Sage FX 2025 Review: Everything You Need to Know

Executive Summary

Sage FX is a no-dealing desk forex broker that started in 2020. The company has its headquarters in Saint Vincent and the Grenadines. Multiple trading platform reviews show that this sage fx review reveals the broker operates as an unregulated multi-asset brokerage firm, offering traders access to forex, cryptocurrencies, indices, commodities, and stocks through the popular MetaTrader 4 platform.

The broker's main highlights include competitive leverage up to 1:500 and commission structures starting from $0. This makes it potentially attractive to various types of traders. Sage FX positions itself as a secure, no-dealing desk broker that promises to deliver value to all traders through variable spreads and multiple funding options including bank transfers, credit/debit cards, e-wallets, and cryptocurrency deposits.

The primary user base consists of traders seeking high leverage opportunities and multi-asset trading capabilities. However, as an unregulated broker, Sage FX may present certain considerations regarding regulatory oversight and investor protection that traders should carefully evaluate before opening accounts.

Important Notice

Sage FX operates as an unregulated broker. Potential clients should be aware that the company may operate under different legal frameworks across various jurisdictions. The lack of regulatory oversight means that standard investor protection measures typically provided by regulated brokers may not be available.

This review is based on available information from multiple trading analysis platforms and user feedback sources. However, given the limited regulatory transparency, this assessment may not encompass all possible trading experiences or operational aspects that individual traders might encounter when using Sage FX's services.

Rating Framework

Broker Overview

Sage FX entered the forex market in 2020. The company established its headquarters in Saint Vincent and the Grenadines. The company operates under a no-dealing desk business model, which theoretically means that client orders are passed directly to liquidity providers without the broker taking the opposite side of trades.

This approach is generally preferred by traders as it can reduce potential conflicts of interest and provide more transparent pricing. The broker has positioned itself in the competitive forex market by offering access to multiple asset classes beyond traditional currency pairs. According to trading platform analyses, Sage FX provides trading opportunities across forex, cryptocurrencies, indices, commodities, and stocks, making it a comprehensive trading destination for diversified portfolios.

The company utilizes the widely-recognized MetaTrader 4 platform. This platform has been an industry standard for over a decade. This platform choice suggests that Sage FX aims to provide familiar trading environments for both novice and experienced traders.

The broker's multi-asset approach, combined with competitive leverage offerings, appears designed to attract traders seeking variety in their trading strategies and asset allocation approaches.

Regulatory Status: Based on available information, Sage FX operates without specific regulatory oversight from major financial authorities. This unregulated status means the broker is not subject to the stringent requirements typically imposed by regulators such as the FCA, ASIC, or CySEC.

Funding Methods: The broker supports multiple deposit and withdrawal options including traditional bank transfers, credit and debit cards, various e-wallet solutions, and cryptocurrency deposits. This provides flexibility for international clients with different banking preferences.

Minimum Deposit Requirements: Specific minimum deposit amounts are not detailed in available sources. This may indicate flexible entry requirements or vary depending on account types offered.

Promotional Offers: Current bonus and promotional structures are not specified in available documentation. This suggests either absence of such programs or limited marketing of promotional activities.

Available Assets: Sage FX offers trading across five major asset categories: foreign exchange pairs, cryptocurrencies, stock indices, commodities, and individual stocks. This provides comprehensive market access for diversified trading strategies.

Cost Structure: The broker employs variable spread pricing with commission structures beginning from $0. However, specific spread ranges and commission details for different asset classes are not extensively detailed in available sources.

Leverage Options: Maximum leverage reaches 1:500. This is competitive within the industry and particularly attractive for traders seeking amplified market exposure, though this level of leverage also increases risk significantly.

Platform Technology: Sage FX exclusively offers MetaTrader 4. The company focuses on this single, well-established platform rather than diversifying across multiple trading interfaces.

Geographic Restrictions: Specific regional limitations or restricted countries are not clearly outlined in available information.

Customer Support Languages: Multi-language support capabilities are not detailed in current sources.

This comprehensive sage fx review indicates that while the broker offers competitive basic features, detailed operational information remains limited in public sources.

