TenTrade 2025 Review: Everything You Need to Know

Executive Summary

TenTrade is an online forex and CFD brokerage platform. It has received mixed reviews in the trading community. This tentrade review shows a broker with moderate trust ratings and a split user experience. The data shows that TenTrade works under the Seychelles Financial Services Authority and serves both retail and institutional clients.

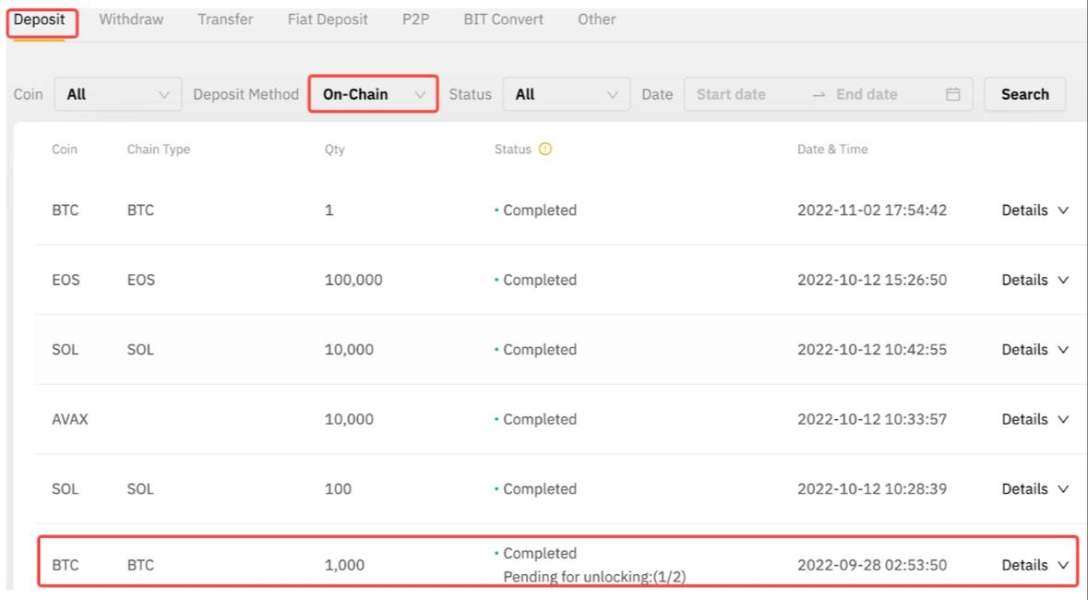

The broker gives access to multiple asset classes. These include forex, cryptocurrencies, commodities, and CFDs, with leverage up to 1:500. User feedback shows TenTrade gets a rating of 2.7 out of 5 stars with a 49% recommendation rate. The platform does well in customer service response and withdrawal processing speed. This has earned positive feedback from some users.

