Regarding the legitimacy of ECN TRADE forex brokers, it provides ASIC and WikiBit, (also has a graphic survey regarding security).

Is ECN TRADE safe?

Pros

Cons

Is ECN TRADE markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

ECN TRADE PTY LTD

Effective Date:

2011-05-20Email Address of Licensed Institution:

shii@innoinvest.com.auSharing Status:

No SharingWebsite of Licensed Institution:

http://www.ecnfxtrade.com/Expiration Time:

--Address of Licensed Institution:

L 11 20 MARTIN PL SYDNEY NSW 2000Phone Number of Licensed Institution:

0292470022Licensed Institution Certified Documents:

Is ECN Trade A Scam?

Introduction

ECN Trade is a forex broker that positions itself as a facilitator of direct market access for traders looking to engage in the foreign exchange market. Established in Australia, ECN Trade claims to offer competitive trading conditions, including low spreads and high leverage. However, the forex market is rife with both legitimate and fraudulent brokers, making it essential for traders to conduct thorough evaluations before committing their funds. This article aims to provide an objective analysis of ECN Trade, exploring its regulatory status, company background, trading conditions, client safety measures, and user experiences. The investigation is based on comprehensive research, including user reviews and regulatory information, to assess whether ECN Trade is safe or potentially a scam.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its legitimacy. ECN Trade claims to be regulated by the Australian Securities and Investments Commission (ASIC), which is one of the most respected financial regulatory bodies globally. However, there are concerns about the authenticity of this claim, as several sources suggest that ECN Trade may not hold a valid ASIC license.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 388737 | Australia | Suspicious Clone |

The importance of regulation cannot be overstated; it provides a safety net for traders, ensuring that the broker adheres to strict financial standards and practices. A lack of credible regulation raises significant red flags, as it often indicates that the broker may not be held accountable for its actions. In the case of ECN Trade, the suspicion surrounding its ASIC registration warrants caution. Traders should always prioritize brokers with verified regulatory licenses from reputable authorities to mitigate risks.

Company Background Investigation

ECN Trade Pty Ltd was founded in 2018, and while it claims to have a solid operational history, details about its ownership structure and management team remain vague. The absence of transparency regarding the company's leadership raises concerns about its credibility. In the competitive world of forex trading, a well-established company with a clear ownership and management structure is crucial for building trust among potential clients.

The management teams background is also pivotal; experienced professionals with a history in finance and trading can significantly enhance a broker's reliability. Unfortunately, ECN Trade does not provide sufficient information about its management, which could leave potential clients questioning its operational integrity. Transparency in business practices is essential for building trust, and the lack of clear communication regarding the company's structure can be a significant drawback for ECN Trade.

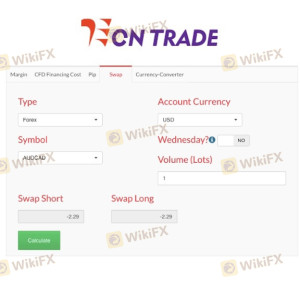

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is vital for any trader. ECN Trade advertises itself as an ECN broker, which typically means lower spreads and commission-based trading. However, it is crucial to analyze the actual costs involved in trading with ECN Trade.

| Fee Type | ECN Trade | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.8 pips | 1.0 - 1.5 pips |

| Commission Model | Variable | Standard |

| Overnight Interest Range | Varies | Varies |

The spreads offered by ECN Trade are higher than the industry average, which could impact profitability, especially for high-frequency traders. Additionally, the commission structure can be complex, with variable fees that may not be clearly outlined upfront. This lack of clarity in pricing can lead to unexpected costs, making it essential for traders to read the fine print before engaging with the broker.

Client Fund Safety

Client fund safety is paramount in the forex trading landscape. ECN Trade claims to implement various safety measures to protect client funds, including segregated accounts and negative balance protection. However, the effectiveness of these measures is often contingent on the broker's regulatory status.

Traders should be aware of the implications of using an unregulated broker. If ECN Trade does not adhere to the strict standards set by regulatory bodies, the safety of client funds may be compromised. There have been reports of withdrawal issues and fund accessibility concerns, which could pose significant risks for traders. Historical disputes regarding fund safety further exacerbate these concerns, highlighting the importance of choosing a broker with a proven track record of safeguarding client assets.

Customer Experience and Complaints

User feedback is a key indicator of a broker's reliability. Reviews of ECN Trade indicate a mixed experience among clients, with numerous complaints regarding withdrawal delays and customer service responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Average |

| Misleading Information | High | Poor |

Common complaints revolve around difficulties in withdrawing funds, which is a significant red flag for any broker. Traders have reported being pressured to deposit more funds before being allowed to withdraw their earnings, a tactic often associated with scams. These issues suggest a lack of accountability on the part of ECN Trade, raising further concerns about its legitimacy.

Platform and Trade Execution

The trading platform offered by ECN Trade is a critical component of the trading experience. It is essential for the platform to be stable, user-friendly, and efficient in executing trades. While ECN Trade utilizes the widely recognized MetaTrader 4 platform, user reviews indicate potential issues with order execution quality, including slippage and rejections.

Traders should expect a seamless trading experience with minimal disruptions. However, reports of execution delays and high slippage rates could hinder trading performance, particularly in volatile market conditions. The potential for platform manipulation is another concern, as brokers with questionable practices may exploit system vulnerabilities to their advantage.

Risk Assessment

Using ECN Trade comes with inherent risks, particularly due to its regulatory status and customer feedback.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of verified regulation raises concerns. |

| Fund Safety Risk | High | Historical issues with fund withdrawals. |

| Execution Risk | Medium | Reports of slippage and order rejections. |

To mitigate these risks, traders should conduct thorough due diligence and consider starting with a demo account to test the platform before committing real funds. Additionally, it is advisable to limit initial deposits and avoid investing more than one can afford to lose.

Conclusion and Recommendations

In conclusion, the evidence suggests that ECN Trade may not be a safe broker for forex trading. The lack of verified regulation, coupled with numerous customer complaints regarding fund withdrawals and service quality, raises significant concerns. While the broker offers some appealing features, the overall risk profile seems unfavorable.

For traders seeking a reliable trading environment, it is advisable to consider alternative brokers with robust regulatory oversight and positive user feedback. Brokers such as Pepperstone and IC Markets are known for their transparency and strong customer service, making them safer options for forex trading. Ultimately, traders should prioritize their safety and choose brokers that demonstrate a commitment to protecting client interests.

Is ECN TRADE a scam, or is it legit?

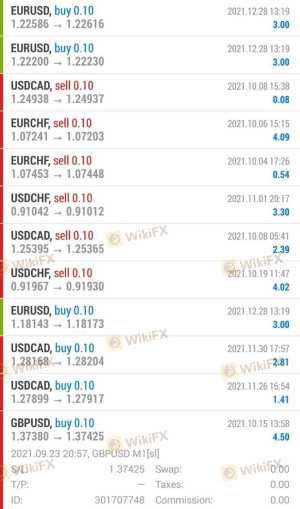

The latest exposure and evaluation content of ECN TRADE brokers.

ECN TRADE Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ECN TRADE latest industry rating score is 2.45, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.45 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.