Pocket Broker 2025 Review: Everything You Need to Know

Executive Summary

Pocket Broker is a rapidly emerging online trading platform that aims to provide users with a flexible trading experience. This pocket broker review presents a neutral overall assessment based on available user feedback and platform information. Some users report negative experiences regarding deposit crediting issues, which raises concerns about the platform's reliability.

The platform's key characteristics include diverse payment options and mobile trading convenience. This makes it attractive to users seeking smartphone-based financial trading solutions. The platform primarily serves both beginners and experienced traders who prefer conducting financial transactions through mobile devices.

According to Google Play data, the application has achieved over 10 million downloads. This indicates a substantial user base that has found value in the platform's offerings. However, user reviews reveal mixed experiences throughout their trading journey.

Positive feedback highlights the diversity of payment options available to users. Complaints about deposits not being credited to accounts balance against these positive aspects. The platform appears to focus heavily on mobile trading accessibility, positioning itself as a convenient solution for on-the-go trading activities.

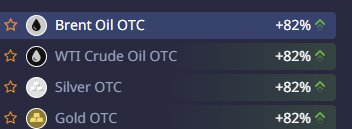

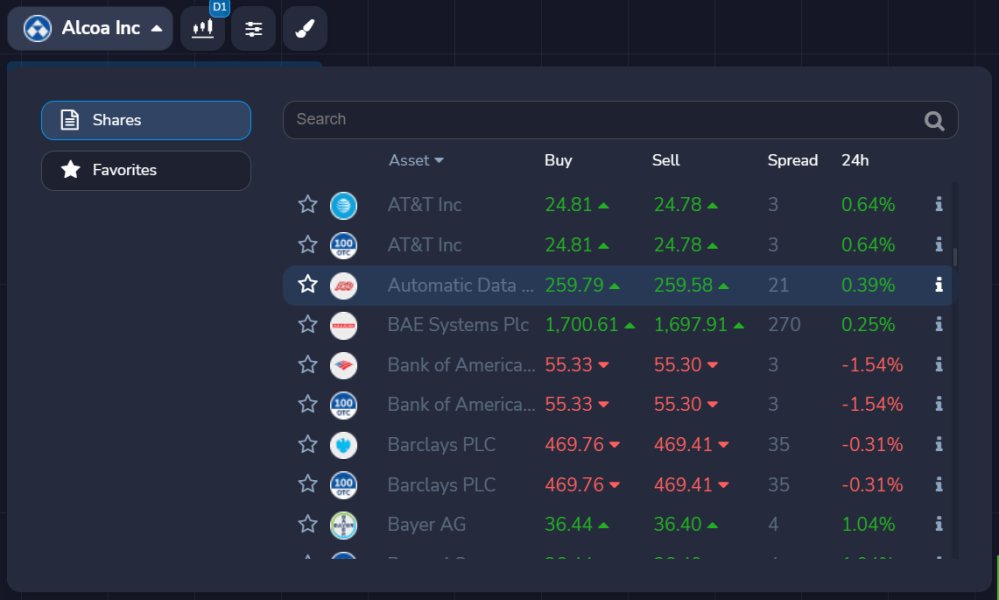

Users can trade across various asset classes including forex, stocks, and cryptocurrencies. This variety provides flexibility for different trading strategies and preferences.

Important Disclaimers

Since specific regulatory information was not mentioned in available sources, users in different regions may face varying legal and regulatory requirements when using this platform. Potential traders should verify local compliance requirements before engaging with the service to ensure they operate within legal boundaries.

This review is based on user feedback and platform-provided information for comprehensive assessment purposes. It does not include independent market analysis or regulatory authority evaluations. Users should conduct their own due diligence and consider consulting with financial advisors before making trading decisions.

