Axiory Review 2025: Everything You Need to Know

Summary

This complete axiory review looks at one of the forex industry's established brokers. It offers insights into its trading environment, regulatory standing, and overall service quality. Axiory has positioned itself as a reliable and user-friendly forex broker since its establishment in 2011, garnering positive feedback from traders particularly regarding order execution and trading conditions. The broker stands out with its diverse platform offerings. These include MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader, alongside robust risk management features such as negative balance protection that ensures trader fund safety.

According to recent industry reports, Axiory has attracted 1,685 new traders in the last 90 days. This indicates growing market confidence in the platform. The broker primarily targets small to medium-sized traders seeking stable trading experiences, offering spreads from 0 pips and maintaining a reputation for reliable order execution without significant slippage issues. Educational resources and regular trading insights further enhance its appeal to developing traders. Meanwhile, its multi-platform approach caters to diverse trading preferences and strategies.

Important Notice

Traders should know that Axiory operates through different regional entities. These include registrations in Mauritius under FSC Mauritius regulation and Belize under FSC Belize oversight. Users must understand that regulatory policies and protection measures may vary between these jurisdictions, potentially affecting the level of investor protection and compensation schemes available. Different regulatory frameworks may also impact available trading instruments, leverage limits, and dispute resolution procedures.

This review is based on publicly available information, user feedback from various trading communities, and industry reports as of 2025. The analysis aims to provide objective insights while acknowledging that individual trading experiences may vary based on account types, trading volumes, and regional regulations.

Rating Framework

Broker Overview

Axiory emerged in the forex industry in 2011 as an online CFDs and forex trading broker. It established itself with a commitment to providing quality trading services to retail and institutional clients. The company has built its reputation on technological innovation and trader-focused solutions, positioning itself as a bridge between traditional forex trading and modern technological advancement. Over its operational years, Axiory has expanded its service offerings while maintaining focus on execution quality and platform diversity. This attracts traders who prioritize reliable trading conditions over aggressive marketing promotions.

The broker's business model centers on providing access to multiple financial markets through various trading platforms. It supports both CFDs and forex trading across different asset classes. Axiory operates on a hybrid model that combines competitive spreads with commission-based structures, though specific details about commission rates require direct inquiry with the broker. The company emphasizes technological infrastructure and regulatory compliance as core pillars of its service delivery. This is reflected in its choice of established platforms and regulatory jurisdictions.

Axiory supports three primary trading platforms: MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. Each caters to different trading styles and preferences. This axiory review finds that the platform diversity allows traders to choose based on their specific needs, whether for algorithmic trading, advanced charting, or social trading features. The broker primarily focuses on CFDs and forex instruments. It provides access to major, minor, and exotic currency pairs alongside commodity and index CFDs. Regulatory oversight comes through FSC Mauritius and FSC Belize, providing dual-jurisdiction coverage that enhances operational flexibility while maintaining regulatory compliance standards.

Regulatory Coverage: Axiory operates under dual regulatory oversight from FSC Mauritius and FSC Belize. This provides traders with regulatory protection under established financial services frameworks. These jurisdictions offer investor protection measures, though the specific compensation schemes and dispute resolution procedures may differ between the two regulatory bodies.

