Cpt Markets 2025 Review: Everything You Need to Know

Summary

Cpt Markets is a forex broker that serves traders across multiple countries. The company has been operating since 2010 and offers many different trading products for all types of traders. This Cpt Markets review shows a broker with strong points in easy access and leverage choices, but it also has areas that need work. The broker attracts traders with very high leverage up to 1:1000 and requires only 20 USD to start trading. This makes it perfect for new traders and people with small amounts of money who want to enter forex markets.

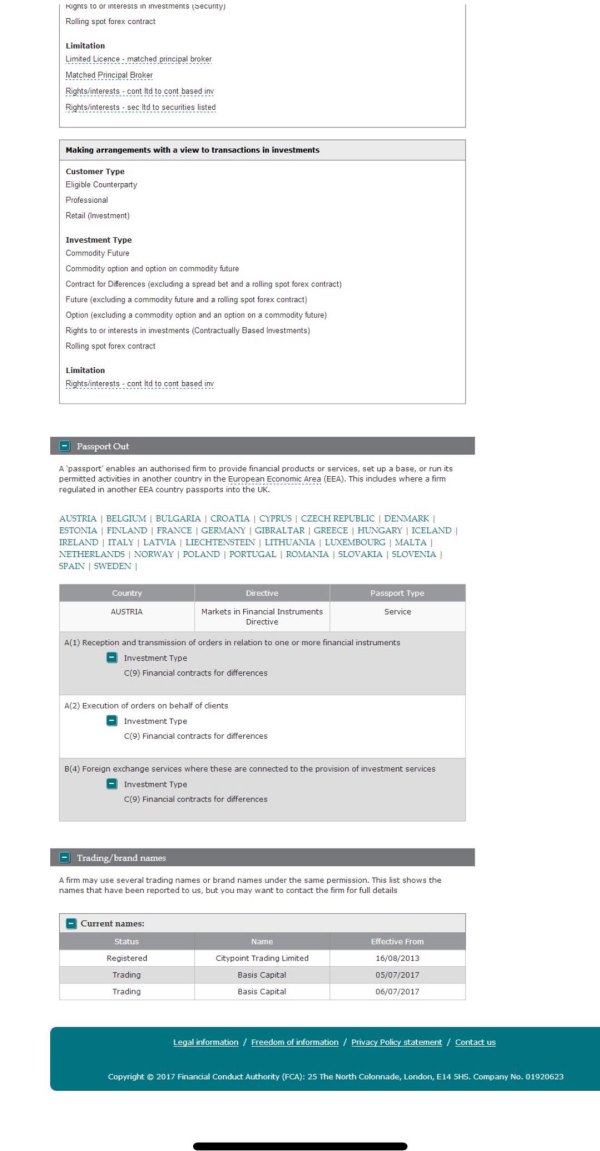

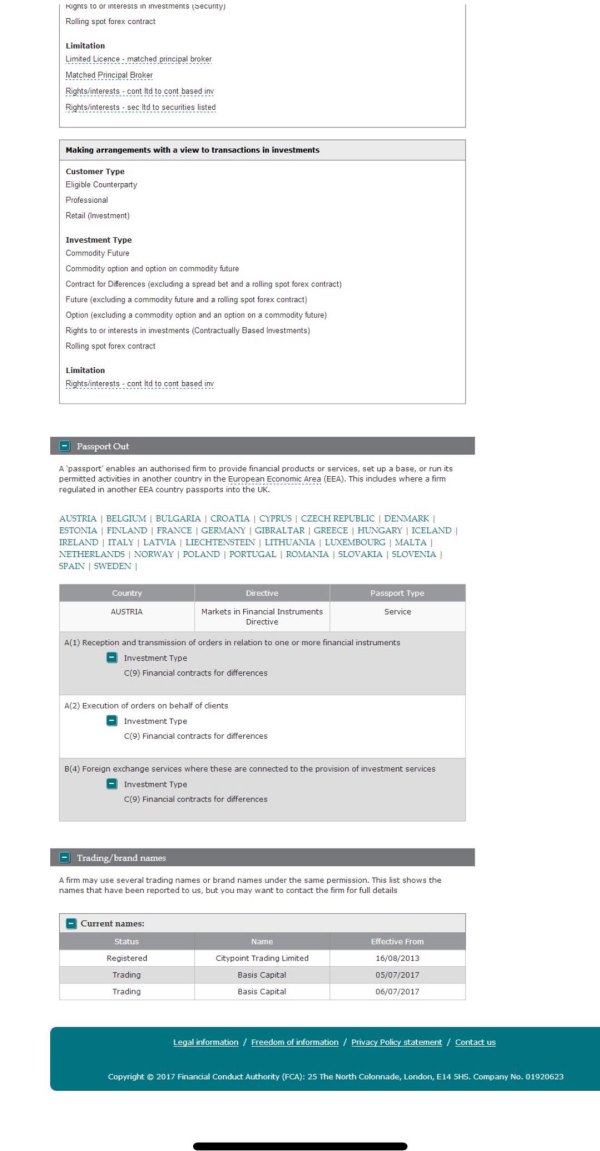

The broker follows rules from three different authorities: FCA, FSCA, and IFSC. However, customer reviews show mixed results with ratings between 3.4/5 and 4/5 on different websites. This means customers are somewhat satisfied but not completely happy. The company has received 75 customer complaints, which shows they need to improve their service. The broker uses STP and ECN trading methods that give traders direct access to markets for professional trading conditions.

Cpt Markets mainly focuses on individual investors and beginners who want high-leverage trading opportunities. The low starting amount and regulation from trusted authorities support this goal.

Important Notice

Traders should know that Cpt Markets operates through different companies in various regions. This means trading conditions, protection levels, and services may change based on where you live. The regulation from FCA, FSCA, and IFSC applies to different regional companies, which might affect your protection and available services.

This review uses detailed analysis of public user reviews, official regulatory information, and market data from multiple sources. The assessment includes user feedback patterns, regulatory compliance records, and market comparisons to give an objective evaluation of the broker's services and performance.

Rating Framework

Broker Overview

