Regarding the legitimacy of AXIORY forex brokers, it provides CYSEC and WikiBit, (also has a graphic survey regarding security).

Is AXIORY safe?

Pros

Cons

Is AXIORY markets regulated?

The regulatory license is the strongest proof.

CYSEC Forex Execution License (STP)

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

UnverifiedLicense Type:

Forex Execution License (STP)

Licensed Entity:

L.F. Investment Ltd

Effective Date:

2015-04-06Email Address of Licensed Institution:

office@purple-trading.comSharing Status:

No SharingWebsite of Licensed Institution:

www.purple-trading.comExpiration Time:

--Address of Licensed Institution:

11 Louki Akrita, 4044, Germasoyia, LimassolPhone Number of Licensed Institution:

+357 25 030 444Licensed Institution Certified Documents:

Is Axiory A Scam?

Introduction

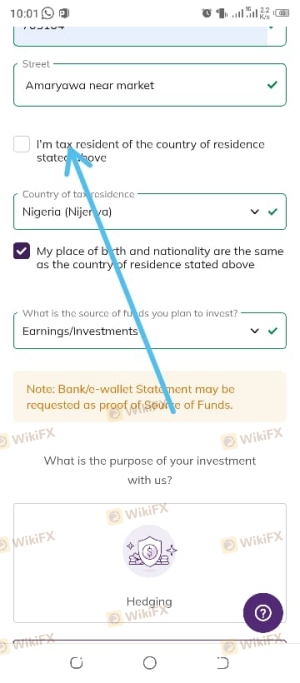

Axiory is a global forex and CFD broker that was established in 2011, primarily based in Belize. It offers a range of trading instruments, including major currency pairs, commodities, and indices, with a focus on providing a transparent trading environment. However, as the forex market is rife with both reputable and dubious brokers, it is crucial for traders to carefully evaluate any broker before committing their funds. This article aims to assess the legitimacy of Axiory by analyzing its regulatory status, company background, trading conditions, and customer experiences. The information presented is derived from various reviews and reports available online, ensuring a comprehensive assessment.

Regulation and Legitimacy

The regulatory environment in which a broker operates is a key indicator of its legitimacy and reliability. Axiory is regulated by the International Financial Services Commission (IFSC) of Belize and the Financial Services Commission (FSC) of Mauritius. Below is a summary of Axiory's regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| IFSC | 000122/15 | Belize | Verified |

| FSC | GB21026376 | Mauritius | Verified |

The IFSC is considered a tier-3 regulator, which means it has less stringent requirements compared to tier-1 regulators such as the FCA or ASIC. However, Axiory's compliance with IFSC regulations indicates that it adheres to certain operational standards. Additionally, Axiory is a member of the Financial Commission, which offers a compensation fund of up to $20,000 for clients in case of broker insolvency. This membership adds a layer of security for traders, as it provides a mechanism for dispute resolution and client fund protection.

Despite the regulatory oversight, the offshore nature of Axiorys licensing may raise concerns among some traders, as offshore jurisdictions have historically attracted less scrupulous brokers. However, recent reforms in Belize's regulatory framework have heightened the standards for obtaining a forex trading license, thereby improving the overall credibility of brokers registered there.

Company Background Investigation

Axiory has a decade-long history in the forex trading industry. Founded in 2011, it has grown from a small operation in Belize to a global broker with representative offices in various locations, including Dubai. The company's ownership structure is not publicly disclosed, which can be a red flag for some traders seeking transparency.

The management team at Axiory includes experienced professionals who have backgrounds in finance and trading. This expertise is crucial as it guides the company's operational strategies and customer service approaches. Axiory promotes transparency in its operations, providing detailed information about its services and trading conditions on its website. The broker has also received several awards, including recognition for its customer service and educational resources, which further enhances its reputation in the industry.

Despite these positive aspects, the lack of detailed ownership information may lead some traders to question the overall transparency of the broker. Nevertheless, Axiory appears to prioritize client relationships and has made efforts to establish a trustworthy brand in the competitive forex market.

Trading Conditions Analysis

Axiory offers a variety of trading accounts, each with different conditions and fee structures. The broker's overall fee structure is competitive, particularly for those looking to trade forex and CFDs. Below is a comparison of core trading costs:

| Fee Type | Axiory | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.2 pips (Nano Account) | From 0.1 pips |

| Commission Model | $6 per lot (Nano Account) | Varies, typically $3-$10 |

| Overnight Interest Range | Varies based on position | Varies based on position |

The spreads offered by Axiory are competitive, especially for the Nano account, which provides access to low spreads with a commission charge. However, traders should be aware that the average spread can increase, especially during volatile market conditions. The commission structure is straightforward, but traders should take note of any additional fees that may apply, particularly for specific account types or trading instruments.

Axiory also offers a demo account, allowing traders to practice trading without risking real money. This is an excellent feature for beginners who wish to familiarize themselves with the trading platform and develop their trading strategies before committing capital.

Customer Fund Safety

Safety of client funds is paramount when choosing a forex broker. Axiory employs several measures to ensure the security of its clients' funds. The broker segregates client funds from its operational funds, holding them in separate bank accounts. This practice is essential for protecting client assets in the event of financial difficulties faced by the broker.

