Tradear 2025 Review: Everything You Need to Know

Executive Summary

This Tradear review looks at a forex broker that works in a hidden spot in the competitive foreign exchange market. Scamadviser says Tradear is "legitimate and safe to use" and is not a fake website. But the broker works without any government watching over it, which creates important concerns for potential traders.

Tradear has a small online presence with about 963 monthly visits and a bounce rate of 47%. It ranks 670th among forex brokers for organic traffic. The platform focuses mainly on forex trading services, though specific details about account types, trading conditions, and platform features stay limited in public information.

User feedback across major review platforms like Trustpilot and FxVerify is very sparse. This makes it hard to judge real-world trading experiences. While the broker seems legitimate based on security checks, the lack of government supervision and limited user reviews suggest potential clients should be careful.

The overall evaluation of Tradear stays neutral. This reflects both its apparent legitimacy and the big information gaps that prevent a clearer assessment.

Important Notice

Potential traders should be very careful when thinking about Tradear since the broker does not seem to be regulated by any government financial authority. This lack of oversight means traders may not have access to standard investor protection measures that licensed brokers typically provide. The absence of detailed regulatory information in available sources shows how important it is to do thorough research before opening an account.

This review uses publicly available information and limited user feedback found across various platforms. Given the lack of complete data about Tradear's operations, trading conditions, and client experiences, readers should get additional information directly from the broker before making any investment decisions.

Rating Framework

Broker Overview

Tradear works as a forex broker in the competitive online trading world, though specific details about when it started and its corporate background stay unclear in available documents. The company seems to focus mainly on foreign exchange trading services. It positions itself within the retail forex market segment.

Without clear government supervision or detailed corporate transparency, Tradear's business model raises questions about its compliance framework and client protection measures. The broker's online presence suggests a small-scale operation with limited marketing reach and modest website traffic compared to established industry players. Traffic data shows Tradear gets about 963 monthly visits, with 99% coming from organic search results.

This limited digital footprint, combined with a 47% bounce rate, shows that the platform may struggle to engage and keep potential clients effectively. The absence of detailed information about Tradear's founding team, corporate history, or business partnerships makes it harder to judge the broker's credibility and long-term success chances. While security platforms like Scamadviser classify the broker as legitimate, the lack of complete background information suggests that potential clients should approach with extra care and seek additional verification before putting in funds.

Regulatory Status: Available sources show that Tradear does not seem to be regulated by any government financial authority. This unregulated status means the broker works without oversight from established financial regulators such as the FCA, CySEC, or ASIC, potentially leaving clients without standard investor protection measures.

