sgx 2025 Review: Everything You Need to Know

1. Abstract

SGX operates under the close supervision of the Monetary Authority of Singapore . Our current sgx review paints a neutral picture overall, showing both strengths and areas that need improvement. With a user rating of 3.7/5, SGX has earned some market trust despite issues with transparency about certain key trading details. MAS recently set up a special review group to help SGX grow and focus on long-term goals. The firm mainly serves investors who want to trade stocks, futures, ETFs, and options. While some important details like account rules, deposit methods, and platform technology are only partly known, this review covers SGX's regulatory support and changing market strategies. As such, the review shows that SGX, backed by strong MAS oversight, remains a good choice for traders who value regulated market access and different types of assets.

2. Notice

SGX's operations are regulated by the Monetary Authority of Singapore . This means that traders from different regions may face regulatory environments that vary in scope and how strictly they are enforced. This review uses publicly available data and user feedback to make its points. While we have tried hard to make sure the analysis is both fair and objective, certain operational details—such as deposit and withdrawal methods, minimum deposit requirements, bonus promotions, and other cost structures—are not detailed in available sources.

3. Rating Framework

Below is the rating framework that evaluates SGX on six dimensions. Each dimension's score reflects the absence of detailed data in several categories.

4. Broker Overview

Company Background and Business Model

SGX is based in Singapore. The company has built itself as a major institution in securities exchange and financial services over many years. The company focuses on different types of assets by helping people trade stocks, futures, ETFs, and options. Despite the lack of a detailed founding timeline in available sources, SGX's strong presence in Singapore's financial system is well documented. The company has a long reputation and works under strict oversight from regulatory bodies, making sure it follows local financial rules. SGX's business model mainly focuses on providing a secure trading environment and a wide range of financial instruments meant to appeal to both institutional and retail investors.

The firm offers interfaces that are designed to serve a broad investor base. While specific details about the trading platform remain unclear in published data, investors can access different asset classes through what appears to be a suite of integrated trading solutions. In addition to stocks, futures, ETF, and options trading, the platform provides various tools for different investment needs. The oversight by the MAS, as mentioned again in this sgx review, serves as the foundation of SGX's regulatory framework ensuring operational integrity and investor protection. Despite the lack of detailed insights into the platform's technology infrastructure, SGX continues to maintain a steady presence in the market because of its adherence to regulatory standards and commitment to meeting changing market needs.

occurrence: sgx review*

In this section, we look deeper into SGX's operational features as available from current sources. We note several areas where concrete details remain unavailable.

Regulatory Region: SGX is fully regulated by the Monetary Authority of Singapore . This ensures that its operations meet the strict local regulations and provides traders with confidence about market oversight and investor protection.

Deposit and Withdrawal Methods: Specific details about available deposit and withdrawal methods were not detailed in the available sources. The precise methods, processing times, and transaction limits remain unspecified.

Minimum Deposit Requirement: The data about the minimum deposit required for account opening with SGX is not provided. Potential investors need to make direct inquiries for this information.

Bonus Promotions: There is no available information about bonus or promotional offers for new or existing clients. Investment decisions should be based only on the trading features and regulatory oversight provided.

Tradable Assets: SGX offers many tradable assets including stocks, futures, ETFs, and options. This diverse asset structure is designed to meet the needs of different investor types, from those seeking long-term equity growth to those interested in derivatives.

Cost Structure: Information on fees, commissions, or other cost-related details has not been provided in the existing resources. The absence of such data in the review means that interested parties should do more research or contact the broker directly for an accurate breakdown.

Leverage Ratios: Leverage details, including maximum allowable ratios, were not provided in the reviewed documents. Therefore, these details remain unclear.

Platform Choices: Although SGX offers a range of trading solutions, specifics about the type or name of platforms were not explained in the available data. More information would be needed to understand the full scope of platform options.

Regional Restrictions: No clear information about region-specific restrictions was noted in the review documents. This means that regulatory applicability is inferred only from the MAS oversight.

Customer Service Languages: Details about the languages supported by SGX's customer service channels were not provided. This leaves questions about multilingual support options for a diverse client base.

occurrence: sgx review*

6. Detailed Score Analysis

6.1 Account Conditions Analysis

The analysis of account conditions for SGX is currently limited due to the lack of complete details in the available data. Specifics about the various account types, such as those made for retail investors versus institutional clients, have not been disclosed. There is also no published information on minimum deposit requirements or the step-by-step account opening process. In many cases, brokers may offer specialized account types that serve specific market needs, but such details for SGX remain unspecified. User feedback about account conditions is sparse, and while general industry sentiment suggests that a transparent process is a significant positive, here we are limited by the lack of clear data. When compared to other regional brokers, more complete account specifications provide better clarity; however, SGX's account conditions fall short in detailed public reporting. Ultimately, investors considering SGX will need to contact the broker directly for deeper insights into account setup and requirements.

