USDC 2025 Review: Everything You Need to Know

Executive Summary

USD Coin has become a top stablecoin choice for forex traders and cryptocurrency investors who want stability in the volatile digital asset market. This usdc review shows that USDC offers high security standards and easy-to-use features, making it especially attractive for traders who want to connect traditional forex markets with cryptocurrency trading.

USDC is a fully-backed stablecoin that maintains a 1:1 connection to the US dollar. It gives forex traders the stability they need while offering the tech benefits of blockchain transactions. The coin has wide support across many trading platforms, including MetaTrader 5, which greatly improves its usefulness for professional traders.

USDC mainly serves forex traders and digital currency investors who value transparency, rule-following, and smooth integration across various trading platforms. Circle and Coinbase back the stablecoin, and these two major players in the crypto space provide extra trust for both institutional and retail users.

User ratings consistently show high satisfaction levels. Many platforms report scores of 9.5/10 or higher. The mix of regulatory compliance, transparent operations, and broad platform support makes USDC a reliable choice for traders who want exposure to cryptocurrency markets without typical volatility concerns.

Important Notice

Regional Regulatory Variations: USDC's regulatory status and available features may vary significantly across different jurisdictions. Traders should thoroughly research and understand the specific regulations governing stablecoin usage in their respective regions before engaging in USDC-related trading activities.

Compliance requirements, tax implications, and platform availability can differ substantially between countries and regulatory frameworks. Review Methodology: This comprehensive evaluation is based on extensive analysis of user feedback, publicly available information, platform integrations, and regulatory disclosures.

Our assessment incorporates data from multiple sources to provide a balanced perspective on USDC's capabilities and limitations as a trading instrument for forex and cryptocurrency markets.

Rating Framework

Broker Overview

Company Background and Foundation

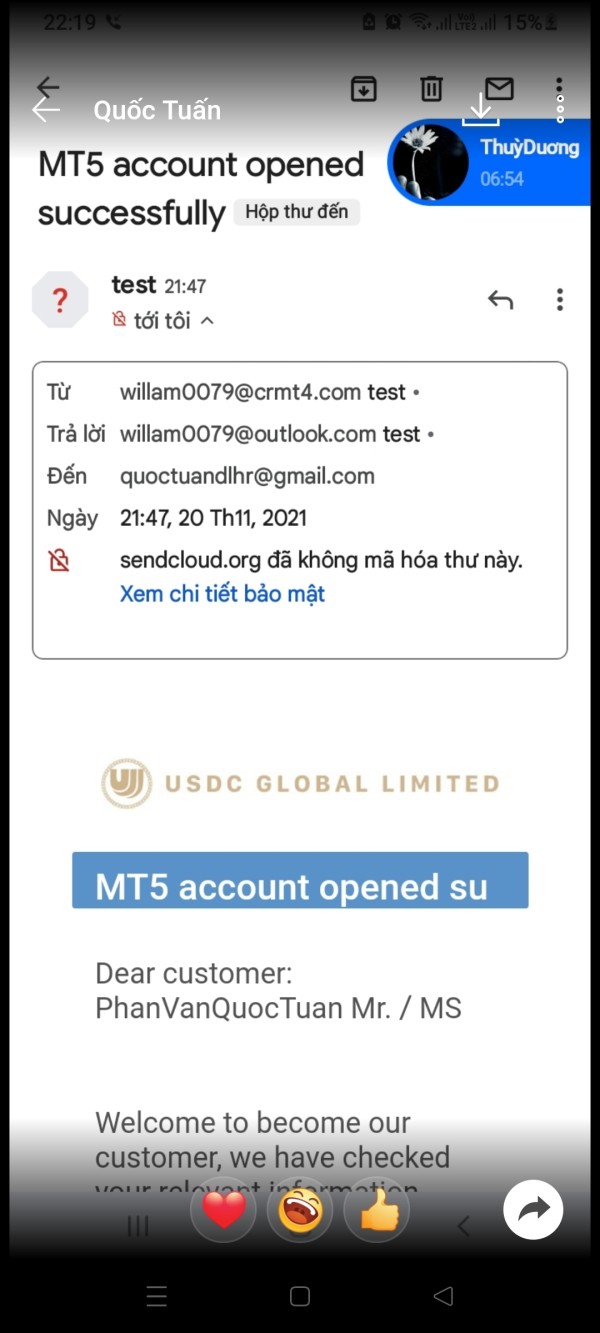

USDC emerged in 2018 as a team effort between Circle and Coinbase. These two prominent companies in the cryptocurrency world created this partnership to build a transparent, fully-backed stablecoin that could serve as a reliable bridge between traditional financial systems and the emerging digital asset economy.

