Is Zion safe?

Business

License

Is Zion Safe or Scam?

Introduction

Zion is an online forex broker that has recently drawn attention in the trading community. As a relatively new player in the foreign exchange market, it positions itself as a provider of various financial instruments, including forex pairs, commodities, and indices. However, the importance of thoroughly evaluating forex brokers cannot be overstated. Traders need to ensure that their chosen broker is legitimate and safe to protect their investments and personal information. In this article, we will investigate Zion's safety and legitimacy through a comprehensive analysis of its regulatory status, company background, trading conditions, customer feedback, and overall risk assessment.

To conduct this investigation, we utilized a range of online resources, including regulatory databases, user reviews, and expert analyses. Our evaluation framework focuses on key areas that directly impact the safety and reliability of a forex broker, allowing potential traders to make informed decisions.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical indicator of its legitimacy. A well-regulated broker is required to adhere to strict legal and operational standards, providing a layer of protection for clients. Unfortunately, Zion operates without any valid regulatory oversight, which raises significant concerns regarding its safety.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | 0538960 | United States | Unauthorized |

As seen in the table above, Zion claims to be regulated by the National Futures Association (NFA); however, this claim is false, as the NFA does not recognize Zion as an authorized broker. This lack of regulation means that there is no oversight of its operations, which can lead to potential misconduct and increased risks for traders. Furthermore, the absence of regulatory protection mechanisms, such as investor compensation schemes, leaves clients vulnerable in case of disputes or financial mishaps. Therefore, the question remains: Is Zion safe? The evidence suggests that it is not.

Company Background Investigation

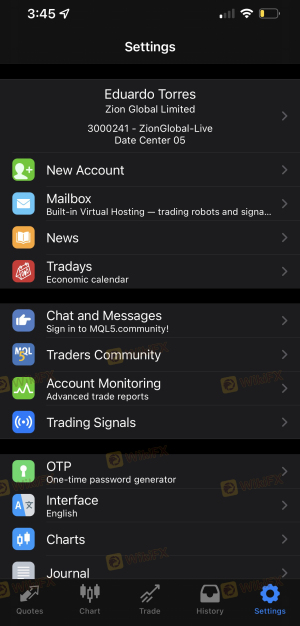

Zion is registered as Zion Global Limited and claims to be based in the United Kingdom. However, the lack of transparency surrounding its ownership and operational history raises red flags. The company has been in operation for approximately 2 to 5 years, but little information is available regarding its founders or management team.

The absence of publicly available data about the company's leadership makes it difficult to assess their expertise and experience in the forex trading industry. A reputable broker typically provides detailed information about its management team and their qualifications, fostering trust and credibility. Unfortunately, Zion's lack of transparency in this area further fuels concerns about its legitimacy and safety.

In terms of information disclosure, user reviews have pointed out that Zion's website is often inaccessible, limiting potential clients' ability to conduct proper due diligence. This lack of transparency raises significant concerns about whether Zion can be considered a safe trading environment.

Trading Conditions Analysis

When evaluating a forex broker, understanding its trading conditions is essential. Zion offers a range of trading instruments, including forex currency pairs, commodities, and indices. However, the absence of clear information regarding its fee structure and trading costs is alarming.

| Fee Type | Zion | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0 pips | 1-2 pips |

| Commission Structure | Not disclosed | Varies (typically $5-$10 per lot) |

| Overnight Interest Range | Not disclosed | Varies (depends on the broker) |

As shown in the table, while Zion advertises spreads starting from 0 pips, there is no information available regarding the commission structure or overnight interest rates. This lack of clarity can be problematic for traders looking to understand their potential costs and profitability. Moreover, the absence of a transparent fee structure can lead to unexpected charges, further questioning the broker's integrity. Hence, it is prudent for traders to ask: Is Zion safe? The lack of transparency in its trading conditions suggests that it may not be.

Customer Funds Security

The safety of customer funds is a paramount concern for any forex trader. A trustworthy broker should implement measures to protect clients' investments, including fund segregation, investor protection schemes, and negative balance protection. Unfortunately, Zion's lack of regulatory oversight means that there are no guarantees regarding the safety of client funds.

