Is X Charter safe?

Pros

Cons

Is X Charter A Scam?

Introduction

X Charter is a forex broker that has recently emerged on the trading scene, attracting the attention of both novice and experienced traders. Positioned as a platform for trading various financial instruments, including currencies, commodities, and indices, X Charter claims to offer competitive trading conditions and a user-friendly interface. However, the rapid rise of online trading has also led to an increase in fraudulent activities, making it essential for traders to conduct thorough evaluations of brokers before committing their funds. In this article, we will investigate the legitimacy of X Charter, examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. Our analysis is based on a comprehensive review of available online resources, including user reviews, regulatory filings, and expert opinions.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in determining its legitimacy. Effective regulation ensures that brokers adhere to strict operational standards, safeguarding traders' investments. In the case of X Charter, the broker claims to be regulated by the US MSB (Money Services Business), but our investigation reveals discrepancies in its registration information.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| US MSB | 31000234126807 | United States | Unverified |

Despite its claims, a search through the UK Companies House and the Financial Conduct Authority (FCA) shows no records of a company named "X Charter." Moreover, the MSB number cited by X Charter belongs to SJT CF Group Limited, further raising suspicions about the broker's regulatory claims. The lack of credible regulatory oversight is a significant red flag, indicating that X Charter may not operate within the bounds of legality, thereby increasing the risks for potential investors.

Company Background Investigation

X Charter's corporate history and ownership structure are essential to understanding its credibility. The broker presents itself as a newly established entity, with its domain registered on January 30, 2024. This brief existence raises concerns about its reliability and operational stability. Furthermore, the absence of publicly available information regarding its management team and operational practices contributes to a lack of transparency.

The website claims to be headquartered in London, UK, but the lack of verifiable corporate records and regulatory registrations suggests that the company may not have a legitimate operational base. A thorough background check reveals that X Charter's claims closely resemble those of known fraudulent brokers, further casting doubt on its authenticity. The absence of detailed disclosures about its ownership and management team is alarming, as it prevents potential investors from assessing the qualifications and experience of those running the broker.

Trading Conditions Analysis

Trading conditions, including fees and spreads, are crucial for traders when selecting a broker. X Charter advertises competitive trading conditions, but a closer examination reveals a lack of transparency regarding its fee structure. The broker does not clearly outline the various costs associated with trading, which is a common practice among legitimate brokers.

| Fee Type | X Charter | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | Unspecified | 1-2 pips |

| Commission Model | Unspecified | $5-$10 per lot |

| Overnight Interest Range | Unspecified | Varies widely |

The absence of specific details regarding spreads, commissions, and overnight interest rates raises concerns about potential hidden fees that could erode trading profits. Moreover, the lack of clear information about deposit and withdrawal methods further complicates the trading experience. Traders should be wary of brokers that do not provide transparent information, as this can lead to unexpected costs and complications.

Client Fund Security

The security of client funds is paramount in the forex trading industry. X Charter's website does not provide sufficient information regarding its fund protection measures. Effective brokers typically implement strict policies for fund segregation, investor protection, and negative balance protection.

However, X Charter's lack of clarity on these critical safety measures raises concerns about the security of client funds. There are no indications that the broker offers segregated accounts or adheres to investor protection schemes, which are essential for safeguarding traders' investments. Additionally, the absence of a solid track record regarding fund security issues further heightens the risks associated with trading through this broker.

