HK Fortune 2025 Review: Everything You Need to Know

Executive Summary

HK Fortune is a new forex broker. It has entered the competitive online trading world and offers many different types of assets for traders who want complete market access. This hk fortune review shows that the broker works under the rules of the Financial Transactions and Reports Analysis Centre of Canada. This gives it a solid foundation of regulatory compliance for its business.

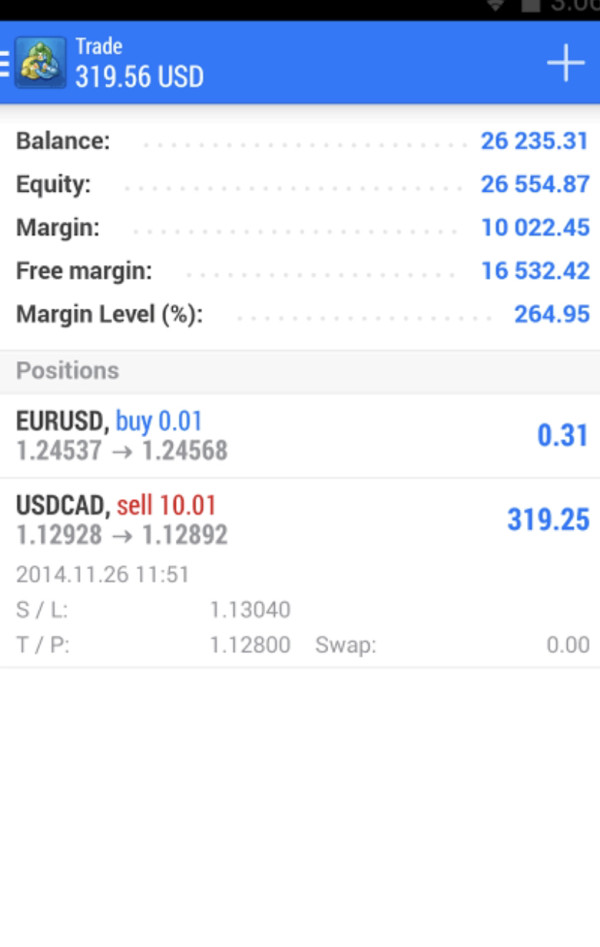

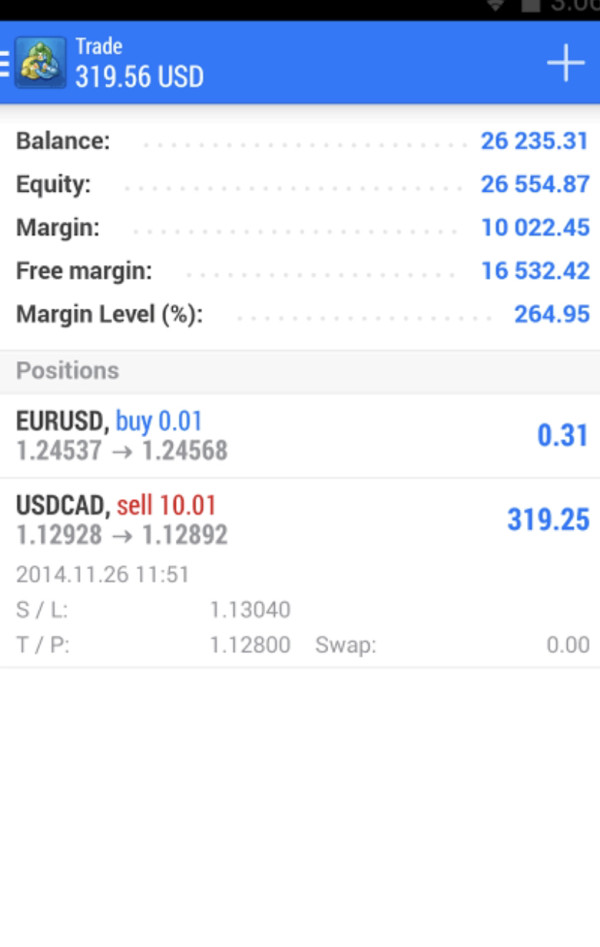

The broker stands out because it uses the MetaTrader 5 trading platform. MT5 serves as the main way to access multiple asset types including forex currency pairs, cryptocurrencies, precious metals, energy commodities, and stock indices. This multi-asset approach makes HK Fortune a potential one-stop solution for traders who prefer to keep all their trading activities under one platform instead of managing multiple broker relationships.

