X Charter 2025 Review: Everything You Need to Know

Executive Summary

This x charter review gives you a complete look at X Charter. X Charter is a forex broker registered in Belize that operates without any regulatory oversight, which creates major safety and reliability concerns for traders who might want to use their services. The broker does stand out by offering very high leverage ratios up to 1:1000 and supports multiple trading platforms including MetaTrader 4, MetaTrader 5, and their own trading apps.

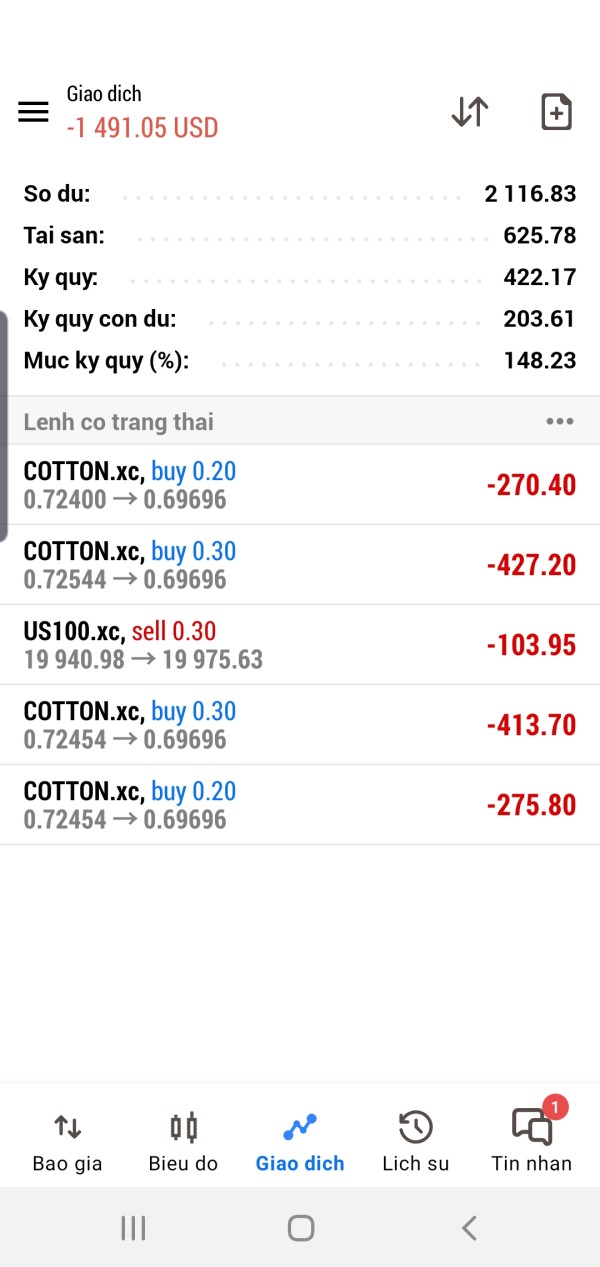

X Charter mainly targets experienced traders who want high-leverage trading opportunities. They offer trading across many different types of assets including forex, stocks, futures, indices, precious metals, energy commodities, and cryptocurrencies. User feedback consistently shows concerns about whether the platform can be trusted and the overall quality of their service, so traders need to carefully think about the risks involved.

Based on the information we found and what users say, X Charter seems right only for seasoned traders. These traders must understand what it means to trade with an unregulated broker and must be able to handle the higher risks that come with it. The mix of high leverage opportunities and regulatory uncertainty creates a trading environment that requires exceptional caution and expert risk management skills.

Important Notice

Regional Entity Differences: X Charter operates as a Belize-registered entity without regulatory supervision. This may expose traders to different legal risks depending on where they live. The absence of regulatory oversight means traders don't have the standard protections that usually come with licensed brokers, including compensation schemes and ways to resolve disputes.

Review Methodology: This evaluation uses publicly available information, user feedback, and industry reports. Our assessment helps traders understand the potential risks and benefits of X Charter's services. Since there's limited transparency and regulatory oversight, traders should do additional research before working with this broker.

Rating Framework

Broker Overview

X Charter was established in 2009. However, some sources say they started operating more recently around 2023, which creates uncertainty about when the broker actually began operating. The company says it's a Belize-registered online investment and trading services provider that focuses mainly on contracts for difference (CFD) trading across multiple asset categories.

This choice of jurisdiction allows the broker to operate with very few regulatory constraints. At the same time, it raises questions about trader protection and how transparent their operations really are. The broker's business model centers on providing CFD trading services across diverse markets, which lets traders speculate on price movements without owning the actual assets.

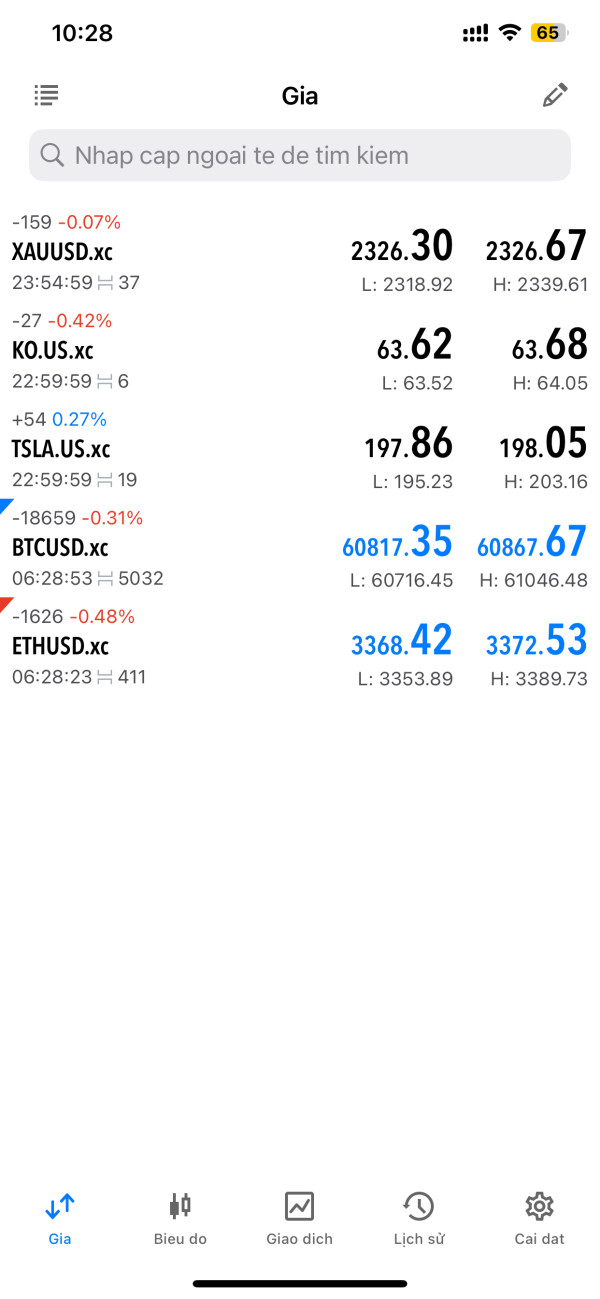

X Charter supports trading in foreign exchange pairs, individual stocks, futures contracts, market indices, precious metals including gold and silver, energy commodities, and various cryptocurrencies. This wide range of assets positions the broker to serve traders with different market interests and investment strategies. X Charter's technology includes support for industry-standard MetaTrader 4 and MetaTrader 5 platforms, plus their own trading applications developed in-house.

The broker's registration in Belize gives them operational flexibility. Some sources mention potential cryptocurrency licensing under the United States Financial Crimes Enforcement Network (FinCEN), which adds complexity to the regulatory landscape. This x charter review emphasizes how important it is for potential clients to understand these jurisdictional details.

Regulatory Jurisdiction: X Charter operates under Belize registration without comprehensive regulatory oversight. This creates potential legal and financial risks for traders who want standard investor protections.

