Omega Pro 2025 Review: Everything You Need to Know

Executive Summary

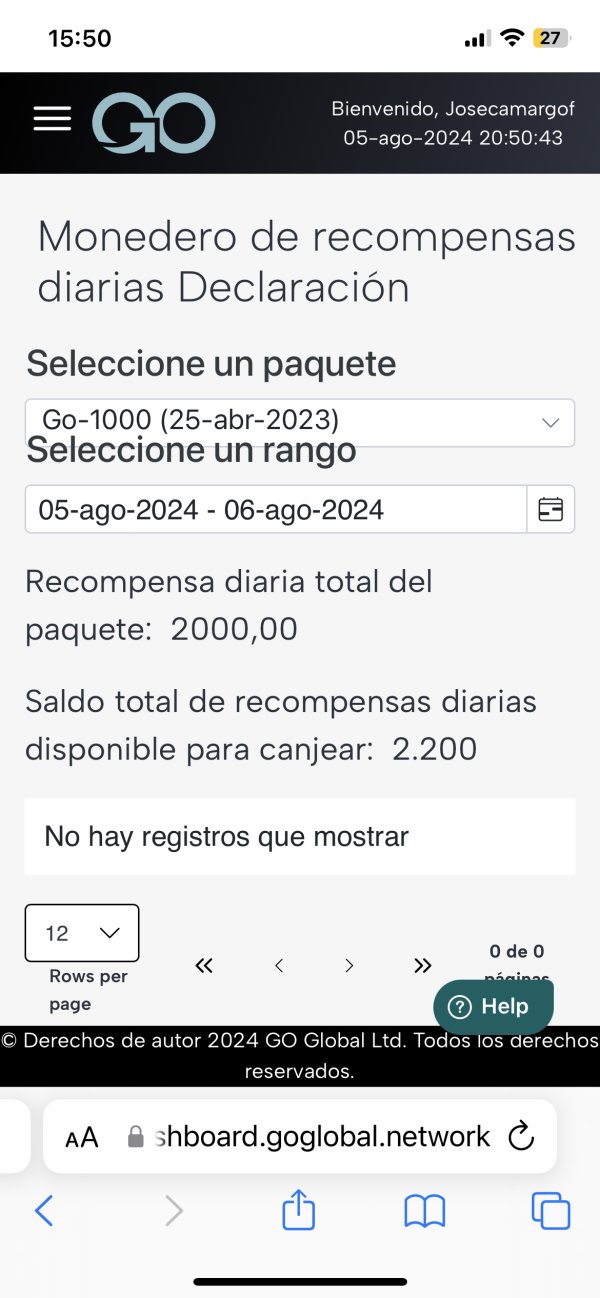

This comprehensive omega pro review examines a trading platform that has gained attention in forex and cryptocurrency markets. However, this attention is not always positive. Based on careful analysis of user feedback and available information, Omega Pro presents itself as a premium FX and cloud mining investment platform that claims to multiply investments through forex and cryptocurrency trading.