The stablecoin operates under the Centre consortium framework, which establishes standards for fiat-backed digital currencies. The primary business model revolves around providing stability in the volatile cryptocurrency market while maintaining the tech advantages of blockchain-based transactions.

USDC serves as a digital dollar equivalent, allowing users to engage in cryptocurrency trading and cross-border transactions without exposure to the price volatility typically associated with digital assets like Bitcoin or Ethereum.

Platform Integration and Asset Coverage

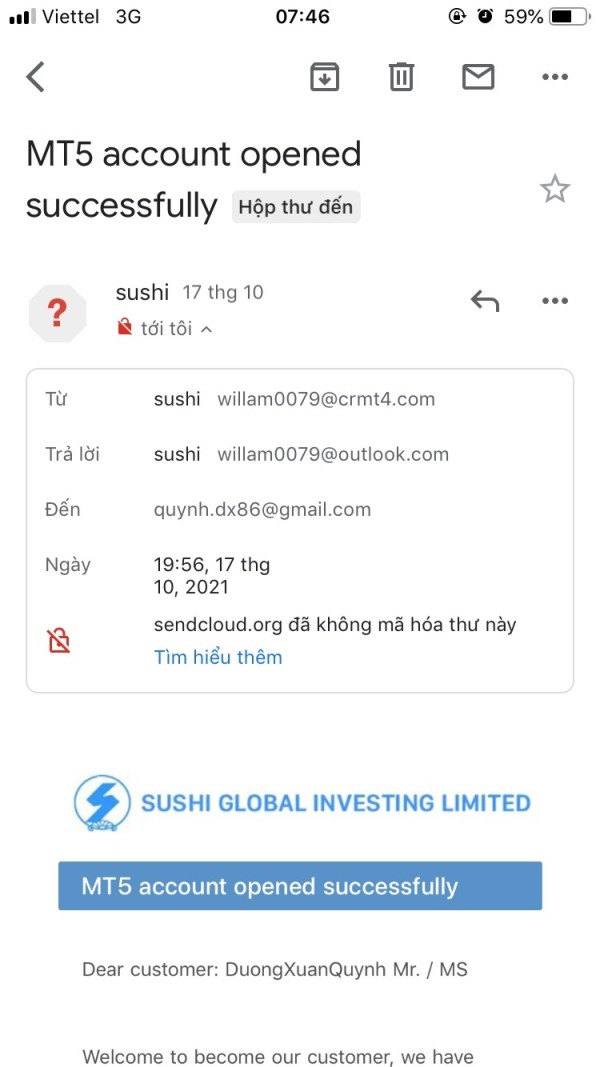

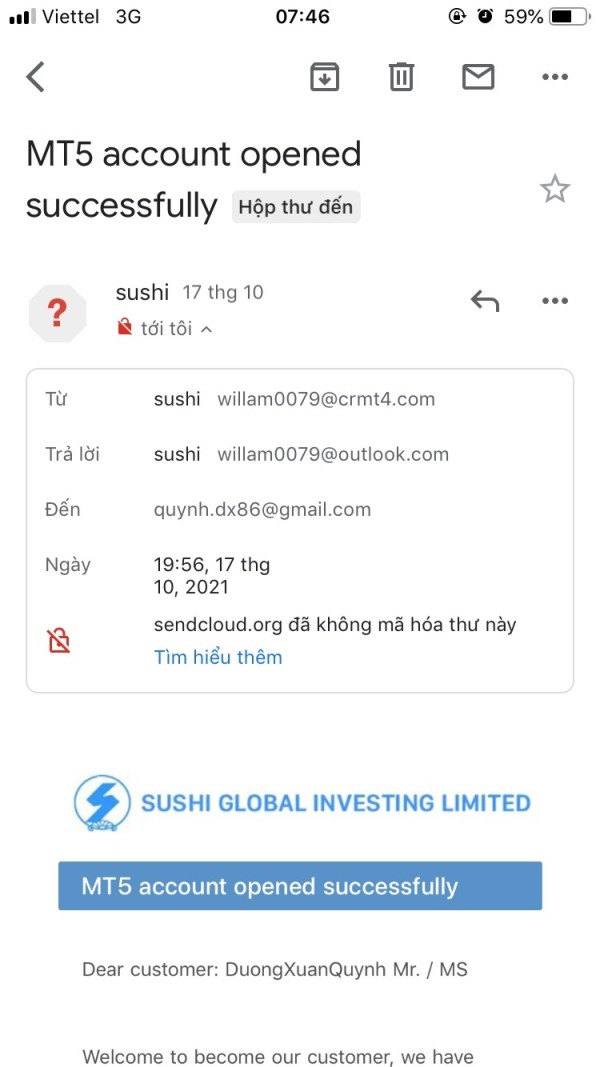

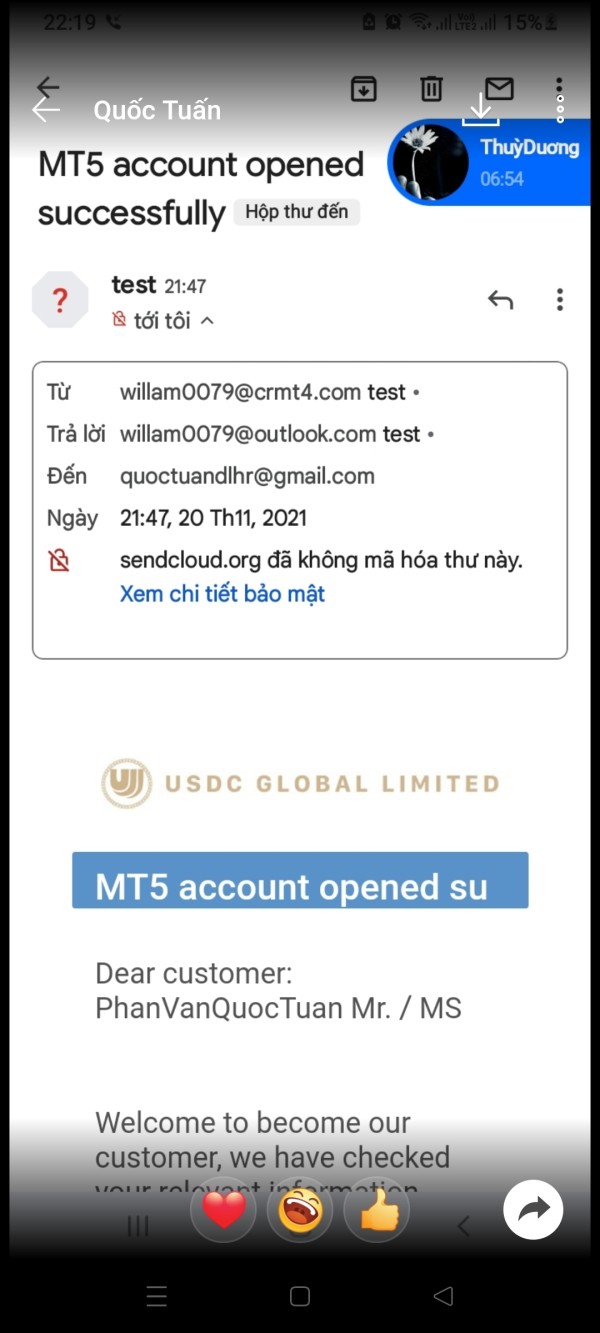

USDC demonstrates remarkable versatility through its widespread support across numerous cryptocurrency exchanges and trading platforms. The integration with MetaTrader 5 represents a significant advancement for forex traders, allowing them to incorporate stablecoin transactions into their traditional trading workflows.

