Regarding the legitimacy of HYCM forex brokers, it provides FCA and WikiBit, (also has a graphic survey regarding security).

Is HYCM safe?

Pros

Cons

Is HYCM markets regulated?

The regulatory license is the strongest proof.

FCA Market Making License (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

HYCM CAPITAL MARKETS (UK) LIMITED

Effective Date:

2001-12-01Email Address of Licensed Institution:

compliance@hycm.com, katerina.oikonomou@uk.hycm.comSharing Status:

No SharingWebsite of Licensed Institution:

www.hycm.co.ukExpiration Time:

--Address of Licensed Institution:

HYCM Capital Markets (UK) Limited 27-28 Clement’s Lane St Clements House London EC4N 7AE UNITED KINGDOMPhone Number of Licensed Institution:

+442039067347Licensed Institution Certified Documents:

Is HYCM A Scam?

Introduction

HYCM, or Henyep Capital Markets, is a prominent player in the forex and CFD trading landscape, boasting over 40 years of experience. Established in 1977, it has evolved from a gold dealer in Hong Kong to a multifaceted trading broker with a global reach. With its headquarters in London and offices in various financial hubs, HYCM caters to a diverse clientele, offering a range of trading instruments including forex, stocks, indices, commodities, and cryptocurrencies. Given the rapid growth of online trading and the proliferation of brokers, traders must exercise caution when selecting a trading partner. Evaluating a broker's legitimacy is crucial, as the industry can harbor unscrupulous entities that may engage in fraudulent practices.

This article aims to provide a comprehensive analysis of HYCM's credibility, examining its regulatory status, company background, trading conditions, customer safety measures, and user experiences. The investigation draws on multiple sources, including regulatory filings, user reviews, and expert analyses, to deliver an objective assessment of whether HYCM operates as a legitimate broker or poses risks to its clients.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its legitimacy. HYCM is regulated by several reputable authorities across different jurisdictions, which adds a layer of security for its clients. Below is a summary of HYCM's regulatory information:

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| Financial Conduct Authority (FCA) | 186171 | United Kingdom | Verified |

| Cyprus Securities and Exchange Commission (CySEC) | 259/14 | Cyprus | Verified |

| Cayman Islands Monetary Authority (CIMA) | 1442313 | Cayman Islands | Verified |

| Dubai Financial Services Authority (DFSA) | F000048 | Dubai | Verified |

The presence of multiple regulatory licenses indicates that HYCM adheres to stringent compliance standards, which is essential for protecting client funds and ensuring fair trading practices. The FCA, for instance, is known for its rigorous oversight and requires brokers to maintain high levels of financial transparency and customer protection. The CySEC also mandates that client funds be kept in segregated accounts, further enhancing safety.

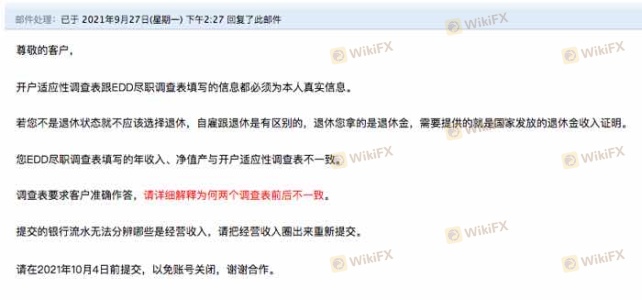

Historically, HYCM has maintained a solid compliance record under these regulators, which is crucial for building trust among traders. However, it is important to note that HYCMs European entity recently renounced its CySEC license, which means it no longer accepts clients from the EU. This development may raise concerns for potential clients in those regions, as it could limit their access to regulatory protections typically afforded to EU-based traders.

Company Background Investigation

HYCM has a rich history dating back to its inception as a gold dealer in Hong Kong. Over the decades, it has transitioned into a comprehensive financial services provider, becoming part of the Henyep Group, which operates in various sectors including education and real estate. This extensive background contributes to HYCM's credibility, as it demonstrates a sustained commitment to the financial markets.

The management team at HYCM is composed of experienced professionals with extensive backgrounds in finance and trading. This expertise is vital for navigating the complexities of the forex market and ensuring that the broker meets the evolving needs of its clients. Furthermore, the company's commitment to transparency is reflected in its regular disclosures regarding financial performance and operational practices, which help build trust among its user base.

