ECN Trade 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive ecn trade review examines a forex broker that presents itself as a potential trading option for global traders seeking secure transactions. ECN Trade operates through an electronic communication network system that directly connects buy and sell orders without third-party intervention. The broker claims to provide ASIC regulation, which adds a layer of legitimacy to its operations.

However, traders should exercise caution when considering ECN Trade due to significant transparency issues. Our analysis reveals substantial gaps in publicly available information about key trading conditions, including spreads, commissions, minimum deposits, and leverage ratios. While the broker promotes its ECN trading model and regulatory compliance, the lack of detailed operational information raises questions about its overall transparency and commitment to client disclosure.

ECN Trade positions itself primarily toward global traders who prioritize security in their trading activities. The broker's emphasis on ECN execution suggests it may appeal to traders seeking direct market access without dealing desk intervention. Nevertheless, the limited available information makes it challenging to provide a definitive assessment of its suitability for different trader profiles.

Important Notice

This review is based on publicly available information and may not reflect the complete picture of ECN Trade's services. Different regional entities may operate under varying regulatory frameworks and trading conditions, which could significantly impact the trading experience for users in different jurisdictions. The ASIC regulation mentioned in available sources may apply to specific regional operations rather than the broker's global presence.

Our evaluation methodology relies on accessible documentation, user feedback, and regulatory information. However, the limited transparency from ECN Trade regarding its operational details means some aspects of this review may be incomplete. Potential traders should conduct their own due diligence and verify current information directly with the broker before making any trading decisions.

Rating Framework

Broker Overview

ECN Trade presents itself as a forex broker utilizing electronic communication network technology to facilitate direct order matching between buyers and sellers. The broker's business model centers on providing ECN execution, which theoretically eliminates dealing desk intervention and offers more transparent pricing through direct market access. This approach appeals to traders who prefer the institutional-style execution that ECN networks typically provide.

According to available information, ECN Trade operates under ASIC regulation, suggesting compliance with Australian financial services standards. The broker emphasizes its commitment to secure trading environments for global traders, positioning itself as a reliable option for those prioritizing transaction safety. However, specific details about the company's establishment date, corporate background, and operational history remain unclear in publicly available documentation.

The broker's service offering appears focused on forex trading through its ECN network, though comprehensive information about available asset classes, trading platforms, and specific account types is notably absent from accessible sources. This ecn trade review finds that while the broker promotes its ECN credentials and regulatory status, the lack of detailed operational transparency presents challenges for potential clients seeking comprehensive broker evaluation.

Regulatory Framework

ECN Trade operates under ASIC regulation, which provides a foundation of regulatory oversight for its trading operations. ASIC regulation typically requires compliance with capital adequacy requirements, client fund segregation, and operational transparency standards.