This usdc review highlights that the broad platform support makes USDC accessible to diverse trading communities. The primary asset class involves digital currency trading pairs, with USDC serving as a stable base currency for various cryptocurrency transactions.

As part of the Centre consortium, USDC maintains strict compliance with relevant legal frameworks and regulatory requirements, particularly within the United States regulatory environment where both Circle and Coinbase operate under established financial oversight.

Regulatory Oversight and Compliance

USDC operates under the regulatory framework established for Circle and Coinbase in the United States. Both companies maintain compliance with applicable financial regulations and undergo regular auditing processes to ensure the full backing of issued USDC tokens with equivalent US dollar reserves.

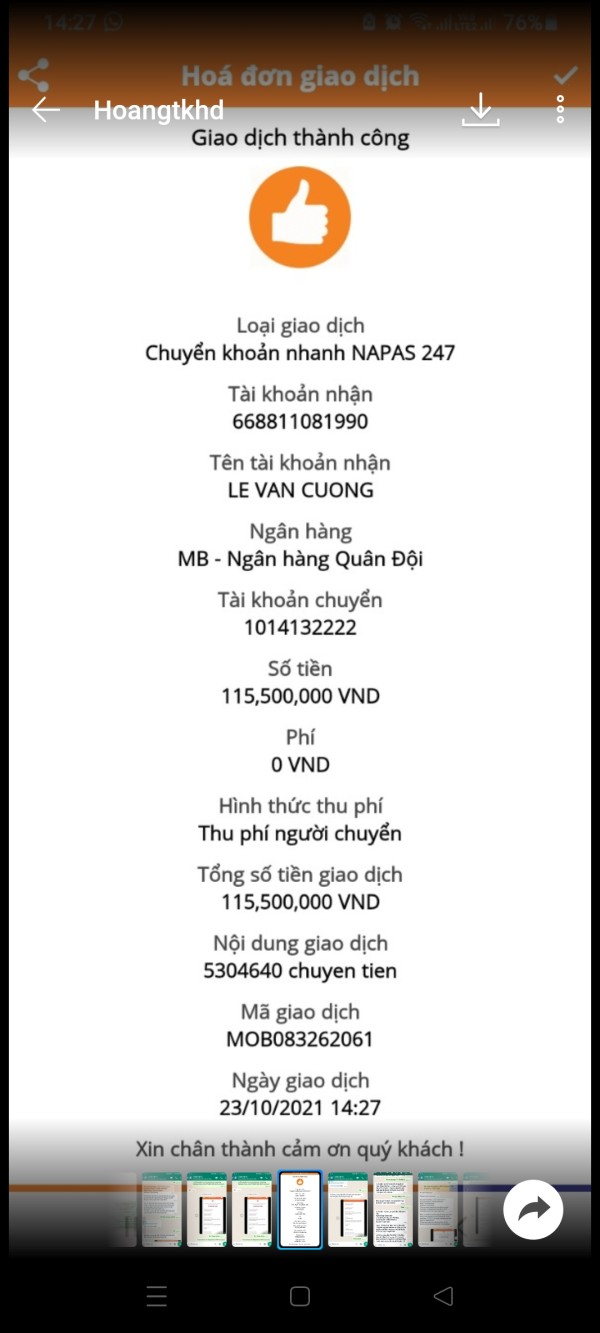

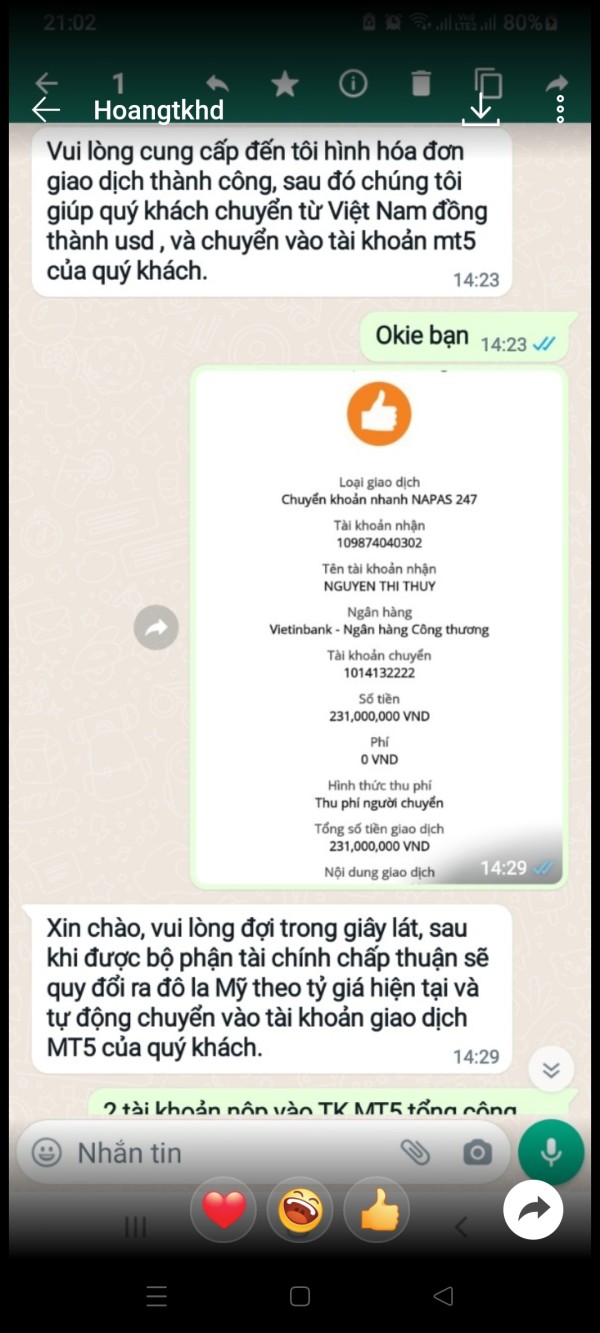

Deposit and Withdrawal Methods

Specific deposit and withdrawal mechanisms vary depending on the trading platform or exchange being utilized. Most platforms supporting USDC offer standard cryptocurrency deposit and withdrawal options through blockchain networks.

Minimum Deposit Requirements

Minimum deposit requirements are not standardized for USDC itself. These parameters are typically determined by individual trading platforms and exchanges that support the stablecoin.

Promotional Offerings

Specific bonus or promotional programs related to USDC usage are not detailed in available source materials. These typically vary by individual platform or exchange.

Available Trading Assets

The primary trading utility involves USDC pairs with other cryptocurrencies, serving as a stable base currency for digital asset trading. The 1:1 USD peg provides stability for portfolio management and risk mitigation strategies.

Cost Structure and Fees