Cpt Markets started in the forex industry in 2010. The company has offices in the United Kingdom, South Africa, and Belize, which helps it serve traders around the world. The broker has built its reputation by providing complete forex and financial trading services to a global customer base. The company uses STP and ECN execution methods to ensure client orders reach the interbank market without interference.

The company's structure shows its commitment to following regulations in different countries. Offices in Wales, Johannesburg, and Belize City help serve different regional markets effectively while maintaining international standards. This setup allows Cpt Markets to offer local services while keeping the same quality across all operations.

The broker provides access to foreign exchange pairs, stock indices, commodities, and individual stocks for traders who want to diversify their portfolios. Cpt Markets operates under three major financial authorities: the Financial Conduct Authority in the United Kingdom, the Financial Sector Conduct Authority in South Africa, and the International Financial Services Commission in Belize. This gives clients multiple layers of protection depending on where they live.

Regulatory Jurisdictions: Cpt Markets follows regulations from FCA, FSCA, and IFSC to ensure it meets international financial standards and protects clients.

Deposit and Withdrawal Methods: Information about available payment methods is not detailed in available documents. Traders need to contact the broker directly for complete payment options.

Minimum Deposit Requirements: The broker requires only 20 USD to start trading, making it suitable for new traders and those with limited starting money.

Bonus and Promotional Offers: Current bonus structures or promotional campaigns are not specified in available documents. Potential traders should ask directly for current offers.

Tradeable Assets: The platform gives access to four major categories: foreign exchange currencies, stock market indices, commodity markets, and individual stock trading.

Cost Structure: Detailed information about spreads, commissions, and other trading costs is not clear in available documents. The broker needs to provide better fee transparency.

