Is Value Trading Markets safe?

Business

License

Is Value Trading Markets Safe or Scam?

Introduction

Value Trading Markets, a forex broker, has positioned itself as a platform for traders seeking opportunities in the foreign exchange market. However, the rise of online trading has also led to an increase in fraudulent activities, making it essential for traders to conduct thorough evaluations of brokers before committing their funds. This article aims to assess the credibility of Value Trading Markets, examining its regulatory status, company background, trading conditions, client fund safety, customer experiences, and overall risks associated with using this broker. The investigation is based on diverse sources, including regulatory databases, customer reviews, and industry reports, to provide a well-rounded perspective on whether Value Trading Markets is safe or potentially a scam.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in determining its safety and legitimacy. Value Trading Markets has been reported to lack valid regulatory licenses, raising significant concerns about its operational legitimacy. A broker's regulation helps ensure that it adheres to strict financial standards and provides a level of protection to its clients. Without proper oversight, traders may face increased risks, including potential fraud or mismanagement of funds.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulation is alarming, as it means that Value Trading Markets operates without the oversight of any recognized financial authority. This lack of regulatory backing can lead to issues such as the inability to resolve disputes, potential fund mismanagement, and exposure to scams. Traders are advised to be cautious and consider the implications of trading with a broker that does not have a regulatory framework in place. The quality of regulation is paramount, and brokers with tier-1 licenses are generally deemed safer options for traders.

Company Background Investigation

Value Trading Markets has a relatively obscure history, with limited information available about its establishment and ownership structure. The lack of transparency raises questions about the broker's accountability and operational integrity. A thorough investigation into the management team reveals little about their professional backgrounds and experiences in the finance and trading sectors. This absence of information can be a red flag for potential investors, as a knowledgeable and experienced management team is crucial for a broker's credibility.

Furthermore, the company's transparency regarding its operations and financial disclosures is minimal. A reputable broker typically provides comprehensive information about its history, ownership, and regulatory compliance. However, the scant details surrounding Value Trading Markets suggest a lack of commitment to transparency, which can lead to mistrust among potential clients. In an industry where trust is essential, the inability to find clear information about the broker's background further supports the notion that traders should exercise caution.

Trading Conditions Analysis

When evaluating the safety of a broker, understanding its trading conditions is vital. Value Trading Markets presents an overall fee structure that appears competitive at first glance; however, the lack of clarity around certain fees raises concerns. Traders often find themselves facing unexpected charges, which can significantly impact their trading profitability.

| Fee Type | Value Trading Markets | Industry Average |

|---|---|---|

| Spread on Major Pairs | 1.5 pips | 1.2 pips |

| Commission Structure | Varies by account type | $3 per lot |

| Overnight Interest Range | High | Average |

The spreads offered by Value Trading Markets seem to be higher than the industry average, which can erode potential profits for traders. Additionally, the commission structure's variability among account types can lead to confusion and unexpected costs. Traders should be wary of any fees that are not clearly outlined in the broker's terms and conditions, as hidden fees can often lead to disputes and dissatisfaction.

Client Fund Safety

The safety of client funds is a paramount concern for any trader. Value Trading Markets reportedly lacks adequate measures to ensure the security of clients' funds. A reputable broker typically employs strict protocols, such as segregating client funds in reputable banks, to protect clients from potential financial mishaps.

Moreover, the absence of investor protection schemes means that clients of Value Trading Markets may not have recourse in the event of a broker insolvency. This lack of safety nets can lead to significant losses for traders, making it crucial for potential clients to consider the implications of using a broker with questionable fund safety practices. Historical complaints regarding fund withdrawal issues further exacerbate concerns about the broker's reliability.

Customer Experience and Complaints

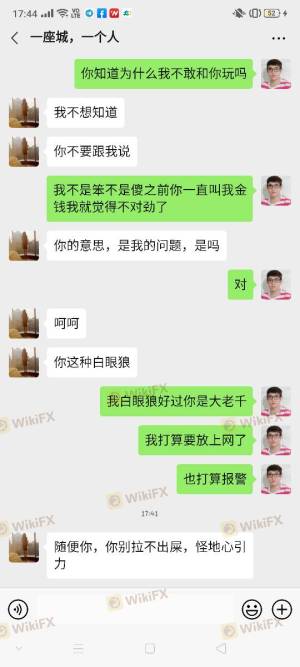

Customer feedback is an essential indicator of a broker's reliability and service quality. Reviews of Value Trading Markets reveal a mixed bag of experiences, with several users reporting difficulties in withdrawing their funds. Common complaints include slow response times from customer support and issues related to account management.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow Response |

| Poor Customer Support | Medium | Inconsistent |

Some customers have reported being unable to withdraw their funds, which raises serious concerns about the broker's operational integrity. In one notable case, a trader expressed frustration over a prolonged withdrawal process, indicating that they had to wait for weeks to access their money. Such experiences can significantly undermine trust in a broker and should be carefully considered by potential clients.

Platform and Trade Execution

The trading platform's performance is another critical factor in assessing a broker's safety. Value Trading Markets offers a platform that is generally user-friendly; however, there are reports of execution delays and slippage, which can affect trading outcomes. Traders need a reliable platform that allows for seamless execution of trades, particularly in the fast-paced forex market.

Additionally, any signs of potential platform manipulation should raise red flags. Traders have reported unusual price movements and discrepancies between market prices and execution prices, leading to suspicions of unfair practices. Such issues can significantly impact a trader's experience and profitability.

Risk Assessment

Using Value Trading Markets presents several inherent risks that potential traders should be aware of. The absence of regulation, coupled with a lack of transparency, raises significant concerns about the broker's legitimacy. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | No regulatory oversight |

| Fund Security | High | Lack of investor protection measures |

| Customer Support | Medium | Inconsistent and slow responses |

| Trading Conditions | Medium | High spreads and unclear fees |

Traders should take these risks into account when considering whether to engage with Value Trading Markets. To mitigate these risks, it is advisable to conduct thorough research and consider alternative brokers with robust regulatory frameworks and proven track records.

Conclusion and Recommendations

In conclusion, the investigation into Value Trading Markets raises several red flags that suggest it may not be a safe option for traders. The absence of regulation, coupled with a lack of transparency regarding its operations and fund safety measures, points to potential risks that could jeopardize clients' investments. Furthermore, the negative customer experiences reported by users indicate that this broker may not provide the level of service and support that traders require.

For those considering trading in the forex market, it is recommended to explore alternative brokers that are well-regulated and have a proven track record of reliability. Brokers such as OANDA, IG, and Forex.com offer robust regulatory oversight, transparent trading conditions, and positive customer experiences. Ultimately, traders should prioritize safety and reliability in their choice of broker to ensure a secure trading environment.

Is Value Trading Markets a scam, or is it legit?

The latest exposure and evaluation content of Value Trading Markets brokers.

Value Trading Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Value Trading Markets latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.