The available information does not present rich details about SGX's toolkit for traders. It is unclear whether SGX offers advanced charting, automated trading support, or comprehensive market research resources that many other exchanges provide. The lack of specific details on educational resources or research materials means traders may find that SGX falls short when it comes to supporting tools necessary for informed trading decisions. Also missing is any reference to educational seminars, webinars, or similar programs that could help investor knowledge. With modern trading platforms increasingly emphasizing robust, integrated tool suites, the absence of detailed evidence of such features in this sgx review leaves a notable gap for potential users. The overall impression is that while the broker's regulatory credentials are strong, the tangible end-user tools available remain poorly outlined. Investors must look to additional sources or direct inquiries to evaluate the actual breadth of resources offered by SGX.

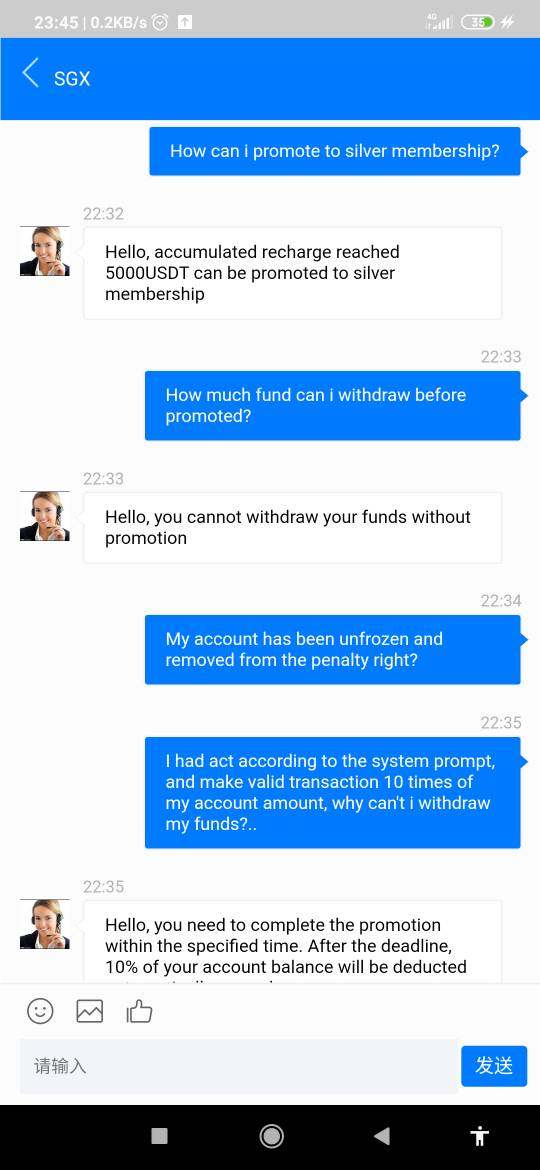

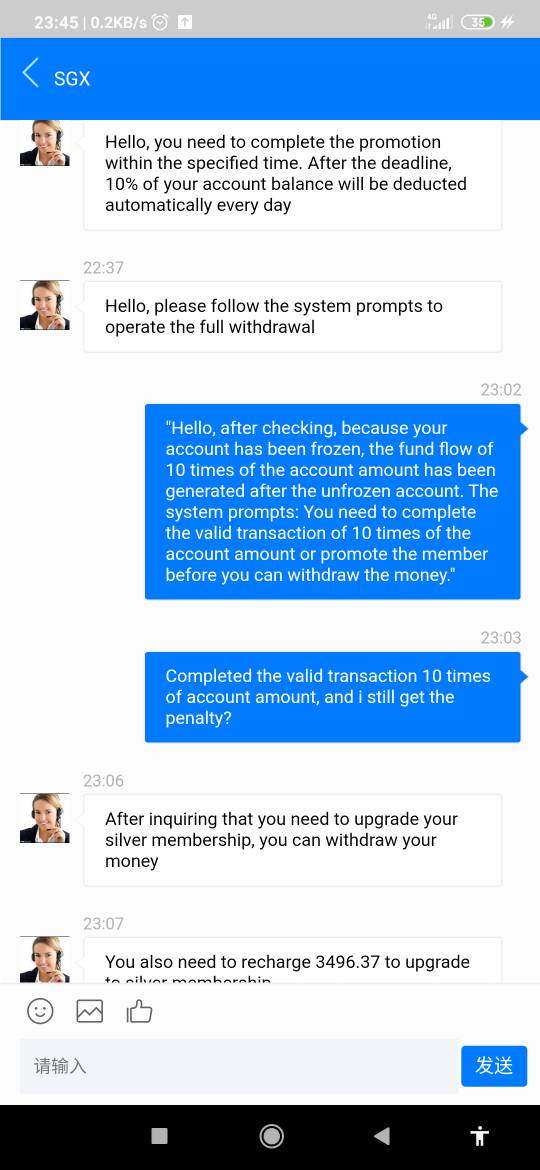

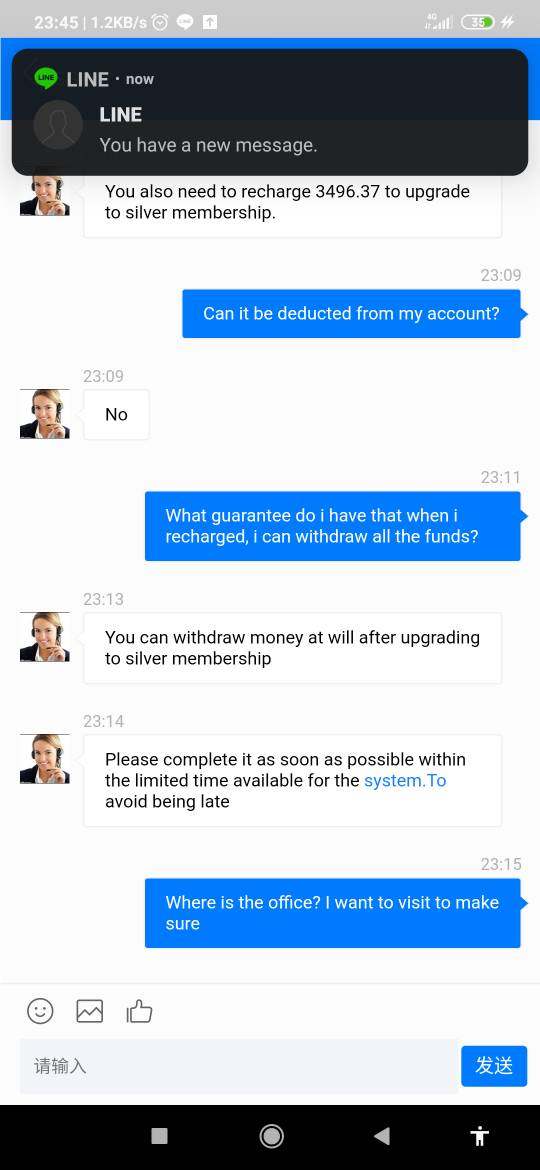

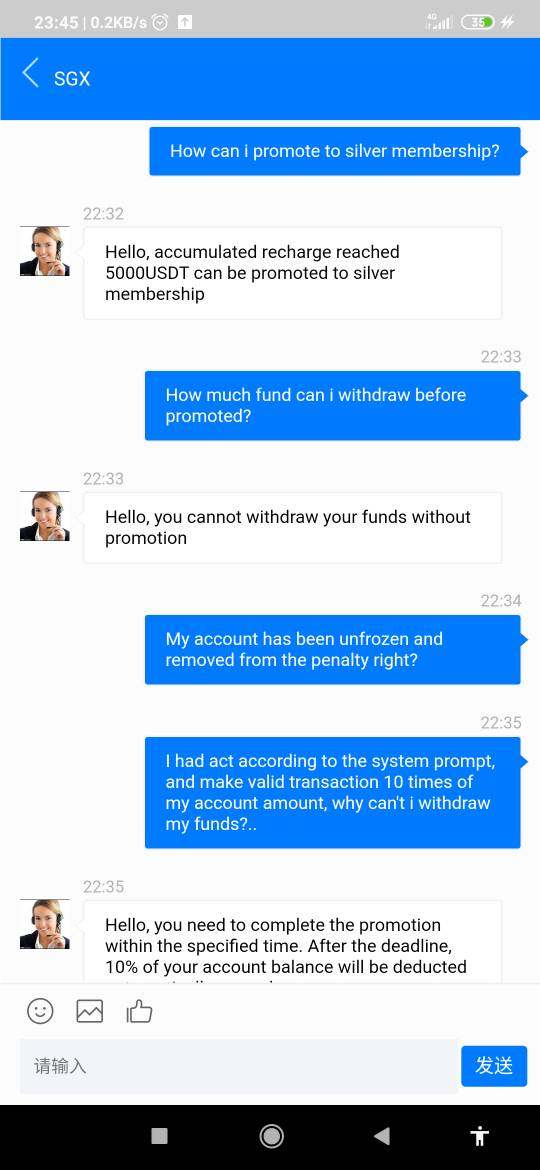

6.3 Customer Service and Support Analysis

SGX's customer service evaluation is challenged by the lack of detailed information about support channels. There is no clear data on aspects such as response times, availability of multi-channel support , or extended operating hours for customer help. In addition, specifics about the languages in which customer support is offered are not provided, which might be a significant drawback for international investors. Evidence from broader market reviews generally emphasizes the importance of strong customer support; however, this review does not supply any concrete user feedback or case studies on the efficiency or quality of SGX's support services. Moreover, comparisons with other institutions that publish detailed support metrics could have shown SGX's position in this area. Without clear data, this evaluation component remains limited to acknowledging that prompt and comprehensive customer service is a vital aspect missing from publicly available information about SGX.

