FXGM 2025 Review: Everything You Need to Know

Executive Summary

FXGM presents itself as a moderately favorable broker. It has garnered recognition within both user communities and the broader financial industry over many years of operation. This FXGM review reveals a Cyprus-based brokerage that operates under the brand name of Depaho Ltd. The company was established in 2011 with a focus on providing forex and CFD trading services to retail investors who want to access global markets.

The broker's standout features include its diverse regulatory oversight and established reputation in the cryptocurrency trading sector. FXGM operates under multiple regulatory frameworks, with primary oversight from the Cyprus Securities and Exchange Commission, which provides a solid foundation for trader protection and operational transparency that meets industry standards. The platform primarily targets small to medium-sized investors and traders with particular interest in cryptocurrency markets.

With a minimum deposit requirement of $200 USD and leverage capabilities reaching up to 1:400, FXGM positions itself as accessible to retail traders. The broker also offers substantial trading power to help traders maximize their market exposure while maintaining reasonable entry requirements. The broker has maintained its presence in the competitive forex market for over a decade, building a reputation that attracts traders seeking exposure to both traditional forex pairs and emerging digital assets.

According to available industry reports, FXGM maintains a trust score of 71 points among users. This indicates a moderate to high level of confidence in the platform's reliability and service delivery across its user base.

Important Notice

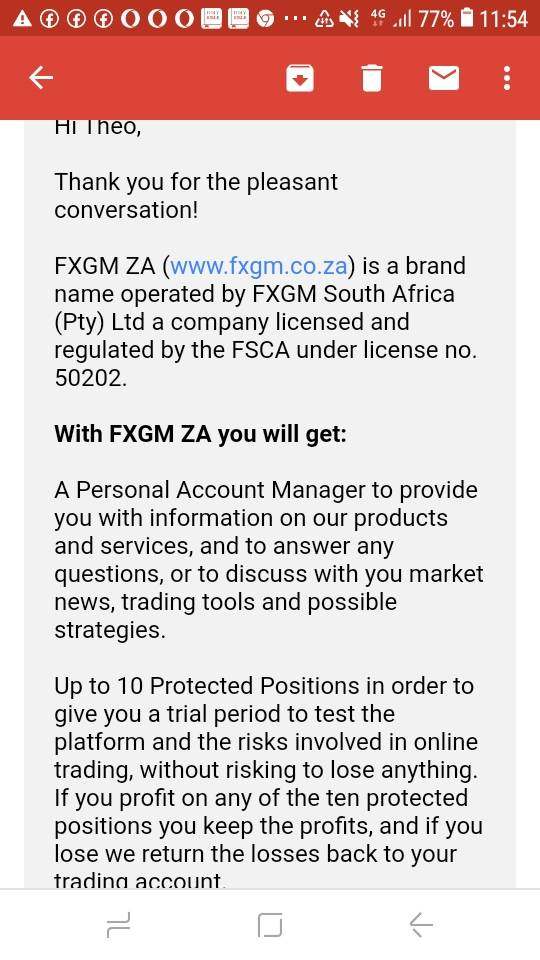

Regional Entity Differences: FXGM operates through multiple international entities with headquarters in various countries. Traders should be aware that regulatory oversight, available services, and trading conditions may vary significantly depending on their geographical location and the specific FXGM entity serving their region, which is common practice among international brokers.

Review Methodology: This comprehensive evaluation is based on publicly available information, regulatory filings, user feedback from various trading communities, and industry reports. All data presented reflects the most current information available as of 2025, though specific terms and conditions may be subject to change as the company updates its services and offerings.

Rating Framework

Broker Overview

FXGM emerged in the competitive forex landscape in 2011 as a brand operated by Depaho Ltd. The company established its primary operations in Cyprus and has grown steadily since its founding. The company has strategically positioned itself within the European regulatory framework while expanding its reach to serve international markets across multiple continents.

Over its decade-plus operational history, FXGM has built a solid reputation by focusing on providing accessible trading solutions for retail investors. These investors seek exposure to global financial markets without the complexity often associated with institutional trading platforms. The brokerage operates as a multi-asset broker, offering comprehensive trading services across forex and contracts for difference.

