Adtrade 2025 Review: Everything You Need to Know

Adtrade, a relatively new player in the forex market, has garnered attention for its trading platform and account offerings. However, a thorough examination reveals a mix of promising features and significant concerns. Notably, the broker lacks regulatory oversight, which raises questions about its legitimacy and safety for traders. This review aims to provide a comprehensive overview of Adtrade, highlighting both its strengths and weaknesses.

Note: It is essential to acknowledge that different entities operating under the Adtrade name may exist across various regions, contributing to the complexity of its evaluation. Our assessment is based on a careful analysis of multiple sources to ensure fairness and accuracy.

Ratings Overview

We score brokers based on a combination of user feedback, expert opinions, and factual data collected from various sources.

Broker Overview

Founded in 2021, Adtrade is based in China and operates without any valid regulatory oversight, which is a significant red flag for potential traders. The broker offers trading through the widely recognized MetaTrader 4 platform, allowing access to various asset classes, including forex, commodities, indices, and cryptocurrencies. However, the absence of regulatory backing and customer support raises concerns about the overall safety and reliability of the trading environment.

Detailed Section

Regulatory Geographies

Adtrade does not appear to be regulated by any recognized financial authority. This lack of oversight is particularly concerning, as it means that traders have no recourse in case of disputes or issues with the broker. According to WikiFX, the broker operates in a high-risk environment, making it crucial for traders to exercise extreme caution.

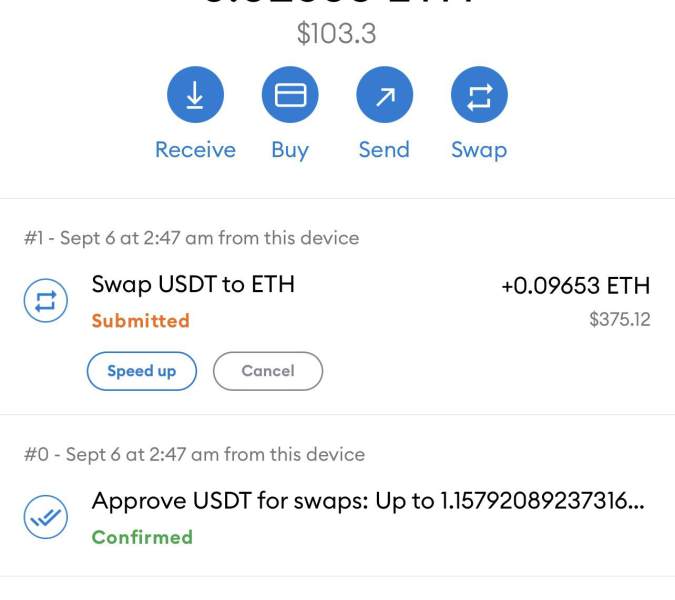

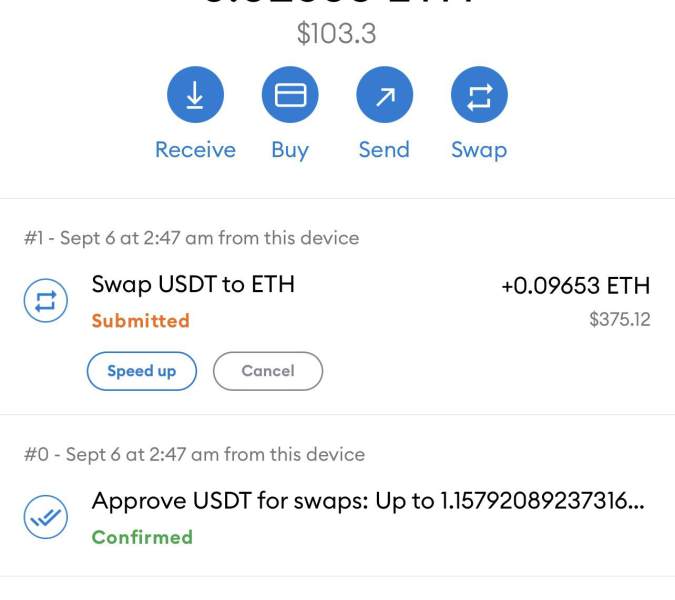

Deposit/Withdrawal Methods

Adtrade supports various deposit and withdrawal methods, including bank wire transfers, credit cards, and cryptocurrency options. However, the specifics regarding transaction fees and processing times are not clearly outlined, which may lead to confusion for users. The minimum deposit required varies by account type, starting at $500 for a standard account.

Minimum Deposit

The broker requires a minimum deposit of $500 for a standard account, escalating to $5,000 for a premium account and $100,000 for a VIP account. These high entry thresholds may deter novice traders from engaging with the platform.

There is currently no information available regarding any bonuses or promotional offers from Adtrade. This absence of incentives may make the platform less appealing compared to competitors that offer attractive bonuses to new traders.

Tradable Asset Classes

Adtrade provides access to a range of asset classes, including forex pairs, commodities such as gold and oil, various stock indices, and cryptocurrencies like Bitcoin and Ethereum. However, the lack of educational resources to help traders understand these markets is a significant drawback.

Costs (Spreads, Fees, Commissions)

The cost structure at Adtrade is somewhat opaque. The standard account features fixed spreads starting from 2.0 pips, while premium accounts offer variable spreads from 1.5 pips. The absence of transparency regarding commission fees further complicates the cost evaluation for potential traders.

Leverage

Adtrade offers a maximum leverage of up to 1:300. While this may attract traders looking to amplify their trading positions, it also significantly increases the risk of substantial losses, particularly for inexperienced traders.

Adtrade primarily utilizes the MetaTrader 4 platform, which is favored by many traders for its user-friendly interface and comprehensive features. However, the lack of additional platform options may limit flexibility for some traders.

Restricted Regions

There is insufficient information regarding specific regions where Adtrade operates or any restrictions on account openings. This ambiguity may pose challenges for traders looking to understand the broker's geographical limitations.

Available Customer Service Languages

Adtrade's customer service appears to be virtually non-existent, which is a major concern for potential users. The absence of reliable support raises questions about the broker's commitment to trader satisfaction and safety.

Repeated Ratings Overview

Detailed Breakdown of Ratings

Account Conditions

The account conditions at Adtrade are concerning, primarily due to the high minimum deposit requirements and lack of competitive advantages typically found in regulated environments. The absence of lower-tier accounts for beginners limits accessibility.

Adtrade's lack of educational resources is a significant drawback. Potential traders are left without the necessary tools to enhance their trading skills or understand market dynamics, which could lead to unfavorable financial outcomes.

Customer Service and Support

The complete absence of customer support is alarming. Traders have no reliable means to seek assistance or resolve issues, which can lead to frustration and mistrust.

Trading Setup (Experience)

While the trading setup is relatively straightforward due to the use of the popular MetaTrader 4 platform, the overall experience is hampered by the lack of support and educational resources.

Trustworthiness

Adtrade's lack of regulation and transparency raises significant red flags regarding its trustworthiness. The absence of oversight can lead to unscrupulous practices and increased risks for traders.

User Experience

User experience is negatively impacted by the lack of customer support and educational resources, leaving traders feeling unsupported and ill-equipped to navigate the complexities of the forex market.

In conclusion, the Adtrade review reveals a broker that presents several concerning issues, particularly regarding regulatory status and customer support. Potential traders should exercise caution and conduct thorough research before engaging with this platform.