BitmaX Review 1

Unluckily, I deposited 4,055 pesos and they laughed at me. They promised me that I could be a millionaire but the truth was not that. The broker was fake and so was the data.

BitmaX Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Unluckily, I deposited 4,055 pesos and they laughed at me. They promised me that I could be a millionaire but the truth was not that. The broker was fake and so was the data.

BitMax is now called AscendEX. This global digital asset exchange has been serving both retail and institutional clients since its establishment in 2018. This comprehensive bitmax review examines a platform that has positioned itself as a multi-faceted cryptocurrency trading venue, offering access to various digital assets and trading pairs for users worldwide.

The exchange has gained attention for its extensive cryptocurrency offerings. It supports multiple trading pairs and provides competitive fee structures for different types of trading activities. According to available reports, BitMax operates as a comprehensive digital asset platform that caters to diverse trading needs, from spot trading to more advanced financial instruments.

However, our analysis reveals several areas where information transparency could be improved. While the platform offers various trading services, specific details regarding regulatory oversight, comprehensive user support systems, and detailed operational procedures remain limited in publicly available documentation. This bitmax review aims to provide traders with a balanced assessment of what to expect when considering this exchange for their cryptocurrency trading activities.

The platform appears to target both individual traders and institutional clients seeking exposure to cryptocurrency markets. However, potential users should carefully consider the available information regarding security measures, regulatory compliance, and customer support quality before making trading decisions.

This bitmax review is based on publicly available information and user feedback collected from various sources as of 2025. Potential traders should be aware that cryptocurrency exchanges operate in a rapidly evolving regulatory environment, and compliance requirements may vary significantly across different jurisdictions.

The information presented in this review reflects the current understanding of BitMax's services and features. However, traders are strongly advised to conduct their own due diligence and verify all details directly with the platform before opening accounts or depositing funds. Regulatory status and available services may differ based on your location and applicable local laws.

Based on available information and analysis, here are our ratings for BitMax across six key dimensions:

| Dimension | Score | Rating |

|---|---|---|

| Account Conditions | 5/10 | Average |

| Tools and Resources | 6/10 | Above Average |

| Customer Service | 4/10 | Below Average |

| Trading Experience | 6/10 | Above Average |

| Trust and Safety | 4/10 | Below Average |

| User Experience | 5/10 | Average |

These ratings reflect the current state of available information about BitMax's services and the transparency of their operations in the competitive cryptocurrency exchange market.

BitMax emerged in the cryptocurrency exchange landscape in 2018 as a global digital asset trading platform. The exchange was designed to serve both retail traders and institutional clients seeking comprehensive cryptocurrency trading solutions. According to Crypto Frontline reports, the platform has positioned itself as a multi-service digital asset exchange that aims to provide various trading opportunities in the rapidly evolving cryptocurrency market.

The company's business model focuses on providing access to multiple cryptocurrency trading pairs while maintaining competitive fee structures. BitMax has developed its operations to accommodate different types of trading activities, from basic spot trading to more sophisticated trading instruments, targeting users who require diverse cryptocurrency exposure and trading capabilities.