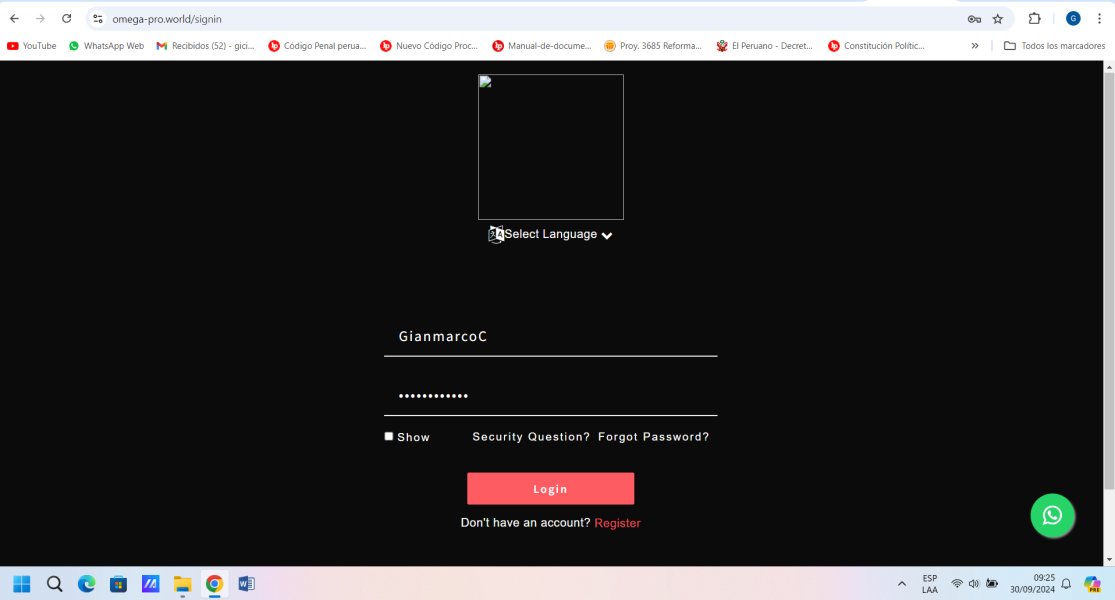

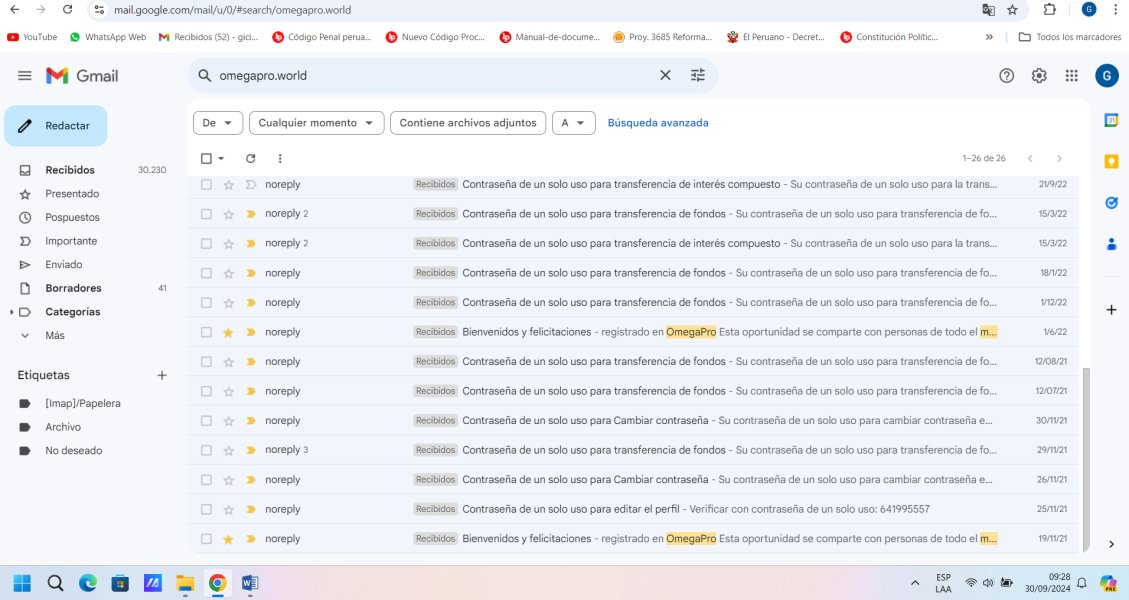

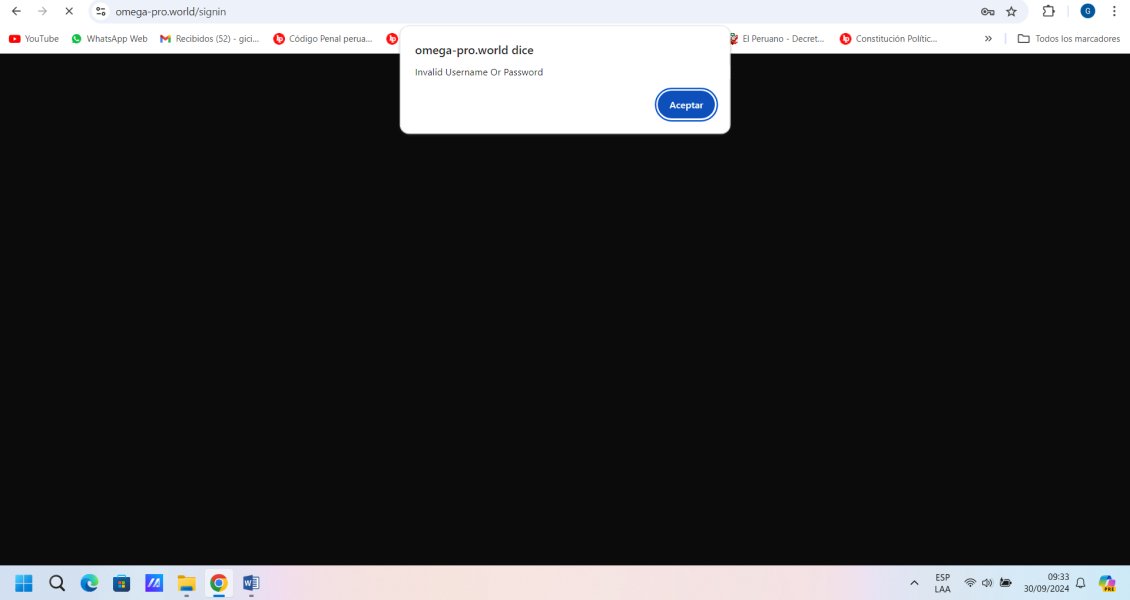

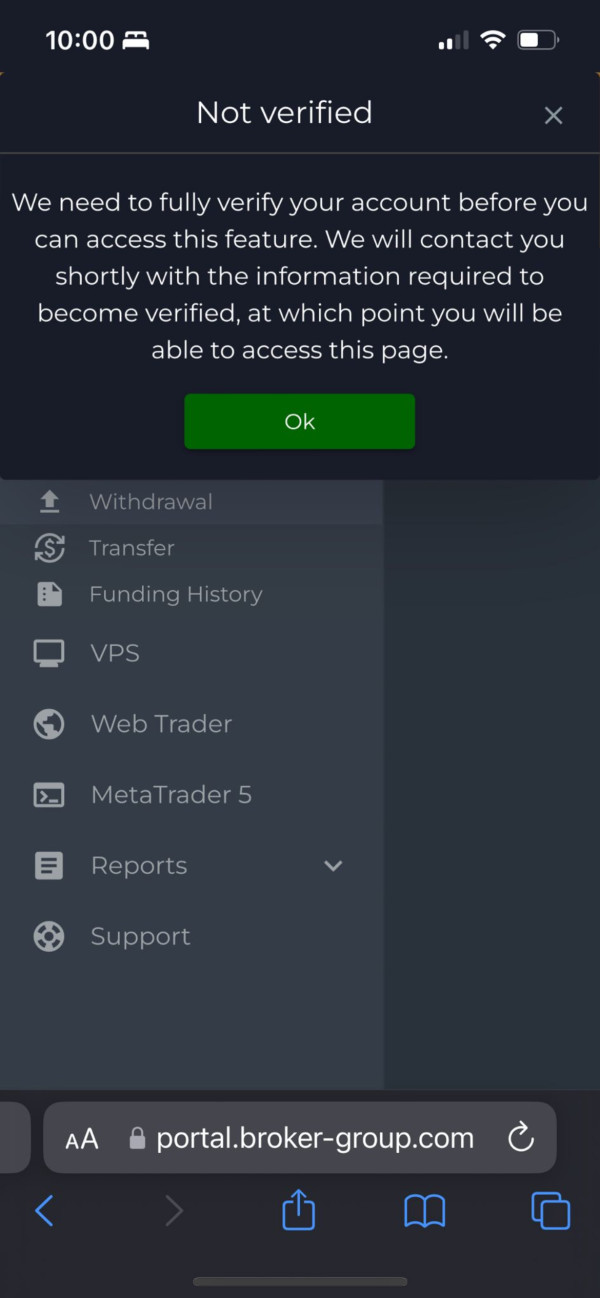

Our investigation reveals concerning patterns that potential investors should carefully consider. The platform's regulatory status remains unclear. No verifiable licensing information from recognized financial authorities exists. User testimonials consistently highlight withdrawal difficulties, with multiple complaints about fund recovery issues that span months. Despite marketing itself as a "regulated company," concrete evidence of proper regulatory oversight is notably absent from all available documentation.

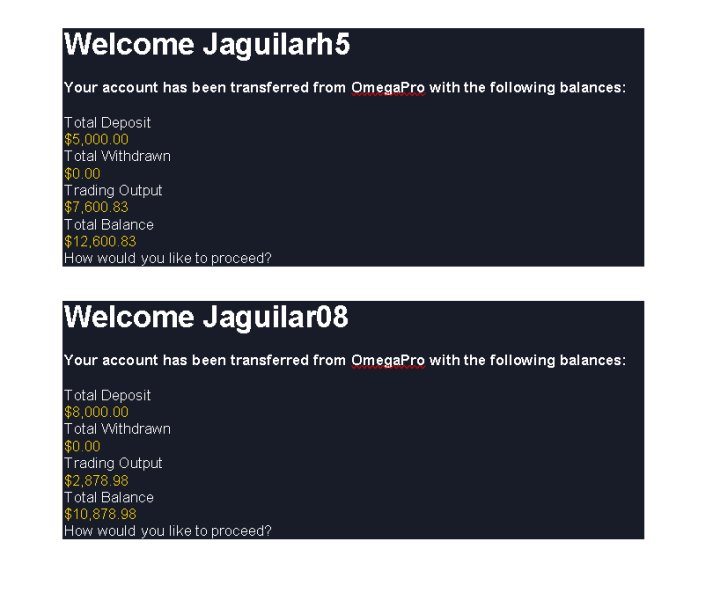

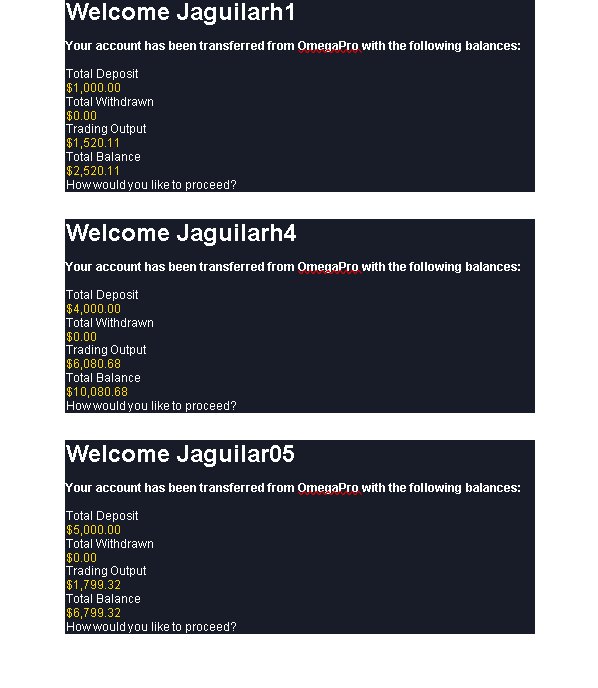

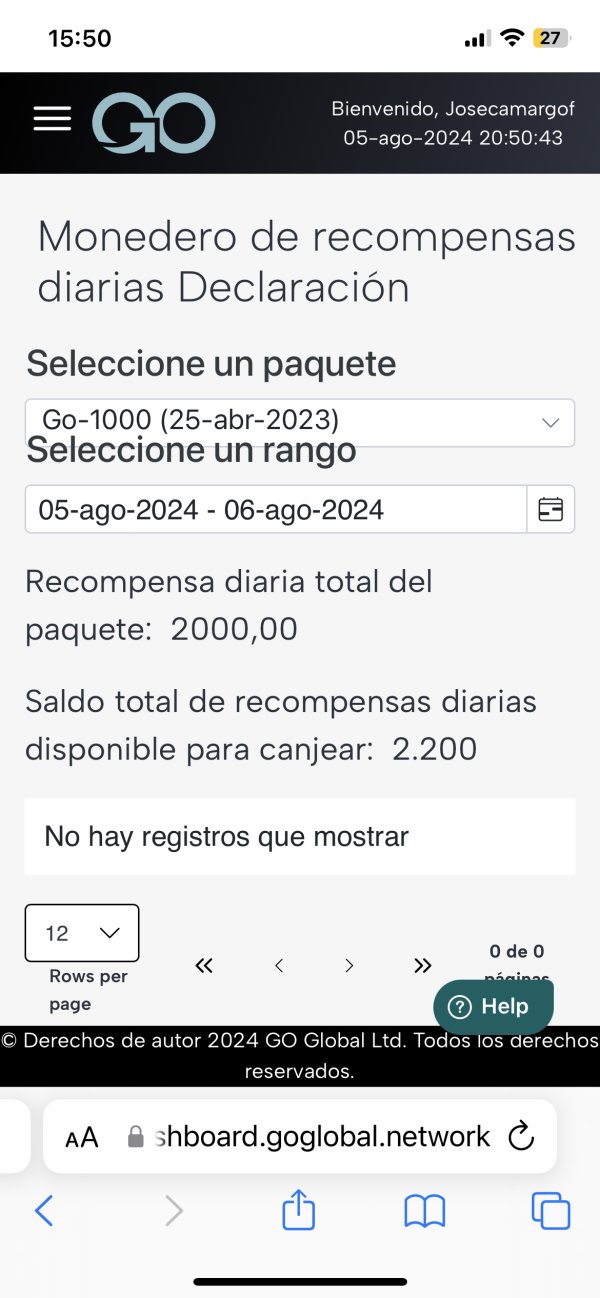

The platform does offer relatively accessible entry points. Some accounts require minimal initial deposits around $29 for management fees, making it superficially attractive to newcomers who want to start trading. Omega Pro claims to provide both forex and cryptocurrency trading opportunities, along with what they term "cloud mining" services that promise additional returns. The business model appears to incorporate multi-level marketing (MLM) elements, requiring users to open multiple accounts for different investment tiers to maximize their potential earnings.

Primary target demographics include novice traders seeking entry into forex and cryptocurrency markets. These traders are particularly attracted by promises of quick returns and low minimum deposits that seem too good to pass up. However, the accumulation of user complaints and lack of transparent regulatory information suggests significant risks that overshadow any potential benefits the platform might offer.

Important Disclaimers

Given the absence of clear regulatory information, users should understand that Omega Pro may operate under different legal frameworks across various jurisdictions. This means investor protection levels can vary significantly depending on location. The lack of transparent licensing means that regulatory recourse may be limited or unavailable in case of disputes or fund recovery issues.

This review is based on publicly available information, user testimonials, and documented complaints from various sources across multiple platforms. Due to limited official documentation from the platform itself, some operational details remain unclear and cannot be verified through independent sources. Potential investors should conduct additional due diligence and consider consulting with financial advisors before making any investment decisions involving this platform.

Rating Framework

Broker Overview

Omega Pro positions itself as a "premium FX & cloud mining investment platform" specializing in forex and cryptocurrency trading. The company's official materials claim it operates as a trading and mining investment platform designed to multiply investments through currency trading activities and automated mining operations. However, fundamental information about the company's establishment date, founding team, and corporate structure remains conspicuously absent from all available documentation and marketing materials.

The platform's business model appears to blend traditional forex trading with cryptocurrency mining investments. This combination is wrapped in what users describe as a multi-level marketing structure that requires significant navigation skills. This hybrid approach requires participants to navigate multiple account types and investment tiers, with representatives encouraging the opening of several accounts to maximize investment potential and unlock higher earning tiers.

According to available information, Omega Pro offers access to forex and cryptocurrency markets. However, specific details about trading instruments, spreads, and execution methods are not clearly documented anywhere. The platform emphasizes its "premium" status and promises of rapid investment multiplication, typical characteristics of investment schemes that prioritize marketing over transparent operational details and regulatory compliance. The absence of detailed information about trading platforms, regulatory compliance measures, and risk management procedures raises significant concerns about the platform's legitimacy and operational standards in the financial services industry.

This omega pro review finds that while the company presents itself professionally through its marketing materials and website design, the lack of verifiable credentials and the prevalence of user complaints suggest potential investors should exercise extreme caution. The professional appearance should not be mistaken for legitimate operations or regulatory compliance.

Regulatory Status: Despite claims of being a "regulated company," no specific regulatory licenses or oversight bodies are mentioned in available documentation. This absence of regulatory transparency represents a significant red flag for potential investors seeking legitimate trading platforms.

