The FTSE brokers emerged to provide a structured platform for trading the UK's most significant index, the FTSE 100. Established in different locales, these brokers often operate under various levels of regulatory oversight, primarily in the UK. However, regulatory transparency has been inconsistent, with some brokers facing scrutiny for their operations, particularly potential fraudulent activities associated with certain platforms.

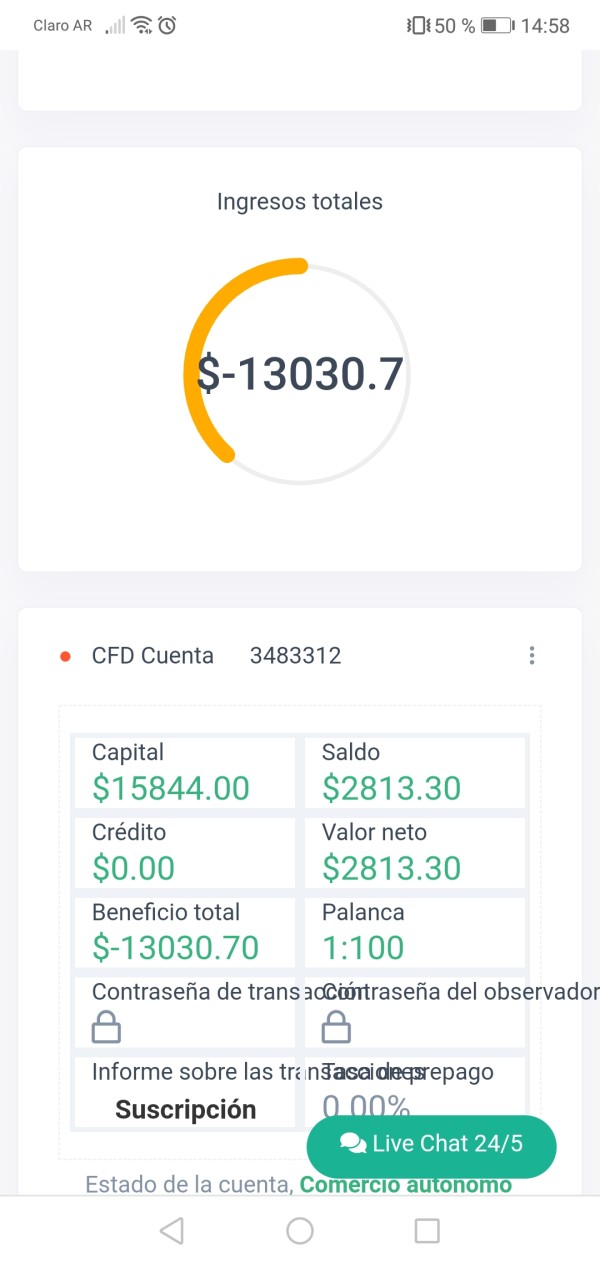