Reports indicate that Zion does not segregate client funds, which means that traders' money could be at risk in the event of the company's insolvency. Additionally, without access to investor protection schemes, clients have no recourse in case of financial disputes or broker misconduct. The absence of negative balance protection is another major concern, as it could leave traders liable for losses exceeding their deposits. Given these factors, it is crucial to consider whether Zion is safe for trading.

Customer Experience and Complaints

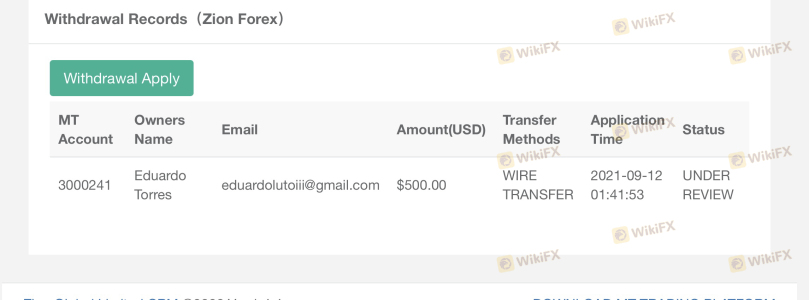

Customer feedback is an invaluable resource for assessing the reliability of a forex broker. Unfortunately, Zion has garnered a significant number of negative reviews from users, with many citing issues related to withdrawal difficulties and poor customer service.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow or unresponsive |

| Lack of Transparency | Medium | Minimal communication |

| Poor Customer Service | High | Unresolved inquiries |

Common complaints include difficulties in withdrawing funds, leading many traders to question whether Zion is a legitimate broker or a potential scam. Users have reported long wait times for withdrawal requests and a lack of communication from the support team. These issues highlight the broker's inadequate customer service and raise concerns about its overall reliability. Therefore, the question arises: Is Zion safe? The evidence points to a troubling trend of customer dissatisfaction.

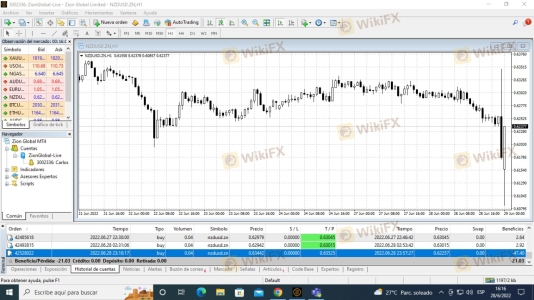

Platform and Trade Execution

The performance of a trading platform is crucial for a seamless trading experience. Zion claims to offer the widely-used MetaTrader 4 (MT4) platform, which is known for its user-friendly interface and advanced trading features. However, user reports indicate that the platform's stability and execution quality may not meet industry standards.

Traders have expressed concerns about potential slippage and order rejections, which can significantly impact trading performance. Additionally, some users have reported experiencing technical issues while using the platform, further questioning its reliability. As traders consider their options, they must ask themselves: Is Zion safe? The evidence suggests that the platform may not provide the level of reliability needed for successful trading.

Risk Assessment

Engaging with an unregulated broker like Zion inherently involves a higher level of risk. The absence of regulatory oversight, coupled with the numerous complaints regarding customer service and withdrawal issues, paints a concerning picture.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | High | Potential loss of funds |

| Operational Risk | Medium | Platform issues and withdrawal delays |

Given these risks, traders should exercise extreme caution when considering Zion as a potential broker. It is advisable to conduct thorough research and seek regulated alternatives that prioritize client safety and transparency.

Conclusion and Recommendations

In conclusion, the analysis of Zion raises significant concerns about its legitimacy and safety. The lack of regulatory oversight, transparency issues, and numerous customer complaints suggest that Zion is not safe for trading. Potential traders should be wary of engaging with this broker, as it may expose them to unnecessary risks and financial loss.

For those seeking reliable trading options, it is advisable to consider well-regulated alternatives that prioritize client protection and provide transparent trading conditions. Brokers such as Axi, IronFX, and ThinkMarkets are examples of reputable firms that offer regulated trading environments, ensuring a safer experience for traders.

Ultimately, the evidence overwhelmingly indicates that Zion should be approached with caution, and potential traders must prioritize their safety by seeking out trustworthy and regulated brokers.

Is Zion a scam, or is it legit?

The latest exposure and evaluation content of Zion brokers.

Zion Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Zion latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.