Rating Framework

Broker Overview

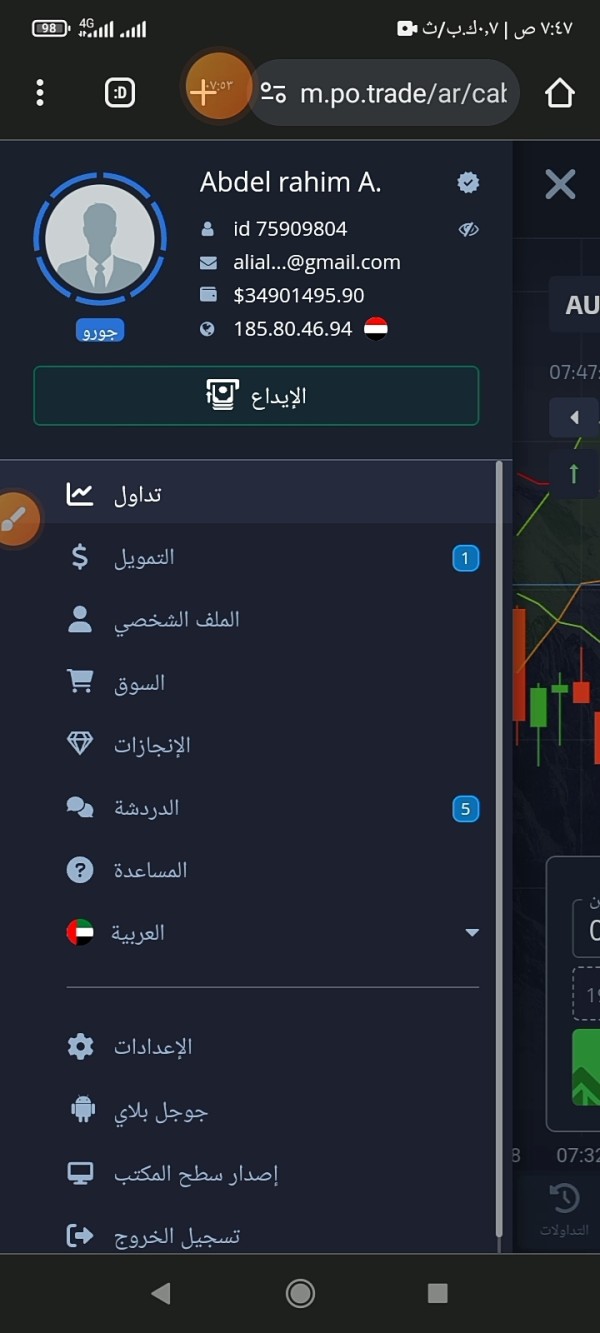

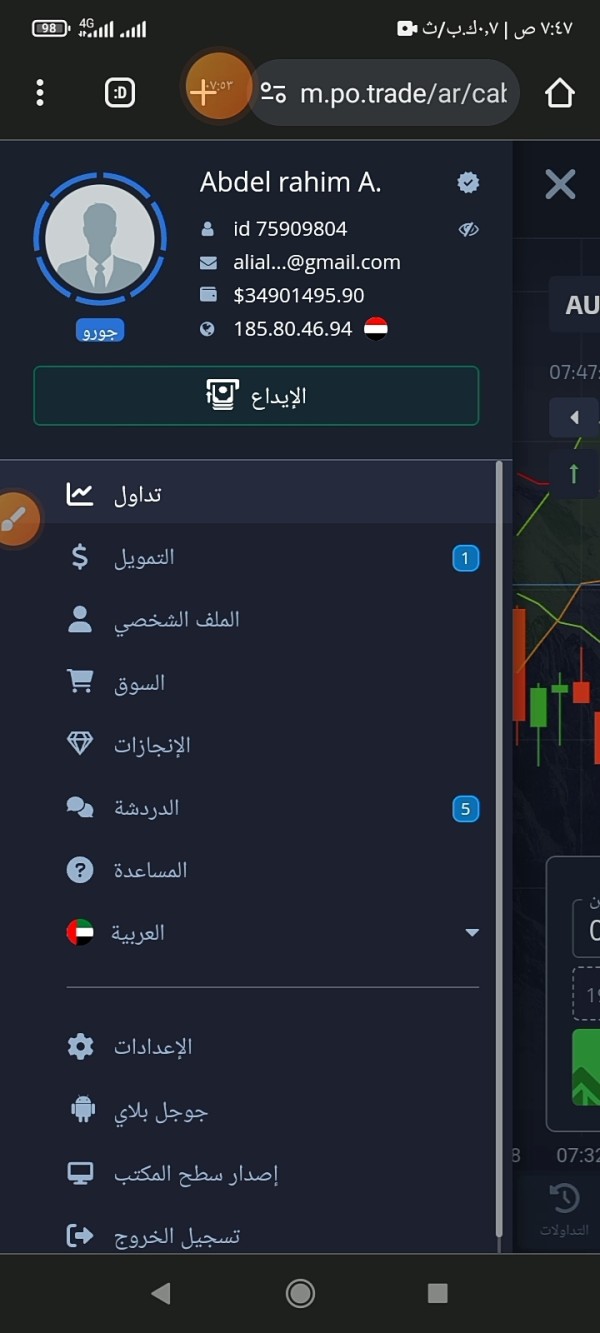

Pocket Broker represents an online trading platform that is rapidly gaining recognition as a popular choice among digital traders. The company has positioned itself as a comprehensive trading solution offering access to stocks, forex, cryptocurrencies, and other securities. While the establishment year is not specified in available information, the platform's business model focuses on providing accessible trading services through digital channels.