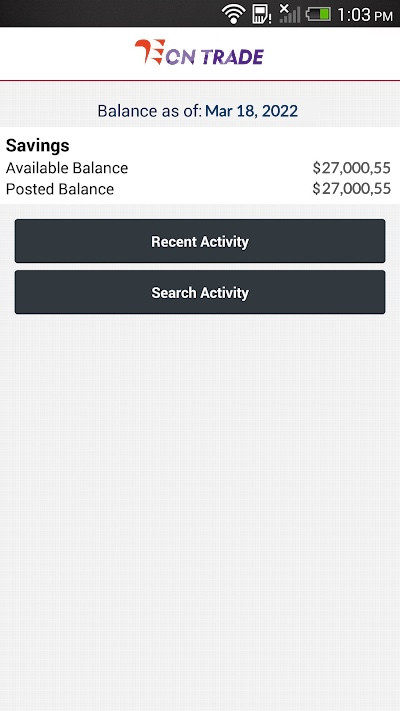

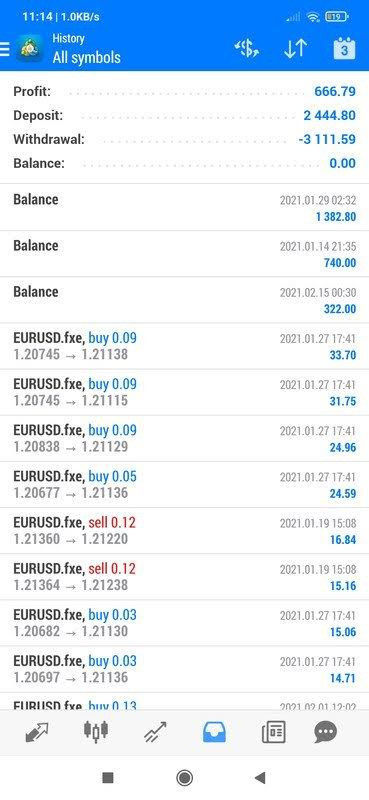

Account and Trading Conditions

Specific information regarding minimum deposit requirements, account types, and trading conditions is not detailed in available sources. The broker has not provided clear documentation about its fee structure, including spreads, commissions, or other trading costs that clients might encounter.

Available Assets and Instruments

The range of tradeable instruments offered by ECN Trade is not explicitly detailed in accessible information. While the broker operates in the forex market, the specific currency pairs, commodities, indices, or other financial instruments available for trading remain unspecified.

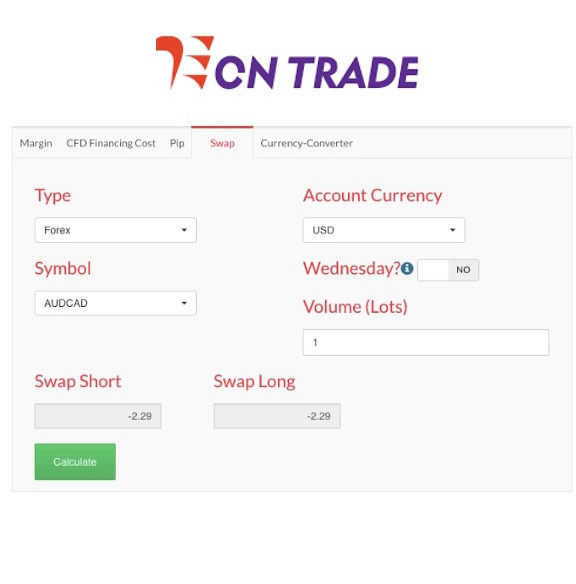

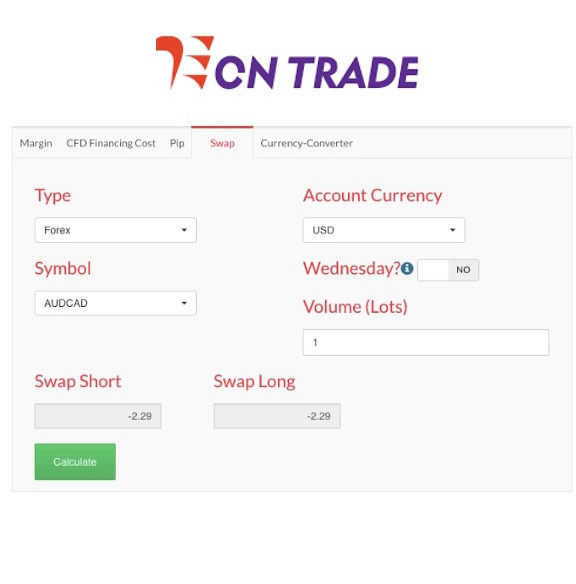

Details about the trading platforms supported by ECN Trade are not provided in available documentation. Information about mobile trading capabilities, platform features, or technological infrastructure is notably absent from public sources.