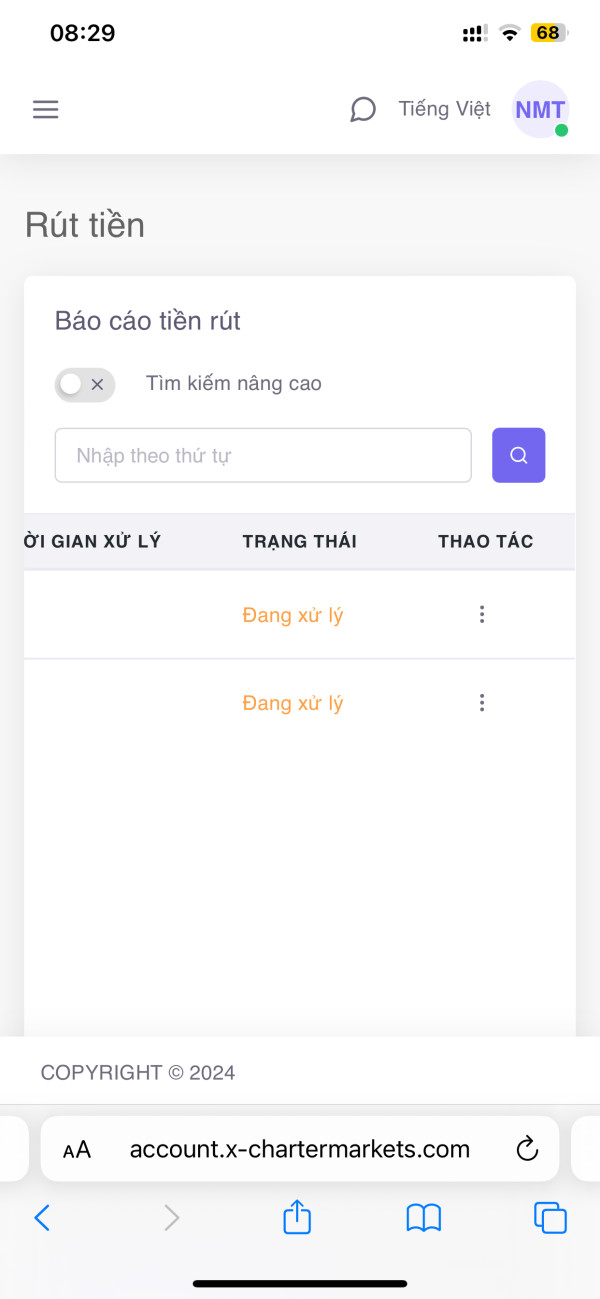

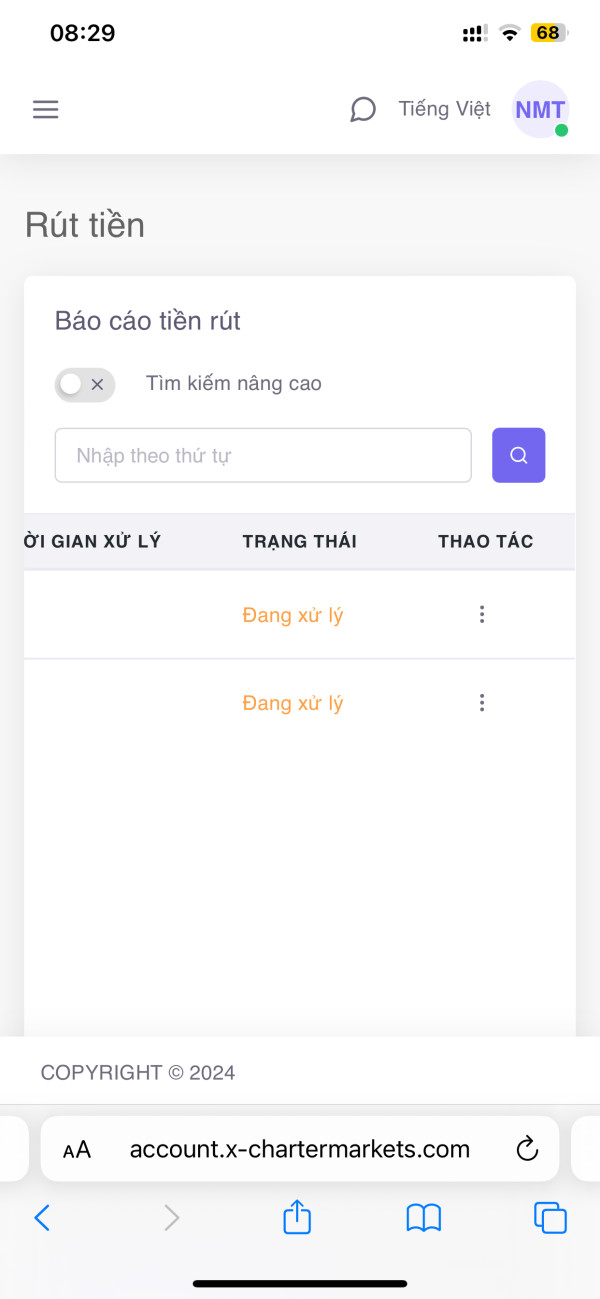

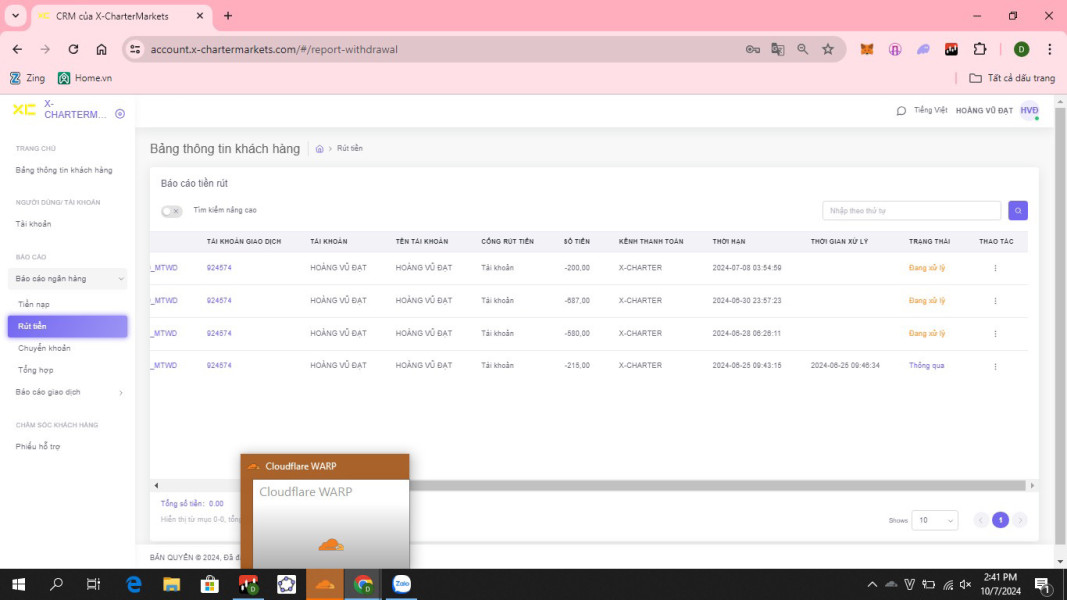

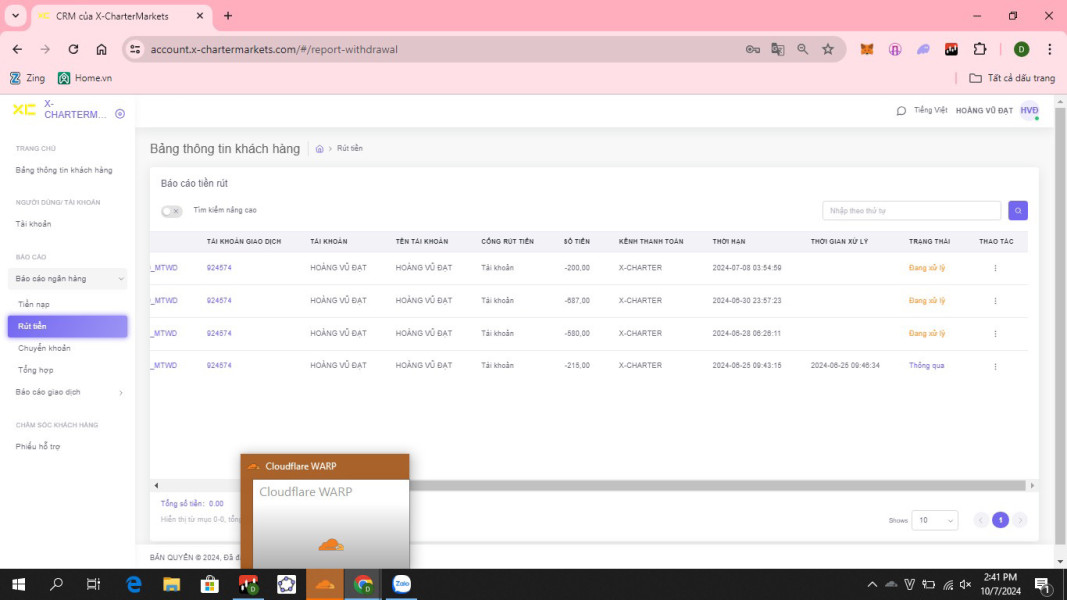

Deposit and Withdrawal Methods: The broker hasn't shared specific information about supported payment methods, processing times, and fees in available documentation.