Account Conditions Analysis

Sage FX's account structure presents both advantages and areas requiring clarification. The broker's offering of leverage up to 1:500 positions it competitively within the high-leverage segment of the forex market, appealing particularly to traders seeking amplified market exposure. The commission structure starting from $0 suggests potential cost advantages, though the specific conditions under which zero commissions apply are not thoroughly detailed in available sources.

The variable spread model employed by Sage FX means that trading costs can fluctuate based on market conditions and liquidity. While this approach can sometimes provide tighter spreads during favorable market conditions, it also introduces uncertainty in trading cost calculations. The absence of detailed information about specific account types suggests either a simplified account structure or limited public disclosure of account variations.

The lack of clear minimum deposit requirements in available sources could indicate flexible entry barriers. This potentially makes the broker accessible to traders with varying capital levels. However, this absence of specific information also creates uncertainty for prospective clients attempting to plan their initial investment.

The broker's NDD model theoretically provides direct market access. This should result in more transparent pricing and reduced conflicts of interest. However, without regulatory oversight, the verification of this claim relies primarily on the broker's self-reporting and user experiences.

Overall, while Sage FX presents competitive leverage and commission structures, the limited transparency regarding account details and requirements represents a significant consideration in this sage fx review assessment of account conditions.

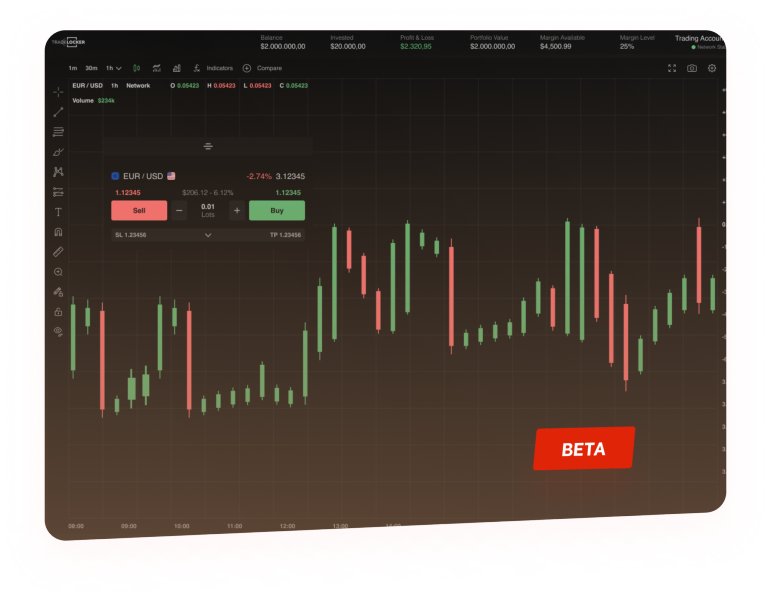

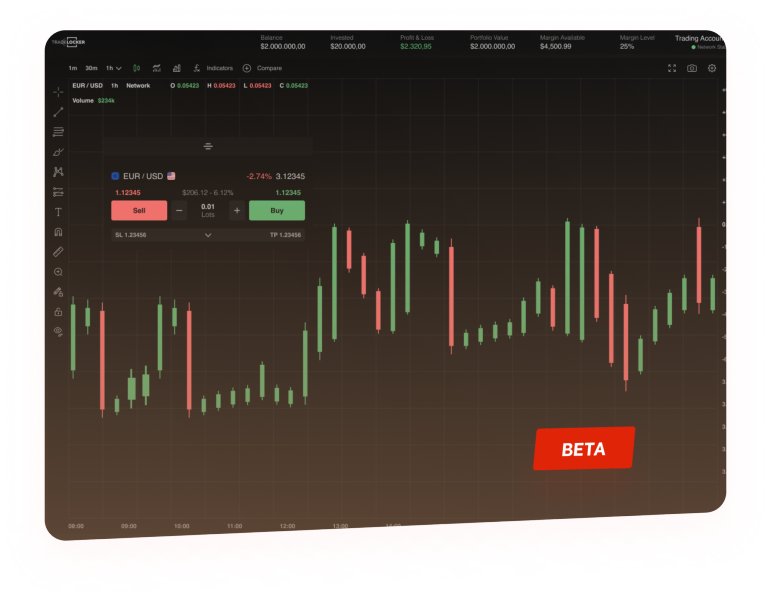

Sage FX's technology infrastructure centers around the MetaTrader 4 platform. This is a strategic choice that provides traders with a familiar and extensively tested trading environment. MT4's comprehensive feature set includes advanced charting capabilities, technical analysis tools, automated trading support through Expert Advisors, and customizable indicators, making it suitable for various trading strategies and experience levels.