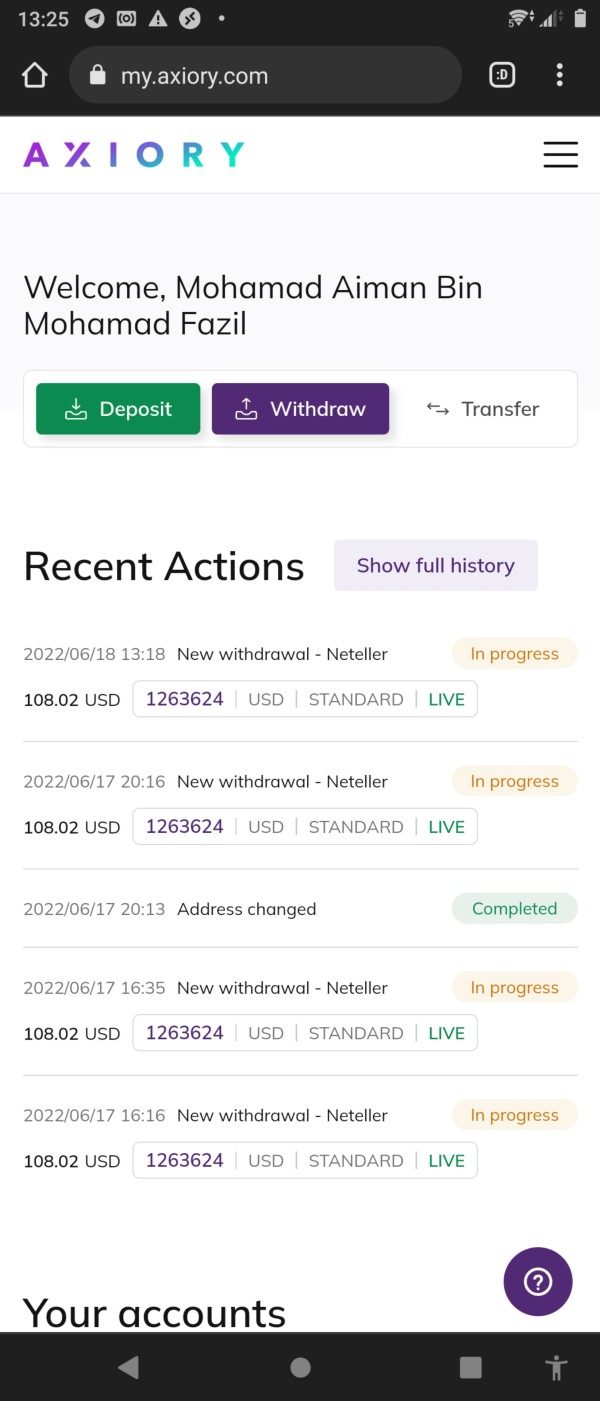

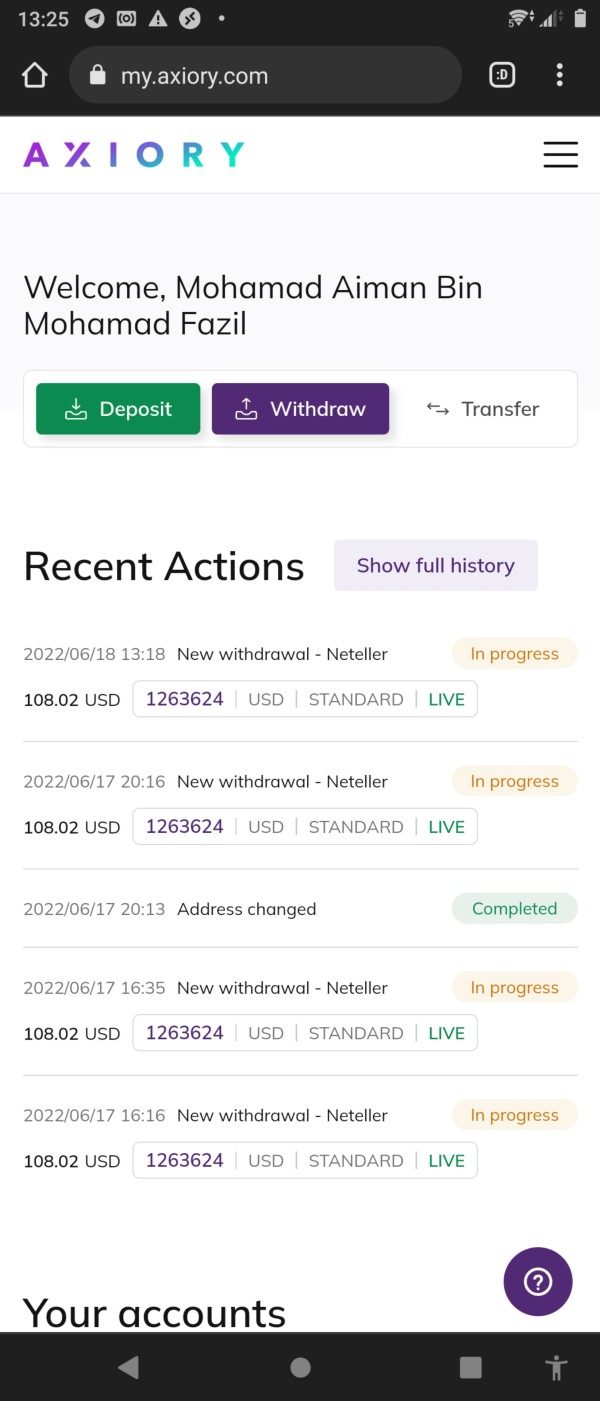

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal methods was not detailed in available materials. This requires direct contact with the broker for complete payment option information.

