Zion 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive zion review examines a forex broker that operates within the financial services sector. Detailed information about specific trading conditions remains limited. Based on available sources, Zion appears to be positioned as a foreign exchange broker specializing in forex trading services. The broker targets various client segments including individual traders and institutional clients seeking forex trading opportunities.

The regulatory landscape for this broker shows some complexity. Different regional entities potentially operate under varying oversight frameworks. While some sources indicate regulatory compliance, the specific details of licensing and supervision require careful examination. The broker's service offerings appear to focus primarily on foreign exchange trading. Comprehensive details about trading platforms, account types, and specific features are not extensively documented in available materials.

For traders considering this broker, it's important to note that the limited availability of detailed information about trading conditions, costs, and user experiences suggests a cautious approach may be warranted. This zion review aims to provide an objective assessment based on available data. It also highlights areas where additional information would be beneficial for potential clients.

Important Disclaimer

This review is based on publicly available information and should be considered alongside individual research. Different regional entities may operate under varying regulatory frameworks. This could significantly impact the trading experience and available services for users in different jurisdictions. Regulatory requirements and compliance standards may differ across regions. These differences potentially affect account conditions, available trading instruments, and client protection measures.

The evaluation methodology employed in this analysis considers industry standards and available information sources. However, traders should conduct their own due diligence and verify current information directly with the broker before making any trading decisions. Market conditions and broker policies may change. This review reflects information available at the time of writing.

Rating Framework

Broker Overview

Zion operates as a foreign exchange broker with a focus on providing forex trading services to various client segments. According to available sources, the company positions itself within the competitive forex brokerage landscape. Specific details about its founding date and corporate history are not extensively documented in publicly available materials.

The broker's business model appears to center around foreign exchange trading services. The official website reportedly operates through a customer relationship management platform. This suggests a focus on client relationship management and potentially personalized service delivery. Specific details about the service model require further verification.

From a regulatory perspective, the broker operates within established financial service frameworks. The specific regulatory oversight and compliance requirements may vary depending on the regional entity and jurisdiction. The company appears to target both individual traders and institutional clients. This suggests a diversified approach to market segments within the forex trading space.

The broker's market positioning emphasizes foreign exchange trading specialization. This indicates a focused approach rather than a broad multi-asset offering. This specialization could potentially provide advantages in terms of expertise and service quality within the forex market. However, it may limit options for traders seeking diversified trading opportunities across multiple asset classes. This zion review continues to examine these aspects in detail throughout the following sections.

Regulatory Oversight: Available information suggests regulatory compliance. Specific regulatory bodies and license numbers require verification through official channels. Different regional operations may fall under varying regulatory frameworks.