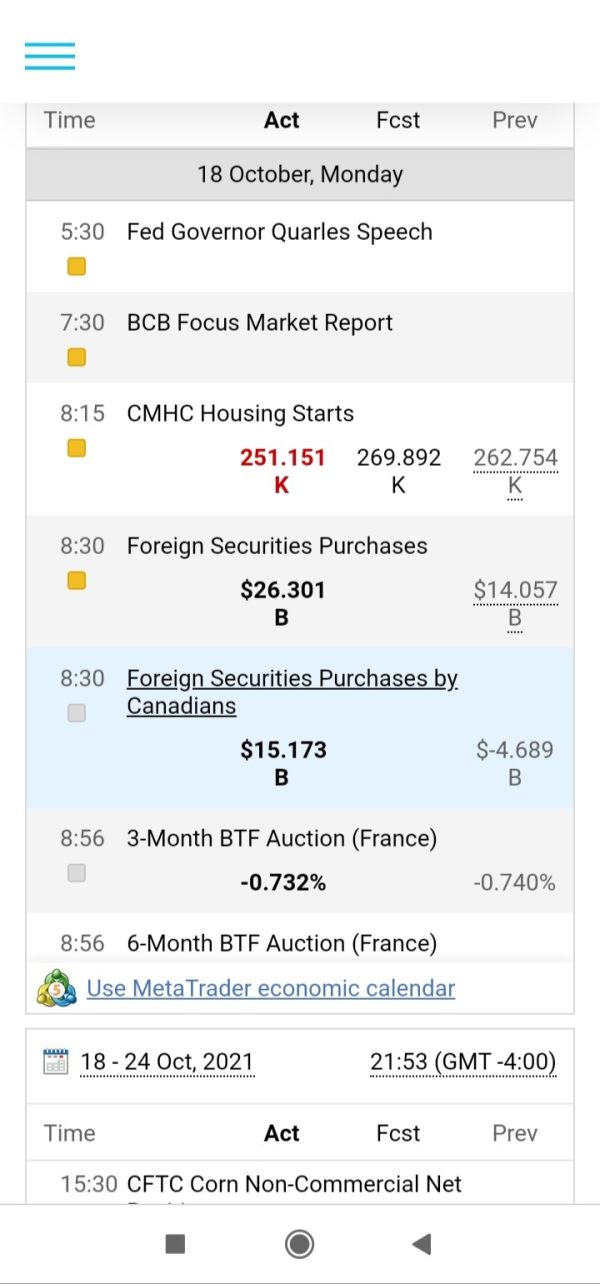

BitMax operates its proprietary trading platform. It offers access to various cryptocurrency assets and trading pairs. According to available information from Cryptowisser, the exchange supports multiple digital assets, though specific details about additional platform integrations such as MetaTrader support are not clearly documented in available sources. The platform's asset coverage includes various cryptocurrencies, with reports indicating support for multiple trading pairs to accommodate different trading strategies and preferences.

Regarding regulatory oversight, specific information about BitMax's regulatory status and supervising authorities is not comprehensively detailed in available public documentation. This represents an area where potential users may need to seek additional clarification directly from the platform to understand the regulatory framework under which their trading activities would operate.

Regulatory Status: Specific regulatory information and supervising authorities are not clearly detailed in available public documentation. This may require potential users to verify regulatory compliance directly with the platform.

Deposit and Withdrawal Methods: Available sources do not provide comprehensive details about specific deposit and withdrawal options, processing times, or associated fees for funding accounts.

Minimum Deposit Requirements: Specific minimum deposit amounts for different account types are not clearly specified in the reviewed documentation.

Bonus and Promotions: Information about current promotional offers, trading bonuses, or new user incentives is not detailed in available sources.

Tradeable Assets: According to available reports, BitMax supports multiple cryptocurrency trading pairs. It provides access to various digital assets for spot trading and other trading activities.

Cost Structure: Available information indicates that BitMax implements a fee structure for different trading activities. However, specific percentage rates and fee schedules may require verification directly with the platform.

