Is PNX FINANCE safe?

Pros

Cons

Is PNX Finance Safe or a Scam?

Introduction

PNX Finance is a forex and CFD broker that has recently entered the trading market, claiming to offer a platform for various financial instruments. Established in 2023, the broker markets itself as a gateway to lucrative returns and sophisticated trading tools, positioning itself as a competitive player in the forex arena. However, as with any trading platform, it is crucial for traders to carefully evaluate the legitimacy and safety of PNX Finance before committing their funds. The importance of conducting thorough due diligence cannot be overstated, especially in an industry rife with scams and unregulated entities. This article aims to provide a comprehensive analysis of PNX Finance, utilizing data from various sources, including user reviews, regulatory filings, and expert assessments, to determine whether PNX Finance is safe or a potential scam.

Regulation and Legitimacy

The regulatory status of a trading platform is one of the most critical factors in assessing its legitimacy. PNX Finance operates without any regulatory oversight from recognized financial authorities, which raises significant concerns regarding its legitimacy and the safety of client funds. Below is a summary of the broker's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

The absence of a regulatory license means that PNX Finance is not subject to the stringent compliance requirements that regulated brokers must adhere to. This lack of oversight can expose traders to a higher risk of fraud, as unregulated brokers are not held accountable for their actions. Moreover, PNX Finance has been noted for operating outside the purview of the National Futures Association (NFA) in the United States, further questioning its credibility. The absence of regulatory protections can lead to scenarios where traders face difficulties in withdrawing funds or experiencing unfair trading practices. Therefore, the question remains: Is PNX Finance safe? The overwhelming evidence suggests that it is not.

Company Background Investigation

PNX Finance claims to have a robust corporate structure and a history of operations dating back to 2012. However, a closer examination reveals discrepancies in its timeline and ownership claims. The broker's website indicates that it was registered only in August 2023, casting doubt on its assertions of being an established entity in the financial market. The company's ownership structure is not transparent, and there is a lack of information regarding its management team and their professional backgrounds. This opacity raises significant questions about the broker's integrity and operational practices.

In the realm of online trading, transparency is paramount. A legitimate broker should openly disclose its management team, ownership, and operational history. PNX Finance, however, has not provided adequate information in these areas, which leads to further skepticism about its authenticity. Without a clear understanding of who is behind the broker, traders may find themselves at risk. Thus, the question of Is PNX Finance safe? remains unanswered, as the lack of transparency is a significant red flag.

Trading Conditions Analysis

The trading conditions offered by PNX Finance are another critical aspect to consider. The broker claims to provide competitive trading fees and a user-friendly experience; however, specific details regarding spreads, commissions, and overnight interest rates are notably absent. This lack of clarity can be concerning for traders who rely on transparent fee structures to make informed decisions. Below is a comparative table of the core trading costs associated with PNX Finance:

| Fee Type | PNX Finance | Industry Average |

|---|---|---|

| Spread on Major Pairs | N/A | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 1-3% |

The absence of specific information about the fee structure could indicate that PNX Finance may impose hidden fees or unfavorable trading conditions. Moreover, user reports have highlighted issues with withdrawal processes, often citing excessive fees or outright refusals to process requests. These factors contribute to an environment where traders may feel vulnerable and exploited. Therefore, the question of Is PNX Finance safe? becomes increasingly pertinent, as the lack of transparency in trading conditions raises the risk of unexpected costs and complications.

Client Fund Security

When evaluating a broker, the safety of client funds is of utmost importance. PNX Finance has not provided sufficient information regarding its fund security measures, including whether client funds are kept in segregated accounts or if there are any investor protection schemes in place. This lack of clarity can lead to concerns about the safety of deposits, especially given the broker's unregulated status.

Moreover, there have been no indications of negative balance protection policies, which could leave traders liable for losses exceeding their account balance. Historical complaints from users suggest that PNX Finance may not have effectively addressed fund security concerns, further questioning its reliability. The absence of robust security measures raises the stakes for potential investors, making it critical to ask: Is PNX Finance safe? Based on current evidence, it appears that the broker does not prioritize the safeguarding of client funds.