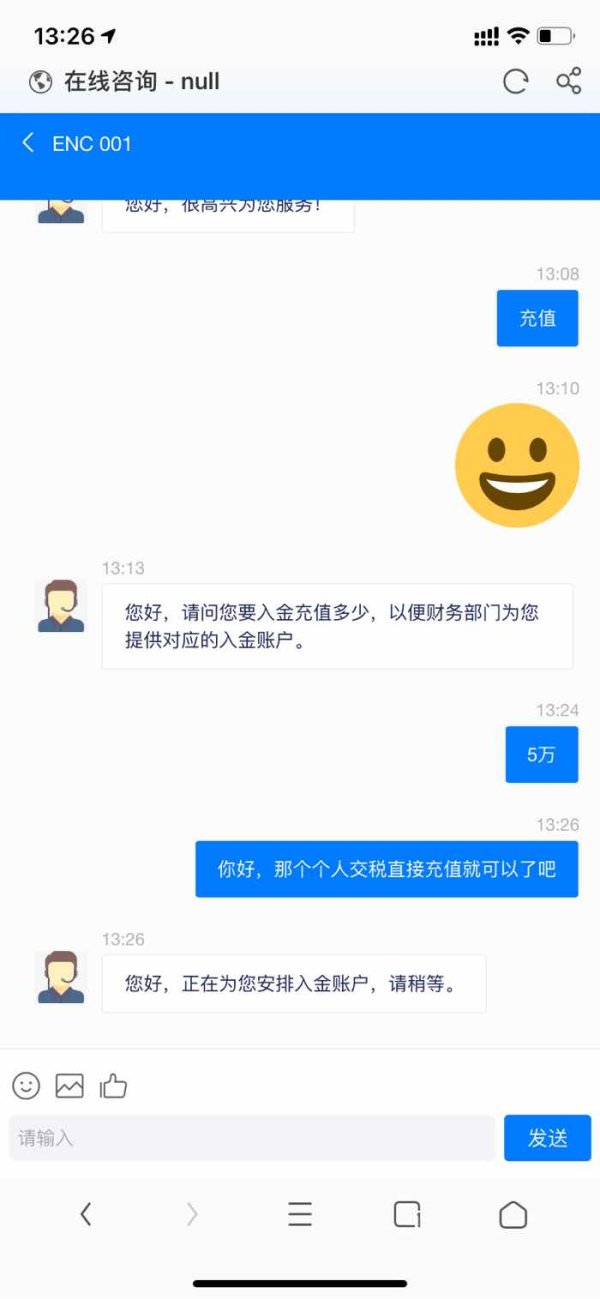

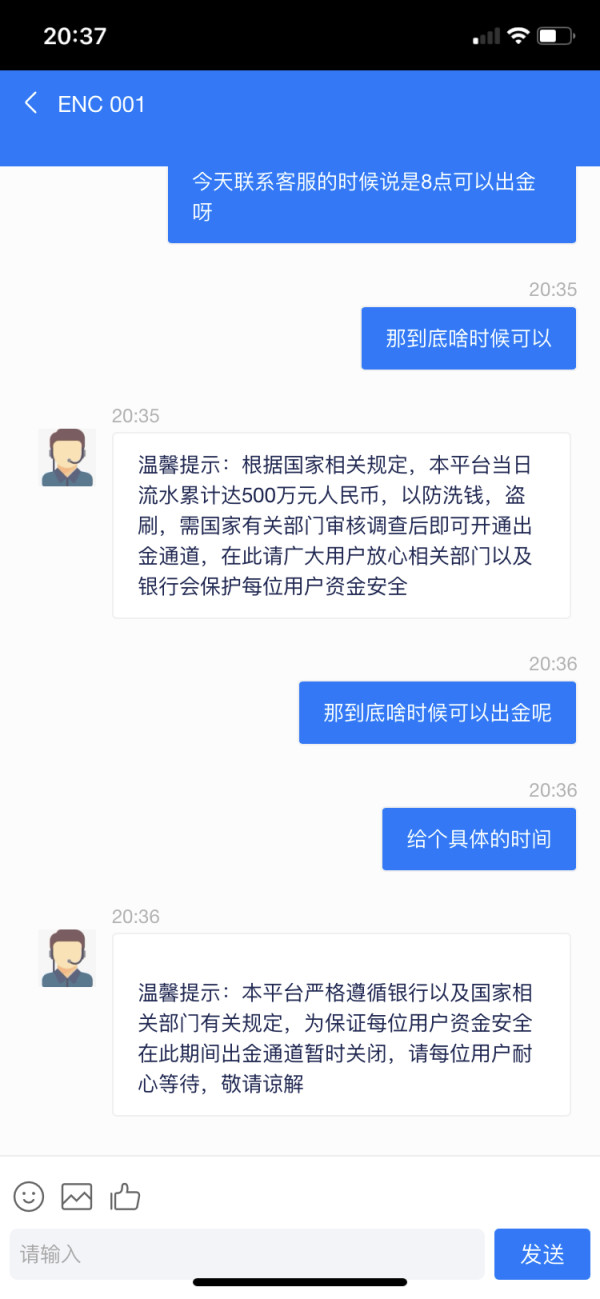

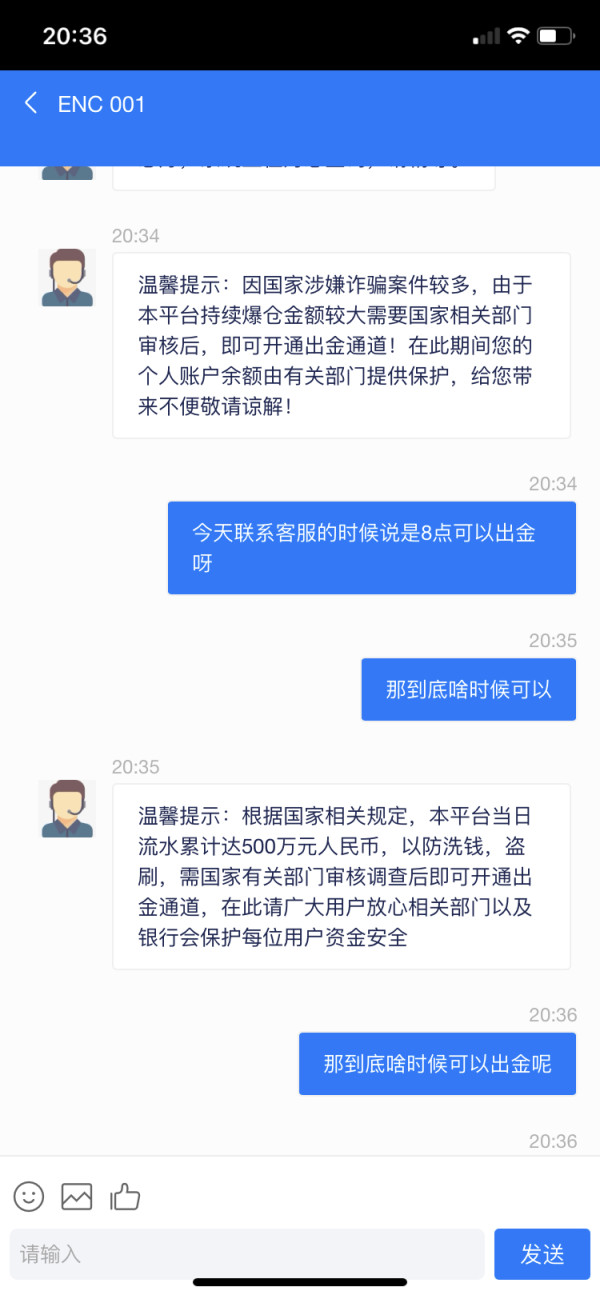

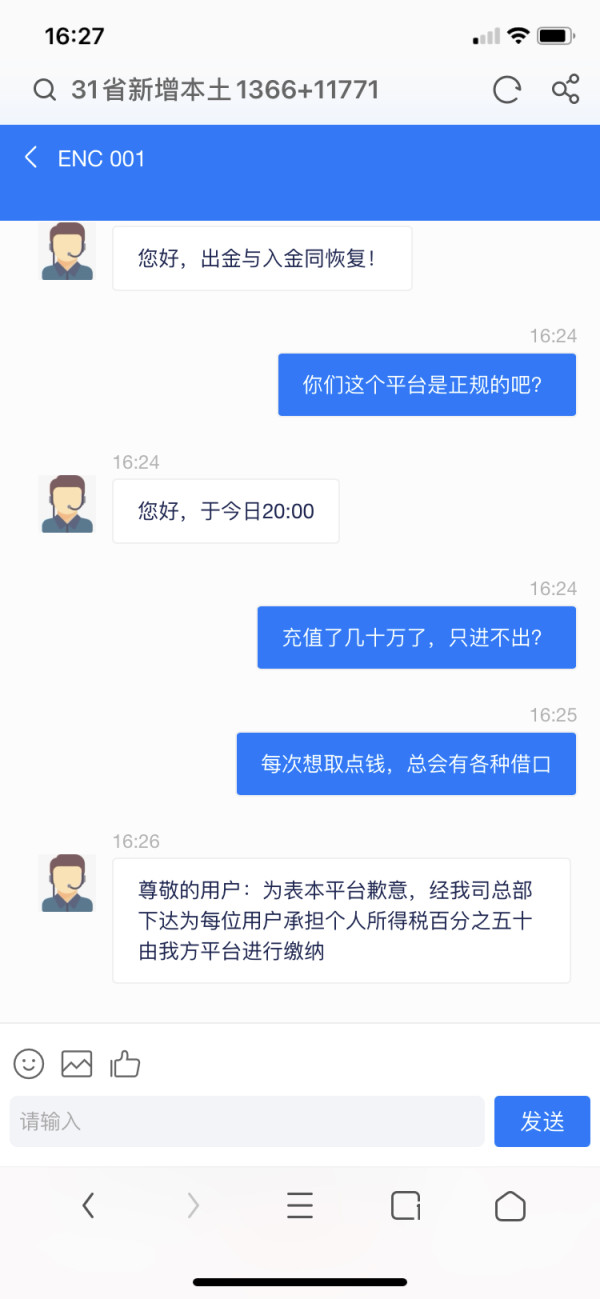

Payment Methods and Procedures

Deposit and withdrawal options, processing times, and associated fees are not detailed in the available information. The broker has not provided comprehensive documentation about its payment processing procedures or supported funding methods.

Customer Support Structure

Information about customer service channels, response times, language support, and service hours is not available in accessible sources. The broker has not detailed its support infrastructure or client communication procedures.

This ecn trade review notes that the significant lack of operational details represents a transparency concern for potential traders evaluating the broker's services.

Account Conditions Analysis

ECN Trade's account conditions present a mixed picture due to limited available information. The broker has not provided detailed documentation about its account types, minimum deposit requirements, or specific features that different account tiers might offer. This lack of transparency makes it difficult for potential traders to understand what to expect when opening an account.