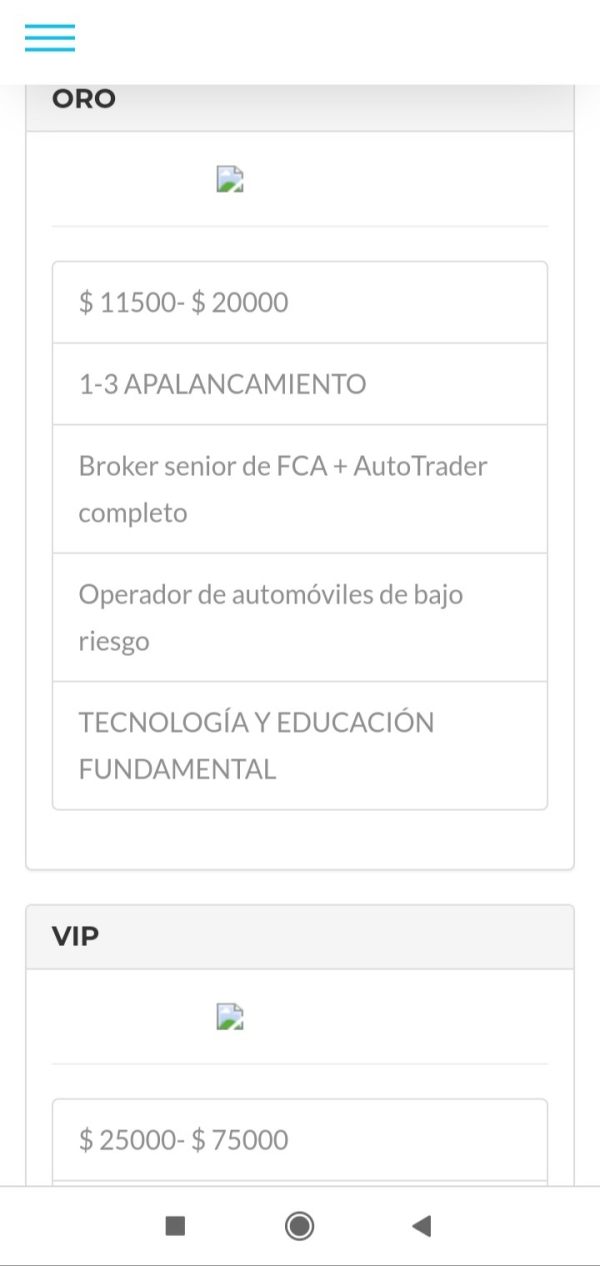

Leverage Options: Specific leverage ratios and margin trading capabilities are not comprehensively detailed in reviewed sources.

Platform Options: The exchange operates its proprietary BitMax trading platform. However, information about additional platform integrations or third-party trading software support is not clearly documented.

Geographic Restrictions: Specific information about regional limitations or restricted jurisdictions is not detailed in available documentation.

Customer Support Languages: Available customer service languages and support options are not comprehensively specified in reviewed sources.

This bitmax review notes that many operational details require direct verification with the platform. Public documentation does not provide comprehensive coverage of all service aspects.

The account conditions at BitMax present a mixed picture for potential traders. While the platform offers cryptocurrency trading services, specific details about account types, their distinct features, and associated benefits are not comprehensively outlined in available public documentation. This lack of transparency regarding account structures makes it challenging for traders to understand what to expect when opening an account.

Minimum deposit requirements are crucial for traders planning their initial investment. However, they are not clearly specified in the reviewed sources. This absence of clear financial requirements creates uncertainty for potential users who need to budget for their trading activities. Additionally, the account opening process, including verification requirements, documentation needs, and approval timeframes, lacks detailed public documentation.

The platform does not appear to offer specialized account types such as Islamic accounts or other region-specific account variations that some traders might require. This limitation could restrict access for certain user groups who need compliant trading solutions. According to available sources, specific account features, trading privileges, and tier-based benefits are not clearly communicated, which impacts the overall assessment of account conditions.

User feedback regarding account setup experiences, approval processes, and account management capabilities is limited in available sources. This makes it difficult to assess real-world user satisfaction with account conditions. This bitmax review finds that the lack of detailed account information represents a significant area for improvement in terms of transparency and user guidance.

BitMax's trading tools and resources show some positive aspects, particularly in terms of cryptocurrency asset variety. According to Cryptowisser reports, the platform provides access to multiple cryptocurrency trading pairs, which gives traders various options for portfolio diversification and trading strategies. This variety represents a strength for traders seeking exposure to different digital assets within a single platform.

However, specific information about advanced trading tools, technical analysis resources, and research capabilities is not comprehensively detailed in available documentation. The platform's analytical tools, charting capabilities, and market research resources lack detailed public description, which makes it difficult to assess the quality and comprehensiveness of these essential trading components.

Educational resources are increasingly important for cryptocurrency traders navigating complex markets. However, they are not clearly outlined in available sources. The absence of detailed information about trading guides, market analysis, webinars, or other educational content represents a gap in the platform's resource offering assessment.

Automated trading support, API access, and third-party integration capabilities are not clearly documented. This may limit the platform's appeal to more advanced traders who rely on algorithmic trading strategies or require extensive customization options. The platform's mobile trading capabilities and cross-device synchronization features also lack detailed documentation in available sources.

Customer service and support represent areas where BitMax's transparency could be significantly improved. Available sources do not provide comprehensive information about customer support channels, availability hours, or response time expectations. This lack of clarity about support accessibility creates uncertainty for traders who may need assistance with their accounts or trading activities.

The quality of customer service, as reflected in user feedback and testimonials, is not well-documented in available sources. Without clear information about support ticket resolution times, live chat availability, phone support options, or email response standards, potential users cannot adequately assess the level of support they might receive.

Multi-language support capabilities are essential for a global cryptocurrency exchange. However, they are not clearly specified in reviewed documentation. This absence of language support information may concern international users who require assistance in their native languages. Additionally, the availability of 24/7 support, which is often expected in cryptocurrency trading due to market operating hours, is not clearly confirmed.

Specific case studies or examples of customer service problem resolution are not available in reviewed sources. This makes it difficult to assess the platform's effectiveness in handling user concerns. The overall lack of detailed customer service information in public documentation suggests this area requires significant attention for transparency improvement.

