WSL Review 1

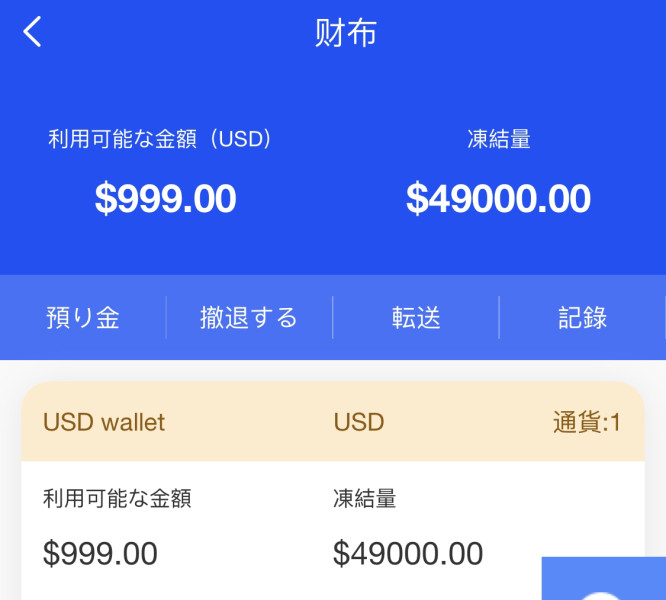

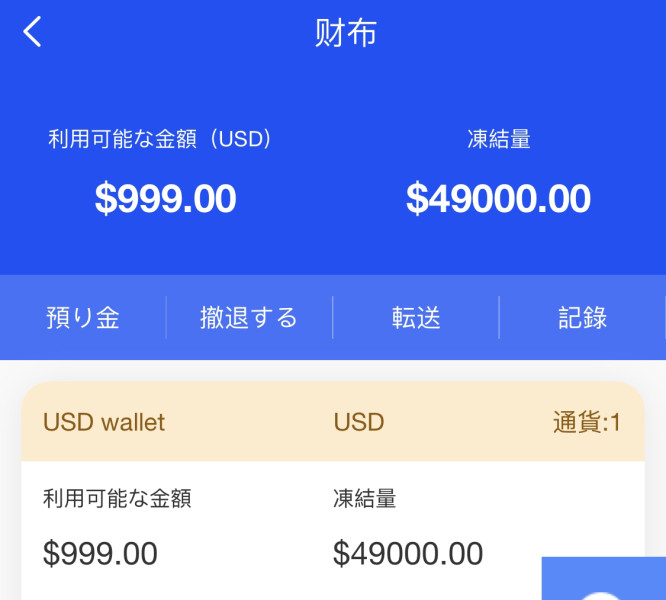

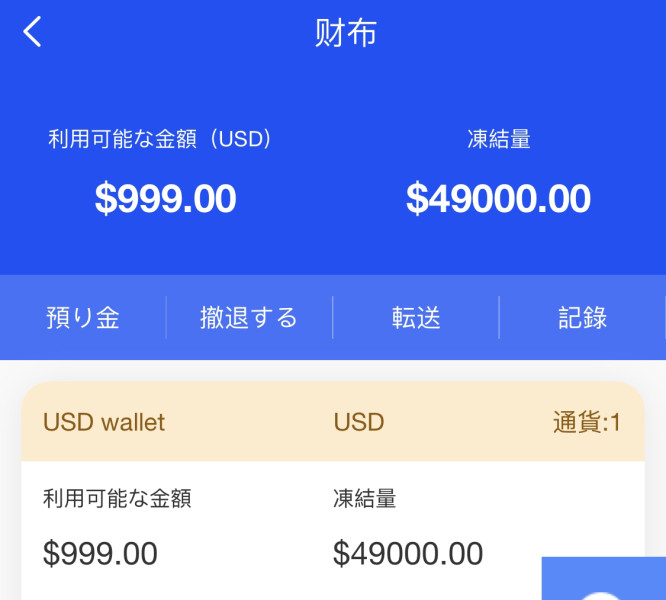

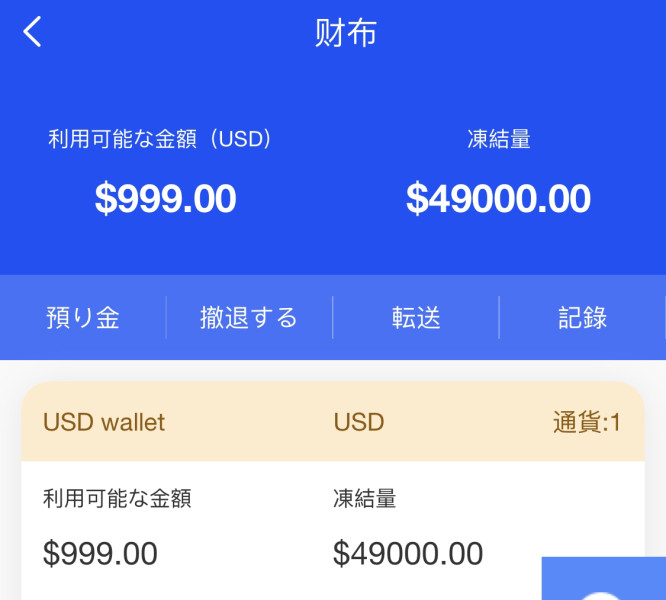

I applied for withdrawal but my account was blocked. They told me to deposit again. After 2 months, I could finally withdraw but I could not contact the female scammer.

WSL Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

I applied for withdrawal but my account was blocked. They told me to deposit again. After 2 months, I could finally withdraw but I could not contact the female scammer.

Our comprehensive wsl review reveals a forex broker that presents both intriguing opportunities and notable information gaps. Based on available data, WSL operates as a forex trading platform. The platform has attracted attention for its claimed zero-cost trading environment, featuring 0ms average trading speed and zero spread costs. However, the lack of comprehensive regulatory information and limited user feedback data raises questions about transparency and accountability.

WSL appears to target traders who prioritize execution speed and minimal trading costs. The platform particularly appeals to those seeking rapid-fire trading capabilities. The platform's technical specifications suggest a focus on high-frequency trading environments, though the absence of detailed platform information and regulatory oversight details requires careful consideration. While the zero spread cost structure may appeal to cost-conscious traders, potential users should exercise due diligence. The limited available information about the company's operational framework and customer protection measures creates uncertainty.

Important Notice

This wsl review is based on publicly available information. It should be considered alongside the fact that regulatory details and comprehensive user feedback data were not available in our research materials. Different jurisdictions may have varying legal requirements and protections for forex trading activities. Traders should always verify current regulatory status and terms of service directly with the broker before making any financial commitments. Our evaluation methodology combines available technical data with industry standard assessment criteria, though some areas lack sufficient information for complete analysis.

| Assessment Category | Score | Rating Basis |

|---|---|---|

| Account Conditions | 6/10 | Limited information available on account types and requirements |

| Tools and Resources | 4/10 | Insufficient data on trading tools and educational resources |

| Customer Service | 4/10 | No specific information on support channels or quality |

| Trading Experience | 7/10 | Strong technical performance with 0ms speed and zero spreads |