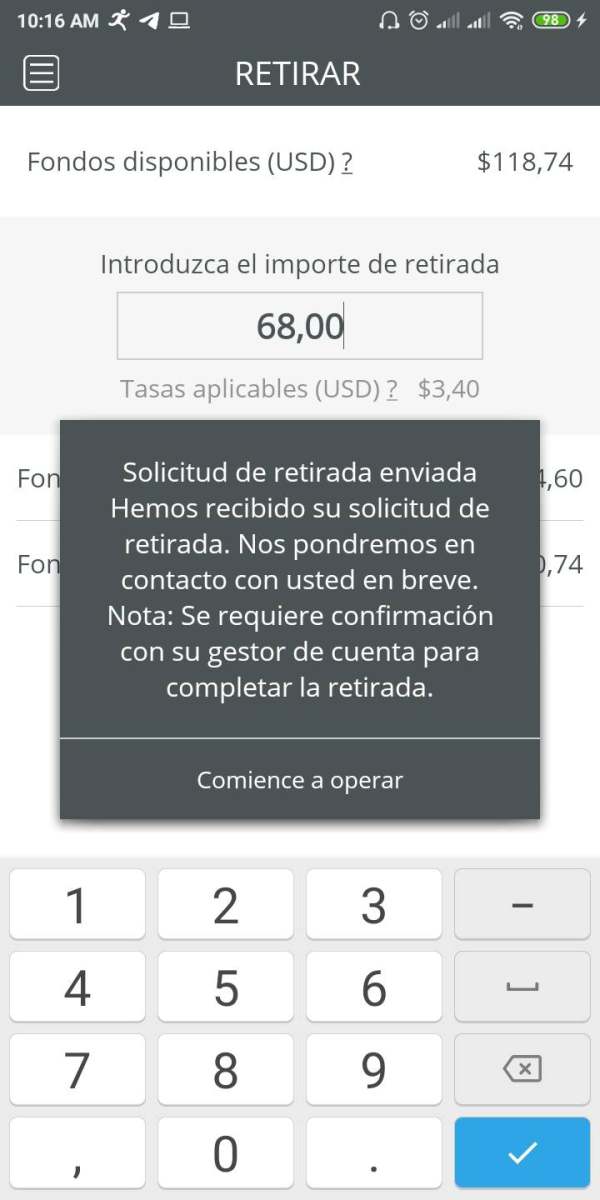

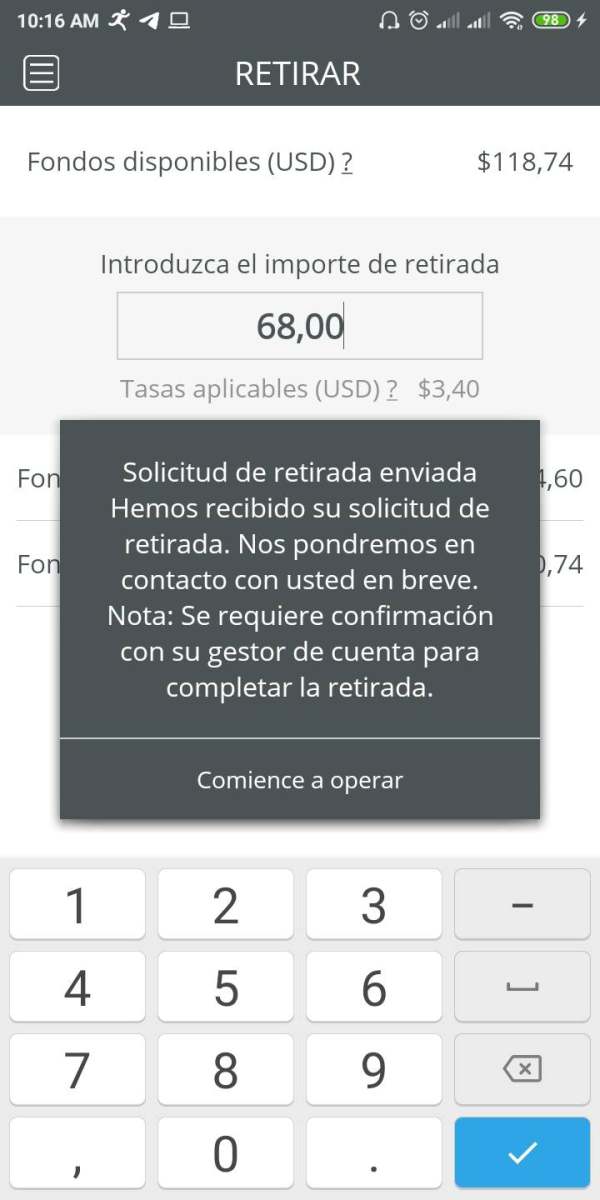

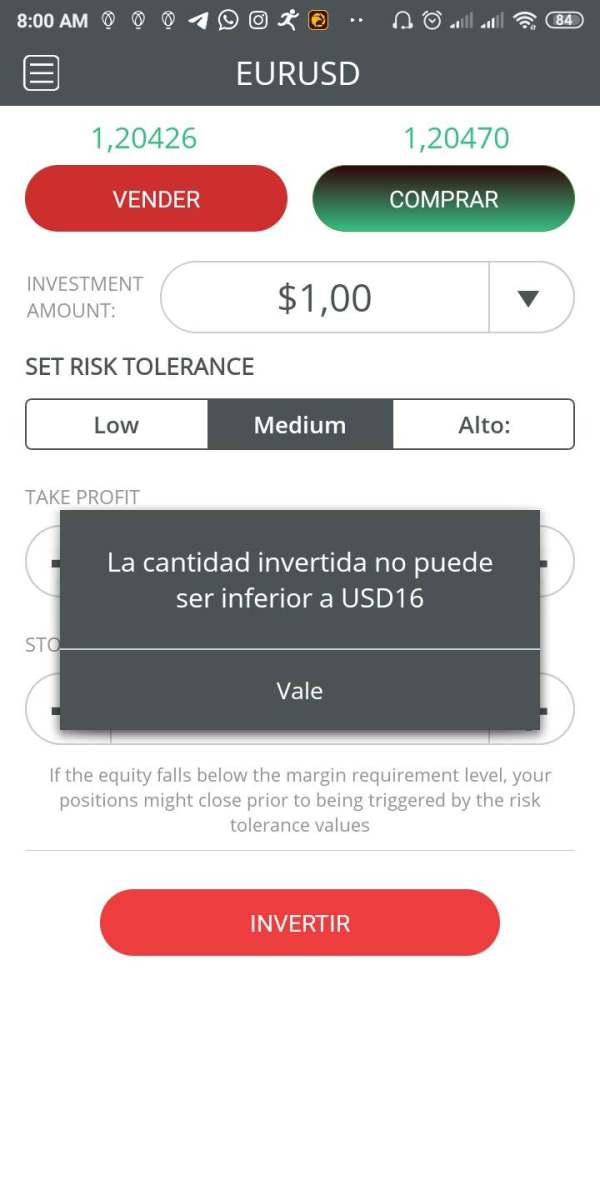

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal methods is not detailed in accessible sources. The absence of clear information about payment processing options, fees, and