Is Voco Markets safe?

Business

License

Is Voco Markets Safe or Scam?

Introduction

Voco Markets is a relatively new player in the forex market, positioning itself as an online trading platform that claims to offer a diverse range of financial instruments, including forex, commodities, and stocks. Given the complexities and risks associated with forex trading, it is crucial for traders to conduct thorough evaluations of the brokers they intend to use. The forex market is rife with unregulated entities and potential scams, making it imperative for investors to ensure that their chosen broker is legitimate and trustworthy. This article investigates the safety and legitimacy of Voco Markets by analyzing its regulatory status, company background, trading conditions, customer feedback, and overall risk profile.

Regulation and Legitimacy

One of the first indicators of a broker's reliability is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to certain standards of conduct and financial integrity. Voco Markets operates without any valid regulatory oversight, which raises significant concerns about its legitimacy. The following table summarizes the core regulatory information related to Voco Markets:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulatory oversight means that Voco Markets is not held accountable by any financial authority, increasing the risk for traders. Reputable regulatory bodies, such as the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC), provide a layer of protection for clients, ensuring that brokers operate transparently and maintain client funds securely. Without such oversight, traders are left vulnerable to potential fraud and mismanagement of their investments. This lack of regulation is a significant red flag when assessing if Voco Markets is safe.

Company Background Investigation

Voco Markets is registered under the name Voco Capital Limited and claims to operate from the Comoros Islands, a jurisdiction known for its lax regulatory framework. The company was established in 2023, making it relatively new in the industry. The lack of a robust history raises questions about its operational stability and long-term viability. Furthermore, details regarding the ownership structure and management team are scarce, with no public information available about the individuals behind the company. This lack of transparency is concerning, as a reputable broker typically provides information about its management team and their professional backgrounds. Investors should be wary of companies that do not disclose such vital information, as it can indicate a lack of accountability. The overall opacity of Voco Markets enhances the skepticism surrounding its legitimacy.

Trading Conditions Analysis

The trading conditions offered by Voco Markets are another critical factor in assessing its safety. The broker claims to offer competitive spreads and various account types, but the absence of clear information regarding fees and commissions raises questions. The following table outlines the core trading costs associated with Voco Markets:

| Fee Type | Voco Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.8 pips | 1.2 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Varies | Varies |

While Voco Markets advertises spreads starting from 1.8 pips, which may seem appealing, it is essential to compare these with industry standards. The average spread for major currency pairs is typically lower, suggesting that Voco Markets may not be as competitive as it claims. Additionally, the lack of a commission structure raises concerns about hidden fees that could be detrimental to traders. The absence of a demo account further complicates the situation, as potential clients cannot test the trading conditions before committing real funds. This lack of transparency in fees and the overall trading environment makes it challenging for traders to assess whether Voco Markets is safe.

Customer Funds Security

The security of customer funds is paramount when evaluating a broker's safety. Voco Markets does not provide clear information about its fund segregation practices or investor protection measures. In reputable firms, client funds are typically held in separate accounts to protect them in case of company insolvency. However, the lack of regulatory oversight and transparency regarding Voco Markets' financial practices raises significant concerns about the safety of traders' investments.

Moreover, the absence of negative balance protection means that traders could potentially lose more than their initial investment, adding another layer of risk. Historical data on Voco Markets does not reveal any significant security breaches, but the lack of information makes it difficult to assess its overall track record. This uncertainty leads to the conclusion that clients' funds may not be safe with Voco Markets, further questioning its legitimacy.

Customer Experience and Complaints

Customer feedback is a valuable resource for evaluating a broker's reliability. Numerous reports and reviews indicate that traders have experienced various issues with Voco Markets, including difficulties in withdrawing funds and poor customer service. The following table summarizes the main types of complaints associated with Voco Markets:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Quality | Medium | Average |

| Misleading Information | High | Poor |

Common complaints include traders' inability to withdraw their funds after making deposits, which is a significant red flag. Additionally, the quality of customer service has been criticized, with many users reporting long response times or inadequate assistance. These patterns of negative feedback suggest that Voco Markets may not prioritize customer satisfaction or transparency, raising further doubts about its safety.

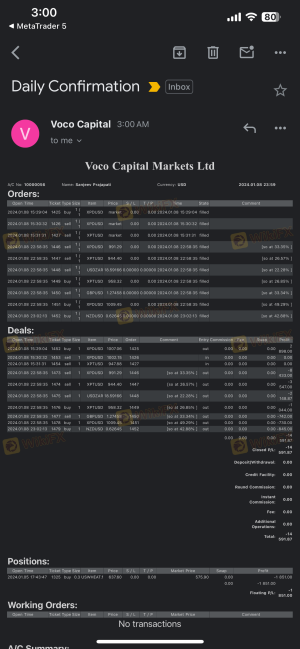

Platform and Execution

The trading platform offered by Voco Markets is another critical aspect of its evaluation. The broker provides access to the popular MetaTrader 5 (MT5) platform, known for its advanced trading tools and user-friendly interface. However, the overall performance, stability, and execution quality of the platform must also be considered. Reports of slippage and order rejections have been noted by users, which can significantly impact trading outcomes. If traders frequently encounter issues with order execution, it can lead to frustration and financial losses.

While the platform itself may be technically sound, the quality of execution and any signs of manipulation must be scrutinized. Traders should be cautious if they notice patterns of unfavorable execution, as this may indicate potential issues with the broker's integrity.

Risk Assessment

Using Voco Markets poses several risks that traders need to consider. The following risk assessment summarizes the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight |

| Fund Security | High | Lack of fund segregation and protection |

| Withdrawal Issues | High | Frequent complaints about withdrawals |

| Customer Support | Medium | Poor response times reported |

Given these risks, potential traders should exercise extreme caution when considering Voco Markets as their trading platform. It is advisable to conduct thorough research and consider alternative brokers with established regulatory frameworks and positive customer feedback.

Conclusion and Recommendations

In conclusion, the investigation into Voco Markets raises significant concerns regarding its safety and legitimacy. The absence of regulatory oversight, coupled with a lack of transparency regarding company operations, trading conditions, and customer feedback, suggests that Voco Markets may not be a trustworthy broker. Traders should be particularly wary of the high risks associated with using this platform, including potential withdrawal issues and inadequate customer support.

For those seeking a reliable trading experience, it is recommended to explore alternative brokers that are regulated by reputable authorities and have a proven track record of customer satisfaction. Brokers such as IG, OANDA, and Forex.com, which offer robust regulatory protections and transparent trading conditions, may be more suitable options for traders looking to minimize risks. Ultimately, ensuring the safety of your investments should be the top priority when selecting a forex broker.

Is Voco Markets a scam, or is it legit?

The latest exposure and evaluation content of Voco Markets brokers.

Voco Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Voco Markets latest industry rating score is 1.37, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.37 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.