Detailed information regarding spreads, commissions, and transaction fees is not specified in source materials. These costs typically depend on the specific trading platform or exchange being used for USDC transactions.

Leverage Options

Leverage ratios and margin trading options for USDC are not detailed in available materials. These features depend on individual platform policies and regulatory restrictions.

Platform Compatibility

USDC enjoys broad support across multiple cryptocurrency exchanges and trading platforms. Notable integration includes MetaTrader 5, expanding its accessibility for traditional forex traders.

Geographic Restrictions

Specific regional limitations are not detailed in source materials. Availability may vary based on local regulatory frameworks and platform policies.

Customer Service Languages

Customer service language options are not specified in available materials. Support services are typically provided by individual platforms rather than USDC directly.

This usdc review emphasizes that while USDC provides the underlying stablecoin infrastructure, specific trading conditions and support services depend largely on the chosen platform or exchange.

Detailed Rating Analysis

Account Conditions Analysis

The account conditions for USDC trading present a unique structure compared to traditional forex brokers. USDC functions as a stablecoin rather than a brokerage service.

The fundamental account feature revolves around the 1:1 USD backing mechanism, which ensures that each USDC token maintains equivalent value to one US dollar through full collateralization. Account accessibility varies significantly depending on the chosen trading platform or exchange.

While USDC itself doesn't impose minimum deposit requirements, individual platforms may establish their own thresholds for account opening and trading activities. The decentralized nature of cryptocurrency markets means that account opening processes differ across platforms, though most require standard identity verification procedures.

