Is Financial IGM safe?

Business

License

Is Financial IGM Safe or Scam?

Introduction

Financial IGM is a forex broker that has recently gained attention in the trading community, primarily for its aggressive marketing strategies and promises of high returns. As the forex market continues to expand, it is crucial for traders to conduct thorough evaluations of brokers before committing their funds. The potential for financial loss is significant, particularly when dealing with unregulated or poorly regulated brokers. This article aims to investigate the legitimacy of Financial IGM, assessing its regulatory status, company background, trading conditions, customer experiences, and overall safety. The investigation draws on a range of sources, including regulatory databases, user reviews, and expert analyses, to provide a comprehensive evaluation of whether Financial IGM is safe or a scam.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its safety. A well-regulated broker is subject to strict oversight, which helps protect traders' interests and funds. Unfortunately, Financial IGM does not appear to be regulated by any recognized financial authority. This lack of regulation raises serious concerns about the broker's legitimacy and the safety of client funds.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of a regulatory license means that traders have little to no recourse in the event of disputes or issues related to withdrawals. Regulatory bodies like the FCA (Financial Conduct Authority) in the UK or ASIC (Australian Securities and Investments Commission) in Australia enforce strict guidelines to ensure brokers operate fairly. Financial IGM's lack of oversight places it in a precarious position, making it more susceptible to engaging in potentially fraudulent practices. Additionally, warnings from various financial watchdogs indicate that the broker may not comply with industry standards, further emphasizing the need for caution among potential clients.

Company Background Investigation

Understanding the history and ownership structure of Financial IGM is essential for assessing its credibility. Unfortunately, information regarding the company's founding, ownership, and management team is scarce. Many reports indicate that the broker operates without transparency, which is a significant red flag. A lack of clear information about the management team and their professional backgrounds raises concerns about the broker's accountability.

Moreover, the company's website does not provide detailed information about its operations or any physical address, which is often a common practice among scam brokers. Transparency in business operations is crucial for building trust with clients, and Financial IGM seems to lack this fundamental aspect. The absence of a clear operational history and a defined management team makes it challenging to ascertain whether Financial IGM is a legitimate broker or merely a facade for fraudulent activities.

Trading Conditions Analysis

When evaluating a broker's reliability, understanding its trading conditions is vital. Financial IGM's fee structure and trading conditions have raised eyebrows among traders. The broker reportedly employs a range of fees that are not clearly disclosed, which can lead to unexpected costs for clients.

| Fee Type | Financial IGM | Industry Average |

|---|---|---|

| Spread on Major Pairs | High | Moderate |

| Commission Model | Hidden Fees | Transparent |

| Overnight Interest Range | Unclear | Clear |

Reports suggest that traders have encountered issues with hidden fees and high spreads, which can significantly impact profitability. Additionally, the lack of clarity regarding overnight interest rates raises concerns about the broker's transparency. Traders should always be cautious of brokers that do not provide clear and upfront information about their fee structures, as this can indicate potential exploitation.

Customer Funds Safety

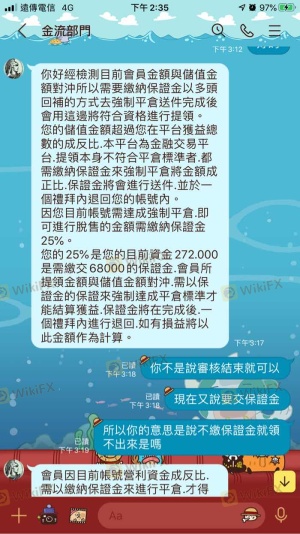

The safety of customer funds is paramount in the forex trading industry. Financial IGM has been criticized for its lack of robust security measures. Reports indicate that the broker does not implement effective fund segregation practices, which means that clients' funds may not be kept separate from the broker's operational funds. This lack of separation can lead to significant risks in the event of financial instability or insolvency.

