SDstar FX 2025 Review: Everything You Need to Know

Executive Summary

This SDstar fx review shows major concerns about an unregulated forex broker that creates big risks for traders. SDstar FX says it works as a true ECN broker with STP-only orders, giving access to over 170 trading tools across different markets including forex. But the broker works without proper rules watching over it, being signed up only in Comoros, a place that lacks recognized financial rule-makers for forex services.

The broker goes after traders who want high leverage chances up to 1:500 and many different trading tools. But user feedback always points out problem areas including high spreads from 3 to 5 pips, big commissions of $25 for standard accounts, and bad customer service experiences. Multiple review websites show that SDstar FX has gotten many complaints about withdrawal problems and poor support answers.

While the broker claims it's signed up in the UK, Saint Vincent and the Grenadines, and the UAE, these sign-ups don't give real regulatory protection for traders. The mix of unregulated status, negative user experiences, and high trading costs makes SDstar FX a high-risk choice that needs extreme care from potential users.

Important Notice

Regional Entity Differences: SDstar FX claims it's signed up across multiple places including the UK, Saint Vincent and the Grenadines, the UAE, and Comoros. But none of these sign-ups give real regulatory watching or trader protection. The Comoros sign-up, especially, offers no recognized financial regulatory framework for forex or brokerage services.

Review Methodology: This review is based on user feedback from multiple review websites, publicly available information, and broker-provided details. Our assessment has not involved direct testing of the platform or checking of all claimed services and features.

Rating Overview

Broker Overview

SDstar FX shows itself as an established forex broker claiming sign-up in multiple places, though specific founding details stay unclear in available papers. The company says it's signed up in the United Kingdom while keeping additional sign-ups in Saint Vincent and the Grenadines and the United Arab Emirates. But these sign-ups don't turn into meaningful regulatory watching or trader protection systems.

The broker puts itself as a true ECN (Electronic Communication Network) provider, claiming to execute all orders through straight-through processing (STP) without dealing desk intervention. This business model theoretically offers traders direct market access with clear pricing, though user experiences suggest implementation challenges.

According to available information, SDstar FX gives access to over 170 trading tools spanning various asset classes, with particular focus on the foreign exchange market. The broker offers leverage ratios up to 1:500, appealing to traders seeking amplified market exposure. But the primary regulatory sign-up lies with Comoros, a place that lacks recognized financial regulatory authorities capable of overseeing forex or brokerage services effectively. This SDstar fx review emphasizes the significant regulatory gap that leaves traders without adequate protection or recourse mechanisms.

Regulatory Status (60-80 words): SDstar FX operates without meaningful regulatory watching, claiming sign-up in Comoros where no recognized financial regulatory authorities supervise forex or brokerage services. While the broker mentions sign-ups in other places, these don't give substantive trader protection or regulatory compliance frameworks.

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal options was not detailed in available papers.

Minimum Deposit Requirements: Minimum deposit requirements were not specified in accessible broker information.

Bonus and Promotions: Details regarding promotional offers or bonus programs were not mentioned in available materials.

Tradeable Assets (60-80 words): The broker gives access to over 170 trading tools across multiple asset classes, with significant focus on foreign exchange markets. The diverse tool selection appears designed to attract traders seeking varied market exposure opportunities.

Cost Structure (80-100 words): SDstar FX implements a cost structure featuring spreads ranging from 3 to 5 pips, which significantly exceeds industry standards for competitive brokers. Standard account holders face additional commission charges of $25, creating a dual-cost environment that substantially increases trading expenses. This pricing model places considerable burden on trader profitability, particularly for frequent traders or those operating smaller account sizes.

Leverage Ratios: Maximum leverage reaches 1:500, offering high amplification for market positions.

Platform Options: Specific trading platform details were not comprehensively covered in available papers.

Geographic Restrictions: Regional limitations were not specified in accessible information.

Customer Support Languages: Language support options were not detailed in available materials.

This SDstar fx review highlights significant information gaps that potential traders should consider when evaluating the broker's transparency and operational clarity.

Detailed Rating Analysis

Account Conditions Analysis (Score: 4/10)

Account conditions at SDstar FX present several concerning elements that significantly impact trader experience and profitability. The broker's cost structure creates immediate disadvantages through high spreads ranging from 3 to 5 pips, substantially exceeding industry standards where competitive brokers typically offer spreads under 2 pips for major currency pairs. The additional $25 commission for standard accounts compounds these costs, creating a dual-fee environment that erodes trading profits.

The lack of specified minimum deposit requirements creates uncertainty for potential clients, making it difficult to plan initial investments or compare costs with other brokers. Available papers don't detail different account types or their specific features, limiting traders' ability to select appropriate account structures for their trading strategies and capital levels.

