Is SGX safe?

Pros

Cons

Is SGX A Scam?

Introduction

The Singapore Exchange (SGX) is a prominent multi-asset exchange that plays a significant role in the global financial landscape. It offers a range of trading services, including stocks, bonds, derivatives, and foreign exchange, positioning itself as a key player in Asia's financial markets. However, with the proliferation of online trading platforms, traders must exercise caution and rigorously evaluate the legitimacy and reliability of such exchanges. The importance of due diligence cannot be overstated, as the risk of encountering fraudulent platforms or scams is ever-present in the financial services industry.

This article aims to provide a comprehensive analysis of SGX, exploring its regulatory standing, company background, trading conditions, customer experiences, and overall risk profile. The evaluation is based on a thorough review of multiple sources, including user feedback, regulatory records, and expert analyses. By employing a structured framework, this article seeks to deliver an objective assessment of whether SGX can be deemed safe for traders or if it raises red flags indicative of a potential scam.

Regulation and Legitimacy

The regulatory environment surrounding a trading platform is crucial for safeguarding investor interests and ensuring fair trading practices. SGX is regulated by the Monetary Authority of Singapore (MAS), which is known for its stringent regulatory framework designed to protect investors and maintain market integrity.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Monetary Authority of Singapore (MAS) | Not applicable | Singapore | Verified |

The MAS oversees all financial institutions in Singapore, ensuring compliance with established rules and standards. SGX's adherence to these regulations is essential for maintaining investor confidence. However, it is important to note that while SGX operates under MAS's jurisdiction, the exchange has faced scrutiny in the past regarding its transparency and operational practices. Historical compliance issues could raise concerns for potential investors about the exchange's reliability and governance.

Company Background Investigation

SGX was established in 1999 through a merger of the Stock Exchange of Singapore, the Singapore International Monetary Exchange, and the Securities Clearing and Computer Services Pte Ltd. This merger consolidated various trading functions, enabling SGX to provide a comprehensive platform for securities and derivatives trading. SGX is publicly listed and owned by shareholders, with a diverse management team that brings a wealth of experience from various sectors within finance.

The management team is composed of professionals with extensive backgrounds in finance, trading, and regulatory affairs. This diversity can enhance the exchange's operational capabilities and strategic direction. However, transparency in corporate governance and information disclosure is essential for fostering trust among investors. While SGX publishes annual reports and financial statements, the depth and clarity of such disclosures can vary, sometimes leading to questions about the exchange's overall transparency.

Trading Conditions Analysis

Understanding the trading conditions offered by SGX is vital for evaluating its attractiveness to traders. SGX provides a variety of trading instruments, including equities, derivatives, and foreign exchange, each accompanied by specific fee structures. The overall cost of trading can significantly impact a trader's profitability.

| Fee Type | SGX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.005% - 0.05% | 0.01% - 0.03% |

| Commission Model | Variable | Variable |

| Overnight Interest Range | Varies | Varies |

SGXs fee structure includes competitive spreads, particularly for major currency pairs. However, traders should be aware of any hidden fees or unusual charges that may apply, especially related to account maintenance or withdrawal processes. Transparency regarding these costs is crucial, as undisclosed fees can erode trading profits and lead to dissatisfaction among users.

Customer Funds Security

The safety of customer funds is paramount when assessing any trading platform. SGX implements several measures to protect investor capital, including the segregation of client funds from operational funds. This segregation is designed to ensure that client assets are not used for the exchange's operational expenses, thereby safeguarding them in the event of financial difficulties.

Additionally, SGX offers investor protection measures, including insurance for specific types of accounts. However, it is essential to review the specifics of these protections, as they can vary based on account types and the nature of the investments. Historical incidents involving fund security can also provide insights into the reliability of SGXs security measures.