The absence of clear information about account opening procedures, verification requirements, and timeline expectations creates uncertainty for prospective clients. Most reputable brokers provide comprehensive details about their account structures, including any special features like Islamic accounts for traders requiring swap-free trading conditions.

Without specific information about leverage ratios, margin requirements, or position sizing rules, traders cannot adequately assess whether ECN Trade's account conditions align with their trading strategies and risk management approaches. The broker's failure to provide transparent account condition details represents a significant shortcoming in its client communication.

The limited availability of account-related information suggests that potential traders would need to contact ECN Trade directly to obtain basic details about trading conditions. This approach contrasts with industry standards where brokers typically provide comprehensive account information publicly. This ecn trade review finds that the lack of account condition transparency significantly impacts the broker's accessibility and user-friendliness for potential clients seeking to make informed decisions.

ECN Trade's trading tools and resources remain largely undocumented in publicly available information, creating significant gaps in understanding what the broker offers to support traders' decision-making processes. Most established brokers provide comprehensive suites of analytical tools, market research, and educational resources to enhance their clients' trading capabilities.

The absence of detailed information about charting capabilities, technical indicators, automated trading support, or third-party platform integrations makes it challenging to assess ECN Trade's technological offerings. Modern traders typically expect access to advanced analytical tools, real-time market data, and sophisticated order management systems.

Educational resources, market analysis, and research materials are essential components of a comprehensive broker offering, yet ECN Trade has not provided clear documentation about these services. The lack of information about webinars, tutorials, market commentary, or analytical reports suggests either limited educational support or poor communication about available resources.

Without details about API access, algorithmic trading support, or integration with popular trading platforms like MetaTrader, it's unclear whether ECN Trade caters to more sophisticated traders who require advanced technological capabilities. The broker's failure to highlight its tools and resources may indicate limitations in these areas or simply reflect poor marketing communication about available services.

