Imperial Markets 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

Imperial Markets positions itself as a promising trading platform, enticing traders with its claims of ultra-low spreads, high leverage up to 1:500, and a diverse array of trading instruments. This alluring proposition is particularly aimed at new traders who are often attracted to the idea of maximizing their returns on minimal initial investments. However, beneath this appealing façade lies a troubling reality: Imperial Markets functions as an unregulated offshore broker, which substantially heightens the risk profile for potential investors. Negative reviews and complaints point to serious issues with fund withdrawals and customer service, leading to skepticism about the platforms legitimacy.

Ultimately, while some new traders may find the low-cost entry and high-leverage opportunities attractive, those with experience or a lower risk tolerance are strongly advised to steer clear of Imperial Markets. The platforms promise of quick gains is overshadowed by a persistent risk—one that could result in significant financial loss.

⚠️ Important Risk Advisory & Verification Steps

Investing with unregulated brokers like Imperial Markets can expose you to considerable risks. To protect yourself, follow these crucial verification steps:

- Check Regulatory Status: Visit the official websites of regulatory bodies to confirm the broker's licensing status. Imperial Markets claims affiliation with several bodies but lacks valid licensing.

- Research User Reviews: Browse trusted review platforms for user experiences, focusing on complaints about fund withdrawals and inadequate customer service.

- Verify Corporate Contact Information: Ensure that company addresses and contact details are accurate and can be confirmed via third-party sources.

Rating Framework

Broker Overview

Company Background and Positioning

Founded in 2013 and operated by Imperial Solutions Ltd, Imperial Markets claims to have its headquarters in the British Virgin Islands and Seychelles. Despite its global brand messaging as a "leader in next-generation financial market services," the broker's unregulated nature casts doubt on its credibility. The truth is, Imperial Markets operates as an offshore broker lacking proper oversight, raising red flags for potential investors.

Core Business Overview

Imperial Markets provides access to various trading instruments, including forex and CFDs, while utilizing the MT5 trading platform. They aim to attract clients by offering high leverage ratios, yet such promises often come with concealed risks. The claim of being regulated by credible financial authorities is consistently contradicted by reports indicating a lack of valid licensing, creating an inconsistent narrative that undermines trust.

Quick-Look Details Table

In-Depth Analysis of Each Dimension

Trustworthiness Analysis

Imperial Markets makes assertions about being authorized by the Seychelles Financial Services Authority (FSA) and the British Virgin Islands Financial Services Commission (FSC). However, investigations reveal no record of such licenses, indicating a severe credibility gap. This lack of regulation is a red flag, signaling that traders might be exposing themselves to potential scams.

User Self-Verification Guide

To ensure the legitimacy of any broker, including Imperial Markets, follow these steps:

- Consult the FSA and FSC websites to check for valid broker registration.

- Investigate online forums and review sites for user feedback and complaints.

- Cross-check corporate contact information against independent sources.

Industry Reputation and Summary

Users report significant concerns over Imperial Markets' credibility. Notable quotes include:

"I think imperial markets is a good platform... but many people say offshore brokers are not that safe."

"Imperial markets is hands down the best broker Ive worked with!"

"The support contacted me, but the response was not good."

Such contrasting reviews highlight the broker's inconsistent reputation and potential operational pitfalls.

Trading Costs Analysis

Advantages in Commissions

Imperial Markets highlights its low-cost trading framework, aiming to attract cost-sensitive traders with spreads reportedly starting at 1.4 pips on major currency pairs. However, the commission structure can be misleading, as traders may not always have the full picture of the costs involved.

The "Traps" of Non-Trading Fees

Customers have expressed dissatisfaction due to high withdrawal fees, which can reach $30, creating an unexpected cost burden for traders wanting to access their funds. This highlights a lack of transparency in fee structure that could adversely affect profitability.

Cost Structure Summary

Ultimately, while low spreads seem beneficial, potential hidden costs and withdrawal challenges represent a double-edged sword, particularly for less experienced traders who may not fully understand the implications.