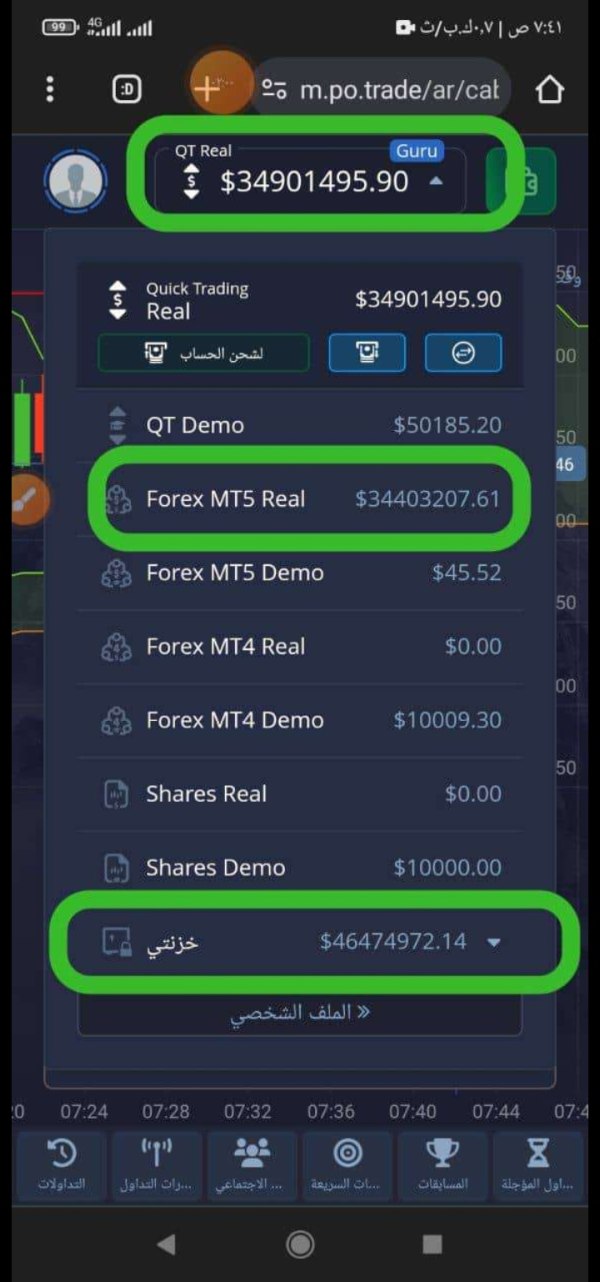

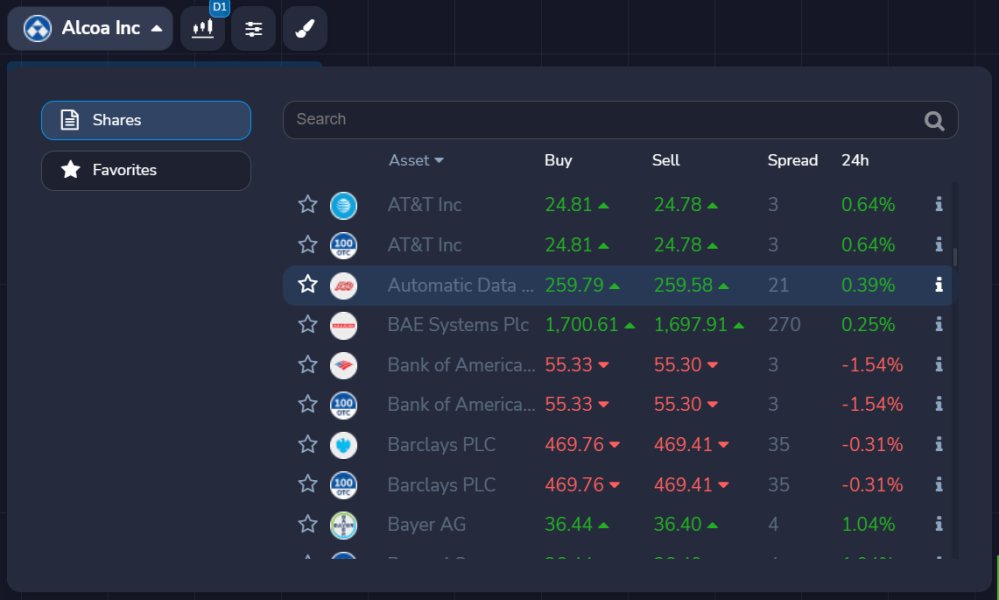

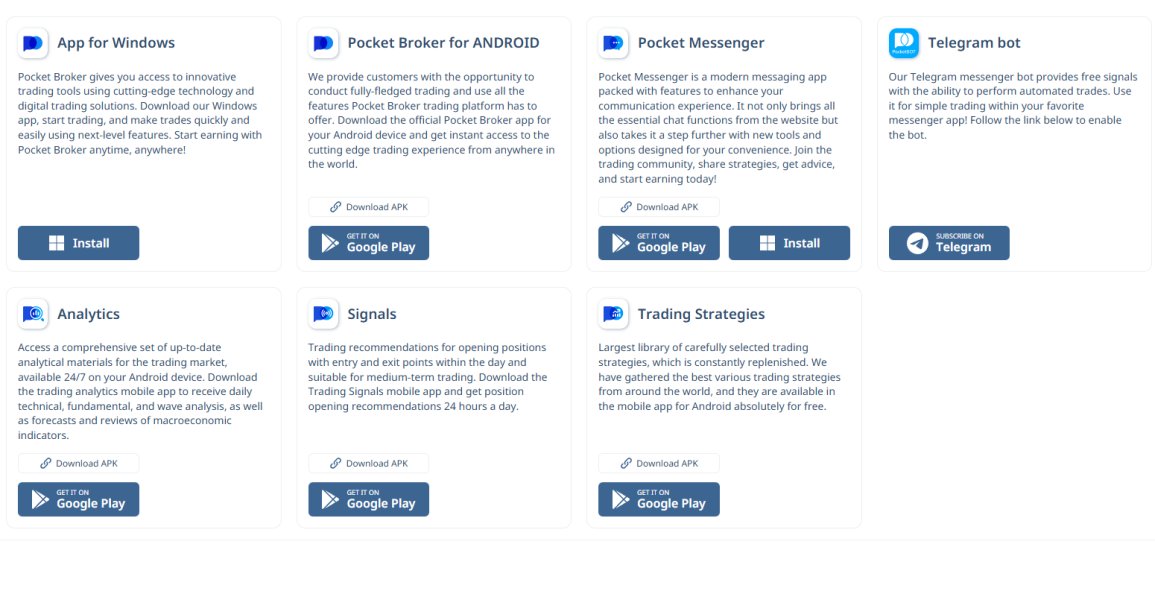

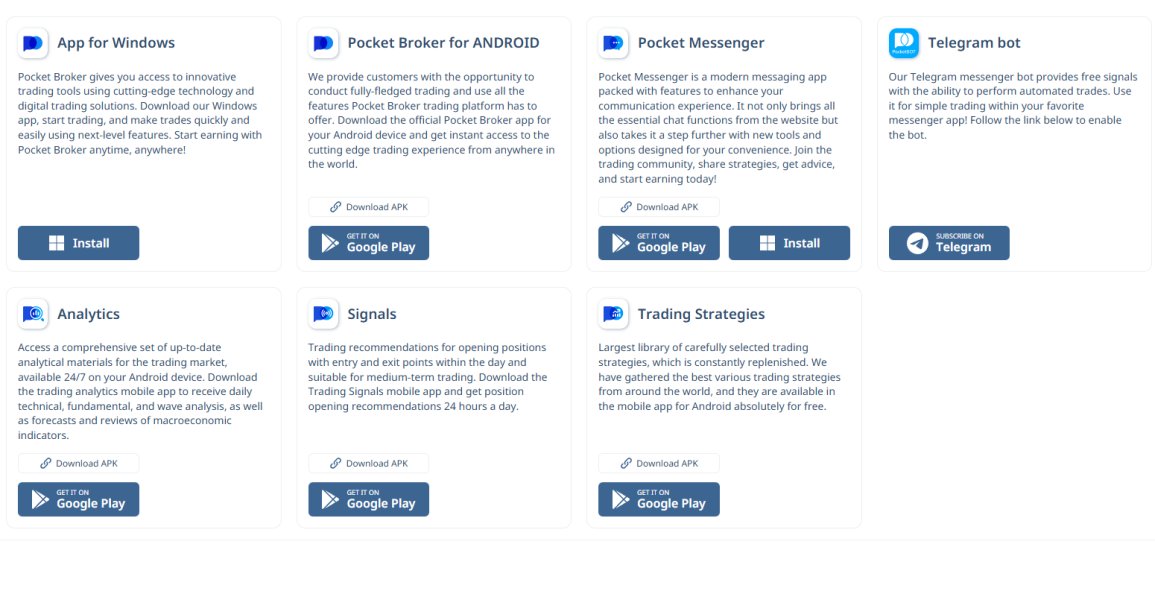

The platform emphasizes mobile-first accessibility for modern traders who prefer smartphone-based activities. It operates as a digital trading environment, primarily delivered through mobile application format to serve users efficiently. Supported asset classes encompass forex pairs, stock securities, and cryptocurrency trading opportunities.

Specific details about trading conditions and asset variety require further clarification from the platform directly. The regulatory framework and specific oversight authorities are not mentioned in available source materials. This represents an important consideration for potential users evaluating platform credibility and safety measures.

According to Google Play statistics, the Pocket Broker application has achieved significant market penetration with over 10 million downloads. This suggests considerable user adoption and market presence among mobile trading enthusiasts. This pocket broker review indicates that while the platform has gained substantial user traction, mixed feedback regarding service reliability requires careful consideration by prospective traders.

Regulatory Jurisdiction: Available information does not specify particular regulatory authorities or jurisdictions under which Pocket Broker operates. This may be a consideration for users seeking regulated trading environments with established oversight.

Deposit and Withdrawal Methods: Pocket Broker provides multiple payment options according to user feedback. Specific payment methods, processing times, and associated fees are not detailed in available sources.

Minimum Deposit Requirements: Specific minimum deposit amounts are not mentioned in available information. Users must make direct platform inquiry for accurate details about funding requirements.

Bonus and Promotional Offers: Information regarding welcome bonuses, promotional campaigns, or trading incentives is not specified in current source materials. Potential users should contact the platform directly for current promotional information.