Leverage Options: Cpt Markets offers competitive leverage up to 1:1000, giving significant trading power for experienced traders who are comfortable with higher risk.

Platform Selection: Specific trading platform information is not detailed in available sources. Traders need direct verification of available platform options.

Geographic Restrictions: Available documents do not specify particular geographic limitations for account opening or trading activities.

Customer Service Languages: Multi-language support details are not specified in available documents.

Detailed Rating Analysis

Account Conditions Analysis

Cpt Markets shows mixed results for account conditions, earning a 6/10 rating based on available information. The broker's best feature is its easy access with a very low minimum deposit of just 20 USD. This makes it one of the most accessible brokers for people new to forex trading and shows the company wants to serve retail traders starting with limited money.

However, detailed information about different account types and their features is missing from available documents. The lack of complete account information makes it hard for potential clients to understand what services and benefits are available at different investment levels. Also, specific details about account opening procedures, required documents, and verification times are not clearly outlined in accessible materials.

Information about special account features is absent, such as Islamic accounts for Sharia-compliant trading or professional accounts for qualified traders. User feedback about account conditions appears limited in available sources, making it challenging to assess real experiences with account setup and management. Compared to industry standards, while the low minimum deposit is competitive, the lack of clear account information hurts Cpt Markets review assessments when evaluating overall account value.

The tools and resources category gets a 5/10 rating mainly due to insufficient information about the broker's technology offerings and educational support systems. Available documents fail to specify which trading platforms are available to clients, which is a significant information gap for potential traders. This makes it hard for people to understand their technology options when choosing a broker.

Market analysis and research resources, which are important for making informed trading decisions, are not detailed in accessible materials. The absence of information about economic calendars, market commentary, technical analysis tools, or research capabilities raises concerns about the broker's commitment to supporting trader education. Educational resources like webinars, tutorials, trading guides, or market education materials are not mentioned in available documents. This lack of educational support information is especially concerning since the broker seems to focus on serving new traders through its low minimum deposit requirement.

Automated trading support, including Expert Advisor compatibility, algorithmic trading options, or copy trading services, remains unspecified in available sources. For modern traders seeking automated solutions or social trading opportunities, this information gap represents a significant limitation. User feedback about tool effectiveness and resource quality is notably sparse in available reviews, making it difficult to assess real satisfaction with the broker's technology and educational offerings.