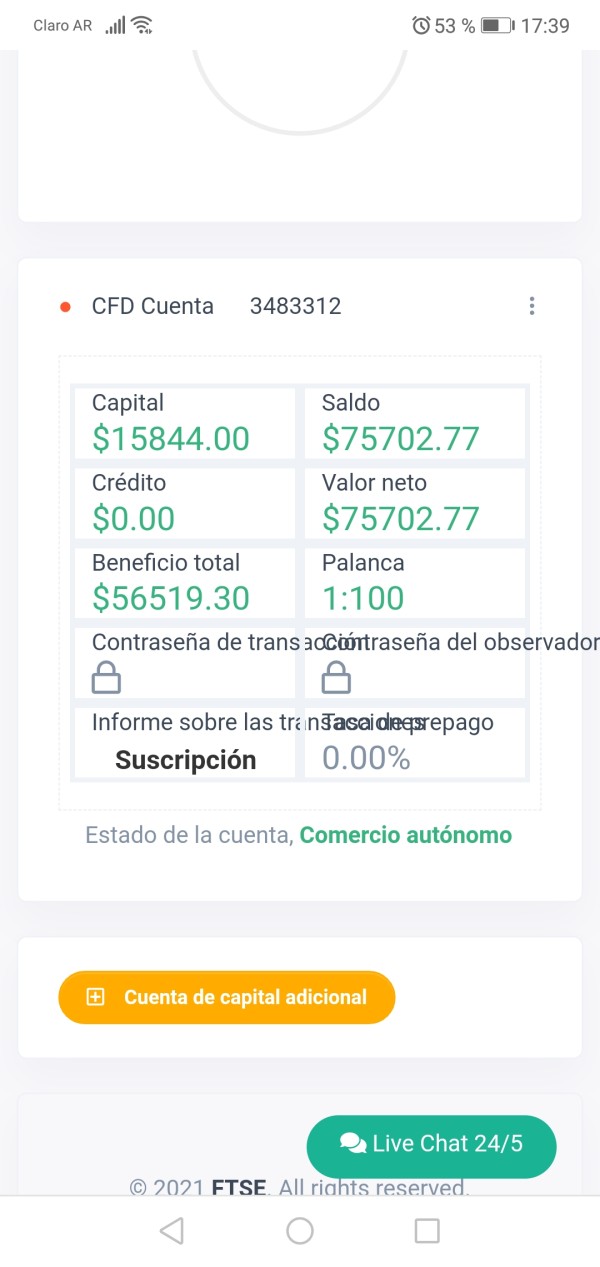

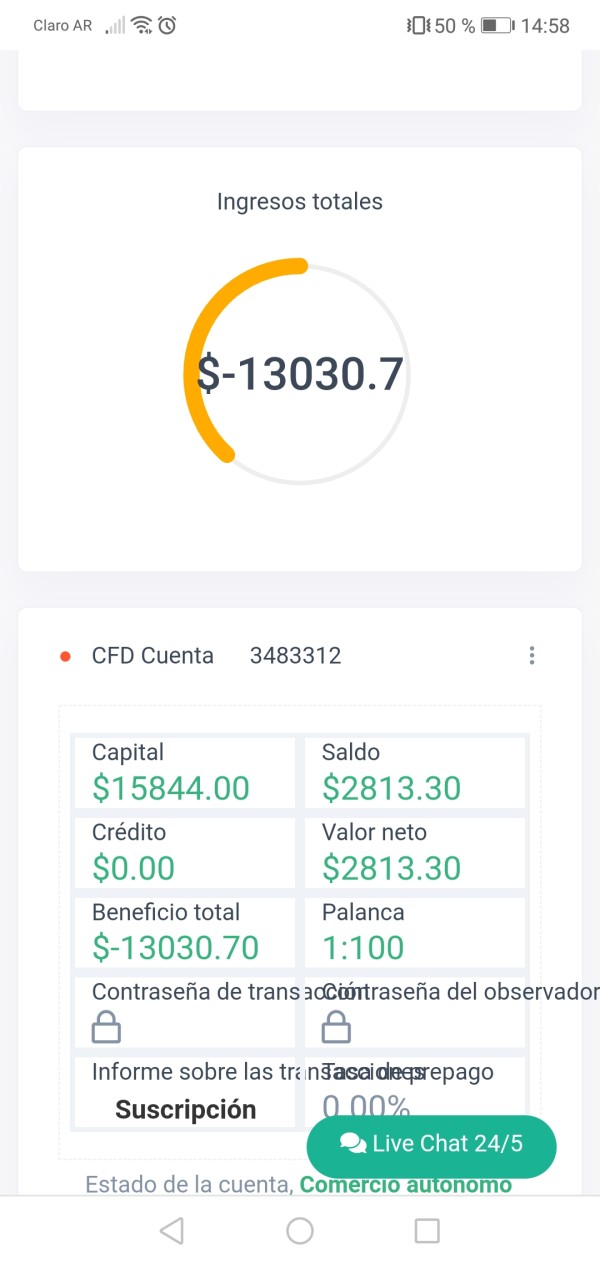

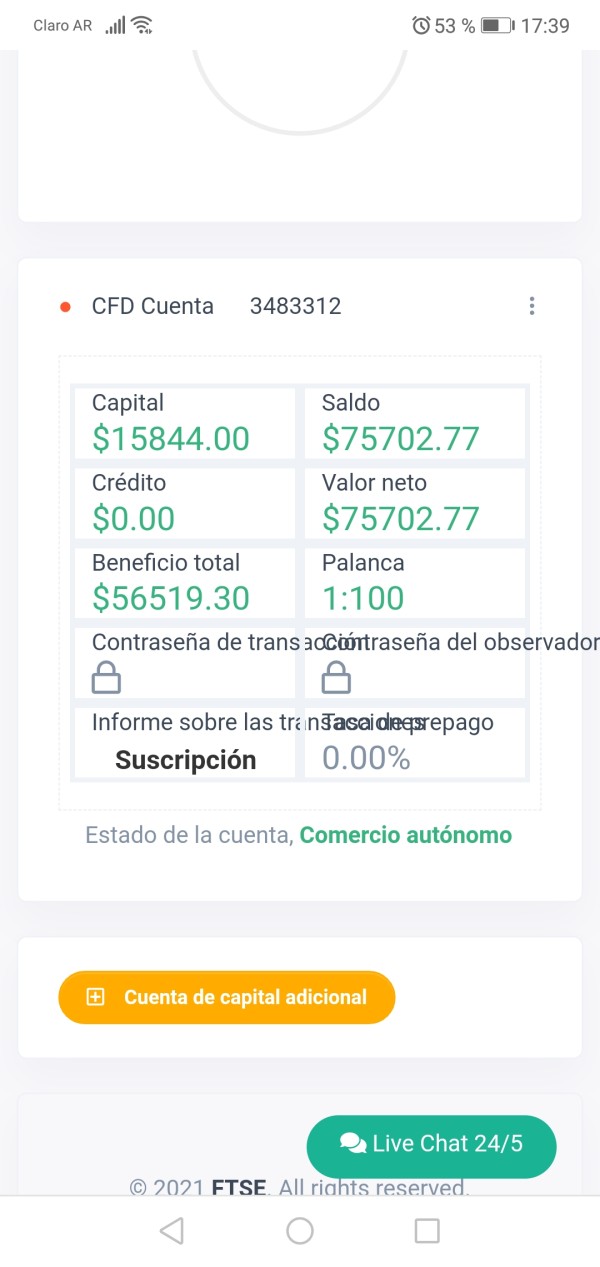

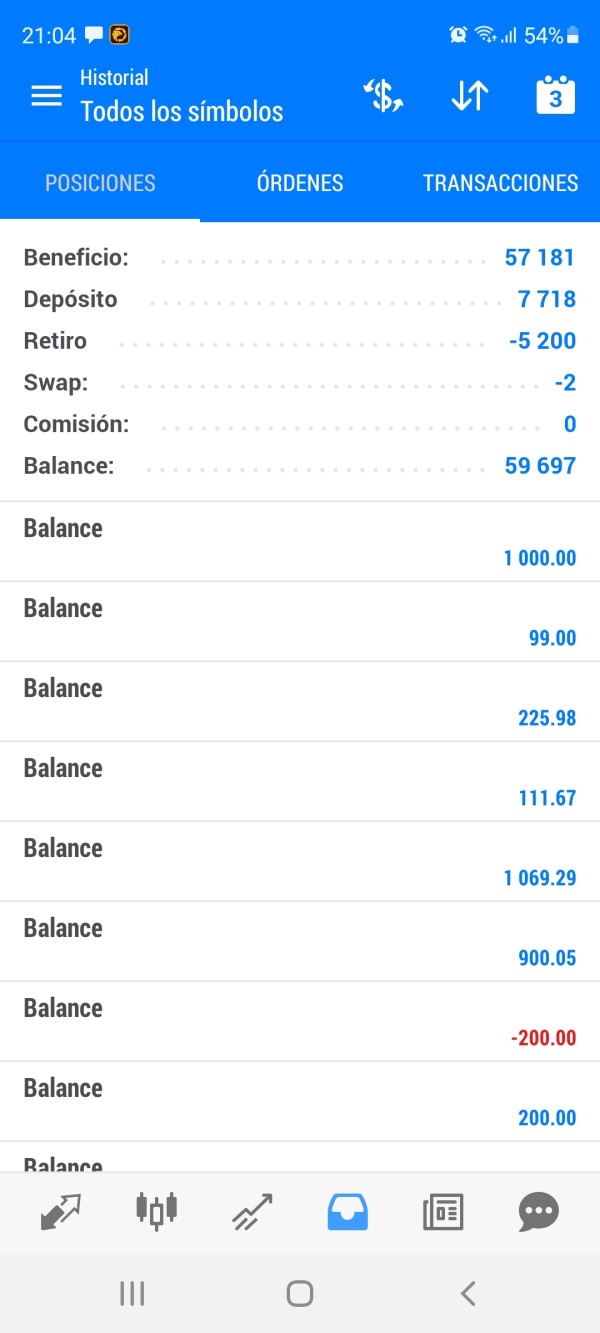

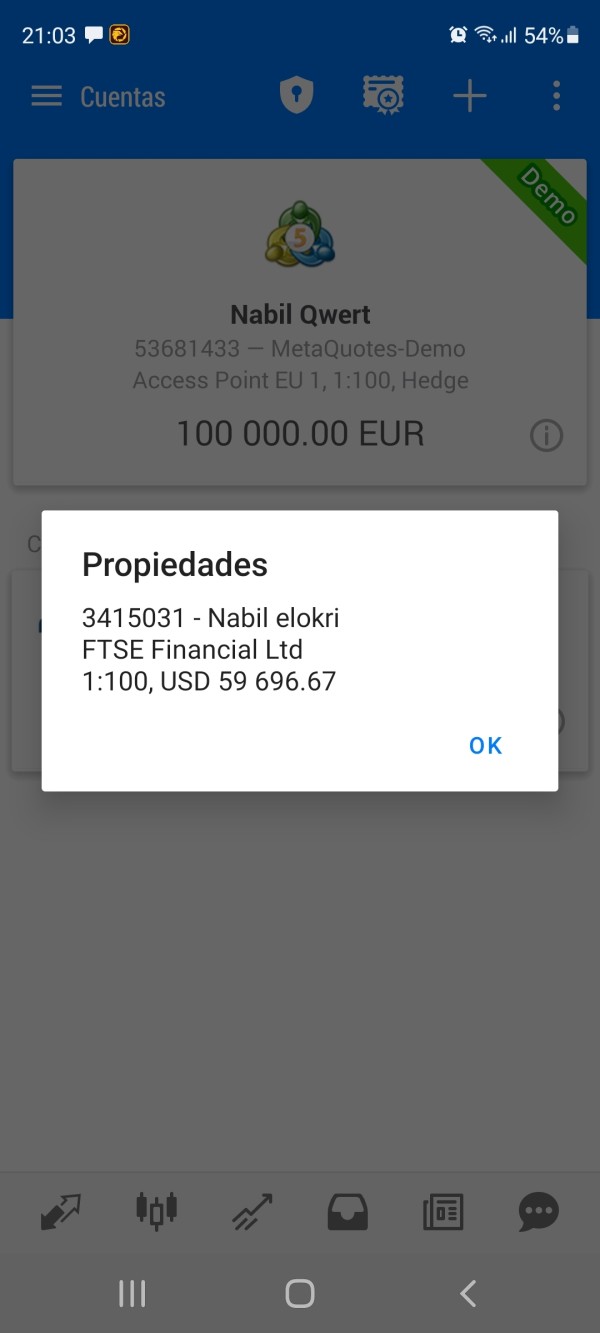

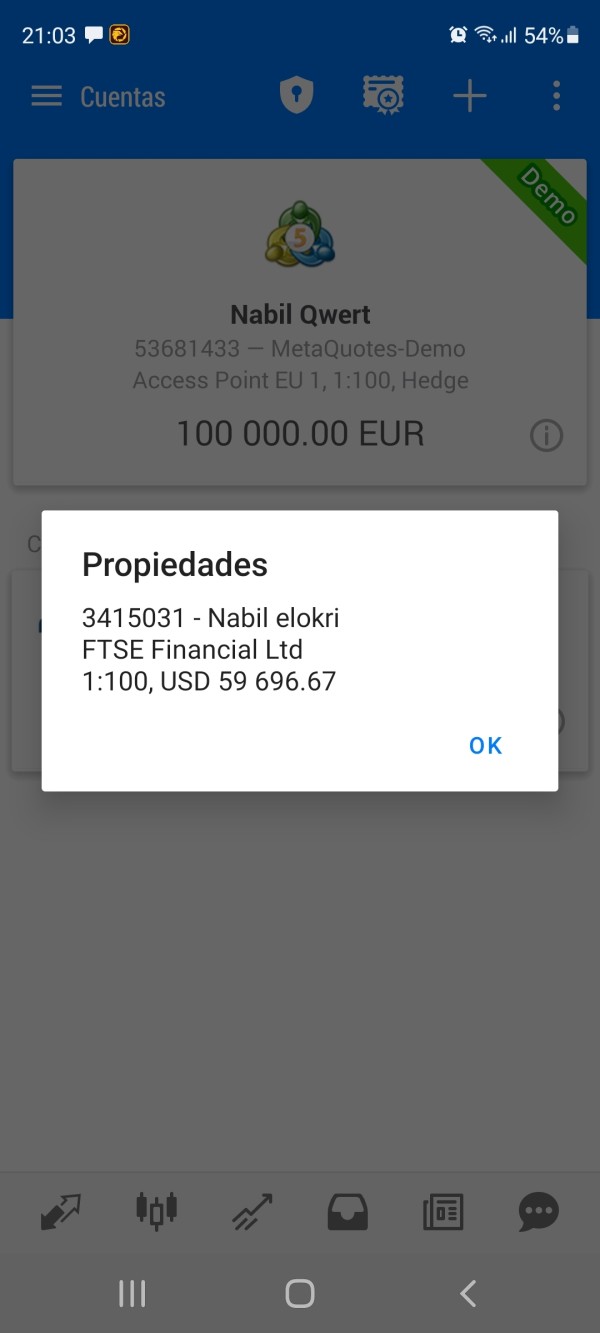

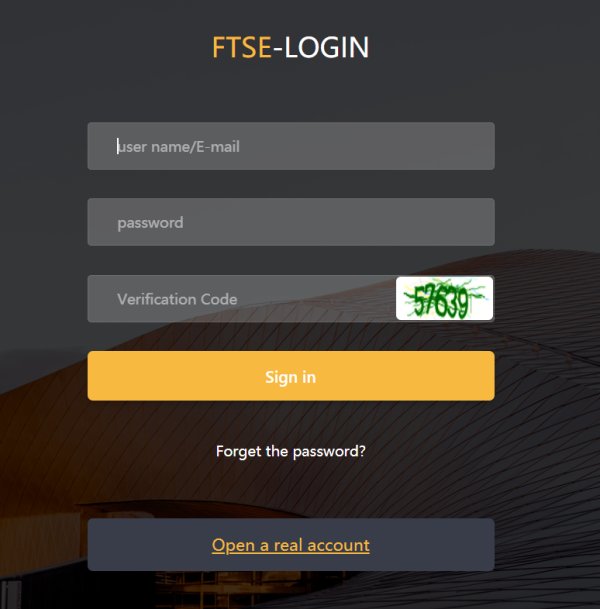

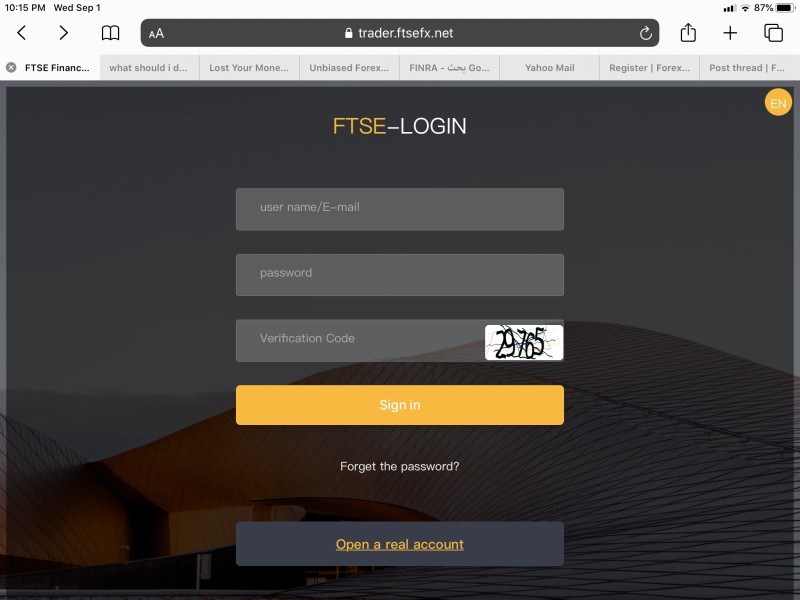

FTSE brokers typically focus on trading various derivatives, including Contracts for Difference (CFDs), providing retail traders access to trade the FTSE 100 index and its underlying constituents. These platforms support both web and mobile applications, with several leveraging advanced trading software like MetaTrader 4 and 5. Users can trade various asset classes, ranging from currencies to commodities, yet differing levels of regulatory compliance can impact user trust and engagement.

The FTSE brokers have varying degrees of regulatory status. For instance, while some are regulated by the FCA, others operate under less stringent jurisdictions, bringing the legitimacy of their operations into question. This inconsistency raises significant concerns regarding fund safety and law compliance among potential traders.

- Check registration with the FCA or respective regulatory body.

- Look for signs of financial health, such as operational history and transparent fee structures.

- Review user testimonials and feedback on platforms like Trustpilot.