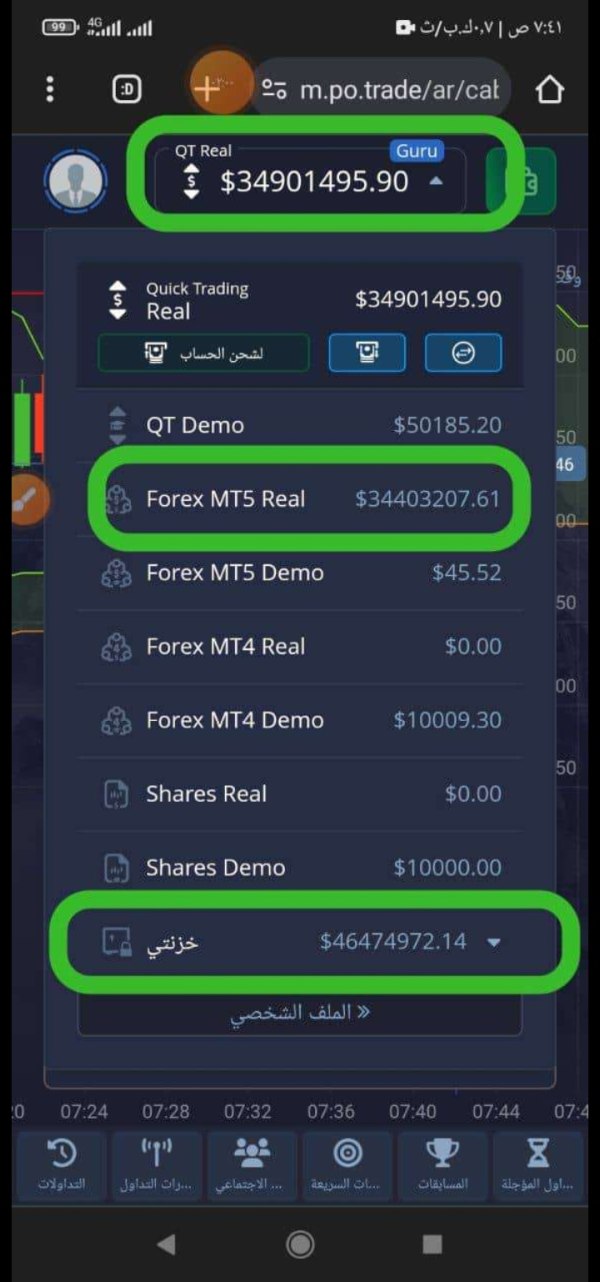

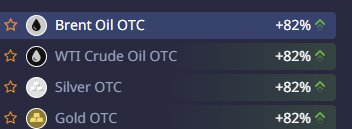

Tradeable Assets: The platform supports trading in stocks, forex currencies, cryptocurrencies, and other securities. The exact number of available instruments and specific markets are not detailed in available sources.

Cost Structure: Specific information about spreads, commission rates, overnight fees, and other trading costs is not mentioned in available sources. Users should verify these details directly with the platform before trading.

Leverage Ratios: Available materials do not specify maximum leverage ratios or margin requirements for different asset classes. This information is crucial for risk management and should be confirmed with the platform.

Platform Options: Pocket Broker primarily operates as a mobile application-based trading platform. It focuses on smartphone and tablet accessibility for user convenience and flexible trading.

Geographic Restrictions: Specific regional limitations or restricted territories are not mentioned in available information. Users should verify availability in their region before attempting to register.

Customer Support Languages: Available source materials do not specify supported languages for customer service communications. International users should confirm language support before engaging with the platform.

This pocket broker review emphasizes that many crucial details require direct verification with the platform due to limited publicly available information.

Detailed Rating Analysis

Account Conditions Analysis (Score: 5/10)

The account conditions evaluation for Pocket Broker faces significant limitations due to insufficient publicly available information regarding specific account types and their characteristics. Available sources do not detail the variety of account options or whether the platform offers different tiers such as basic, premium, or VIP accounts. The distinguishing features each account type might provide remain unclear to potential users.

Minimum deposit requirements remain unspecified in current source materials. This makes it impossible to assess the accessibility and reasonableness of entry-level funding requirements. The lack of transparency regarding financial commitments represents a significant information gap for potential users attempting to evaluate platform suitability.

The account opening process convenience and required documentation are not described in available information. This leaves questions about verification procedures, processing timeframes, and user experience during onboarding. Additionally, specialized account features such as Islamic accounts for Sharia-compliant trading, demo accounts for practice, or institutional accounts for larger traders are not mentioned in available sources.