| Trust and Regulation | 3/10 | Lack of clear regulatory information raises concerns |

| User Experience | 5/10 | Insufficient user feedback data for comprehensive assessment |

WSL operates as a forex trading platform. The company has positioned itself in the competitive foreign exchange market landscape. According to available information, the company focuses specifically on forex trading services, though comprehensive details about its corporate structure and operational history remain limited in publicly accessible sources. The platform appears to emphasize technical performance and cost efficiency as its primary value propositions.

The broker's business model centers around providing forex trading services with an emphasis on execution speed and minimal cost structure. Available data indicates that WSL has implemented technical infrastructure designed to support rapid trade execution. The platform reports average trading speeds of 0ms. This technical specification, combined with zero spread costs, suggests the platform may be targeting active traders and those engaged in high-frequency trading strategies. However, specific details about the company's founding principles, management team, and long-term strategic vision are not detailed in available materials.

Regulatory Status: Specific regulatory information was not detailed in available materials. This represents a significant information gap for potential traders seeking comprehensive oversight details.

Deposit and Withdrawal Methods: Available materials do not specify the range of funding options or withdrawal processes offered by the platform.

Minimum Deposit Requirements: Specific minimum deposit amounts are not mentioned in accessible documentation.

Promotional Offers: Information about bonuses, promotional campaigns, or incentive programs is not available in current materials.

Trading Assets: The platform focuses on forex trading. However, specific currency pairs and the breadth of available instruments are not detailed in available sources.

Cost Structure: Available data indicates zero spread costs. Other potential fees, commissions, or trading costs are not specified in accessible materials. This wsl review notes that while zero spreads appear attractive, traders should verify the complete fee structure.

Leverage Options: Specific leverage ratios and margin requirements are not detailed in available information.

Platform Technology: While technical performance metrics are available, specific platform software details and features are not comprehensively covered.

Geographic Restrictions: Information about regional availability and restrictions is not specified in current materials.

Customer Service Languages: Available support languages and communication options are not detailed in accessible sources.