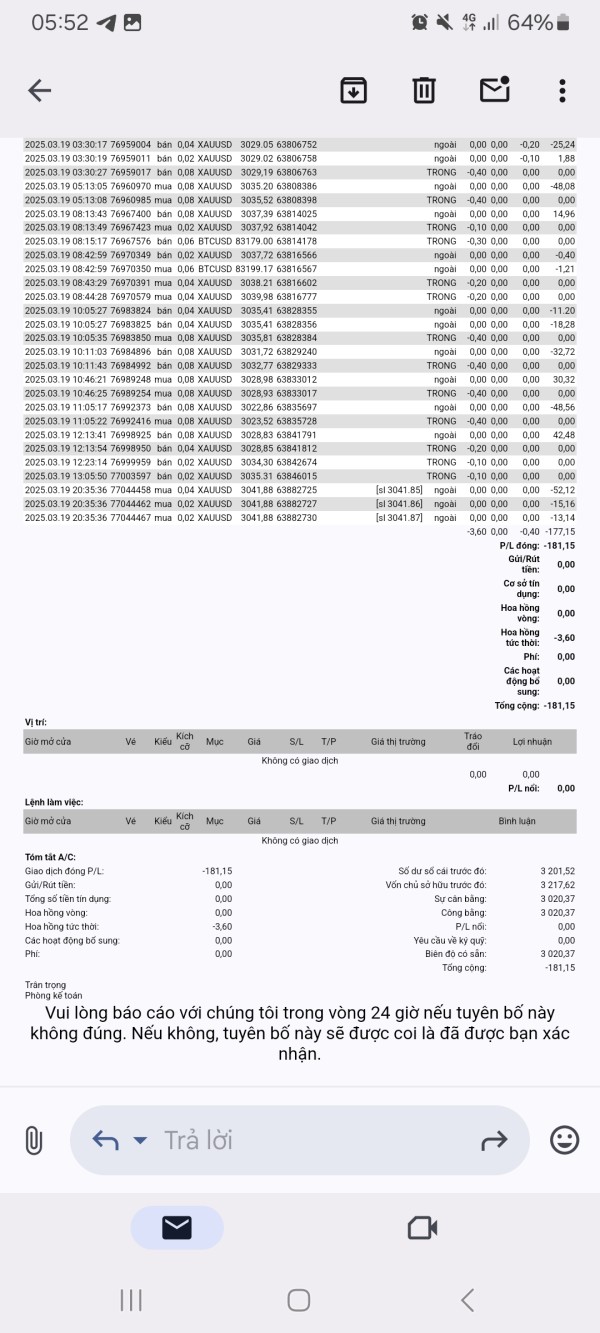

However, the broker has problems in other areas. These issues relate to account conditions and overall trading experience. The commission structure costs $3.5 per lot per side, though spread information stays limited in available documents. TenTrade supports MetaTrader 5 platform and offers trading in over 40 currency pairs and 15 cryptocurrency pairs. This positions it as a multi-asset trading provider in the competitive brokerage market.

Important Disclaimer

TenTrade operates under the Seychelles Financial Services Authority. This may present different regulatory standards compared to major financial jurisdictions. Potential clients should know that regulatory frameworks can vary greatly between regions. This may impact trader protections and dispute resolution methods.

This review uses publicly available information, user feedback, and industry reports. Trading involves substantial risk, and past performance does not guarantee future results. The information presented may contain errors or become outdated. Readers should conduct their own research before making any trading decisions.

Rating Framework

Broker Overview

TenTrade positions itself as a complete online brokerage platform. It serves both retail and institutional trading clients. The company operates mainly under Seychelles jurisdiction and offers multi-asset trading services across various financial instruments. While the exact founding date is not specified in available documents, TenTrade has established itself as a mid-tier broker in the competitive online trading space.

The broker's business model centers on providing access to global financial markets through electronic trading platforms. TenTrade offers trading in forex markets with over 40 currency pairs, cryptocurrency trading with 15 digital asset pairs, and CFD trading on indices, commodities, and stocks. The company emphasizes its commitment to serving diverse client needs through multiple account types and trading conditions.

Industry reports show that TenTrade operates under license SD082 from the Seychelles Financial Services Authority. This tentrade review shows that the broker supports MetaTrader 5 platform, which is widely known for its advanced trading capabilities and automated trading support. The company's regulatory framework and operational structure suggest a focus on serving international clients, particularly those seeking access to leveraged trading products and diverse asset classes.

Regulatory Jurisdiction: TenTrade operates under the Seychelles Financial Services Authority with license number SD082. This regulatory framework provides basic oversight but may offer different investor protections compared to tier-one jurisdictions.

