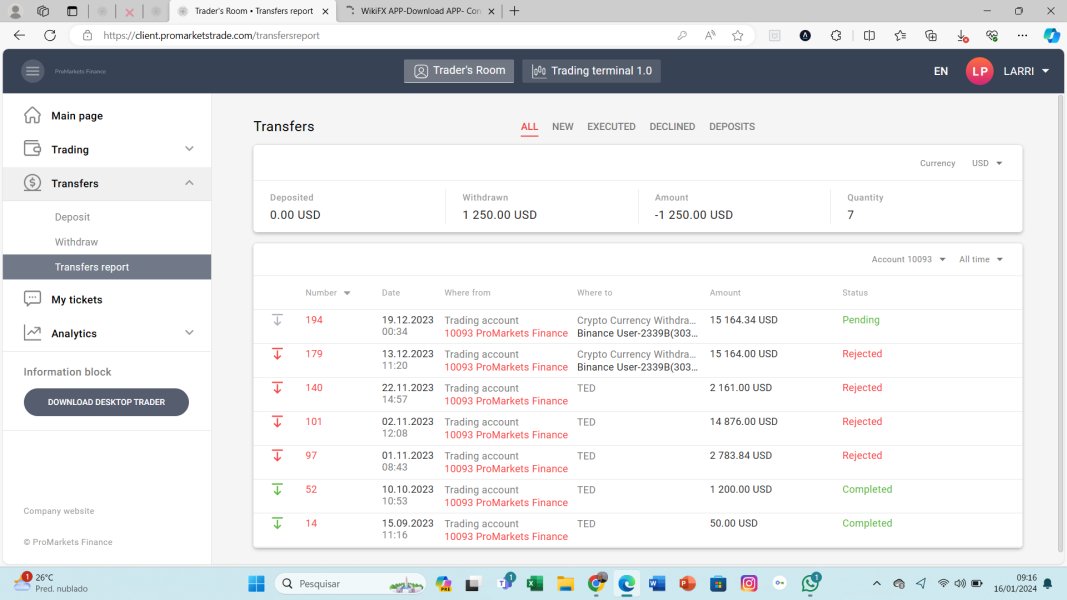

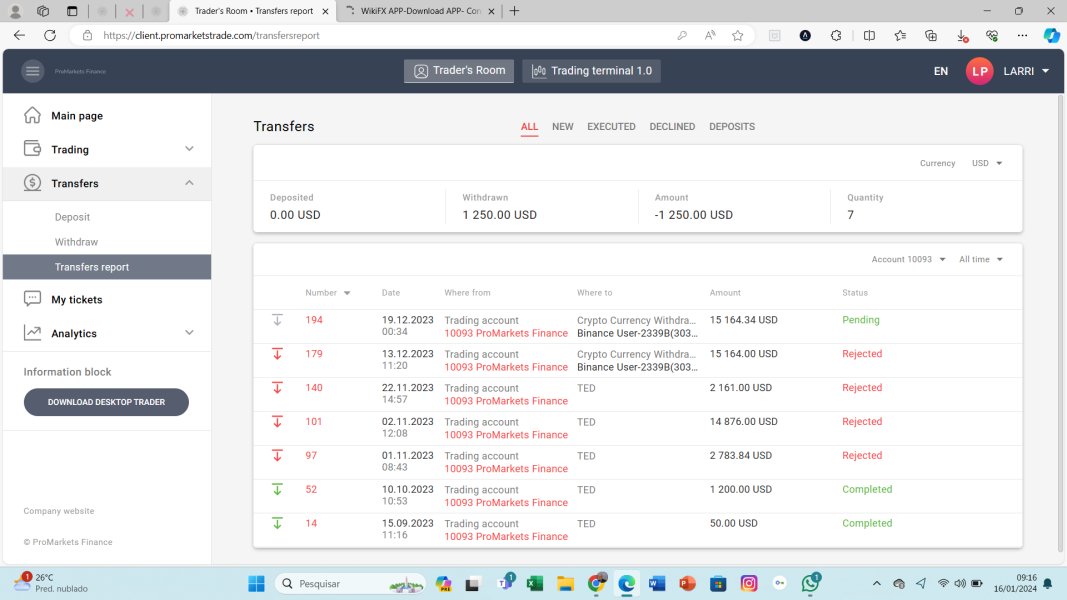

The available information about deposit and withdrawal methods is not enough to detail the specific payment methods offered. Users have struggled to find complete guidance about how funds can be moved in and out of their accounts, which makes it harder to trust the platform. Critical aspects like the minimum deposit requirement are also not clearly stated in the available documents. This lack of clarity leaves potential investors unsure about their initial capital commitment.

ProMarkets Finance provides no detailed information or clear incentives regarding bonus promotions. The absence of bonus offers or cash-back promotions, which reputable brokers commonly highlight to attract and keep clients, adds to the growing list of red flags.

The range of tradable assets is limited to forex pairs and cryptocurrencies, making the platform's offerings very narrow compared to competitors. Users don't get clear details about the cost structure, including spreads, commissions, or any hidden fees that may apply. There's a notable lack of information on these cost aspects, which further hurts the platform's credibility. The leverage ratios offered also remain unspecified in available resources, which prevents investors from accurately assessing potential risk levels.

Platform selection is also unclear, with no clear indication of which trading platforms or interfaces are available to clients. The absence of specific details about available platforms adds another layer of uncertainty, especially for those who need advanced trading tools. There's also no information on regional restrictions, so users worldwide may face different impacts when they use the platform. Finally, details about customer service, such as supported languages, remain unspecified, which further emphasizes the overall lack of transparency from the broker. This section of the promarkets finance review shows the widespread lack of transparency in multiple critical areas.

Detailed Rating Analysis

1. Account Conditions Analysis