User feedback consistently highlights dissatisfaction with account conditions, particularly regarding the high cost structure that makes profitable trading significantly more challenging. The absence of detailed information about special account features, such as Islamic accounts or professional trader options, suggests limited accommodation for diverse trader needs.

The combination of high costs, limited transparency, and negative user experiences regarding account conditions contributes to the below-average rating. This SDstar fx review emphasizes that traders should carefully consider these factors before committing funds to the platform.

SDstar FX offers over 170 trading tools, giving reasonable diversity for traders seeking exposure to multiple markets. This extensive tool selection represents the primary strength in the tools and resources category, allowing traders to diversify portfolios across various asset classes including foreign exchange markets. The variety of available tools suggests the broker attempts to cater to different trading strategies and market preferences.

But the quality and accessibility of these trading tools remain unclear from available papers. User feedback indicates mixed experiences with tool effectiveness, suggesting potential gaps between advertised offerings and actual utility. The absence of detailed information about research and analysis resources limits traders' ability to make informed decisions about market opportunities.

Educational resources and learning materials were not specifically mentioned in available information, representing a significant gap for traders seeking to develop their skills or understanding of market dynamics. Modern traders increasingly value comprehensive educational support, making this absence a notable limitation.

Automated trading support and advanced analytical tools were not detailed in accessible papers, potentially limiting appeal for sophisticated traders or those employing algorithmic strategies. The moderate rating reflects the positive aspect of tool diversity balanced against unclear tool quality and missing educational components.

Customer Service and Support Analysis (Score: 4/10)

Customer service represents a significant weakness for SDstar FX, with user feedback consistently highlighting poor support experiences. Available papers don't specify customer service channels, response timeframes, or availability hours, creating uncertainty about support accessibility when traders encounter issues or require assistance.

User reviews across multiple platforms indicate frustrating experiences with customer service representatives, including slow response times and inadequate problem resolution. These negative experiences are particularly concerning given the broker's unregulated status, as traders have limited alternative recourse mechanisms when standard support channels fail to address their concerns adequately.

The absence of specified multilingual support options may limit accessibility for international traders, particularly those whose primary language differs from the broker's default communication language. Modern forex brokers typically provide comprehensive language support to serve global client bases effectively.

Response quality appears inconsistent based on user feedback, with many traders reporting that support representatives lack sufficient knowledge or authority to resolve complex issues. This limitation becomes particularly problematic when traders face account access issues, withdrawal difficulties, or technical platform problems requiring immediate attention.

The combination of poor user feedback, limited specified support channels, and unclear service parameters contributes to the below-average rating for customer service and support.

Trading Experience Analysis (Score: 5/10)

The trading experience at SDstar FX presents mixed elements that result in an average overall assessment. While the broker claims to operate as a true ECN provider with straight-through processing, user experiences suggest implementation challenges that affect actual trading conditions. The high spread environment, ranging from 3 to 5 pips, significantly impacts trading experience by increasing the cost threshold traders must overcome to achieve profitability.

Platform stability and execution speed were not comprehensively detailed in available papers, creating uncertainty about technical performance during active trading sessions. User feedback indicates varying experiences with order execution, though specific data regarding slippage rates or requote frequency was not available for analysis.

The absence of detailed platform information limits assessment of functionality completeness, including charting capabilities, order types, and analytical tools integration. Modern traders expect sophisticated platform features that support complex trading strategies and comprehensive market analysis.

Mobile trading experience details were not specified in accessible information, representing a significant gap given the increasing importance of mobile accessibility for contemporary traders. The ability to monitor and manage positions remotely has become essential for many trading approaches.

The leverage offering up to 1:500 provides flexibility for traders seeking amplified market exposure, though this high leverage also increases risk levels substantially. This SDstar fx review notes that the moderate rating reflects the balance between available leverage options and concerns about cost structure and platform transparency.

Trust and Reliability Analysis (Score: 3/10)

Trust and reliability represent the most significant concerns with SDstar FX, primarily due to the broker's unregulated status and lack of meaningful oversight mechanisms. The claimed sign-up in Comoros gives no substantive regulatory protection, as this place lacks recognized financial regulatory authorities capable of supervising forex or brokerage operations effectively.

While SDstar FX claims additional sign-ups in the UK, Saint Vincent and the Grenadines, and the UAE, these sign-ups don't translate to regulatory oversight or trader protection frameworks. The absence of legitimate regulatory supervision leaves traders without recourse mechanisms when disputes arise or when broker practices become questionable.

User feedback consistently raises concerns about the broker's reliability, with multiple complaints regarding withdrawal difficulties and inadequate response to client concerns. These negative experiences, combined with the unregulated status, create substantial trust deficits that potential traders must consider carefully.

