Regarding the legitimacy of TenTrade forex brokers, it provides FSA, CYSEC, FSA and WikiBit, (also has a graphic survey regarding security).

Is TenTrade safe?

Pros

Cons

Is TenTrade markets regulated?

The regulatory license is the strongest proof.

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Evalanch Ltd

Effective Date:

--Email Address of Licensed Institution:

info@evalanch.comSharing Status:

No SharingWebsite of Licensed Institution:

https://www.10tradefx.com, https://www.tentrade.com, https://www.10trade.comExpiration Time:

--Address of Licensed Institution:

CT House, Office 5B, Providence, Mahe, SeychellesPhone Number of Licensed Institution:

+2484344087Licensed Institution Certified Documents:

CYSEC Forex Execution License (STP)

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

UnverifiedLicense Type:

Forex Execution License (STP)

Licensed Entity:

Holiway Investments Ltd

Effective Date:

2014-10-10Email Address of Licensed Institution:

compliance@holiwayltd.comSharing Status:

No SharingWebsite of Licensed Institution:

www.miltonprime.euExpiration Time:

--Address of Licensed Institution:

Archiepiskopou Makariou III, 41, Office 13, 1065 Nicosia, CyprusPhone Number of Licensed Institution:

35722353557Licensed Institution Certified Documents:

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Milton Global Ltd

Effective Date:

--Email Address of Licensed Institution:

hiro@holiwayltd.comSharing Status:

No SharingWebsite of Licensed Institution:

https://www.miltonprime.comExpiration Time:

--Address of Licensed Institution:

Office 1, Unit 2, 2nd Floor, Dekk Complex, Plaisance, Mahe, SeychellesPhone Number of Licensed Institution:

4344573Licensed Institution Certified Documents:

Is TenTrade A Scam?

Introduction

TenTrade, a forex and CFD broker based in Seychelles, has emerged as a notable player in the online trading scene. Established in 2021, it aims to provide a comprehensive trading platform for a diverse range of financial instruments, including forex, cryptocurrencies, and commodities. However, as the forex market continues to grow, so does the number of unregulated or poorly regulated brokers, making it essential for traders to exercise caution when selecting a trading partner. This article aims to investigate whether TenTrade is a trustworthy broker or a potential scam, utilizing a structured evaluation framework that includes regulatory status, company background, trading conditions, fund safety, and customer experiences.

Regulation and Legitimacy

The regulatory status of a forex broker is crucial as it often determines the level of investor protection and operational transparency. TenTrade claims to be regulated by the Seychelles Financial Services Authority (FSA), a relatively new and less stringent regulatory body. Below is a summary of TenTrade's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Seychelles FSA | SD 082 | Seychelles | Active |

The Seychelles FSA is classified as a tier-3 regulator, which means it imposes minimal oversight compared to tier-1 regulators like the UK's Financial Conduct Authority (FCA) or Australia's Securities and Investments Commission (ASIC). While TenTrade is legally registered under this authority, the lack of a robust regulatory framework raises concerns about the broker's accountability and the protection of client funds.

In addition to its Seychelles license, there are reports suggesting that TenTrade may also be associated with a suspicious Cypriot license. The combination of these regulatory factors creates a complex landscape, indicating that while TenTrade operates legally, the level of investor protection may not be adequate.

Company Background Investigation

TenTrade is operated by Evalanch Ltd., a company that has been in existence since 2021. The broker's headquarters is located in Seychelles, a jurisdiction known for its lax regulatory environment. The ownership structure is not entirely transparent, with limited information available about the management team. This lack of disclosure raises questions about the broker's accountability and operational integrity.

The company has positioned itself as a modern trading platform, aiming to attract traders with various levels of experience. However, the absence of detailed information regarding the management team's qualifications and industry experience adds to the uncertainty surrounding TenTrade's operations. Transparency is a vital factor for trust, and the limited information available may deter potential clients who prioritize a broker's credibility.

Trading Conditions Analysis

TenTrade offers a variety of trading accounts, each with different conditions and fees. The overall fee structure includes spreads, commissions, and overnight interest rates. Below is a comparison of TenTrade's core trading costs against the industry average:

| Fee Type | TenTrade | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 1.2 pips | From 0.5 pips |

| Commission Model | Zero commission | $3 per lot |

| Overnight Interest Range | Varies | Varies |

TenTrade's spreads start from 1.2 pips for its pro account, which is relatively competitive but not as low as some industry leaders. The absence of commission fees on certain accounts may attract traders looking to minimize costs. However, the high spreads could impact profitability, especially for high-frequency traders.