Furthermore, Financial IGM does not provide any investor protection policies, such as negative balance protection or compensation schemes. This absence of safety nets leaves clients vulnerable to losing their entire investment without any recourse. Historical complaints about difficulty in withdrawing funds further highlight the potential risks associated with trading with Financial IGM.

Customer Experience and Complaints

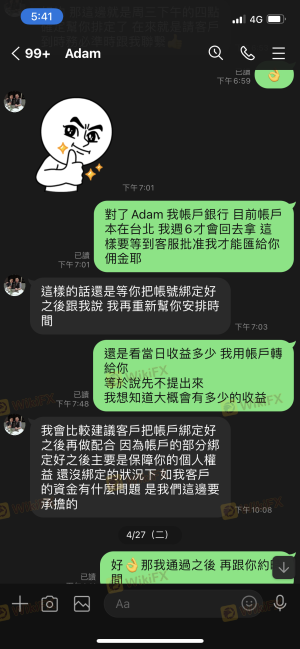

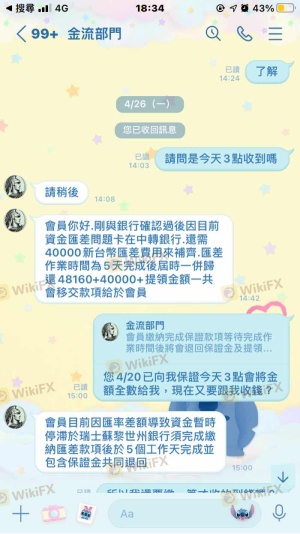

Customer feedback plays a crucial role in assessing a broker's reliability. Unfortunately, many reviews of Financial IGM indicate a pattern of negative experiences among users. Common complaints include difficulties in withdrawing funds, pressure to deposit more money, and unresponsive customer service.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Pressure to Deposit | Medium | Unresolved |

| Poor Customer Service | High | Lacking |

Many users have reported that their withdrawal requests were either delayed or denied outright, which is a significant concern for any trader. Additionally, the aggressive marketing tactics employed by Financial IGM often lead to users feeling pressured to invest more money than they initially intended. The company's lack of responsiveness to complaints exacerbates the situation, leaving clients feeling frustrated and unsupported.

Platform and Execution

The trading platform offered by Financial IGM is another critical aspect to consider. Reports suggest that the platform may not provide a stable or reliable trading environment. Users have experienced issues with order execution, including slippage and rejected orders, which can be detrimental to trading strategies.

Moreover, any indications of platform manipulation can raise serious concerns about the broker's integrity. A reliable trading platform should offer transparent execution and support traders in making informed decisions. Unfortunately, the feedback surrounding Financial IGM's platform raises questions about its reliability and the overall trading experience.

Risk Assessment

Assessing the risks associated with trading through Financial IGM is crucial for potential clients. The lack of regulation, transparency, and customer support all contribute to a high-risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulation |

| Financial Risk | High | Poor fund protection |

| Operational Risk | Medium | Platform instability |

Traders should be aware of these risks and consider whether they can afford to engage with a broker that exhibits such significant red flags. It is advisable to seek alternative options that provide better regulatory oversight and customer support.

Conclusion and Recommendations

In conclusion, the evidence suggests that Financial IGM presents several red flags that indicate it may not be a safe broker. The lack of regulation, transparency, and poor customer feedback point to a high potential for risk. Traders should exercise extreme caution when considering this broker and be aware of the possibility of encountering issues related to fund withdrawals and customer service.

For those seeking to engage in forex trading, it is recommended to consider alternative brokers that are well-regulated and have a proven track record of reliability. Brokers regulated by top-tier authorities offer a safer trading environment and greater peace of mind for investors. Always prioritize safety and due diligence when selecting a trading partner in the forex market.

Is Financial IGM a scam, or is it legit?

The latest exposure and evaluation content of Financial IGM brokers.

Financial IGM Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Financial IGM latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.