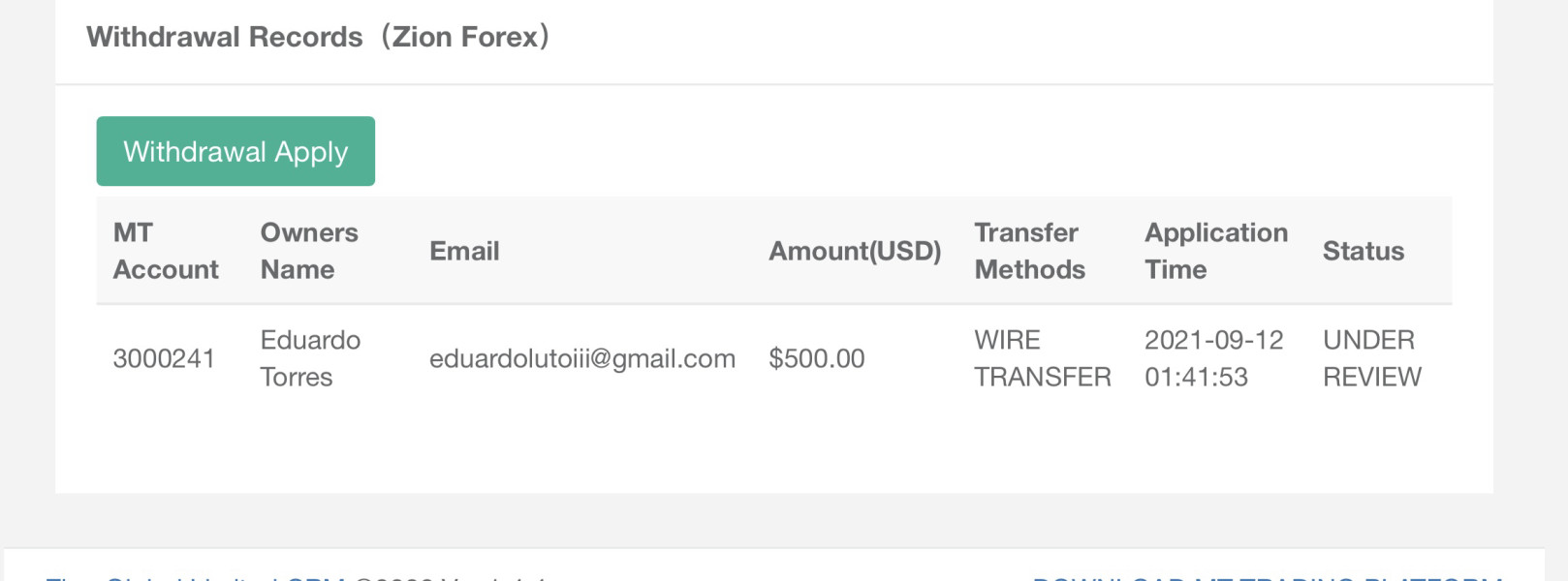

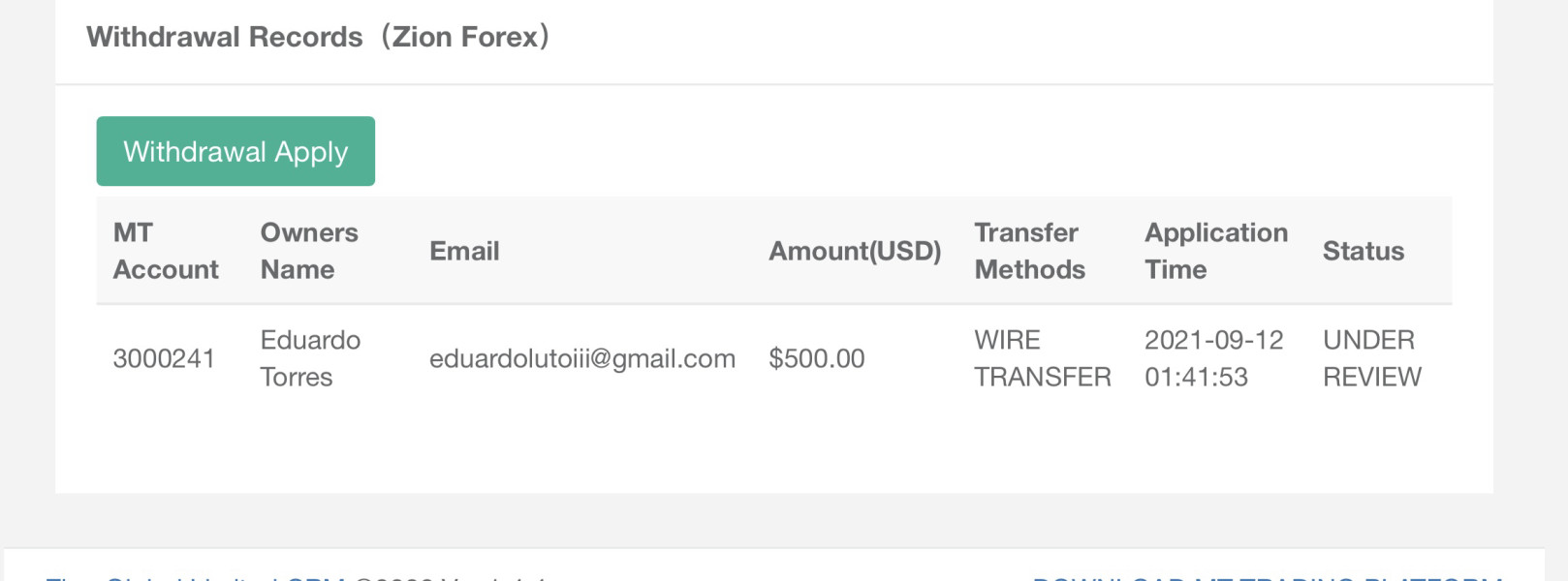

Deposit and Withdrawal Methods: Specific information about available payment methods, processing times, and associated fees is not detailed in available sources. Traders should verify current payment options directly with the broker.