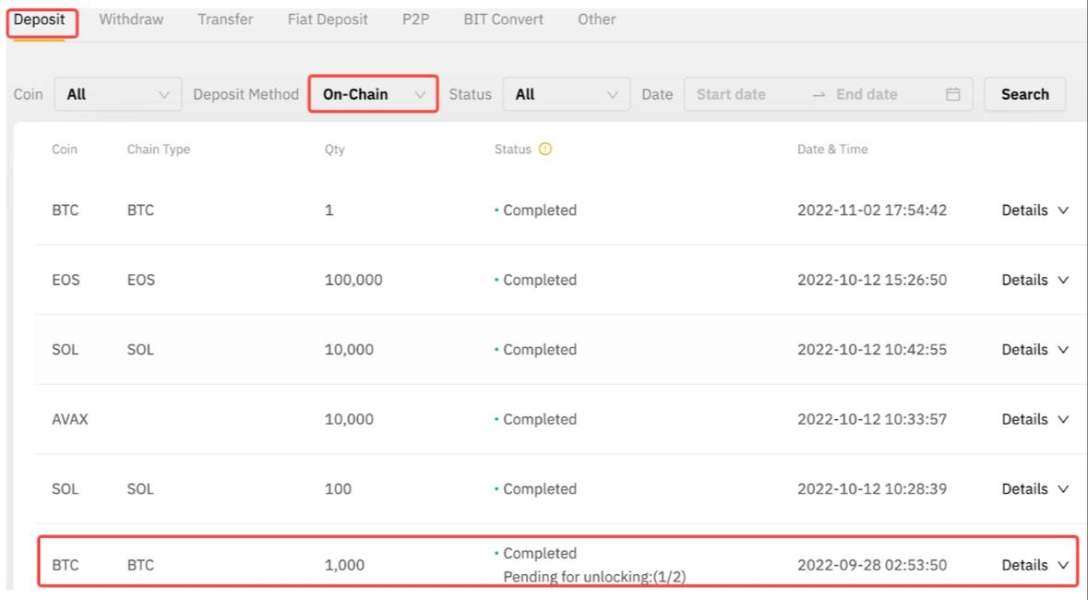

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods is not detailed in available documents. Potential clients should contact the broker directly for current payment processing options.

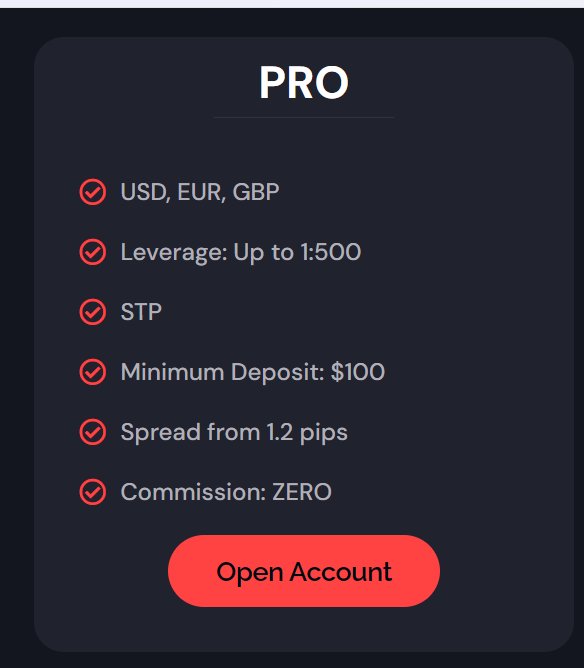

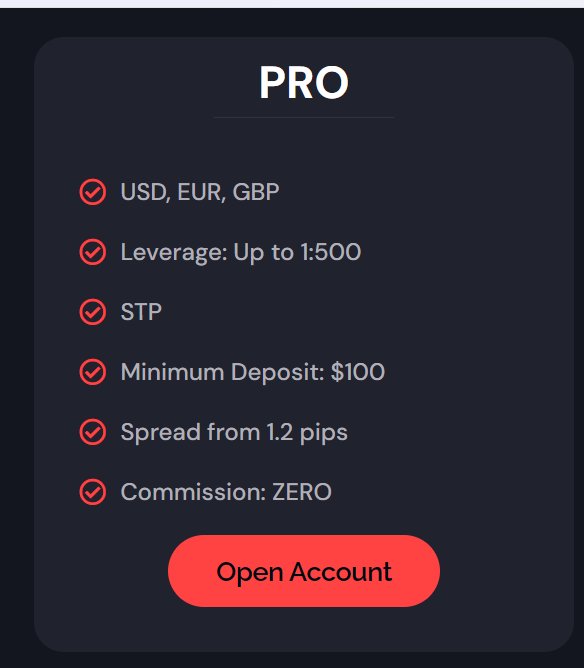

Minimum Deposit Requirements: The minimum deposit requirement is not specified in available sources. This information gap represents a potential concern for prospective traders seeking transparent account opening conditions.