The transparency of the collateralization process represents a significant advantage, with regular attestations confirming the full backing of circulating USDC tokens. However, the lack of standardized account types across platforms can create confusion for traders accustomed to traditional forex account structures.

This usdc review notes that while the underlying asset provides excellent stability, account conditions ultimately depend on platform selection rather than USDC-specific features.

USDC excels in the tools and resources category through its extensive integration across multiple trading platforms and exchanges. The inclusion of MetaTrader 5 support represents a significant advancement, allowing traditional forex traders to incorporate stablecoin functionality into familiar trading environments.

This integration bridges the gap between conventional forex trading and cryptocurrency markets. The widespread platform support extends beyond MetaTrader 5 to include major cryptocurrency exchanges, decentralized finance protocols, and various trading applications.

This broad compatibility ensures that traders can access USDC functionality regardless of their preferred trading environment or strategy approach. However, specific research and analysis resources dedicated to USDC are limited compared to traditional currency pairs.

Educational resources focusing on stablecoin trading strategies and risk management are not extensively detailed in available materials. The automated trading support varies by platform, with some exchanges offering advanced algorithmic trading features while others provide basic transaction capabilities.

The strength in this category comes from platform diversity and integration capabilities rather than proprietary tools or resources. The blockchain-based nature of USDC enables 24/7 trading availability and global accessibility, providing flexibility that traditional forex markets cannot match.

Customer Service and Support Analysis

Customer service and support for USDC present a complex landscape due to the decentralized nature of cryptocurrency markets. Unlike traditional brokers that provide centralized customer support, USDC users typically rely on support services from their chosen trading platforms or exchanges rather than direct support from Circle or Coinbase for routine trading issues.

The availability of customer service channels varies significantly across different platforms supporting USDC. Some major exchanges offer comprehensive support including live chat, email, and phone support, while smaller platforms may provide limited assistance options.

Response times and service quality depend entirely on the platform being used rather than standardized USDC support protocols. Multi-language support availability differs across platforms, with larger international exchanges typically offering broader language options compared to smaller or region-specific platforms.

Customer service hours also vary, though the global nature of cryptocurrency markets means that some level of support is often available around the clock on major platforms. The lack of centralized customer support represents both a challenge and a reflection of the decentralized cryptocurrency ecosystem.

Users must evaluate platform-specific support quality when choosing where to trade USDC, making platform selection a critical factor in overall user experience.

Trading Experience Analysis

The trading experience with USDC varies considerably depending on the chosen platform and trading strategy. Platform stability and execution speed depend on the underlying exchange infrastructure rather than USDC-specific factors.

Major exchanges typically provide robust trading environments with minimal downtime, while smaller platforms may experience occasional technical issues. Order execution quality for USDC transactions generally reflects the efficiency of blockchain networks and exchange matching engines.

The stablecoin's 1:1 USD peg means that price slippage concerns differ from traditional volatile cryptocurrency trading, though network congestion can occasionally impact transaction speed and costs. Platform functionality ranges from basic buy/sell interfaces on simple exchanges to advanced trading features on professional platforms.

The integration with MetaTrader 5 provides familiar functionality for forex traders, including chart analysis, technical indicators, and automated trading capabilities. Mobile trading experiences vary significantly across platforms, with some offering comprehensive mobile applications while others provide limited mobile functionality.

The blockchain-based nature of USDC enables cross-platform compatibility, allowing users to manage holdings across multiple applications and services. This usdc review emphasizes that trading experience quality depends heavily on platform selection rather than inherent USDC characteristics, making due diligence in platform evaluation essential for optimal trading outcomes.

