Is HK Fortune safe?

Pros

Cons

Is HK Fortune Safe or Scam?

Introduction

HK Fortune, officially known as Hong Kong Fortune Forex Group Limited, positions itself as an online trading platform in the forex market, offering a range of financial instruments including forex currency pairs, cryptocurrencies, stock indexes, energies, precious metals, and commodities. However, the influx of negative reviews and regulatory concerns surrounding this broker has prompted many traders to question its legitimacy. As the forex market can be rife with scams and unregulated entities, it is crucial for traders to conduct thorough due diligence before engaging with any broker. This article aims to provide a comprehensive analysis of HK Fortune, evaluating its regulatory status, company background, trading conditions, customer experiences, and overall safety to determine if HK Fortune is truly safe or a potential scam.

Regulation and Legitimacy

The regulatory status of a broker is a key indicator of its legitimacy and reliability. A well-regulated broker is typically subject to strict oversight, which helps protect traders' funds and ensure fair trading practices. Unfortunately, HK Fortune does not hold a valid regulatory license from any recognized authority. The following table summarizes the broker's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | Unauthorized | United States | Not Verified |

The lack of a valid license raises significant concerns about the broker's operations and the safety of traders' funds. Moreover, HK Fortune has been flagged for operating outside its claimed regulatory scope, further adding to the suspicion surrounding its legitimacy. The absence of regulatory oversight means that traders have limited recourse in the event of disputes or fraudulent activities, making it imperative for potential clients to exercise caution when considering this broker.

Company Background Investigation

HK Fortune was established in 2021, but detailed information about its ownership structure and management team remains elusive. The broker claims to operate from Hong Kong, yet it fails to provide adequate transparency regarding its corporate structure or the identities of its executives. This lack of transparency is a red flag, as reputable brokers usually disclose such information to build trust with their clients.

Furthermore, the company's website has been reported as non-functional, which is often a warning sign of potential fraud. The absence of contact information, such as a phone number or physical address, exacerbates concerns about the broker's transparency and accountability. Without a clear understanding of the company's background and its management's professional experience, it becomes increasingly difficult for traders to trust HK Fortune.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for assessing its overall value. HK Fortune claims to provide competitive trading conditions; however, specific details regarding fees, spreads, and commissions are not readily available. This lack of transparency can be problematic for traders seeking to understand the true cost of trading with this broker.

The following table outlines the core trading costs associated with HK Fortune:

| Fee Type | HK Fortune | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | Varies |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The absence of clear information regarding spreads and commission structures raises concerns about potential hidden fees, which could significantly impact traders' profitability. Moreover, the lack of a demo account limits traders' ability to test the platform before committing real funds, which is a standard practice among reputable brokers.

Client Fund Safety

The safety of client funds is paramount when evaluating any broker. HK Fortune has not provided sufficient information about its fund security measures. Key aspects to consider include whether client funds are held in segregated accounts, the presence of investor protection schemes, and policies regarding negative balance protection.

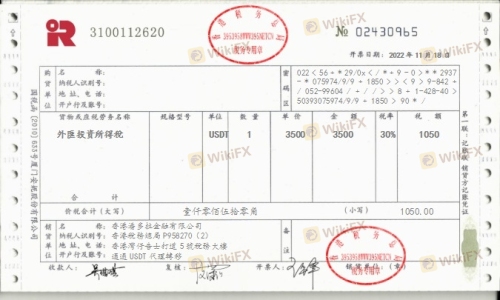

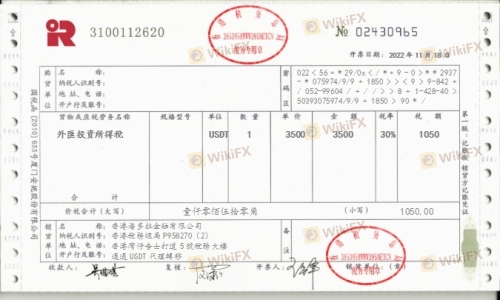

Due to its unregulated status, HK Fortune may not be required to implement these safety measures, thereby exposing traders to significant risks. Historical complaints from users indicate issues related to fund withdrawals, which further underscores the potential dangers of trading with this broker. If traders encounter difficulties accessing their funds, it can lead to substantial financial losses, making it crucial to consider the safety of funds when evaluating if HK Fortune is safe.

Customer Experience and Complaints

Customer feedback is a vital component in assessing the reliability of a broker. A review of various platforms reveals that HK Fortune has garnered numerous negative reviews from clients. Common complaints include withdrawal issues, lack of responsive customer support, and difficulties in accessing funds.

The following table categorizes the main complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Slow |

| Transparency Concerns | High | Unaddressed |

Typical cases highlight traders who have been unable to withdraw their funds after multiple requests, with some reporting that their accounts were locked without explanation. These complaints raise serious concerns about the broker's operational integrity and customer service quality, further questioning whether HK Fortune is a safe option for traders.

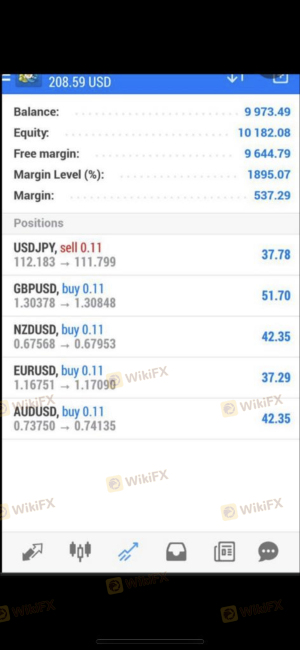

Platform and Trade Execution

The trading platform offered by HK Fortune is said to be MetaTrader 5 (MT5), a widely recognized platform known for its advanced trading capabilities. However, the overall performance, stability, and user experience of the platform remain largely unverified due to the lack of accessible user feedback.

Issues such as slippage, order execution quality, and potential manipulation are critical factors that traders should evaluate when considering a broker. Without clear evidence of the platform's reliability, traders may face unexpected challenges during their trading activities, which can lead to financial losses.

Risk Assessment

Utilizing HK Fortune carries inherent risks, primarily due to its unregulated status and the plethora of negative reviews from users. The following risk scorecard summarizes the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight |

| Fund Safety Risk | High | Lack of transparency and withdrawal issues |

| Customer Service Risk | Medium | Slow response times and unresolved complaints |

To mitigate these risks, traders are advised to conduct thorough research, avoid depositing large sums of money, and consider using alternative, well-regulated brokers that offer better protections and transparency.

Conclusion and Recommendations

In conclusion, the evidence suggests that HK Fortune is not a safe broker for traders. The lack of valid regulatory oversight, coupled with numerous negative reviews and complaints regarding fund withdrawals and customer service, raises significant red flags. Traders should be particularly cautious when considering this broker, as engaging with unregulated entities poses substantial risks to their investments.

For those seeking reliable trading options, it is advisable to choose brokers that are well-regulated by reputable authorities, such as the FCA, ASIC, or CySEC. Brokers like AvaTrade, Go Markets, and Rakuten Securities offer robust regulatory protections and transparent trading conditions, making them safer alternatives for traders looking to navigate the forex market.

Is HK Fortune a scam, or is it legit?

The latest exposure and evaluation content of HK Fortune brokers.

HK Fortune Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

HK Fortune latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.