HK Fortune targets investors who value variety. They seek the convenience of accessing different financial markets through one unified trading environment. The broker's focus on providing multiple asset classes shows it understands modern traders' needs for portfolio variety and risk management across different market sectors.

However, it's important to note that HK Fortune is still new in the forex brokerage space. The broker is still building its track record and creating its reputation within the trading community. The broker's regulatory status under Canadian oversight provides some confidence, though traders should do their own research about the specific protections and guarantees available under this regulatory framework.

Important Notice

When considering this hk fortune review, traders should know that HK Fortune operates under Canadian regulation through the Financial Transactions and Reports Analysis Centre of Canada. This regulatory framework may create different operational procedures, legal protections, tax effects, and client safeguards depending on the trader's location and local regulatory requirements.

The regulatory environment in different areas can greatly impact the trading experience. This includes available leverage ratios, client fund protection measures, and dispute resolution systems. Traders should carefully review how their local regulations work with the broker's Canadian regulatory status before opening an account.

This review is based on available information from public sources and does not include real-time user feedback or recent market developments. The forex brokerage world changes rapidly, and traders are encouraged to verify current information directly with the broker and check recent user experiences before making trading decisions.

Rating Framework

Broker Overview

Company Background and Establishment

HK Fortune operates as Hong Kong Fortune Forex Group Limited. The company entered the online trading services market in 2021 and positions itself as a complete financial services provider in the competitive forex brokerage world. As a new entity in the industry, the company has focused on building its presence by offering a broad range of trading opportunities across multiple asset classes.

The broker's business model centers on providing online trading services that help both new and experienced traders. These traders seek exposure to various financial markets. HK Fortune has structured its operations to serve as a bridge between individual traders and global financial markets, making it easier to access trading opportunities that might otherwise be difficult for retail investors to access independently.

Trading Infrastructure and Asset Coverage

This hk fortune review highlights the broker's commitment to providing strong trading infrastructure through the MetaTrader 5 platform. MT5 serves as the primary trading environment for all client activities. The choice of MT5 shows the broker's focus on offering advanced trading capabilities and complete market analysis tools to its client base.

The broker's asset coverage spans multiple financial markets. This includes foreign exchange currency pairs, cryptocurrency markets, stock indices, energy commodities, precious metals, and various commodity markets. This varied offering reflects HK Fortune's strategy to position itself as a complete trading solution rather than specializing in a single market segment.

HK Fortune operates under the regulatory supervision of the Financial Transactions and Reports Analysis Centre of Canada. This provides the regulatory framework governing the broker's operations and client relationships. This Canadian regulatory oversight establishes the legal foundation for the broker's activities and defines the compliance standards that govern its business practices.

Regulatory Jurisdiction and Oversight

HK Fortune operates under the regulatory authority of the Financial Transactions and Reports Analysis Centre of Canada. This ensures compliance with Canadian financial regulations and anti-money laundering requirements. This regulatory framework provides the legal foundation for the broker's operations and establishes the compliance standards governing client relationships.

Deposit and Withdrawal Methods

Specific information about deposit and withdrawal methods is not detailed in available source materials. Traders interested in funding options should contact the broker directly to understand available payment methods, processing times, and any fees involved.

Minimum Deposit Requirements

The minimum deposit requirement for opening an account with HK Fortune is not specified in available information sources. Prospective clients should ask the broker directly to understand the capital requirements for different account types.

