Rifa 2025 Review: Everything You Need to Know

Executive Summary

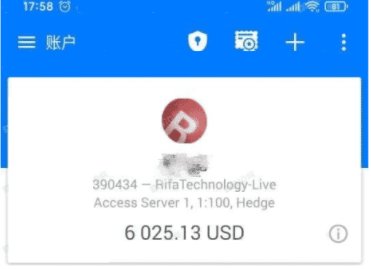

This Rifa review shows a concerning look at a forex broker that has drawn major negative attention from traders. Rifa says it is a global brokerage company with operations in Hong Kong and the UK, offering trading services across multiple asset classes including forex currency pairs, precious metals, crude oil, and CFDs. Our detailed analysis shows major red flags that potential traders must carefully consider.

The broker's biggest weakness is its withdrawal process, with multiple user complaints reporting problems getting their money back. Users report being asked to pay extra taxes before withdrawals, only to find their funds remain locked away. While Rifa claims to offer diverse trading tools, the lack of clear regulatory information and growing fraud claims seriously hurt its reputation. This Rifa review targets traders seeking multi-asset exposure, but we strongly advise extreme caution given the documented withdrawal issues and trust concerns that hurt this broker.

Important Notice

Regional Entity Differences: Rifa operates through entities registered in Hong Kong and the UK, though specific regulatory oversight details remain unclear in available documentation. The lack of clear regulatory information from recognized financial authorities seriously impacts user confidence and legal protections.

Review Methodology: This evaluation is based on available user feedback, public information, and documented complaints. Due to limited transparent disclosure from the broker, we cannot verify all operational details, and traders should conduct additional research before engaging with this platform.

Rating Framework

Broker Overview

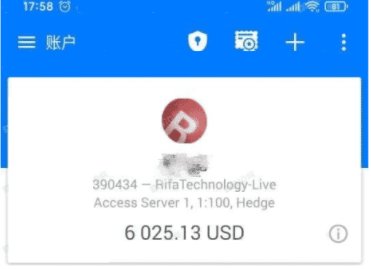

Rifa presents itself as a global brokerage company with headquarters spanning Hong Kong and the UK, though the exact establishment date remains undisclosed in available materials. The company operates as a multi-asset broker, providing trading services across various financial instruments including foreign exchange markets, precious metals trading, crude oil commodities, and contracts for difference. Despite its claims of international presence, the broker's operational transparency and regulatory compliance remain questionable areas that seriously impact its market credibility.

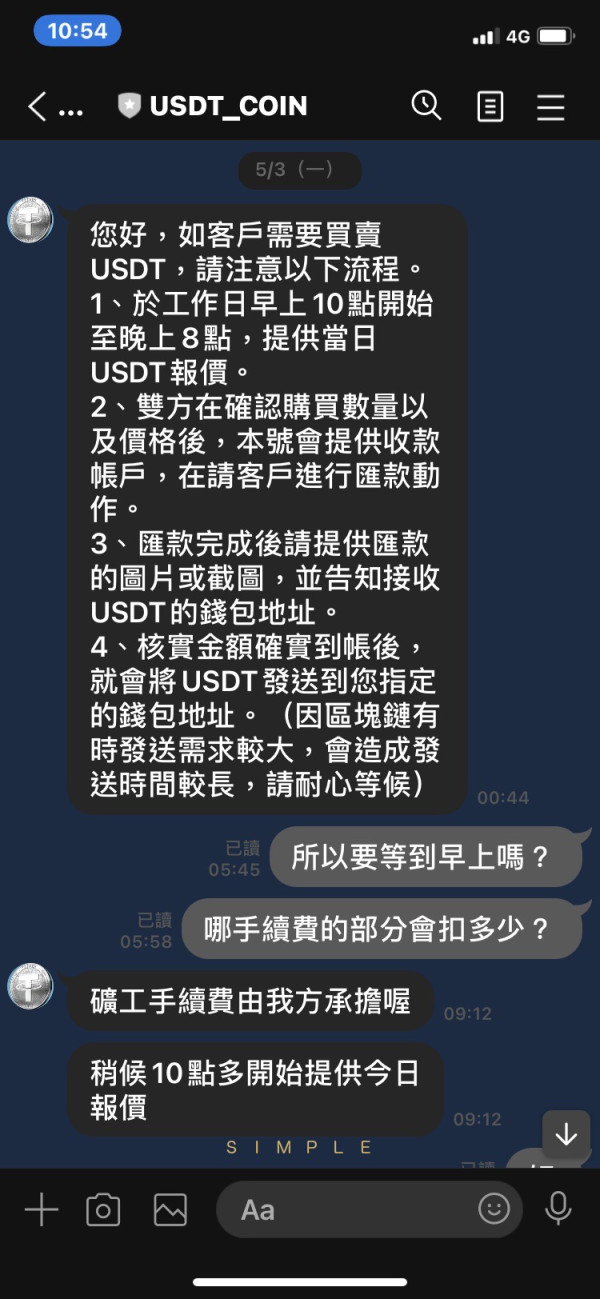

The broker's business model focuses on providing access to global financial markets through electronic trading platforms, though specific platform details are not fully disclosed in available documentation. Rifa targets retail traders seeking exposure to multiple asset classes, positioning itself as a one-stop solution for diverse investment needs. However, this Rifa review reveals that the broker's actual service delivery falls short of its marketing promises, particularly regarding fund security and withdrawal processes, which represent critical concerns for potential users.