This business model allows traders to access various financial instruments through a single platform. It streamlines the trading experience for both novice and experienced market participants who value convenience and efficiency. FXGM's approach emphasizes accessibility and user-friendly services, making it particularly attractive to traders who are transitioning from traditional investment vehicles to more dynamic trading environments.

The company's regulatory foundation centers around its authorization from the Cyprus Securities and Exchange Commission. This authorization is supplemented by additional regulatory relationships across multiple jurisdictions to serve its diverse international client base. This multi-layered regulatory approach provides enhanced credibility and offers traders various levels of protection depending on their location and the specific services they utilize.

The broker's commitment to regulatory compliance has been a cornerstone of its growth strategy and reputation building within the financial services industry. This focus on compliance helps maintain user trust and ensures operational standards meet international requirements.

Regulatory Jurisdiction: FXGM operates under the primary oversight of the Cyprus Securities and Exchange Commission. The company also maintains additional regulatory relationships across multiple international jurisdictions to serve its diverse client base effectively.

Deposit and Withdrawal Methods: Specific information regarding available deposit and withdrawal methods was not detailed in available documentation. Industry standards typically include bank transfers, credit cards, and electronic payment systems for user convenience.

Minimum Deposit Requirements: The platform maintains an accessible entry point with a minimum deposit requirement of $200 USD. This positioning works favorably for small to medium-sized retail investors who want to start trading without large initial commitments.

Bonus and Promotional Offers: Current promotional offerings and bonus structures were not specifically detailed in available public information. Traders should inquire directly for current incentive programs and special offers that may be available.

Tradeable Assets: FXGM provides access to forex currency pairs and contracts for difference. The platform covers major asset classes including foreign exchange markets and derivative instruments for diversified trading opportunities.

Cost Structure: Detailed information regarding spreads, commissions, and fee structures was not comprehensively available in public documentation. This indicates the need for direct inquiry to obtain current pricing information and trading costs.

Leverage Ratios: The platform offers leverage capabilities up to 1:400. This provides significant trading power while requiring appropriate risk management from traders who choose to use high leverage levels.

Platform Options: Specific trading platform information was not detailed in available materials. Industry standards typically include MetaTrader platforms or proprietary solutions designed for user-friendly trading experiences.

Geographic Restrictions: Specific regional limitations were not outlined in available documentation. Traders should verify availability in their region before opening accounts.

Customer Support Languages: Available customer service languages were not specified in current public information. Multilingual support is typically important for international brokers serving diverse client bases.

Detailed Rating Analysis

Account Conditions Analysis (7/10)

FXGM's account structure demonstrates a balanced approach to serving retail traders with its $200 USD minimum deposit requirement. This entry level strikes an appropriate balance between accessibility and serious trading intent for most retail investors. This entry level makes the platform accessible to small and medium-sized investors who may be testing the waters of forex trading or seeking to diversify their investment portfolios without committing substantial capital upfront.

The leverage offering of up to 1:400 represents a significant feature for traders seeking to maximize their market exposure. While this level of leverage can amplify both profits and losses, it provides experienced traders with the flexibility to implement various trading strategies and position sizing approaches that match their risk tolerance. However, the absence of detailed information regarding different account tiers, specific features for various account types, and any special account offerings such as Islamic accounts represents a transparency gap.

Potential clients may find this lack of detailed account information concerning when making their broker selection decisions. The account opening process details were not comprehensively outlined in available materials, which could indicate either a streamlined approach or a lack of transparency in onboarding procedures.

This FXGM review notes that while the basic account requirements appear reasonable, the limited public information about advanced account features and benefits may require direct communication with the broker. Complete understanding of all account options and benefits requires additional research beyond publicly available materials.

The evaluation of FXGM's trading tools and resources reveals a significant information gap that impacts the overall assessment. Without detailed information about specific trading platforms, analytical tools, or research capabilities, it becomes challenging to provide a comprehensive evaluation of the broker's technological offerings and support resources that traders rely on for market analysis.