The trading experience on BitMax shows some positive elements, particularly regarding cryptocurrency asset availability. The platform's support for multiple trading pairs provides traders with various opportunities for executing different trading strategies and accessing diverse cryptocurrency markets. This variety can enhance the overall trading experience for users seeking comprehensive cryptocurrency exposure.

Platform stability and execution speed are critical factors for cryptocurrency trading success. However, they are not comprehensively documented in available user feedback or technical performance reports. Without specific information about order execution times, platform uptime statistics, or latency measurements, it's challenging to assess the technical quality of the trading experience.

The functionality and user interface of the BitMax trading platform lack detailed description in available sources. Important aspects such as order types, charting capabilities, real-time data accuracy, and platform responsiveness are not clearly documented, which impacts the ability to assess the overall trading environment quality.

Mobile trading experience is increasingly important for cryptocurrency traders who need to monitor markets and execute trades on the go. However, it is not comprehensively detailed in available documentation. The synchronization between desktop and mobile platforms, mobile-specific features, and mobile platform stability require further clarification for a complete trading experience assessment. This bitmax review finds that while asset variety is a strength, technical performance transparency needs improvement.

Trust and safety considerations present significant concerns in this BitMax assessment. The most notable issue is the lack of clear regulatory information in available public documentation. For cryptocurrency exchanges, transparent regulatory compliance and oversight details are crucial for user confidence, yet specific regulatory authorities, licenses, or compliance frameworks are not clearly outlined in reviewed sources.

Security measures and fund protection protocols are mentioned in general terms by some sources. However, they lack detailed documentation about specific security implementations. Information about cold storage procedures, insurance coverage, audit results, or third-party security assessments is not comprehensively available, which impacts the ability to assess the platform's security robustness.

According to Cryptogeek reports, there have been discussions about safety concerns and potential scam allegations. However, specific details about these concerns and their resolution are not clearly documented. Such discussions in the cryptocurrency community can significantly impact user confidence and require transparent addressing by the platform.

Company transparency regarding ownership structure, management team, financial backing, and operational procedures is limited in available sources. For users considering significant fund deposits, this lack of comprehensive transparency about company operations and leadership represents a considerable trust concern. The absence of detailed information about regulatory compliance, security audits, and operational transparency suggests that potential users should exercise additional caution and conduct thorough due diligence.

User experience assessment for BitMax reveals a mixed landscape with several areas lacking sufficient information for comprehensive evaluation. Overall user satisfaction levels are not clearly documented in available sources, making it difficult to assess how well the platform meets user expectations in real-world trading scenarios.

Interface design and usability aspects of the BitMax platform are not comprehensively detailed in available documentation. Important user experience factors such as navigation intuitiveness, visual design quality, feature accessibility, and overall platform responsiveness lack detailed description, which impacts the ability to assess the platform's user-friendliness.

Registration and verification processes form users' first impressions of a platform. However, they are not clearly outlined in available sources. Information about required documentation, verification timeframes, approval processes, and potential complications during account setup is not comprehensively available, creating uncertainty for prospective users.

Fund management experience includes deposit and withdrawal processes, transaction confirmations, and account balance management. It lacks detailed documentation in reviewed sources. These operational aspects significantly impact daily user experience but are not clearly described in available information.

Common user complaints or frequently reported issues are not well-documented in available sources. This makes it difficult to identify potential pain points or areas where users typically encounter difficulties. The absence of comprehensive user feedback compilation suggests that potential users may need to seek additional information from community forums or direct platform contact to understand the real-world user experience.

This comprehensive bitmax review reveals a cryptocurrency exchange that offers some positive aspects, particularly in terms of asset variety and trading pair availability. However, it faces significant challenges in transparency and information accessibility. BitMax appears to provide multiple cryptocurrency trading opportunities, which can appeal to traders seeking diverse digital asset exposure within a single platform.

However, the platform's suitability for different user types remains unclear due to limited information about account conditions, regulatory compliance, and customer support quality. The lack of comprehensive documentation about operational procedures, security measures, and user experience creates uncertainty that potential traders must carefully consider.

The main advantages identified include cryptocurrency trading pair variety and competitive positioning in the digital asset market. Conversely, significant disadvantages include limited regulatory transparency, insufficient customer service documentation, and unclear operational procedures that may concern users prioritizing security and regulatory compliance in their trading platform selection.

Potential users should conduct thorough due diligence and verify all operational details directly with BitMax before making trading decisions. This is particularly important regarding regulatory status, security measures, and customer support capabilities.

FX Broker Capital Trading Markets Review