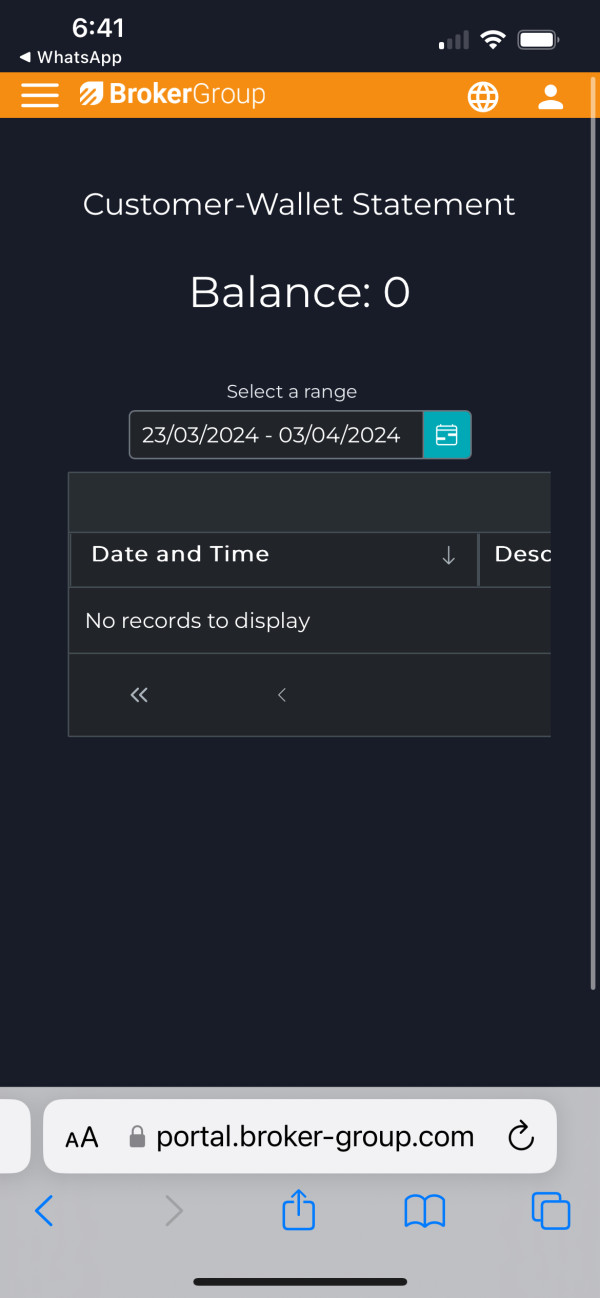

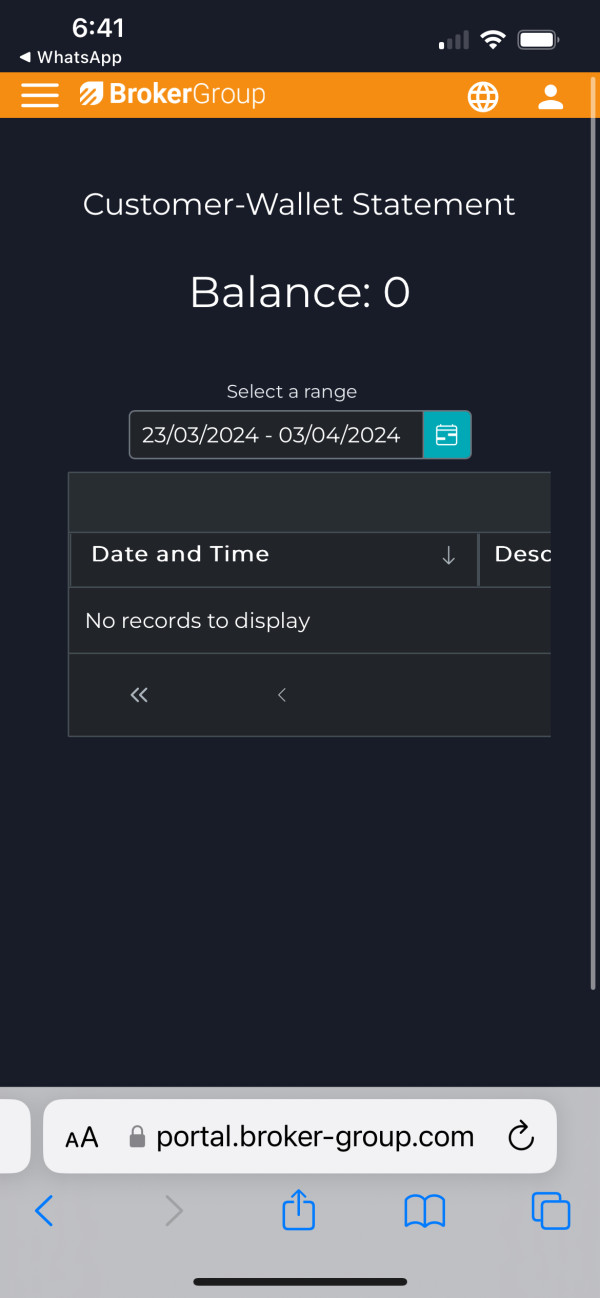

Deposit and Withdrawal Methods: Specific information about supported payment methods remains unclear in available documentation. However, users report difficulties with withdrawal processes across multiple testimonials and complaint forums.