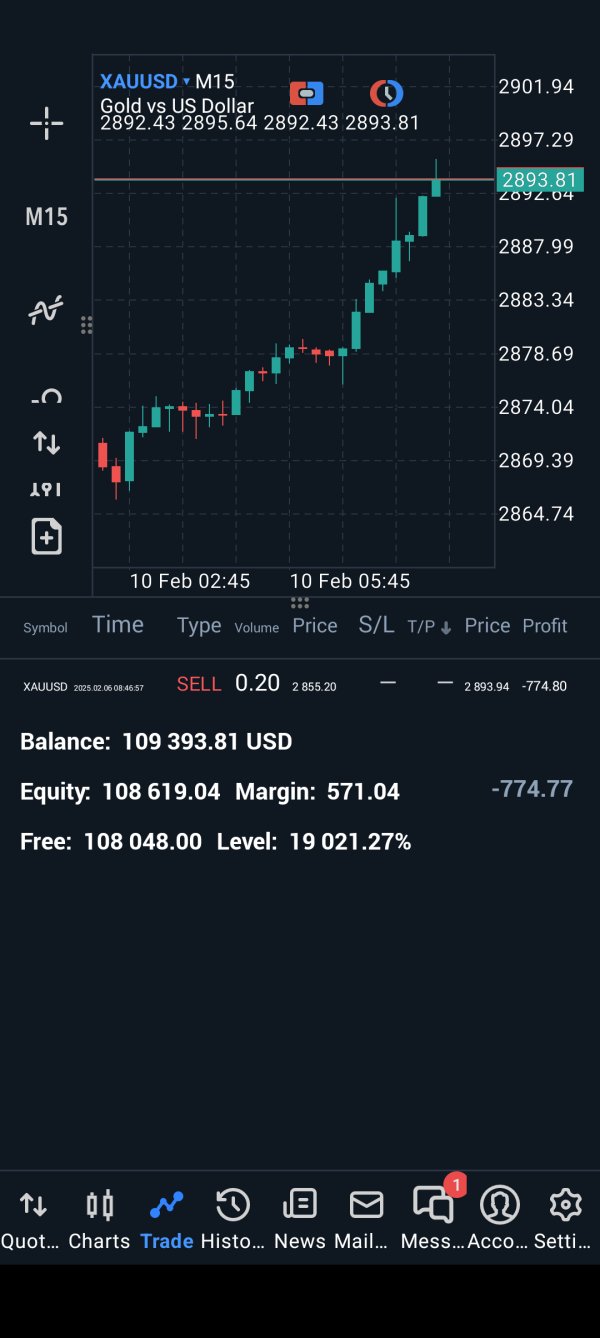

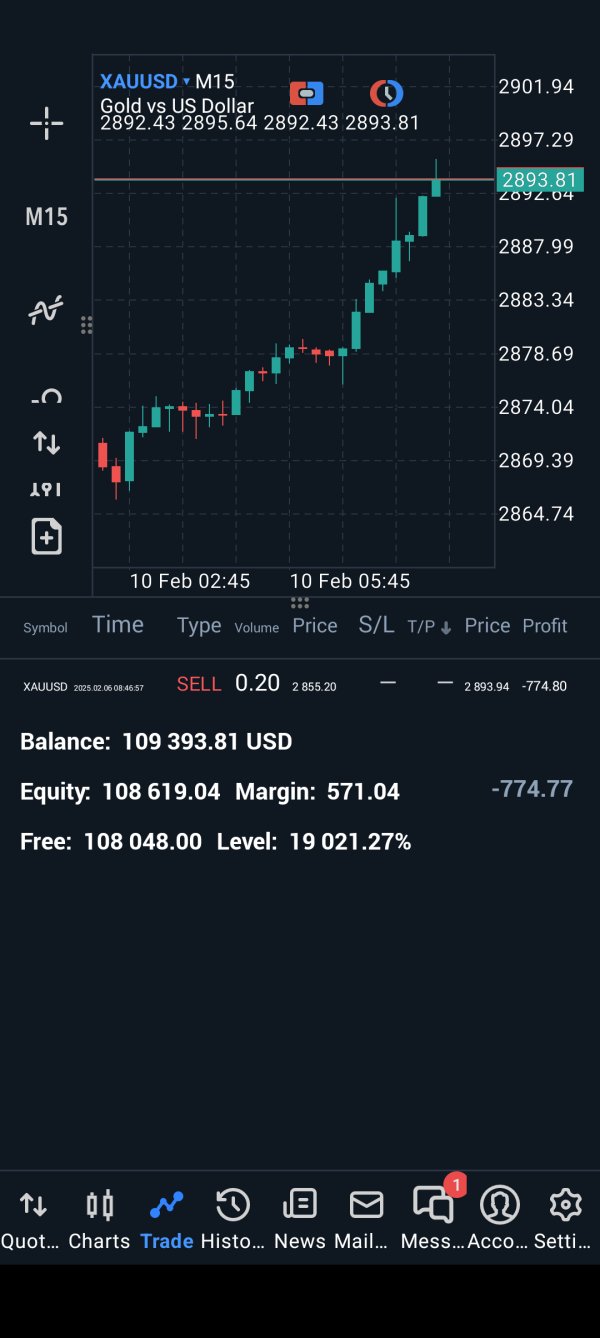

Imperial Markets offers the MT5 trading platform, known for its advanced analytical capabilities and user-friendly interface. However, the availability of a good platform is undermined by the overarching lack of regulation, leading to questions regarding user safety and fund security.

The platform provides powerful tools for trading, including real-time market analysis and charting capabilities. However, the absence of robust educational materials for novice traders is a missed opportunity, potentially leaving these users underprepared.

User reviews indicate varying experiences with Imperial Markets' platform usability, with some praising the functioning of MT5. However, quotes like:

"The response was not good"

echo the broader concerns regarding customer service and support for platform-related inquiries.

User Experience Analysis

User Journey and Accessibility

Feedback on user experience is mixed, reflecting a gap between initial account opening ease and the withdrawal process's complexities. New traders may find themselves drawn in by the platforms user interface but subsequently disappointed by the lag in accessing their funds.

Feedback Mechanisms

Users frequently mention poor responses from customer support when issues arise, further complicating their trading journey. Reliable communication channels are critical for traders, and the reports indicate that these may not be well-established with Imperial Markets.

Summary of Overall Experience

Overall, while the website and trading platform exhibit modern features, the consensus among users is that the experience can quickly devolve if issues arise, especially regarding fund withdrawals.

Customer Support Analysis

Imperial Markets offers support primarily through email and live chat; however, many users report slow or inadequate responses, especially during critical account issues. The support-less environment leaves traders feeling isolated when they encounter difficulties.