processing times represents a big transparency gap.

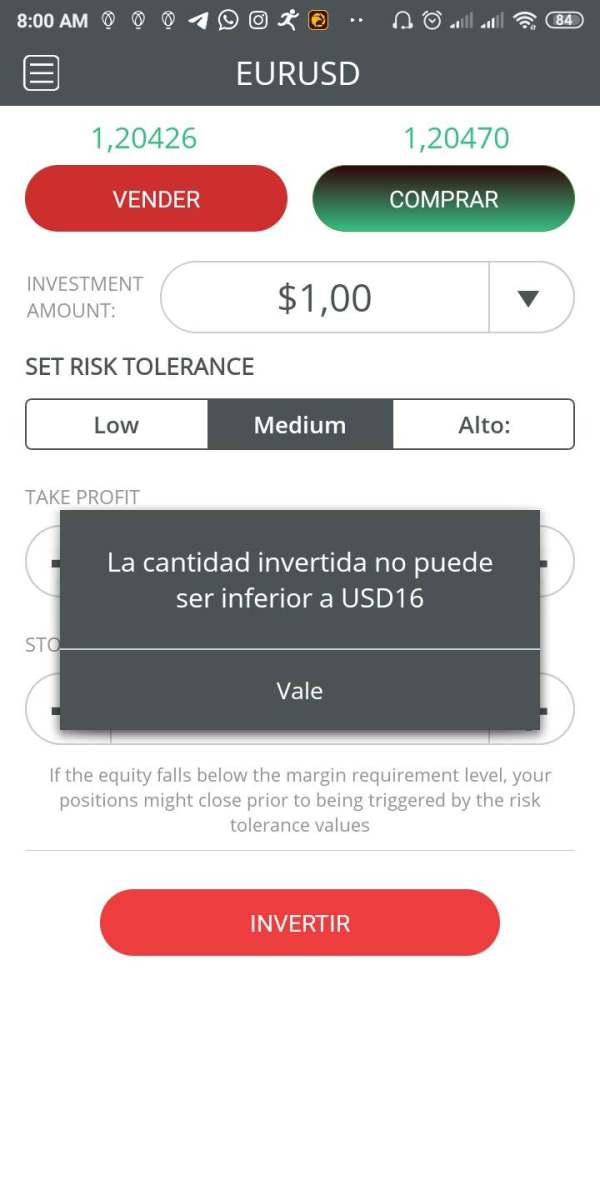

Minimum Deposit Requirements: No specific minimum deposit amounts are mentioned in available documents. This makes it difficult for potential traders to understand the financial commitment required to begin trading.