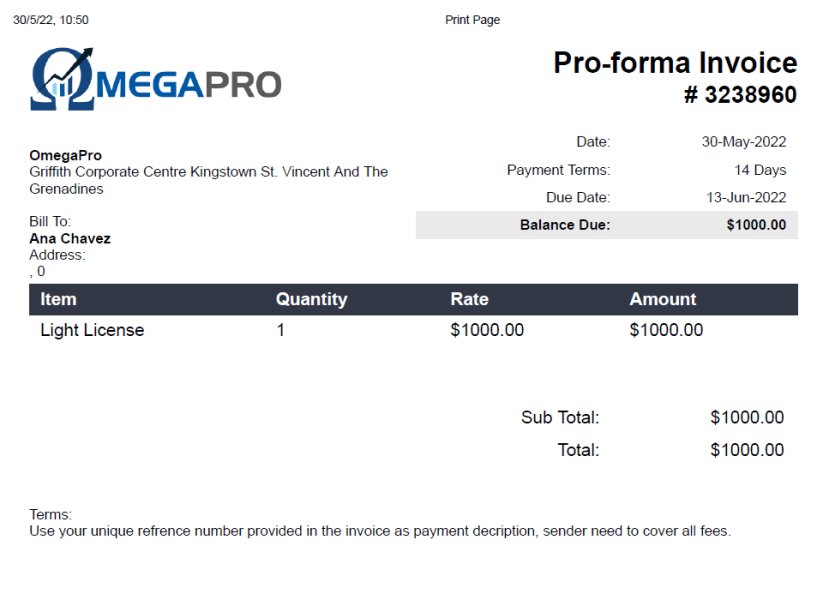

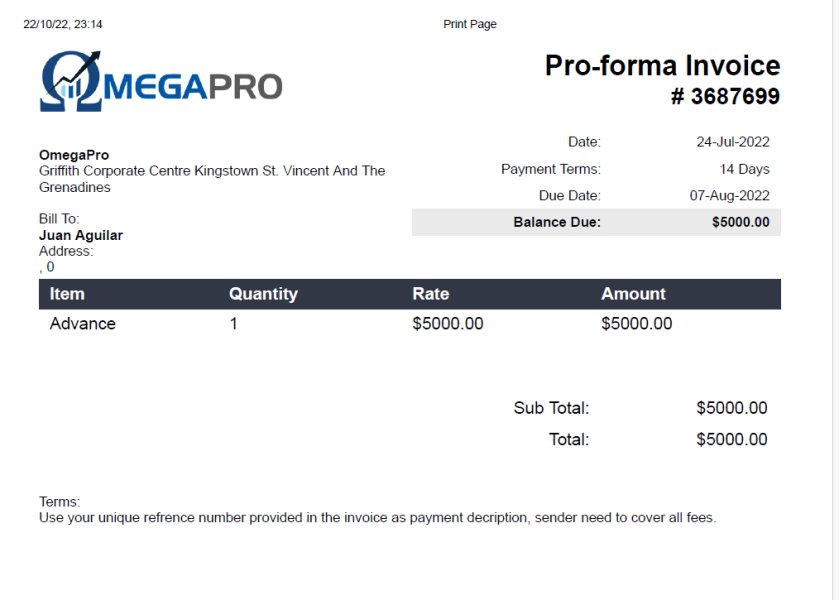

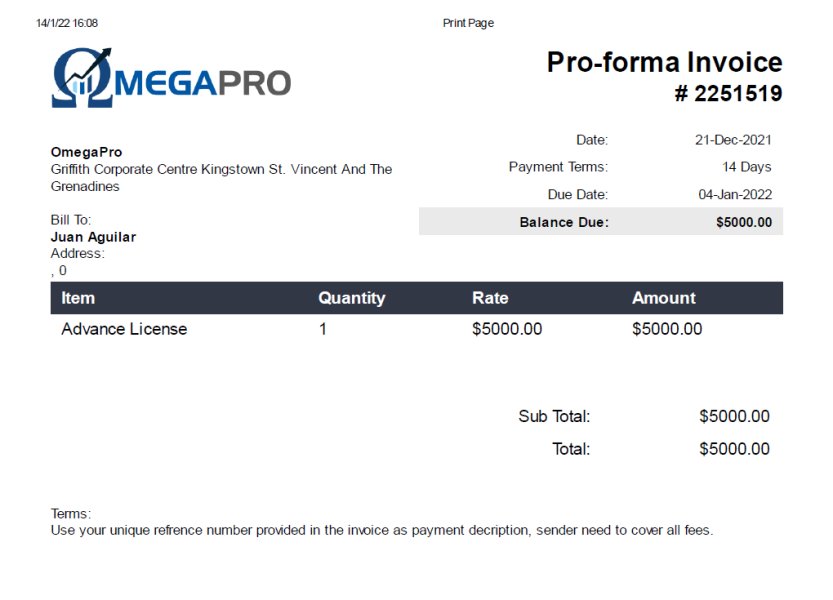

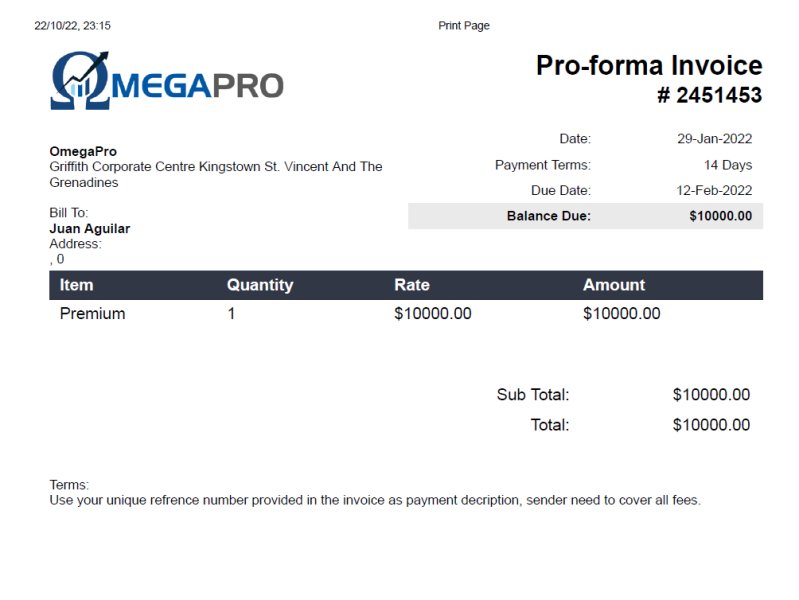

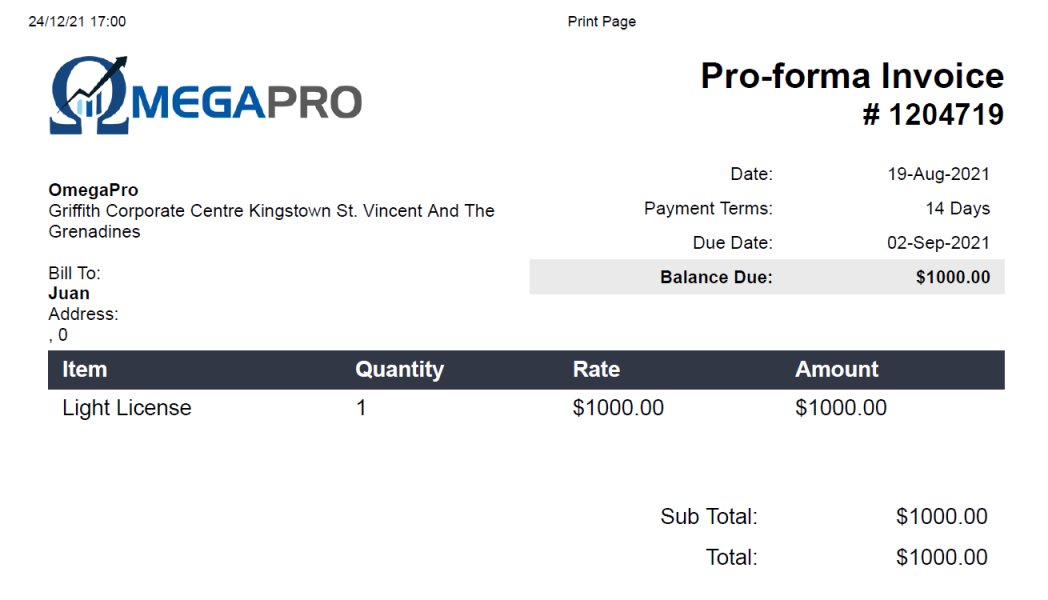

Minimum Deposit Requirements: The platform advertises a $29 one-time management fee for basic access. Account tiers include Starter Accounts at $100 and Premium Accounts at $1,000 for higher-level access.

Bonuses and Promotions: No specific promotional offers or bonus structures are detailed in available information. The platform appears to focus on investment multiplication promises rather than traditional trading bonuses.

Tradeable Assets: The platform focuses on forex and cryptocurrency trading, with additional claims about cloud mining investment opportunities. Specific instruments and asset lists are not clearly documented.

Cost Structure: Commission rates, spreads, and leverage information are not transparently provided in accessible documentation. This makes it difficult for potential users to assess true trading costs and profitability.

Leverage Ratios: Specific leverage offerings are not detailed in available materials. This information gap prevents traders from understanding risk exposure levels.

Platform Options: The only mentioned trading tool is "Algo-Trade Fiat Experts." However, comprehensive platform information is notably absent from all marketing materials.

Geographic Restrictions: Specific regional limitations are not clearly outlined in available documentation. This lack of clarity creates uncertainty about legal access across different jurisdictions.

Customer Support Languages: Supported languages for customer service are not specified in accessible materials. This information gap affects international users seeking support in their native languages.

This omega pro review reveals concerning gaps in basic operational transparency that legitimate brokers typically provide clearly and prominently.

Detailed Rating Analysis

Account Conditions Analysis (Score: 4/10)

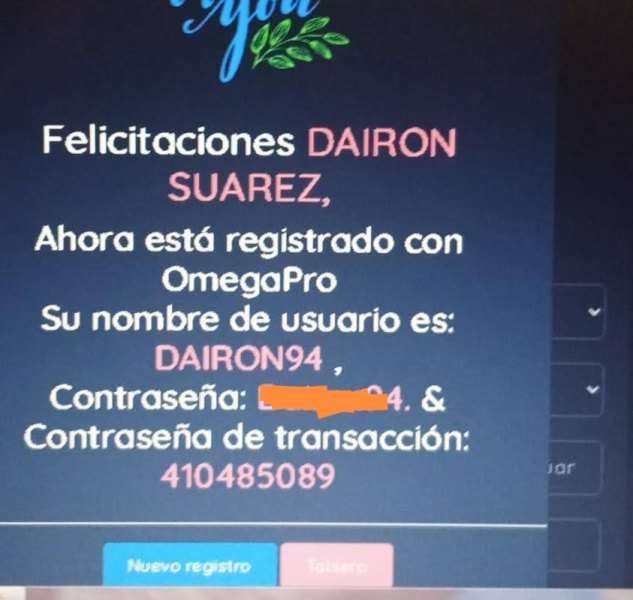

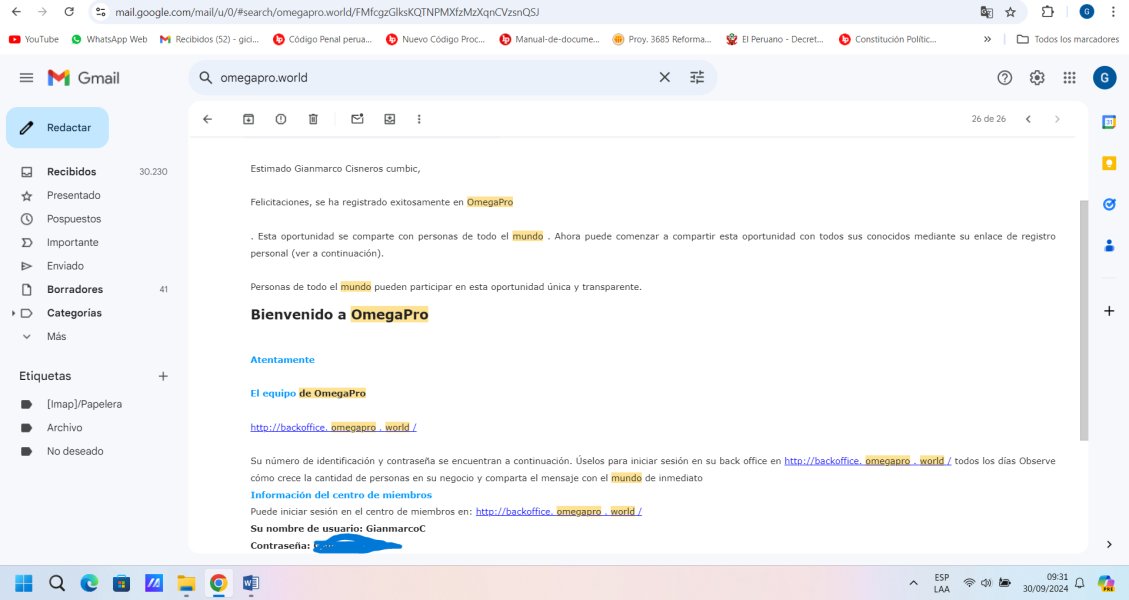

Omega Pro's account structure presents a mixed picture of accessibility and transparency concerns that potential users should carefully evaluate. The platform offers multiple account tiers, including Starter Accounts requiring $100 minimum deposits and Premium Accounts with $1,000 thresholds for advanced features. Additionally, users encounter a $29 one-time management fee, which while relatively low, represents an additional cost layer not always clearly communicated upfront during the registration process.

