Regarding the legitimacy of AMG forex brokers, it provides FCA and WikiBit, (also has a graphic survey regarding security).

Is AMG safe?

Pros

Cons

Is AMG markets regulated?

The regulatory license is the strongest proof.

FCA Inst Deriv Trading License (STP)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

Clone FirmLicense Type:

Inst Deriv Trading License (STP)

Licensed Entity:

AMG Capital Partners Limited

Effective Date:

2003-09-16Email Address of Licensed Institution:

info@amgcapitalpartners.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

Flat 7 58 York Road Tunbridge Wells Kent TN1 1JY UNITED KINGDOMPhone Number of Licensed Institution:

+4402073767344Licensed Institution Certified Documents:

Is AMG Safe or Scam?

Introduction

AMG, or AMG Capital Partners Limited, is a broker based in the United Kingdom that entered the forex market in 2017. It positions itself as a platform for retail traders looking to engage in foreign exchange trading, offering access to various trading instruments through the widely used MetaTrader 4 platform. However, in an industry rife with scams and fraudulent schemes, it is crucial for traders to conduct thorough assessments of brokers before investing their hard-earned money. The safety of a trading environment can significantly impact a trader's success and financial well-being.

This article aims to provide an objective analysis of whether AMG is a safe broker or a potential scam. The investigation draws on various sources, including regulatory information, user reviews, and financial data, to evaluate AMG's credibility. The assessment framework includes an examination of regulatory compliance, company background, trading conditions, customer fund safety, user experiences, platform performance, and overall risk evaluation.

Regulation and Legitimacy

The regulatory status of a broker is a fundamental aspect that determines its safety and legitimacy. AMG claims to be regulated by the Financial Conduct Authority (FCA) in the UK. However, there have been indications that AMG may be operating as a clone firm, which raises significant concerns about its regulatory status and the safety of funds held with them.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 225540 | United Kingdom | Potential Clone Firm |

The FCA is known for its stringent regulatory framework, which ensures that brokers adhere to high standards of financial conduct. However, the emergence of clone firms—entities that falsely claim to be regulated by legitimate authorities—complicates matters. Investors should be cautious, as engaging with a clone firm can lead to significant financial losses. The lack of effective regulation and the potential for fraudulent activity necessitate a careful evaluation of AMGs compliance history and operational transparency.

Company Background Investigation

AMG Capital Partners Limited has a relatively short history since its establishment in 2017. The company's ownership structure and management team are critical factors in assessing its reliability. Unfortunately, detailed information about the management team and their professional backgrounds is scarce, which raises questions about the company's transparency.

The absence of comprehensive disclosures regarding the company's operations and its leadership can be a red flag for potential investors. A transparent broker typically provides detailed information about its management team, including their qualifications and experience in the financial industry. The lack of such information may indicate that AMG is not fully committed to maintaining a trustworthy relationship with its clients.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for traders to make informed decisions. AMG's fee structure and trading conditions have come under scrutiny, particularly regarding the transparency of costs associated with trading.

| Fee Type | AMG | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | Not Available | 1.0 - 2.0 pips |

| Commission Model | Not Specified | Varies |

| Overnight Interest Range | Not Available | 0.5% - 1.5% |

The absence of clear information about spreads, commissions, and overnight interest rates may indicate a lack of transparency that could lead to unexpected costs for traders. Such practices are often associated with less reputable brokers, making it imperative for potential clients to seek clarity on these aspects before opening an account.

Client Fund Safety

The safety of client funds is paramount when selecting a broker. AMG claims to implement various safety measures, including segregated accounts for client funds. However, the effectiveness and enforcement of these measures remain unclear.

Investors should inquire whether AMG participates in any compensation schemes that protect clients in the event of insolvency. Additionally, the absence of historical issues related to fund safety can be a positive indicator, but it does not guarantee future protection against potential risks.

Customer Experience and Complaints

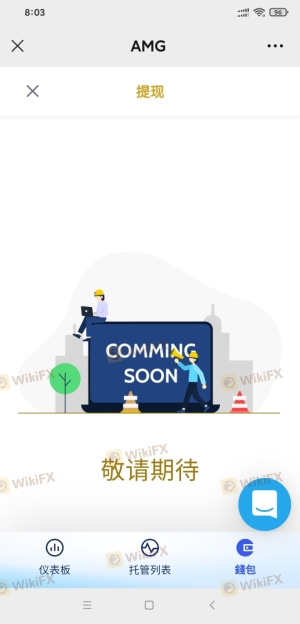

User feedback is invaluable when assessing a broker's reliability. AMG has received mixed reviews, with several complaints highlighting issues related to fund withdrawals and customer service responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Average |

Common complaints include difficulties in withdrawing funds, which is a major concern for traders. In some cases, users have reported being unable to access their funds, which raises significant alarm bells about the broker's operational integrity.

Platform and Execution

AMG utilizes the MetaTrader 4 platform, known for its user-friendly interface and comprehensive trading tools. However, the overall performance of the platform, including order execution quality, slippage, and rejection rates, is crucial for traders.

Traders have reported issues with order execution, including delays and slippage, which can negatively impact trading outcomes. Any signs of platform manipulation should be carefully monitored, as they can indicate deeper operational issues within the brokerage.

Risk Assessment

Engaging with AMG poses various risks that traders should be aware of.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Potential clone firm status. |

| Financial Risk | Medium | Lack of transparency in fees and withdrawal issues. |

| Operational Risk | High | Reports of poor customer service and execution issues. |

Traders should consider these risks when deciding whether to engage with AMG. Implementing risk mitigation strategies, such as trading with smaller amounts or utilizing demo accounts, can help minimize potential losses.

Conclusion and Recommendations

In conclusion, the investigation into AMG reveals several concerning factors that suggest it may not be a safe broker for trading. The potential for it to be a clone firm, coupled with a lack of transparency regarding fees, operational issues, and customer complaints, raises significant red flags.

Traders should exercise extreme caution and consider alternative, more reputable brokers that offer clear regulatory oversight and a proven track record of reliability. For those seeking safer options, it is advisable to look for brokers regulated by top-tier authorities such as the FCA or ASIC, which provide stronger protections for traders.

In summary, is AMG safe? The evidence suggests that caution is warranted, and potential investors should be wary of engaging with this broker without thorough due diligence.

Is AMG a scam, or is it legit?

The latest exposure and evaluation content of AMG brokers.

AMG Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

AMG latest industry rating score is 1.60, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.60 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.