Bonuses and Promotions: Current promotional offerings, welcome bonuses, or trading incentives are not detailed in available sources. This suggests either limited promotional activity or poor information disclosure.

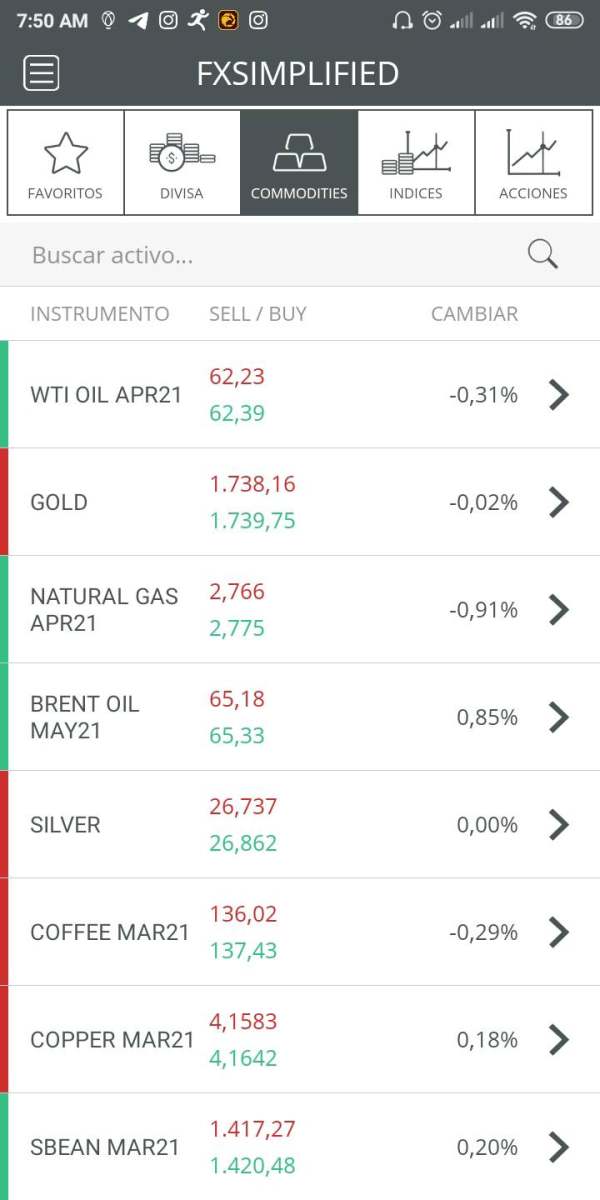

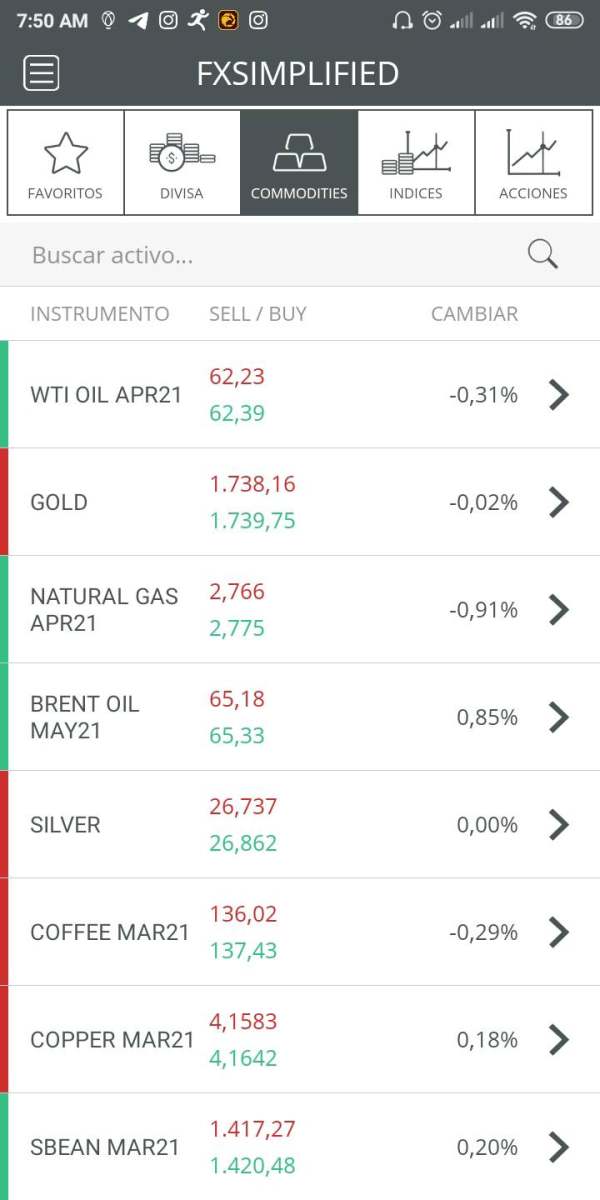

Tradeable Assets: Based on available information, Tradear seems to focus mainly on forex trading. However, the specific range of currency pairs, exotic options, or additional asset classes remains unspecified.

Cost Structure: Detailed information about spreads, commissions, overnight fees, and other trading costs is not readily available in public sources. This makes cost comparison with other brokers challenging.

Leverage Options: Specific leverage ratios offered to different account types or jurisdictions are not mentioned in accessible documents.

Platform Options: The trading platforms provided by Tradear are not specifically identified in available sources. This leaves questions about whether the broker offers MetaTrader, proprietary platforms, or web-based solutions.

Geographic Restrictions: Information about restricted countries or regional limitations is not detailed in available sources.

Customer Support Languages: The range of languages supported by customer service teams is not specified in accessible documents.

This Tradear review highlights big information gaps that potential clients should address through direct communication with the broker.

Detailed Rating Analysis

Account Conditions Analysis (Score: 3/10)

The account conditions offered by Tradear get a poor rating due to the big lack of available information about account types, minimum deposits, and specific trading terms. Without detailed documents about different account tiers, their respective features, or minimum funding requirements, potential traders cannot properly judge whether the broker's offerings match their trading capital and strategy requirements.

The absence of information about account opening procedures, verification requirements, or processing times further reduces the transparency that professional traders expect from reputable brokers. Additionally, no mention of specialized account types such as Islamic accounts, professional trader accounts, or managed account options suggests either limited product diversity or inadequate information disclosure. The lack of clear fee structures, account maintenance costs, or inactivity charges makes it impossible to calculate the true cost of maintaining an account with Tradear.

