Is HonorFX safe?

Software Index

License

Is Honor FX A Scam?

Introduction

Honor FX is a forex and CFD broker that has been operating since its establishment in 2017. Based in Saint Vincent and the Grenadines, with additional offices in Mauritius and Malaysia, Honor FX positions itself as a competitive player in the online trading market. With claims of offering low spreads and a user-friendly trading platform, it aims to attract both novice and experienced traders. However, the forex market is notorious for its potential risks and scams, making it essential for traders to conduct thorough due diligence before choosing a broker. This article aims to evaluate the legitimacy of Honor FX by examining its regulatory status, company background, trading conditions, client safety measures, customer experiences, platform performance, and overall risk assessment.

Regulation and Legitimacy

One of the primary factors to consider when assessing the reliability of a forex broker is its regulatory status. Regulatory bodies enforce rules and standards that protect traders and ensure fair trading practices. Honor FX claims to be regulated by several authorities; however, these are not considered top-tier regulators, which raises concerns about the level of investor protection provided.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Services Commission (FSC) | GB20025826 | Mauritius | Verified |

| Labuan Financial Services Authority (LFSA) | MB/21/0072 | Malaysia | Verified |

| Financial Services Authority (FSA) | 25034 IBC 2018 | Saint Vincent and the Grenadines | Verified |

While Honor FX is regulated in Mauritius and Malaysia, both jurisdictions are known for their less stringent regulations compared to countries like the UK or the US. The lack of a strong regulatory framework can expose traders to higher risks. Additionally, there have been numerous complaints regarding withdrawal issues and transparency, which could indicate a lack of compliance with regulatory standards.

Company Background Investigation

Honor FX is operated by Honor Capital Markets Limited, which has been in business for several years. The company's history indicates a focus on providing accessible trading services, but details about its ownership structure are somewhat opaque. The management teams backgrounds and their experience in the financial sector are not clearly disclosed, raising concerns about the company's transparency.

The broker claims to prioritize client trust through education and transparency, yet the lack of comprehensive information about its management and operational practices can be alarming for potential clients. Transparency in a brokerage firm is crucial as it builds trust and confidence among traders. Unfortunately, Honor FX's limited disclosure may deter traders who prioritize safety and accountability.

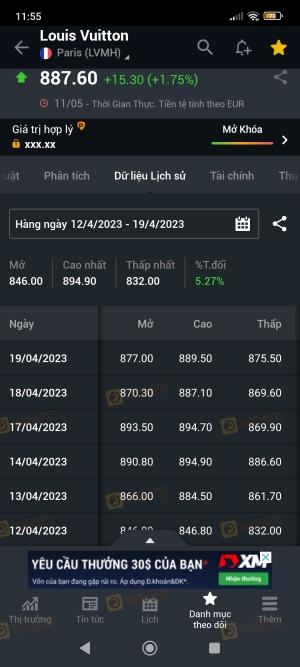

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions, including fees and spreads, is vital. Honor FX offers a variety of trading accounts, including standard and ECN accounts, with varying minimum deposits and spreads. However, the fee structure can be complex, and some traders have reported unexpected costs.

| Fee Type | Honor FX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 1.5 pips | From 1.0 pips |

| Commission Model | No commission on standard accounts; $7/lot on ECN | Varies by broker |

| Overnight Interest Range | Varies by account type | Varies by broker |

The spreads offered by Honor FX, particularly for the standard accounts, are above the industry average, which may not be competitive for active traders. Additionally, the commission structure for the ECN account may not be favorable for traders who execute high volumes. This could deter potential clients who seek cost-effective trading solutions.

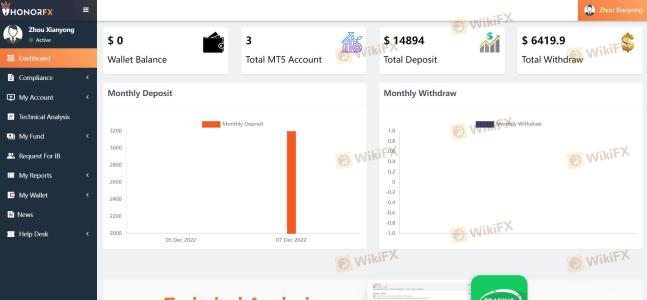

Client Funds Safety

The safety of client funds is paramount when choosing a forex broker. Honor FX claims to implement several measures to protect client funds, including segregated accounts and negative balance protection. However, the effectiveness of these measures can vary, especially given the brokers offshore status.

The lack of a robust investor protection scheme, typically offered by top-tier regulatory bodies, raises concerns about the security of client funds. Historical complaints about withdrawal issues further exacerbate these concerns, suggesting that clients may face challenges in accessing their funds when needed.

Customer Experience and Complaints

Customer feedback is a critical aspect of assessing a broker's reliability. Reviews for Honor FX present a mixed picture; while some users report positive experiences, others highlight significant issues, particularly regarding withdrawals and customer support.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response or no resolution |

| Poor Customer Support | Medium | Limited availability and vague answers |

Many complaints indicate that clients struggle to withdraw their funds, with some claiming that their accounts were frozen or that they were pressured to continue trading instead of processing withdrawals. These patterns of complaints are concerning and suggest potential operational flaws within the brokerage.

Platform and Execution

The trading platform offered by Honor FX is MetaTrader 5 (MT5), known for its advanced features and user-friendly interface. However, the performance of the platform, including order execution quality, is crucial for traders.

Users have reported varying experiences with order execution, including instances of slippage and rejections. Such issues can significantly impact trading outcomes, especially for those employing strategies that rely on precise execution. The absence of clear data regarding any potential platform manipulation is also a red flag for traders.

Risk Assessment

Engaging with Honor FX comes with several risks that potential clients should consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Operates under offshore regulations with limited protections |

| Fund Safety Risk | High | History of withdrawal issues and lack of compensation schemes |

| Execution Risk | Medium | Reports of slippage and rejected orders |

Given these risks, it is advisable for traders to approach Honor FX with caution. Conducting thorough research and considering alternative brokers with stronger regulatory oversight may be prudent.

Conclusion and Recommendations

In conclusion, while Honor FX presents itself as a legitimate forex broker, several factors raise concerns about its reliability. The combination of offshore regulation, complaints about fund withdrawals, and mixed customer reviews suggest that potential traders should exercise caution.

For traders seeking safety and reliability, it may be beneficial to explore alternatives that offer stronger regulatory protections and transparent operational practices. Brokers like IG, OANDA, or Forex.com, which are regulated by top-tier authorities, may provide a more secure trading environment.

Ultimately, traders must weigh the potential risks against their trading goals and preferences before choosing to engage with Honor FX.

Is HonorFX a scam, or is it legit?

The latest exposure and evaluation content of HonorFX brokers.

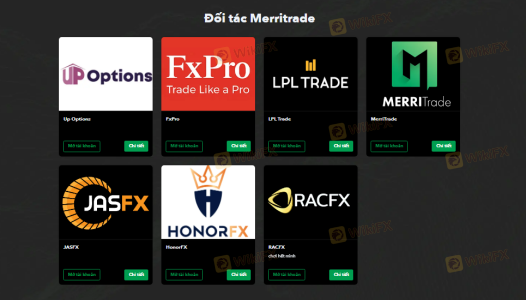

HonorFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

HonorFX latest industry rating score is 2.36, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.36 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.