Industry Reputation and Summary

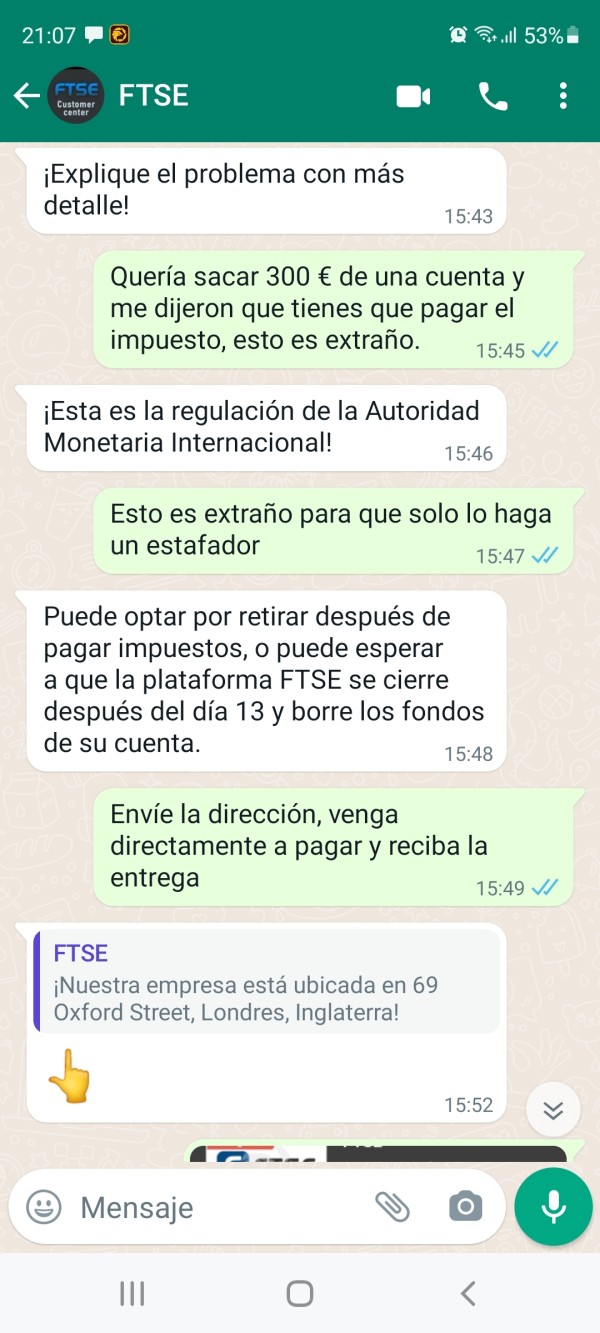

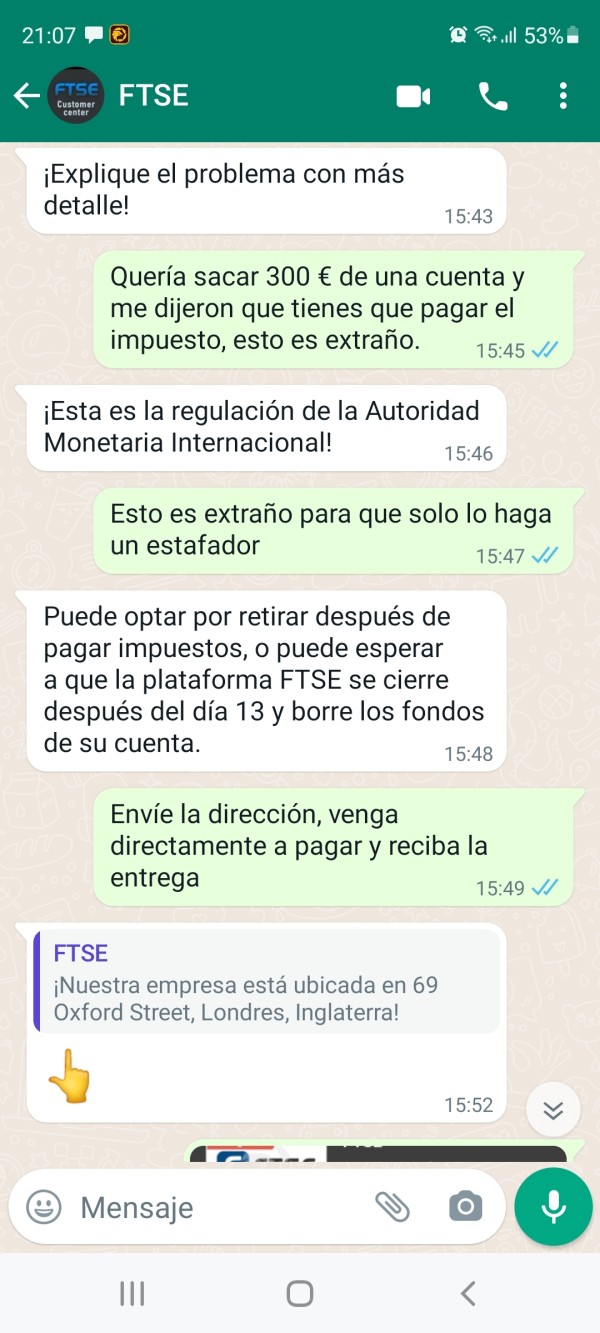

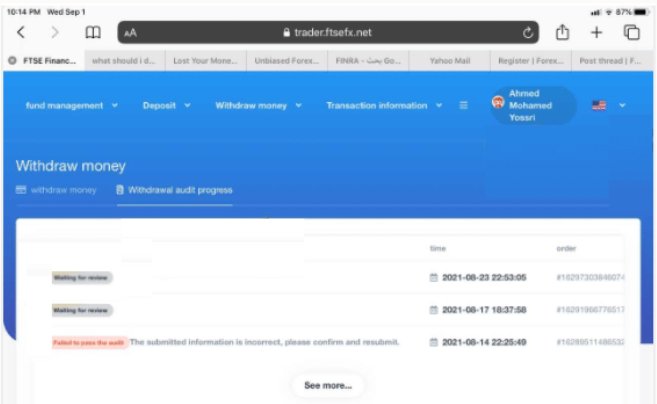

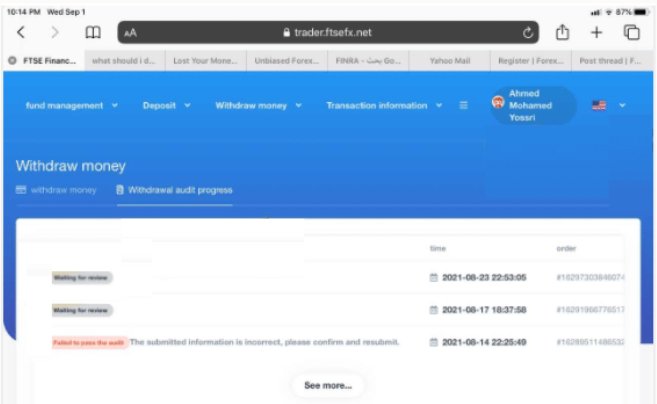

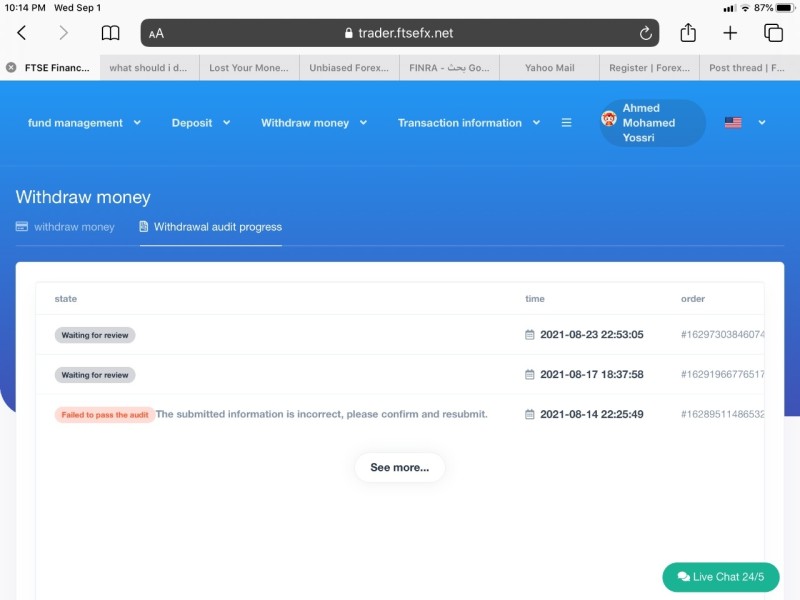