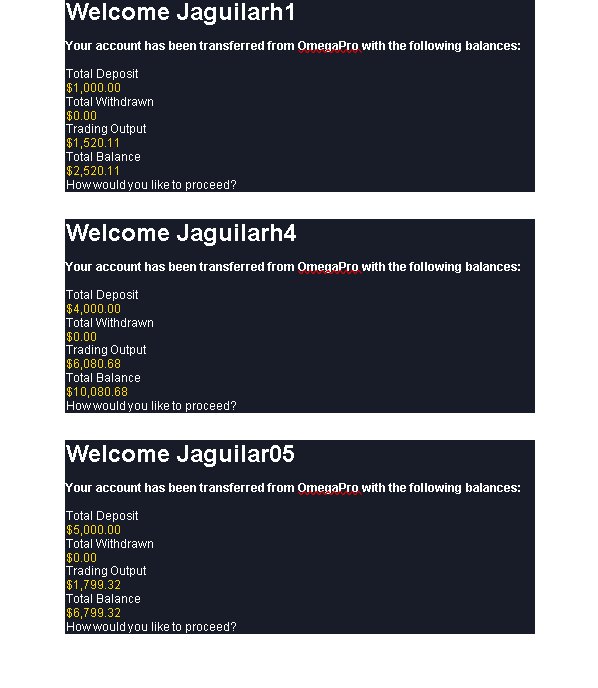

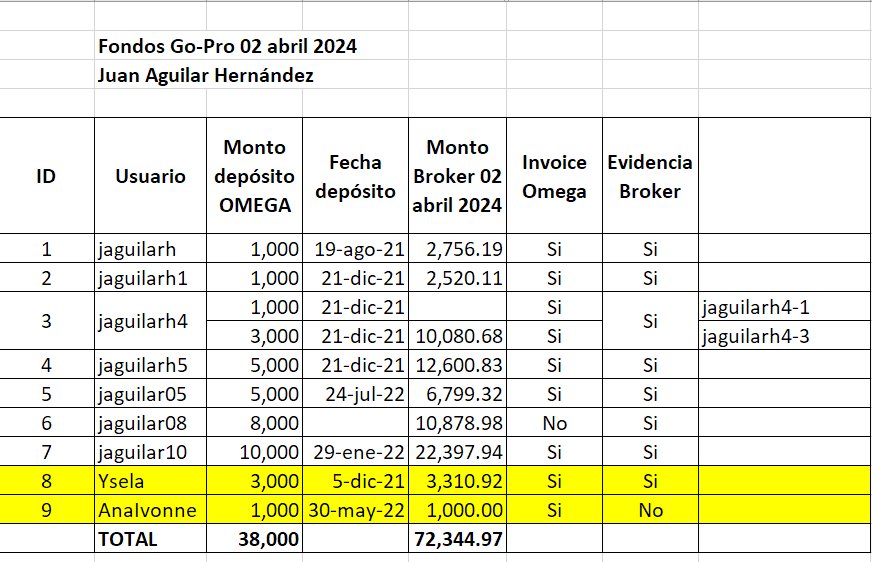

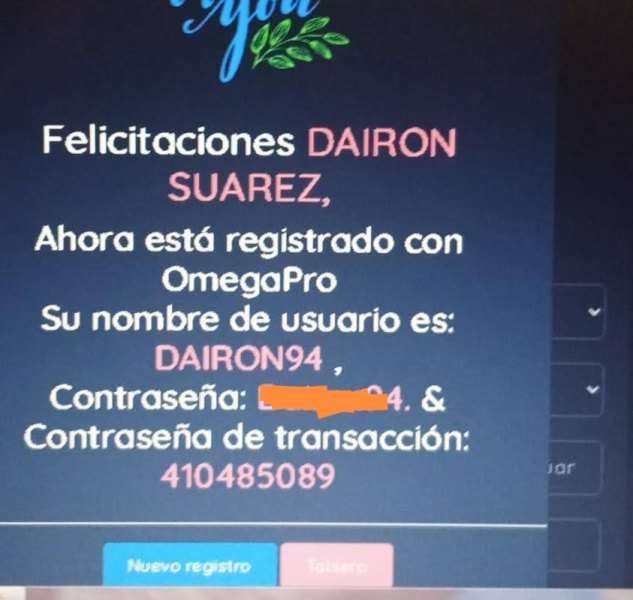

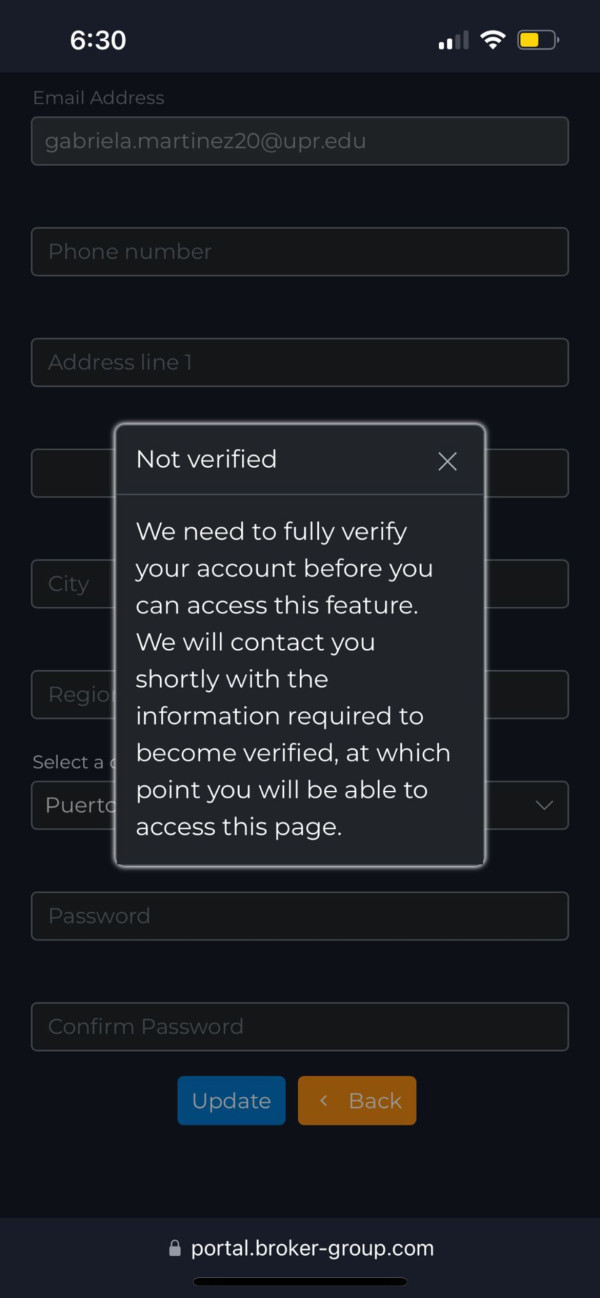

The account opening process, as described by users, involves creating multiple accounts to access different investment opportunities and earning tiers. This requirement adds unnecessary complexity and suggests a structure more aligned with MLM schemes than traditional forex brokers that typically offer single-account access. User testimonials indicate that representatives actively encourage opening several accounts to "maximize investment potential," raising questions about the necessity and transparency of such requirements for legitimate trading operations.

However, fundamental account information that traders typically require remains unclear across all available documentation. Commission structures, spread information, and specific trading conditions are not transparently provided anywhere. This lack of clarity makes it impossible for potential users to accurately assess the true cost of trading through the platform or compare it with legitimate alternatives.

The relatively low minimum deposit requirements might appear attractive to newcomers seeking affordable entry into forex markets. However, the absence of detailed terms and conditions, combined with user reports of withdrawal difficulties, significantly undermines the apparent accessibility benefits and suggests hidden costs or restrictions.

This omega pro review finds that while entry barriers appear low, the lack of transparent account conditions and complex multi-account requirements create significant concerns about the platform's legitimacy and user-friendliness.

The platform's trading tools and educational resources appear severely limited based on available information from multiple sources. The only specifically mentioned trading tool is "Algo-Trade Fiat Experts," though detailed information about its functionality, features, or effectiveness is not provided in any accessible documentation. This lack of detail makes it impossible to assess whether the tool provides genuine trading value or simply serves as a marketing term.

Unlike established forex brokers that typically offer comprehensive trading platforms, market analysis tools, economic calendars, and educational resources, Omega Pro's offerings in this area remain largely undocumented. The absence of detailed platform information suggests either limited tool availability or poor transparency in communicating available resources to potential users who need these tools for informed trading decisions.

Research and analysis resources, which are crucial for informed trading decisions in volatile forex and cryptocurrency markets, are notably absent from available materials. Educational content, webinars, market insights, and trading guides - standard offerings from legitimate brokers - are not mentioned in the platform's accessible documentation or user testimonials.

The lack of comprehensive platform information also extends to mobile trading capabilities, automated trading support, and integration with popular trading platforms like MetaTrader. This absence of detailed tool information makes it difficult for serious traders to assess whether the platform can meet their trading needs or provide competitive features compared to established alternatives.

User testimonials focus primarily on investment returns and withdrawal issues rather than trading tool experiences. This pattern suggests that the platform's primary appeal may be investment promises rather than robust trading infrastructure that supports successful trading activities.

Customer Service and Support Analysis (Score: 2/10)