Industry standards typically include access to advanced charting capabilities, technical analysis tools, economic calendars, market research, and educational resources. However, the absence of specific details about FXGM's offerings in these areas suggests either a minimalist approach to tool provision or insufficient public disclosure of available resources that could benefit traders. Educational resources play a crucial role in broker evaluation, particularly for platforms targeting small to medium-sized investors who may benefit from learning materials and market analysis.

The lack of detailed information about educational offerings, webinars, tutorials, or market commentary represents a missed opportunity for transparency. This may also indicate limited investment in trader development resources that help users improve their trading skills and market understanding.

Automated trading support and third-party tool integration are increasingly important features for modern traders. Without specific information about expert advisor support, API access, or integration capabilities, potential users cannot adequately assess the platform's suitability for their trading style and requirements, which may limit the platform's appeal to advanced traders.

Customer Service and Support Analysis (6/10)

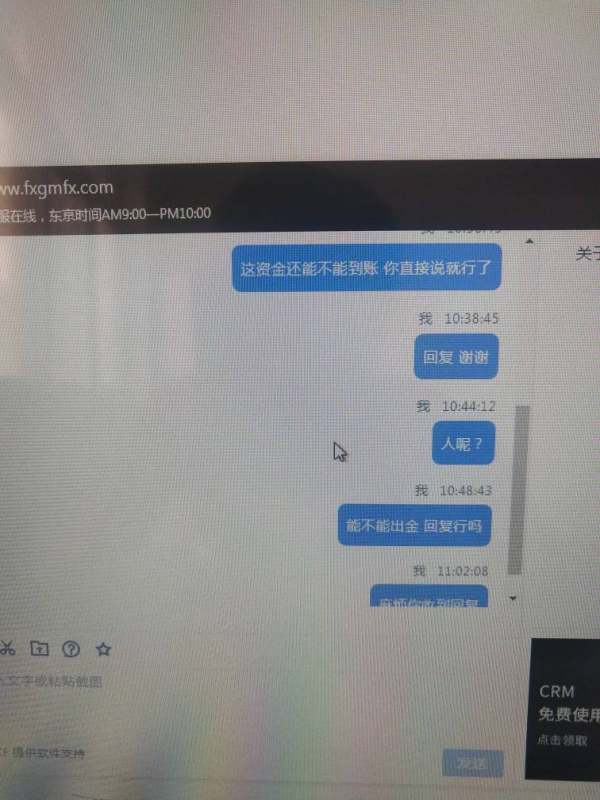

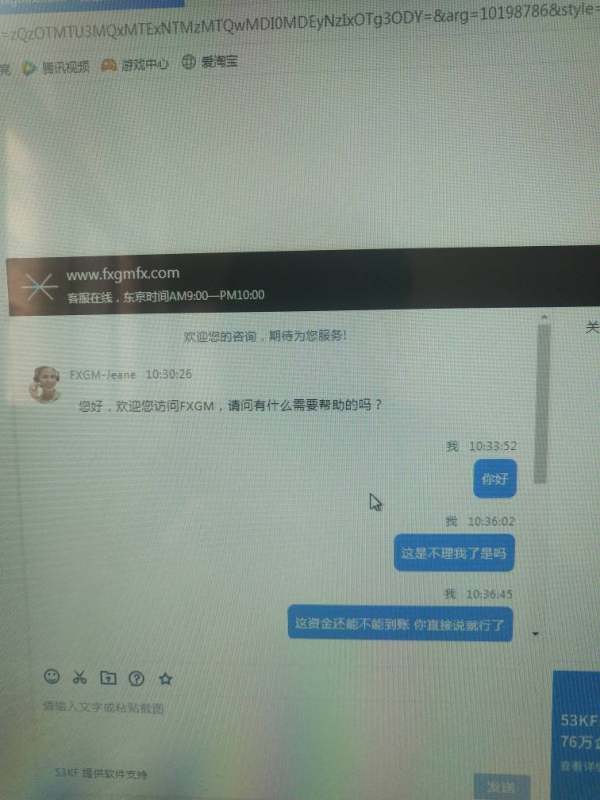

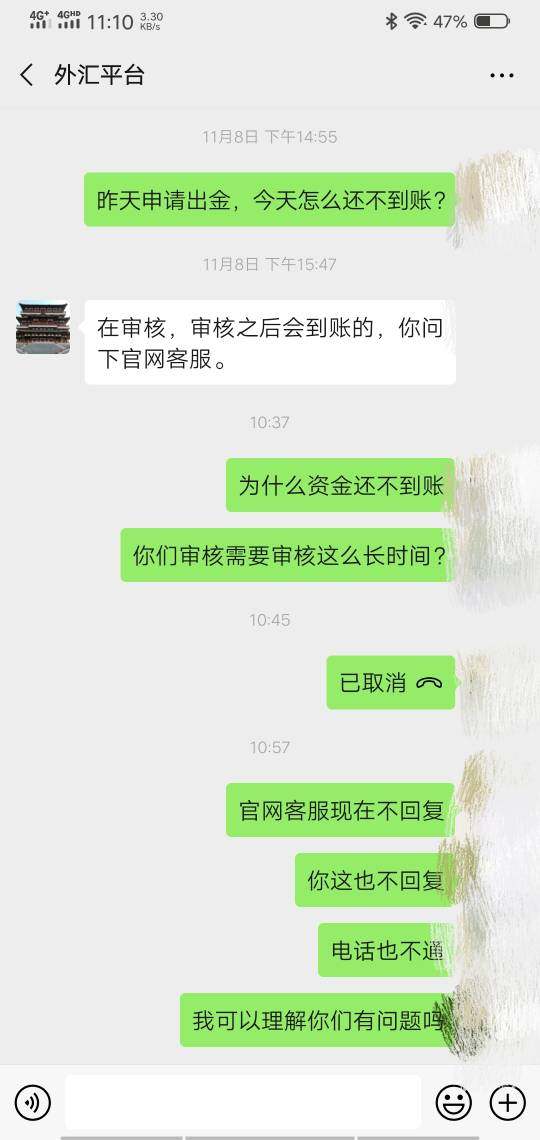

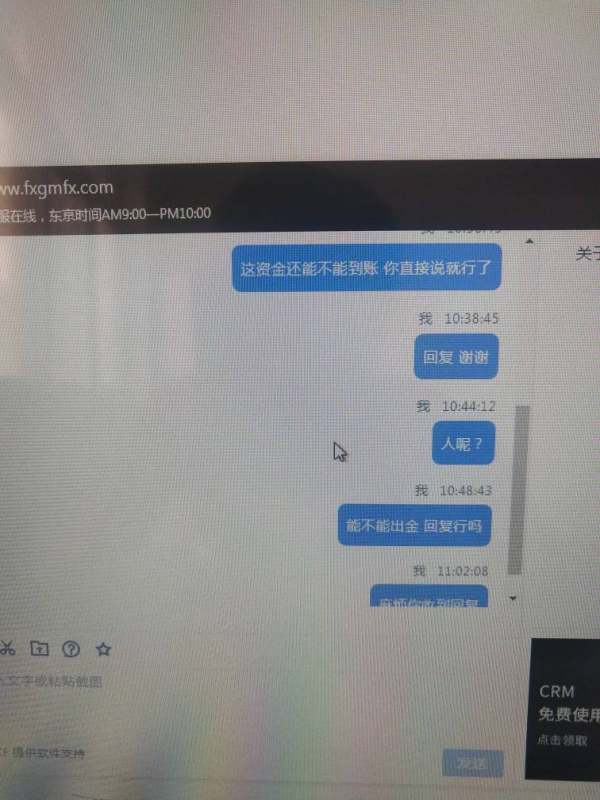

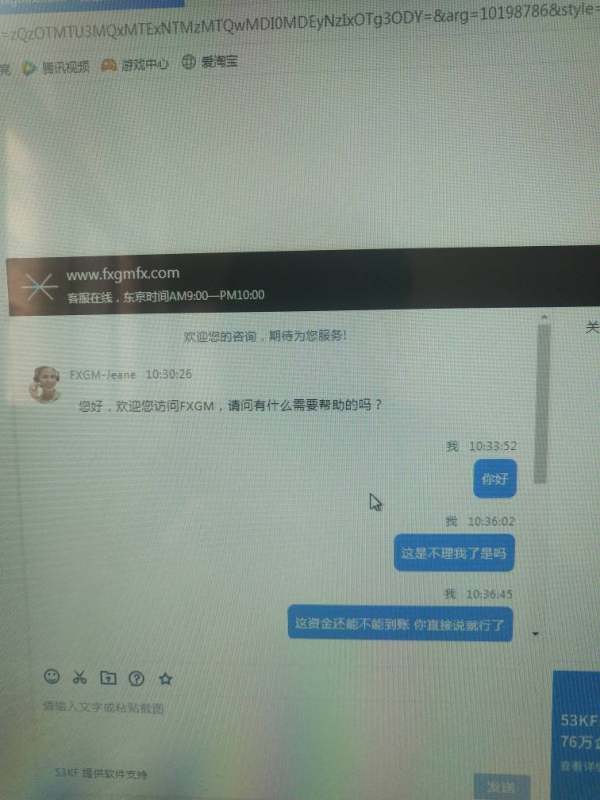

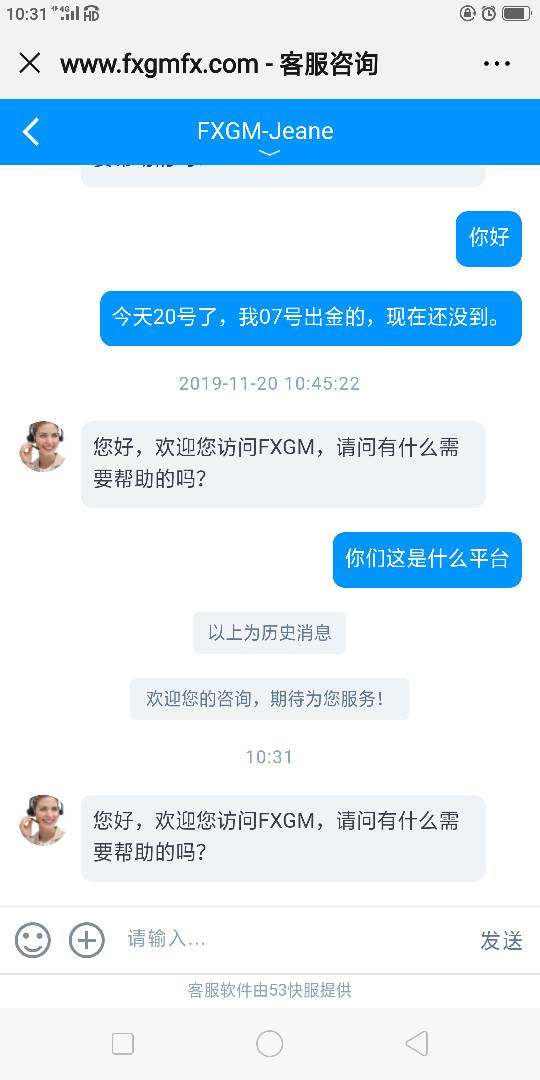

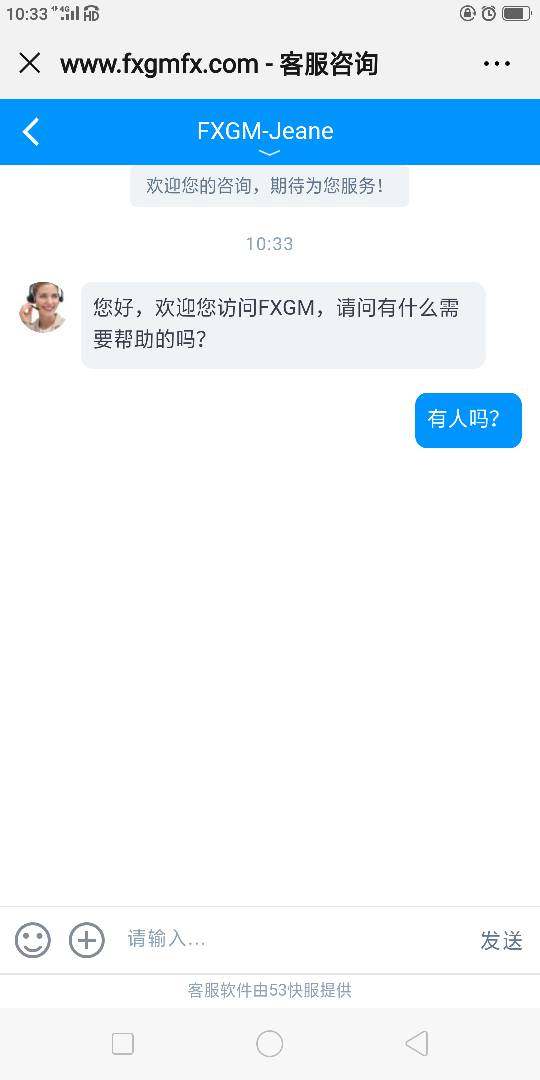

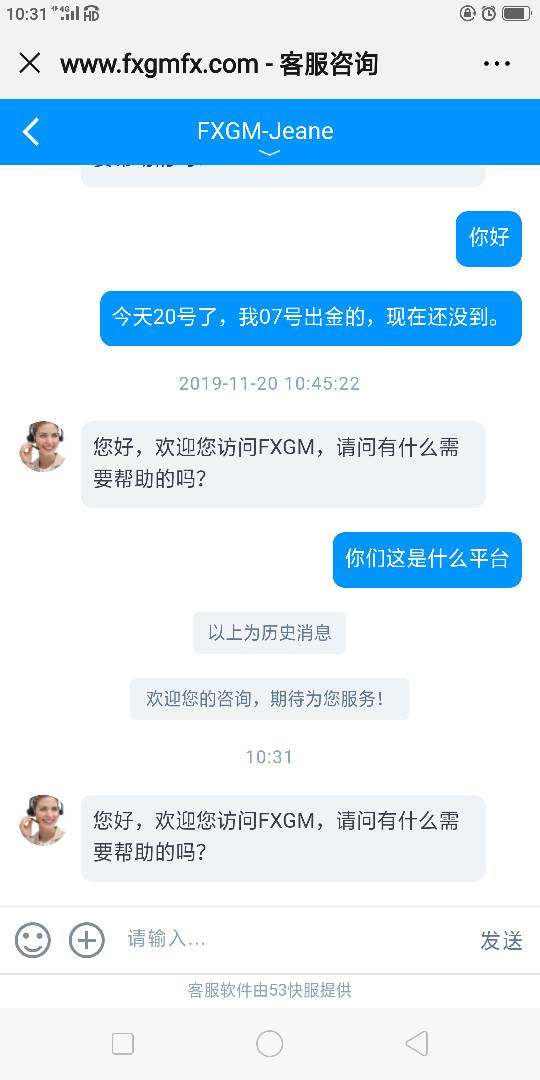

Customer service evaluation for FXGM faces limitations due to insufficient public information about specific support channels, response times, and service quality metrics. The absence of detailed customer service information makes it difficult to assess the broker's commitment to client support and problem resolution capabilities that are essential for trader satisfaction.

Effective customer support typically encompasses multiple communication channels including live chat, telephone support, email assistance, and comprehensive FAQ sections. The availability of these services across different time zones and in multiple languages significantly impacts user experience, particularly for international clients operating in various global markets where timing and communication clarity are crucial. Response time expectations and service quality standards are crucial factors in customer satisfaction, especially in the fast-paced trading environment.

Technical issues or account problems can have immediate financial implications for active traders who need quick resolution. Without specific performance metrics or user feedback regarding support quality, this evaluation relies on general industry observations and limited user testimonials that may not represent the complete service experience.

The multilingual support capability becomes particularly important for an internationally focused broker like FXGM, serving clients across different regions and language preferences. The absence of detailed language support information may indicate limited international service capabilities or insufficient disclosure of available services that could help international clients feel more confident about support accessibility.

Trading Experience Analysis (6/10)

The trading experience evaluation for FXGM encounters significant challenges due to limited available information about platform stability, execution quality, and user interface design. These factors are fundamental to trader satisfaction and platform effectiveness, making their absence in public documentation a notable concern for potential users who need reliable trading conditions.