The platform's stability and widespread adoption in the forex industry represent significant advantages for Sage FX users. MT4's mobile compatibility ensures that traders can access their accounts and execute trades across different devices, maintaining connectivity to markets regardless of location. The platform's support for automated trading strategies through Expert Advisors appeals to traders seeking systematic trading approaches.

However, the exclusive reliance on MT4 also presents limitations. The platform, while reliable, lacks some of the advanced features found in newer trading platforms such as MT5 or proprietary solutions offered by other brokers. Features like additional order types, more extensive fundamental analysis tools, or enhanced market depth information are not available through the MT4-only approach.

The broker's multi-asset offering through a single platform provides convenience. This allows traders to access forex, cryptocurrencies, indices, commodities, and stocks without switching between different trading interfaces. This integration can streamline portfolio management and reduce the learning curve for traders familiar with MT4.

Available information does not detail additional research resources, educational materials, or proprietary analysis tools that might complement the trading platform. The absence of information about market research, economic calendars, or educational content represents a potential gap in the broker's resource offering compared to more comprehensive broker packages.

Customer Service and Support Analysis

The evaluation of Sage FX's customer service capabilities faces significant limitations due to the absence of detailed information about support structures, availability, and service quality in publicly available sources. This lack of transparency regarding customer support represents a notable concern for potential clients who prioritize reliable assistance and communication channels.

Without specific information about available contact methods, response times, or support hours, prospective traders cannot adequately assess whether Sage FX's customer service aligns with their requirements. The absence of clearly documented support channels such as live chat, phone support, email assistance, or ticket systems creates uncertainty about how issues would be addressed.

The broker's multi-language support capabilities remain unclear. This could be particularly important for international clients who prefer assistance in their native languages. Given Sage FX's international focus and multi-regional client base, comprehensive language support would typically be expected, but verification of such services is not possible based on available information.

Response time expectations, service quality standards, and problem resolution procedures are not documented in accessible sources. These factors are crucial for traders who may need urgent assistance during volatile market conditions or when experiencing technical difficulties.

The company's self-description as promising to "deliver the best value to all traders" suggests customer-focused intentions. However, without concrete evidence of service delivery standards or user testimonials, this remains an unverified claim. The absence of detailed customer service information in this review reflects the limited publicly available data rather than confirmed service deficiencies.

Trading Experience Analysis

Sage FX's no-dealing desk model theoretically provides advantages in trade execution by routing orders directly to liquidity providers. This potentially results in faster execution speeds and reduced slippage compared to dealing desk brokers. This approach should minimize conflicts of interest since the broker profits from spreads and commissions rather than trading against clients.

The MetaTrader 4 platform offers a stable and familiar trading environment with comprehensive order management capabilities. The platform's reliability and extensive feature set contribute positively to the overall trading experience, providing tools for technical analysis, automated trading, and portfolio management. MT4's proven track record in the forex industry suggests that basic platform functionality should meet standard trading requirements.

Variable spreads mean that trading costs can fluctuate based on market conditions. This potentially provides opportunities for lower costs during favorable market periods while also introducing uncertainty in cost calculations. The commission structure starting from $0 appears competitive, though specific conditions and asset-class variations are not detailed in available sources.

The high leverage availability up to 1:500 enables significant position sizing relative to account capital. This appeals to traders seeking amplified market exposure. However, this level of leverage also substantially increases risk, requiring careful risk management practices from users.

Mobile trading capabilities through MT4's mobile applications should provide flexibility for traders requiring access to markets while away from desktop computers. The platform's cross-device synchronization helps maintain consistent trading experiences across different access points.