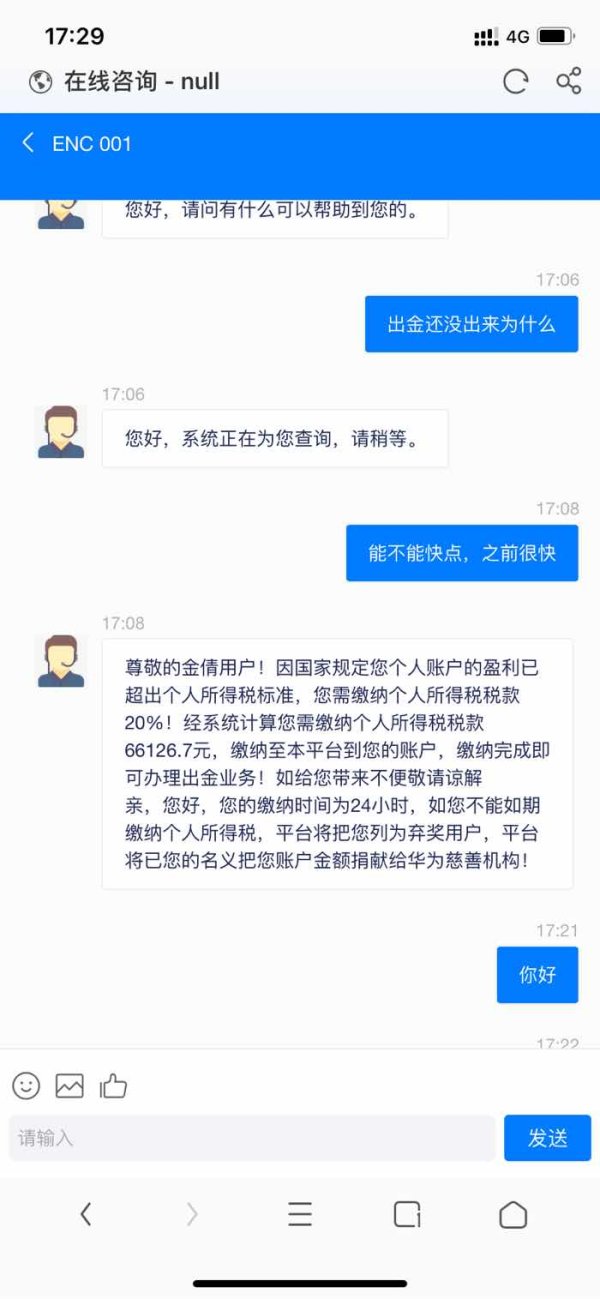

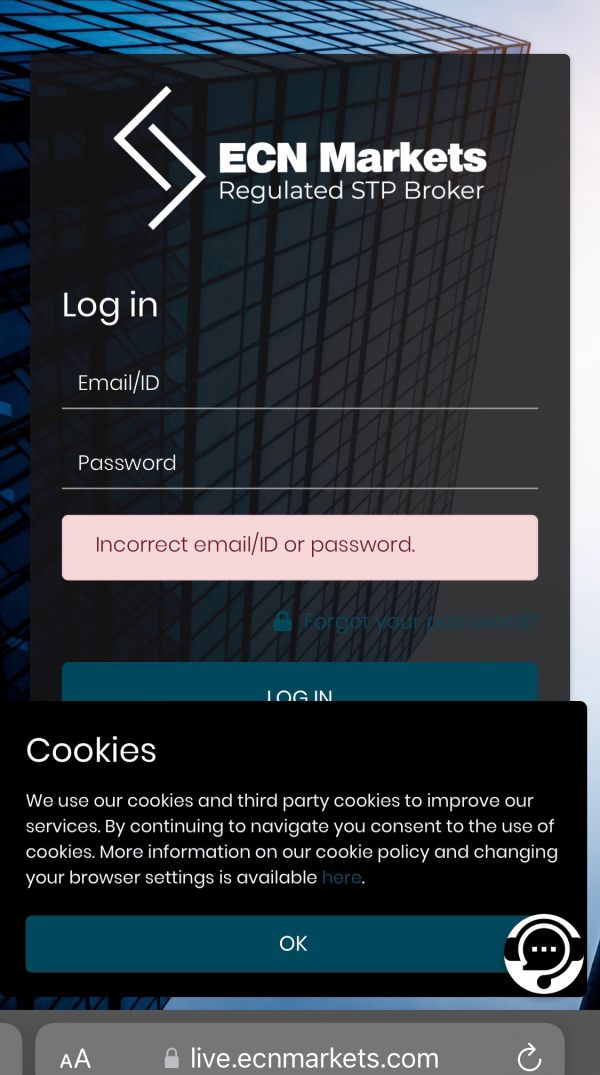

Customer Service and Support Analysis

ECN Trade's customer service infrastructure lacks detailed documentation, making it difficult to assess the quality and accessibility of client support services. The broker has not provided information about available communication channels, whether through phone, email, live chat, or other contact methods that traders typically expect.

Response times and service quality metrics are not available in public documentation, preventing potential clients from understanding what level of support they might receive. Most reputable brokers publish their customer service hours, multilingual support capabilities, and average response times to set appropriate client expectations.

The absence of information about dedicated account managers, technical support specialists, or educational support staff suggests either limited service offerings or inadequate communication