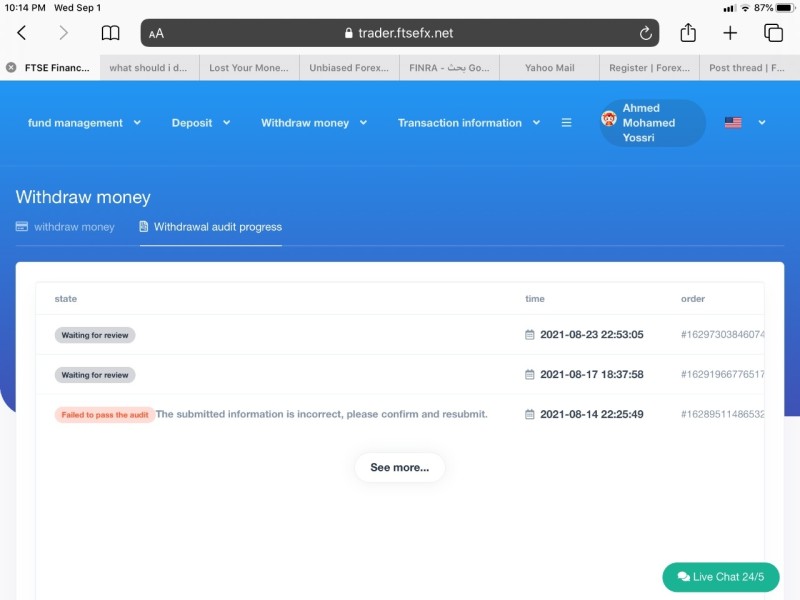

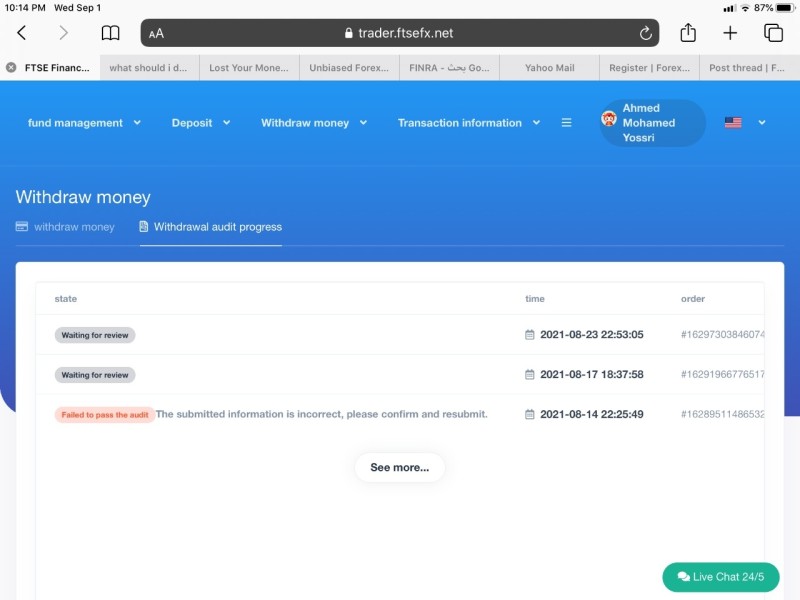

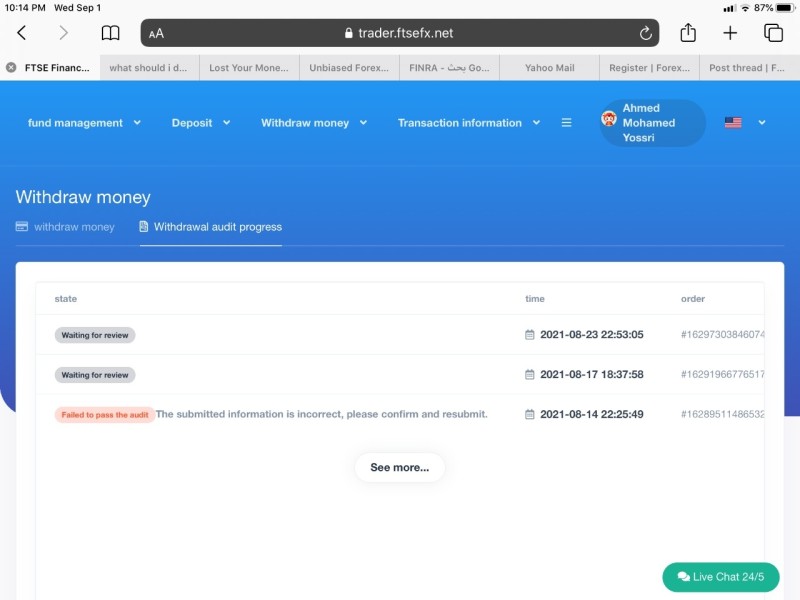

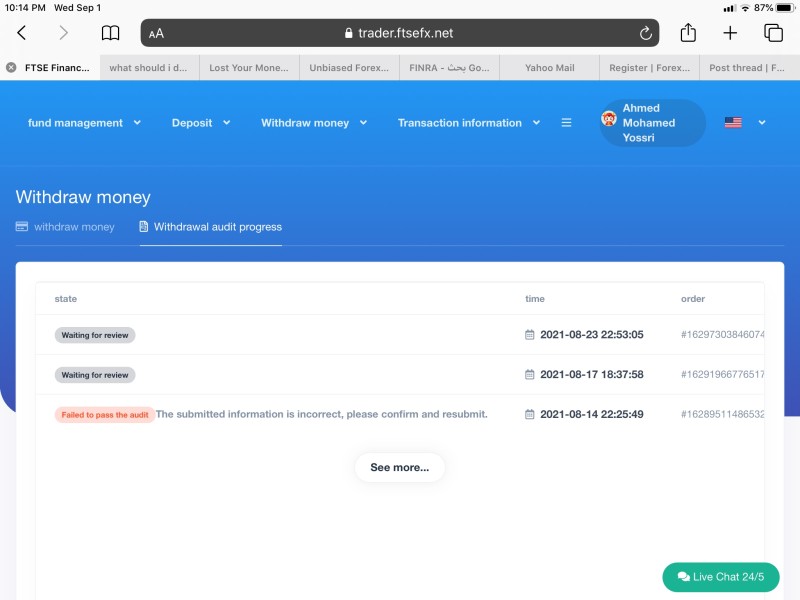

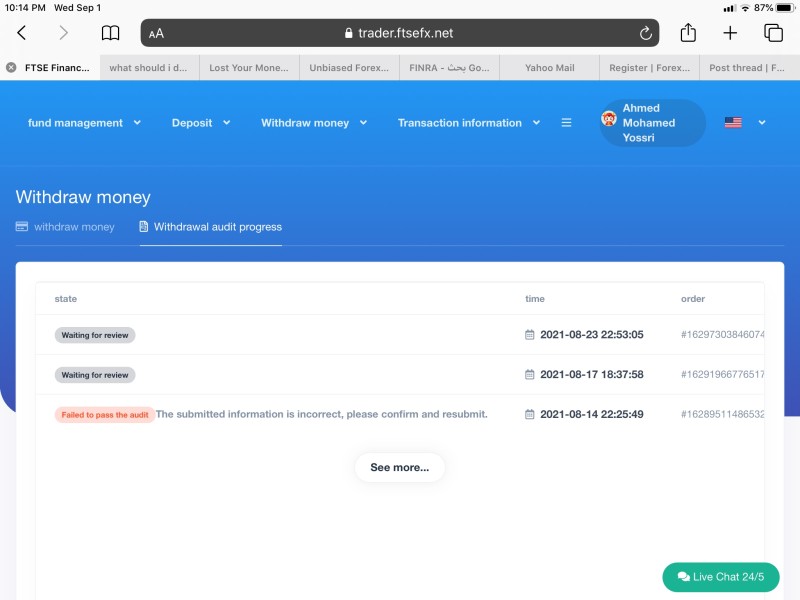

When considering user feedback, reports of difficulties with withdrawals and unresponsive customer service have raised red flags. Brokers with low ratings on platforms such as WikiFX underline the necessity for potential clients to conduct thorough due diligence.

6.2 Trading Costs Analysis

"The double-edged sword effect."