Minimum Deposit Requirements: Minimum deposit requirements were not specified in the available documentation. This suggests potential variation based on account types or regional regulations.

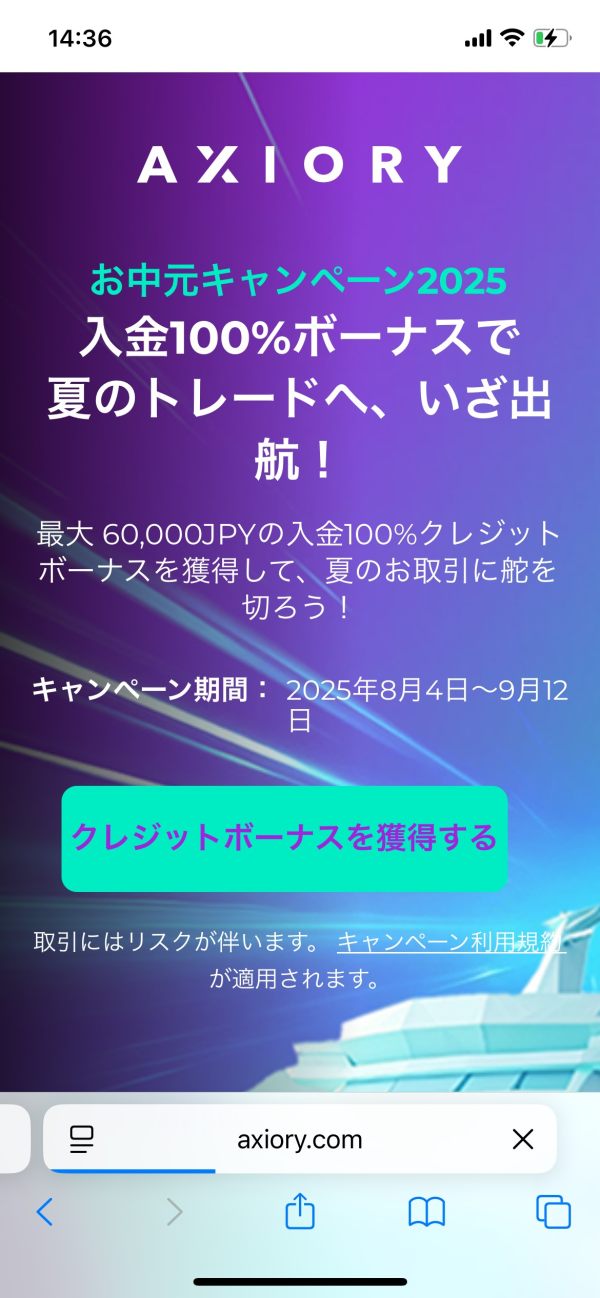

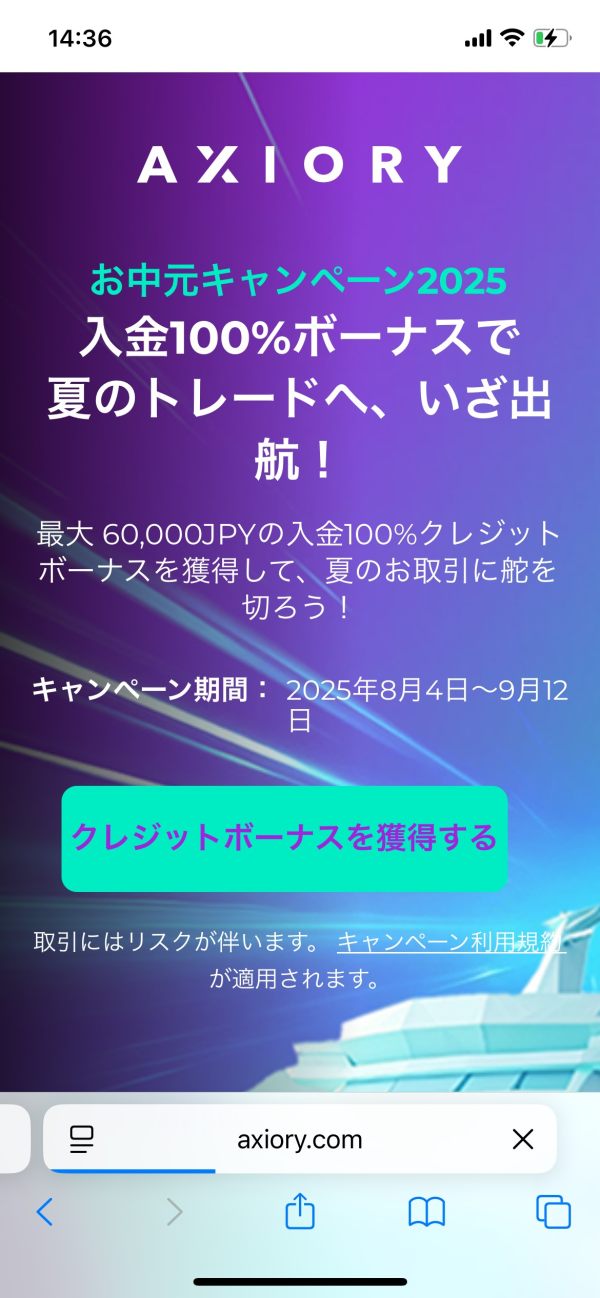

Bonus and Promotions: Current promotional offerings and bonus structures were not mentioned in available materials. This indicates that Axiory may focus on trading conditions rather than promotional incentives.

Tradeable Assets: The broker supports CFDs and forex trading across multiple asset categories. These include major, minor, and exotic currency pairs, along with commodities and indices, providing diversified trading opportunities for different market preferences.

Cost Structure: Trading costs begin with spreads from 0 pips. This suggests competitive pricing for active traders. However, commission structures and additional fees require direct verification with the broker for complete cost transparency.

Leverage Options: Specific leverage ratios were not detailed in available materials. These likely vary based on account types, asset classes, and regulatory requirements in different jurisdictions.

Platform Selection: Axiory offers MT4, MT5, and cTrader platforms. These accommodate different trading styles from manual analysis to automated strategies, with each platform providing distinct advantages for various trader preferences.

Geographic Restrictions: Specific regional limitations were not detailed in available documentation. However, regulatory constraints typically apply based on local financial services regulations.

Customer Support Languages: Available customer service languages were not specified in current materials. This requires direct inquiry for multilingual support confirmation.

Detailed Rating Analysis

Account Conditions Analysis (6/10)

Axiory's account conditions present a mixed picture that reflects both competitive elements and areas requiring greater transparency. The broker offers spreads starting from 0 pips, which positions it competitively within the industry, particularly for active traders who prioritize tight spreads over other features. However, this axiory review identifies significant gaps in publicly available information regarding account types, minimum deposit requirements, and specific account features that potential clients need for informed decision-making.