Minimum Deposit Requirements: X Charter has not publicly disclosed minimum deposit thresholds for different account types. This makes it difficult for potential clients to assess how accessible their services are.

Bonus and Promotional Offers: Current promotional strategies, welcome bonuses, or ongoing incentive programs are not detailed in available source materials.

Tradeable Assets: The platform supports comprehensive asset coverage including major and minor forex pairs, individual equities, commodity futures, stock indices, precious metals, energy products, and digital currencies.

Cost Structure: Detailed information about spreads, commission rates, overnight financing charges, and other trading costs is not available in public documentation.

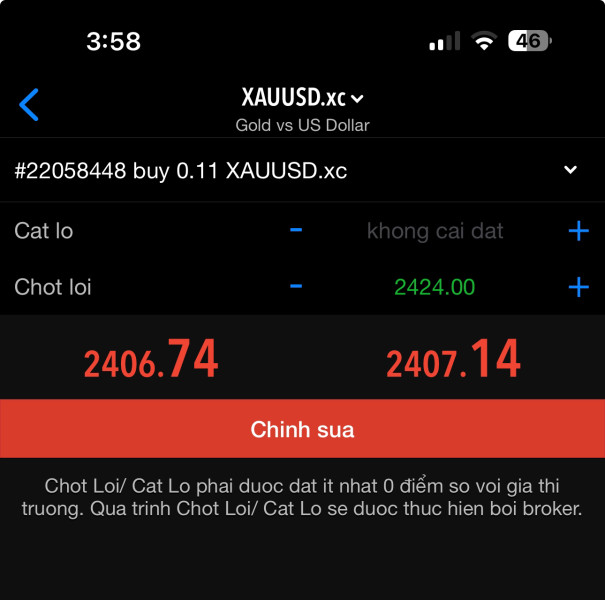

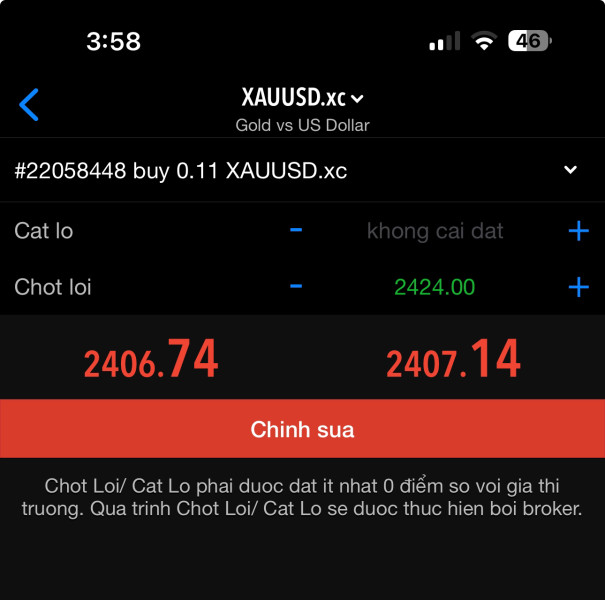

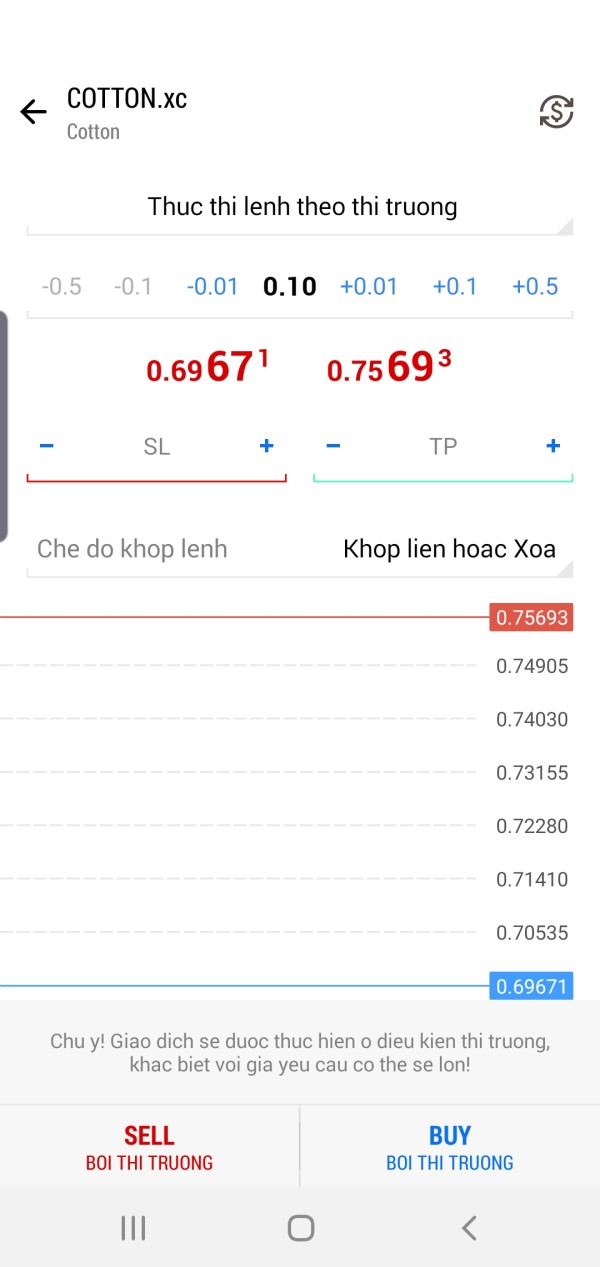

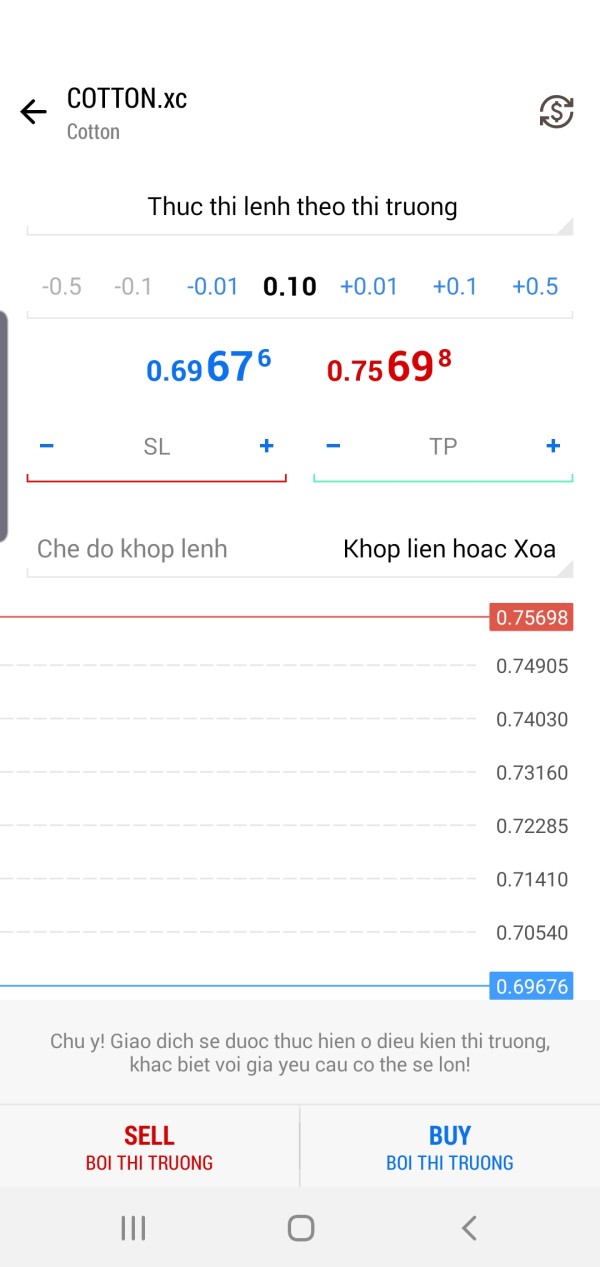

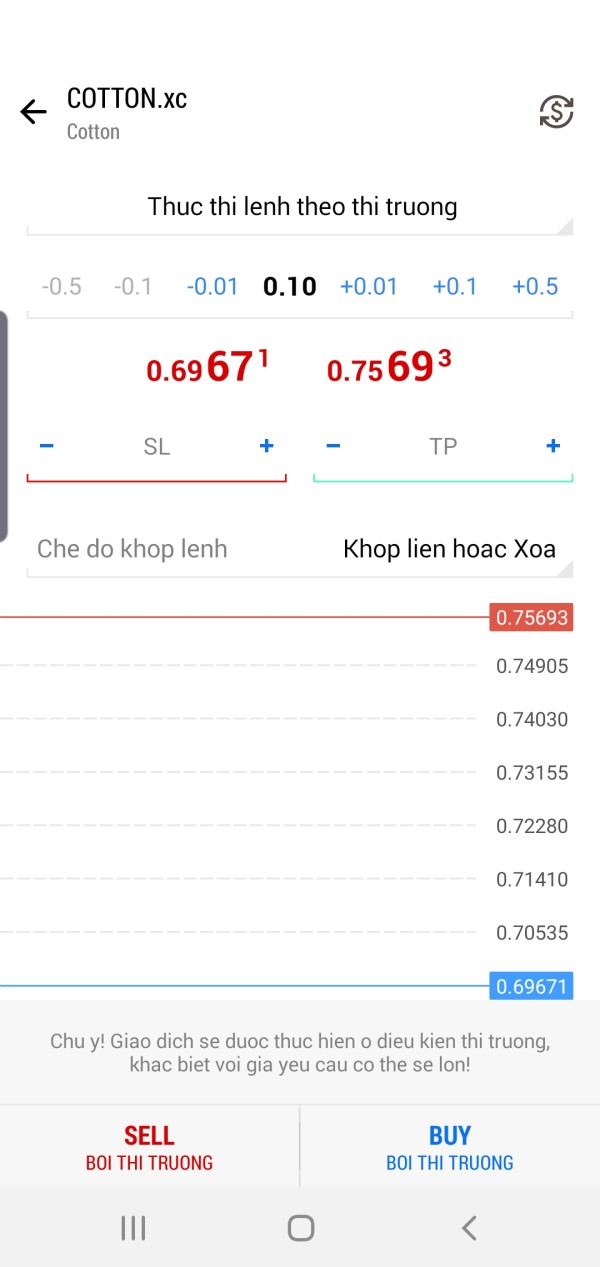

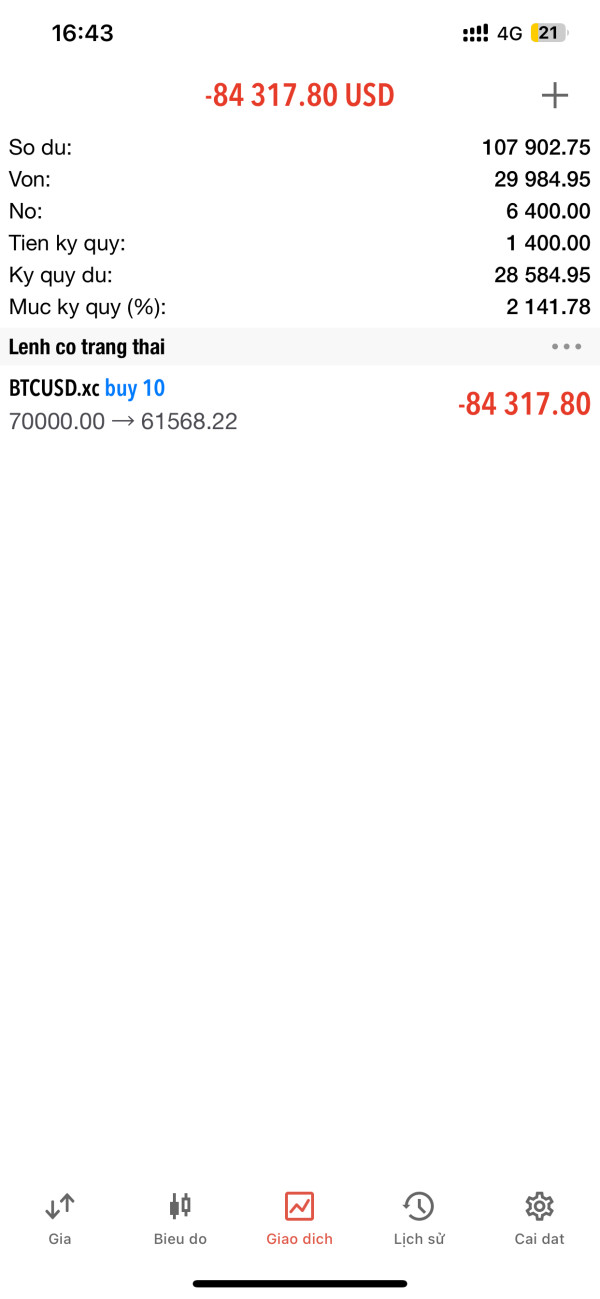

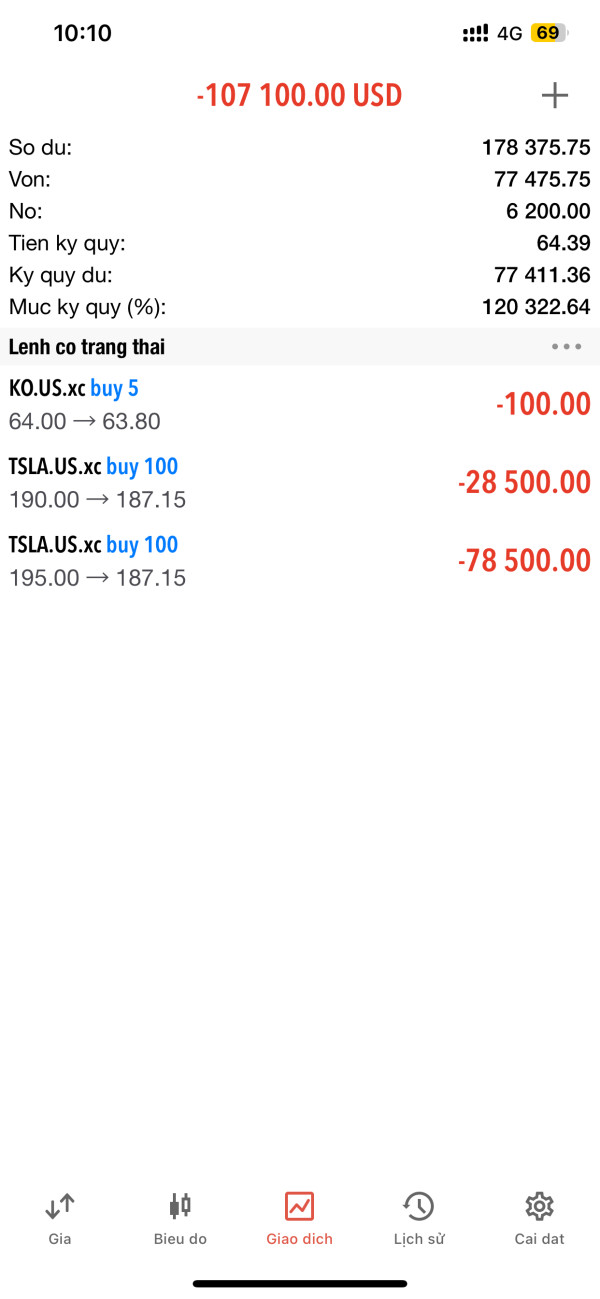

Leverage Ratios: X Charter offers competitive leverage up to 1:1000. This provides significant capital amplification opportunities for experienced traders.