6.4 Trading Experience Analysis

In this sgx review, the trading experience is an area where clear details are notably absent. Information about platform stability, order execution speed, and the user-friendliness of the trading interface is not provided in the available sources. Key performance indicators, such as latency and reliability of trade execution, have not been thoroughly discussed. Moreover, there is little mention of whether SGX offers a fully integrated mobile application or supports advanced trading features that modern investors demand. The evaluation also lacks commentary on specific trading conditions such as slippage, spread competitiveness, and additional features that might enhance the overall trading environment. This shortfall forces us to conclude that while the regulatory backing is strong, the direct trading experience remains an area that has not been thoroughly examined in the available data. Thus, for investors seeking an in-depth understanding of this critical area, additional direct testing or further inquiry may be necessary.

occurrence: sgx review*

Additional Keyword occurrence: sgx review

6.5 Trustworthiness Analysis

The trustworthiness of SGX is strengthened mainly by its regulatory framework provided by the Monetary Authority of Singapore . MAS oversight is a critical standard in the financial industry and provides some assurance about the broker's operational integrity and investor protection mechanisms. However, further details such as the specifics of fund protection measures, transparent financial reporting practices, and the handling of any negative market events remain underreported in the available information. It is noted that MAS's establishment of a dedicated review group to strengthen SGX's market development indicates active regulatory involvement in addressing potential shortcomings. Although several aspects of corporate transparency and real-time