The absence of detailed information about different account tiers creates uncertainty for prospective traders. This includes their respective benefits and qualification criteria. While competitive spreads suggest favorable trading conditions, the lack of transparency regarding commission structures, account maintenance fees, and upgrade requirements limits the ability to fully assess the value proposition. Additionally, information about special account features such as Islamic accounts, VIP services, or institutional offerings remains undocumented in available materials.

The account opening process details are not outlined completely. This makes it difficult to assess the efficiency and requirements for new client onboarding. Without clear information about documentation requirements, verification timelines, and account activation procedures, potential clients cannot adequately prepare for the registration process or set appropriate expectations for account setup duration.

Axiory demonstrates strong performance in tools and resources. It offers a complete suite of trading platforms that cater to diverse trader preferences and strategies. The availability of MT4, MT5, and cTrader provides flexibility for traders ranging from beginners to advanced algorithmic traders, with each platform offering distinct advantages in terms of functionality, analysis tools, and automation capabilities.

The broker's educational platform and regular trading insights represent valuable resources for trader development. However, specific details about the depth and frequency of educational content require further investigation. The provision of negative balance protection stands out as a significant risk management tool, ensuring that traders cannot lose more than their account balance during volatile market conditions, which adds substantial value to the overall service offering.

However, information about additional analytical tools remains limited in available documentation. This includes market research resources, economic calendars, and third-party integrations. The quality and comprehensiveness of research materials, signal services, and advanced analytical tools that complement the trading platforms would significantly impact the overall value assessment for serious traders who rely on comprehensive market analysis.