The account conditions assessment for WSL faces significant limitations. This is due to insufficient publicly available information about account types, structures, and requirements. Without detailed specifications about different account tiers, minimum deposit requirements, or special account features, it becomes challenging to provide a comprehensive evaluation of the broker's account offerings. This information gap is particularly concerning for potential traders who need to understand the financial commitments and account options available.

Industry standards typically include multiple account types catering to different trader profiles. These range from beginner-friendly accounts with lower minimum deposits to premium accounts offering enhanced features and support. The absence of clear account structure information in this wsl review suggests that potential clients would need to contact the broker directly to understand available options. This lack of transparency in basic account information contributes to the moderate rating, as traders generally prefer clear, upfront information about account requirements and features.

The evaluation of trading tools and resources reveals a significant information deficit. This impacts the overall assessment. Available materials do not provide details about analytical tools, charting capabilities, market research resources, or educational materials that might be available to traders. Modern forex trading platforms typically offer comprehensive tool suites including technical analysis indicators, economic calendars, market news feeds, and educational resources to support trader development.

The absence of information about automated trading support, expert advisors, or API access further limits the assessment of WSL's technological offerings. Educational resources, which are increasingly important for broker differentiation and trader success, are not detailed in available materials. This lack of information about tools and resources significantly impacts the platform's appeal to traders who rely on comprehensive analytical and educational support for their trading activities.

Customer service evaluation is severely hampered by the lack of available information. There are no details about support channels, response times, and service quality metrics. Effective customer support is crucial in forex trading, where technical issues or account problems can have immediate financial implications. Without details about available support methods such as live chat, phone support, email response times, or help desk availability, it's impossible to assess the quality of customer care.

The absence of information about multilingual support capabilities, support hours, or specialized assistance for different account types further complicates the evaluation. Industry best practices include 24/5 support during market hours, multiple communication channels, and knowledgeable staff capable of addressing both technical and trading-related inquiries. The lack of customer service information in available materials suggests potential clients would need to test support responsiveness before committing to the platform.

The trading experience assessment benefits from some concrete technical data. This particularly includes the reported 0ms average trading speed and zero spread costs. These metrics suggest that WSL has invested in technical infrastructure designed to provide rapid order execution, which is particularly valuable for scalping strategies and high-frequency trading approaches. The zero spread cost structure, if accurately implemented, could provide significant cost advantages for active traders.

However, the evaluation is limited by the absence of information about platform stability, order execution quality during high volatility periods, and the range of order types supported. Mobile trading capabilities, platform customization options, and integration with third-party tools are not detailed in available materials. This wsl review recognizes the strong technical performance indicators while noting that comprehensive trading experience assessment requires additional platform functionality details that are currently unavailable.

The trust and regulation assessment reveals the most significant concerns in this evaluation. The absence of clear regulatory information, licensing details, and oversight mechanisms raises important questions about trader protection and platform accountability. Regulatory oversight is fundamental to forex broker credibility, providing essential protections including segregated client funds, dispute resolution mechanisms, and operational standards compliance.

Without specific regulatory authority licensing, compensation scheme participation, or transparency about corporate structure and ownership, potential traders face elevated risk considerations. The lack of information about fund segregation practices, audit procedures, and financial reporting further compounds trust concerns. Industry best practices include clear regulatory disclosure, regular financial audits, and participation in investor compensation schemes, none of which are detailed in available materials about WSL.

User experience evaluation is constrained by the limited availability of user feedback, testimonials, and community discussions about the platform. Comprehensive user experience assessment typically draws from multiple sources including user reviews, community forums, and independent feedback platforms. The absence of substantial user feedback data makes it difficult to assess real-world platform performance, customer satisfaction levels, and common user concerns.

Interface design quality, registration process efficiency, and overall platform usability cannot be thoroughly evaluated without additional user experience data. The lack of information about account verification procedures, fund processing times, and user-reported issues further limits the assessment. This information gap is particularly significant as user experience often reveals practical aspects of broker operations that technical specifications alone cannot capture.

This comprehensive wsl review reveals a forex broker with notable technical performance claims but significant information gaps. These gaps impact overall assessment confidence. While the reported zero spread costs and 0ms trading speeds present attractive features for cost-conscious and speed-focused traders, the lack of comprehensive regulatory information and limited transparency about operational details raise important considerations for potential users.

WSL may be suitable for experienced traders who prioritize execution speed and low costs. This particularly applies to those comfortable with conducting additional due diligence about regulatory status and operational practices. However, the platform may not be ideal for traders seeking comprehensive educational resources, detailed account options, or extensive customer support information. The primary advantages include potential cost savings and rapid execution, while the main drawbacks center on limited transparency and insufficient regulatory clarity.

FX Broker Capital Trading Markets Review