This opacity in account conditions, combined with limited user feedback about actual account experiences, contributes to the low rating in this critical evaluation dimension.

User feedback regarding account conditions is notably absent from major review platforms, preventing any assessment of client satisfaction with account setup, maintenance, or management processes.

Tradear's tools and resources get a below-average rating mainly due to the absence of detailed information about trading tools, analytical resources, and educational materials. Professional forex trading requires access to complete charting packages, technical indicators, economic calendars, and market analysis tools, yet no specific information about such resources is available in public documents.

The lack of information about research capabilities, market commentary, or analytical support suggests either limited resource offerings or poor communication of available tools. Modern forex traders expect access to real-time news feeds, economic data, and professional market analysis, but Tradear's provision of such resources remains unclear. Educational resources, which are increasingly important for retail forex traders, are not mentioned in available sources.

The absence of trading guides, webinars, tutorials, or market education materials may show limited commitment to client development and trading success.

Limited user feedback prevents assessment of tool quality, reliability, or usefulness in actual trading scenarios, contributing to the below-average rating.

Customer Service and Support Analysis (Score: 4/10)

Customer service evaluation for Tradear is hurt by the lack of detailed information about support channels, availability, and service quality. Professional forex trading requires reliable customer support, particularly during volatile market conditions or technical difficulties, yet specific details about Tradear's support infrastructure are not readily available.