Regulatory Jurisdiction: Rifa claims registration in Hong Kong, though specific regulatory authority oversight and license numbers are not clearly disclosed in available documentation.

Deposit and Withdrawal Methods: Specific funding options and supported payment processors are not detailed in accessible broker information.

Minimum Deposit Requirements: The required initial deposit amount for account opening is not specified in available materials.

Bonus and Promotions: No information regarding welcome bonuses, trading incentives, or promotional offers is documented in current resources.

Tradeable Assets: The broker provides access to forex currency pairs, precious metals, crude oil trading, and various CFD instruments across multiple markets.

Cost Structure: Detailed information regarding spreads, commissions, and additional trading fees is not transparently disclosed in available documentation.

Leverage Ratios: Maximum leverage offerings and margin requirements are not specified in accessible broker materials.

Platform Options: Specific trading platform software and technology solutions are not fully detailed in current documentation.

Geographic Restrictions: Regional limitations and restricted territories are not clearly outlined in available information.

Customer Support Languages: Supported communication languages for client services are not specified in accessible materials.

This Rifa review highlights major information gaps that potential traders should consider concerning when evaluating this broker.

Detailed Rating Analysis

Account Conditions Analysis (3/10)

The account conditions offered by Rifa present major concerns that seriously impact this broker's appeal to serious traders. Available information lacks crucial details regarding account types, minimum deposit requirements, and specific account features that traders typically expect from reputable brokers. The absence of clear account tier structures, trading conditions, and benefit differences raises immediate red flags about the broker's operational transparency.