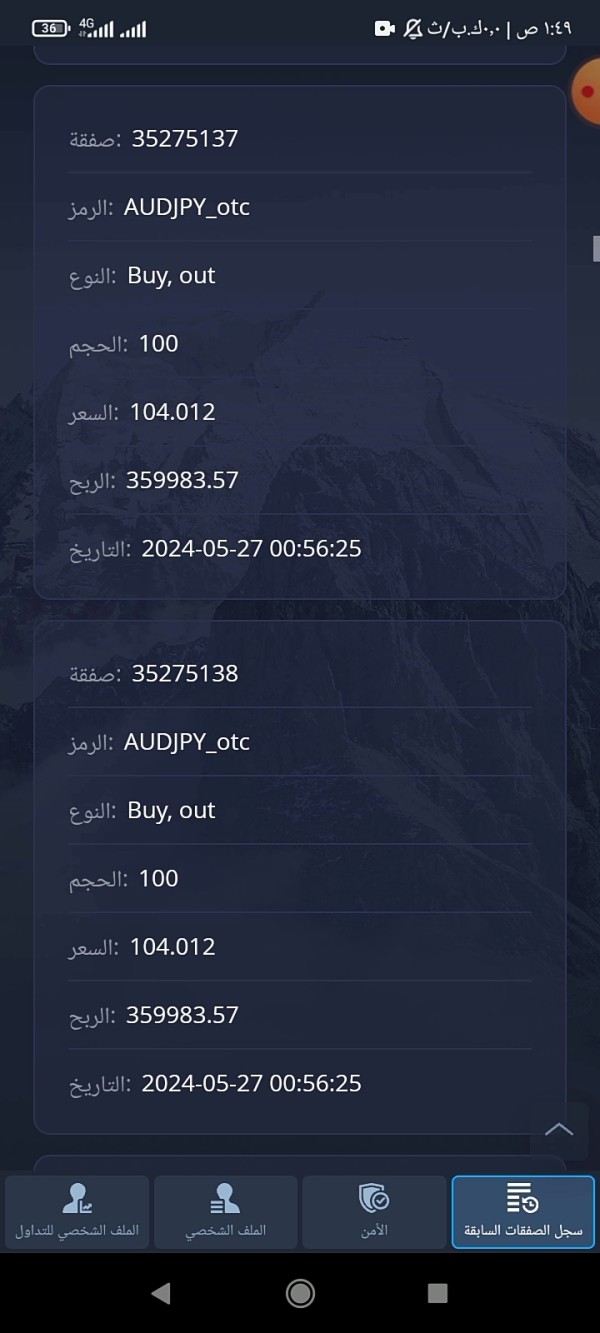

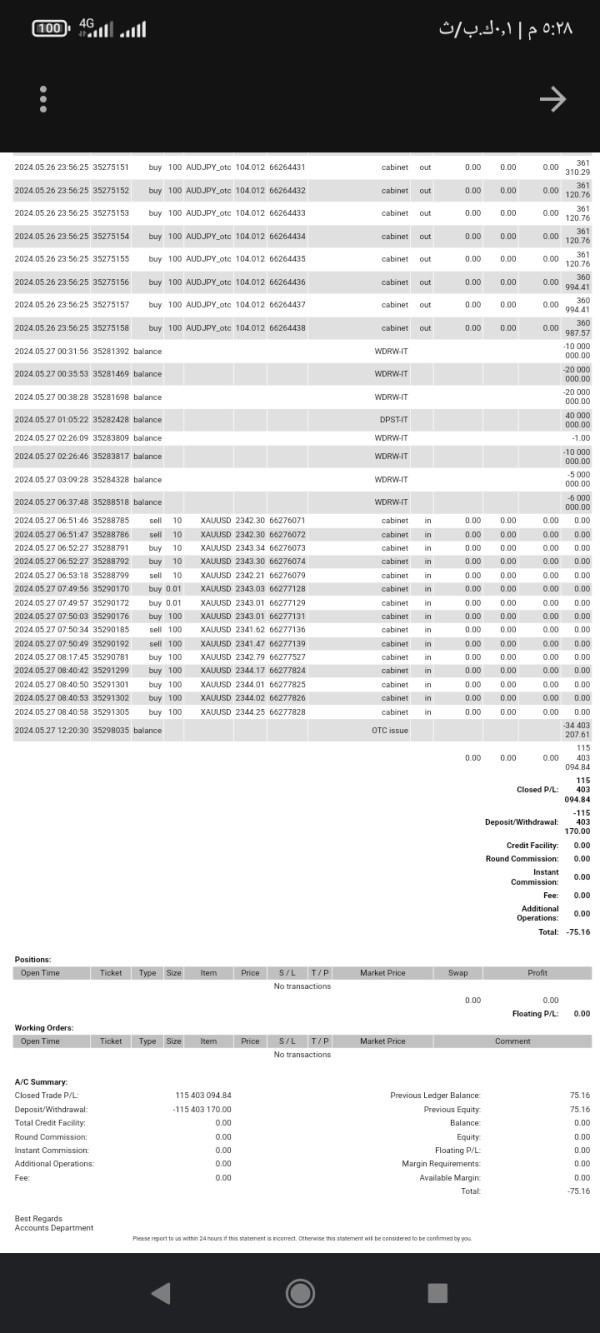

User feedback regarding deposit issues raises concerns about account management reliability and operational efficiency. Specifically, complaints about deposits not being credited to accounts suggest potential problems with basic account functionality. This pocket broker review indicates that while the platform may offer multiple account options, the lack of detailed information and reported deposit problems contribute to a moderate rating in this category.