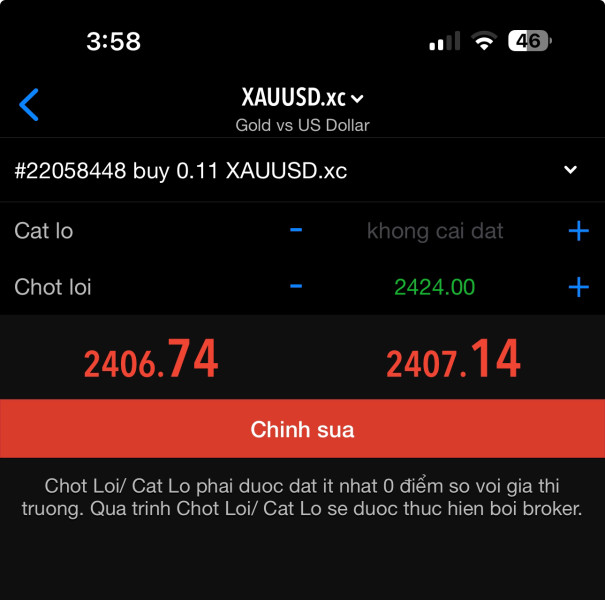

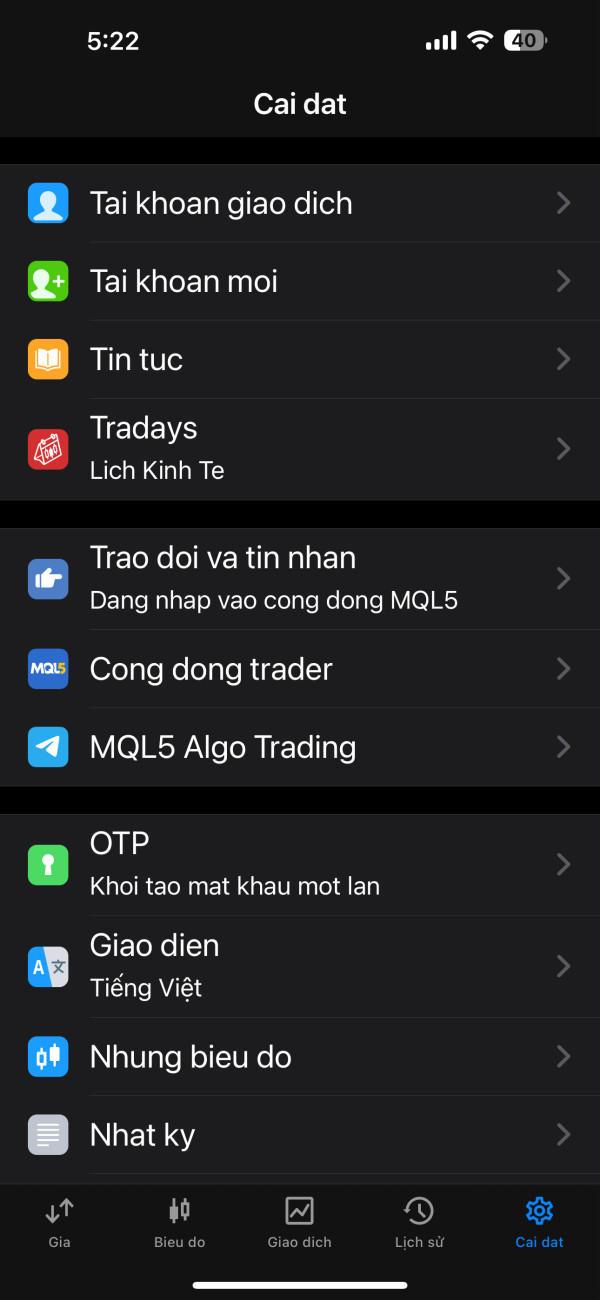

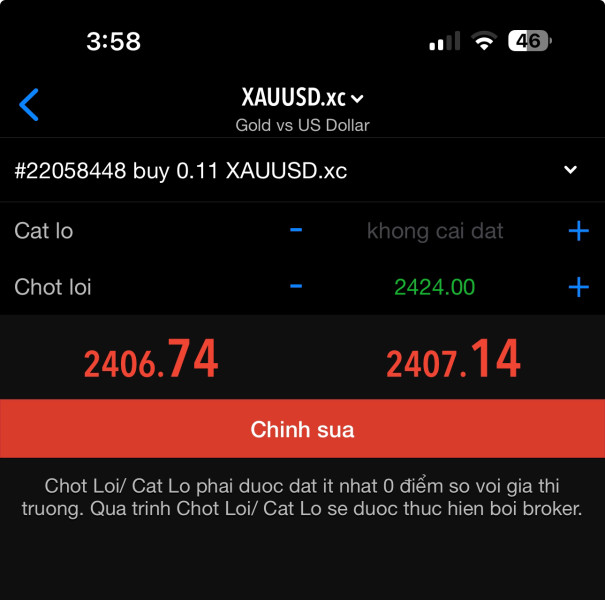

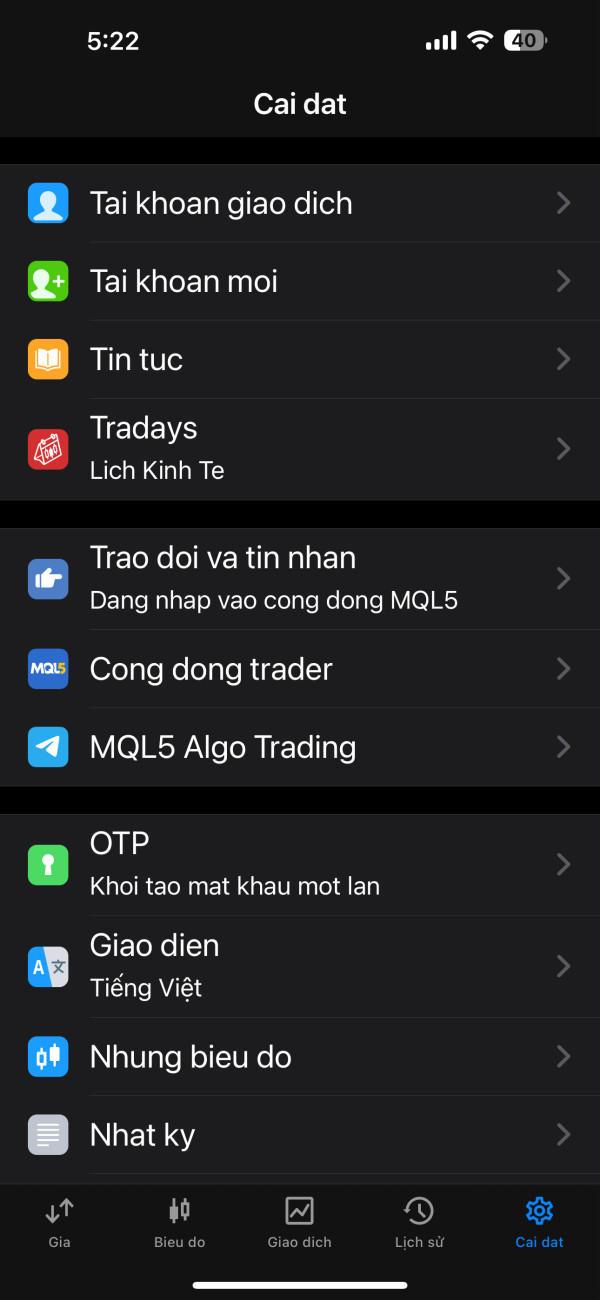

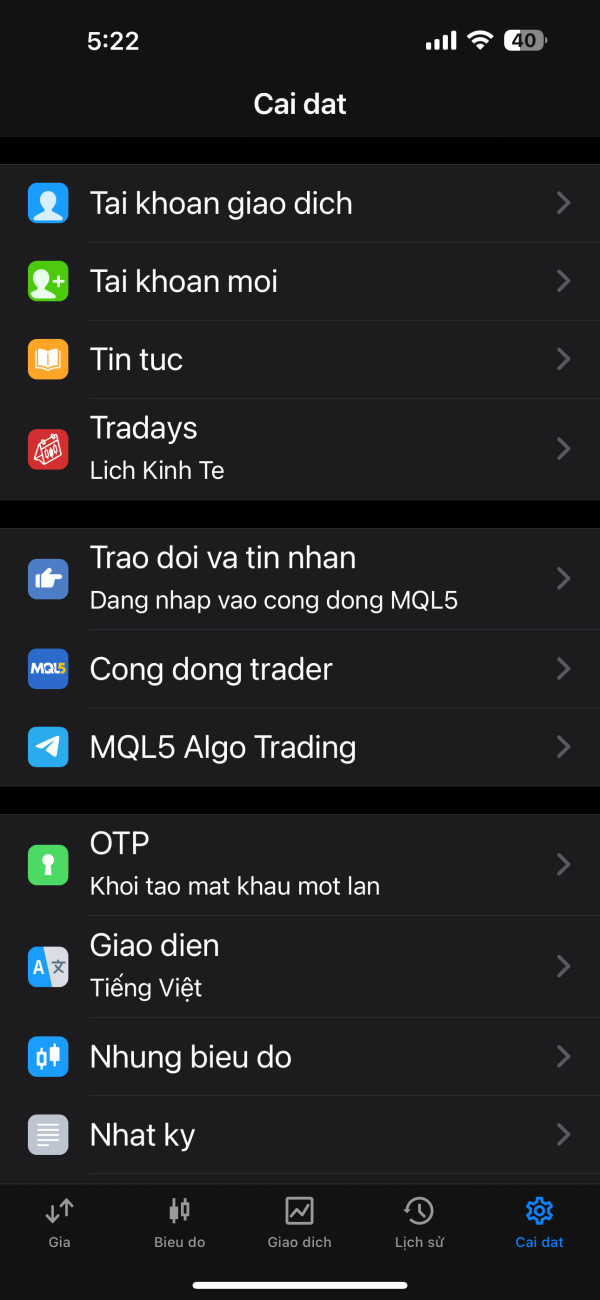

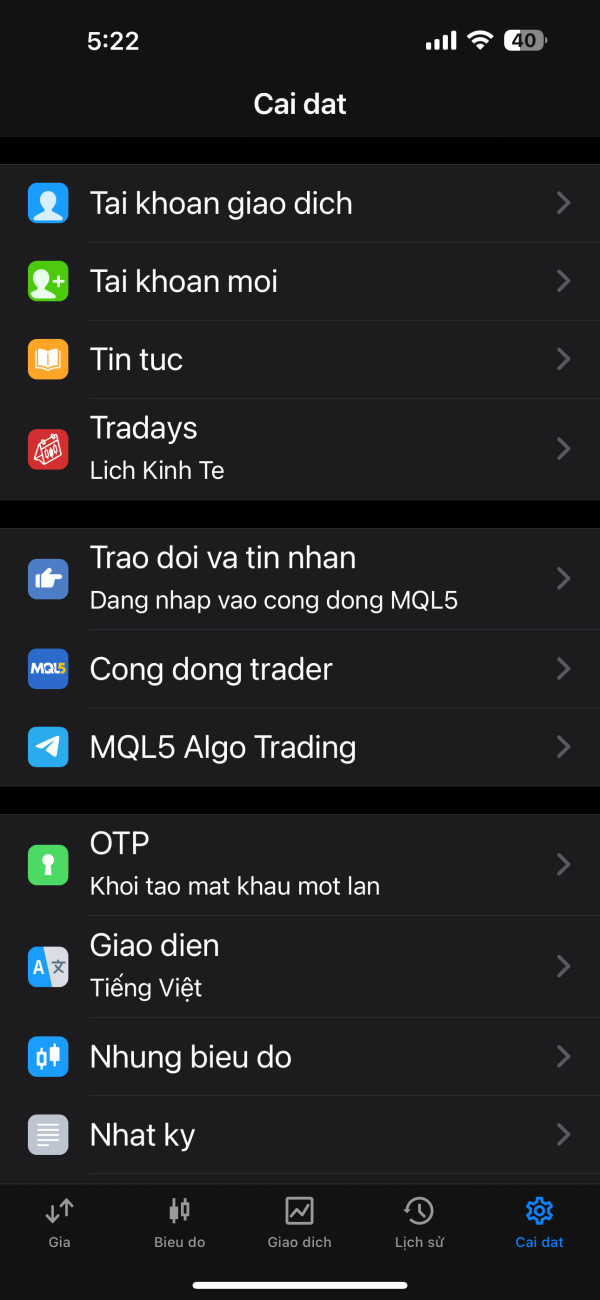

Platform Options: Traders can access markets through MetaTrader 4, MetaTrader 5, and proprietary applications. This ensures flexibility in trading environments.

Geographic Restrictions: Specific jurisdictional limitations and restricted territories are not clearly outlined in available materials.

Customer Support Languages: The range of supported languages for customer service interactions is not specified in current documentation. This x charter review highlights these information gaps as areas that need further clarification.

Detailed Rating Analysis

Account Conditions Analysis (5/10)

X Charter's account structure reportedly includes four distinct account types. However, specific details about features, benefits, and requirements remain largely undisclosed. This lack of transparency significantly hurts potential clients' ability to make informed decisions about account selection based on their trading needs and how much capital they have available.

The absence of published minimum deposit information creates uncertainty for traders trying to assess how accessible the broker is across different experience levels and financial capabilities. Without clear deposit thresholds, traders cannot effectively plan their initial investment or compare X Charter's requirements against industry standards and what competitors offer. Account opening procedures and verification requirements are similarly undocumented in available sources, which raises questions about how efficient the broker's onboarding process is and what their compliance standards are.

The lack of information about specialized account features, such as Islamic accounts for traders requiring Sharia-compliant trading conditions, further limits the broker's appeal to diverse trading communities. User feedback about account management experiences is notably absent from available sources, which prevents potential clients from understanding real-world account operation challenges or benefits. The combination of limited transparency and unclear account structures contributes to the modest rating in this category.

This x charter review emphasizes the need for greater account-related transparency from the broker.

