Regarding the legitimacy of LDN Global Markets forex brokers, it provides MISA and WikiBit, (also has a graphic survey regarding security).

Is LDN Global Markets safe?

Pros

Cons

Is LDN Global Markets markets regulated?

The regulatory license is the strongest proof.

MISA Forex Trading License (EP)

Mwali International Services Authority

Mwali International Services Authority

Current Status:

RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

LDN GLOBAL MARKETS LLC

Effective Date:

2023-04-19Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is LDN Global Markets A Scam?

Introduction

LDN Global Markets is a forex broker that positions itself as a provider of a wide range of trading instruments including forex, commodities, cryptocurrencies, and indices. Established in Saint Vincent and the Grenadines, it claims to offer competitive trading conditions and a user-friendly platform. However, with the rise of online trading, the forex market has also seen an increase in unregulated brokers that can potentially scam unsuspecting traders. Therefore, it is crucial for traders to conduct thorough due diligence before engaging with any broker. This article investigates the legitimacy of LDN Global Markets, evaluating its regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and associated risks through a combination of narrative analysis and structured information.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its legitimacy. LDN Global Markets claims to be registered with the Financial Services Authority (FSA) of Saint Vincent and the Grenadines. However, it is essential to note that the FSA does not regulate forex trading or brokerage services. This lack of oversight raises significant concerns regarding the safety and security of client funds.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| SVG FSA | #1547 | Saint Vincent & Grenadines | Not Validated |

The absence of a legitimate regulatory framework means that LDN Global Markets operates without any supervision, exposing its clients to high risks. Furthermore, the FSA has explicitly stated that it does not issue licenses for forex trading or brokerage, which effectively places LDN Global Markets outside the bounds of regulatory protection. This situation is alarming, especially for novice traders who may not fully understand the implications of trading with an unregulated broker.

Company Background Investigation

LDN Global Markets was established in 2021, but details about its ownership and management team remain vague. The lack of transparency regarding its corporate structure raises questions about accountability and trustworthiness. A reputable broker typically provides clear information about its founders and management team, including their qualifications and experience in the financial industry.

The broker claims to operate from multiple global offices, including locations in London and Cyprus. However, investigations reveal that these claims may not be substantiated, as no verifiable corporate presence has been found in these jurisdictions. This lack of transparency is concerning, as it suggests that the company may be attempting to mislead potential clients about its legitimacy and operational footprint.

Trading Conditions Analysis

LDN Global Markets advertises competitive trading conditions, including high leverage and low spreads. However, the actual cost of trading can significantly impact a trader's profitability. The broker claims to offer spreads starting from 1.5 pips on major currency pairs, but this can vary depending on market conditions and account type.

| Fee Type | LDN Global Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 1.5 pips | 1.0-2.0 pips |

| Commission Structure | $0 (Bronze) | $0 - $10 |

| Overnight Interest Range | Varies | Varies |

While the broker does not charge commissions on the Bronze account, higher-tier accounts incur fees, which may not be clearly communicated. Additionally, the reliance on cryptocurrencies for deposits and withdrawals can be a red flag, as these transactions are irreversible, making it difficult for clients to recover funds in case of a dispute.

Client Fund Safety

Client fund security is paramount in the forex trading industry. LDN Global Markets claims to implement measures for client fund protection, such as segregated accounts. However, without regulatory oversight, there is no guarantee that these measures are effectively enforced. The broker does not provide clear information regarding negative balance protection, which is a critical feature that helps safeguard traders from losing more than their deposited funds.

Historically, many brokers operating in unregulated environments have faced issues with fund safety, leading to substantial losses for clients. As such, the lack of a robust safety net for client funds at LDN Global Markets is concerning and warrants caution.

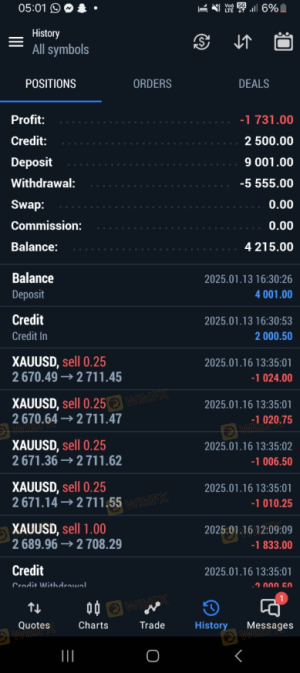

Customer Experience and Complaints

Customer feedback plays a significant role in assessing a broker's reliability. Reviews of LDN Global Markets are mixed, with some users praising the platform's ease of use and customer support, while others report difficulties in withdrawing funds and a lack of responsiveness from the support team.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Transparency | Medium | Average |

| Customer Support Delays | High | Poor |

Common complaints include delayed withdrawals and a perceived lack of transparency regarding fees and account management. For instance, some clients have reported that their withdrawal requests were either denied or took an extended period to process, creating frustration and distrust.

Platform and Trade Execution

LDN Global Markets utilizes the popular MetaTrader 5 (MT5) platform, which is known for its advanced trading features and user-friendly interface. However, the broker's execution quality has been questioned, with reports of slippage and order rejections.

The execution quality is crucial for traders, especially in the volatile forex market. Any signs of manipulation or poor execution can significantly impact a trader's profitability. There have been anecdotal reports of clients experiencing issues with order execution, which raises concerns about the integrity of the trading environment.

Risk Assessment

The overall risk of trading with LDN Global Markets is elevated due to its unregulated status and the associated lack of investor protection.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No legitimate oversight. |

| Fund Safety | High | Potential for fund mismanagement. |

| Execution Risk | Medium | Reports of slippage and order rejections. |

Traders considering LDN Global Markets should be aware of these risks and take appropriate measures to mitigate them, such as starting with a small investment and conducting thorough research before committing significant funds.

Conclusion and Recommendations

Based on the evidence presented, LDN Global Markets exhibits several red flags that suggest it may not be a safe or reliable broker. The lack of legitimate regulatory oversight, transparency issues, and mixed customer feedback all contribute to a concerning picture.

Traders are advised to exercise extreme caution if considering this broker for their trading activities. It may be prudent to seek alternatives that offer robust regulatory protections, transparent operations, and positive customer reviews. Some recommended brokers include those regulated by reputable financial authorities such as the FCA, ASIC, or CySEC, which provide a higher level of investor protection and trustworthiness.

Is LDN Global Markets a scam, or is it legit?

The latest exposure and evaluation content of LDN Global Markets brokers.

LDN Global Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

LDN Global Markets latest industry rating score is 2.76, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.76 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.