Promotional Offers: Current bonus and promotional structures are not detailed in available documents. This suggests either limited promotional activities or insufficient public disclosure of such programs.

Tradeable Assets: TenTrade offers a diverse range of trading instruments. These include over 40 forex currency pairs, 15 cryptocurrency pairs, and CFD products covering indices, commodities, and individual stocks.

Cost Structure: The broker uses a commission-based pricing model with charges of $3.5 per lot per side. Spread information and additional fees are not fully detailed in available sources.

Leverage Options: TenTrade provides leverage up to 1:500. This represents relatively high leverage compared to many regulated brokers in major jurisdictions.

Platform Selection: The broker supports MetaTrader 5 platform. Additional proprietary or third-party platform options are not specified in available documents.

Geographic Restrictions: Specific information about geographic restrictions and service availability is not detailed in current sources.

Customer Support Languages: The range of supported languages for customer service is not specified in available documents. This tentrade review suggests multilingual support based on the broker's international positioning.

Detailed Rating Analysis

Account Conditions Analysis (5/10)

TenTrade's account conditions present a mixed picture. They reflect both opportunities and limitations for potential traders. The commission structure of $3.5 per lot per side places the broker in the mid-range category for transaction costs. However, the absence of detailed spread information makes complete cost assessment challenging.

The lack of publicly available information about minimum deposit requirements raises transparency concerns. Most reputable brokers clearly communicate their account opening requirements. This information gap may indicate either frequently changing conditions or insufficient disclosure practices. User feedback analysis shows that account conditions receive moderate ratings from the trading community.

The broker offers leverage up to 1:500. This appeals to traders seeking higher capital efficiency but also increases risk exposure significantly. This leverage level is much higher than what many tier-one regulated brokers offer. It reflects the more permissive regulatory environment in Seychelles.

Account type variety and specific features such as Islamic accounts are not detailed in available sources. This tentrade review finds that the overall account conditions framework lacks the complete structure and transparency typically expected from leading industry players. This contributes to the moderate rating in this category.

TenTrade shows strength in its tools and resources offering. This is particularly true in asset diversity and platform support. The broker provides access to over 40 forex currency pairs, covering major, minor, and exotic currency combinations that satisfy most trading strategies and preferences.

The cryptocurrency trading offering includes 15 digital asset pairs. This positions TenTrade competitively in the growing crypto CFD market. This diverse asset selection extends to traditional CFD products covering indices, commodities, and individual stocks. It provides traders with complete market exposure opportunities.

MetaTrader 5 platform support represents a significant advantage. This platform offers advanced charting capabilities, automated trading support through Expert Advisors, and complete technical analysis tools. The MT5 platform's institutional-grade features support both retail and professional trading activities.

However, specific information about proprietary research tools, educational resources, and market analysis materials is not detailed in available sources. Many leading brokers supplement platform offerings with complete educational content and market research. The absence of such information in this review suggests potential gaps in value-added services that could enhance the overall trading experience.

Customer Service and Support Analysis (8/10)

Customer service emerges as one of TenTrade's strongest performance areas. This is based on available user feedback. Reviewer comments show that the broker demonstrates responsive customer support that addresses client inquiries and concerns effectively.

User testimonials specifically highlight fast response times and helpful service representatives. One reviewer noted that "Tentrade has got one of the best customer service for a broker." This indicates superior performance in this critical area. This positive feedback suggests that TenTrade prioritizes client support and maintains adequate staffing levels to handle customer inquiries.