Advantages in Commissions

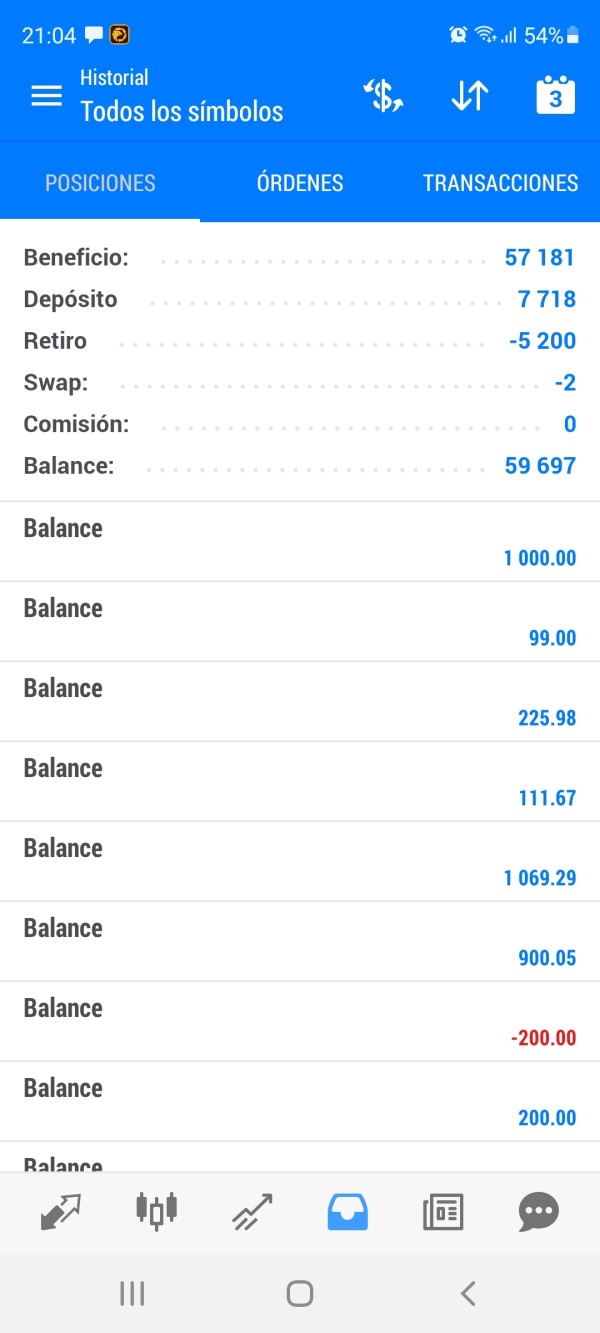

Many FTSE brokers offer low commissions, making them attractive for cost-conscious traders. For instance, spreads can start at 0.1 pips, and commission-free trading is available across several platforms, providing substantial savings on transaction costs.

"I was surprised by how low my commissions were compared to my previous broker." - User Review

The "Traps" of Non-Trading Fees

Despite low trading costs, traders should be aware of potential hidden fees that can erode profits. Issues frequently cited in user complaints include high withdrawal fees and inactivity charges.

"I didn't expect a withdrawal fee to be so steep. Always check the fine print!" - User Complaint

Cost Structure Summary

Overall, for retail traders who engage primarily in CFD trading, the low commission structures may favorably impact long-term profitability. However, those with a more infrequent trading approach may find their profits eaten away by various fees.

"Professional depth vs. beginner-friendliness."

Platform Diversity

FTSE brokers predominantly utilize well-regarded trading platforms such as MetaTrader 4 and 5, accompanied by proprietary solutions that support a variety of trading styles. This variety provides traders freedom in executing their strategies effectively.

Quality of Tools and Resources

The effectiveness of analytical tools varies across brokers. Some provide comprehensive charting tools and market analysis, while others fall short, offering limited information that may impede traders' decision-making processes.

Platform Experience Summary

User experiences indicate mixed reviews regarding usability; some find navigating the MT4 platform challenging due to its outdated interface, while others appreciate the customizability available.

6.4 User Experience Analysis

"Navigating the complexities of trading amidst varied support."

User Interaction with Broker Platforms

Experiences reported by users on FTSE brokers reveal frequent complaints about customer service responsiveness and the effective resolution of issues. Many traders have indicated feeling left in the dark when faced with platform-related challenges.

Feedback on Usability

Traders note that while some platforms offer robust functionalities, the lack of prompt support can lead to frustration, particularly for novice traders seeking guidance on fundamental trading queries.

6.5 Customer Support Analysis

"The lifeline for navigating challenges."

Availability and Responsiveness

Customer service quality is a significant determining factor for traders when selecting a broker. However, many users have voiced concerns regarding slow response times and limited support channels, particularly for urgent queries.

User Experiences with Support

Traders have frequently cited inadequate customer support as a barrier to satisfactory trading experiences. Instances of long wait times for email responses or delayed live chat support have led to negative user sentiments.

6.6 Account Conditions Analysis

"How account setups can support or hinder trading."

Account Types and Conditions

FTSE brokers tend to offer limited account types, which can restrict trading strategies and adaptability. While some brokers provide swap-free accounts and various leveraged options, the variety of account conditions can create confusion and limit accessibility for less experienced traders.

Suitability for Different Trader Profiles

While certain accounts may cater well to beginners and novice traders through simplified structures, the lack of options for more experienced traders seeking advanced strategies can be a drawback.

Quality Control

To ensure accuracy and transparency, all information conflicts have been addressed, particularly regarding regulatory details across different brokers. Moreover, the findings from user reviews and assessments were balanced to reflect both positive and negative feedback, contributing to a well-rounded portrayal of FTSE brokers.

- Specific user experiences regarding withdrawal processes and customer service.

- Detailed information concerning the regulatory status of all mentioned brokers.

In conclusion, while trading through FTSE brokers offers numerous opportunities for retail traders, it necessitates thorough scrutiny of broker legitimacy, support quality, and trading conditions to navigate potential pitfalls effectively. Careful evaluation of regulatory environments and user experiences is essential for optimizing trading outcomes in this complex landscape.