Is SUNDELL LIMITED safe?

Business

License

Is Sundell Limited A Scam?

Introduction

Sundell Limited has emerged in the forex market as a trading platform that claims to offer various financial instruments, including forex, commodities, indices, and cryptocurrencies. Established in December 2022, the broker has attracted attention due to its aggressive marketing strategies. However, the growing number of complaints and warnings from financial authorities have raised significant concerns about its legitimacy. As a trader, it is crucial to carefully evaluate any forex broker before investing, as the industry is rife with scams and unregulated entities. This article aims to investigate the safety and legitimacy of Sundell Limited by examining its regulatory status, company background, trading conditions, and customer experiences. Our analysis is based on various online sources, user reviews, and regulatory information to provide a comprehensive overview of whether Sundell Limited is safe or a scam.

Regulation and Legitimacy

Sundell Limited's regulatory status is a critical factor in assessing its safety. The broker claims to operate under the jurisdiction of the UK, yet it lacks authorization from the Financial Conduct Authority (FCA), the primary regulatory body overseeing financial services in the UK. According to the FCA's official warnings, Sundell Limited is not authorized to provide financial services, indicating that it operates without proper oversight.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | N/A | UK | Not Authorized |

The absence of regulation poses significant risks for traders, as they have no recourse in the event of disputes or financial losses. Regulatory bodies like the FCA are essential for ensuring that brokers adhere to industry standards, including the segregation of client funds and the provision of negative balance protection. The lack of a verified license raises red flags about Sundell Limited's operations, suggesting that it may not be a trustworthy platform for trading.

Company Background Investigation

Sundell Limited was founded in December 2022, making it a relatively new player in the forex market. The company claims to be based in London, but there is little information available about its ownership structure or management team. The lack of transparency regarding the company's history and key personnel is concerning, as reputable brokers typically provide detailed information about their management and operational practices.

The company's website, sundell-fx.com, does not offer insights into the qualifications or experience of its leadership, which further complicates the assessment of its legitimacy. A credible broker should have a clear and accessible profile, including information about its founders and their expertise in the financial industry. The absence of such details for Sundell Limited raises questions about its credibility and reliability.

Trading Conditions Analysis

When evaluating whether Sundell Limited is safe, it is essential to analyze its trading conditions, including fees and commissions. The broker claims to offer competitive spreads and a range of trading instruments, but specific details regarding fees are often vague or absent. This lack of transparency can be a warning sign, as traders may encounter unexpected costs that can significantly impact their profitability.

| Fee Type | Sundell Limited | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 2.1 pips | 1.0-1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The reported spread of 2.1 pips on major currency pairs is considerably higher than the industry average, indicating that trading costs may be unfavorable for clients. Moreover, the lack of clear information on commission structures and overnight interest rates further complicates the evaluation of trading conditions at Sundell Limited. Traders should be cautious when dealing with brokers that do not provide transparent fee structures, as hidden costs can erode potential profits.

Client Funds Security

Client funds security is a paramount concern for any trader considering whether Sundell Limited is safe. The broker's website does not provide adequate information regarding its policies on fund segregation, investor protection, or negative balance protection. In regulated environments, brokers are required to keep client funds in segregated accounts to ensure that they are not used for operational expenses. The absence of such practices at Sundell Limited raises significant concerns about the safety of client investments.

Furthermore, the lack of any history of compliance or regulatory oversight means that traders have no assurance that their funds will be protected in the event of financial difficulties or fraud. Traders should be particularly wary of engaging with brokers that do not have robust security measures in place, as this can lead to substantial financial losses.