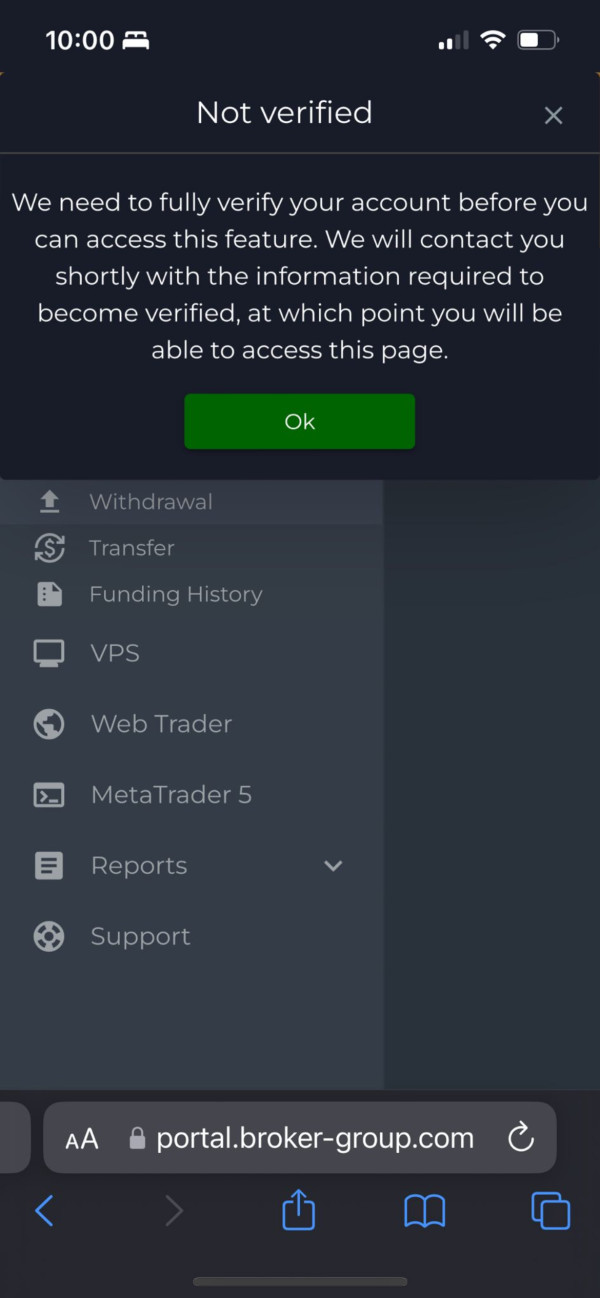

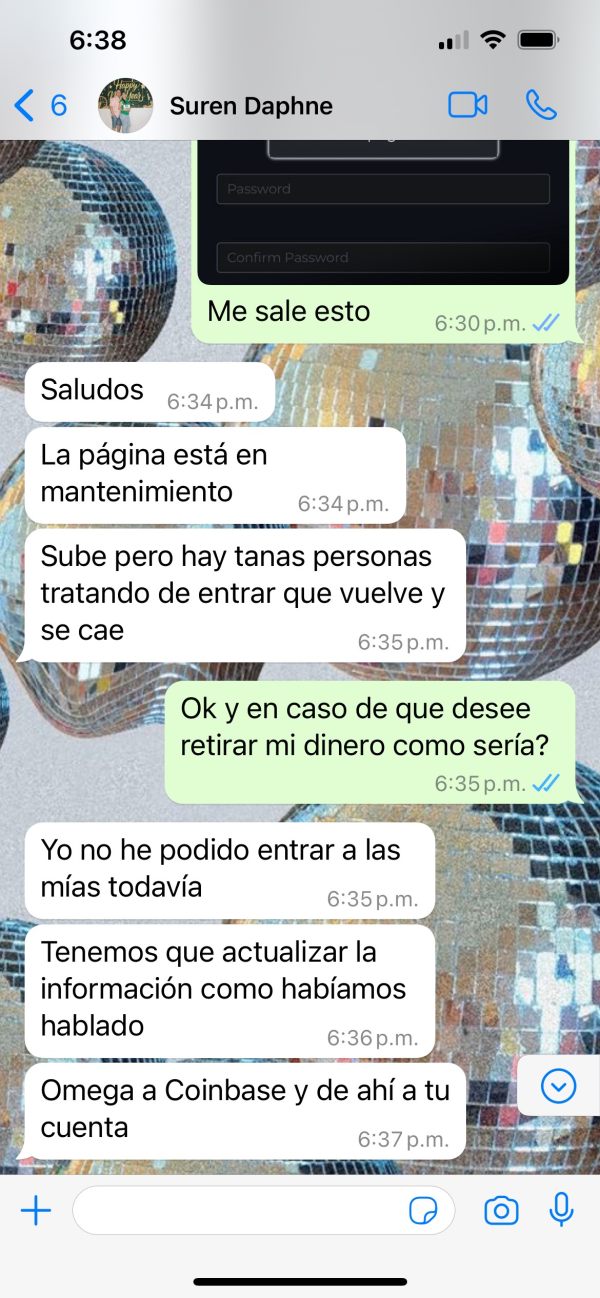

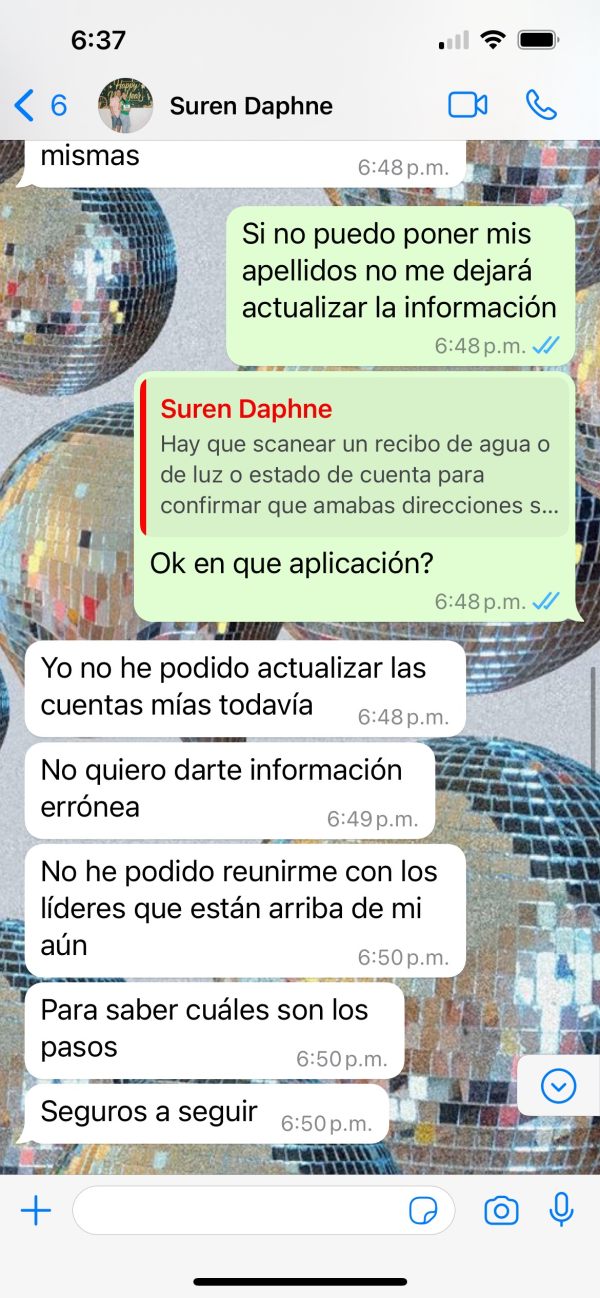

Customer service represents one of the most concerning aspects of Omega Pro based on user feedback and available information from multiple complaint sources. Multiple user testimonials specifically highlight difficulties in contacting support representatives and receiving assistance with withdrawal requests and basic account issues. These problems appear systematic rather than isolated incidents affecting individual users.