When evaluating the account conditions, ProMarkets Finance clearly falls short across several basic parameters. The promarkets finance review shows that the broker fails to provide detailed information about key elements such as account types, minimum deposit requirements, and any associated costs like spreads or commissions. Users repeatedly report a lack of clarity in these areas, which has caused general dissatisfaction. The account opening process is neither smooth nor transparent, and there's no evidence to support the availability of specialized accounts, such as Islamic accounts, or any advanced account features. The inability to verify these essential details not only complicates the decision-making process for potential investors but also raises significant concerns about the overall operational effectiveness of the platform. Compared to established brokers that offer clear and precise account information, ProMarkets Finance remains unclear. Given the recurring negative user feedback about account transparency, this aspect scores a modest 3 out of 10, which reinforces the overall unfavorable picture painted in the promarkets finance review.

The analysis of trading tools and educational resources shows a similarly unpromising picture for ProMarkets Finance. According to available information, the broker offers limited details about the array of trading platforms or analytical tools that might be available to traders. The promarkets finance review indicates that while there's an emphasis on both forex and cryptocurrency markets, there's a clear lack of detailed information about the quality or variety of the trading tools provided. Unlike other brokers that supply comprehensive platforms complete with automated trading, backtesting, and educational libraries, ProMarkets Finance doesn't give users adequate details about either technical or fundamental analysis tools. The absence of dedicated educational materials or consistent updates on market analytics further reduces the overall utility of the resources provided. This shortage hurts traders' ability to make informed decisions. The scarcity of verifiable information means that potential users must rely on external information sources rather than on robust, in-house trading tools. Such factors result in a below-average score of 4 out of 10 for tools and resources, as reported in this promarkets finance review.