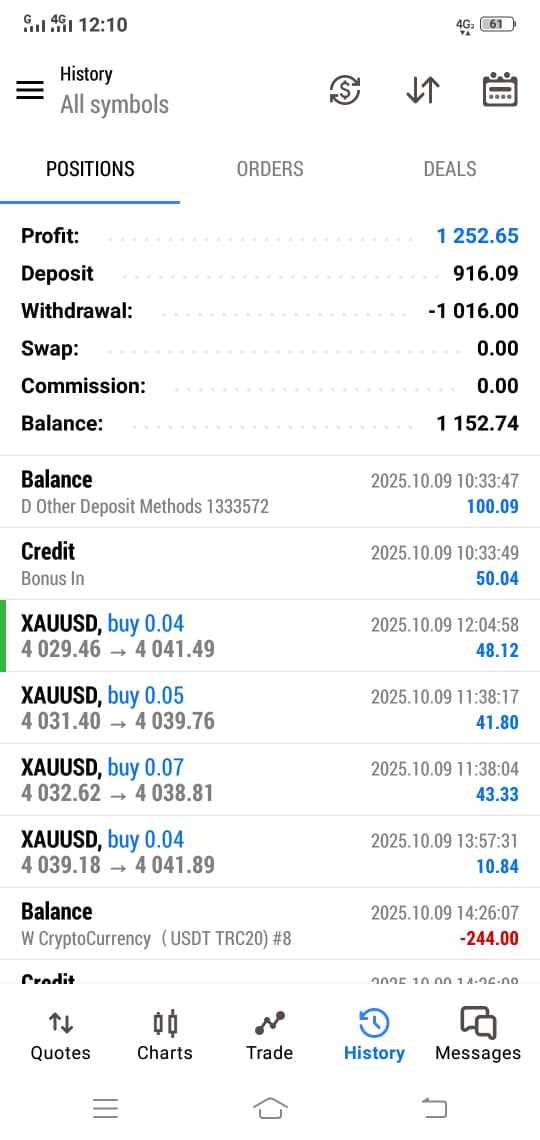

The quick withdrawal processing that users frequently mention reflects efficient back-office operations and customer service coordination. Fast withdrawal processing often indicates well-organized internal procedures and adequate attention to client fund management requirements.

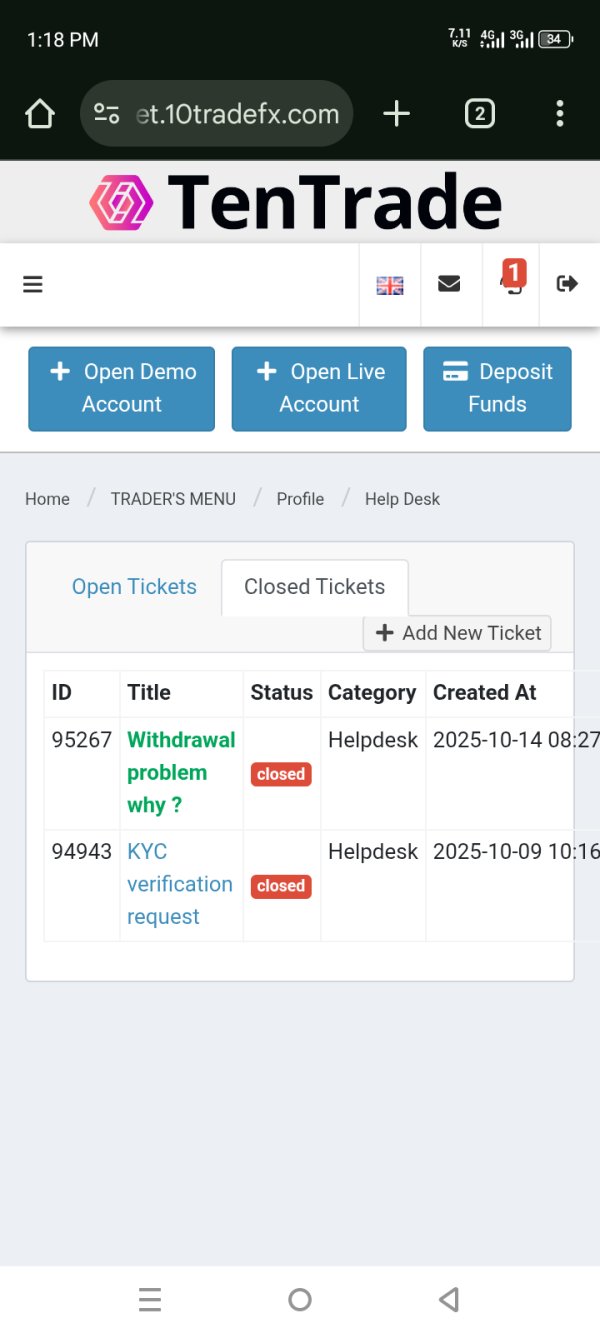

However, specific information about customer service channels, availability hours, and multilingual support capabilities is not detailed in available sources. The overall positive user sentiment about customer service quality suggests that TenTrade invests appropriately in this area. More complete information about service structure would enhance transparency and client confidence.