Additionally, TenTrade's fee structure may include hidden charges or unfavorable policies that could affect traders' overall experience. Transparency regarding fees is essential, and any unexpected costs could lead to dissatisfaction among clients.

Client Fund Safety

The safety of client funds is a paramount concern for any trader. TenTrade claims to implement several safety measures, including holding client funds in segregated accounts at reputable banks. This practice is designed to protect clients' money in the event of financial difficulties faced by the broker. Furthermore, TenTrade offers negative balance protection, which prevents clients from losing more than their deposited amount.

However, the regulatory environment in Seychelles poses inherent risks. The lack of a robust investor protection scheme means that clients may have limited recourse in the event of disputes or financial issues. Historical data regarding any past incidents of fund mismanagement or disputes involving TenTrade remains unclear, further complicating the assessment of fund safety.

Customer Experience and Complaints

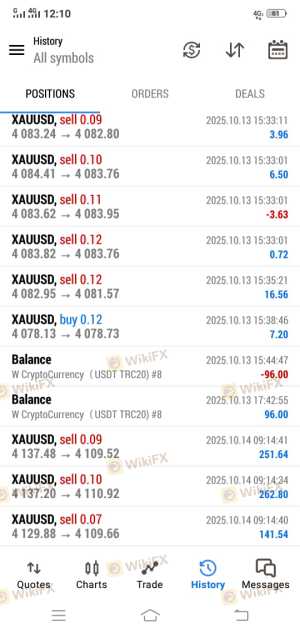

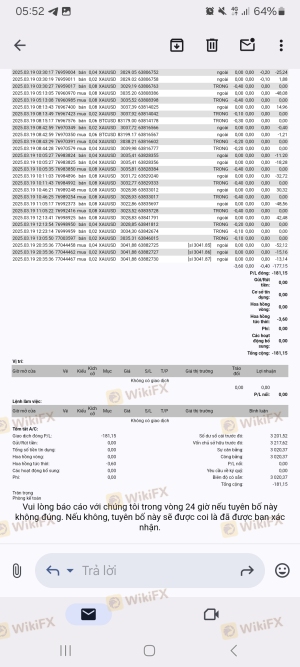

Customer feedback plays a crucial role in evaluating a broker's reliability. Reviews of TenTrade reveal a mixed bag of experiences, with some clients praising the platform's ease of use and customer support, while others express frustration over withdrawal issues and unresponsive service.

Common complaints include difficulties in withdrawing funds, with clients often reporting that their withdrawal requests were delayed or declined without clear explanations. Below is a summary of major complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Unresponsive Customer Support | Medium | Varies |

| Account Closure without Notice | High | Lack of communication |

Two typical cases involve clients who reported being unable to withdraw their funds after profitable trades, leading to accusations of fraud from the broker. These incidents highlight the importance of evaluating a broker's withdrawal policies and customer service responsiveness.

Platform and Trade Execution

TenTrade utilizes the popular MetaTrader 5 (MT5) platform, known for its user-friendly interface and advanced trading features. The platform allows for various order types and provides access to a wide range of financial instruments. However, the execution quality, including slippage and rejection rates, remains a critical aspect of the trading experience.

While there have been no widespread reports of platform manipulation, the lack of comprehensive data on order execution quality raises concerns. Traders should be cautious and monitor their trading experiences closely to ensure that the platform operates as advertised.

Risk Assessment

Engaging with TenTrade involves several risks, primarily due to its regulatory status and reported customer experiences. The following risk assessment summarizes key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Operates under a tier-3 regulator. |

| Fund Safety Risk | Medium | Segregated accounts but limited protections. |

| Customer Service Risk | Medium | Mixed feedback on support responsiveness. |

| Trading Conditions Risk | Medium | Higher spreads may impact profitability. |

Traders should consider implementing risk mitigation strategies, such as starting with a demo account or investing only a small amount initially.

Conclusion and Recommendations

In conclusion, while TenTrade operates legally under the Seychelles FSA, its tier-3 regulatory status and mixed customer feedback raise significant concerns regarding its reliability. The lack of transparency about its ownership and management, coupled with reported withdrawal issues, suggests that potential clients should proceed with caution.

For traders prioritizing strong regulatory oversight and a proven track record, it may be advisable to consider alternative brokers with tier-1 regulation, such as those regulated by the FCA or ASIC. These brokers typically offer better investor protection and more transparent operations.

Ultimately, the decision to engage with TenTrade should be based on individual risk tolerance and trading goals. Traders are encouraged to conduct thorough research and consider their options carefully before committing funds to any broker.

Is TenTrade a scam, or is it legit?

The latest exposure and evaluation content of TenTrade brokers.

TenTrade Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TenTrade latest industry rating score is 4.19, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 4.19 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.