Is FFX safe?

Pros

Cons

Is FFX Safe or Scam?

Introduction

FFX is a relatively new player in the forex market, having been established in 2017. Operating from New Zealand, it aims to provide a trading platform for both novice and experienced traders. However, as with any forex broker, it is essential for traders to exercise caution and conduct thorough evaluations before entrusting their funds. The forex market is known for its volatility and the potential for fraud, making it imperative for traders to ensure they are dealing with a reputable broker. This article will investigate whether FFX is safe or a scam by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

Regulatory Status and Legitimacy

The regulatory environment surrounding a forex broker is a crucial factor in determining its legitimacy and safety. FFX claims to be regulated under the Financial Service Providers Register (FSPR) in New Zealand. However, it is important to note that the FSPR does not provide the same level of investor protection as more stringent regulatory bodies, such as the UK's Financial Conduct Authority (FCA) or the U.S. Commodity Futures Trading Commission (CFTC).

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSPR | 580147 | New Zealand | Revoked |

FFX's license has been revoked, raising concerns about its operational legitimacy. This revocation indicates that traders should be cautious when considering this broker for their trading activities. Regulatory oversight is essential to ensure that brokers adhere to strict standards and provide adequate protection for traders' funds. Without such oversight, there is a heightened risk of fraudulent activities.

Company Background Investigation

FFX was founded in 2017, positioning itself as a forex broker targeting a diverse clientele. However, the broker's history is relatively short, and there is limited information about its ownership structure and management team. Transparency in a broker's operations is vital for building trust among potential clients.

The management team's background and experience in the financial industry play a significant role in determining the broker's reliability. Unfortunately, there is a lack of detailed information regarding the qualifications of FFX's management, which could raise red flags for potential investors. A broker that is not forthcoming about its leadership and operational practices may not have the best interests of its clients in mind.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its overall reliability. FFX provides a trading platform that utilizes MetaTrader 4 (MT4), a widely used trading software. However, the broker's fee structure is a critical aspect that requires scrutiny.

| Fee Type | FFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | TBD | TBD |

| Commission Model | TBD | TBD |

| Overnight Interest Range | TBD | TBD |

While specific figures for FFX's trading costs are not readily available, it is important to compare them with industry standards. If the fees are significantly higher than average, it could indicate a potential issue. Moreover, unusual fees or hidden costs can lead to unexpected losses for traders. Therefore, a careful review of the fee structure is necessary to determine if FFX is competitive and fair in its pricing.

Customer Funds Security

The safety of customer funds is a paramount concern for any trader. FFX claims to implement measures to ensure the security of client funds, including the use of segregated accounts. Segregated accounts are essential to protect traders' money from being used for the broker's operational expenses.

However, the lack of detailed information regarding investor protection schemes, such as negative balance protection, raises concerns. Traders need to be aware of whether their funds are adequately safeguarded against potential losses. Historical data on FFX's financial stability and any past incidents related to fund security should also be taken into account when evaluating the broker's reliability.

Customer Experience and Complaints

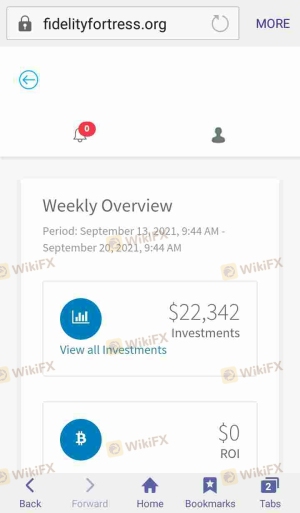

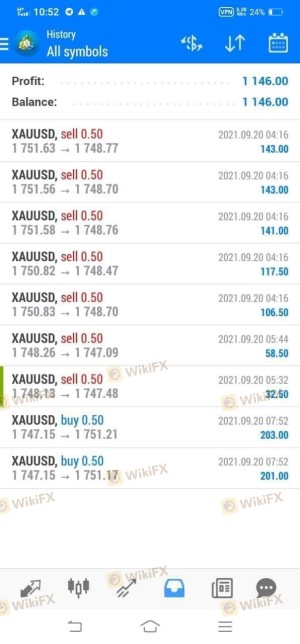

Customer feedback is a critical indicator of a broker's trustworthiness. FFX has received various reviews, with many users expressing dissatisfaction with their experiences. Common complaints include difficulties in withdrawing funds and inadequate customer support.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Delayed Response |

| Customer Support Quality | Medium | Inconsistent |

For example, some users have reported being unable to withdraw their funds for extended periods, leading to frustration and concerns about the broker's legitimacy. These complaints highlight the importance of assessing the broker's responsiveness and commitment to resolving issues. A broker that fails to address customer concerns in a timely manner may not be a safe choice for traders.

Platform and Trade Execution

The performance and reliability of a trading platform are essential for a successful trading experience. FFX utilizes the popular MT4 platform, known for its user-friendly interface and robust features. However, the execution quality, including slippage rates and order rejection instances, must also be evaluated.

Traders often report issues with order execution, which can significantly impact their trading outcomes. If FFX exhibits signs of platform manipulation or consistently fails to execute trades as intended, it may indicate underlying issues that could jeopardize traders' investments.

Risk Assessment

Using FFX as a forex broker comes with inherent risks that need to be understood. The lack of robust regulatory oversight, combined with customer complaints and potential issues with fund security, raises concerns about the overall risk associated with trading through this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Revoked license raises concerns. |

| Customer Service Risk | Medium | Complaints about withdrawal issues. |

| Trading Execution Risk | Medium | Potential issues with order execution. |

To mitigate these risks, traders should conduct thorough due diligence before engaging with FFX. It may also be wise to start with a smaller investment to assess the broker's reliability before committing larger amounts.

Conclusion and Recommendations

In conclusion, the investigation into FFX raises several red flags regarding its safety and legitimacy as a forex broker. The revoked license, combined with customer complaints and limited transparency, suggests that traders should exercise caution. While some may find value in FFX's offerings, the potential risks cannot be ignored.

For traders seeking reliable alternatives, it is advisable to consider brokers that are well-regulated by reputable authorities and have a proven track record of customer satisfaction. Always prioritize safety and transparency when choosing a forex broker to ensure a secure trading experience.

In summary, while FFX may present itself as a viable trading option, the evidence suggests that traders should be wary and consider more reputable alternatives in the forex market.

Is FFX a scam, or is it legit?

The latest exposure and evaluation content of FFX brokers.

FFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FFX latest industry rating score is 1.60, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.60 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.