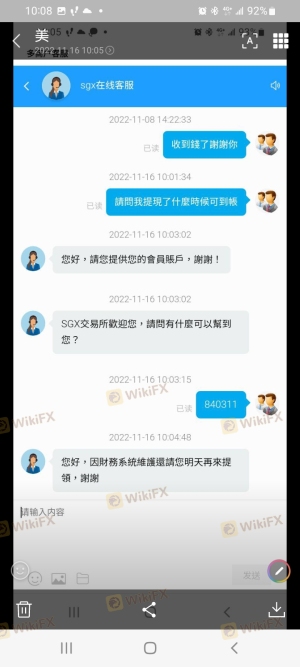

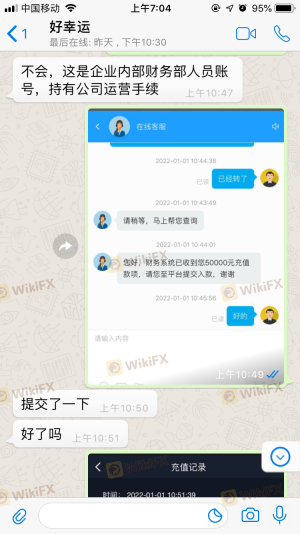

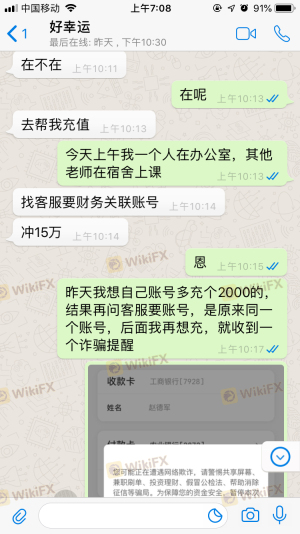

Customer Experience and Complaints

User feedback is a valuable indicator of a trading platform's reliability and service quality. Reviews of SGX reveal a mixed bag of experiences, with some users praising the platform's functionality and range of services, while others highlight issues related to customer service and fund withdrawals.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Service | Medium | Mixed feedback |

| Platform Stability | Low | Generally stable |

Common complaints include difficulties in withdrawing funds and slow responses from customer service representatives. Such issues can significantly affect user satisfaction and may indicate underlying operational inefficiencies. A few notable cases involve users reporting prolonged delays in fund withdrawals, which raises concerns about SGXs responsiveness and reliability.

Platform and Execution

The performance and stability of a trading platform are critical to ensuring a seamless trading experience. SGX's trading platform is generally regarded as stable, offering a user-friendly interface and access to various trading instruments. However, traders have reported occasional issues with order execution, including slippage and rejections.

The quality of order execution is vital, as delays or errors can lead to significant financial losses. While SGX has made efforts to maintain high execution standards, any signs of manipulation or unfair practices should be scrutinized closely.

Risk Assessment

Engaging with SGX carries inherent risks, as with any trading platform. These risks can stem from market volatility, regulatory changes, and operational challenges within the exchange itself.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Market Risk | High | Fluctuations in asset prices can lead to significant losses. |

| Regulatory Risk | Medium | Changes in regulations could impact trading conditions. |

| Operational Risk | Medium | Issues related to platform stability and customer service. |

To mitigate these risks, traders are advised to conduct thorough research, maintain a diversified portfolio, and employ risk management strategies such as stop-loss orders.

Conclusion and Recommendations

In conclusion, while SGX operates under a regulated framework and offers a range of trading services, potential investors should remain vigilant. The exchange has faced scrutiny regarding its transparency and customer service responsiveness. Therefore, it is essential for traders to assess their risk tolerance and conduct due diligence before engaging with SGX.

For those who prioritize regulatory oversight and user experience, exploring alternative platforms that are well-regulated and have strong customer support may be advisable. Platforms such as Moomoo, Webull, and DBS Vickers offer competitive trading conditions and are known for their robust regulatory frameworks. Overall, while SGX presents opportunities for trading, caution and thorough evaluation are recommended to ensure a safe trading experience.

Is SGX a scam, or is it legit?

The latest exposure and evaluation content of SGX brokers.

SGX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SGX latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.