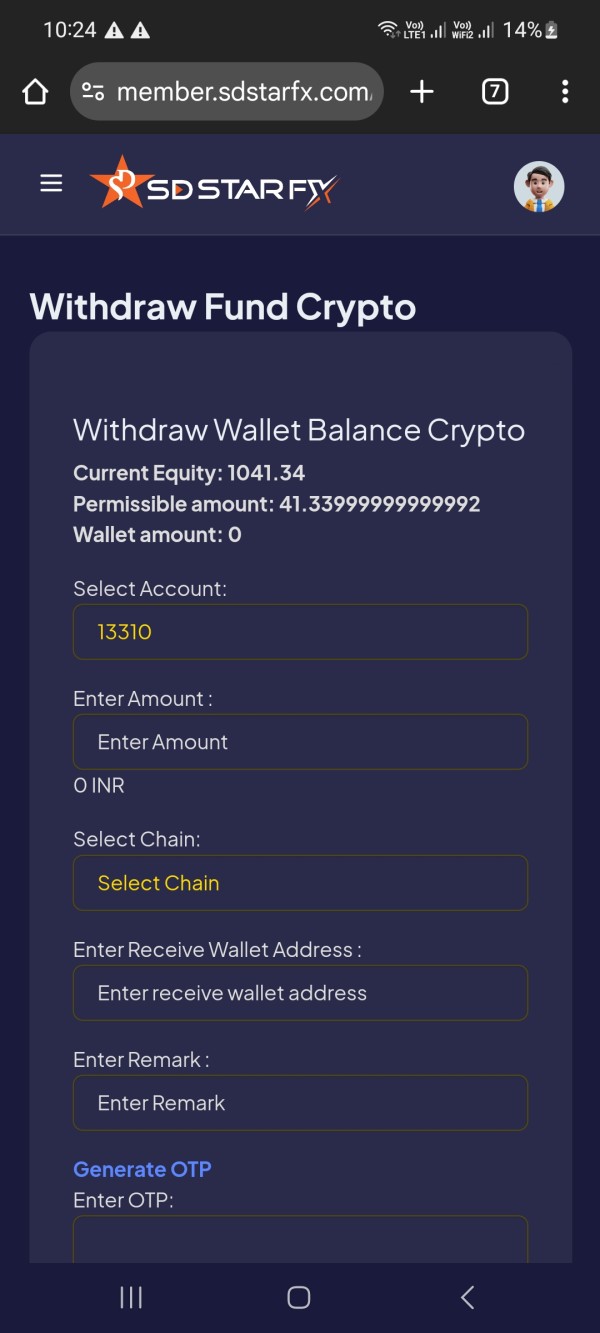

Fund security measures were not detailed in available papers, representing another significant trust concern. Legitimate brokers typically provide clear information about client fund segregation, insurance coverage, and regulatory protection mechanisms. The absence of such information raises questions about asset protection protocols.

Company transparency appears limited, with insufficient publicly available information about financial health, operational procedures, or corporate governance structures. The combination of regulatory gaps, negative user experiences, and limited transparency contributes to the poor trust and reliability rating.

User Experience Analysis (Score: 4/10)

Overall user satisfaction with SDstar FX appears consistently low based on feedback across multiple review platforms. Users frequently express dissatisfaction with various aspects of their trading experience, from initial account setup through ongoing platform usage and support interactions. The high cost structure, featuring substantial spreads and commissions, represents a primary source of user frustration.

Interface design and platform usability details were not comprehensively covered in available papers, limiting assessment of the user experience quality. But user feedback suggests challenges with platform navigation and functionality that impact overall satisfaction levels.

Sign-up and account verification processes were not detailed in accessible information, though user experiences indicate potential complications or delays in account setup procedures. Smooth onboarding processes are essential for positive initial user experiences, making this information gap significant.