Minimum Deposit Requirements: The minimum deposit amount for account opening is not specified in available documentation. This indicates the need for direct inquiry with the broker for current requirements.

Promotional Offers: Details about welcome bonuses, promotional campaigns, or special offers are not documented in available sources. This suggests either limited promotional activity or the need for direct verification.

Trading Assets: The primary focus appears to be on foreign exchange trading. The broker specializes in forex services. The range of available currency pairs and specific trading instruments requires verification.

Cost Structure: Specific information about spreads, commissions, overnight fees, and other trading costs is not detailed in available sources. This represents a significant information gap for potential traders evaluating the broker's competitiveness.

Leverage Options: Maximum leverage ratios and margin requirements are not specified in available documentation. This is crucial information for risk management and trading strategy planning.

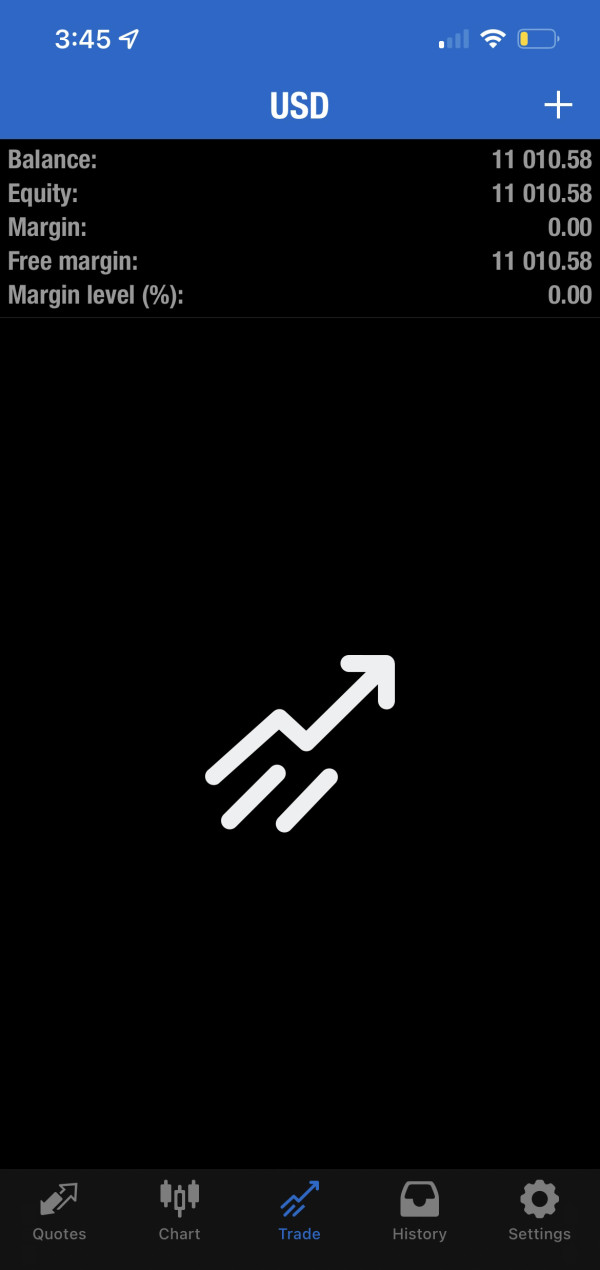

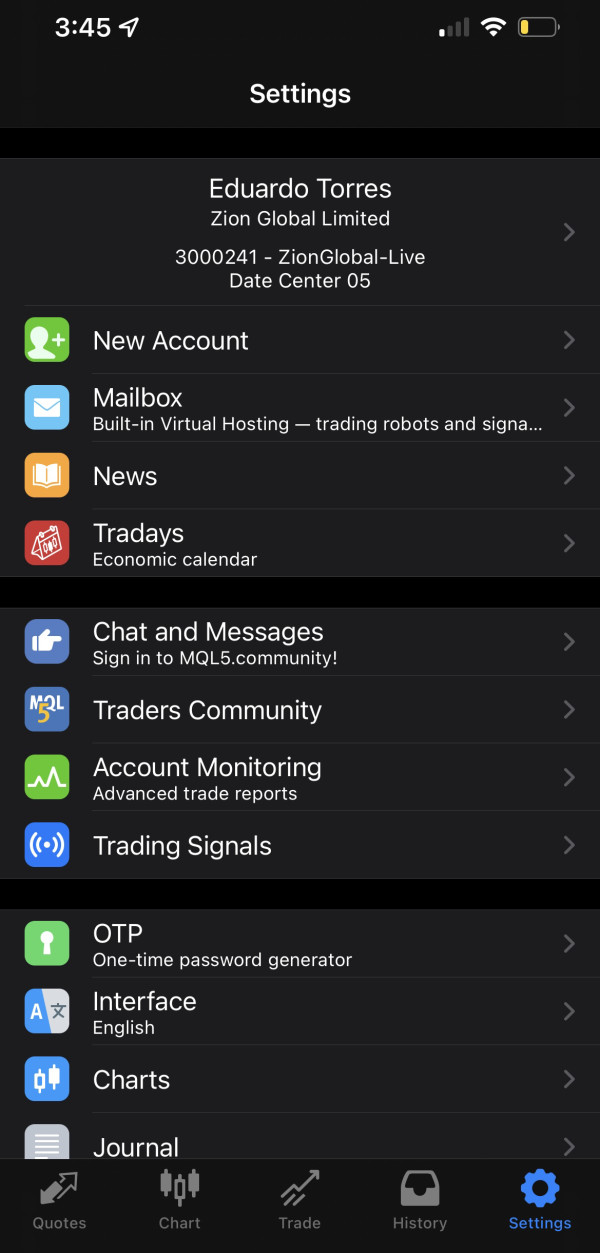

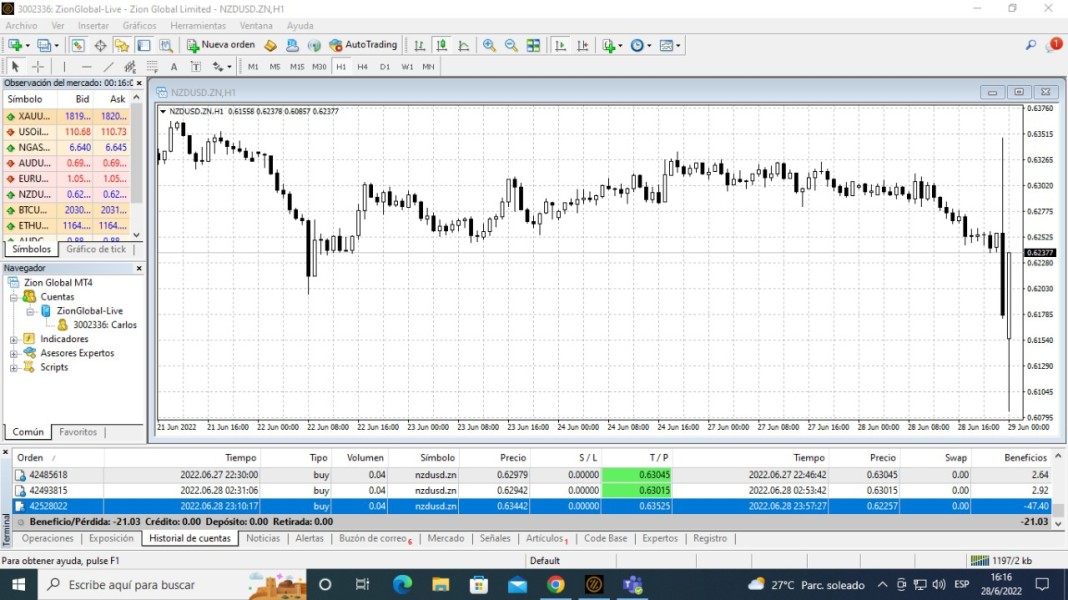

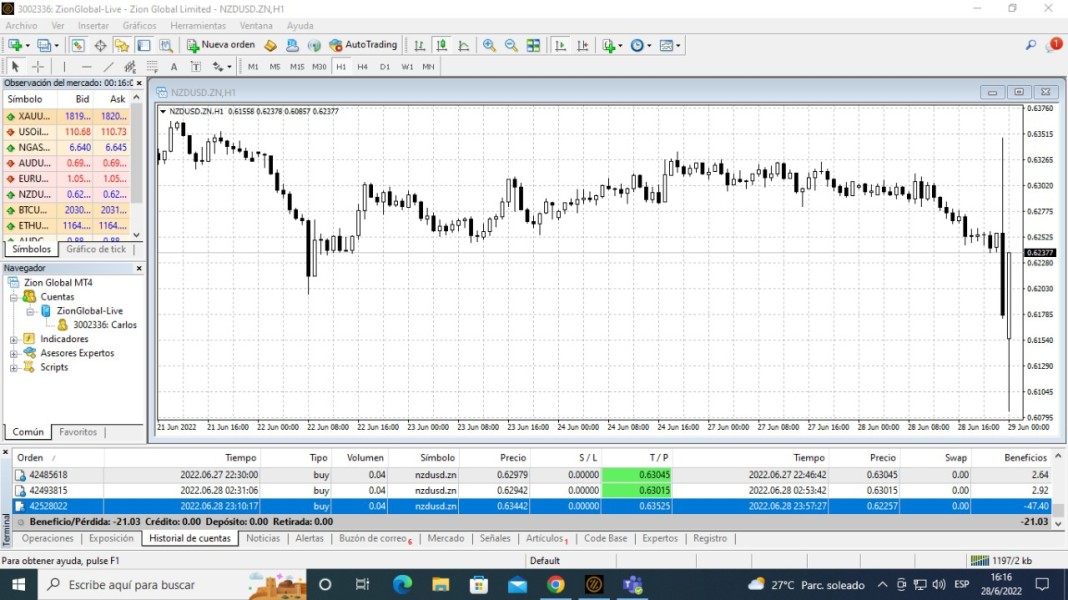

Platform Selection: Details about available trading platforms, whether proprietary or third-party solutions like MetaTrader, are not documented in accessible sources.

Regional Restrictions: Information about geographical limitations or restricted jurisdictions is not available in current sources. This requires direct verification for specific regions.

This zion review highlights that many critical details require direct verification with the broker due to limited publicly available information.

Account Conditions Analysis

The account conditions for Zion present a mixed picture based on available information. While the broker appears to offer forex trading services, specific details about account types, minimum deposits, and account features are not comprehensively documented in accessible sources. This lack of detailed information makes it challenging for potential traders to fully evaluate the broker's account offerings against industry standards.

