Is USDC safe?

Business

License

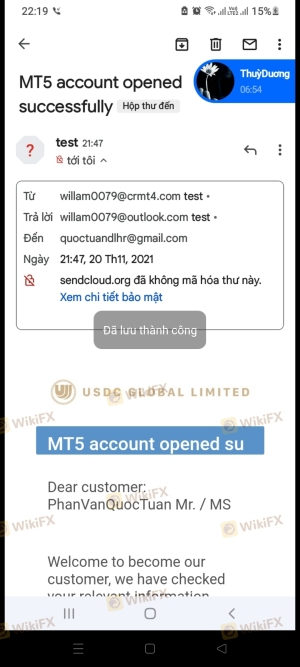

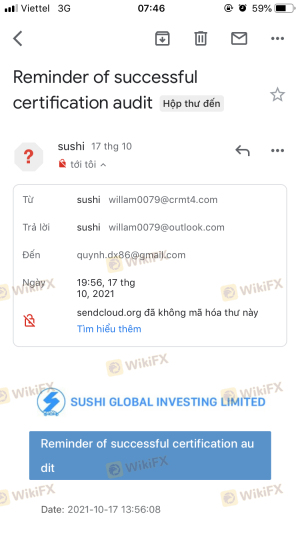

Is USDC A Scam?

Introduction

USDC, also known as USDC Global Limited, positions itself as a broker in the forex market, offering various trading opportunities including forex, ETFs, and CFDs. However, with the proliferation of online trading platforms, the need for traders to carefully assess the legitimacy and safety of these brokers has never been more crucial. As the trading landscape becomes increasingly complex, understanding the regulatory environment, company background, and customer experiences can significantly influence your trading decisions. This article aims to provide an objective analysis of USDC, focusing on its regulatory status, company background, trading conditions, customer safety measures, and overall reputation in the trading community. Our investigation is based on a comprehensive review of available online resources, user feedback, and industry reports to determine whether USDC is safe or if it poses risks to potential investors.

Regulation and Legitimacy

The regulatory status of a broker is paramount in assessing its legitimacy. Regulation serves as a protective layer for traders, ensuring that brokers adhere to established guidelines and practices designed to safeguard client funds and maintain market integrity. In the case of USDC, it claims to be regulated by the Financial Conduct Authority (FCA) in the UK; however, this assertion has been widely disputed.

| Regulatory Body | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| FCA | N/A | UK | Not Verified |

Despite its claims, USDC does not appear in the FCA's official registry, raising significant concerns about its regulatory compliance. The absence of credible regulation is a red flag, as it indicates that USDC operates without the oversight necessary to ensure fair trading practices. Unregulated brokers often lack the financial safeguards that protect traders, making it essential for potential clients to approach USDC with caution. Furthermore, the broker's claims of regulatory compliance appear to be part of a broader pattern of misleading information, as multiple sources have indicated that USDC is not a legitimate entity in the forex market. This lack of regulation and transparency leads to the conclusion that USDC is not safe for trading.

Company Background Investigation

A thorough investigation into USDC's company background reveals a lack of transparency regarding its ownership and operational history. The broker claims to be based in the UK, but no verifiable information supports this assertion. This ambiguity extends to the company's ownership structure, with no publicly available details about its founders or key management personnel.

The absence of a clear history raises questions about the broker's credibility and trustworthiness. A reputable broker typically provides information about its founders and management team, along with their professional backgrounds, to instill confidence in potential clients. In contrast, USDC's lack of transparency suggests a concerning level of opacity that could indicate a higher risk for traders. The absence of a clear company history and ownership details further compounds the uncertainty surrounding USDC, leading to doubts about whether USDC is safe for traders.

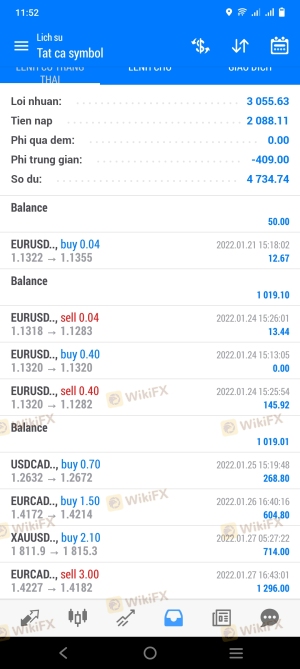

Trading Conditions Analysis

When evaluating a broker, understanding the overall trading conditions, including fees and spreads, is essential. USDC offers various account types, each with different trading conditions, but the specifics are often unclear or misleading.

| Fee Type | USDC | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.2 pips | 1.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | 1.5% | 1.0% |

While USDC advertises low spreads, the reality may differ, as many user reviews indicate hidden fees and unexpected charges. Such practices are common among unregulated brokers, who may employ deceptive pricing structures to maximize their profits at the expense of traders. Additionally, the lack of a clear commission model raises further concerns, as traders may find themselves facing unexpected costs when executing trades. The overall fee structure suggests that USDC is not safe for traders seeking transparent and fair trading conditions.