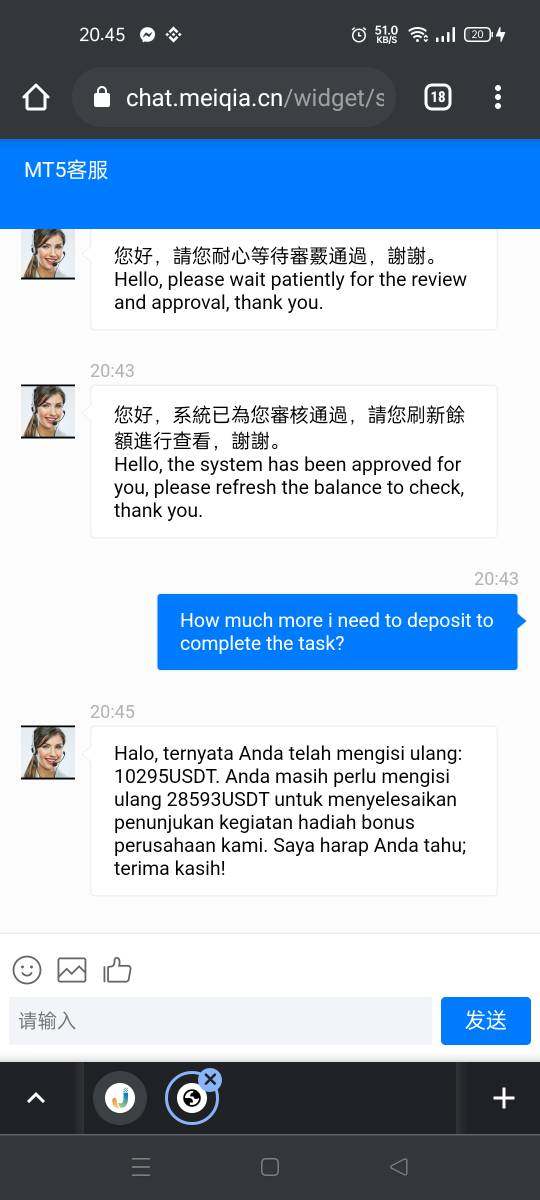

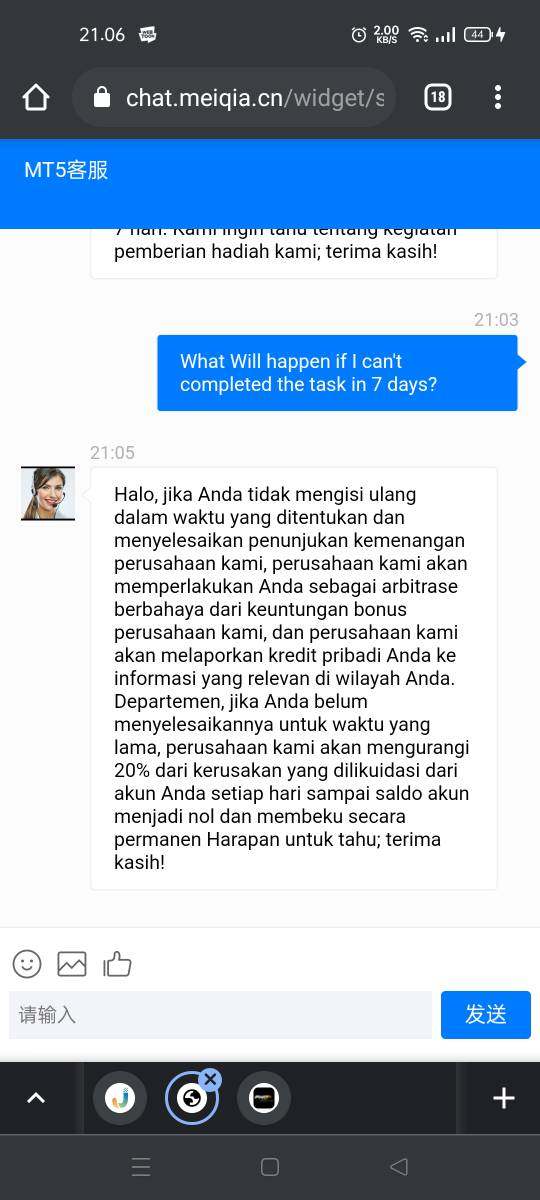

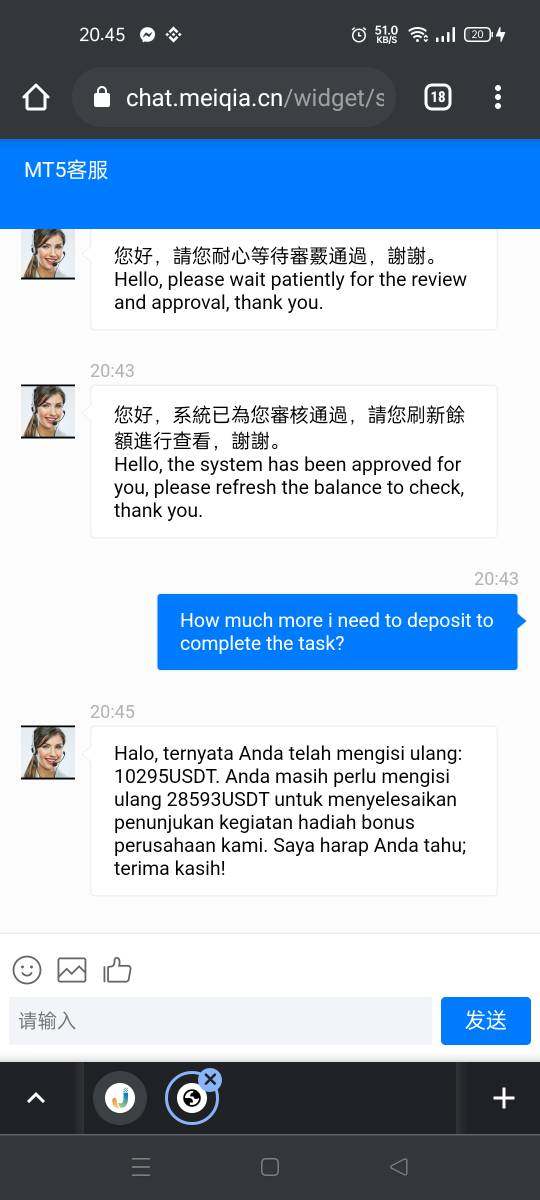

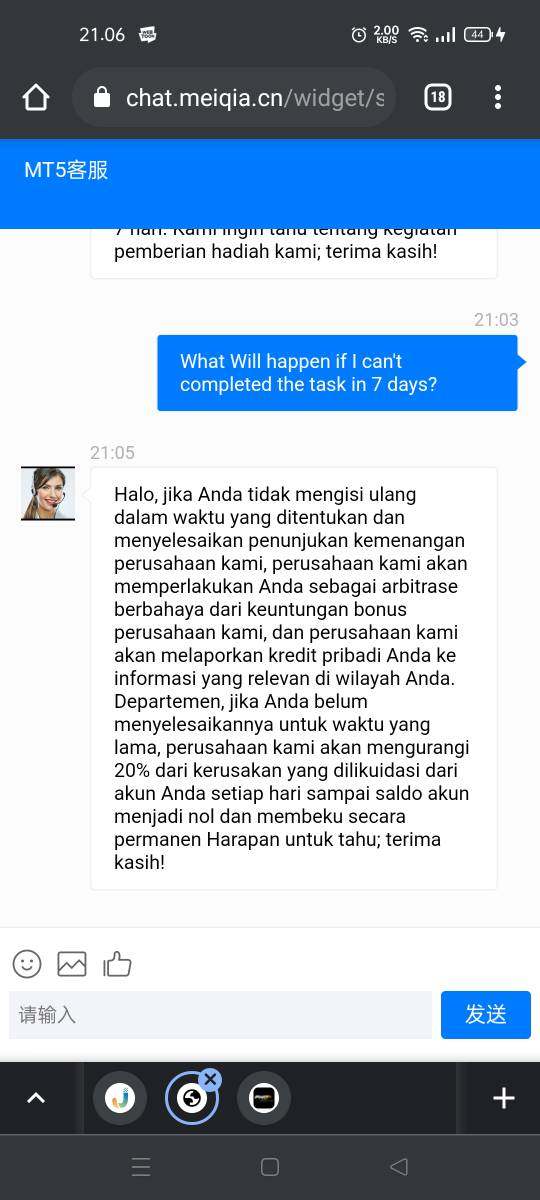

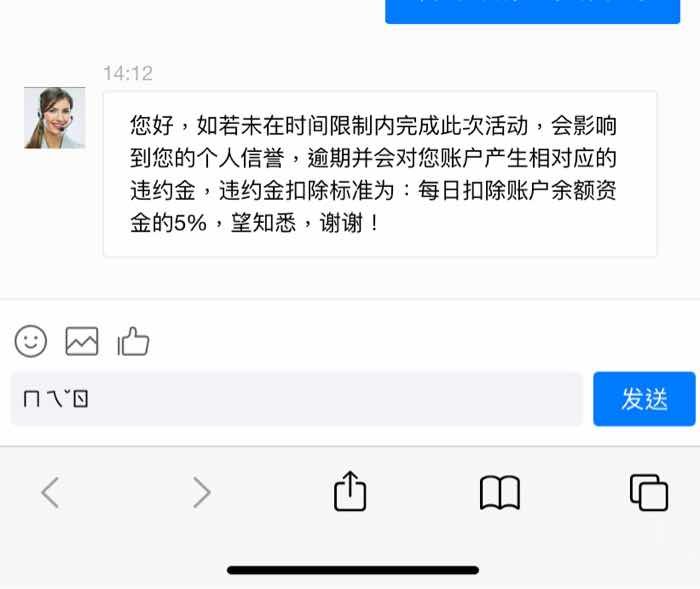

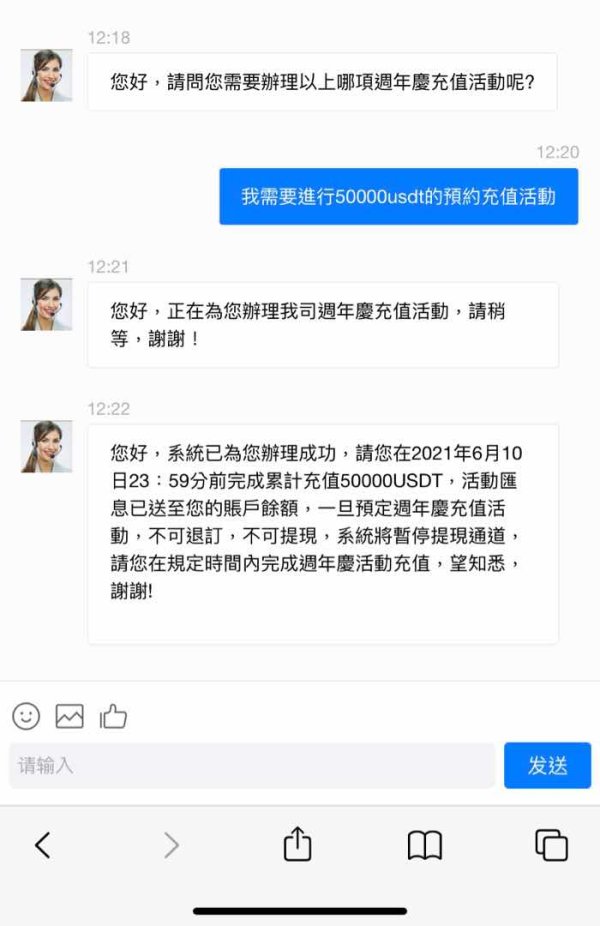

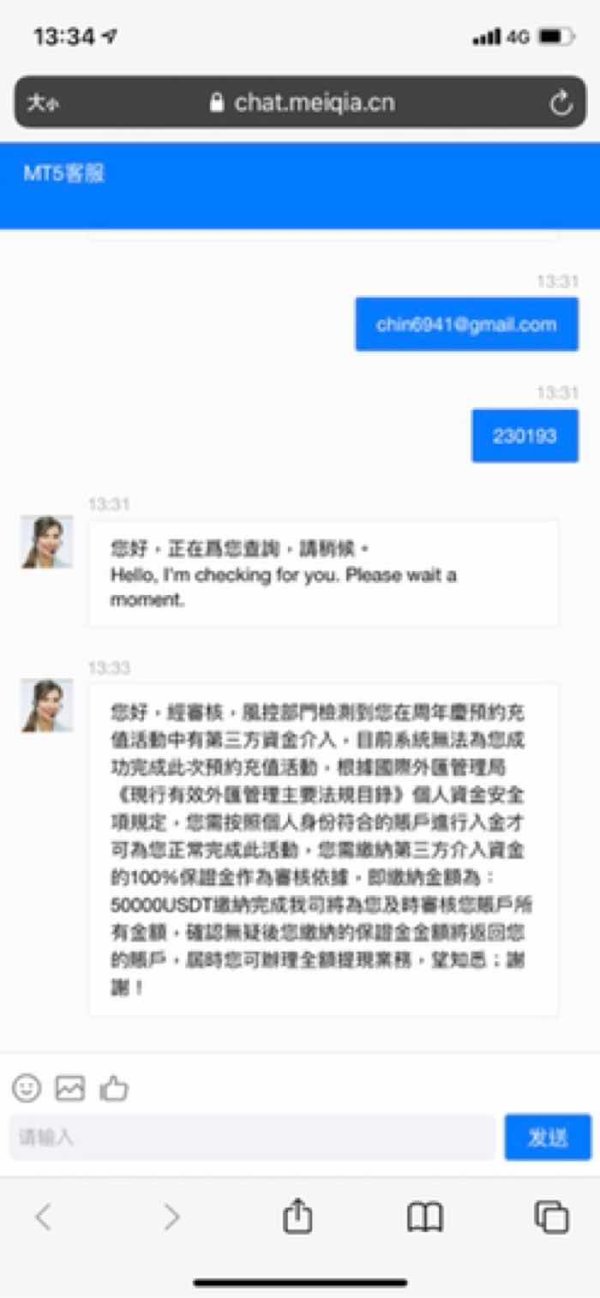

