Is VHG safe?

Pros

Cons

Is VHG Safe or Scam?

Introduction

VHG, a forex broker operating in the financial markets, has been generating attention among traders looking for new platforms to engage in currency trading. With the rise of online trading, the need for traders to critically assess the reliability and safety of forex brokers has become paramount. As the forex market can be rife with scams and unregulated entities, understanding the legitimacy of a broker like VHG is crucial for protecting one's investments. This article will investigate whether VHG is safe or a scam by examining its regulatory status, company background, trading conditions, client experiences, and risk factors. The evaluation will be based on a comprehensive analysis of available data, user reviews, and regulatory information.

Regulation and Legitimacy

A broker's regulatory status is a vital indicator of its legitimacy. VHG's current regulatory situation raises several red flags, as it operates without any recognized regulatory oversight. This lack of regulation can expose traders to significant risks, including potential fraud and the inability to recover funds in case of disputes. Below is a summary of VHG's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of a valid regulatory license is concerning, as it often implies that the broker is not subject to the strict compliance requirements imposed by reputable financial authorities. Consequently, the lack of oversight could lead to unfair trading practices and a higher likelihood of scams. In the forex industry, brokers regulated by top-tier authorities such as the FCA (UK) or ASIC (Australia) are generally considered safer due to their adherence to stringent operational standards. VHG's unregulated status suggests that it may not prioritize client protection, making it essential for traders to proceed with caution.

Company Background Investigation

Understanding a broker's history and ownership structure can provide insights into its operational integrity. VHG appears to have limited publicly available information regarding its establishment and ownership. This lack of transparency can be a warning sign, as reputable brokers typically provide detailed information about their history, management team, and corporate structure.

The management teams qualifications and experience play a critical role in a broker's reputation. Unfortunately, VHG does not disclose substantial information about its management, which raises questions about the competency and credibility of its leadership. Transparency in operations and a clear communication strategy are essential for building trust with clients, and VHG's apparent lack of such practices may deter potential traders.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly impact a trader's experience and profitability. VHG claims to provide competitive trading fees; however, the specifics of its fee structure remain unclear, raising concerns about hidden costs. Below is a table comparing VHG's trading costs with industry averages:

| Fee Type | VHG | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 0.5 - 1.5% |

The lack of detailed information regarding spreads, commissions, and interest rates can lead to unexpected costs that may affect a trader's bottom line. Moreover, VHGs failure to provide clear and transparent trading conditions may be indicative of potential issues that could arise during trading, such as unfavorable spreads or hidden fees.

Client Funds Safety

The safety of client funds is a critical consideration when evaluating any forex broker. VHG's measures for safeguarding client funds are not well-documented, which is a fundamental aspect that traders should consider. Effective brokers typically implement strict fund segregation policies, ensuring that client funds are kept separate from the company's operational funds. This practice protects clients in the event of the broker's insolvency.

Furthermore, the absence of investor protection schemes, such as those provided by regulatory bodies, raises concerns about the safety of deposits with VHG. Historical data regarding past fund security issues or disputes involving VHG is also lacking, which can complicate the assessment of its reliability. Without robust protection measures, traders may face significant risks when trading through VHG.

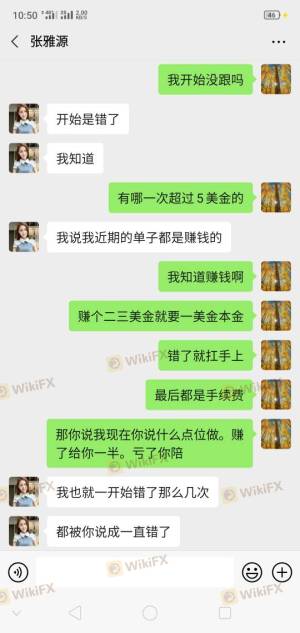

Customer Experience and Complaints

Customer feedback is a valuable source of information when assessing a broker's credibility. Reviews and complaints about VHG indicate a mixed experience among users. Common complaints include difficulties in withdrawing funds, lack of customer support, and issues with trading execution. Below is a summary of the primary complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Inconsistent |

| Execution Problems | High | Unresolved |

Several users have reported that they were unable to withdraw their funds, a significant concern that suggests potential fraudulent practices. The lack of timely and effective responses from VHG regarding these complaints raises further doubts about its commitment to customer satisfaction and transparency.

Platform and Trade Execution

The performance of a trading platform is crucial for a successful trading experience. VHG's platform has been criticized for instability, leading to execution delays and slippage. Traders have reported instances of orders not being executed as requested, which can result in significant financial losses. The absence of reliable performance metrics and user feedback regarding platform functionality is concerning.

Moreover, potential signs of platform manipulation, such as frequent execution failures or unusual price movements, can indicate deeper issues within the broker's operations. Traders considering VHG should be aware of these risks and evaluate whether they are comfortable trading on a platform with such reported deficiencies.

Risk Assessment

Using VHG presents several risks that traders must consider. Below is a summary of the key risk areas associated with trading through this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | High | Unclear fee structures and withdrawal issues |

| Operational Risk | Medium | Platform instability and execution problems |

To mitigate these risks, traders should conduct thorough due diligence before engaging with VHG. It is advisable to only trade with brokers that are regulated by reputable authorities, as this can significantly reduce the likelihood of encountering fraudulent practices.

Conclusion and Recommendations

In conclusion, the evidence suggests that VHG may pose significant risks to traders. The broker's lack of regulation, unclear trading conditions, and poor customer feedback raise serious concerns about its legitimacy. While some traders may still consider engaging with VHG, it is crucial to approach with caution.

For traders seeking safer alternatives, it is recommended to explore brokers that are regulated by top-tier authorities, offer transparent trading conditions, and have a positive reputation among users. Brokers such as Forex.com, IG, and OANDA are examples of reputable options that provide a higher level of security and customer service. Ultimately, ensuring the safety of your investments should always be the top priority when choosing a forex broker.

In summary, is VHG safe? The evidence leans towards a conclusion that potential traders should be wary and consider more reputable options for their trading activities.

Is VHG a scam, or is it legit?

The latest exposure and evaluation content of VHG brokers.

VHG Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

VHG latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.