Is Tradear safe?

Pros

Cons

Is Tradear Safe or Scam?

Introduction

Tradear is an online trading platform that positions itself as a full-service broker, offering a range of financial instruments, including forex, commodities, indices, and cryptocurrencies. Established in 2018 and based in Vanuatu, Tradear aims to cater to both novice and experienced traders by providing various account types and trading options. However, the forex market is rife with scams and unregulated brokers, making it imperative for traders to conduct thorough evaluations before committing their funds. This article investigates the legitimacy of Tradear by analyzing its regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and associated risks. The insights are drawn from a comprehensive review of online sources and user feedback.

Regulation and Legitimacy

The regulatory status of a broker is a crucial factor in determining its safety and reliability. Tradear claims to be regulated by the Vanuatu Financial Services Commission (VFSC); however, this regulatory body is often criticized for its lenient oversight. Below is a summary of Tradear's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Vanuatu Financial Services Commission (VFSC) | 17935 | Vanuatu | Regulated but with low oversight |

While the VFSC provides some level of regulation, it lacks the stringent requirements imposed by more reputable authorities such as the FCA (UK) or ASIC (Australia). The absence of robust regulatory oversight raises concerns about the protection of client funds and the overall transparency of Tradear's operations. Additionally, Tradear has faced warnings from various financial regulators, including the CNMV in Spain, which further casts doubt on its legitimacy. Overall, the regulatory quality and historical compliance of Tradear suggest a higher risk profile for potential investors.

Company Background Investigation

Tradear is owned by Capitalia Group, which is registered in Vanuatu. The company was established in 2018 and primarily serves clients in Latin America. However, details about the management team and their professional backgrounds are scarce. This lack of transparency raises questions about the company's operational integrity and commitment to ethical trading practices.

The ownership structure and company history suggest that Tradear is relatively new and may not have the experience or stability that more established brokers possess. Furthermore, the limited information available about the company's operations and management may deter potential clients who prioritize transparency and accountability. Overall, the opacity surrounding Tradear's ownership and operational history contributes to a perception of risk and uncertainty.

Trading Conditions Analysis

Tradear's trading conditions reveal a mixed bag of offerings. The broker advertises competitive spreads, but many users have reported encountering hidden fees. The following table summarizes the core trading costs associated with Tradear:

| Fee Type | Tradear | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.0 - 1.5 pips |

| Commission Model | $0 - $5 | $0 - $5 |

| Overnight Interest Range | Varies | Varies |

Tradear's fee structure includes monthly maintenance fees and withdrawal fees, which may not be clearly communicated to clients upfront. Traders have reported unexpected charges, particularly during the withdrawal process, which can significantly impact overall profitability. Additionally, the lack of a demo account and transparency regarding trading conditions may deter new traders from engaging with the platform. Overall, while Tradear presents itself as a competitive broker, the complex fee structure and hidden costs could pose challenges for traders seeking a straightforward trading experience.

Client Fund Security

The safety of client funds is paramount when choosing a forex broker. Tradear claims to implement various security measures, including SSL encryption to protect sensitive data. However, the lack of a compensation scheme and the absence of segregated accounts raise concerns about the overall safety of client funds.

Tradear does not offer negative balance protection, which means that traders could potentially lose more than their initial investment. Historical complaints regarding delayed withdrawals and funds being inaccessible further exacerbate concerns about the safety of client capital. In the absence of robust regulatory oversight and protective measures, the risk of financial loss remains high for traders using Tradear.

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability. Many users have reported negative experiences with Tradear, particularly regarding withdrawal issues and customer service responsiveness. The following table outlines the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Hidden Fees | Medium | Average |

| Customer Support Issues | High | Poor |

Common complaints include lengthy withdrawal processes, unexpected fees, and inadequate customer support. Many users have shared stories of being unable to access their funds or facing significant delays when attempting to withdraw. These issues have led to a general sense of distrust among traders and have raised serious questions about Tradear's operational practices.

Platform and Trade Execution

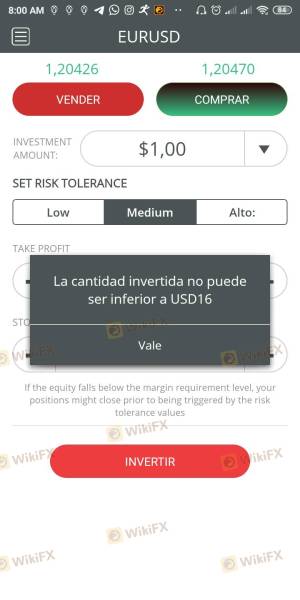

Tradear offers a proprietary web-based trading platform, which lacks the advanced features of popular platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5). Users have reported issues with platform stability, particularly during periods of high market volatility. The quality of order execution, including slippage and rejection rates, has also come under scrutiny. Traders have expressed concerns about the reliability of the platform, which could hinder their trading performance.

Risk Assessment

Engaging with Tradear presents several risks that traders should consider. Below is a risk assessment summary:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of stringent regulatory oversight |

| Financial Risk | High | Potential for hidden fees and withdrawal issues |

| Operational Risk | Medium | Platform stability and execution quality |

To mitigate these risks, traders are advised to conduct thorough due diligence before depositing funds, consider using smaller amounts for initial trading, and explore alternative brokers with better regulatory oversight and transparency.

Conclusion and Recommendations

In conclusion, while Tradear presents itself as a legitimate forex broker, multiple factors raise significant concerns regarding its safety and reliability. The lack of robust regulatory oversight, coupled with numerous user complaints about withdrawal issues and hidden fees, suggests that traders should exercise caution.

For those considering trading with Tradear, it is crucial to weigh the risks and potential drawbacks carefully. If you are a novice trader or someone who values strong regulatory protection and transparent trading conditions, it may be wise to explore alternative brokers with a proven track record. Recommended alternatives include brokers regulated by reputable authorities like the FCA or ASIC, which offer better client protection and a more transparent trading environment.

Overall, is Tradear safe? The evidence indicates that potential traders should proceed with caution and consider the associated risks before committing their funds.

Is Tradear a scam, or is it legit?

The latest exposure and evaluation content of Tradear brokers.

Tradear Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Tradear latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.