Customer Service and Support Analysis

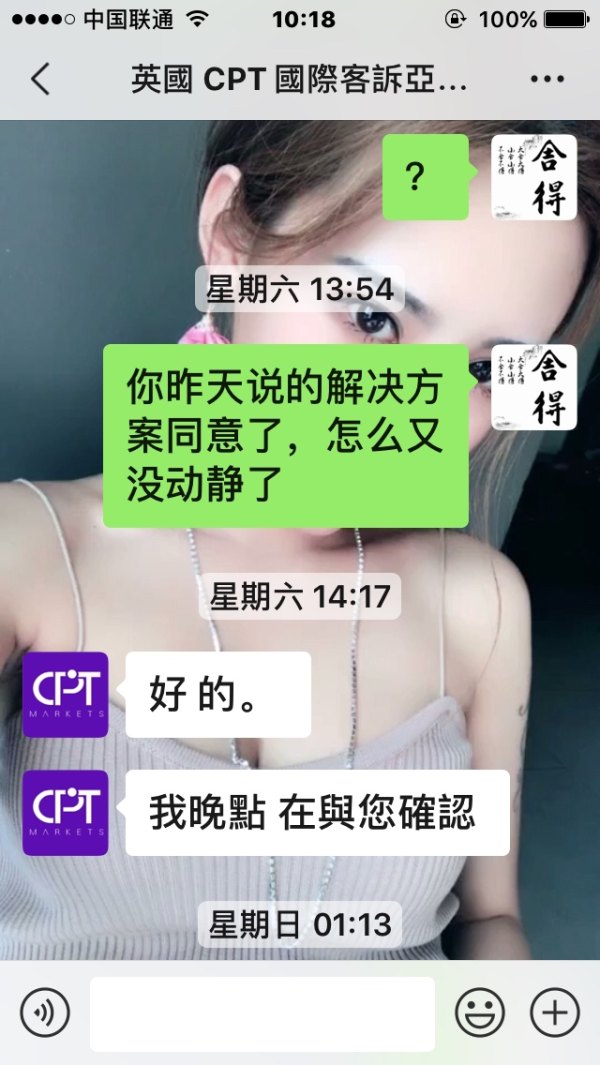

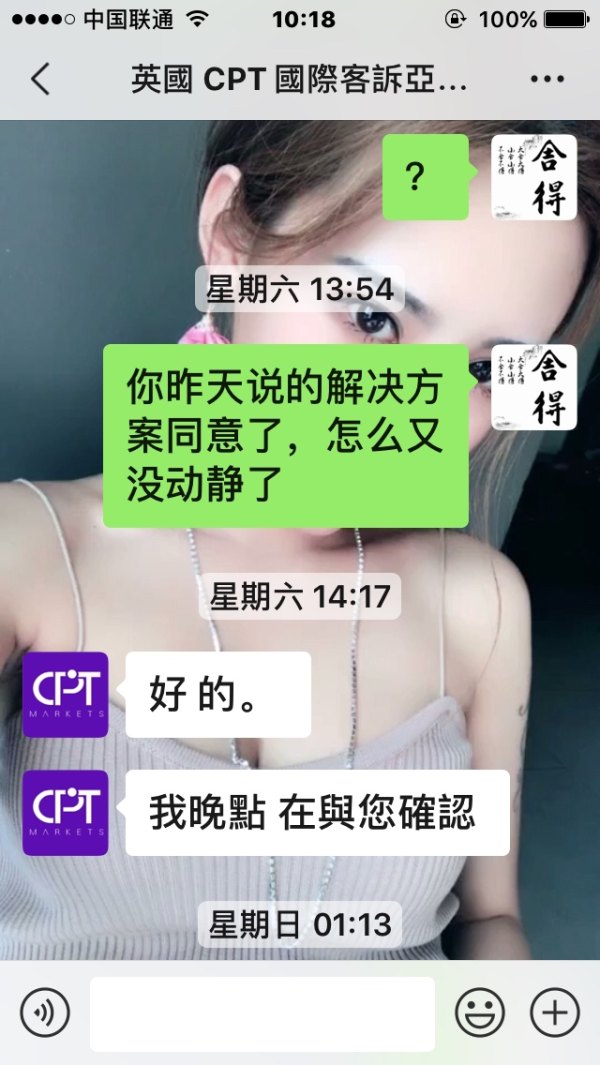

Customer service gets a 6/10 rating, with 75 customer complaints serving as a primary concern about service quality and responsiveness. This complaint volume suggests potential issues with service delivery, response times, or problem-solving effectiveness that prospective clients should carefully consider. The number of complaints indicates that many users experience problems that require formal complaint processes.

Available documents do not specify customer service channels, such as live chat availability, telephone support hours, or email response commitments. The absence of clear communication channel information makes it difficult for potential clients to understand how they can access support when needed. Response time commitments and service level agreements are not detailed in accessible materials, leaving questions about how quickly clients can expect help with trading issues, account problems, or technical difficulties.

Service quality indicators, including staff expertise levels, problem-solving capabilities, and overall professionalism, cannot be adequately assessed from available information. The complaint data suggests room for improvement in service delivery standards and client satisfaction protocols. Multi-language support capabilities and service availability hours are not specified in available documents, potentially limiting accessibility for international clients who need support in their native languages or outside standard business hours.