X Charter demonstrates strength in platform diversity by supporting both MetaTrader 4 and MetaTrader 5. These are industry-leading trading platforms known for their robust functionality, technical analysis capabilities, and automated trading support. This dual-platform approach ensures traders can access familiar interfaces while benefiting from advanced features and extensive customization options.

The broker's asset coverage spans multiple markets including forex, equities, commodities, indices, and cryptocurrencies. This provides traders with diverse opportunities for portfolio diversification and market exposure. This comprehensive asset selection enables traders to implement various strategies across different market sectors without requiring multiple broker relationships.

However, available information lacks details about specific research resources, market analysis tools, educational materials, or proprietary trading indicators that could enhance the trading experience. The absence of information about automated trading support, expert advisors compatibility, or algorithmic trading capabilities limits our assessment of the broker's technological sophistication. Despite these information gaps, the confirmed support for established trading platforms and diverse asset classes provides a solid foundation for trading activities.

This contributes to the relatively positive rating in this category.

Customer Service and Support Analysis (4/10)

User evaluations consistently express concerns about X Charter's service quality. However, specific details about customer support channels, availability hours, and response times remain undisclosed in available documentation. This lack of transparency about support infrastructure raises questions about the broker's commitment to client service excellence.

The absence of information about multilingual support capabilities may limit accessibility for international traders who need assistance in their native languages. Without clear communication channels or published service standards, potential clients cannot assess whether the broker's support infrastructure meets their expectations or trading requirements. Available user feedback suggests service quality concerns, though specific examples of support interactions, problem resolution cases, or customer satisfaction metrics are not provided in source materials.

The lack of detailed support information, combined with user concerns about service quality, contributes to the below-average rating in this critical category.