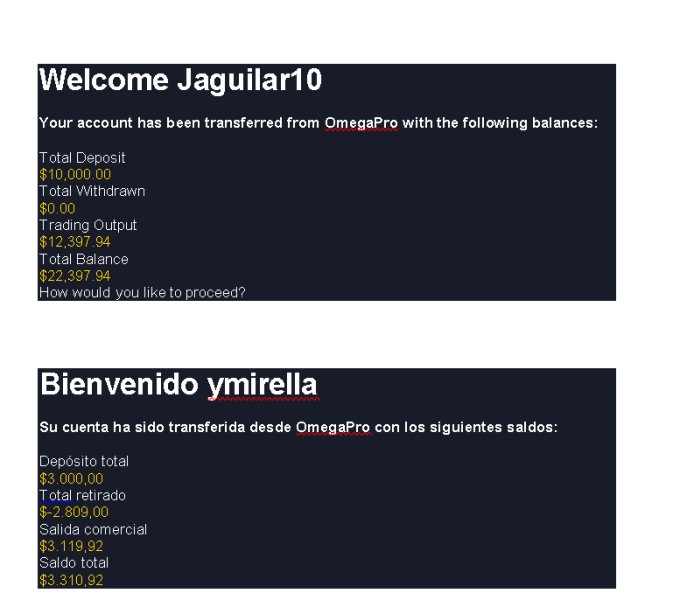

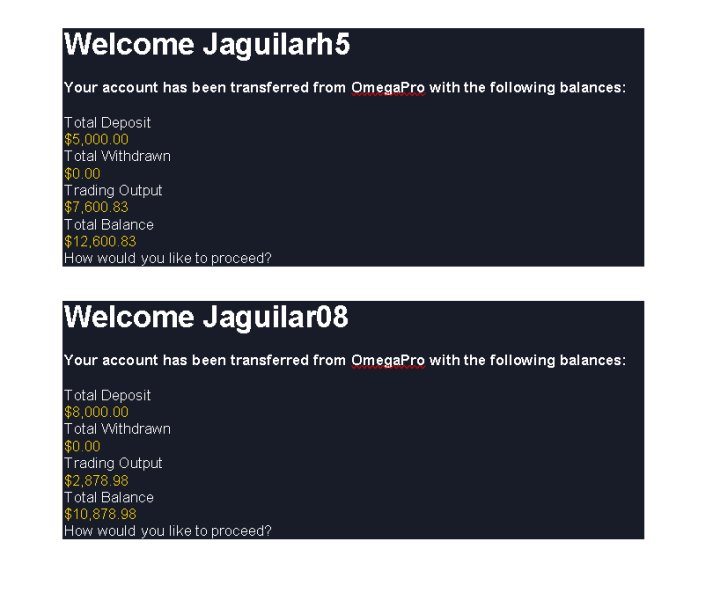

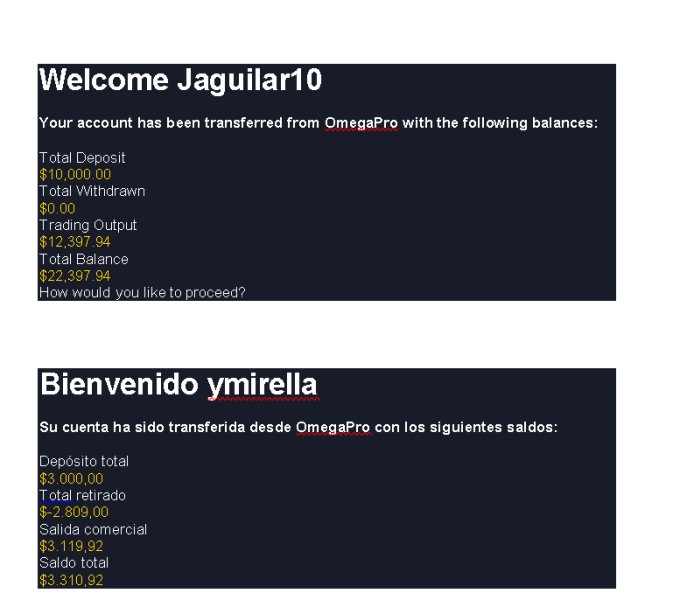

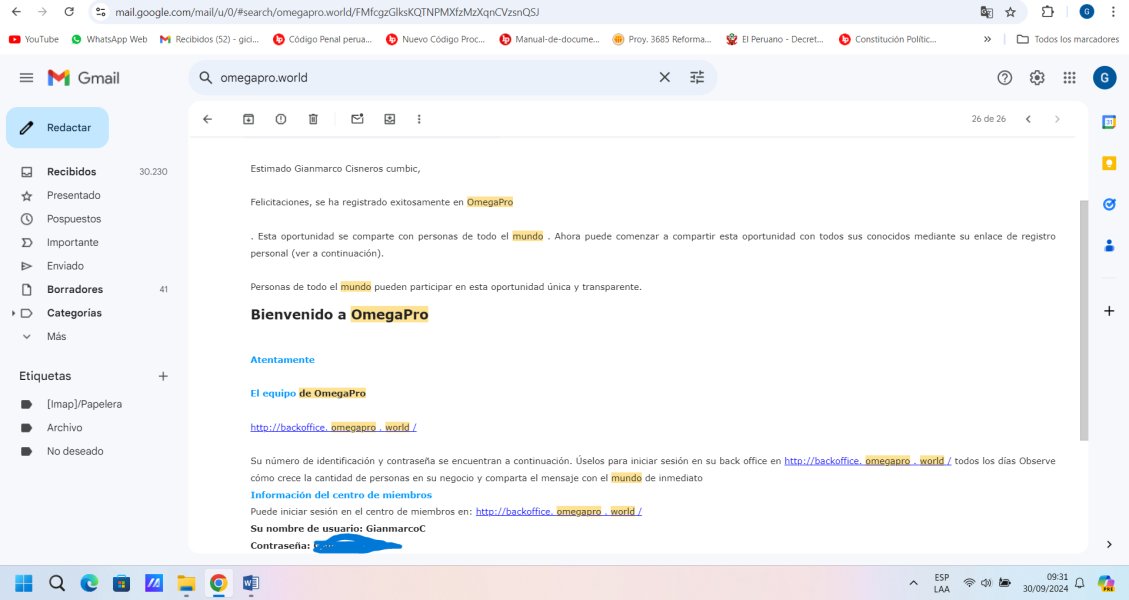

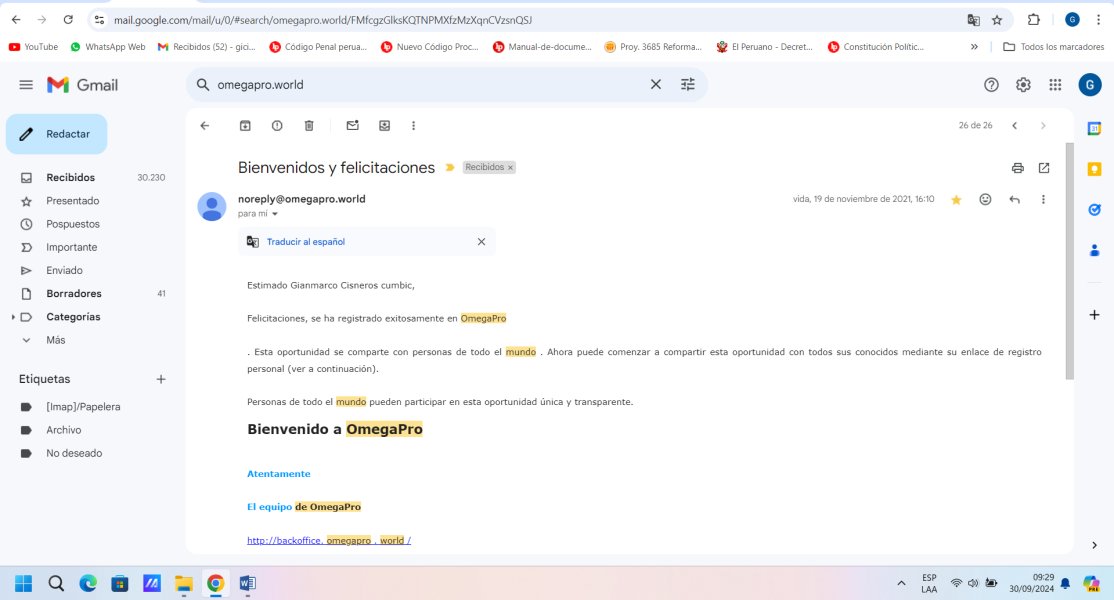

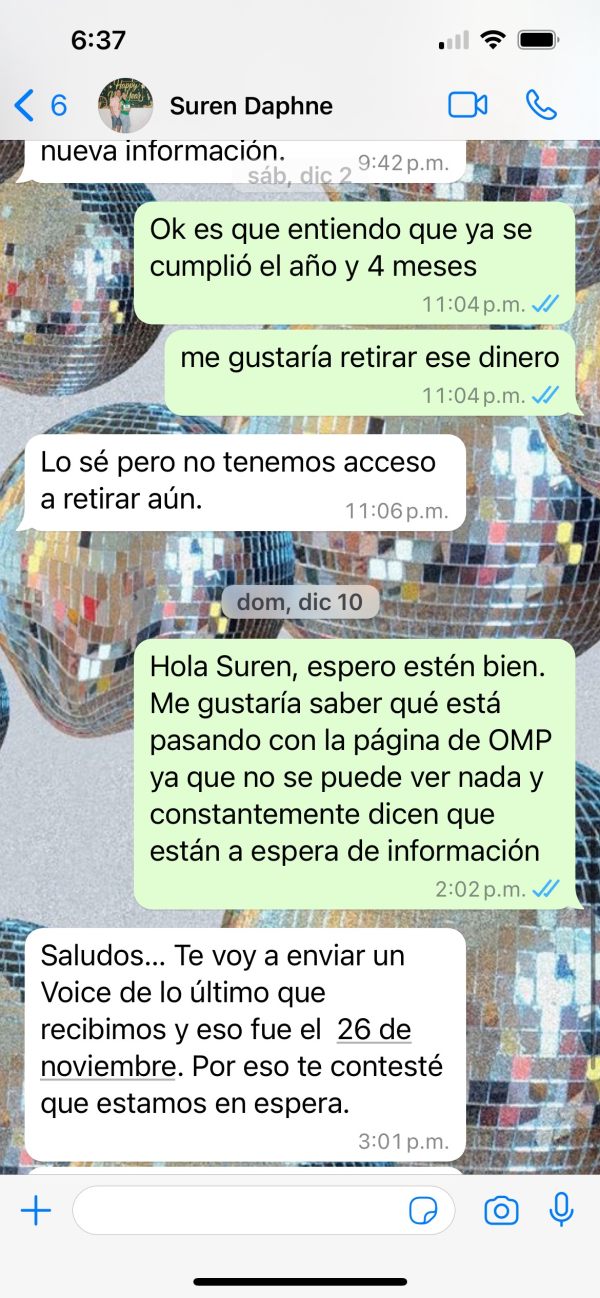

User complaints consistently mention challenges in fund recovery, with testimonials describing months-long attempts to withdraw investments without success or adequate support. One user specifically stated, "I made an investment in omega pro and to date I have not been able to recover my money," indicating systemic customer service failures in handling withdrawal requests and basic account management needs.

The platform does not clearly outline available customer support channels, response timeframes, or escalation procedures anywhere in accessible documentation. Standard customer service features like live chat availability, phone support hours, or ticket systems are not documented in accessible materials, creating uncertainty about how users can seek help when problems arise.

Multiple user testimonials describe being assigned to representatives who encourage additional investments rather than addressing existing concerns about withdrawals or account issues. This pattern suggests a customer service model prioritizing new deposits over existing customer satisfaction and legitimate withdrawal requests, which is inconsistent with legitimate financial service operations.

The absence of clear complaint resolution procedures and the prevalence of user reports about unresponsive support creates significant concerns. These issues raise questions about the platform's commitment to customer service excellence and regulatory compliance standards that legitimate brokers must maintain.

Trading Experience Analysis (Score: 3/10)