3. Customer Service and Support Analysis

Customer service remains one of the most criticized aspects of ProMarkets Finance. User feedback consistently points to long response times and poor service quality when compared to industry standards. As highlighted in this promarkets finance review, the broker doesn't provide clear details about the available customer service channels or about the operational hours or multilingual support that are typically expected from a top-tier broker. Many users have expressed frustration over unresolved questions, coupled with an overall experience that suggests inadequate support in handling technical or financial disputes. The lack of any structured or detailed communication pathway only increases concerns about the platform's commitment to customer care. The absence of success stories or positive reinforcement in customer testimonials further shows the deficiencies in support infrastructure. The resulting negative customer experiences significantly damage the broker's reputation, earning a low score of 3 out of 10. For a reliable trading environment, the inadequacy of customer service in handling even basic inquiries remains a major red flag within this evaluation.

4. Trading Experience Analysis

The trading experience on ProMarkets Finance has been reported to be far from optimal. Users have frequently raised concerns about the stability and performance of the trading platform. This promarkets finance review shows that many traders experience issues such as frequent slippage, re-quotes, and order execution problems, all of which can disrupt effective trading strategies. Critical aspects such as the speed of order execution and the reliability of the trading interface are severely compromised, which leads to an overall diminished trading environment. The absence of detailed information about mobile trading or advanced analytical features suggests that the platform doesn't meet the contemporary standards expected in a competitive market. The persistent negative feedback about technical performance and functionality significantly hurts confidence in the platform's ability to facilitate efficient trading. Users who require consistent performance and deep liquidity often find these shortcomings particularly harmful. In light of these observations, the trading experience component scores only 4 out of 10. This further reinforces the findings outlined in the promarkets finance review, indicating that the trading environment has many issues that prevent user performance and satisfaction.

5. Trust Analysis

Trust and credibility remain the most pressing issues when assessing ProMarkets Finance. A central concern, as thoroughly emphasized in this promarkets finance review, is that the broker is unregulated, which leaves investors without the safeguards provided by recognized regulatory bodies. This lack of regulatory oversight has led to numerous allegations of fraudulent practices and has been linked to reported cases of financial loss among users. The broker provides very little transparent information about its operational practices or corporate governance structures. The scarcity of independent audits or verifiable credentials further worsens the climate of mistrust that surrounds the platform. Investors are left questioning the safety of their funds, as the absence of clear risk management protocols or investor protection measures is particularly alarming. Coupled with widespread negative user reviews and unresolved complaints, the overall industry reputation of ProMarkets Finance is extremely poor. These multiple trust deficits result in a terrible score of only 2 out of 10 in this analysis, which shows significant concerns that potential investors should consider very carefully.

6. User Experience Analysis

User experience with ProMarkets Finance is marked by consistent dissatisfaction and frustration. The overall feeling among users is that the trading platform and its associated services fall well short of industry expectations. Key issues include a difficult registration process, a lack of intuitive interface design, and difficulties in navigating the platform, which are made worse by problems with fund deposit and withdrawal processes. In many accounts, users have highlighted the absence of timely updates or notifications, which makes it difficult to track account performance and execute trades smoothly. Negative feedback centers on the poor handling of issues related to potential scams and unexplained financial losses, which adds to the users' overall complaints. The lack of a cohesive user experience not only hurts confidence but also results in a significant competitive disadvantage in the crowded forex and cryptocurrency brokerage market. This results in a modest rating of 3 out of 10. To create genuine user satisfaction, significant improvements in interface design, transparency during account setup, and more responsive funds management are urgently needed, as repeatedly emphasized in this promarkets finance review.

Conclusion

In summary, ProMarkets Finance presents a highly unfavorable profile. The promarkets finance review reveals a broker that is unregulated, lacking in transparency, and continually damaged by negative user feedback across multiple dimensions. From poor account conditions and underwhelming tools to deficient customer support and a problematic trading experience, there is little that distinguishes the platform positively. With no demonstrable safeguarding measures in place, the overall trust deficit further confirms the conclusion that this broker is unsuitable for any investor—especially beginners seeking safety and reliability. Prospective users are strongly advised to consider alternative brokers with established regulatory credentials and robust support systems before engaging with ProMarkets Finance.