Account opening procedures and verification requirements are not specified in available materials. This could indicate either a streamlined process or the need for direct contact with the broker for detailed information. The absence of clearly defined account tiers or specialized account types in public documentation may suggest a simplified account structure. However, this requires confirmation.

Minimum deposit requirements, which are crucial for trader decision-making, are not specified in available sources. This information gap makes it difficult to assess the broker's accessibility for different trader segments. It affects evaluation for both beginners and experienced professionals. Similarly, details about account currencies, multi-currency support, and currency conversion policies are not documented.

Special account features such as Islamic accounts for Muslim traders, professional accounts for qualified investors, or managed account options are not mentioned in available materials. The lack of information about account-related benefits, such as dedicated account managers, preferential spreads, or exclusive research access, further limits the ability to assess the broker's competitive position.

This zion review notes that the limited transparency regarding account conditions may require potential clients to engage directly with the broker for comprehensive information. This could impact the decision-making process for traders who prefer readily available details.

The trading tools and resources offered by Zion are not extensively detailed in available public information. This presents challenges for traders seeking comprehensive analytical and educational support. While the broker operates as a forex specialist, specific information about proprietary trading tools, market analysis resources, or educational materials is not documented in accessible sources.

Research and analysis capabilities, which are essential for informed trading decisions, are not specified in available materials. This includes the absence of information about market reports, economic calendars, technical analysis tools, or fundamental analysis resources. The lack of documented research offerings may indicate either limited analytical support or the need for direct inquiry about available resources.

Educational resources, which are particularly important for novice traders, are not mentioned in available sources. This includes the absence of information about trading tutorials, webinars, market education programs, or trading strategy guides. The educational component is crucial for broker evaluation. It's especially important for traders seeking to develop their skills and market knowledge.

Automated trading support, including expert advisors, copy trading, or social trading features, is not documented in available information. These tools have become increasingly important in modern forex trading. Their absence from public documentation may indicate limited automation capabilities.

Trading calculators, risk management tools, and position sizing utilities are also not specified in available sources. These practical tools are essential for effective trading management and their availability could significantly impact the trading experience. The limited information about tools and resources suggests that potential clients may need to conduct direct inquiries to fully understand the broker's offerings in this area.

Customer Service and Support Analysis

Customer service and support capabilities for Zion are not comprehensively documented in available public sources. This makes it challenging to assess the quality and accessibility of client support services. The broker's approach to customer service, including available contact methods, response times, and service quality standards, requires direct verification due to limited publicly available information.