Trading Experience Analysis (6/10)

The trading experience evaluation is hampered by limited user feedback and absence of specific performance data about platform stability, execution speeds, or order processing quality. While X Charter supports established trading platforms like MT4 and MT5, the actual implementation quality and server reliability remain unclear from available sources. Information about slippage rates, execution speeds, pricing accuracy, and platform downtime is not available in current documentation, which prevents comprehensive assessment of the actual trading environment quality.

The lack of specific user testimonials about trading experiences limits understanding of real-world platform performance under various market conditions. Mobile trading capabilities through proprietary applications are mentioned but not detailed, leaving questions about mobile platform functionality, feature completeness, and user interface quality. The absence of information about spread stability, liquidity provision, and market depth further complicates trading experience evaluation.

Despite platform diversity and asset coverage, the lack of specific performance feedback and technical details results in a moderate rating for this category. This x charter review emphasizes how important platform performance transparency is for trader confidence.

Trustworthiness Analysis (3/10)

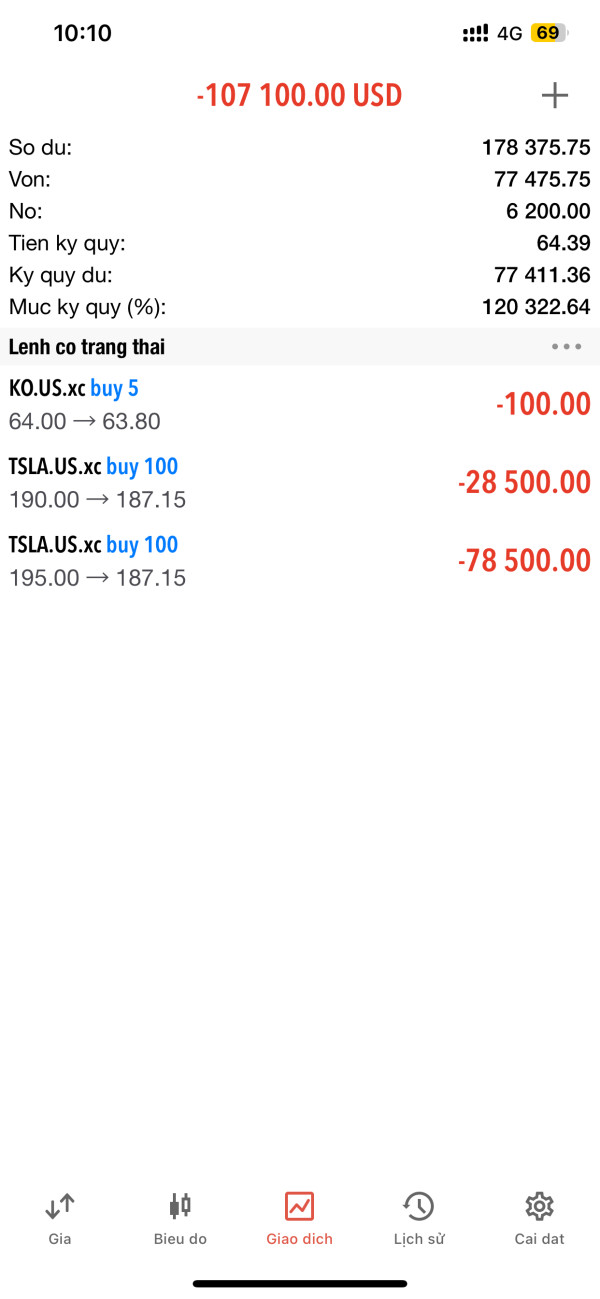

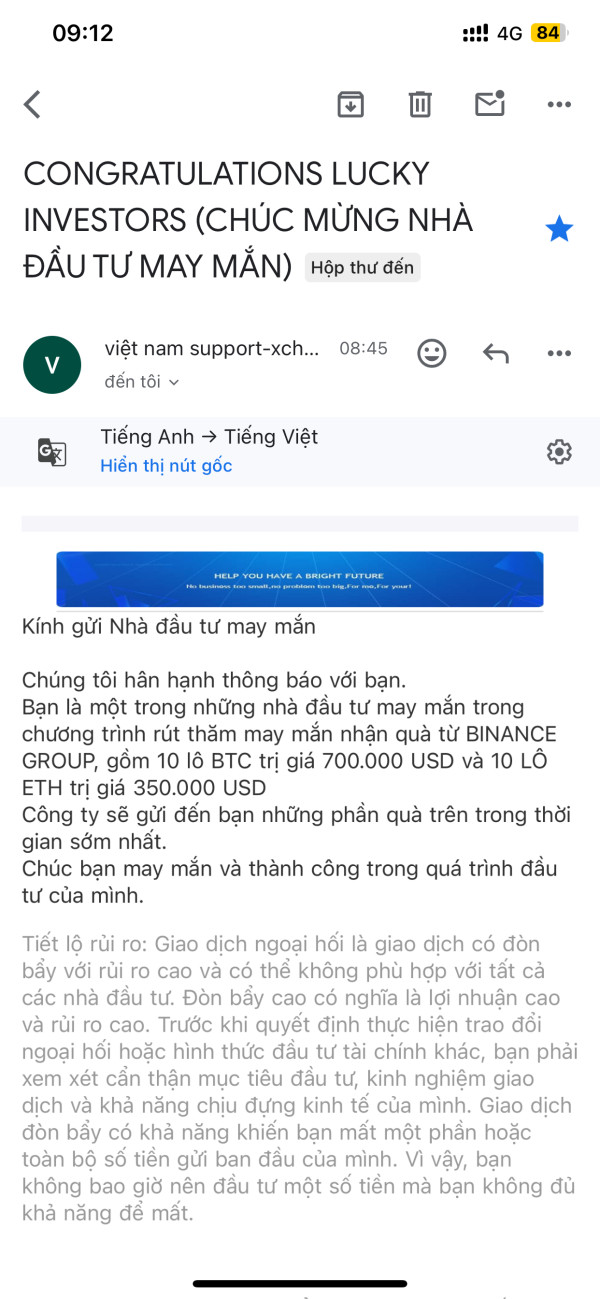

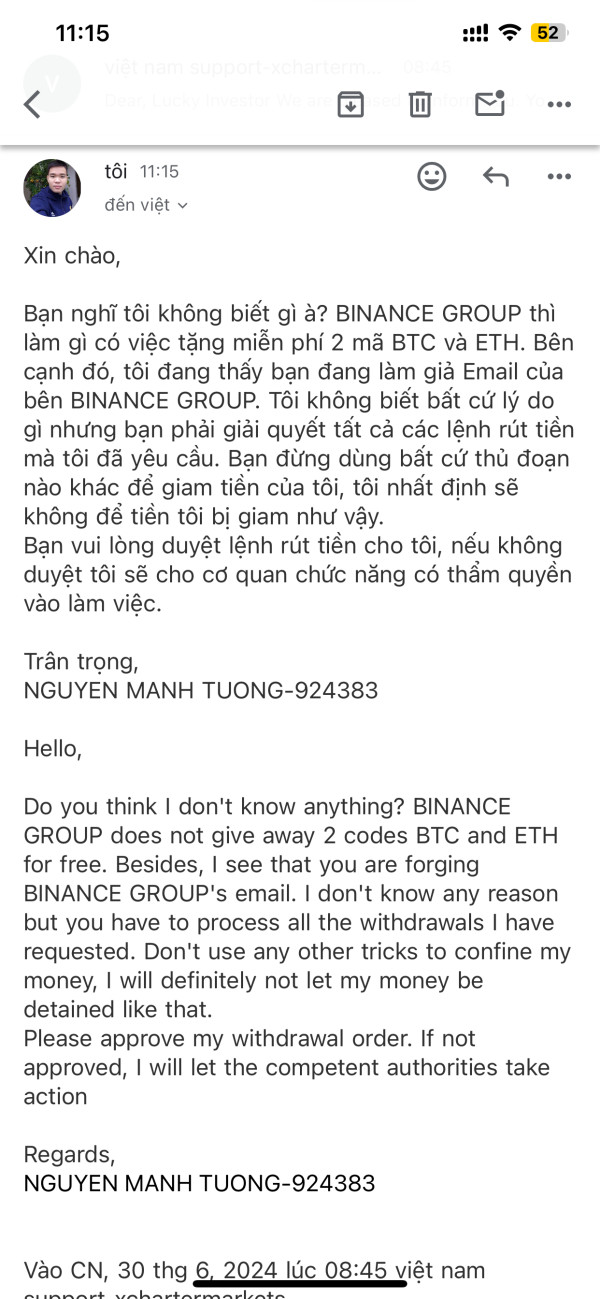

X Charter's trustworthiness faces significant challenges due to its unregulated status and Belize registration. This provides minimal investor protection compared to major financial jurisdictions. The absence of regulatory oversight means traders lack access to compensation schemes, dispute resolution mechanisms, and standard consumer protections available with licensed brokers.