Trading Experience Analysis

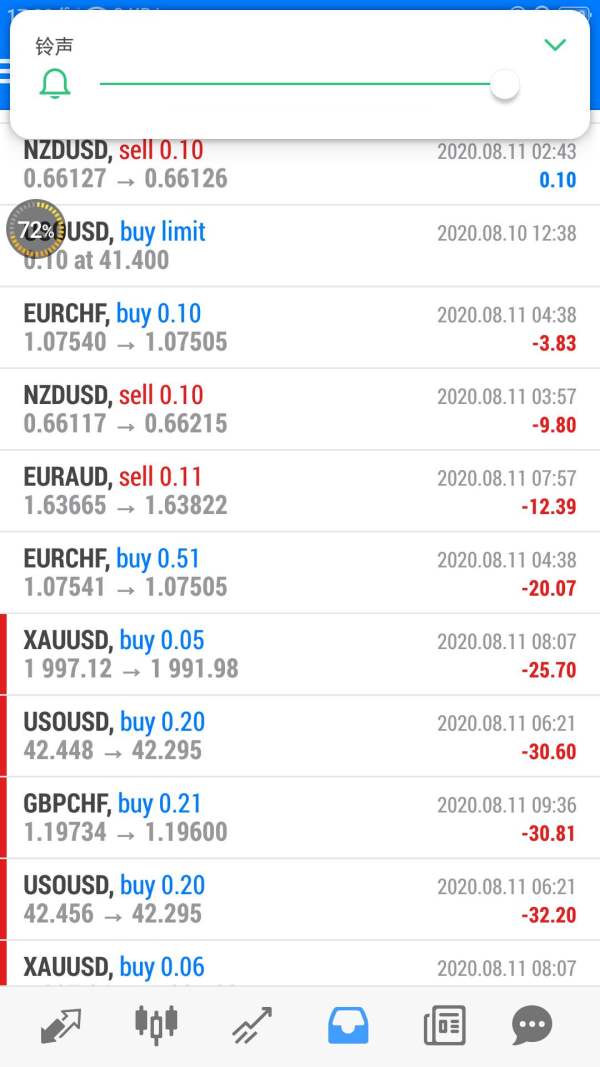

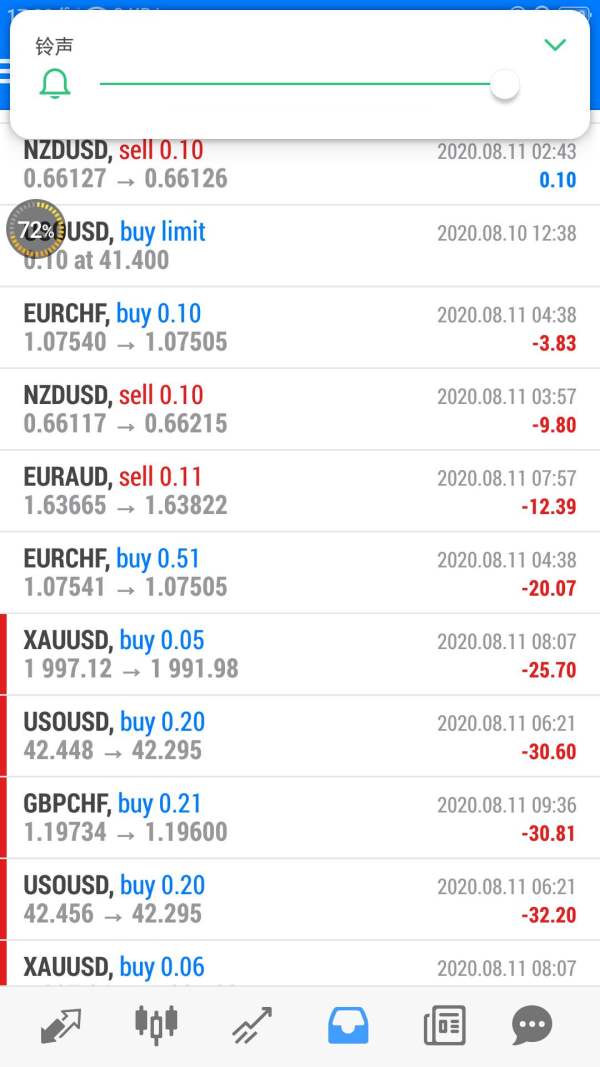

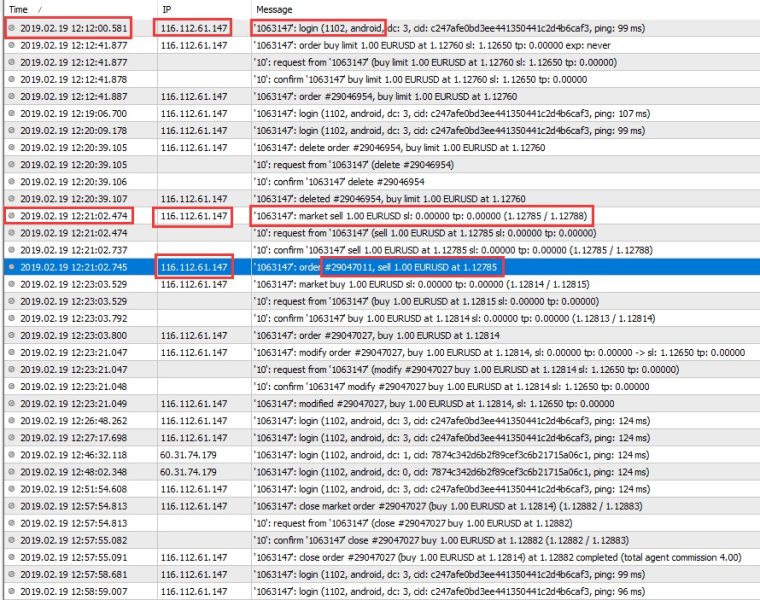

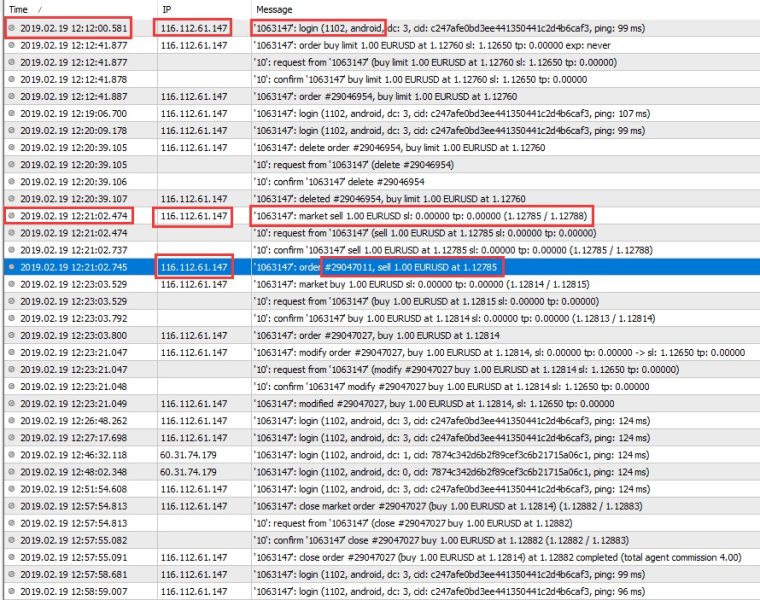

The trading experience category achieves a 7/10 rating, mainly supported by the broker's use of STP and ECN execution models. These methods provide direct market access and professional trading conditions that typically result in faster order processing and reduced conflicts of interest compared to market maker models.