Platform stability and execution speed directly impact trading success, particularly in volatile market conditions where rapid price movements can affect trade outcomes. Without specific user feedback or performance data regarding order execution times, slippage rates, or system uptime statistics, this FXGM review cannot provide detailed insights into the platform's technical performance that traders depend on for successful trading operations. The mobile trading experience has become increasingly important as traders seek flexibility and accessibility across different devices and locations.

The absence of specific information about mobile platform capabilities, features, and performance represents a gap in understanding the complete trading experience offered by FXGM. Mobile trading functionality is essential for traders who need to monitor and manage positions while away from their primary trading setups.

Trading environment factors such as available order types, risk management tools, and platform customization options significantly influence user satisfaction and trading effectiveness. The limited public information about these features makes it challenging for potential users to assess platform suitability for their specific trading strategies and requirements, which could impact their decision to choose FXGM over competitors with more transparent feature disclosure.

Trustworthiness Analysis (8/10)

FXGM demonstrates strong credentials in the trustworthiness category, primarily anchored by its regulatory oversight from the Cyprus Securities and Exchange Commission and additional regulatory relationships across multiple jurisdictions. This multi-layered regulatory approach provides enhanced credibility and demonstrates the company's commitment to operating within established legal frameworks that protect trader interests.

The broker's establishment in 2011 and continued operation over more than a decade indicates operational stability and market resilience. This longevity in the competitive forex market suggests effective business management and the ability to adapt to changing market conditions and regulatory requirements that have evolved significantly over the past decade. According to available user feedback, FXGM maintains a trust score of 71 points, indicating moderate to high confidence among its user base.

This score reflects user perceptions of the platform's reliability, security measures, and overall trustworthiness in handling client funds and executing trades consistently. The score suggests that most users have positive experiences with the platform's fundamental operations and security protocols.

The company's reputation within the cryptocurrency trading sector adds another dimension to its trustworthiness profile, suggesting expertise in emerging financial markets. This specialization demonstrates the ability to adapt to new trading opportunities and technological developments in the rapidly evolving digital asset space. This specialization may attract traders seeking exposure to digital assets while maintaining traditional forex trading capabilities within a single platform.

User Experience Analysis (7/10)

User experience evaluation for FXGM reveals generally positive feedback from the trading community, with particular strength noted in cryptocurrency trading services. The overall user sentiment appears favorable, suggesting that the platform successfully meets the basic needs of its target demographic of small to medium-sized investors who value straightforward trading solutions.

The platform's positioning toward traders interested in cryptocurrency markets appears to resonate well with users seeking diversified trading opportunities beyond traditional forex pairs. This specialization may provide a competitive advantage and enhanced user satisfaction for traders with specific interest in digital asset markets that have grown significantly in popularity and trading volume. The minimum deposit requirement of $200 USD aligns well with the needs of the target user base, providing accessibility without creating barriers to entry.

This approach appears to successfully attract users who appreciate the balance between accessibility and serious trading intent. The deposit level suggests the platform understands its target market and has structured its entry requirements accordingly.

However, the limited available information about user interface design, platform navigation, and overall user journey indicates either minimal public disclosure or potential areas for improvement. Better documentation of user experience features and platform usability could help potential clients better understand what to expect from the trading environment and overall service experience.

Conclusion

This comprehensive FXGM review reveals a broker that occupies a solid middle ground in the competitive forex market, with particular strengths in regulatory compliance and cryptocurrency trading services. The platform demonstrates clear suitability for small to medium-sized investors seeking accessible entry points into forex and CFD trading without the complexity of institutional-level platforms.

FXGM's primary advantages include its diverse regulatory oversight, reasonable minimum deposit requirements, and established reputation within the cryptocurrency trading community. The broker's decade-plus operational history and trust score of 71 points indicate reliable service delivery and user satisfaction within its target market segment, suggesting consistent performance over time.

However, the evaluation also reveals significant transparency gaps, particularly regarding trading platforms, detailed fee structures, and comprehensive service offerings. These information limitations may require potential users to engage directly with the broker for complete service understanding, which could impact the decision-making process for some traders seeking comprehensive public information before commitment to any trading platform.