Support channel availability, such as live chat, telephone support, email assistance, or help desk services, is not specified in accessible materials. This information gap makes it difficult for potential clients to understand how they can access assistance when needed. This is a crucial factor in broker selection, especially for new traders who may require frequent support.

Response time commitments and service level agreements are not documented in available sources. Quick and efficient customer support is essential in forex trading. Market conditions can change rapidly and traders may need immediate assistance with technical or account-related issues. The absence of clear service standards in public documentation may indicate varying support quality.

Multilingual support capabilities are not specified. This could impact accessibility for international traders. Given the global nature of forex markets, the ability to provide support in multiple languages is often considered a significant advantage. The lack of information about language support may limit the broker's appeal to diverse trader populations.

Operating hours for customer support services are not documented. This includes whether 24/5 support is available to match forex market hours. The availability of support during active trading sessions is crucial for addressing urgent issues that may arise during market volatility. Without clear information about support availability, traders cannot adequately assess the broker's commitment to client service.

Trading Experience Analysis

The trading experience with Zion requires careful evaluation due to limited publicly available information about platform capabilities, execution quality, and overall trading environment. While the broker specializes in foreign exchange trading, specific details about platform stability, execution speeds, and trading conditions are not comprehensively documented in accessible sources.

Platform stability and performance metrics are not specified in available materials. This makes it difficult to assess the reliability of the trading infrastructure. In forex trading, platform uptime and consistent performance are crucial factors that can significantly impact trading outcomes. This is especially true during high-volatility market conditions or major economic announcements.

Order execution quality, including information about slippage rates, rejection rates, and execution speeds, is not documented in available sources. These factors are essential for evaluating the broker's ability to provide fair and efficient trade execution. They directly impact trading profitability and overall user satisfaction.

Trading platform functionality and available features are not detailed in accessible information. This includes the absence of specifications about charting capabilities, technical indicators, order types, and advanced trading features. Experienced traders often require these features for effective market analysis and trade management.

Mobile trading capabilities and cross-platform synchronization are not mentioned in available sources. Given the increasing importance of mobile trading in today's fast-paced markets, the lack of information about mobile platform features may indicate limited mobile trading support. It could also suggest the need for direct verification of mobile capabilities.

The overall trading environment, including market depth information, price transparency, and trading conditions during different market sessions, is not documented in available materials. This zion review notes that the limited transparency regarding trading experience factors may require extensive direct communication with the broker for comprehensive evaluation.

Trust and Safety Analysis

Trust and safety considerations for Zion present a mixed assessment based on available information. While some regulatory oversight appears to be in place, the specific details of regulatory compliance, client fund protection, and safety measures require careful examination. Verification through official channels is necessary.

Regulatory compliance forms the foundation of broker trustworthiness. While some sources suggest regulatory oversight, the specific regulatory bodies, license numbers, and compliance standards are not clearly documented in accessible materials. This lack of detailed regulatory information makes it challenging to verify the broker's legal standing and client protection measures.

Client fund segregation and protection mechanisms are not specified in available sources. The separation of client funds from company operational funds is a fundamental safety requirement in regulated forex trading. The absence of clear information about fund protection measures raises important questions about client asset security.

Company transparency regarding ownership, management, and corporate structure is limited in available public information. Transparent corporate governance and clear identification of company principals are important factors in establishing trust with potential clients. The lack of detailed corporate information may impact confidence levels.

Financial stability and capital adequacy information are not documented in accessible sources. The broker's financial strength and ability to meet client obligations during adverse market conditions are crucial factors for long-term trading relationships. This information gap represents a significant consideration for potential clients.

Third-party audits, regulatory reporting, and compliance certifications are not mentioned in available materials. Independent verification of the broker's operations and compliance standards through recognized auditing firms or regulatory reporting provides additional assurance of trustworthiness. The absence of such information may require direct verification with relevant regulatory authorities.

User Experience Analysis

User experience evaluation for Zion is constrained by limited available feedback and documented user testimonials in accessible sources. The overall user satisfaction levels, common user experiences, and community feedback are not comprehensively represented in available materials. This makes it challenging to provide a complete assessment of the broker's user experience quality.

Interface design and usability factors are not detailed in available sources. This includes information about platform navigation, user-friendly features, and accessibility options. Modern traders expect intuitive and efficient trading interfaces. The lack of specific information about user interface quality may indicate the need for direct platform evaluation.