Customer Experience and Complaints

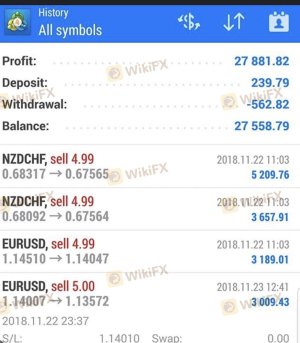

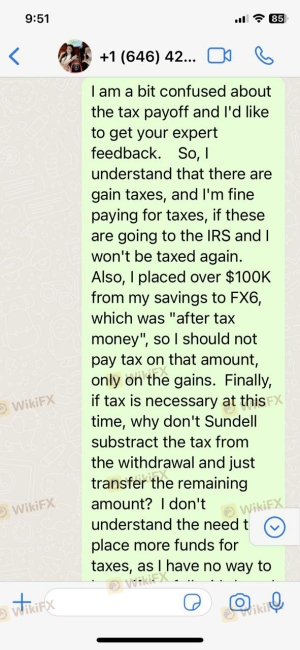

Customer feedback is invaluable in determining whether Sundell Limited is a scam or a legitimate broker. Numerous reviews on platforms like Trustpilot indicate that many users have experienced significant issues, particularly with fund withdrawals. Common complaints include difficulties in accessing funds, lack of customer support, and claims that the broker employs tactics to prevent withdrawals once larger deposits are made.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Lacks Response |

| Customer Support Issues | Medium | Delayed Response |

| Misleading Information | High | No Clarification |

A typical case involves users who reported being able to withdraw small amounts initially, only to face obstacles when attempting to withdraw larger sums. This pattern suggests that Sundell Limited may employ deceptive practices to lure in traders before restricting access to their funds. The overall negative sentiment surrounding customer experiences raises serious concerns about the brokers reliability and integrity.

Platform and Trade Execution

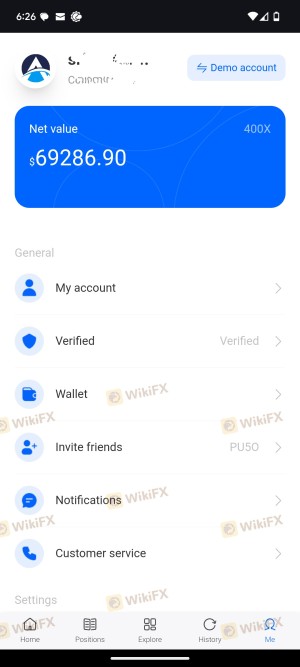

The performance and reliability of the trading platform are crucial factors in determining whether Sundell Limited is safe. While the broker claims to offer a proprietary web-based trading platform, user reviews indicate that the platform is often buggy and lacks essential features found in industry-standard platforms like MetaTrader 4 or 5. This raises concerns about order execution quality, potential slippage, and the overall user experience.

Traders have reported instances of delayed order execution and unexpected rejections, which can adversely affect trading outcomes. A reliable trading platform should provide seamless execution, but the issues reported by users suggest that Sundell Limited's platform may not meet these standards.

Risk Assessment

In evaluating the overall risk of trading with Sundell Limited, several key risk factors emerge. The broker's lack of regulation, high trading costs, and negative user feedback contribute to a high-risk profile. Traders should be aware of the following risk categories:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight or protection |

| Financial Risk | High | High trading costs and potential losses |

| Operational Risk | Medium | Platform reliability issues |

To mitigate these risks, traders are advised to conduct thorough due diligence before investing. Seeking alternative brokers with established regulatory oversight and positive user reviews can provide a safer trading environment.

Conclusion and Recommendations

In conclusion, the evidence suggests that Sundell Limited is not a safe broker and exhibits several characteristics typical of a scam. The lack of regulatory oversight, combined with numerous complaints from users regarding fund withdrawals and poor customer support, raises significant concerns about the broker's legitimacy. Traders should exercise extreme caution when considering investments with Sundell Limited and should be wary of the potential risks involved.

For those looking for safer trading alternatives, it is advisable to consider brokers that are regulated by reputable authorities such as the FCA or CFTC, which offer investor protection and transparent trading conditions. Overall, staying informed and cautious is essential in navigating the forex market, especially when dealing with brokers like Sundell Limited.

Is SUNDELL LIMITED a scam, or is it legit?

The latest exposure and evaluation content of SUNDELL LIMITED brokers.

SUNDELL LIMITED Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SUNDELL LIMITED latest industry rating score is 1.39, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.39 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.