Trust and Security Analysis

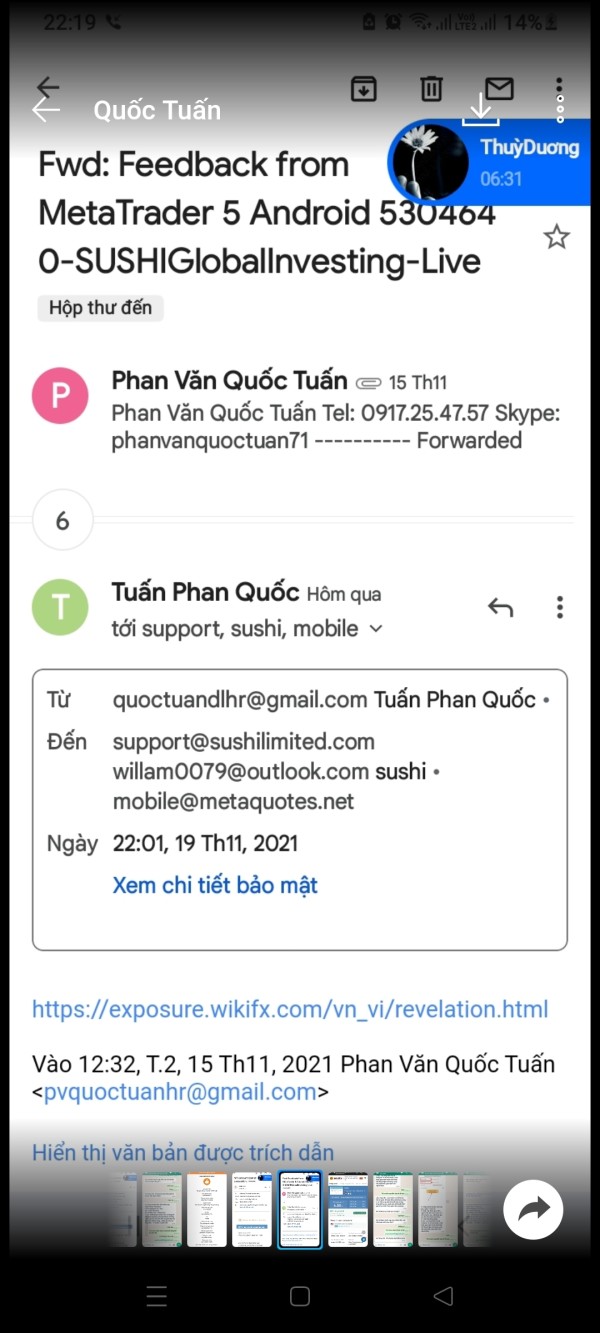

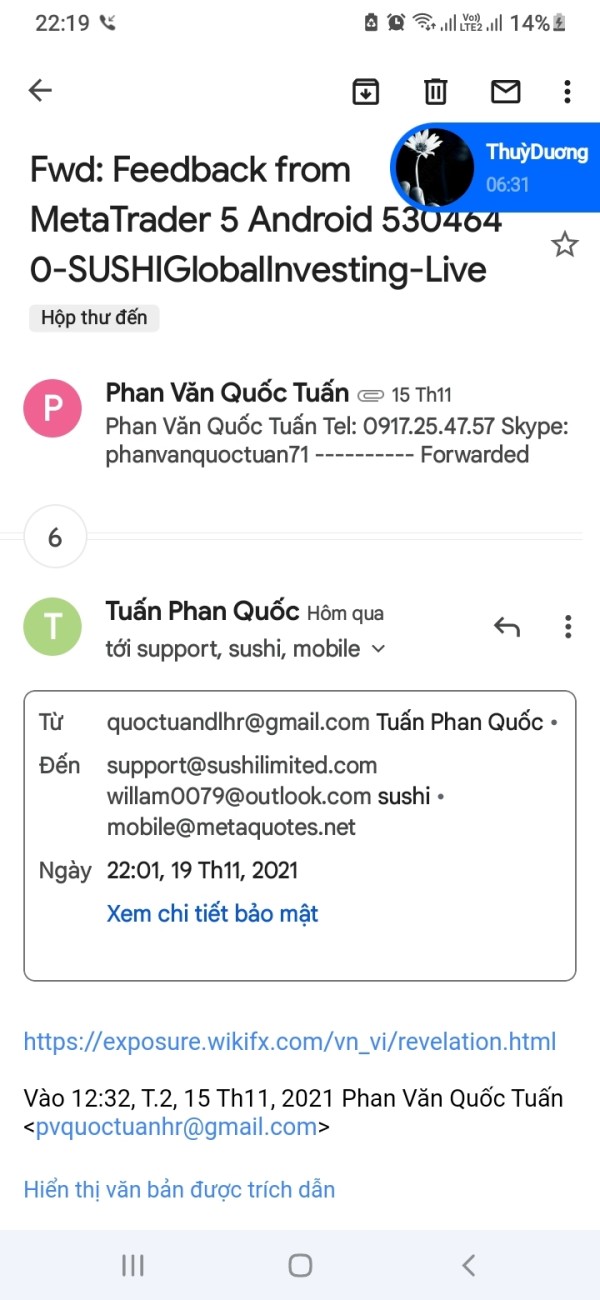

USDC demonstrates exceptional trust and security credentials through its regulatory compliance and backing by established financial entities. Circle and Coinbase, the companies behind USDC, operate under US regulatory oversight and maintain transparency through regular attestations of the dollar reserves backing circulating tokens.

The full collateralization model provides fundamental security for USDC holders, with each token backed by equivalent US dollar reserves held in regulated financial institutions. Regular audits and attestations by reputable accounting firms provide ongoing verification of reserve adequacy, addressing concerns about fractional backing that have affected other stablecoins.

Regulatory compliance represents a significant strength, with both backing companies maintaining licenses and regulatory relationships with US financial authorities. This regulatory standing provides additional assurance compared to stablecoins operating in less regulated environments or with unclear regulatory status.

The transparent operations model includes regular reporting of reserve composition and audit results, allowing users to verify the backing of their holdings. However, the decentralized nature of cryptocurrency markets means that security also depends on individual platform security measures and user wallet management practices.

Industry reputation remains strong, with USDC maintaining its peg stability through various market stress periods and gaining acceptance among institutional users. The absence of significant negative events or controversies further reinforces the trust profile, though users must remain vigilant about platform-specific security risks.

User Experience Analysis

User satisfaction with USDC consistently rates highly across multiple platforms, with scores frequently reaching 9.5/10 or higher. The combination of stability, broad platform support, and ease of use contributes to positive user experiences across diverse trading communities.

The overall user satisfaction stems from USDC's ability to provide cryptocurrency market access without the volatility concerns associated with other digital assets. Traders appreciate the ability to maintain dollar-equivalent holdings while participating in 24/7 cryptocurrency markets and accessing decentralized finance opportunities.