Client Experience and Complaints

User feedback is a vital component in assessing a broker's credibility. Numerous reports have surfaced regarding negative experiences with PNX Finance, primarily focusing on difficulties with withdrawals and unresponsive customer service. Below is a summary of the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Customer Support | Medium | Slow |

| Transparency Concerns | High | None |

Many users have reported that their withdrawal requests have been delayed or denied altogether, often accompanied by vague explanations regarding fees or account restrictions. Additionally, the company's customer support has been criticized for being unhelpful and difficult to reach, further exacerbating user frustrations. A few notable case studies illustrate these issues:

Case Study 1: A trader who deposited $10,000 reported that they were unable to withdraw their funds after being pressured to deposit more money for "tax clearance." This experience highlights the potential for manipulative tactics that are often employed by scam brokers.

Case Study 2: Another user claimed to have successfully traded for several months but faced significant delays when attempting to withdraw profits. The broker cited "technical issues" without providing a clear timeline for resolution.

- AvaTrade: Well-regulated with a solid reputation.

- IG Group: Offers a range of trading instruments with robust customer support.

- Saxo Bank: Known for transparency and reliability in the trading environment.

These accounts raise serious concerns about the operational integrity of PNX Finance, leading to the critical question: Is PNX Finance safe? The overwhelming evidence of negative user experiences suggests that it is not.

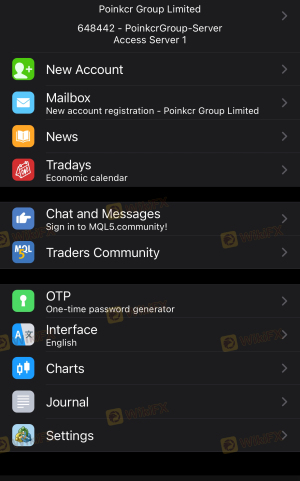

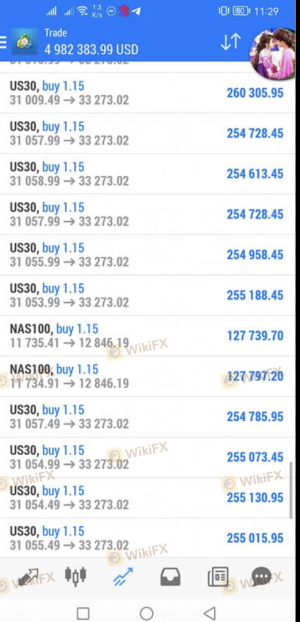

Platform and Trade Execution

The trading platform is a crucial aspect of any trading experience, and PNX Finance claims to offer the popular MetaTrader 5 (MT5) platform. However, user reviews indicate that the platform may suffer from performance issues, including slow execution times and occasional system crashes. Traders have also reported instances of slippage and order rejections, which can significantly impact trading outcomes.

In terms of platform manipulation, there have been allegations that PNX Finance engages in practices that could disadvantage traders, such as artificially inflating spreads during high volatility periods. These issues raise significant concerns about the reliability and fairness of the trading environment provided by PNX Finance. Therefore, the question of Is PNX Finance safe? is increasingly relevant, as the platform's performance issues may lead to substantial financial risks for traders.

Risk Assessment

Using PNX Finance presents a range of risks that potential investors should consider. Below is a summary of the key risk areas associated with trading with this broker:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status increases potential for fraud. |

| Withdrawal Risk | High | Reports of difficulties in retrieving funds. |

| Transparency Risk | Medium | Lack of clear information on fees and conditions. |

| Platform Reliability | High | Performance issues may impact trading outcomes. |

Given these risks, it is advisable for traders to exercise extreme caution when considering PNX Finance as a trading option. To mitigate these risks, potential investors should seek out regulated brokers with a proven track record of transparency and customer support.

Conclusion and Recommendations

In conclusion, the evidence overwhelmingly suggests that PNX Finance is not a safe trading platform. Its lack of regulation, negative user experiences, and transparency concerns raise significant red flags for potential investors. The question of Is PNX Finance safe? has been answered through a thorough examination of the broker's practices and user feedback, leading to the conclusion that it is not a trustworthy option for trading.

For traders seeking a reliable trading experience, it is recommended to consider reputable alternatives that are regulated and have positive user reviews. Some trustworthy brokers include:

Investors should prioritize their financial safety and choose brokers that adhere to regulatory standards, ensuring a secure trading experience.

Is PNX FINANCE a scam, or is it legit?

The latest exposure and evaluation content of PNX FINANCE brokers.

PNX FINANCE Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

PNX FINANCE latest industry rating score is 1.37, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.37 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.