In terms of corporate governance, HYCM adheres to high standards of accountability, which is essential for maintaining regulatory compliance. The companys operations are regularly audited by external firms, ensuring that its financial practices align with industry standards. This level of oversight is crucial for safeguarding client interests and maintaining a transparent trading environment.

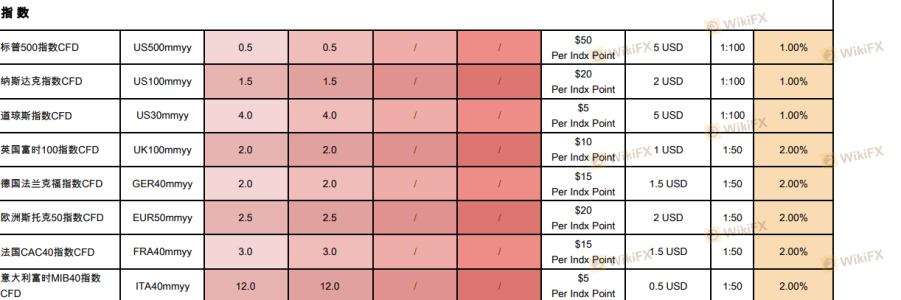

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is essential for assessing overall value. HYCM offers a competitive fee structure that appeals to a wide range of traders. The broker provides three account types: Fixed, Classic, and Raw, each designed to cater to different trading styles and preferences.

Fee Structure Comparison

| Fee Type | HYCM | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 1.2 pips | 1.5 pips |

| Commission Model | $4 (Raw Account) | Varies (typically $5) |

| Overnight Interest Range | Varies by instrument | Varies by broker |

The Fixed Account offers spreads starting from 1.8 pips with no commissions, making it suitable for beginners who prefer predictable costs. The Classic Account features variable spreads starting from 1.2 pips, which may appeal to casual traders. The Raw Account is tailored for experienced traders seeking tighter spreads, starting from 0.2 pips, but incurs a commission of $4 per round turn.

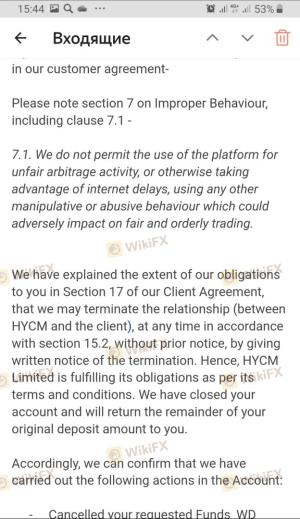

While the spreads are competitive, it is essential for traders to be aware of any potential hidden fees, such as withdrawal fees or inactivity fees. HYCM charges a $10 monthly inactivity fee after three months of inactivity, which may be a drawback for infrequent traders. Overall, HYCM's fee structure is generally favorable compared to industry averages, but traders should remain vigilant about any additional costs that may arise.

Client Funds Safety

Client fund safety is paramount when selecting a broker. HYCM implements several measures to ensure the security of its clients' funds. One of the key practices is the segregation of client funds, which means that client deposits are held in separate accounts from the company's operational funds. This practice is crucial for protecting client assets in the event of financial difficulties faced by the broker.

Additionally, HYCM offers negative balance protection, which prevents clients from losing more than their initial investment. This feature is particularly important in the highly leveraged environment of forex trading, where market fluctuations can lead to significant losses. The presence of regulatory oversight from reputable authorities such as the FCA and CySEC further enhances the safety of client funds, as these regulators impose strict requirements on brokers regarding capital reserves and operational practices.

Despite these safeguards, it is essential for traders to remain informed about any historical issues related to fund security. Currently, there are no significant controversies or allegations against HYCM regarding the mishandling of client funds, which is a positive indicator of its operational integrity.