response to adverse events have not been disclosed, the underlying regulatory support should provide a certain level of confidence among investors. In essence, while SGX's trustworthiness comes from strict MAS oversight, investors may still require additional detailed disclosures to fully gauge the effectiveness of these inherent safeguards.

6.6 User Experience Analysis

User experience evaluation for SGX is mainly informed by an overall user rating of 3.7/5, based on a survey of 473 anonymous employee reviews. This suggests a moderate level of satisfaction among users, though the precise breakdown of factors such as interface design, ease of registration, and overall operational feel is not fully detailed. The available data stops short of explaining the website or trading platform's user interface or the effectiveness of the mobile trading setup. Furthermore, common user concerns—such as difficulties in navigating the platform or experiencing delays in trade execution—were not specifically identified. While the combined score provides a general sense of mixed satisfaction, the absence of detailed user feedback limits our understanding of the precise problem areas. In this context, for investors weighing the pros and cons of SGX, it is essential to supplement this review with direct platform trials to determine if the user experience aligns with their trading needs.

occurrence: sgx review*

7. Conclusion

In summary, this sgx review indicates that while SGX benefits from the strong regulatory oversight of the Monetary Authority of Singapore, the detailed operational transparency remains limited. Investors will appreciate the regulated environment and diverse asset range but should note that several key aspects—such as detailed account conditions, trading tools, customer support quality, and platform stability—have not been fully disclosed. Consequently, SGX appears best suited for investors seeking exposure to the Singapore market backed by MAS credibility, yet those requiring detailed operational information may need further investigation.