Customer Experience and Complaints

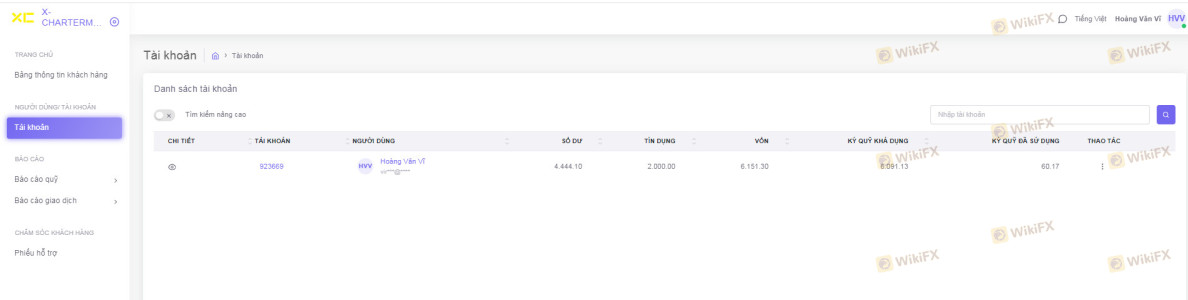

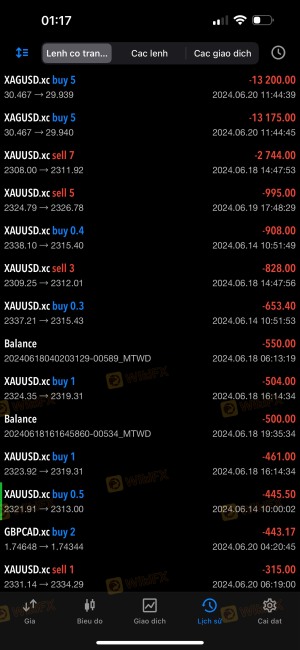

Customer feedback is an invaluable resource for assessing a broker's reliability. Reviews and testimonials about X Charter indicate a pattern of complaints related to withdrawal issues and poor customer service. Many users report difficulties in processing withdrawal requests, with funds becoming inaccessible for extended periods.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/no response |

| Customer Service Quality | Medium | Inadequate support |

Several users have shared experiences of being unable to withdraw their funds, leading to suspicions of fraudulent practices. The lack of timely responses from customer support exacerbates these concerns, as traders often feel helpless when facing issues with their accounts. These patterns of complaints are alarming and suggest that X Charter may not prioritize customer satisfaction or operational integrity.

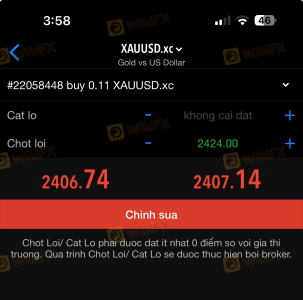

Platform and Trade Execution

The performance of a trading platform is crucial for a seamless trading experience. X Charter claims to offer a proprietary trading platform with advanced features; however, there is limited information available regarding its actual performance. Traders have reported issues related to order execution quality, including slippage and rejected orders.

The absence of detailed information about the platform's stability and execution metrics raises concerns about potential manipulation or operational inefficiencies. Traders should be cautious of platforms that lack transparency regarding execution quality, as this can significantly impact trading outcomes.

Risk Assessment

Using X Charter poses several risks that potential traders should consider. The broker's lack of credible regulation, transparency, and customer service issues contribute to a high-risk profile for traders.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unverified claims and lack of regulatory oversight. |

| Financial Risk | High | Potential hidden fees and withdrawal issues. |

| Operational Risk | Medium | Platform performance and execution quality concerns. |

To mitigate these risks, traders are advised to perform due diligence before engaging with X Charter. This includes researching alternative brokers with strong regulatory backing, transparent fee structures, and positive customer reviews.

Conclusion and Recommendations

In conclusion, the evidence gathered during this investigation strongly indicates that X Charter may not be a trustworthy broker. The lack of credible regulatory oversight, transparency regarding trading conditions, and numerous customer complaints raise significant concerns about its legitimacy. Traders should exercise extreme caution and consider avoiding X Charter in favor of more reputable alternatives.

For those seeking reliable trading options, it is advisable to explore brokers that are well-regulated, have a proven track record of customer satisfaction, and provide transparent information about fees and trading conditions. By doing so, traders can better protect their investments and ensure a more secure trading experience.

Is X Charter a scam, or is it legit?

The latest exposure and evaluation content of X Charter brokers.

X Charter Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

X Charter latest industry rating score is 1.34, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.34 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.