about available support resources. Traders often require assistance with platform navigation, account management, and technical issues, making comprehensive support essential.

Without clear documentation about complaint resolution procedures, escalation processes, or client protection measures, it's challenging to assess ECN Trade's commitment to client satisfaction and dispute resolution. The lack of transparent customer service information represents a significant concern for traders who value reliable support when issues arise.

Trading Experience Analysis

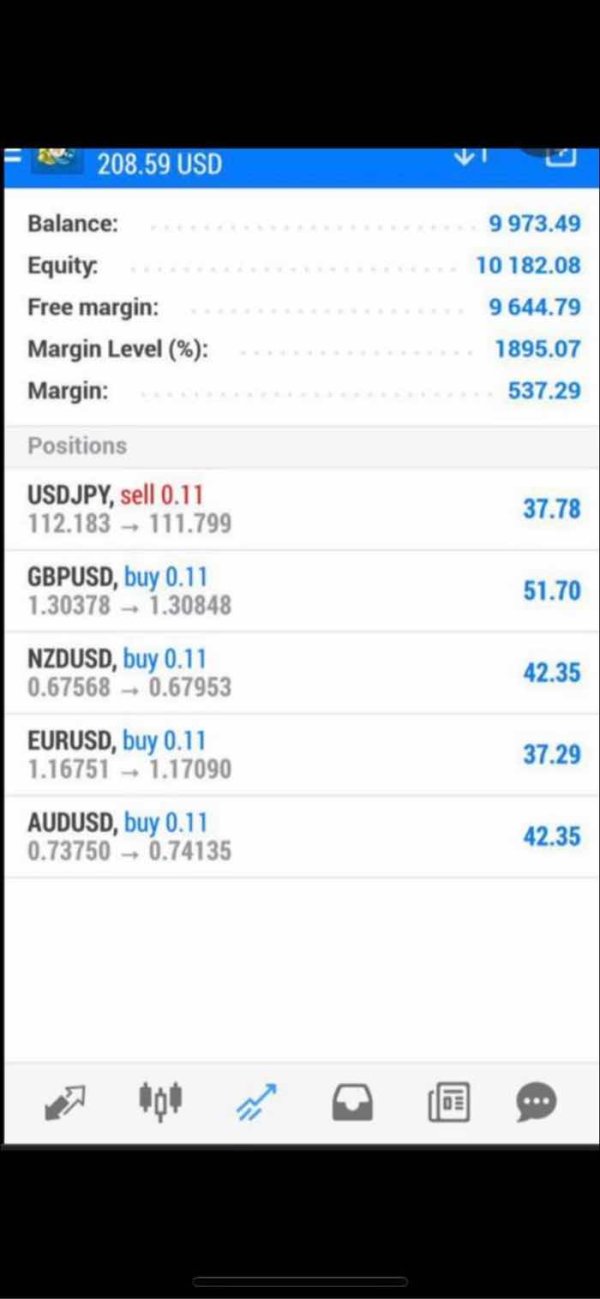

ECN Trade's trading experience centers around its electronic communication network model, which theoretically provides direct market access and transparent pricing. ECN execution typically offers advantages like faster order processing, reduced slippage, and elimination of dealing desk conflicts of interest, which could benefit active traders seeking institutional-style execution.