Customer Service and Support Analysis (7/10)

Customer service evaluation for Axiory reveals a generally positive landscape based on the absence of significant user complaints in available feedback. This suggests adequate service delivery and problem resolution capabilities. The lack of documented negative experiences regarding support quality, response times, or issue resolution indicates that the broker maintains reasonable service standards for its client base.

However, this analysis is constrained by limited specific information about support channels. This includes availability hours, response time commitments, and multilingual capabilities. The absence of detailed information about live chat availability, phone support coverage, email response standards, and escalation procedures makes it difficult to assess the comprehensiveness and accessibility of customer support services.

The geographic coverage of support services remains unclear from available materials. This is particularly true for clients in different time zones. Additionally, specialized support for different account types, technical assistance quality, and the availability of dedicated account managers for higher-tier clients requires direct verification with the broker for accurate assessment.

Trading Experience Analysis (8/10)

The trading experience with Axiory receives strong ratings based on user feedback indicating smooth order execution without significant slippage or requote issues. This axiory review finds that traders have not reported major technical problems, platform crashes, or execution delays that commonly plague less reliable brokers. This suggests robust technological infrastructure and reliable liquidity provision.

Platform stability appears consistent across the offered trading environments. Users report satisfactory performance during both normal and volatile market conditions. The availability of multiple platforms allows traders to choose based on their specific requirements, whether for advanced charting, automated trading, or social trading features, enhancing the overall trading experience flexibility.

However, specific performance metrics are not documented in available materials. These include average execution speeds, slippage statistics, and uptime percentages. Mobile trading experience, platform customization options, and advanced order types availability require direct testing or broker confirmation. The quality of market data feeds, news integration, and real-time price accuracy also impact the overall trading experience but lack detailed documentation in current resources.

Trust Factor Analysis (7/10)

Axiory's trust factor assessment reveals a moderately positive profile based on regulatory oversight from FSC Mauritius and FSC Belize. This provides dual-jurisdiction regulatory coverage that enhances operational credibility. The regulatory framework offers investor protection measures and operational standards that contribute to overall broker reliability, though specific license numbers and detailed regulatory compliance records require direct verification.

The provision of negative balance protection demonstrates commitment to client fund safety and risk management. This enhances trust and confidence in the broker's operational practices. The absence of documented negative events, regulatory actions, or significant client complaints in available materials suggests stable operational history and adequate compliance management.

However, limited transparency regarding company ownership constrains the complete trust assessment. This includes financial backing, management team credentials, and audited financial statements. Information about client fund segregation practices, insurance coverage, compensation schemes, and third-party audits would significantly enhance the trust evaluation. Additionally, industry awards, recognition, or independent ratings from established financial services evaluation organizations are not documented in available materials.

User Experience Analysis (7/10)

User experience evaluation for Axiory indicates generally positive satisfaction levels based on available feedback. However, complete user satisfaction metrics and detailed experience assessments are limited in current documentation. Traders have not reported significant interface usability issues or platform navigation problems, suggesting adequate user interface design and functionality across the offered platforms.

The multi-platform approach caters to different user preferences and experience levels. This allows traders to select environments that match their trading styles and technical requirements. The absence of reported registration or verification process complications suggests reasonably streamlined onboarding procedures, though specific timeline and requirement details require direct confirmation.

However, detailed user journey analysis lacks complete documentation. This includes account funding convenience, withdrawal processing experiences, platform learning curves, and customer support interaction quality. Mobile application performance, cross-device synchronization, and platform customization capabilities also impact user experience but require direct testing for accurate assessment. User retention rates, satisfaction surveys, and comparative user experience studies would provide more robust evaluation foundations.

Conclusion

This complete axiory review positions the broker as a reliable choice for small to medium-sized traders seeking stable trading experiences with competitive conditions. Axiory's strengths lie in its diverse platform offerings, competitive spreads starting from 0 pips, and robust risk management features including negative balance protection. The dual regulatory oversight from FSC Mauritius and FSC Belize provides operational credibility, while positive user feedback regarding order execution and platform stability supports its reputation for reliability.

The broker particularly suits traders who prioritize platform diversity and execution quality over aggressive promotional offerings or extensive research resources. However, areas requiring improvement include greater transparency regarding account conditions, detailed cost structures, and complete service documentation that would enable more informed decision-making for prospective clients.