Promotional Offers and Bonuses

Details about specific bonus programs, promotional offers, or incentive structures are not mentioned in available source materials. Traders should verify current promotional offerings directly with the broker.

Trading Asset Categories

This hk fortune review confirms that the broker offers access to multiple asset categories. These include forex currency pairs for traditional currency trading, cryptocurrency markets for digital asset exposure, stock indices for equity market participation, energy commodities, precious metals trading, and various commodity markets for portfolio variety.

Cost Structure and Pricing

Specific information about spreads, commission structures, overnight financing costs, and other trading fees is not detailed in available source materials. Traders should request complete pricing information directly from the broker to understand the total cost of trading.

Leverage Ratios

Available information does not specify the leverage ratios offered by HK Fortune. Leverage availability may vary based on asset class, account type, and regulatory requirements applicable to the trader's jurisdiction.

Trading Platform Options

HK Fortune uses MetaTrader 5 as its primary trading platform. This provides clients with access to advanced charting tools, technical analysis capabilities, and automated trading features built into the MT5 environment.

Geographic Restrictions

Specific geographic restrictions or limitations on service availability are not detailed in available source materials. Prospective clients should verify service availability in their area.

Customer Support Languages

Information about available customer support languages is not specified in available source materials.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of HK Fortune's account conditions presents challenges due to limited publicly available information about specific account structures and terms. This hk fortune review cannot provide a complete assessment of account types, as detailed information about different account levels, their respective features, and associated benefits is not available in source materials.

Without specific information about minimum deposit requirements, traders cannot assess how accessible the broker's services are across different capital levels. The absence of detailed spread information, commission structures, and fee schedules makes it difficult to evaluate how competitive the broker's pricing model is compared to industry standards.

Account opening procedures, verification requirements, and the time frame for account activation are not detailed in available sources. Additionally, information about special account features such as Islamic accounts, professional trader accounts, or institutional account options is not provided.

The lack of specific account condition details represents a significant information gap that prospective clients would need to address through direct communication with the broker. This limitation prevents a thorough evaluation of how HK Fortune's account offerings compare to industry standards and competitor offerings.

HK Fortune's provision of the MetaTrader 5 platform represents a significant strength in terms of trading tools and technological infrastructure. MT5 is recognized as an advanced trading platform that offers complete charting capabilities, technical analysis tools, and support for automated trading strategies through Expert Advisors.

The platform's multi-asset trading capabilities align well with HK Fortune's diverse asset offering. This allows traders to manage positions across forex, cryptocurrencies, commodities, and indices within a single trading environment. This integration can enhance trading efficiency and portfolio management capabilities for active traders.

However, specific information about additional research resources, market analysis tools, educational materials, or proprietary trading tools is not available in source materials. The absence of details about daily market analysis, economic calendars, trading signals, or educational webinars limits the assessment of the broker's complete support for trader development and market understanding.

The availability of mobile trading applications, web-based trading platforms, or additional software tools beyond MT5 is not specified. Additionally, information about the broker's approach to supporting algorithmic trading, social trading features, or advanced order types is not detailed in available sources.

Customer Service and Support Analysis

The evaluation of HK Fortune's customer service capabilities is significantly limited by the absence of specific information about support channels, availability hours, and service quality metrics. Without details about available communication methods such as live chat, telephone support, email assistance, or callback services, it's impossible to assess how accessible customer support is.

Response time expectations, service level agreements, and the overall quality of customer service interactions cannot be evaluated based on available information. The absence of user testimonials or feedback about customer service experiences further limits the assessment of this crucial aspect of broker operations.

Multi-language support capabilities, which are essential for international brokers serving diverse client bases, are not specified in available source materials. The availability of support during different market hours, weekend assistance, or emergency contact procedures is also not detailed.