The evaluation of trading tools and resources at Pocket Broker reveals mixed results based on available information. Users express satisfaction with the diversity of payment options available on the platform. However, specific details about trading tools, analytical resources, and platform capabilities remain largely unspecified in current source materials.

Available information does not detail the range of technical analysis tools, charting capabilities, or market research resources that traders can access through the platform. The absence of information regarding educational materials, trading guides, webinars, or other learning resources represents a significant gap. Users seeking comprehensive trading support may find this lack of information concerning.

Automated trading support is not mentioned in available sources, including expert advisors, copy trading features, or algorithmic trading capabilities. This limits the assessment of platform sophistication and its appeal to more advanced trading strategies. Modern traders often expect these features as standard offerings from competitive platforms.

However, positive user feedback regarding payment option diversity suggests that the platform has invested effort in providing flexible financial transaction capabilities. The mobile-focused approach may offer convenience for users prioritizing accessibility and on-the-go trading functionality. Specific mobile features and capabilities require further clarification from the platform directly.

The moderate rating reflects the platform's apparent strength in payment flexibility balanced against the lack of detailed information about comprehensive trading tools and educational resources.

Customer Service and Support Analysis (Score: 4/10)

Customer service evaluation for Pocket Broker reveals concerning patterns based on available user feedback. The most significant issue identified involves user complaints about deposits not being credited to accounts. This suggests potential deficiencies in customer service responsiveness and problem resolution capabilities that directly affect user satisfaction.

Available information does not specify the customer service channels offered to users. Whether users can access support through live chat, email, phone, or other communication methods remains unclear. Response time expectations and service availability hours are not detailed, making it difficult to assess the accessibility and efficiency of support services.

The quality of customer service interactions cannot be thoroughly evaluated based on current source materials, including staff professionalism and problem-solving effectiveness. However, the existence of unresolved deposit crediting issues suggests that users may experience difficulties obtaining satisfactory resolutions to their concerns. This represents a fundamental service failure that affects user trust and satisfaction.

Multi-language support capabilities are not mentioned in available information. This may limit accessibility for international users who require support in their native languages. The absence of detailed customer service information, combined with reported user issues, contributes to concerns about the platform's commitment to comprehensive user support.

This pocket broker review indicates that while customer service channels may exist, the reported deposit issues and lack of detailed support information suggest room for improvement.

Trading Experience Analysis (Score: 7/10)

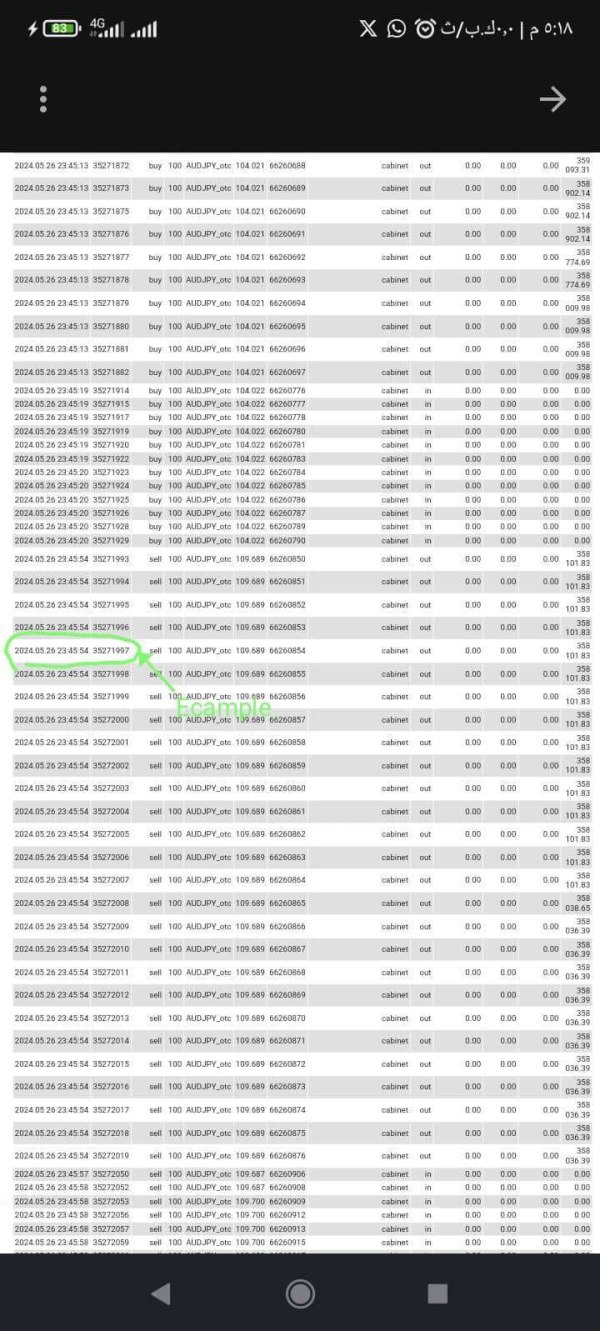

The trading experience assessment for Pocket Broker shows promising indicators despite limited detailed information about specific platform features. The platform's achievement of over 10 million downloads on Google Play suggests that a substantial number of users find the trading experience sufficiently satisfactory. This level of user adoption indicates acceptable performance for mobile trading activities.