Additionally, Axiory offers negative balance protection, which means that clients cannot lose more money than they have deposited in their trading accounts. This feature is particularly beneficial for traders who use high leverage, as it mitigates the risk of significant losses during volatile market conditions.

Despite these safety measures, potential clients should be aware of the inherent risks associated with trading in the forex market. While Axiory has not reported any significant security breaches or fund safety issues, traders should remain vigilant and monitor their accounts regularly.

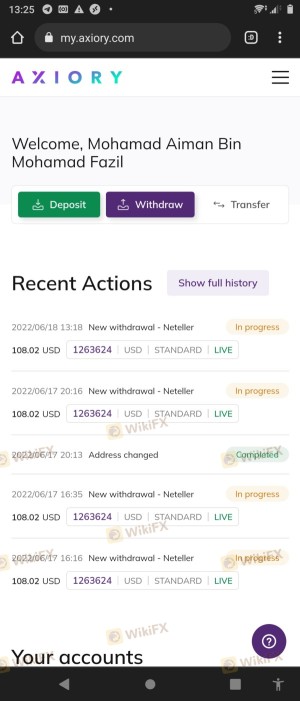

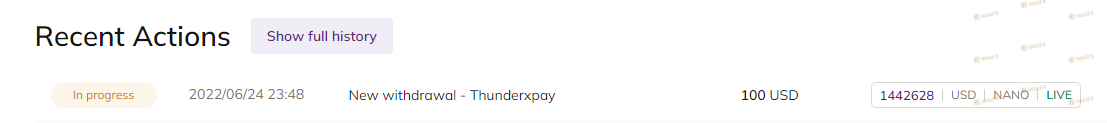

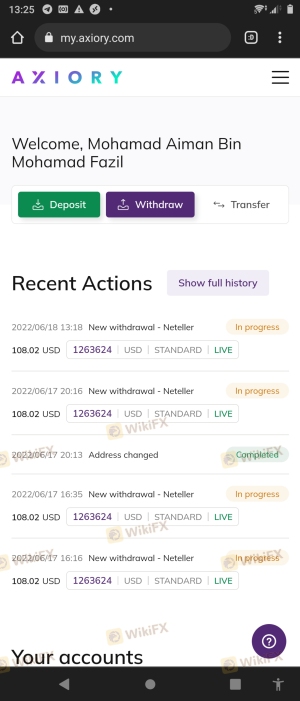

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing the reliability of a broker. Axiory has received mixed reviews from clients, with many praising its customer support and trading conditions, while others have raised concerns about withdrawal processes and account management. Below is a summary of common complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | Moderate | Generally responsive |

| Platform Stability | High | Under investigation |

| Customer Support Issues | Low | Quick response times |

One typical case involved a trader who experienced delays in withdrawing funds, citing that the process took longer than expected. Axiory's customer support team responded promptly, ensuring that the issue was addressed. However, such complaints highlight the need for potential traders to be aware of the withdrawal timelines and procedures before opening an account.

Platform and Trade Execution

Axiory provides access to several trading platforms, including MetaTrader 4, MetaTrader 5, and cTrader. These platforms are known for their user-friendly interfaces and robust trading tools. The broker claims to offer fast order execution with minimal slippage, which is essential for traders who rely on precise entry and exit points.

However, some users have reported instances of platform instability, particularly during high volatility periods. This can lead to rejected orders or delays in trade execution, which may adversely affect trading performance. Traders should consider these factors when evaluating whether Axiory's platforms meet their trading needs.

Risk Assessment

Trading with Axiory presents certain risks, as is the case with any forex broker. Below is a summary of the key risks associated with trading with Axiory:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Offshore regulation may pose risks |

| Withdrawal Risk | Medium | Delays reported by some clients |

| Platform Risk | High | Instances of instability noted |

To mitigate these risks, traders should ensure they fully understand the brokers terms and conditions, maintain regular communication with customer support, and consider using a demo account to familiarize themselves with the trading environment before committing significant capital.

Conclusion and Recommendations

In conclusion, Axiory is not a scam, but potential clients should exercise caution. The broker is regulated by the IFSC and FSC, which provides a degree of legitimacy, but it operates within offshore jurisdictions that may not offer the same level of protection as tier-1 regulators. While Axiory has implemented several safety measures to protect client funds, including negative balance protection and fund segregation, traders should be aware of the mixed customer feedback regarding withdrawal processes and platform stability.

For beginner traders or those looking for a reliable forex broker, Axiory may be a suitable option, especially for those who appreciate competitive spreads and a user-friendly trading environment. However, more experienced traders or those dealing with larger sums may want to consider brokers with stronger regulatory oversight and a more extensive range of trading instruments.

Overall, Axiory offers a solid trading experience but comes with inherent risks typical of offshore brokers. Potential clients are encouraged to conduct their own research and consider alternative brokers with stronger regulatory frameworks if they seek a higher level of security and reliability.

Is AXIORY a scam, or is it legit?

The latest exposure and evaluation content of AXIORY brokers.

AXIORY Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

AXIORY latest industry rating score is 2.45, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.45 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.