Interface design and usability vary by platform, though the standardized nature of USDC means that users can expect consistent functionality across different trading environments. The blockchain-based structure enables seamless transfers between platforms and services, providing flexibility that traditional banking systems cannot match.

Registration and verification processes depend on chosen platforms rather than USDC-specific requirements. Most platforms require standard identity verification procedures, though the specific requirements and processing times vary significantly across different exchanges and services.

The user base primarily consists of forex traders seeking cryptocurrency market exposure and digital currency investors valuing stability. The broad appeal across different trader types reflects USDC's versatility and effectiveness in serving diverse market needs.

Common user feedback emphasizes appreciation for stability, transparency, and broad platform compatibility, while occasional concerns focus on platform-specific issues rather than USDC itself.

Conclusion

This comprehensive usdc review reveals that USD Coin stands as a highly secure and user-friendly stablecoin option that effectively serves the needs of forex traders and cryptocurrency investors. The combination of full collateralization, regulatory compliance, and broad platform support creates a compelling proposition for traders seeking stability in digital asset markets.

USDC is particularly well-suited for forex traders looking to expand into cryptocurrency markets, digital currency investors prioritizing stability, and anyone seeking efficient cross-border transaction capabilities. The 1:1 USD peg provides familiar value stability while enabling access to the technological advantages of blockchain-based transactions.

The primary strengths include exceptional security through full collateralization, transparent operations with regular auditing, widespread platform integration including MetaTrader 5, and consistently high user satisfaction ratings. However, the reliance on platform-specific features for trading conditions and customer support represents a consideration for potential users, as the overall experience depends significantly on platform selection rather than USDC-inherent characteristics.