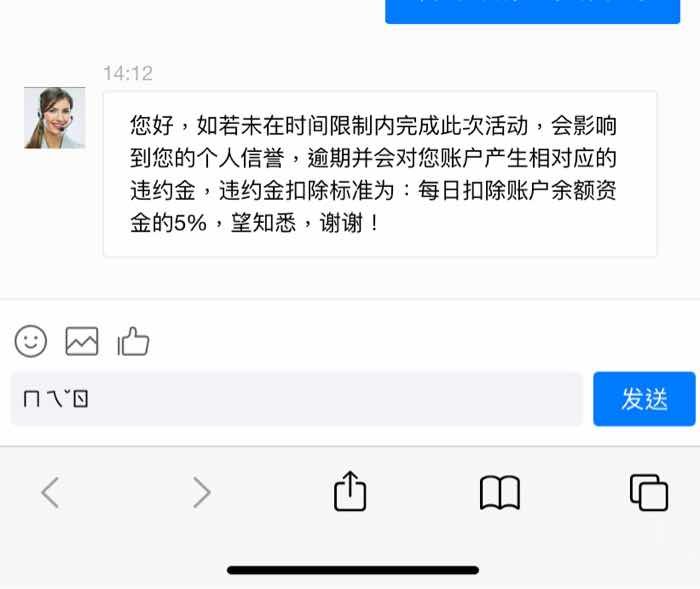

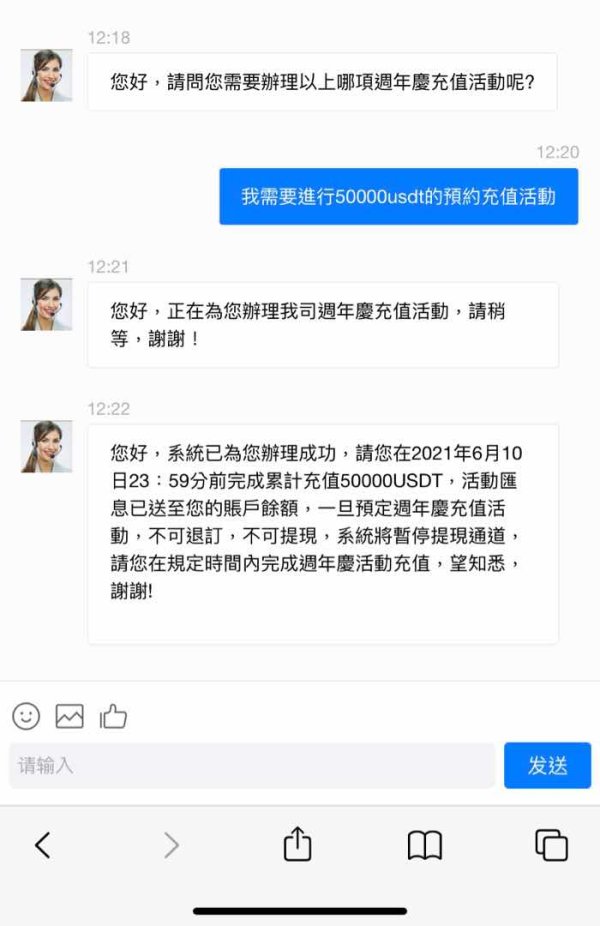

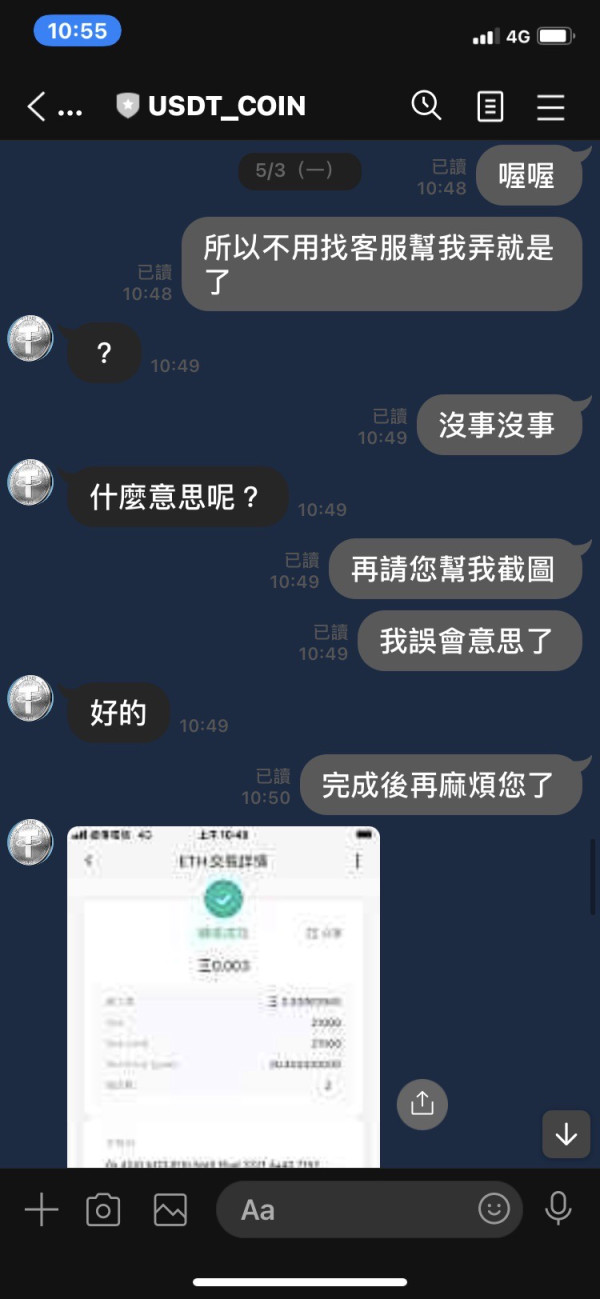

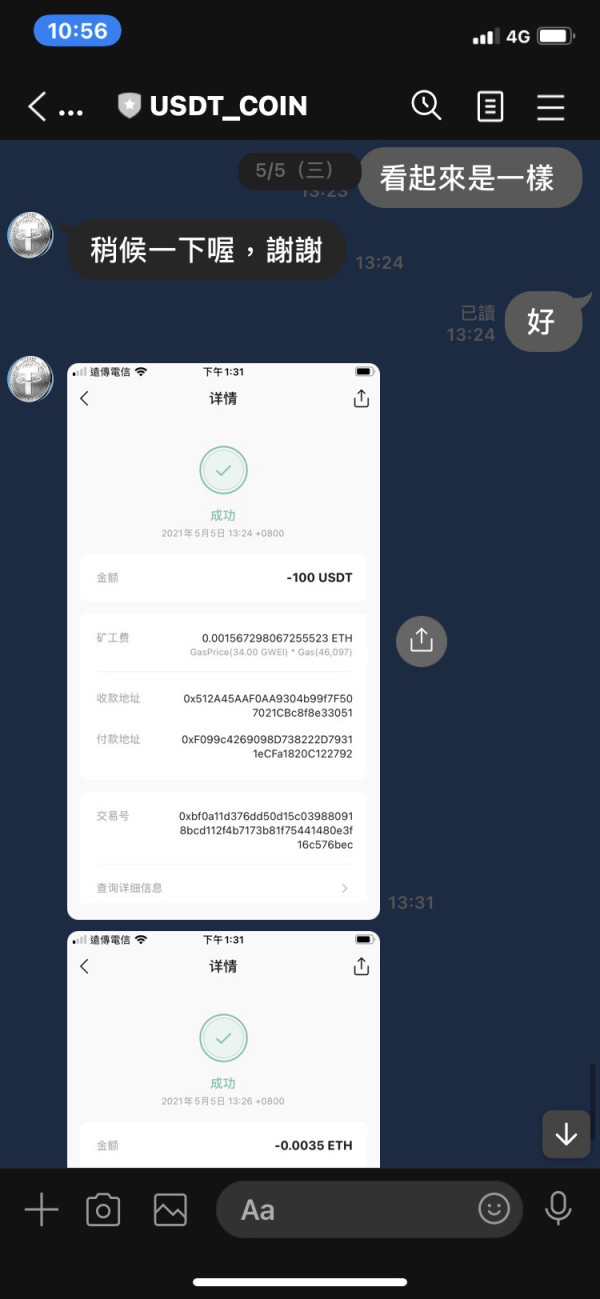

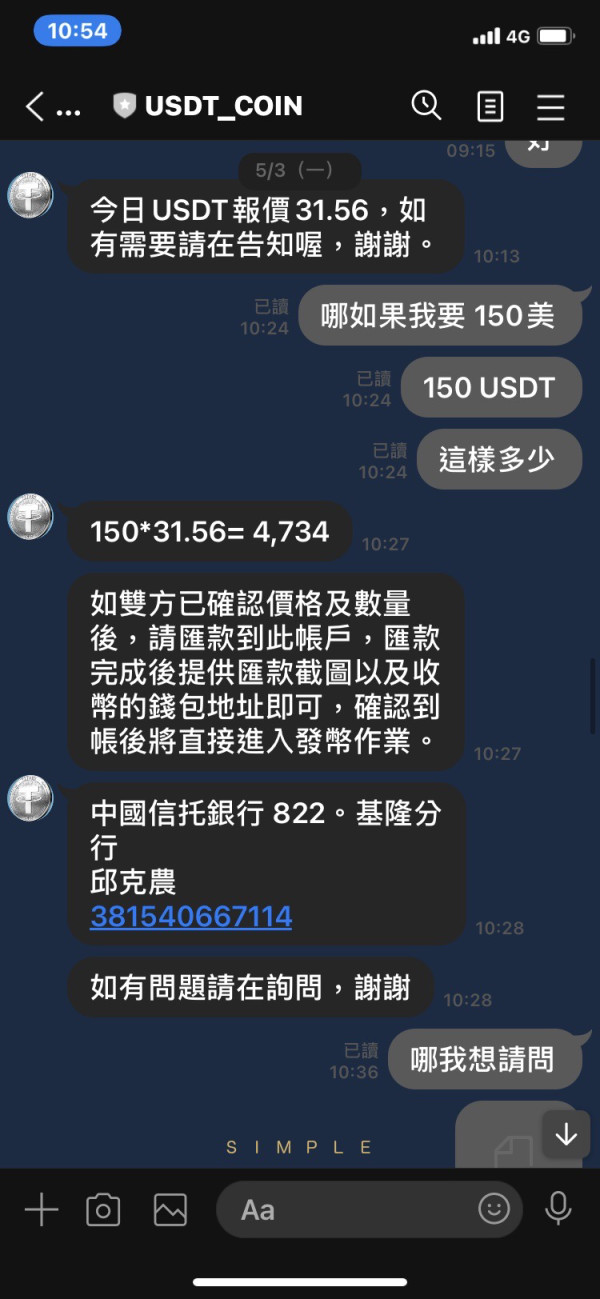

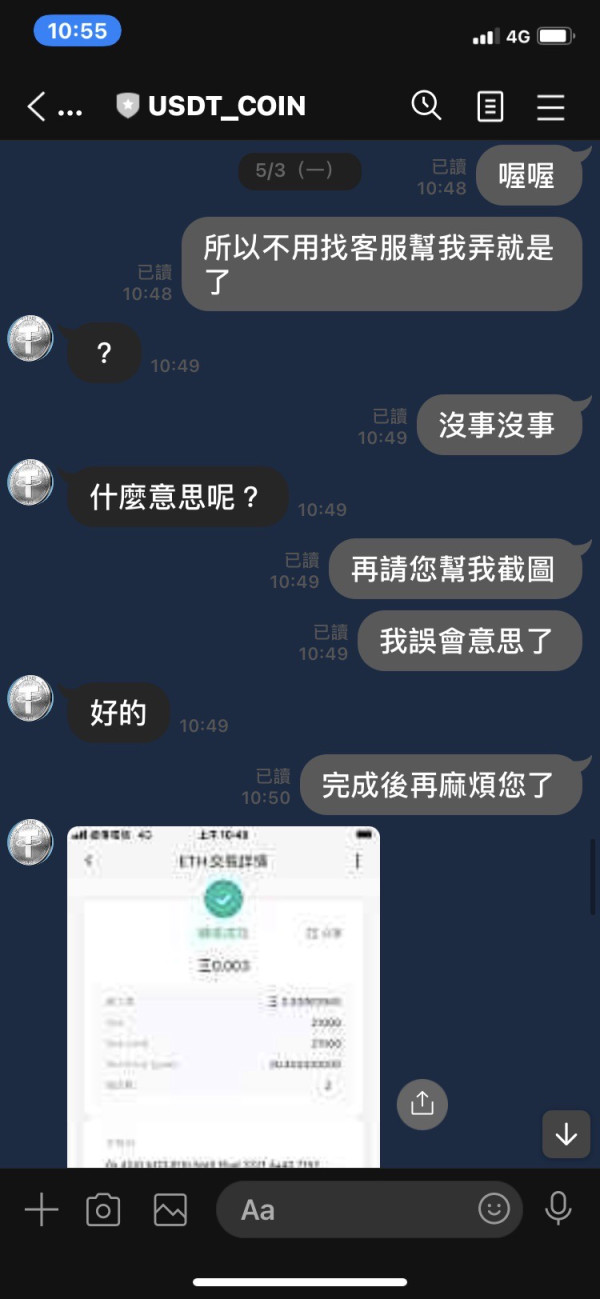

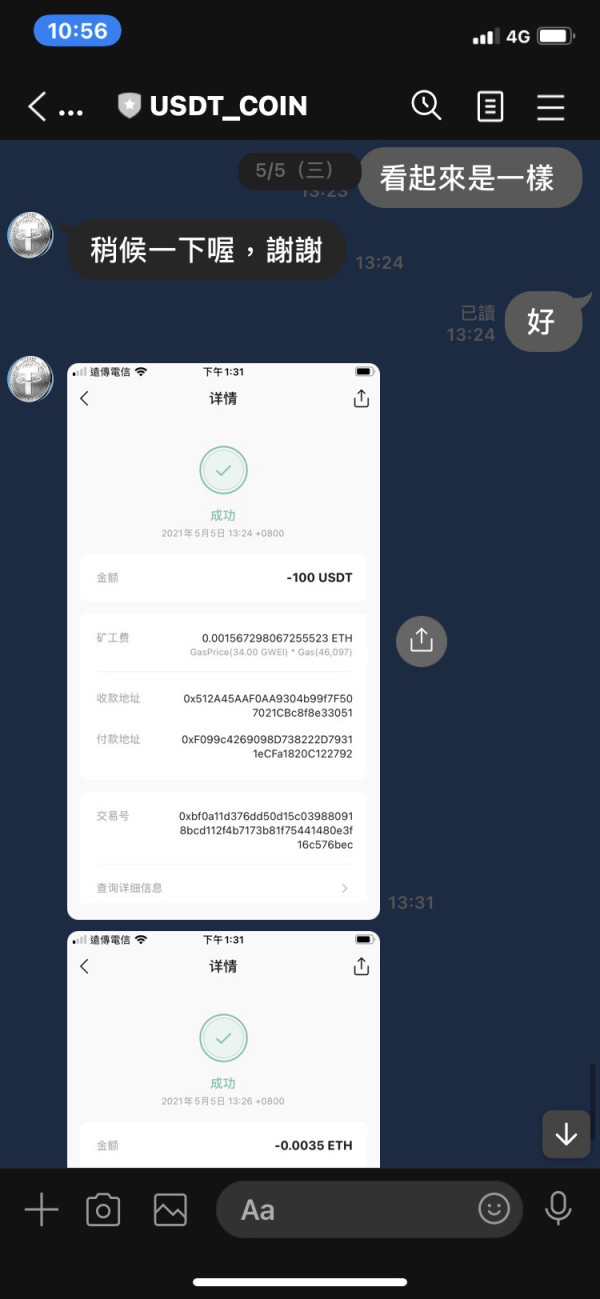

Most critically, user feedback consistently highlights severe withdrawal difficulties that fundamentally undermine any potential account benefits. According to documented complaints, users report being asked to pay additional taxes ranging up to 30% of their account balance before withdrawal processing, only to find their funds remain locked even after compliance. This pattern suggests systematic issues with fund recovery that make account opening extremely risky regardless of other conditions.

The lack of information regarding Islamic accounts, demo account availability, and account protection features further diminishes Rifa's appeal. Professional traders require clear understanding of account specifications, yet this Rifa review finds that essential details remain undisclosed, creating an environment of uncertainty that reputable brokers typically avoid through comprehensive disclosure.