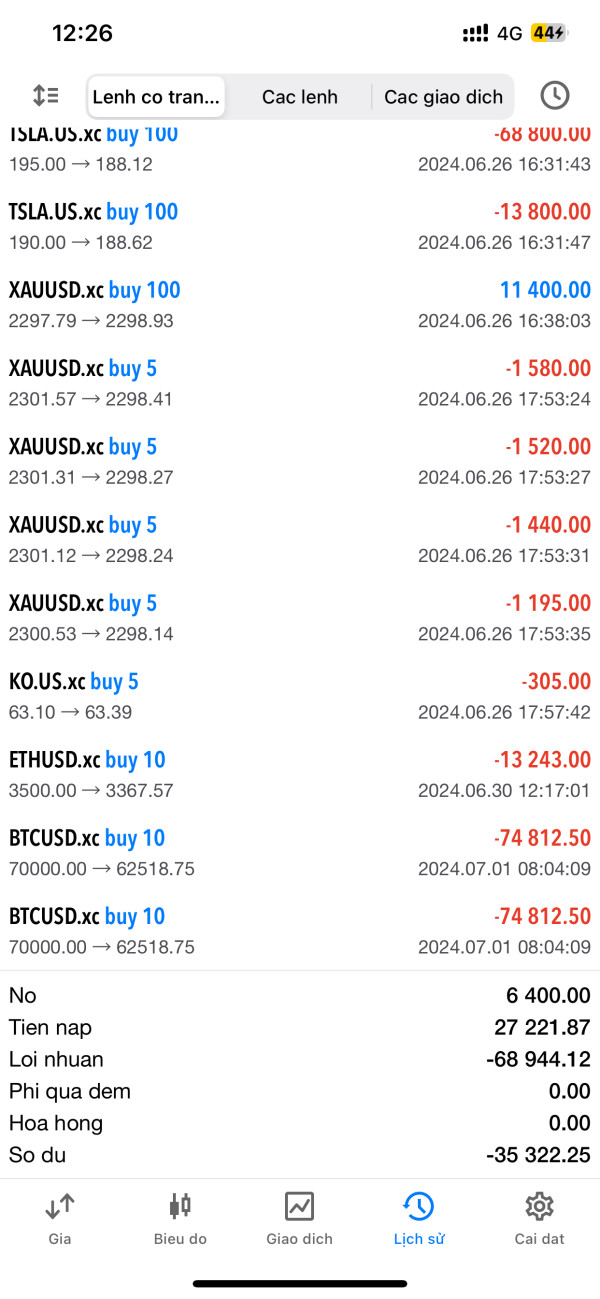

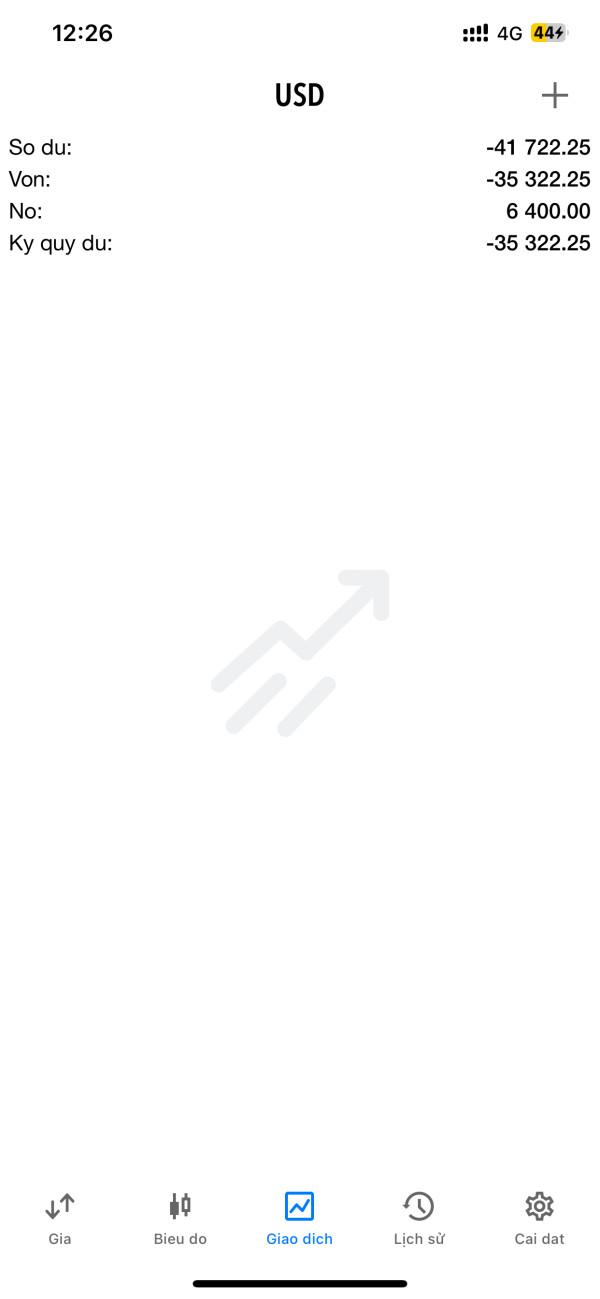

Available information does not detail specific fund security measures, segregated account policies, or insurance coverage that could protect client deposits. The lack of transparency about financial reporting, audit procedures, or operational oversight raises concerns about the broker's accountability and financial stability. User evaluations express safety and reliability concerns, though specific incidents or resolution examples are not provided in available sources.

The absence of third-party ratings, industry certifications, or independent assessments further complicates trustworthiness evaluation. The combination of regulatory absence, limited transparency, and user safety concerns significantly impacts the trustworthiness rating, making this a critical consideration for potential clients.

User Experience Analysis (5/10)

Overall user satisfaction appears compromised by low trust levels and safety concerns. However, specific interface design, usability metrics, or user journey assessments are not available in current documentation. The lack of detailed user feedback about platform navigation, feature accessibility, or overall satisfaction limits comprehensive user experience evaluation.

Registration and verification process efficiency remains undocumented, preventing assessment of onboarding convenience and compliance procedures. Similarly, fund operation experiences including deposit and withdrawal procedures, processing times, and associated challenges are not detailed in available sources. Common user complaints center on safety and reliability concerns rather than specific platform functionality issues, suggesting that trust factors significantly impact overall user experience perception.

The absence of positive user testimonials or satisfaction metrics further complicates experience assessment. The broker's suitability for experienced traders seeking high leverage opportunities is noted, though this comes with significant caution requirements due to regulatory and safety concerns. The moderate rating reflects the balance between platform capabilities and trust-related challenges affecting user experience.

Conclusion

X Charter operates as an unregulated Belize-registered broker that presents significant risks due to the absence of regulatory oversight and user concerns about safety and reliability. While the broker offers attractive features including high leverage ratios up to 1:1000 and support for multiple trading platforms, these benefits are overshadowed by substantial trust and safety concerns. The broker may suit experienced traders specifically seeking high-leverage opportunities who possess sophisticated risk management skills and understand the implications of trading with unregulated entities.

However, the combination of regulatory absence, limited transparency, and user safety concerns makes X Charter unsuitable for most traders, particularly those prioritizing security and investor protection. Primary advantages include exceptional leverage opportunities and diverse platform support, while significant disadvantages encompass regulatory absence, limited transparency, and compromised user trust levels, making careful risk assessment essential for any potential engagement.