Common Complaints About Service

Numerous complaints about the challenge of withdrawing funds signal an overarching problem with customer support. Reports of lengthy delays in resolution add to trader frustration, as emphasized by the lack of accountability seen in user reviews.

Summary of Customer Service

Customer support is critical in the trading landscape, and Imperial Markets appears to fall short in this respect, with several users expressing disappointment over their interactions with the support team.

Account Conditions Analysis

Types of Accounts Offered

Imperial Markets offers various account types, catering from standard accounts requiring a minimum deposit of $200 to premium accounts demanding $10,000. Each offers distinct leverage and spreads, but these minimums may restrict potential traders from accessing the platform easily.

Leverage and Margin Requirements

The high leverage ratios provided by Imperial Markets are enticing but come with inherent risks. With a leverage of up to 1:500, users must be cautious, as trading with high leverage can lead to significant losses.

Account Experience Summary

While account conditions vary and attempt to cater to diverse trading needs, the limitations imposed by high minimum deposits and concerns over corporate governance complicate the overall user experience.

Conclusion

In summary, while Imperial Markets entices traders with low fees, high leverage, and a broad range of assets, it is fundamentally a high-risk broker. The absence of reputable regulatory oversight combined with numerous negative user experiences regarding withdrawals and customer support raise significant concerns about its legitimacy. New traders seeking high-risk platforms may be tempted, but the underlying risks should make responsible investors think twice. Choose wisely; your investment security depends on it.