Platform stability and execution speed data are not specifically detailed in available documents, making it difficult to assess real performance metrics such as order execution times, system uptime, or platform reliability during high-volatility periods. Order execution quality indicators, including slippage statistics, requote frequencies, and fill rates, are not provided in accessible materials, but these metrics are important for traders seeking to understand the practical trading environment they can expect.

Platform functionality completeness, including available order types, charting capabilities, technical indicators, and customization options, remains unspecified in available sources. This information gap limits the ability to assess whether the trading environment meets modern trader expectations. Mobile trading experience details, including app availability, mobile platform features, and cross-device synchronization capabilities, are not mentioned in available documents, which is important since mobile trading is crucial in today's market.

Trading environment specifics, such as typical spread ranges, market depth visibility, and liquidity provider information, are not detailed in accessible materials. This Cpt Markets review finds that greater transparency in trading conditions would benefit potential clients' decision-making processes.

Trust and Security Analysis

Trust and security earn a 7/10 rating, mainly based on the broker's multi-jurisdictional regulatory status under FCA, FSCA, and IFSC oversight. These regulatory relationships provide multiple layers of client protection and show the company's commitment to operating within established financial frameworks. The FCA regulation provides significant credibility given the UK regulator's reputation for strict oversight and complete client protection measures, while FSCA oversight adds credibility within the South African market and IFSC regulation provides international operational flexibility.

Specific fund security measures, such as segregated account policies, deposit insurance coverage, or negative balance protection, are not detailed in available documents. These security features are important for client confidence and should be more clearly communicated. Company transparency about ownership structure, financial reporting, or operational policies is not comprehensively addressed in accessible materials, and greater transparency in corporate governance and financial stability would enhance client confidence.

Industry reputation indicators include some awards and recognition, suggesting positive standing within the financial services community. However, the 75 customer complaints indicate areas where reputation management and client satisfaction require attention. The handling of negative events and complaint resolution processes are not specifically detailed in available documents, making it difficult to assess how effectively the company addresses client concerns and maintains operational standards.

User Experience Analysis

User experience gets a 6/10 rating, reflecting the mixed feedback indicated by user ratings of 3.4/5. This suggests moderate satisfaction levels with considerable room for improvement and indicates that while some clients find the service acceptable, others experience significant issues that impact their overall satisfaction.

Overall user satisfaction appears moderate based on available feedback, with the complaint volume of 75 incidents suggesting that a notable portion of users encounter problems. This level of complaint activity indicates systematic issues that may affect user experience quality. Interface design and usability information is not detailed in available documents, making it difficult to assess how user-friendly the trading platforms and account management systems are in practice, though modern traders expect intuitive, responsive interfaces that support efficient trading activities.

Registration and verification process experiences are not specifically detailed in accessible materials. The low minimum deposit suggests the broker aims to minimize barriers to account opening, but actual user experiences with onboarding procedures remain unclear. Funding operation experiences, including deposit and withdrawal processing times, fee structures, and available payment methods, are not comprehensively detailed in available sources, yet these operational aspects significantly impact user satisfaction and should be more transparently communicated.

Common user complaints, based on the 75 reported issues, suggest areas where service delivery falls short of client expectations. Specific complaint categories are not detailed in available documents, but understanding these complaint patterns would help potential clients assess likely experience quality and service limitations.

Conclusion

This Cpt Markets review reveals a broker that offers accessibility and regulatory compliance but requires significant improvements in service quality and information transparency. The 20 USD minimum deposit and 1:1000 leverage make it attractive for beginners seeking high-leverage trading opportunities, but the presence of 75 customer complaints and moderate user ratings indicate ongoing service challenges.

The broker works best for novice traders and individual investors who prioritize low entry barriers and high leverage options over comprehensive educational resources and premium customer service. However, potential clients should carefully consider the reported service issues and information gaps before committing to this platform. Key advantages include regulatory oversight from reputable authorities and accessible account opening requirements, while primary drawbacks center on service quality concerns and insufficient transparency regarding trading conditions and platform features.