Account registration and verification processes are not specified in available materials. A smooth and efficient onboarding experience is crucial for new traders. Unclear or complicated registration procedures can significantly impact initial user satisfaction. The absence of detailed information about these processes may require direct experience or inquiry.

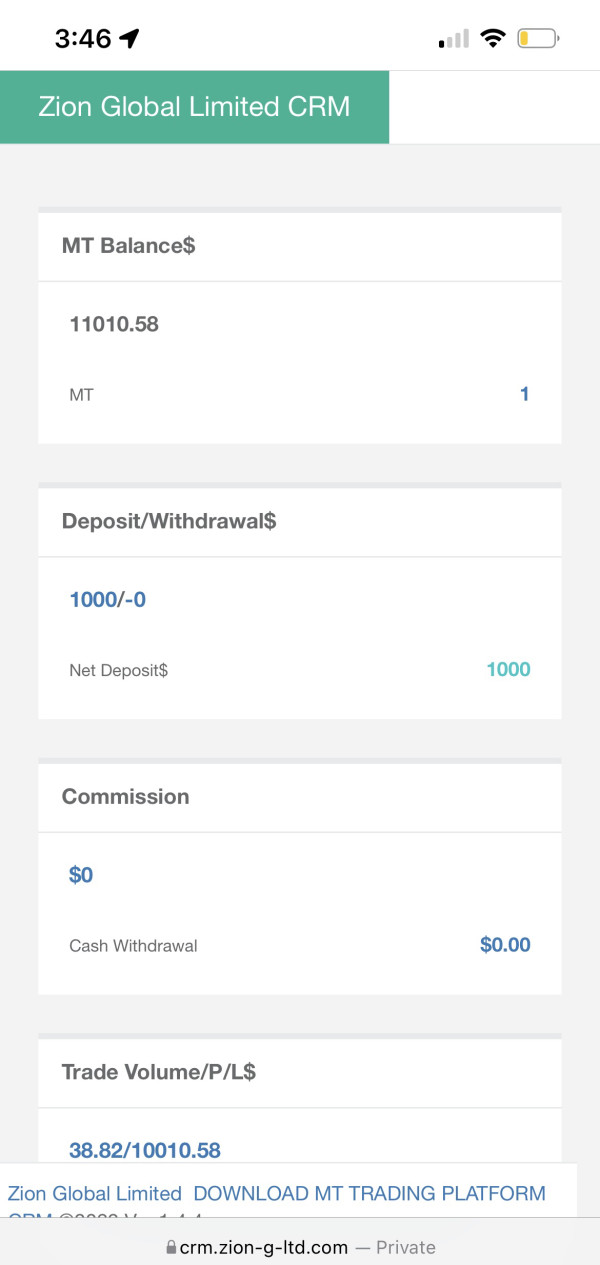

Fund management experience, including deposit and withdrawal procedures, processing times, and user satisfaction with payment processes, is not documented in accessible sources. Efficient and transparent fund operations are essential for positive user experiences. The lack of information about these critical processes represents a significant evaluation gap.

Common user complaints or satisfaction areas are not represented in available materials. User feedback typically provides valuable insights into real-world trading experiences, platform reliability, customer service quality, and overall satisfaction levels. The absence of documented user experiences makes it difficult to assess the broker's actual performance from a client perspective.

User demographic analysis and trader type suitability are not specified in available sources. Different brokers often cater to specific trader segments, from beginners to advanced professionals. Understanding the target user base can help potential clients assess compatibility. The limited information about user experiences and target demographics requires direct evaluation for comprehensive assessment.

Conclusion

This comprehensive zion review reveals a forex broker operating in the foreign exchange market with limited publicly available information about specific trading conditions, services, and user experiences. While the broker appears to maintain some regulatory compliance and focuses on forex trading specialization, the lack of detailed information about critical aspects such as trading costs, platform features, and client experiences presents challenges for thorough evaluation.

The broker may be suitable for traders who prefer to conduct detailed due diligence through direct communication. It might work for those comfortable with limited publicly available information. However, traders who prefer comprehensive transparency and readily available detailed information about trading conditions may find the current level of public disclosure insufficient for confident decision-making.

The main advantages appear to include regulatory oversight and specialization in foreign exchange trading. The primary limitations involve limited transparency regarding trading conditions, costs, and user experiences. Potential clients should consider conducting extensive direct inquiries and possibly testing services through demo accounts before committing to live trading with this broker.