The absence of information about support channels such as live chat, telephone support, email response times, or help desk hours makes it difficult to judge the broker's commitment to client service. Additionally, no information about multilingual support capabilities or regional service teams suggests potential limitations for international clients. Without documented service level agreements, response time commitments, or escalation procedures, potential clients cannot judge whether Tradear provides the level of support required for serious forex trading activities.

The lack of user testimonials about support experiences further complicates service quality evaluation.

The scarcity of user reviews specifically addressing customer service experiences prevents meaningful assessment of support quality, responsiveness, or problem resolution effectiveness.

Trading Experience Analysis (Score: 5/10)

The trading experience dimension gets an average rating due to insufficient information about platform performance, execution quality, and overall trading environment. While no significant negative reports about trading experience are evident in available sources, the lack of detailed platform specifications, execution statistics, or user experience data prevents a more positive assessment.

Critical trading factors such as order execution speed, slippage rates, platform stability, and mobile trading capabilities are not documented in accessible sources. The absence of information about trading platform features, customization options, or advanced order types suggests either limited platform sophistication or inadequate information disclosure. Market execution quality, including spread competitiveness, requote frequency, and execution transparency, cannot be assessed due to insufficient data.

Additionally, no information about trading restrictions, position limits, or scalping policies makes it difficult to evaluate suitability for different trading strategies.

Limited user feedback about actual trading experiences prevents assessment of platform reliability, execution quality, or overall trading satisfaction, contributing to the average rating in this Tradear review.

Trust and Safety Analysis (Score: 2/10)

Trust and safety get the lowest rating in this evaluation due to Tradear's unregulated status and limited transparency about client protection measures. The absence of regulatory oversight from established financial authorities means traders lack access to standard investor protection schemes, compensation funds, or regulatory dispute resolution mechanisms.

Without regulatory supervision, there are no mandated segregation requirements for client funds, capital adequacy standards, or operational compliance monitoring. This regulatory gap significantly increases counterparty risk and reduces client protection compared to regulated alternatives in the forex market. The limited corporate transparency, including unclear information about company ownership, financial backing, or operational history, further reduces trust indicators.

Additionally, the absence of published financial statements, audit reports, or regulatory filings prevents assessment of the company's financial stability and operational integrity.

The lack of substantial user reviews or independent verification of safety measures compounds trust concerns, making this the most significant weakness identified in the evaluation.

User Experience Analysis (Score: 4/10)

User experience evaluation is significantly limited by the lack of client feedback and detailed platform information. The modest website traffic and high bounce rate of 47% suggest that many visitors do not find the platform sufficiently engaging or informative to proceed with account opening or further exploration.

The absence of detailed information about account opening procedures, verification processes, or onboarding experiences makes it difficult to judge the user-friendliness of initial interactions with the broker. Additionally, no information about platform intuitive design, navigation ease, or mobile accessibility prevents evaluation of day-to-day usability. Without user testimonials about deposit and withdrawal experiences, platform reliability, or overall satisfaction levels, it's challenging to determine whether Tradear provides a positive user experience comparable to established industry players.

The lack of information about user interface design, customization options, or user support materials suggests potential limitations in user experience optimization.

The scarcity of comprehensive user feedback across major review platforms prevents meaningful assessment of client satisfaction levels, usability concerns, or overall experience quality.

Conclusion

This Tradear review reveals a forex broker that, while appearing legitimate according to security assessment platforms, operates with significant transparency limitations and regulatory gaps. The broker's unregulated status represents the most substantial concern for potential traders, as it eliminates standard investor protections and regulatory oversight that characterize reputable forex brokers.

The extensive information gaps regarding account conditions, trading costs, platform features, and client services make it difficult to recommend Tradear to serious forex traders who require comprehensive information for informed decision-making. The limited user feedback and modest online presence further suggest that the broker has not established a significant market presence or client base. Potential users considering Tradear should exercise extreme caution and conduct thorough due diligence, including direct communication with the broker to obtain detailed information about trading conditions, regulatory compliance, and client protection measures before committing any trading capital.