However, the absence of detailed information about execution speeds, slippage statistics, or server uptime creates uncertainty about actual trading performance. Without regulatory oversight or third-party verification of execution quality claims, traders must rely on the broker's representations and personal experience.

Trust Factor Analysis

The trust evaluation of Sage FX faces significant challenges due to the broker's unregulated status. This represents the most substantial concern in assessing reliability and safety. Operating without oversight from established financial regulators such as the FCA, ASIC, CySEC, or other recognized authorities means that standard investor protection measures typically required by regulated brokers are not guaranteed.

The absence of regulatory oversight eliminates several key protective mechanisms including segregated client funds, compensation schemes, regular financial audits, and standardized complaint resolution procedures. These protections are fundamental components of regulated broker operations and their absence significantly impacts the overall trust assessment.

Sage FX's establishment in Saint Vincent and the Grenadines, while legitimate, places the company in a jurisdiction known for lighter regulatory requirements compared to major financial centers. This jurisdictional choice, combined with the unregulated status, raises questions about the level of operational oversight and financial transparency maintained by the company.

The limited availability of detailed company information, financial statements, or third-party audits in public sources further compounds trust concerns. Established, regulated brokers typically provide extensive transparency about their operations, financial standing, and regulatory compliance status.

User feedback and independent reviews that could provide insight into the broker's reliability and trustworthiness are not readily available in sufficient detail to form comprehensive assessments. The absence of substantial user testimonials or independent evaluations makes it difficult to verify the company's operational claims and service delivery.

Without regulatory backing or comprehensive third-party validation, potential clients must rely primarily on the broker's self-reported information and limited available user experiences when assessing trustworthiness.

User Experience Analysis

The assessment of Sage FX's user experience faces limitations due to insufficient publicly available user feedback and detailed operational information. The broker's choice to utilize MetaTrader 4 as its primary platform suggests an intention to provide familiar trading environments, as MT4's widespread adoption means many traders already possess familiarity with its interface and functionality.

The multi-asset trading capability through a single platform potentially streamlines the user experience by eliminating the need to navigate multiple trading interfaces for different asset classes. This integration could appeal to traders seeking simplified portfolio management across forex, cryptocurrencies, indices, commodities, and stocks.

However, the exclusive reliance on MT4 also limits user choice in trading platforms. Some traders might prefer more modern interfaces, advanced features available in newer platforms, or proprietary solutions that offer unique functionality. The single-platform approach may not accommodate all user preferences or trading styles.

The registration and account verification processes are not detailed in available sources. This makes it impossible to assess the efficiency and user-friendliness of onboarding procedures. Similarly, fund deposit and withdrawal experiences, which significantly impact overall user satisfaction, lack sufficient documentation for comprehensive evaluation.

The absence of detailed information about user interface customization options, educational resources, or customer support quality creates gaps in understanding the complete user journey. These factors typically play crucial roles in determining overall satisfaction and long-term user retention.

The broker's targeting of traders seeking high leverage and multi-asset access suggests a focus on experienced traders who prioritize trading conditions over comprehensive support services. However, without substantial user testimonials or independent reviews, verification of actual user satisfaction levels remains challenging.

Conclusion

This sage fx review presents a mixed assessment of the broker's offerings. Sage FX demonstrates competitive features in certain areas, particularly regarding leverage options up to 1:500 and commission structures starting from $0, combined with multi-asset trading capabilities through the reliable MetaTrader 4 platform. The no-dealing desk model theoretically provides advantages in execution and pricing transparency.

However, significant concerns emerge from the broker's unregulated status, which eliminates standard investor protections and regulatory oversight typically expected in the forex industry. The limited availability of detailed operational information, user feedback, and transparency regarding company practices creates additional uncertainty for potential clients.

Sage FX appears most suitable for experienced traders who prioritize high leverage access and multi-asset trading capabilities while accepting the risks associated with unregulated brokers. The broker's offerings may appeal to traders comfortable with managing elevated risk levels in exchange for potentially favorable trading conditions, though careful due diligence and risk management practices become even more critical given the regulatory circumstances.