Platform stability and execution speed details are not specifically mentioned in available sources. However, the high download volume implies acceptable performance levels that meet user expectations for mobile trading. Order execution quality, including information about slippage rates and requote frequency, requires direct platform evaluation as these details are not available in current source materials.

The mobile-centric approach appears to be a primary strength of the platform. It is designed specifically for smartphone and tablet trading, which aligns with modern trading preferences. This focus on mobile accessibility provides convenience for users who prioritize flexible trading locations and timing.

Platform functionality completeness cannot be thoroughly assessed based on available information. However, the diverse asset class offerings including forex, stocks, and cryptocurrencies suggest reasonable trading variety for different user preferences. The trading environment characteristics, including spread stability and liquidity access, require further investigation through direct platform testing.

The relatively high rating reflects the substantial user adoption indicated by download statistics. This suggests that despite information limitations, many users find the platform's trading experience meets their basic requirements.

Trust and Reliability Analysis (Score: 3/10)

Trust and reliability evaluation for Pocket Broker reveals significant concerns that potential users should carefully consider before committing funds to the platform. The absence of specific regulatory information in available sources represents a major transparency gap. This affects overall platform credibility assessment and raises questions about compliance standards.

Regulatory qualifications and oversight authorities are not mentioned in current source materials. This leaves questions about compliance standards, financial oversight, and user protection measures that regulated platforms typically provide. The lack of regulatory transparency is particularly concerning for traders seeking secure and compliant trading environments.

Fund security measures are not detailed in available information, including segregated account policies, insurance coverage, and client money protection protocols. Without clear fund protection information, users cannot adequately assess the safety of their invested capital. This represents a significant risk factor for potential users.

Company transparency regarding ownership structure, financial statements, operational history, and corporate governance is not evident in available sources. Industry reputation indicators such as awards, recognitions, or third-party certifications are not mentioned. This limits credibility assessment options for users seeking to verify platform legitimacy.

The existence of user complaints regarding deposit crediting issues represents a negative factor affecting trust levels. These reported problems, combined with the absence of regulatory information and limited transparency, contribute to significant concerns about platform reliability.

User Experience Analysis (Score: 6/10)

User experience evaluation for Pocket Broker presents a mixed picture based on available feedback and platform characteristics. Overall user satisfaction appears varied, with positive aspects balanced against notable concerns that affect the complete user journey. The platform's substantial download numbers indicate that many users find the interface sufficiently accessible for their trading needs.

Interface design and usability specifics are not detailed in available information. However, the mobile-first approach suggests focus on intuitive smartphone interaction that appeals to modern traders. The registration and verification process convenience is not described in current source materials, leaving questions about onboarding efficiency and user-friendliness during initial platform engagement.

Account setup procedures and required documentation processes require direct platform evaluation to assess user-friendliness. Fund operation experience represents a significant concern area, with user feedback indicating deposit crediting issues that directly impact the financial transaction experience. These problems affect user confidence and operational convenience, representing a notable weakness in the overall user journey.

Common user complaints appear to center on deposit processing reliability. This is a fundamental operational requirement for trading platforms that must function properly for user satisfaction. However, positive feedback regarding payment option diversity suggests that the platform has invested in providing flexible financial transaction methods.

The moderate rating reflects the balance between apparent mobile accessibility strengths and reported operational issues. User demographics appear to favor mobile-oriented traders seeking convenient access, though service reliability concerns affect overall experience quality.

Conclusion

Pocket Broker emerges as a developing online trading platform offering flexible trading options with a strong mobile-first approach. This pocket broker review reveals a neutral overall assessment due to mixed user feedback and operational concerns that potential users should carefully consider. The platform demonstrates potential appeal for users seeking smartphone-based financial trading solutions, particularly given its substantial market penetration with over 10 million downloads.

The platform's primary strengths lie in its diverse payment options and mobile accessibility. This makes it potentially suitable for traders who prioritize convenience and flexible transaction methods. However, significant concerns regarding trust and reliability require careful consideration by prospective users.

The absence of regulatory information and reported deposit crediting issues represent major areas of concern. Potential users should approach Pocket Broker with caution, conducting thorough due diligence regarding regulatory compliance, fund security measures, and customer service quality before committing funds. While the platform may serve users seeking basic mobile trading functionality, the identified concerns suggest limitations for more demanding trading requirements.

More experienced traders or those requiring comprehensive regulatory protection might consider alternative platforms with stronger transparency and regulatory credentials.