Customer Funds Security

The safety of customer funds is a critical aspect of any trading platform. USDC claims to implement various measures to protect client funds, including fund segregation and negative balance protection. However, the effectiveness of these measures remains questionable given the broker's unregulated status.

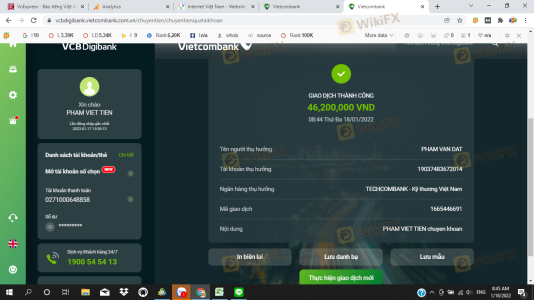

Traders should be aware that without proper regulatory oversight, there is no guarantee that USDC adheres to industry standards for fund security. Historical complaints from users indicate issues with fund withdrawals and account management, suggesting that USDC may not provide the necessary safeguards to protect traders' investments. The lack of transparency regarding its fund security measures further exacerbates concerns about whether USDC is safe for traders looking to protect their capital.

Customer Experience and Complaints

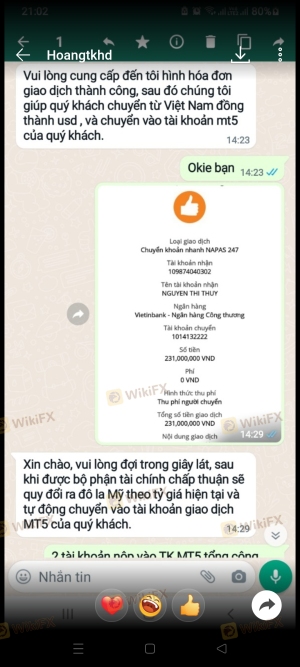

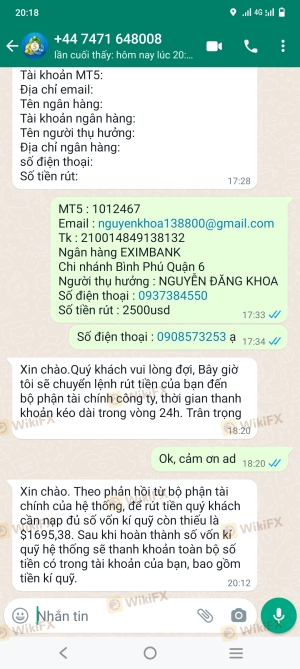

Analyzing customer feedback is vital to understanding a broker's reputation. A review of user experiences with USDC reveals a troubling pattern of complaints, primarily concerning withdrawal issues and unresponsive customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Unresponsive Support | Medium | Poor |

| Misleading Fees | High | Poor |

Many users report difficulties in withdrawing their funds, often facing requests for additional deposits or fees before they can access their money. Such practices are indicative of potential scams, where brokers make it increasingly difficult for clients to retrieve their investments. Additionally, the company's response to complaints has been largely inadequate, with many users expressing frustration over unhelpful customer service interactions. This negative feedback raises significant concerns about the overall reliability of USDC, suggesting that USDC is not safe for traders who prioritize responsive customer service and reliable fund access.

Platform and Trade Execution

The trading platform's performance is another critical factor in evaluating a broker. USDC claims to offer a robust trading platform with features that cater to both novice and experienced traders. However, user reviews often highlight issues with platform stability, including frequent downtimes and slow execution speeds.

Traders have also reported instances of slippage and rejected orders, which can significantly impact trading outcomes. Such issues raise suspicions of potential platform manipulation, further eroding trust in USDC's operations. The lack of transparency regarding platform performance metrics makes it challenging to assess whether USDC provides a reliable trading environment. Consequently, the evidence suggests that USDC is not safe, particularly for traders who depend on a stable and efficient trading platform.

Risk Assessment

Using USDC as a trading platform entails several risks that potential investors should consider.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns. |

| Fund Security Risk | High | Lack of transparency regarding fund protection. |

| Customer Service Risk | Medium | Poor response to complaints and withdrawal issues. |

Given the unregulated status of USDC, traders face significant risks, including the potential loss of funds and difficulties in resolving disputes. To mitigate these risks, traders should conduct thorough due diligence before engaging with USDC and consider using regulated brokers that offer better protections.

Conclusion and Recommendations

In conclusion, the evidence gathered suggests that USDC is not safe for traders. The broker's lack of regulation, transparency issues, and negative customer feedback collectively paint a concerning picture of its operations. Potential investors should exercise extreme caution and consider alternative brokers that are regulated and have a proven track record of reliability and customer satisfaction. For those seeking trustworthy trading options, it is advisable to explore brokers that adhere to strict regulatory standards and prioritize client safety.

Is USDC a scam, or is it legit?

The latest exposure and evaluation content of USDC brokers.

USDC Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

USDC latest industry rating score is 1.48, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.48 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.