The lack of information about customer service training, technical support capabilities, and problem resolution procedures represents a significant gap in understanding how HK Fortune supports its clients beyond the basic trading platform provision. Prospective clients would need to evaluate customer service quality through direct interaction with the broker's support team.

Trading Experience Analysis

The assessment of trading experience with HK Fortune is limited by little information about platform performance, execution quality, and overall user experience. While the broker uses MetaTrader 5, which is known for its stability and functionality, specific performance metrics such as execution speeds, slippage rates, and platform uptime statistics are not available.

Order execution quality, including the broker's approach to order processing, re-quotes, and price improvement, cannot be evaluated based on available information. The absence of details about the broker's execution model, whether market making or straight-through processing, limits understanding of the trading environment.

Platform functionality beyond basic MT5 features, such as advanced order types, one-click trading, or mobile trading capabilities, is not specifically detailed. Information about server locations, latency optimization, and technical infrastructure supporting the trading environment is also not available.

This hk fortune review cannot provide insights into the practical trading experience. This includes ease of navigation, chart customization options, or the overall user interface quality. User feedback about platform stability, mobile app functionality, and overall trading satisfaction is not available in source materials.

Trust and Reliability Analysis

HK Fortune's regulatory status under the Financial Transactions and Reports Analysis Centre of Canada provides a foundation for trust and reliability assessment. Canadian regulatory oversight generally includes requirements for financial reporting, compliance monitoring, and adherence to anti-money laundering standards, which contribute to operational transparency.

However, specific details about the broker's regulatory license number, regulatory history, or any regulatory actions are not provided in available information. The absence of information about client fund segregation, deposit protection schemes, or compensation fund participation limits the assessment of financial security measures.

Company transparency factors such as ownership structure, financial statements, auditing procedures, or corporate governance practices are not detailed in available sources. Information about the broker's track record, industry awards, or recognition from financial publications is also not available.

The broker's relatively recent establishment in 2021 means that long-term track record data is naturally limited. Without access to user reviews, industry ratings, or third-party assessments, the evaluation of reputation and reliability relies primarily on regulatory status rather than demonstrated performance history.

User Experience Analysis

The evaluation of user experience with HK Fortune faces significant limitations due to the absence of user feedback, testimonials, or detailed interface descriptions in available source materials. Without specific user reviews or experience reports, it's impossible to assess overall user satisfaction levels or identify common user concerns.

Interface design quality, ease of navigation, and the overall user-friendliness of the trading platform beyond standard MT5 features cannot be evaluated. Information about account registration procedures, verification processes, and the overall onboarding experience for new clients is not available.

The quality of fund management experiences, including deposit and withdrawal procedures, processing times, and user satisfaction with financial transactions, cannot be assessed based on available information. Additionally, common user complaints, frequently reported issues, or areas where users have expressed dissatisfaction are not documented in source materials.

User demographic information, typical trader profiles, or feedback about which types of traders find the platform most suitable is not available. The absence of user experience data represents a significant limitation in providing complete guidance about the broker's suitability for different trader types and experience levels.

Conclusion

This hk fortune review reveals a broker that presents both opportunities and uncertainties for potential clients. HK Fortune's strengths lie in its multi-asset trading approach and the use of the robust MetaTrader 5 platform, which provides a solid technological foundation for diverse trading activities. The broker's regulatory oversight by the Financial Transactions and Reports Analysis Centre of Canada offers a measure of regulatory compliance and operational legitimacy.

However, the significant gaps in available information about account conditions, pricing structures, customer service quality, and user experiences present challenges for complete evaluation. Prospective clients considering HK Fortune should be prepared to conduct additional research through direct communication with the broker to obtain essential details about trading costs, account requirements, and service quality.

HK Fortune appears most suitable for traders who prioritize asset diversity and are comfortable with newer brokerage entities that are still establishing their market presence. The broker's multi-asset approach may appeal to traders seeking portfolio variety opportunities within a single trading platform, though the lack of detailed user feedback suggests a cautious approach is advisable for new clients.