Is FTSE safe?

Pros

Cons

Is FTSE A Scam?

Introduction

FTSE, a name often associated with the Financial Times Stock Exchange, has established itself as a notable player in the forex and trading markets since its inception. As a broker, it claims to offer a platform for trading various financial instruments, including forex and CFDs. However, with the increasing number of scams in the financial sector, traders must exercise caution when evaluating brokers like FTSE. This article aims to provide a comprehensive analysis of FTSE, focusing on its regulatory status, company background, trading conditions, customer safety, client experiences, platform performance, and overall risk assessment. The investigation draws upon multiple credible sources, including user reviews and industry reports, to form a balanced perspective on whether FTSE is safe or potentially a scam.

Regulation and Legitimacy

Understanding the regulatory framework surrounding a broker is crucial for determining its legitimacy. Regulation serves as a safeguard for traders, ensuring that the broker adheres to strict financial standards and practices. In the case of FTSE, the regulatory status appears to be concerning. According to various reviews, FTSE lacks valid regulatory oversight, which raises significant red flags regarding its operations.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unverified |

The absence of regulation from reputable authorities such as the Financial Conduct Authority (FCA) in the UK or the Cyprus Securities and Exchange Commission (CySEC) indicates that FTSE operates without the necessary oversight that protects traders. This lack of regulatory compliance can lead to potential risks, including the mismanagement of client funds and the absence of investor protection mechanisms. Moreover, historical compliance issues have emerged, with warnings from financial regulators about FTSE's operations, further solidifying the view that FTSE is not safe for trading.

Company Background Investigation

FTSE's history is relatively recent, having been established in 2017. However, details about its ownership structure and management team are scarce, contributing to concerns about transparency. A lack of information regarding the company's founders and their professional backgrounds can lead to uncertainty about the broker's reliability.

Transparency is a critical factor in building trust with clients, and FTSE's failure to disclose essential information about its operations and management team raises questions. Investors should be wary of companies that do not provide clear information about their leadership and organizational structure, as this can indicate potential issues regarding accountability and governance.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions, including fees and spreads, is essential. FTSE's fee structure has raised eyebrows among traders. Reports indicate that while FTSE offers competitive spreads, there are hidden fees that can significantly impact trading profitability.

| Fee Type | FTSE | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.0 pips |

| Commission Model | Variable | Fixed/Variable |

| Overnight Interest Range | 0.5% - 2% | 0.5% - 1.5% |

The discrepancies in the fee structure, particularly the overnight interest rates, suggest that FTSE may not be as transparent as it claims. Traders should be cautious of any broker that imposes higher-than-average fees, as this can erode potential profits and indicate underlying issues with the broker's business model. Such conditions may also reflect a lack of commitment to providing a fair trading environment, further questioning whether FTSE is safe for traders.

Customer Funds Safety

The safety of customer funds is paramount when selecting a broker. FTSE's policies regarding fund security have come under scrutiny. Reports indicate that FTSE does not maintain segregated accounts for client funds, which is a standard practice among reputable brokers to ensure that traders' money is protected.

Additionally, the absence of investor protection mechanisms, such as negative balance protection, increases the risk for traders. These factors contribute to a perception that FTSE may not prioritize the safety and security of its clients' funds. Historical incidents involving fund mismanagement further exacerbate concerns, leading to the conclusion that FTSE is not safe for traders looking to protect their investments.

Customer Experience and Complaints

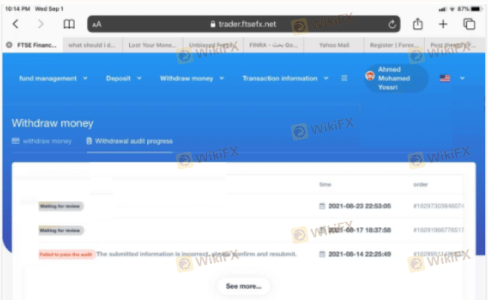

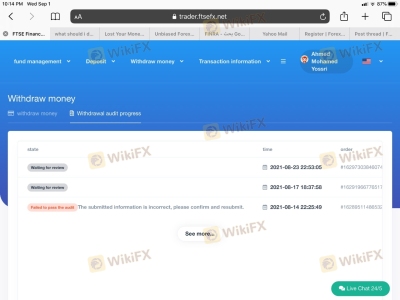

Customer feedback is a vital aspect of assessing a broker's reliability. Reviews of FTSE reveal a mixed bag of experiences, with numerous complaints highlighting issues with customer service and fund withdrawals. Common complaints include delayed responses to inquiries and difficulties in processing withdrawal requests, which can be particularly alarming for traders.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow |

| Customer Support | Medium | Inconsistent |

| Platform Performance | Low | Average |

Several users have reported significant delays in receiving their funds, which raises questions about the broker's operational efficiency and reliability. In one case, a trader experienced a withdrawal request that took over a month to process, leading to frustration and distrust. Such issues indicate that FTSE is not safe for traders who prioritize timely access to their funds.

Platform and Execution

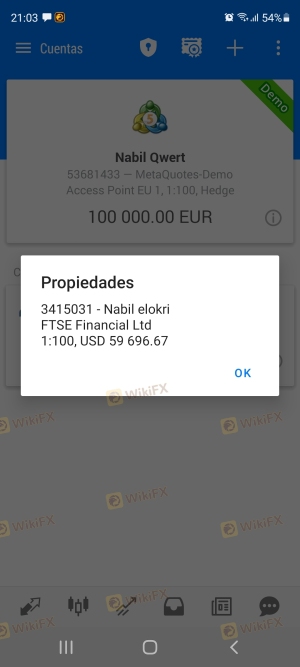

The performance and stability of a trading platform are critical for traders. FTSE utilizes the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, which are known for their reliability. However, user feedback suggests that there may be issues with order execution quality, including slippage and rejections.

Traders have reported instances of significant slippage during volatile market conditions, which can adversely affect trading outcomes. Additionally, some users have expressed concerns about potential platform manipulation, although concrete evidence is lacking. This situation warrants caution, as any signs of platform issues can significantly impact a trader's experience and profitability.

Risk Assessment

Engaging with FTSE presents several risks that traders must consider. The lack of regulation, transparency issues, hidden fees, and complaints regarding fund withdrawals contribute to a high-risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulation |

| Fund Safety Risk | High | No segregated accounts |

| Execution Risk | Medium | Issues with slippage |

| Customer Support Risk | Medium | Slow response times |

To mitigate these risks, traders should conduct thorough research, utilize demo accounts to test the platform, and consider diversifying their investments across multiple brokers. It is crucial to remain vigilant and informed about potential risks associated with trading with FTSE.

Conclusion and Recommendations

In conclusion, the evidence suggests that FTSE is not safe for traders. The lack of regulatory oversight, transparency issues, and numerous customer complaints indicate that potential risks outweigh the benefits of trading with this broker. Traders should exercise extreme caution and consider alternative options that prioritize regulatory compliance and customer safety.

For those seeking reliable brokers for trading, consider reputable alternatives such as IG, Pepperstone, or Plus500, which offer robust regulatory frameworks, competitive trading conditions, and positive customer feedback. By choosing a well-regulated broker, traders can enhance their chances of success while minimizing risks in the volatile forex market.

Is FTSE a scam, or is it legit?

The latest exposure and evaluation content of FTSE brokers.

FTSE Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FTSE latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.