Is T-Rea safe?

Business

License

Is T-Rea A Scam?

Introduction

T-Rea is a forex broker that positions itself as a sophisticated trading platform offering a wide array of trading instruments and services. With the allure of high leverage and minimal deposit requirements, it attracts both novice and experienced traders. However, in the volatile world of forex trading, it is crucial for traders to exercise caution and thoroughly evaluate any broker before investing their hard-earned money. The potential for scams and fraudulent practices is significant in this industry, making it essential for traders to conduct due diligence. This article aims to investigate T-Rea's legitimacy by examining its regulatory status, company background, trading conditions, customer safety measures, user experiences, and overall risks involved.

Regulation and Legitimacy

The regulatory status of a forex broker is a key indicator of its reliability and safety. T-Rea claims to be regulated by several financial authorities, including the Cyprus Securities and Exchange Commission (CySEC) and the International Financial Services Commission (IFSC) of Belize, among others. However, a deeper investigation reveals discrepancies in these claims.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Cyprus Securities and Exchange Commission | N/A | Cyprus | Not Found |

| International Financial Services Commission | N/A | Belize | Not Found |

| Financial Services Commission of Mauritius | N/A | Mauritius | Not Found |

The above table illustrates that T-Rea does not appear to have valid licenses from the claimed regulatory bodies. This lack of credible regulation raises significant concerns about the broker's operational legitimacy and adherence to industry standards. The absence of regulatory oversight means that traders have little recourse in the event of disputes or fraudulent activities. Furthermore, the broker's claims of compliance with the laws of Vanuatu, a known offshore jurisdiction, further complicate its credibility. Overall, the lack of verified regulation indicates that traders should approach T-Rea with caution.

Company Background Investigation

T-Rea's history and ownership structure play a vital role in assessing its trustworthiness. The broker claims to have been in operation for several years, but many reviews indicate that its website was last updated in 2021, which raises questions about its operational continuity and transparency.

The management team behind T-Rea is not well-documented, and there is a lack of publicly accessible information regarding their professional backgrounds and qualifications. This lack of transparency can be a red flag, as reputable brokers typically provide detailed information about their leadership and operational structure. Moreover, the absence of clear ownership details raises concerns about accountability in the event of disputes or issues.

In terms of information disclosure, T-Rea's website does not provide comprehensive insights into its business practices, trading conditions, or risk disclosures. This opacity can be detrimental for traders who rely on accurate and transparent information to make informed decisions. In summary, the lack of a clear company background and management transparency adds to the skepticism surrounding T-Rea's legitimacy.

Trading Conditions Analysis

Understanding the trading conditions offered by T-Rea is essential for evaluating its overall value proposition. The broker claims to provide competitive spreads and a variety of account types, but many of these claims lack substantiation.

| Fee Type | T-Rea | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The table above highlights the absence of specific data regarding T-Reas trading costs. This lack of clarity is concerning, as reputable brokers typically disclose their fee structures transparently. Furthermore, T-Rea's claims of high leverage and low minimum deposits may appear attractive, but they can also lead to significant risks for inexperienced traders.

Additionally, several reviews suggest that T-Rea employs unusual fees or commissions that may not be disclosed until after account creation. Such practices are often indicative of brokers that may engage in deceptive tactics to maximize their profits at the expense of traders. In light of these factors, the overall trading conditions at T-Rea warrant careful scrutiny.

Customer Funds Safety

The safety of client funds is paramount when choosing a forex broker. T-Rea claims to implement various measures to protect customer deposits, including segregated accounts and investor protection policies. However, the actual effectiveness of these measures is questionable.

Many reviews indicate that T-Rea does not provide adequate information about its fund security protocols, making it challenging for traders to assess the safety of their investments. The lack of transparency regarding fund segregation and the absence of any insurance or compensation schemes further exacerbate concerns about the safety of client funds.

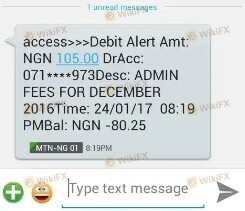

Historically, there have been reports of funds being difficult to withdraw, with clients alleging that T-Rea imposes unnecessary delays and additional fees. Such practices not only erode trust but also pose significant risks to traders capital. Given these concerns, it is crucial for potential clients to evaluate T-Rea's fund safety measures critically.

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing a broker's reliability. A review of user experiences with T-Rea reveals a pattern of complaints related to poor customer service, withdrawal issues, and lack of transparency.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Unresponsive |

| Poor Customer Support | Medium | Slow Response |

| Misleading Information | High | No Clarification |

The table above summarizes the most common complaints associated with T-Rea. Many users report significant delays in withdrawing their funds, often citing vague explanations from customer support. Additionally, complaints about misleading information regarding trading conditions and fees are prevalent.

Two notable cases illustrate these issues: one user reported being unable to withdraw funds after several attempts, while another claimed that customer support failed to address their concerns adequately. Such experiences indicate a troubling trend that potential clients should consider seriously. The overall customer experience with T-Rea raises significant red flags.

Platform and Trade Execution

The trading platform's performance is critical for a seamless trading experience. T-Rea claims to offer a user-friendly interface with advanced trading tools, but user reviews tell a different story. Many traders report issues with platform stability, order execution quality, and slippage.

In terms of order execution, users have noted instances of significant slippage during volatile market conditions, leading to unexpected losses. Moreover, complaints about rejected orders and technical glitches further exacerbate concerns about the platform's reliability.

Given these issues, it is essential for traders to assess whether T-Rea's platform meets their trading needs effectively. The quality of trade execution and platform performance should be a crucial consideration for anyone contemplating trading with T-Rea.

Risk Assessment

Using T-Rea as a forex broker presents several risks that traders should evaluate carefully. The following risk assessment summarizes key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of valid regulation raises concerns. |

| Fund Safety | High | Unclear fund protection measures. |

| Customer Service | Medium | Poor response to complaints. |

| Trading Conditions | High | Lack of transparency in fees and conditions. |

The table above highlights the significant risks associated with T-Rea. Traders should be particularly cautious about the regulatory risks and fund safety concerns. To mitigate these risks, it is advisable to conduct thorough research and consider alternative brokers with better reputations and regulatory oversight.

Conclusion and Recommendations

In conclusion, the investigation into T-Rea reveals several alarming indicators that suggest it may not be a safe choice for forex trading. The lack of verified regulation, questionable fund safety measures, and numerous customer complaints raise significant concerns about the broker's legitimacy.

For traders considering their options, it is crucial to prioritize safety and reliability. Reputable alternatives to T-Rea include brokers regulated by top-tier authorities such as the FCA, ASIC, or CySEC. These brokers typically offer better protection for client funds, transparent trading conditions, and responsive customer service. In light of the findings, it is strongly recommended that traders exercise caution and consider all available options before engaging with T-Rea.

Is T-Rea a scam, or is it legit?

The latest exposure and evaluation content of T-Rea brokers.

T-Rea Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

T-Rea latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.