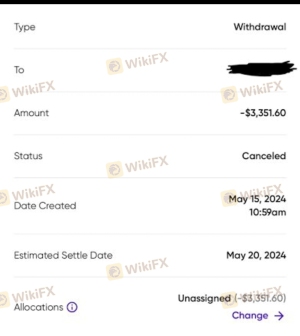

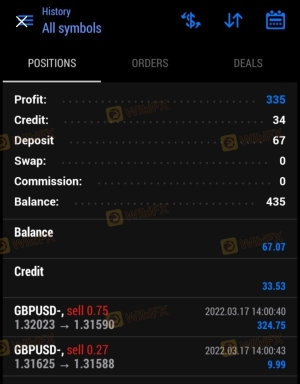

Customer Experience and Complaints

Analyzing customer feedback provides valuable insights into the overall trading experience with HYCM. User reviews indicate a mixed but generally favorable perception of the broker. Many clients appreciate the user-friendly trading platforms and responsive customer support, which is available in multiple languages. However, some common complaints have been noted.

Common Complaint Types

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | Medium | Generally responsive |

| Account Restrictions | High | Slow resolution |

| Customer Support Availability | Medium | Limited hours |

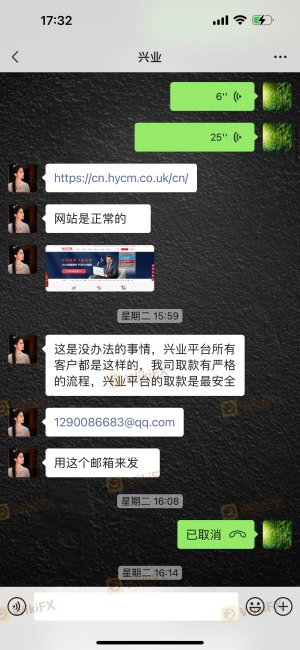

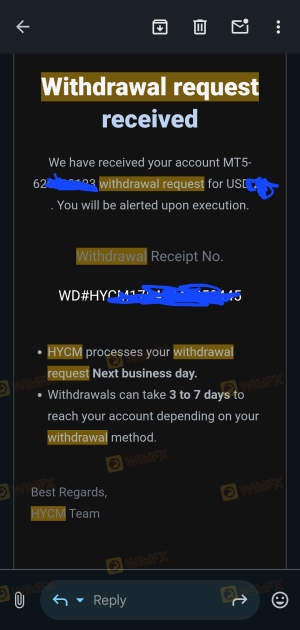

For instance, several users have reported delays in the withdrawal process, which can be frustrating for traders expecting timely access to their funds. While HYCM typically processes withdrawal requests within one business day, external factors such as banking procedures may extend this timeframe.

Additionally, some clients have expressed concerns about account restrictions, particularly regarding sudden limitations on trading activity. Although HYCM has a generally positive reputation for customer support, the responses to these complaints can vary in speed and effectiveness.

Platform and Trade Execution

The performance of trading platforms is a critical aspect of the trading experience. HYCM offers both the widely used MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, both of which are known for their reliability and advanced features.

Traders report that the platforms are stable and user-friendly, providing access to a wide range of trading tools and resources. The execution quality is generally high, with minimal slippage reported. However, it is essential for traders to remain vigilant for any signs of platform manipulation, such as unexpected price changes or order rejections.

Risk Assessment

Using HYCM as a trading partner comes with inherent risks, as is the case with any broker. Traders should be aware of the following key risk areas:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Compliance | Medium | Dependence on multiple regulators can lead to inconsistencies. |

| Withdrawal Processing | Medium | Delays may occur, impacting liquidity. |

| Market Volatility | High | High leverage can amplify losses. |

To mitigate these risks, traders are advised to maintain a diversified portfolio, use risk management strategies, and remain informed about market conditions. Additionally, it is prudent to familiarize oneself with HYCM's policies regarding withdrawals and account management to avoid any unexpected issues.

Conclusion and Recommendations

In conclusion, HYCM is not a scam; it is a well-established broker with a long history of operation and multiple regulatory licenses. While it offers competitive trading conditions and robust security measures for client funds, traders should remain cautious and informed about the potential risks associated with trading.

For those considering HYCM, it is advisable to conduct thorough research based on individual trading needs and risk tolerance. Beginners may find the Fixed or Classic accounts suitable, while experienced traders might prefer the Raw account for its tighter spreads.

If you are seeking alternatives, consider brokers like AvaTrade or FXPro, which also offer comprehensive services and are well-regulated. Ultimately, the choice of broker should align with your trading style, goals, and the level of risk you are willing to accept.

Is HYCM a scam, or is it legit?

The latest exposure and evaluation content of HYCM brokers.

HYCM Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

HYCM latest industry rating score is 7.20, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.20 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.