Rifa's trading tools and resources receive a moderate rating primarily due to the diversity of available asset classes, though major limitations exist in transparency and educational support. The broker provides access to forex currency pairs across major, minor, and exotic categories, along with precious metals trading opportunities in gold and silver markets. Additionally, crude oil trading and various CFD instruments expand the available trading universe for users seeking diversified exposure.

However, specific details regarding trading tools, analytical resources, and market research capabilities remain largely undisclosed in available documentation. Modern traders expect access to advanced charting tools, market analysis, economic calendars, and educational resources that support informed decision-making. The absence of clear information about these critical trading supports seriously limits the broker's appeal to serious market participants.

Furthermore, no information is available regarding automated trading support, expert advisors, or algorithmic trading capabilities that have become standard expectations in contemporary forex trading. While the asset diversity provides some value, the lack of comprehensive tool disclosure and educational resources prevents Rifa from achieving higher ratings in this crucial category.

Customer Service and Support Analysis (4/10)

Customer service represents a critical weakness in Rifa's operational framework, with documented user complaints revealing major deficiencies in support quality and responsiveness. Available feedback indicates that users experience major difficulties when attempting to resolve withdrawal issues, with customer service representatives reportedly directing clients to pay additional fees rather than facilitating legitimate fund recovery requests.

The specific customer service channels, operating hours, and response time commitments are not clearly disclosed in available documentation, creating additional uncertainty for potential users. Professional trading environments require reliable, accessible support systems that can address technical issues, account problems, and trading concerns promptly and effectively.

User testimonials describe frustrating experiences with customer service managers who allegedly demand tax payments before processing withdrawals, suggesting either inadequate training or potentially fraudulent operational practices. The absence of clear escalation procedures, complaint resolution mechanisms, and service level agreements further undermines confidence in Rifa's customer support capabilities. These documented service failures seriously impact the broker's overall reliability and user satisfaction potential.

Trading Experience Analysis (5/10)

The trading experience with Rifa receives an average rating due to limited available information regarding platform performance, execution quality, and overall trading environment. While users have not provided extensive feedback about specific trading platform functionality, the documented withdrawal issues create major concerns about the overall trading ecosystem and operational reliability.

Platform stability, order execution speed, and trade processing quality are fundamental components of professional trading experiences, yet specific performance metrics and user testimonials regarding these aspects are not fully available. The absence of detailed platform specifications, supported order types, and execution statistics makes it difficult for traders to assess whether Rifa can meet their operational requirements.

Mobile trading capabilities, platform customization options, and advanced trading features remain undisclosed in available documentation. This Rifa review notes that while no major trading platform failures have been specifically reported, the overall operational concerns and withdrawal difficulties suggest that the trading experience may be compromised by broader systematic issues that affect user confidence and trading effectiveness.

Trust and Reliability Analysis (2/10)

Trust and reliability represent Rifa's most serious weaknesses, with multiple factors contributing to an extremely poor rating in this critical category. The broker faces documented fraud allegations and user complaints that fundamentally undermine its credibility as a legitimate financial service provider. These concerns are compounded by insufficient regulatory transparency and questionable operational practices.

Regulatory oversight appears limited, with Hong Kong registration claimed but specific regulatory authority supervision and license verification remaining unclear. Legitimate brokers typically provide comprehensive regulatory information, including license numbers, regulatory body contacts, and compliance documentation that allows users to verify operational legitimacy independently.

The documented pattern of withdrawal difficulties, combined with reports of additional tax demands and fund recovery failures, suggests systematic operational issues that extend beyond isolated incidents. User testimonials describe experiences consistent with fraudulent practices, including requests for additional payments that fail to result in fund access. These documented concerns, combined with limited regulatory transparency and operational disclosure gaps, create an environment where user funds appear to be at major risk.

User Experience Analysis (3/10)

The overall user experience with Rifa receives a poor rating due to documented difficulties in critical operational areas, particularly fund management and customer interaction. User feedback consistently highlights withdrawal problems as the primary source of dissatisfaction, with multiple reports describing failed attempts to recover invested funds despite meeting stated requirements.

Platform interface design, registration processes, and account verification procedures are not fully documented in available user feedback, though the focus on withdrawal difficulties suggests that these issues overshadow other experience elements. Professional traders require seamless, transparent operational processes that support efficient fund management and trading activities.

The documented user complaints reveal a pattern of frustration and financial loss that seriously impacts overall satisfaction. Users report feeling misled by withdrawal requirements and additional fee demands that fail to result in fund access. This Rifa review identifies these experience failures as fundamental operational deficiencies that make the broker unsuitable for serious trading activities, regardless of other potential platform features or trading opportunities.

Conclusion

This comprehensive Rifa review reveals a broker with major operational deficiencies that seriously outweigh any potential benefits from its multi-asset trading offerings. While Rifa provides access to diverse financial instruments including forex, precious metals, crude oil, and CFDs, the documented withdrawal difficulties and fraud allegations create unacceptable risks for potential users.

The broker may appeal to traders seeking multi-asset exposure, but only those with extremely high risk tolerance should consider engagement, and even then, such involvement is strongly discouraged given the documented fund recovery issues. The primary advantages include asset diversity, while critical disadvantages encompass withdrawal difficulties, limited regulatory transparency, and poor customer service quality that fundamentally compromise the trading experience and user fund security.