Is Rifa safe?

Business

License

Is Rifa Safe or a Scam?

Introduction

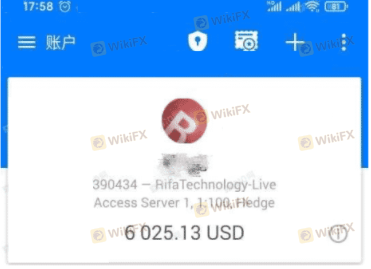

Rifa, officially known as Rifa Technology Company Limited, positions itself as a global brokerage firm operating primarily in the forex market. Founded in 2020 and registered in the United Kingdom, Rifa claims to provide a range of trading instruments, including forex currency pairs, precious metals, crude oil, and contracts for difference (CFDs). However, the rise of online trading has led to an influx of brokers, making it crucial for traders to assess the credibility and reliability of each platform. With numerous reports of scams and fraudulent activities in the forex industry, traders need to exercise caution when selecting a broker. This article aims to evaluate whether Rifa is safe for trading or if it poses potential risks to investors. The analysis is based on a thorough investigation of its regulatory status, company background, trading conditions, customer feedback, and overall risk assessment.

Regulation and Legitimacy

The regulatory status of a brokerage is one of the most critical factors in determining its legitimacy and safety. Rifa currently holds an NFA unauthorized regulatory status, which raises significant concerns about its operational integrity. Regulated brokers are typically subject to oversight by financial authorities, ensuring compliance with established financial regulations. Without such regulation, traders may find themselves vulnerable to fraudulent activities or misconduct.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | N/A | United States | Unauthorized |

The absence of a valid regulatory license is a major red flag. Rifa's official website is also reported to be non-functional, which further complicates the assessment of its legitimacy. Additionally, user feedback indicates a troubling pattern of complaints related to withdrawal issues and overall service quality. Historical compliance issues, including previous fines from regulatory bodies, further cast doubt on Rifa's commitment to maintaining industry standards.

Company Background Investigation

Rifas history is relatively short, having been established in 2020. Despite its recent inception, the company claims to have a global presence with operations in different regions, including Hong Kong. However, the lack of transparency regarding its ownership structure and management team raises questions about its credibility. A well-established brokerage typically has a clear organizational structure, with experienced professionals at the helm.

The management team's qualifications and industry experience are essential indicators of a broker's reliability. Unfortunately, Rifa does not provide comprehensive information about its management, which may lead potential clients to question the firm's operational capabilities. Furthermore, the company's transparency in disclosing important information such as financial reports and operational practices is minimal, which is concerning for potential investors.

Trading Conditions Analysis

When evaluating a broker, understanding its fee structure is vital for traders. Rifa offers a notably low minimum deposit requirement of just $10, which may be appealing to novice traders. However, the overall cost structure lacks clarity, with reports of hidden fees and unclear commission policies.

| Fee Type | Rifa | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | Varies (1-3 pips) |

| Commission Model | N/A | Varies by broker |

| Overnight Interest Range | N/A | Varies (0.5% - 2%) |

The absence of clear information regarding spreads and commissions raises concerns about potential hidden costs that could eat into traders' profits. A lack of transparency in fee structures is often a sign of a broker that may not have the best interests of its clients in mind, further contributing to the question of whether Rifa is safe.

Client Funds Security

The security of client funds is a paramount concern for any trader. Rifa's policies regarding fund safety are not well-documented, which is alarming for potential clients. A reputable broker typically segregates client funds from operational funds to ensure that traders' money is protected in the event of financial difficulties. Additionally, investor protection schemes are often in place to safeguard client assets.

Unfortunately, Rifa's lack of information on these critical aspects raises significant concerns. There have been no documented measures regarding negative balance protection or investor compensation schemes, leaving clients vulnerable in case of a financial mishap. Historical issues related to fund security, including complaints about withdrawal difficulties, further exacerbate these concerns.

Customer Experience and Complaints

Customer feedback is an essential component in assessing a broker's reliability. Reviews of Rifa indicate a pattern of dissatisfaction among clients, particularly regarding withdrawal processes and customer service responsiveness. Many users have reported difficulties in accessing their funds, which is a major red flag when evaluating whether Rifa is safe for trading.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Inconsistent |

| Transparency | High | Lacking |

Common complaints include delayed withdrawals and unresponsive customer support, which are significant issues for any trading platform. A couple of notable cases highlight these problems: one user reported being unable to withdraw funds after multiple attempts, while another faced unexpected fees when trying to access their account. These experiences suggest that Rifa may not prioritize customer satisfaction, further questioning its safety as a trading platform.

Platform and Trade Execution

The performance and reliability of a trading platform are critical for traders. Rifa claims to offer proprietary trading platforms, but details regarding their functionality and user experience are scarce. The quality of order execution, including slippage and rejection rates, is crucial for successful trading.

Without firsthand accounts or detailed reviews of the platform's performance, it is challenging to ascertain its reliability. Given the reported issues with customer service and withdrawals, there is a possibility that the platform may not deliver the level of performance expected by traders.

Risk Assessment

Using Rifa as a trading platform presents several risks that potential traders should consider. The lack of regulation, transparency, and consistent customer feedback all contribute to a heightened risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Unauthorized status raises concerns. |

| Fund Security | High | Lack of transparency in fund protection. |

| Customer Support | Medium | Reports of poor responsiveness. |

To mitigate these risks, potential traders are advised to conduct thorough due diligence before engaging with Rifa. Seeking alternative brokers with robust regulatory oversight and positive user reviews is a prudent approach.

Conclusion and Recommendations

In conclusion, the evidence suggests that Rifa may not be a safe trading platform. The combination of unauthorized regulatory status, customer complaints regarding withdrawals, and lack of transparency raises significant red flags. Traders should exercise extreme caution when considering this broker.

For those looking for reliable alternatives, it is advisable to explore well-regulated brokers with positive reputations, such as Forex.com or TD Ameritrade. These brokers offer the necessary regulatory protections and have established a record of positive customer experiences. Ultimately, ensuring the safety of investments should be a top priority for any trader, making it crucial to choose a broker that prioritizes transparency and customer service.

Is Rifa a scam, or is it legit?

The latest exposure and evaluation content of Rifa brokers.

Rifa Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Rifa latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.