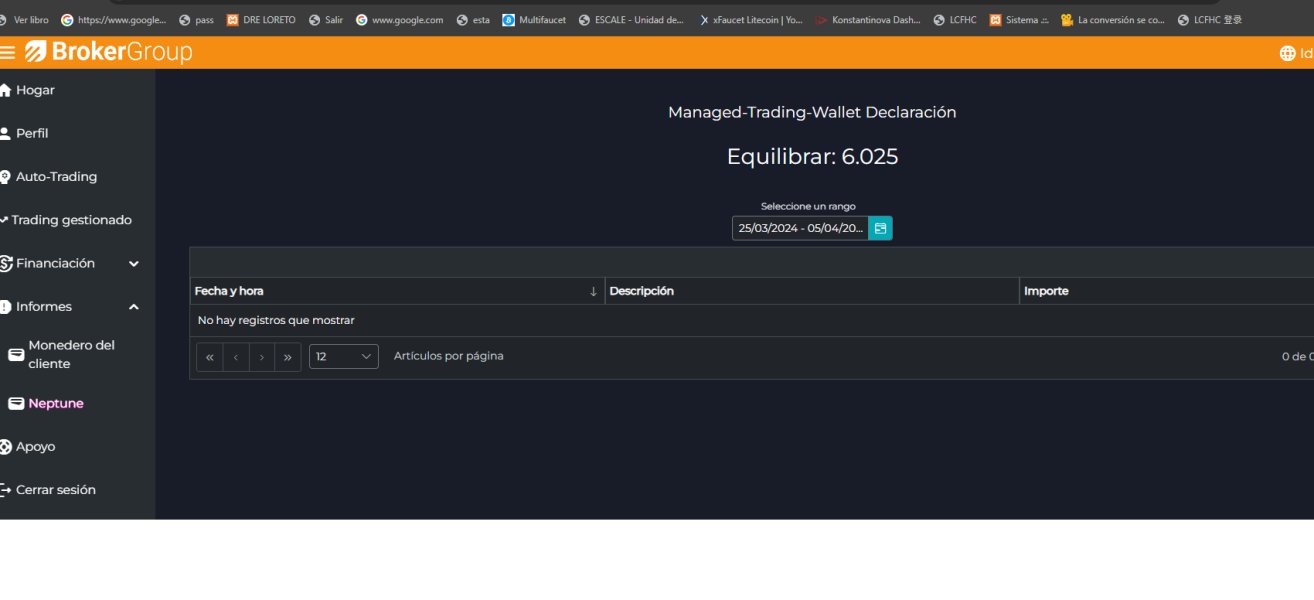

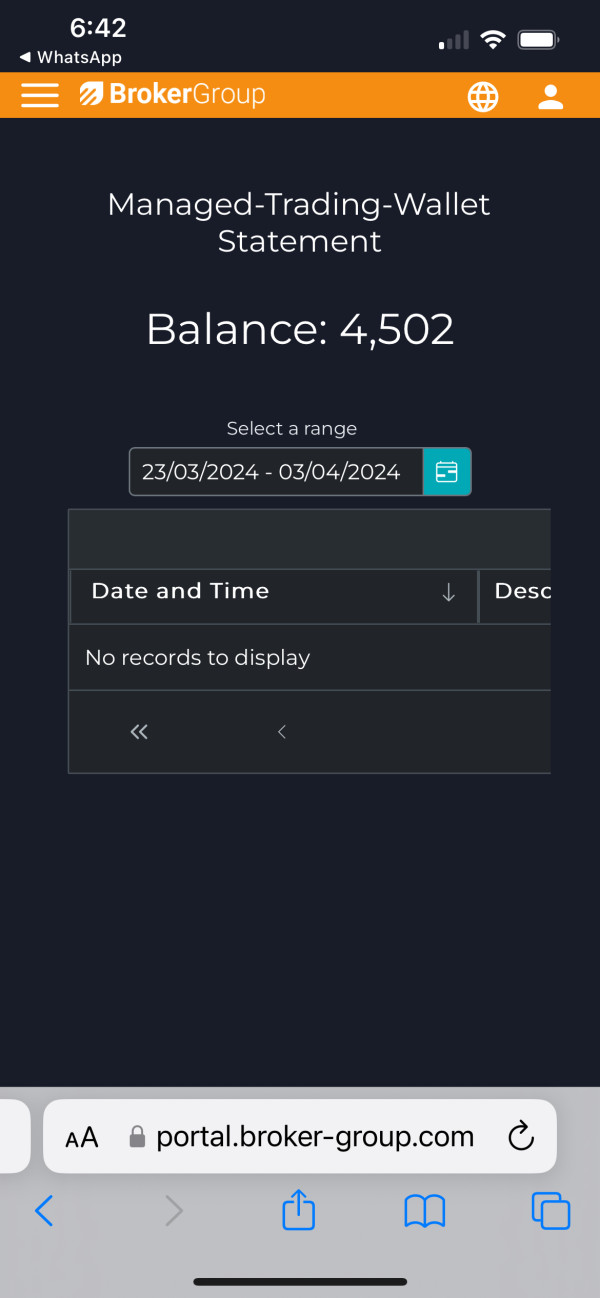

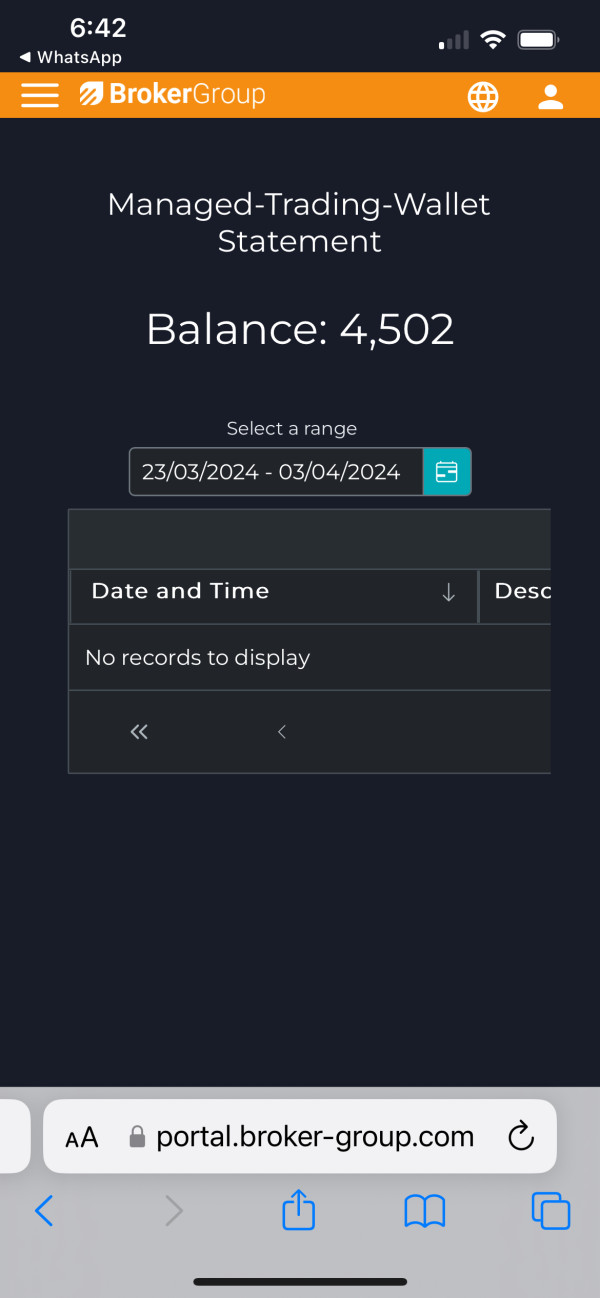

The overall trading experience on Omega Pro appears compromised by fundamental operational issues and lack of transparency that affect daily platform use. User testimonials focus primarily on investment difficulties rather than positive trading experiences, suggesting systemic problems with the platform's core functionality. This pattern indicates that users struggle with basic platform operations rather than enjoying successful trading activities.

Platform stability and execution quality cannot be properly assessed due to the absence of detailed technical specifications or user feedback about trading performance metrics. Unlike established brokers that provide comprehensive information about order execution speeds, slippage statistics, and platform uptime, Omega Pro lacks such transparency completely, making it impossible to evaluate trading quality.

The trading environment appears primarily designed around investment packages rather than traditional forex trading. Users describe a system requiring multiple account openings and complex investment tier navigation that differs significantly from standard retail forex trading experiences. This structure may confuse users expecting conventional trading platforms with straightforward buy and sell functionality.

Mobile trading capabilities and platform accessibility are not documented in available materials anywhere. This makes it impossible to assess whether users can effectively manage positions and monitor markets across different devices, which is essential in today's mobile-first trading environment where market opportunities can arise at any time.

Most critically, user testimonials consistently highlight withdrawal difficulties that fundamentally compromise the trading experience regardless of any potential profits earned. The inability to reliably access profits or recover initial investments represents a critical failure in basic platform functionality that overshadows any potential trading features the platform might offer.

This omega pro review finds that withdrawal issues and operational opacity create a trading environment that fails to meet basic industry standards for reliability and user satisfaction.

Trustworthiness Analysis (Score: 2/10)

Omega Pro's trustworthiness faces severe challenges based on regulatory transparency, user feedback, and operational practices that raise significant red flags. The most significant concern is the complete absence of verifiable regulatory oversight despite marketing claims of being a "regulated company" that operates under proper financial authority supervision.

Legitimate forex brokers typically display regulatory licenses prominently and provide easy verification through regulatory body websites that users can independently check. Omega Pro's failure to provide such information raises immediate red flags about its legal operating status and investor protection measures that legitimate platforms must maintain.

User testimonials consistently describe experiences consistent with fraudulent operations, including withdrawal denials, unresponsive customer service, and pressure to make additional deposits rather than processing legitimate withdrawal requests. Multiple users specifically describe their experiences as potential "scams," indicating widespread trust issues among the platform's user base that extend beyond isolated incidents.

The multi-level marketing structure described by users adds additional concerns about the platform's primary business model and revenue sources. MLM elements in financial services often indicate focus on recruitment rather than legitimate trading services, further undermining trustworthiness and suggesting the platform prioritizes new user acquisition over existing customer service.

Corporate transparency is notably lacking, with no clear information about company leadership, physical addresses, or verifiable business registration details available anywhere. This absence of basic corporate information makes it impossible for users to verify the platform's legitimacy or pursue legal recourse if needed when problems arise.

The accumulation of negative user testimonials, combined with regulatory opacity and withdrawal difficulties, creates a pattern consistent with fraudulent operations. This pattern differs significantly from legitimate financial services that maintain transparency and regulatory compliance as core operational principles.

User Experience Analysis (Score: 3/10)

The overall user experience on Omega Pro appears significantly compromised by operational issues and design flaws that prioritize marketing over functionality and user satisfaction. User testimonials consistently describe frustrating experiences centered around withdrawal difficulties and unresponsive customer service rather than positive trading outcomes or successful platform interactions.

The platform's requirement for multiple account openings creates unnecessary complexity that confuses users and adds administrative burden without clear benefits. This multi-account structure appears designed to increase user investment rather than improve trading experience, suggesting user experience is secondary to revenue generation goals rather than customer satisfaction.

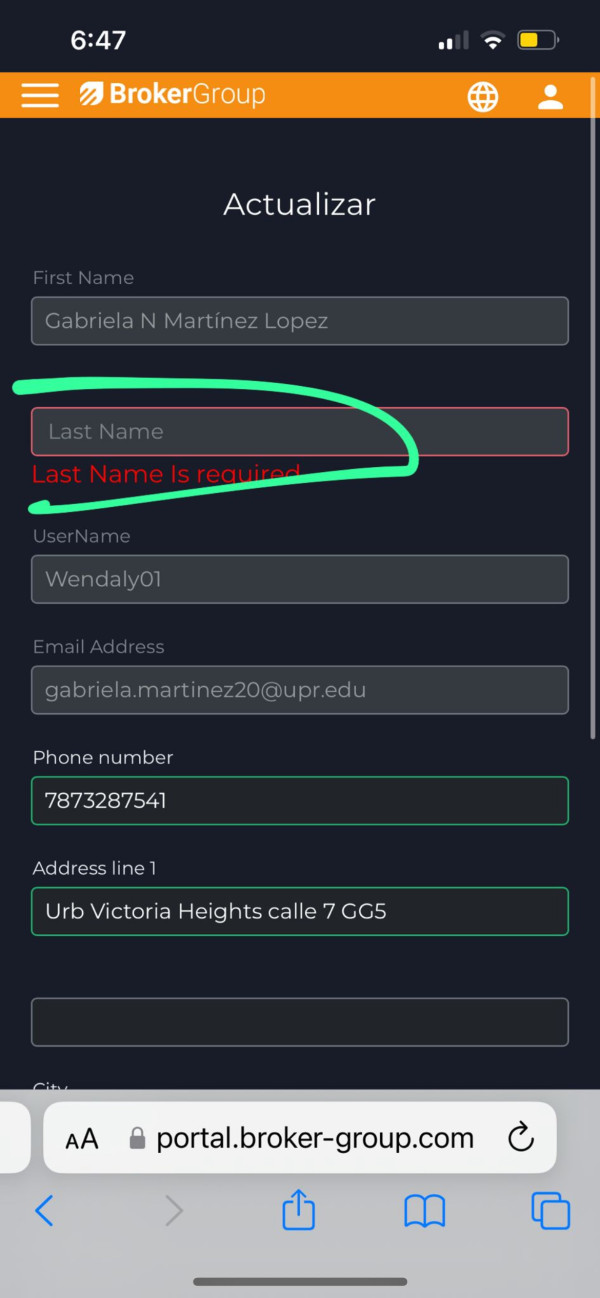

Registration and verification processes are not clearly documented, though user testimonials suggest involvement of personal representatives who guide users through complex investment tier selections. While personal guidance might seem beneficial, user reports indicate these representatives often pressure additional investments rather than providing genuine support for trading success or account management.

Fund management represents the most critical user experience failure, with consistent reports of withdrawal denials and months-long delays in fund recovery attempts. This fundamental failure in basic platform functionality creates severe user frustration and financial stress that overshadows any potential positive features the platform might offer to new users.

The absence of transparent pricing, clear terms of service, and straightforward account management tools further compromises user experience significantly. Users appear to navigate a complex system without clear understanding of costs, risks, or procedures for account management and fund recovery, creating confusion and uncertainty throughout their platform interaction.

Common user complaints center on feeling misled about the platform's legitimacy, difficulty accessing invested funds, and lack of responsive customer support when problems arise. These consistent patterns suggest systematic user experience failures rather than isolated incidents that could be resolved through improved customer service or platform updates.

Conclusion

This comprehensive omega pro review reveals a platform that presents significant risks for potential investors despite marketing claims of legitimacy and profitability. The absence of regulatory oversight, combined with consistent user complaints about withdrawal difficulties and potential fraudulent practices, creates a risk profile that far outweighs any potential benefits the platform might offer.

While the platform may appeal to newcomers through low minimum deposit requirements and promises of quick returns, the fundamental operational issues and lack of transparency suggest it operates more as an investment scheme than a legitimate trading platform. The multi-level marketing elements and pressure for multiple account openings further support concerns about the platform's true business model and primary revenue sources.

Potential users, particularly novice traders seeking entry into forex and cryptocurrency markets, should exercise extreme caution and consider regulated alternatives that provide transparent operations, reliable customer service, and verifiable regulatory protection. The consistent pattern of user complaints and withdrawal difficulties suggests that Omega Pro fails to meet basic standards for legitimate financial services and investor protection.