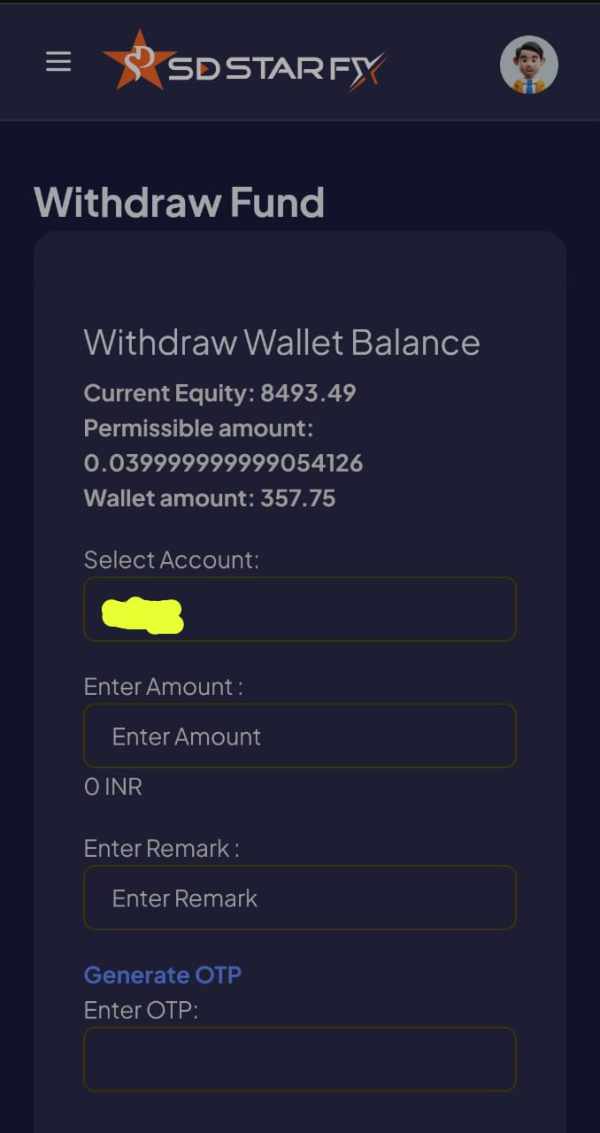

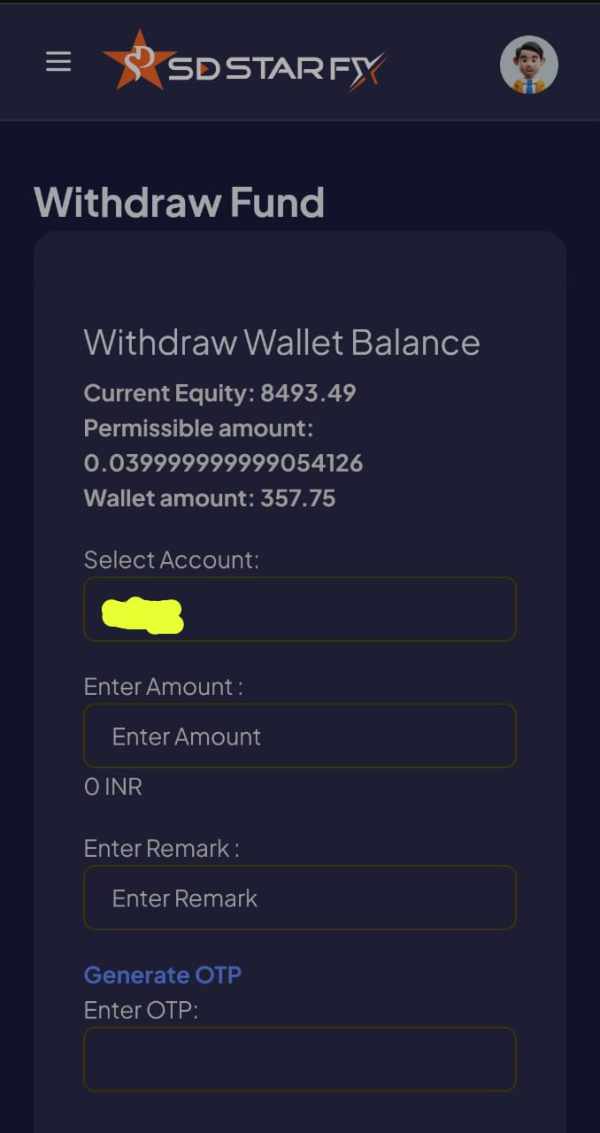

The absence of detailed information about fund operation experiences, including deposit and withdrawal procedures, creates uncertainty about transaction efficiency and reliability. User complaints often center on difficulties accessing funds, suggesting problematic withdrawal processes that significantly impact user satisfaction.

Common user complaints focus on the combination of high trading costs, poor customer service, and withdrawal difficulties. These issues create compounding negative experiences that drive overall dissatisfaction. The broker appears most suitable for traders specifically seeking high leverage opportunities, though the associated risks and costs make it inappropriate for most trading approaches.

Conclusion

This SDstar fx review reveals a broker with significant limitations that outweigh its few positive attributes. While SDstar FX offers over 170 trading tools and high leverage up to 1:500, the combination of unregulated status, high trading costs, and consistently negative user feedback creates substantial concerns for potential traders.

The broker may appeal to experienced traders specifically seeking high leverage opportunities and willing to accept elevated risks. But the lack of regulatory protection, expensive cost structure with spreads up to 5 pips plus $25 commissions, and poor customer service make SDstar FX unsuitable for most trading approaches.

Primary advantages include tool diversity and high leverage availability, while significant disadvantages encompass regulatory gaps, excessive costs, and negative user experiences. Traders should exercise extreme caution and consider regulated alternatives that provide better protection and more favorable trading conditions.