However, the lack of detailed information about platform stability, execution speeds, and order fill quality makes it difficult to verify whether ECN Trade delivers on its ECN promises. Traders need reliable platforms that can handle various market conditions without technical failures or execution delays that could impact trading performance.

The broker has not provided information about its technological infrastructure, server locations, or redundancy measures that ensure platform reliability during high-volatility periods. These technical aspects significantly impact trading experience, particularly for scalpers and high-frequency traders who depend on consistent execution quality.

Without user testimonials or performance metrics about platform functionality, order execution quality, or mobile trading capabilities, it's challenging to assess the actual trading experience ECN Trade provides. The absence of detailed platform information and user feedback represents a significant gap in evaluating the broker's operational capabilities.

This ecn trade review finds that while the ECN model offers theoretical advantages, the lack of specific information about implementation and performance limits confidence in the actual trading experience quality.

Trust and Regulation Analysis

ECN Trade's regulatory status under ASIC provides a foundation for trust, as the Australian Securities and Investments Commission maintains strict oversight of financial services providers. ASIC regulation typically requires compliance with capital adequacy standards, client fund segregation, and operational transparency requirements that protect trader interests.

However, the limited transparency about the broker's corporate structure, ownership, and operational history raises questions about overall trustworthiness. Most established brokers provide detailed company information, including management team details, corporate addresses, and regulatory compliance history to build client confidence.

The absence of information about client fund protection measures, insurance coverage, or compensation schemes that might protect traders in case of broker insolvency represents a significant transparency gap. These protections are crucial considerations for traders evaluating broker safety and long-term reliability.

Without clear documentation about the broker's compliance procedures, audit practices, or regulatory reporting, it's difficult to assess the depth of its commitment to regulatory standards beyond basic licensing requirements. The broker's failure to provide comprehensive regulatory and safety information may indicate either limited protections or inadequate communication about existing safeguards.

While ASIC regulation provides basic regulatory oversight, the lack of additional transparency measures and safety information prevents a complete assessment of ECN Trade's trustworthiness and long-term reliability for trader funds and operations.

User Experience Analysis

ECN Trade's user experience remains largely undefined due to limited available feedback and documentation about client interactions with the broker's services. The lack of detailed user testimonials, satisfaction surveys, or independent reviews makes it challenging to assess how clients perceive their overall experience with the broker.

Interface design and platform usability information is not available in public sources, preventing evaluation of how user-friendly ECN Trade's systems might be for traders of different experience levels. Modern traders expect intuitive interfaces, streamlined navigation, and efficient workflow design that supports their trading activities.

Account registration and verification processes are not documented, leaving potential clients uncertain about onboarding procedures, required documentation, or timeline expectations. Smooth onboarding experiences significantly impact initial user satisfaction and long-term client relationships.

The absence of information about common user complaints, satisfaction metrics, or improvement initiatives suggests either limited client feedback collection or poor communication about user experience priorities. Most established brokers actively seek and publish client feedback to demonstrate their commitment to service improvement.

Without comprehensive user experience data, potential traders cannot adequately assess whether ECN Trade's services align with their expectations and requirements. The broker's limited communication about user experience aspects represents a significant gap in its client-focused marketing and service development approach.

Conclusion

This ecn trade review reveals a broker with potential regulatory legitimacy through ASIC oversight but significant transparency challenges that impact its overall assessment. While ECN Trade's electronic communication network model offers theoretical advantages for traders seeking direct market access, the substantial lack of operational details creates uncertainty about service quality and reliability.

ECN Trade may be suitable for experienced traders who can conduct thorough due diligence and are comfortable with limited publicly available information. However, newer traders or those preferring comprehensive transparency might find better options with brokers offering more detailed service documentation and user feedback.

The broker's main strength lies in its ASIC regulatory status, which provides basic regulatory oversight and compliance requirements. However, its primary weakness is the significant lack of transparency regarding trading conditions, platform features, costs, and user experience, which limits confidence in its overall service offering and long-term reliability as a trading partner.