Trading Experience Analysis (6/10)

The trading experience with TenTrade appears to offer moderate satisfaction levels. This is based on available user feedback and platform capabilities. MetaTrader 5 platform support provides traders with professional-grade tools and functionality. These include advanced charting, automated trading capabilities, and complete order management features.

The high leverage availability up to 1:500 appeals to traders seeking maximum capital efficiency. However, this also increases risk exposure significantly. The diverse asset selection across forex, cryptocurrencies, and CFDs provides flexibility for various trading strategies and market preferences.

However, specific information about execution quality, slippage rates, and platform stability is not fully detailed in available sources. User ratings of 2.7 out of 5 stars suggest mixed experiences, with some traders encountering challenges that impact overall satisfaction levels.

The commission structure of $3.5 per lot per side, combined with unspecified spread levels, makes complete cost assessment difficult for traders. This tentrade review shows that while the basic trading infrastructure appears adequate, the overall experience may lack the refinement and consistency that characterize top-tier brokerage services.

Trust and Regulation Analysis (5/10)

TenTrade's trust and regulatory profile presents a moderate risk assessment. This is based on available information. The broker operates under license SD082 from the Seychelles Financial Services Authority. This provides basic regulatory oversight but may offer different investor protections compared to major financial jurisdictions.

Scam Detector analysis shows that TenTrade receives a medium trust score of 58. This indicates neither high-risk nor high-confidence categorization. This moderate trust rating reflects the typical assessment for brokers operating under offshore regulatory frameworks.

The Seychelles regulatory environment offers more flexible operational conditions for brokers. However, it may provide limited investor compensation schemes and dispute resolution mechanisms compared to jurisdictions like the UK, EU, or Australia. Traders should understand these regulatory differences when evaluating counterparty risk.

Specific information about client fund segregation, insurance coverage, and financial transparency measures is not detailed in available sources. The absence of complete safety information contributes to the moderate trust rating. Leading brokers typically provide detailed disclosures about client protection measures and corporate governance structures.

User Experience Analysis (5/10)

TenTrade's user experience reflects a polarized client base with mixed satisfaction levels. The 2.7 out of 5 star rating and 49% recommendation rate indicate that approximately half of users would recommend the broker. The other half express reservations about their experience.

Positive user feedback consistently highlights fast withdrawal processing and responsive customer service as key strengths. These operational efficiencies suggest that TenTrade maintains adequate infrastructure for core client service functions and prioritizes timely fund processing.

However, the moderate overall rating suggests that users encounter challenges in other areas of the trading experience. Common concerns in user feedback often relate to account conditions, trading costs, and platform performance. Specific complaint patterns are not detailed in available sources.

The diverse asset offering and MetaTrader 5 platform support appeal to traders seeking variety and professional trading tools. However, the mixed user sentiment suggests that execution quality, cost transparency, or service consistency may not meet all client expectations. This results in the moderate user experience rating.

Conclusion

This tentrade review reveals a broker with mixed performance characteristics. It may appeal to specific trader segments while presenting limitations in other areas. TenTrade shows particular strength in customer service responsiveness and withdrawal processing efficiency. This earns positive recognition from users who prioritize these operational aspects.

The broker suits traders seeking diverse asset access, high leverage options, and responsive customer support. The MetaTrader 5 platform support and complete instrument selection provide adequate tools for various trading strategies and market preferences.

However, TenTrade faces challenges in transparency, cost disclosure, and overall user satisfaction that may concern quality-focused traders. The moderate trust rating and mixed user feedback suggest careful evaluation is warranted before committing significant capital to this platform.